Global Preventive Maintenance Software Market Size, Share and Analysis Report By Component (Software, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Application (Asset Management & Work Order Scheduling, Inventory & Spare Parts Management, Predictive Maintenance Integration, Compliance & Reporting, Others), By End-User Industry (Manufacturing, Oil & Gas, Energy & Utilities, Healthcare & Facilities Management, Transportation & Logistics, Government & Public Sector, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 178759

- Number of Pages: 386

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- By Component

- By Deployment Mode

- By Organization Size

- By Application

- By End-User Industry

- Regional Overview

- Key Market Segments

- By Application

- Emerging Trends Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

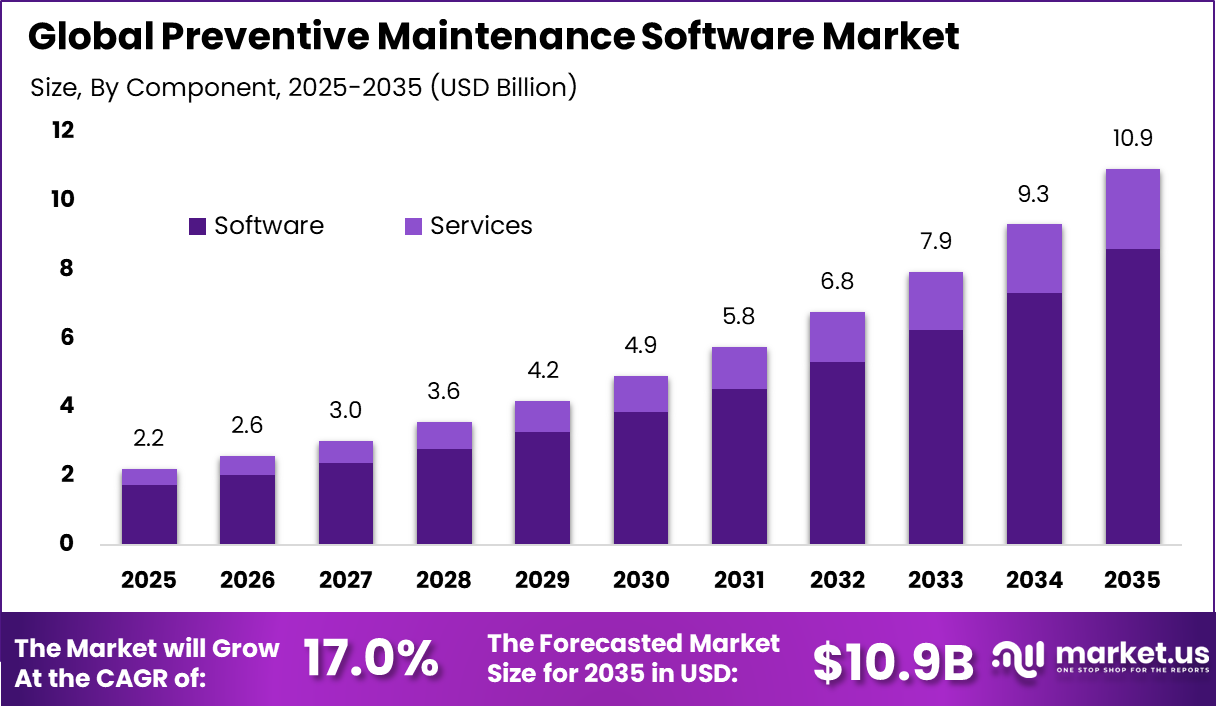

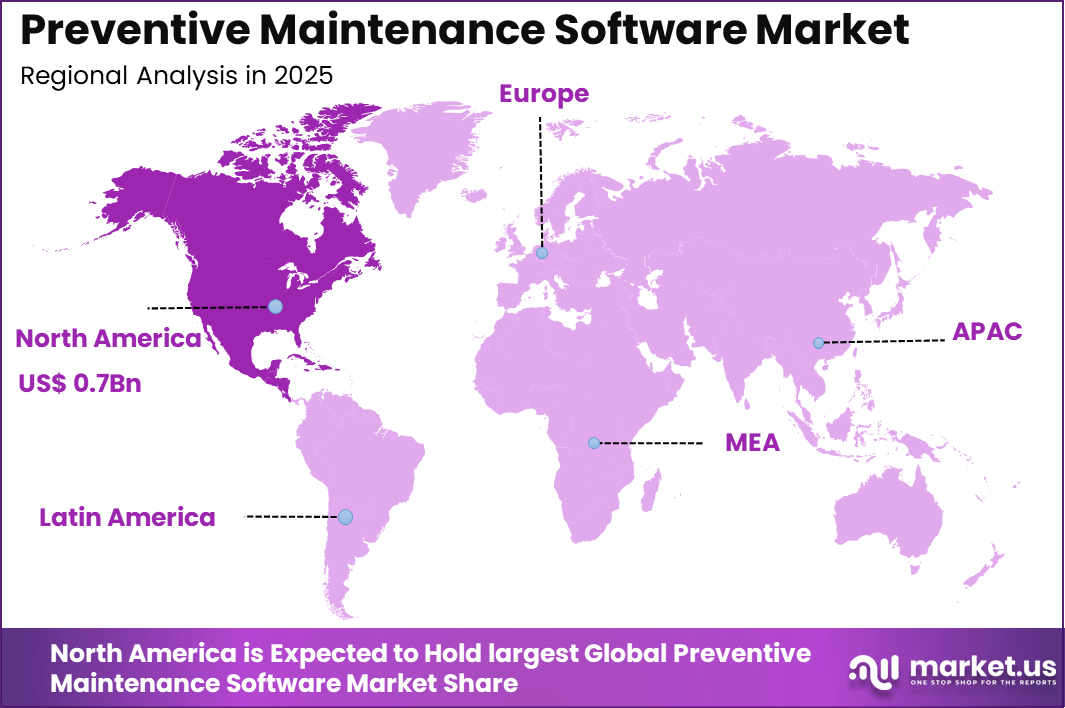

The Global Preventive Maintenance Software Market size is expected to be worth around USD 10.9 Billion By 2035, from USD 2.2 billion in 2025, growing at a CAGR of 17% during the forecast period from 2026 to 2035. North America held a dominant Market position, capturing more than a 36.2% share, holding USD 0.7 Billion revenue.

The Preventive Maintenance Software Market refers to digital solutions that help organizations plan, schedule, and execute maintenance activities aimed at preventing asset failures before they occur. These software platforms track equipment condition, usage patterns, and historical performance to trigger maintenance tasks at optimal times.

