Global Multi Screen Advertising Market Size, Share, Statistics Analysis Report By Type (Software, Services), By Device Platform (Desktop/Laptop, Mobile/Tablet, Gaming Consoles, Televisions, Others), By Content Type (Static, Dynamic, Interactive), By Ad Format (In App Ads, In Page Executions, Overlays, Pre and Mid Roll Ads), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 147526

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Business Benefits

- Analyst’s Viewpoint

- U.S. Market Leadership

- Type Analysis

- Device Platform Analysis

- Content Type Analysis

- Ad Format Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Key Growth Factors

- Emerging Trends

- Key Player Analysis

- Top Opportunities for Players

- Recent Developments

- Report Scope

Report Overview

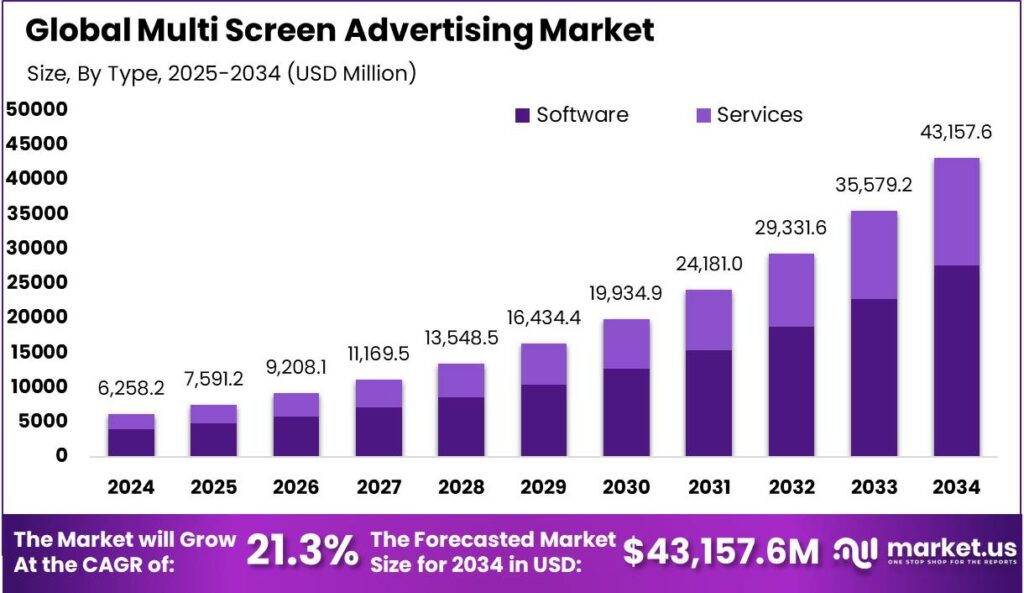

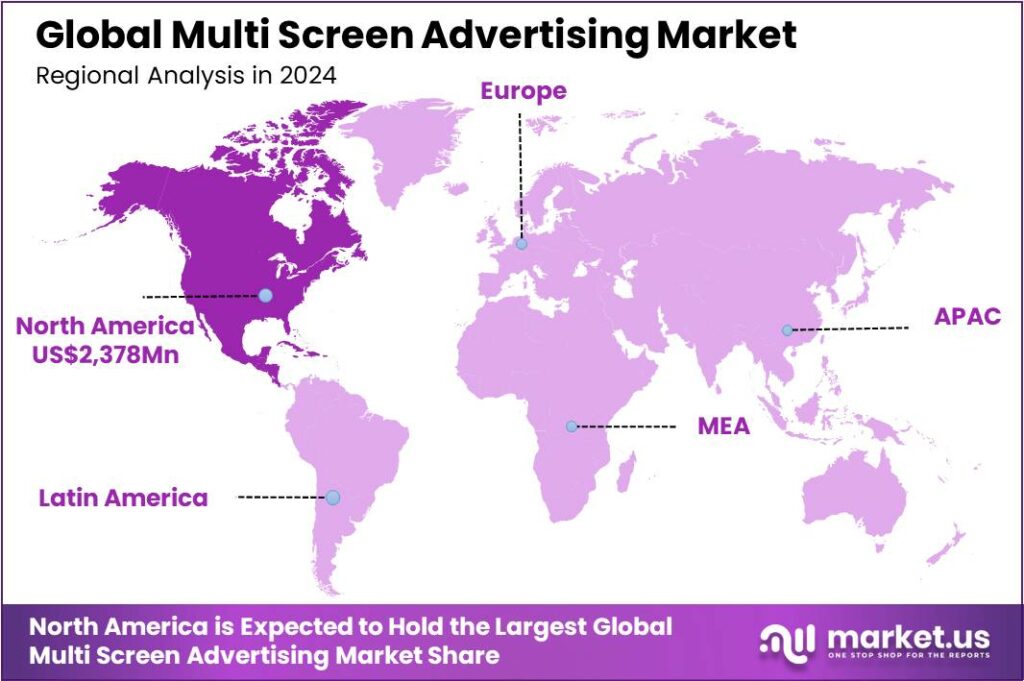

The Multi Screen Advertising Market size is expected to be worth around USD 43,157.6 Mn By 2034, from USD 6,258.2 Mn in 2024, growing at a CAGR of 21.30% during the forecast period. In 2024, North America led the global Multi-Screen Advertising market with over 38% market share and revenues exceeding USD 2,378 mn. The U.S. market reached a valuation of USD 2,252.1 mn, highlighting the growing importance of multi-screen content delivery.

Multi screen advertising refers to the strategic practice of delivering advertisements across multiple digital screens simultaneously, such as smartphones, tablets, desktops, smart TVs, and digital out-of-home (DOOH) platforms. The core idea is to reach audiences across all devices, ensuring a consistent brand experience. This approach boosts visibility, reinforces messaging, and tracks user engagement across platforms.

The demand for multi-screen advertising is driven by the proliferation of digital devices and the increasing consumption of content across multiple platforms. Advertisers recognize the importance of reaching audiences wherever they are, necessitating strategies that encompass various screens to maintain consistent messaging and maximize reach.