The objective is to reduce unplanned downtime, extend asset life, and improve operational efficiency. As enterprises pursue digital transformation across operations and manufacturing, preventive maintenance software has become a foundational component of asset management strategies. The market has grown steadily due to the increasing complexity of industrial environments and the rising cost of equipment failures.

One major driver of the Preventive Maintenance Software Market is the growing emphasis on operational efficiency and cost reduction. Unplanned equipment failures can lead to significant production losses, safety incidents, and repair expenses. By implementing preventive maintenance software, organizations can anticipate potential issues and schedule maintenance activities before breakdowns occur. This proactive approach supports higher uptime and predictable maintenance budgeting.

According to a 2025 Plant Engineering study, 88% of manufacturing companies rely on preventive maintenance strategies. In addition, 40% of these companies have adopted predictive maintenance supported by analytics tools. This reflects a growing shift toward integrated maintenance models across industrial facilities.

Demand for preventive maintenance software is observed across industries with critical physical assets and production processes. Manufacturing enterprises require structured maintenance planning to ensure smooth operations and compliance with safety standards. Energy and utility companies deploy these solutions to manage power generation and distribution equipment with high reliability requirements. Transportation and logistics sectors also adopt preventive maintenance to support vehicles, fleets, and infrastructure elements.

Top Market Takeaways

- By Component, Software accounted for 78.6% of the total market share, reflecting strong enterprise demand for automated maintenance planning, predictive analytics, and integrated reporting platforms that reduce operational downtime.

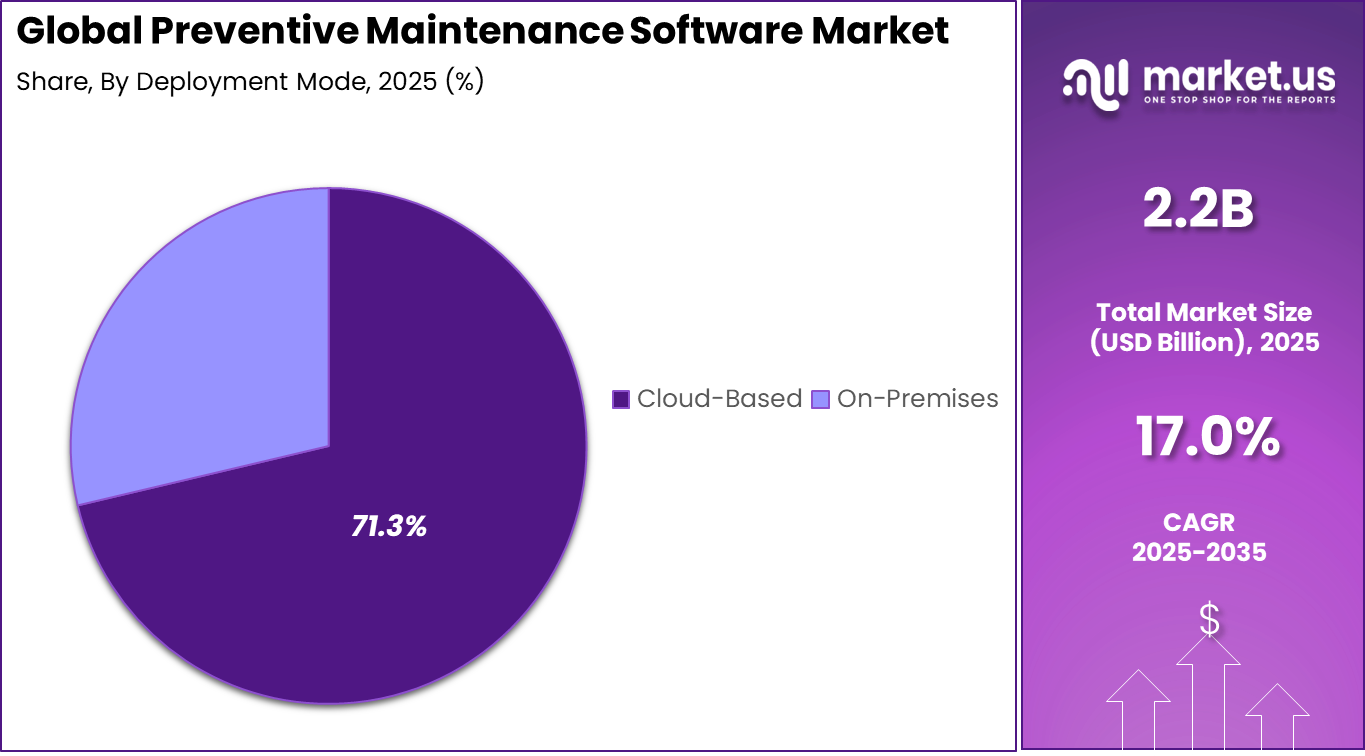

- By Deployment Mode, Cloud-based solutions held 71.3%, supported by scalable infrastructure, remote access capabilities, and lower upfront implementation costs. Cloud deployment also enables centralized monitoring across distributed facilities.

- By Organization Size, Large Enterprises captured 62.7% of the market, driven by complex asset portfolios, multi site operations, and structured maintenance compliance requirements.

- By Application, Asset Management and Work Order Scheduling represented 52.4% of total adoption, as organizations prioritize real time asset tracking, preventive servicing, and efficient task allocation to extend equipment lifespan.

- By End-User Industry, Manufacturing led with 41.8%, supported by increasing focus on minimizing production disruptions and improving overall equipment effectiveness.