The primary reason for the heightened demand in multi-screen advertising is the changing media consumption habits of consumers. With individuals frequently switching between devices, advertisers recognize the necessity of maintaining a presence across all screens to capture and retain audience attention.

Current market trends indicate a strong emphasis on video content, with video ads expected to account for a significant portion of multi-screen advertising spend. Interactive and shoppable ads are also gaining traction, offering consumers engaging experiences that bridge the gap between content and commerce.

The increasing adoption of technologies such as programmatic advertising, real-time bidding, and cross-device tracking is revolutionizing the multi-screen advertising landscape. These technologies facilitate automated ad buying and placement, optimizing campaign performance and efficiency.

Key reasons for adopting these technologies include the need for scalability, improved targeting accuracy, and enhanced return on investment. By leveraging advanced tools, advertisers can streamline operations, reduce costs, and deliver more relevant content to their audiences, thereby increasing engagement and conversion rates.

Key Takeaways

- The Global Multi-Screen Advertising Market size is projected to reach USD 43,157.6 Million by 2034, growing from USD 6,258.2 Million in 2024, at a CAGR of 21.30% during the forecast period from 2025 to 2034.

- In 2024, the Software segment held a dominant market position, capturing more than 64% of the global market share in multi-screen advertising.

- In 2024, the Mobile/Tablet segment held a dominant market position, accounting for over 45% of the global share in the multi-screen advertising market.