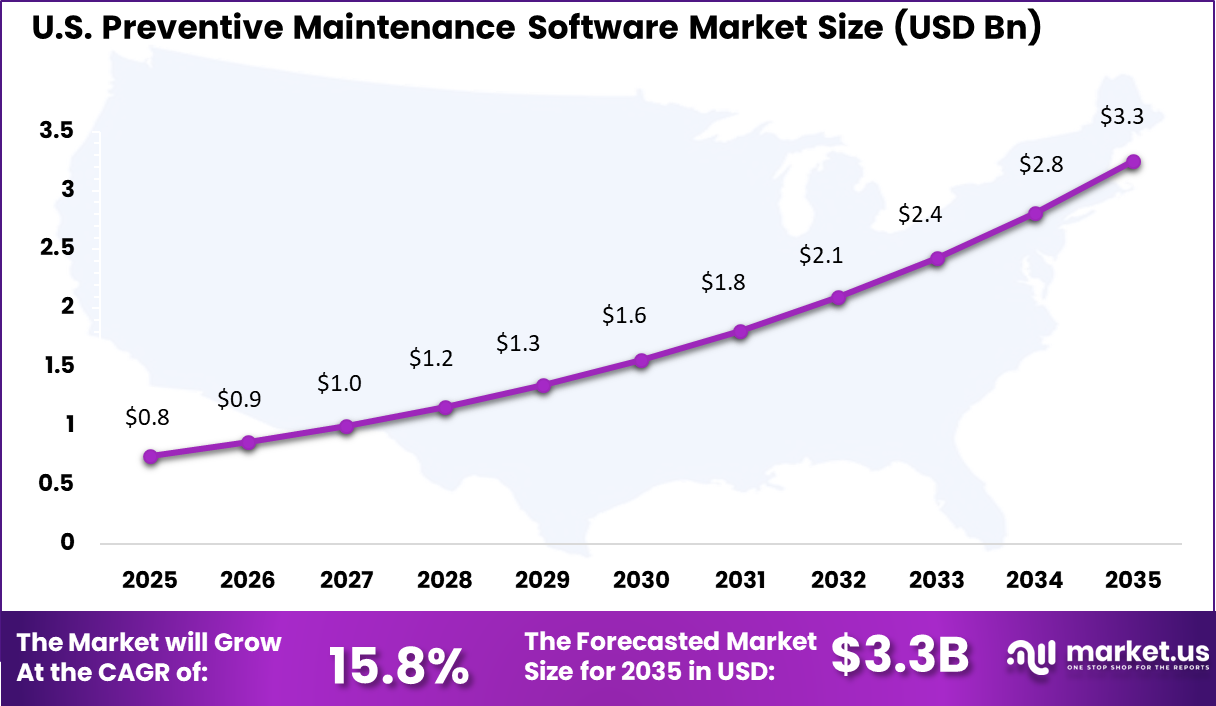

- Regionally, North America held 36.2% of the global market share, with the U.S. market valued at USD 0.75 billion in 2025 and expanding at a CAGR of 15.85%, driven by industrial automation adoption and digital transformation initiatives across maintenance operations.

By Component

Software accounts for 78.6% of the preventive maintenance software market. Organizations are increasingly adopting digital platforms to automate maintenance planning and equipment monitoring. Preventive maintenance software enables structured scheduling, tracking of service intervals, and documentation of repair activities.

This reduces unexpected equipment failures and improves operational reliability. As industries focus on minimizing downtime, software adoption continues to strengthen. Modern platforms integrate with enterprise resource planning and inventory systems. This allows seamless coordination between maintenance teams and procurement departments.

Automated alerts and performance dashboards enhance visibility into asset health. Predictive analytics capabilities further support proactive intervention. The growing emphasis on operational efficiency explains the dominant share of software within this market.

By Deployment Mode

Cloud-based deployment represents 71.3% of the preventive maintenance software market. Organizations prefer cloud platforms due to scalability, remote accessibility, and reduced infrastructure costs. Cloud solutions allow maintenance teams to access real-time asset data from multiple locations. This improves coordination across distributed facilities.

The flexibility of cloud infrastructure supports continuous system updates and performance optimization. Cloud platforms also enable integration with IoT sensors and connected devices. Real-time equipment monitoring enhances preventive planning accuracy.

Automatic backups and centralized data storage strengthen reliability and compliance. Enterprises benefit from subscription-based models that align with operational budgets. These advantages continue to drive strong adoption of cloud-based deployment models.

By Organization Size

Large enterprises account for 62.7% of total market adoption. These organizations manage extensive asset portfolios across manufacturing plants, warehouses, and service centers. Preventive maintenance systems provide centralized oversight and standardized procedures. This reduces maintenance inconsistencies and supports better cost control.

Large enterprises prioritize digital tools to enhance asset lifecycle management. Enterprise environments often require integration across multiple departments and geographic regions. Maintenance software ensures consistent reporting and performance tracking at scale.

Automated scheduling reduces manual workload and improves resource allocation. Data-driven insights help optimize maintenance budgets and extend equipment lifespan. The complexity of enterprise operations explains their leading share in this segment.

By Application

Asset management and work order scheduling represent 52.4% of the application segment. Organizations rely on structured scheduling systems to prevent equipment breakdowns and production delays. Maintenance software automates work order creation based on predefined service intervals or performance metrics. This ensures timely intervention and reduces reactive repairs.

Improved scheduling enhances workforce productivity and asset utilization. Comprehensive asset tracking also supports better inventory planning for spare parts. Real-time updates provide transparency into maintenance progress and resource allocation.

Historical data analysis helps identify recurring issues and optimize maintenance strategies. Enhanced coordination between operations and maintenance teams strengthens overall efficiency. The central role of scheduling and asset tracking explains this segment’s strong position.

By End-User Industry

Manufacturing accounts for 41.8% of the preventive maintenance software market. Production facilities depend heavily on machinery that must operate continuously to meet output targets. Preventive maintenance solutions help reduce downtime and protect critical equipment.

Automated monitoring ensures consistent performance and safety compliance. This strengthens operational stability within manufacturing environments. Manufacturers increasingly integrate maintenance software with industrial IoT systems.

Sensor data provides insights into equipment wear and performance trends. Early detection of anomalies minimizes costly breakdowns. Digital maintenance records also support regulatory compliance and audit readiness. The high reliance on machinery explains manufacturing’s significant share in this market.

Regional Overview

North America holds 36.2% of the global preventive maintenance software market. The region demonstrates strong adoption of digital asset management and industrial automation technologies. Organizations prioritize operational efficiency and cost optimization through structured maintenance programs. Investment in cloud infrastructure further supports software deployment. This drives steady market expansion across industries.

The United States leads regional growth with a market value of USD 0.75 Bn and a CAGR of 15.85%. Enterprises across manufacturing, energy, and transportation sectors are modernizing maintenance practices. Adoption of connected equipment and analytics-driven monitoring strengthens demand. Continuous focus on reducing downtime supports sustained growth. North America remains a stable and expanding market for preventive maintenance software solutions.

Key Market Segments

By Component

- Software

- Services

By Deployment Mode

- Cloud-based

- On-premises

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Application

- Asset Management & Work Order Scheduling

- Inventory & Spare Parts Management

- Predictive Maintenance Integration

- Compliance & Reporting

- Others

By End-User Industry

- Manufacturing

- Oil & Gas, Energy & Utilities

- Healthcare & Facilities Management

- Transportation & Logistics

- Government & Public Sector

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends Analysis

The Preventive Maintenance Software market is increasingly influenced by the integration of predictive analytics and IoT enabled monitoring systems. Organizations are deploying connected sensors on equipment to collect real time performance data, which is then analyzed through maintenance platforms to anticipate potential failures. This shift from reactive to data driven preventive strategies is improving asset reliability and reducing unexpected downtime.

Another emerging trend is the adoption of cloud based and mobile enabled maintenance platforms. Enterprises are prioritizing remote accessibility, enabling maintenance teams to receive alerts, update work orders, and track asset conditions through mobile devices. Cloud deployment improves scalability and simplifies integration with enterprise resource planning systems.

Driver Analysis

A key driver of the Preventive Maintenance Software market is the rising need to minimize equipment downtime and extend asset lifecycle. Unplanned breakdowns can disrupt operations, increase repair costs, and impact productivity. Preventive maintenance systems help schedule timely inspections and servicing activities based on usage patterns and historical performance data. This structured approach enhances operational continuity and cost efficiency.

Another major driver is the increasing adoption of automation and Industry 4.0 initiatives across industrial sectors. Smart factories and automated production lines require continuous monitoring and proactive maintenance strategies. Maintenance software supports integration with machine data systems, enabling informed decision making. As organizations invest in digital transformation, preventive maintenance solutions become a strategic operational tool.

Restraint Analysis

One restraint affecting market growth is the high initial implementation cost associated with advanced preventive maintenance systems. Deployment may require integration with legacy infrastructure, sensor installation, and employee training. Smaller enterprises may face budget constraints that delay adoption. Return on investment can take time to realize, especially in facilities with limited digital maturity.

Another restraint involves resistance to organizational change and limited technical expertise. Maintenance teams accustomed to manual record keeping may hesitate to adopt digital systems. Insufficient training can reduce the effectiveness of software utilization. These internal challenges can slow implementation and limit the full benefits of preventive maintenance solutions.

Opportunity Analysis

A significant opportunity exists in expanding preventive maintenance solutions across emerging markets with growing industrialization. Rapid development of manufacturing, energy, and transportation infrastructure increases demand for asset reliability solutions. Governments and enterprises are emphasizing operational efficiency and sustainability.

Vendors that provide scalable and cost effective platforms can capture new regional demand. Another opportunity lies in integrating artificial intelligence and machine learning within maintenance software. Advanced algorithms can analyze historical and real time equipment data to optimize maintenance schedules and resource allocation. AI driven insights enhance predictive accuracy and reduce unnecessary servicing.