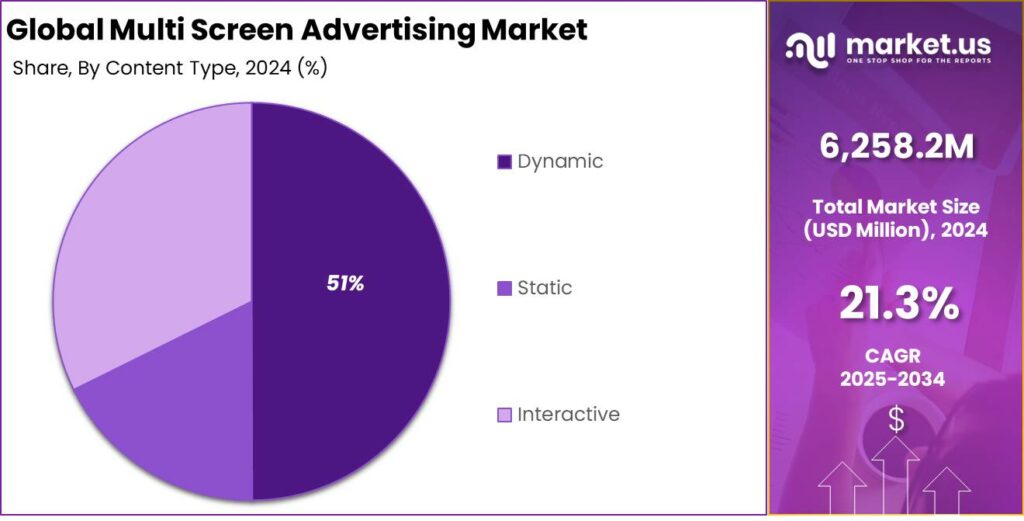

- The Dynamic segment held a dominant market position in 2024, capturing over 51% of the total share in the Multi-Screen Advertising market.

- In 2024, the In-App Ads segment held a dominant market position, capturing more than 35% of the global Multi-Screen Advertising Market share.

- North America dominated the global Multi-Screen Advertising market in 2024, holding over 38% of the total market share, with revenues exceeding USD 2,378 million.

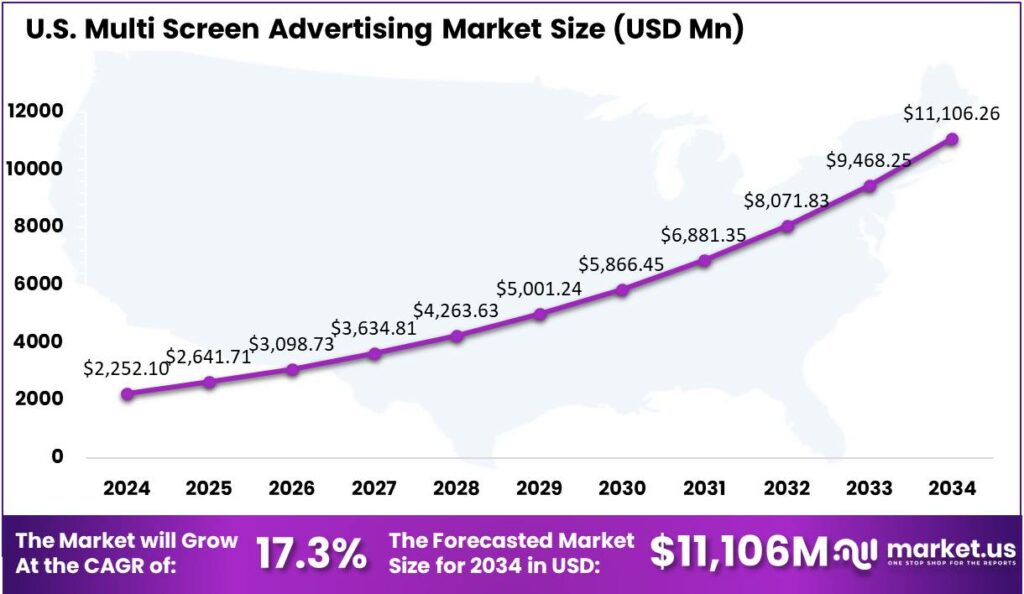

- In 2024, the U.S. Multi-Screen Advertising Market reached a valuation of USD 2,252.1 million, reflecting the increasing significance of delivering content across multiple connected screens.

Business Benefits

Consistent messaging across multiple screens strengthens brand identity and boosts recognition. Repeated exposure on different devices increases consumer awareness, making them more likely to choose the brand when purchasing. According to a Wipro report, consumers exposed to ads across multiple screens have a 74% brand recall rate, compared to 50% for those who saw the ad only on TV.

Multi-screen advertising can be more cost-effective compared to traditional single-channel campaigns. By leveraging various platforms, businesses can reach a broader audience without significantly increasing their marketing budgets. Additionally, the ability to measure and optimize campaigns ensures that resources are allocated efficiently, maximizing the return on investment.

Multi-screen engagement enables businesses to deliver personalized, interactive experiences. By adapting content to each device, brands capture attention more effectively, boosting customer relationships and fostering loyalty and trust.

An independent study for Thinkbox by COG Research shows that 81% of viewers with a second screen are more likely to stay in the room or avoid changing the channel during ad breaks, compared to 72% of those who watch ads without one.

Analyst’s Viewpoint

Multi-screen advertising is evolving due to several key factors. The rise of connected devices has fragmented media consumption, requiring cross-platform strategies. Consumers demand personalized, seamless experiences, pushing data-driven advertising. With TV viewership declining and streaming on the rise, ad spending is shifting to digital. Real-time engagement and cross-device measurement are now essential.

Technological advancements are driving multi-screen advertising forward. Real-time bidding, dynamic content optimization, and AI-driven audience segmentation enhance ad delivery and targeting. Interactive and shoppable ads on connected TVs offer immersive experiences, while improved cross-device tracking helps optimize budgets.

The regulatory environment is growing more complex, with stricter rules on data privacy and consumer protection. Laws like the EU’s Digital Markets Act and ongoing U.S. privacy law discussions highlight a global push for tighter digital advertising regulations. Advertisers must balance compliance with maintaining effective multi-screen strategies.

U.S. Market Leadership

In 2024, the U.S. Multi-Screen Advertising Market reached a valuation of USD 2,252.1 million, reflecting the growing importance of delivering content across multiple connected screens. This market focuses on advertising strategies for smartphones, tablets, laptops, smart TVs, and other digital devices. As audiences engage across multiple screens, U.S. advertisers now use synchronized, cross-platform campaigns to boost brand visibility and engagement.

The market is poised for robust expansion, projected to grow at a compound annual growth rate (CAGR) of 17.3% from 2025 onward. Growth is driven by rising mobile internet use, streaming platform popularity, and data-driven advertising. As consumers use multiple devices daily, brands adopt cross-screen strategies for consistent, non-intrusive messaging.

Technological advancements in audience tracking, AI-driven media planning, and analytics are transforming the U.S. multi-screen advertising landscape. These tools provide deeper insights into user behavior, enabling more precise ad targeting and improved ROI. As a result, the U.S. remains a leading and highly profitable market, drawing significant investment in ad tech and content distribution.

In 2024, North America held a dominant position in the global Multi-Screen Advertising market, capturing over 38% of the total market share, with revenues exceeding USD 2,378 million. This regional dominance is primarily driven by the high digital penetration rate, widespread use of smart devices, and mature advertising infrastructure across the United States and Canada.

North America’s advanced programmatic advertising and AI-driven adtech tools enable real-time, personalized content across multiple devices. With U.S. consumers using over three digital devices daily, advertisers must keep messaging consistent across screens. This has made the region a hub for innovation in dynamic creative optimization, cross-platform attribution, and responsive ad formats.

North America’s media habits fuel multi-screen advertising growth, as platforms like Netflix, Hulu, Disney+, and YouTube see increased viewership across devices. This trend encourages marketers to build cross-platform campaigns that maintain consistent brand messaging at every touchpoint.

Strong regulatory support and frameworks like the IAB’s Transparency and Consent Framework (TCF) enhance transparency and accountability in North America’s digital advertising. These standards foster ethical ad targeting and boost advertiser confidence, positioning the region as a global leader and trendsetter in multi-screen advertising.

Type Analysis

In 2024, the Software segment held a dominant market position, capturing more than a 64% share in the global multi screen advertising market. This dominance is primarily attributed to the rapid adoption of programmatic advertising platforms and automation tools that streamline campaign delivery across multiple screens.

Businesses are increasingly investing in advertising software that can offer real-time data analytics, audience targeting, and cross-platform optimization. These capabilities enable advertisers to create personalized ad experiences and maximize returns on digital campaigns, which is not as easily achievable through manual or service-led approaches.

Software solutions offer marketers greater flexibility and control through AI-driven platforms and centralized dashboards, enabling budget management, performance monitoring, and creative adjustments with minimal intervention. This efficiency supports cost-effective scalability, especially for industries like retail, travel, and media.

The integration of third-party data and behavioral insights enhances software solutions, allowing precise audience segmentation based on habits, device use, and engagement. This ensures consistent messaging and brand recall across fragmented consumer attention, positioning software as a key innovator in multi-screen advertising.

Device Platform Analysis

In 2024, the Mobile/Tablet segment held a dominant market position, capturing more than 45% of the global share in the multi-screen advertising market. Smartphone and tablet penetration, especially in regions like Asia-Pacific, North America, and Latin America, drives mobile ad spending as mobile internet usage surpasses desktop. The portability of mobile devices allows brands to engage users throughout the day, boosting campaign effectiveness.