Challenge Analysis

A primary challenge in this market is ensuring seamless integration with diverse enterprise systems. Organizations often operate multiple asset management, inventory, and enterprise resource planning platforms. Aligning preventive maintenance software with these systems requires technical customization and standardized data formats. Integration complexity can increase deployment time and operational overhead.

Another challenge involves maintaining data accuracy and consistency across connected assets. Sensor malfunction, incomplete records, or inconsistent data entry can affect predictive reliability. Ensuring data governance and quality control is critical for accurate maintenance planning. Without reliable data inputs, the effectiveness of preventive maintenance software can be significantly reduced.

Competitive Analysis

The Preventive Maintenance Software Market is led by established enterprise vendors with strong global capabilities. IBM Corporation through Maximo, SAP SE, Oracle Corporation, and Infor, Inc. provide integrated asset and maintenance management platforms. These solutions are widely adopted across manufacturing, energy, utilities, and transportation sectors. Their strength lies in deep integration with enterprise resource planning systems and advanced analytics tools.

Schneider Electric SE and Bentley Systems, Incorporated further enhance competition by offering industry focused maintenance and asset performance solutions. Rockwell Automation, Inc. plays a strategic role through Fiix, Inc., while eMaint, a Fluke company, supports industrial clients with cloud based maintenance platforms.

MVP Plant, a PTC company, connects maintenance workflows with product lifecycle systems. These vendors focus on predictive maintenance, IoT enabled monitoring, and real time asset visibility. Their solutions are designed to reduce downtime and improve equipment reliability. Strong automation expertise and industrial partnerships support their long term market positioning.

Mid sized and specialized providers such as UpKeep Maintenance Management, Limble CMMS, ManagerPlus, Maintenance Connection, and DIMO Maint focus on simplicity and rapid deployment. These companies target small and medium enterprises seeking mobile friendly and cost efficient systems. Subscription based pricing improves accessibility and supports recurring revenue models.

Top Key Players in the Market

- IBM Corporation (Maximo)

- SAP SE

- Oracle Corporation

- Infor, Inc.

- Schneider Electric SE

- Bentley Systems, Incorporated

- Rockwell Automation, Inc.

- eMaint (a Fluke company)

- Fiix, Inc. (a Rockwell Automation company)

- UpKeep Maintenance Management

- Limble CMMS

- ManagerPlus

- Maintenance Connection

- MVP Plant (a PTC company)

- DIMO Maint

- Others

Recent Developments

- SAP pushed S/4HANA predictive maintenance updates through mid-2025, adding ML models for vibration and heat anomalies. Despite on-prem support winding down by late 2025, cloud versions gained traction in auto plants. Clients report 20% faster repair cycles with embedded analytics. This keeps SAP competitive in enterprise-scale fleets.

- Bentley pushed digital twins for bridges and rails in 2025, tying into preventive schedules via iTwin platform. Schneider rumors highlight its appeal for hardware-software bundles. Users track defects proactively, avoiding millions in emergency fixes. It’s niche but growing in public works.

Report Scope

Report Features Description Market Value (2025) USD 2.2 Bn Forecast Revenue (2035) USD 10.9 Bn CAGR(2026-2035) 17% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Application (Asset Management & Work Order Scheduling, Inventory & Spare Parts Management, Predictive Maintenance Integration, Compliance & Reporting, Others), By End-User Industry (Manufacturing, Oil & Gas, Energy & Utilities, Healthcare & Facilities Management, Transportation & Logistics, Government & Public Sector, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation (Maximo), SAP SE, Oracle Corporation, Infor, Inc., Schneider Electric SE, Bentley Systems, Incorporated, Rockwell Automation, Inc., eMaint (a Fluke company), Fiix, Inc. (a Rockwell Automation company), UpKeep Maintenance Management, Limble CMMS, ManagerPlus, Maintenance Connection, MVP Plant (a PTC company), DIMO Maint, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Preventive Maintenance Software MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Preventive Maintenance Software MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation (Maximo)

- SAP SE

- Oracle Corporation

- Infor, Inc.

- Schneider Electric SE

- Bentley Systems, Incorporated

- Rockwell Automation, Inc.

- eMaint (a Fluke company)

- Fiix, Inc. (a Rockwell Automation company)

- UpKeep Maintenance Management

- Limble CMMS

- ManagerPlus

- Maintenance Connection

- MVP Plant (a PTC company)

- DIMO Maint

- Others