The Mobile/Tablet segment excels due to its alignment with shifting consumer behavior. With more time spent on apps, social media, and short-form videos, mobile screens are now the primary contact point for digital content. Formats like vertical videos, stories, and interactive media boost engagement, leading to higher click-through rates and improved performance metrics for mobile campaigns.

The rise of location-based advertising and real-time targeting further amplifies the strength of mobile platforms. Using geolocation data and AI-powered audience insights, brands can now serve hyper-personalized ads on mobile devices, which results in more relevant user experiences.

The dominance of the Mobile/Tablet segment is also driven by seamless integration across multi-screen campaigns. Mobile devices often initiate user-brand interactions that continue on other screens like desktops, smart TVs, or gaming consoles. This cross-device journey enhances brand recall and enables more synchronized, measurable advertising efforts through mobile-first strategies.

Content Type Analysis

In 2024, the Dynamic segment held a dominant market position in the Multi-Screen Advertising market, capturing over 51% of the total share. The strong performance of this segment is largely driven by advertisers’ growing preference for adaptable and real-time content that can be personalized based on user behavior, location, or device type.

The dominance of the dynamic segment is driven by the use of AI and machine learning in ad creation and delivery. These technologies allow marketers to analyze viewer behavior and customize ads in real-time across various devices, offering a competitive edge. This has boosted demand for dynamic ad platforms, especially in retail, entertainment, and travel sectors.

Dynamic content caters to consumers’ multitasking and short attention spans by offering interactive, updated ads that capture attention better than static formats. This leads to higher click-through rates, engagement, and return on ad spend, making it an efficient solution for advertisers adjusting to shifting audience behavior.

The rise of programmatic advertising and real-time bidding (RTB) has boosted dynamic ads, enabling real-time ad creation based on user behavior. This enhances ad relevance, improving brand recall and conversions. As advertisers seek greater flexibility, automation, and personalization, dynamic content is expected to lead in the coming years.

Ad Format Analysis

In 2024, the In-App Ads segment held a dominant market position, capturing more than a 35% share of the global Multi Screen Advertising Market. This leading position can be attributed to the rising time users spend on mobile applications across entertainment, gaming, social media, and e-commerce. The embedded nature of in-app advertising ensures higher user attention, as ads are delivered seamlessly within content consumption flows.

In-app ads also benefit from advanced targeting capabilities, leveraging first-party data from app usage patterns, user behavior, location, and device attributes. This data-driven personalization allows advertisers to deliver highly relevant messages, which improves user experience and ad effectiveness. Additionally, app-based advertising provides real-time analytics and performance tracking, allowing for quick optimization of campaigns.

Another major reason for the dominance of in-app ads is the growth of mobile gaming and short-form video platforms. These environments offer native, skippable, and interactive ad placements that enhance viewer engagement without disrupting the experience. Popular gaming apps and video-sharing platforms have emerged as high-traffic venues for dynamic ad placements.

Furthermore, in-app advertising benefits from better ad fraud protection compared to open web environments. App stores’ closed ecosystems and SDK integrations enable secure ad delivery with stronger transparency and verification. This reduces the risk of invalid traffic, ensuring more reliable impressions and safeguarding ad spend.

Key Market Segments

By Type

- Software

- Services

By Device Platform

- Desktop/Laptop

- Mobile/Tablet

- Gaming Consoles

- Televisions

- Others

By Content Type

- Static

- Dynamic

- Interactive

By Ad Format

- In App Ads

- In Page Executions

- Overlays

- Pre and Mid Roll Ads

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Cross-Device Consumer Behavior

The rapid shift in consumer behavior toward using multiple devices simultaneously has significantly influenced the growth of multi-screen advertising. People now engage with content across various screens televisions, smartphones, tablets, and computers often at the same time.

This behavior has created new opportunities for advertisers to reach audiences more effectively. For instance, a viewer might watch a live sports event on TV while checking related statistics or social media on their phone. This simultaneous usage allows advertisers to reinforce their messages across different platforms, increasing the chances of engagement.

Restraint

Ad Intrusiveness and Viewer Fatigue

Multi-screen advertising, while beneficial, faces challenges like ad intrusiveness and viewer fatigue. The high volume of ads across devices can overwhelm consumers, leading to decreased engagement and negative brand perceptions. Additionally, the rise of ad blockers reflects growing resistance to intrusive ads.

Ad blockers obstruct data collection, interfering with tracking systems crucial for assessing campaign success. This results in incomplete customer profiles, complicating personalized marketing and accurate attribution. To counter these challenges, advertisers are exploring alternatives like native advertising and content marketing, which offer value without disrupting the user experience.

Opportunity

Interactive and Personalized Advertising

The evolution of technology has opened doors for more interactive and personalized advertising experiences. Brands can now leverage data analytics to deliver tailored content that aligns with individual consumer preferences, enhancing engagement and conversion rates.

Advertisers can leverage advanced targeting capabilities, delivering personalized content based on viewer preferences and behaviors. Additionally, the integration of interactive features, such as shoppable ads and real-time performance tracking, enhances consumer engagement and provides measurable outcomes.

The expansion of CTV advertising aligns with the evolving media consumption landscape, offering advertisers a dynamic platform to connect with audiences. By capitalizing on this opportunity, brands can enhance their multi-screen strategies, achieving greater impact and return on investment.

Challenge

Fragmented Measurement and Attribution

One of the significant challenges in multi-screen advertising is the fragmented nature of measurement and attribution. With consumers interacting with multiple devices, tracking the effectiveness of campaigns across different platforms becomes complex.

Fragmentation in the multiscreen TV ecosystem makes it challenging for advertisers to fully understand the customer journey and allocate budgets effectively. To reach audiences, advertisers need a diverse strategy that meets viewers where they are across multiple screens. In addition to fragmentation making it difficult for advertisers to understand the customer journey and allocate budgets effectively, the growing complexity of consumer behavior across various devices further complicates targeting.

Key Growth Factors

- Wider Audience Reach: Advertising across multiple devices TVs, phones, and tablets allows brands to reach a larger audience in various locations. Since different age groups and interests use different screens, this strategy helps marketers connect with a more diverse audience, regardless of where they are or what they’re watching.

- Stronger Brand Awareness: Seeing ads across multiple devices boosts brand recall. Repeated exposure on TV, mobile, and social media makes your brand feel familiar and trustworthy, increasing the chances people will choose your product when they’re ready to buy.

- Higher Engagement: People are more likely to interact with ads when they see them on different platforms. For example, someone might see an ad on TV and then click it on their phone. This cross-screen experience boosts engagement and leads to better campaign results.

- Data-Driven Targeting: Multi-screen advertising allows brands to use data from TV, streaming, and mobile to better understand their audience and deliver more relevant ads. This smarter targeting helps maximize the effectiveness of your advertising budget.

- Centralized and Efficient Management: Using a system that lets you control all your screens from one place makes it easier to update and manage your campaigns. This saves time and money, and helps keep your message consistent across every device.

Emerging Trends

One significant trend is the integration of artificial intelligence (AI) in advertising strategies. AI enables the creation of dynamic and personalized ad content, ensuring that messages resonate with individual users across different screens. This personalization enhances user engagement and improves the effectiveness of advertising campaigns.

A significant development is the focus on interactive and immersive ad formats, allowing brands to create engaging experiences on connected TVs. This includes features like QR-enabled ads and vertical videos, blending traditional TV advertising with digital interactivity.

Contextual targeting has become more important, with advertisers focusing on delivering relevant content based on the viewing context rather than just user behavior. The growth of connected TV (CTV) and OTT platforms has also expanded reach, enabling brands to connect with audiences who have moved away from traditional cable TV.

Key Player Analysis

Key players in Multi Screen Advertising Market are investing in better technology, smarter targeting, and more creative ad formats to keep up.

Sky Mobile, part of Sky Group, is making a big impact in multi screen advertising through its focus on seamless media integration. Sky’s strength lies in its access to data from both mobile and TV users. This gives advertisers powerful insights into user behavior across different devices. Sky AdSmart, its addressable TV advertising platform, allows brands to target specific households based on viewing habits and mobile data.

Orange SA, a leading telecom operator in Europe, uses its vast network and customer data to offer effective multi screen ad solutions.It has also partnered with advertising technology firms to enhance its ability to deliver personalized and measurable campaigns. Orange’s uniqueness lies in its local market knowledge combined with its technological partnerships, allowing it to connect with audiences in a relevant and efficient way.

Alphabet Inc., the parent company of Google, is the global leader in multi screen advertising. Platforms like YouTube, Google Search, and the Google Display Network dominate digital advertising. Alphabet’s strength lies in its unmatched ability to gather and analyze data across devices, enabling highly targeted ads. Its scale, data-driven approach, and focus on AI and machine learning drive continuous innovation in ad targeting and performance.

Top Key Players in the Market

- Sky Mobile

- Orange SA

- Alphabet Inc.

- Microsoft Corporation

- Netflix Inc.

- Roku Inc.

- AT&T Inc.

- NTT DoCoMo Inc.

- Verizon Wireless

- Vodafone Group PLC

- Meta Platforms, Inc

- Baidu, Inc.

- Tencent Holdings Ltd.

- Alibaba Group Holding Ltd.

- Samsung Electronics Co. Ltd.

- The Walt Disney Company

- Comcast Corporation

- Verizon Communications, Inc.

- Other Key Players

Top Opportunities for Players

- Surge in Digital Video Consumption: Consumers are increasingly engaging with video content across multiple devices, including smartphones, tablets, and smart TVs. This trend is fueled by the proliferation of streaming platforms and the preference for on-demand content. Advertisers can capitalize on this by creating cohesive video campaigns that seamlessly transition across screens, enhancing brand visibility and engagement.

- Expansion of Connected TV (CTV) Advertising: The rise of Connected TVs has reshaped advertising, enabling targeted and interactive ads. With many households using CTVs, advertisers can deliver personalized content, using data analytics to optimize placements and measure effectiveness. This shift enhances the ability to reach audiences in a more engaging and measurable manner.

- Growth of Programmatic Advertising: Programmatic advertising enables real-time, automated buying and placement of ads across multiple platforms. Programmatic advertising enables more efficient, data-driven campaigns by targeting specific demographics. As technology evolves, it enhances multi-screen strategies, offering advertisers optimized tools for success.

- Integration of Interactive and Shoppable Content: Interactive ads and shoppable content are on the rise, enabling direct consumer engagement with ads. This integration streamlines the journey from awareness to purchase, boosting the consumer experience and offering measurable results for advertisers. By adding interactive elements, brands can enhance engagement and drive conversions across multiple devices.

- Emphasis on Cross-Device Measurement and Attribution: Understanding the customer journey across devices is vital for optimizing advertising strategies. Advanced measurement tools and attribution models help track interactions and evaluate campaign effectiveness, enabling data-driven decisions that align with consumer behaviors and preferences.

Recent Developments

- In April 2025, Samsung Ads launched “Creative Canvas,” an interactive advertising format featuring QR-enabled ads and vertical videos, aiming to enhance engagement on connected TVs.

- March 2024, Microsoft Advertising underwent restructuring, becoming part of the new Microsoft AI division, emphasizing AI integration in advertising solutions

- In 2024, Netflix expanded its advertising capabilities by partnering with platforms like The Trade Desk, Google’s Display & Video 360, and Magnite, enhancing programmatic advertising options.

Report Scope

Report Features Description Market Value (2024) USD 6,258.2 Mn Forecast Revenue (2034) USD 43,157.6 Mn CAGR (2025-2034) 21.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Software, Services), By Device Platform (Desktop/Laptop, Mobile/Tablet, Gaming Consoles, Televisions, Others), By Content Type (Static, Dynamic, Interactive), By Ad Format (In App Ads, In Page Executions, Overlays, Pre and Mid Roll Ads) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sky Mobile, Orange SA, Alphabet Inc., Microsoft Corporation, Netflix Inc., Roku Inc., AT&T Inc., NTT DoCoMo Inc., Verizon Wireless, Vodafone Group PLC, Meta Platforms, Inc, Baidu, Inc., Tencent Holdings Ltd., Alibaba Group Holding Ltd., Samsung Electronics Co. Ltd., The Walt Disney Company, Comcast Corporation, Verizon Communications, Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Multi Screen Advertising MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Multi Screen Advertising MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sky Mobile

- Orange SA

- Alphabet Inc.

- Microsoft Corporation

- Netflix Inc.

- Roku Inc.

- AT&T Inc.

- NTT DoCoMo Inc.

- Verizon Wireless

- Vodafone Group PLC

- Meta Platforms, Inc

- Baidu, Inc.

- Tencent Holdings Ltd.

- Alibaba Group Holding Ltd.

- Samsung Electronics Co. Ltd.

- The Walt Disney Company

- Comcast Corporation

- Verizon Communications, Inc.

- Other Key Players