Global Pressure Transducer Market Size, Share, Statistics Analysis Report By Technology (Piezoresistive Strain Gauge, Capacitance, Other Technologies), By Pressure Type (Gauge Pressure, Absolute Pressure, Differential Pressure), By End-Use Industry (Consumer Electronics, Healthcare, Industrial, Automotive, Oil and Gas, Other End-Use Industries), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: December 2024

- Report ID: 134348

- Number of Pages: 203

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Impact of AI on Pressure Transducer Market

- Technology Analysis

- Pressure Type Analysis

- End-Use Industry Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

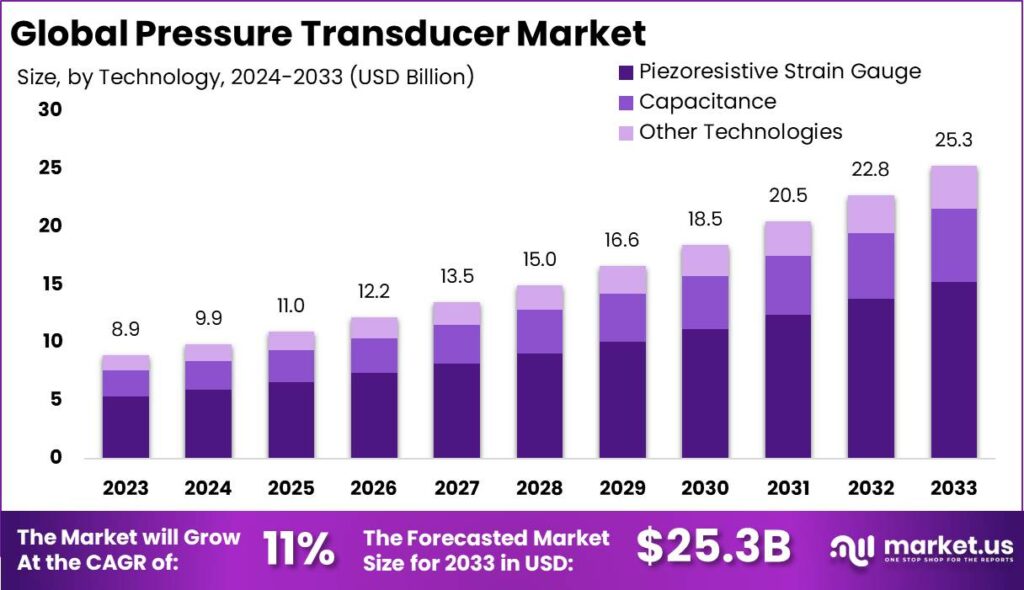

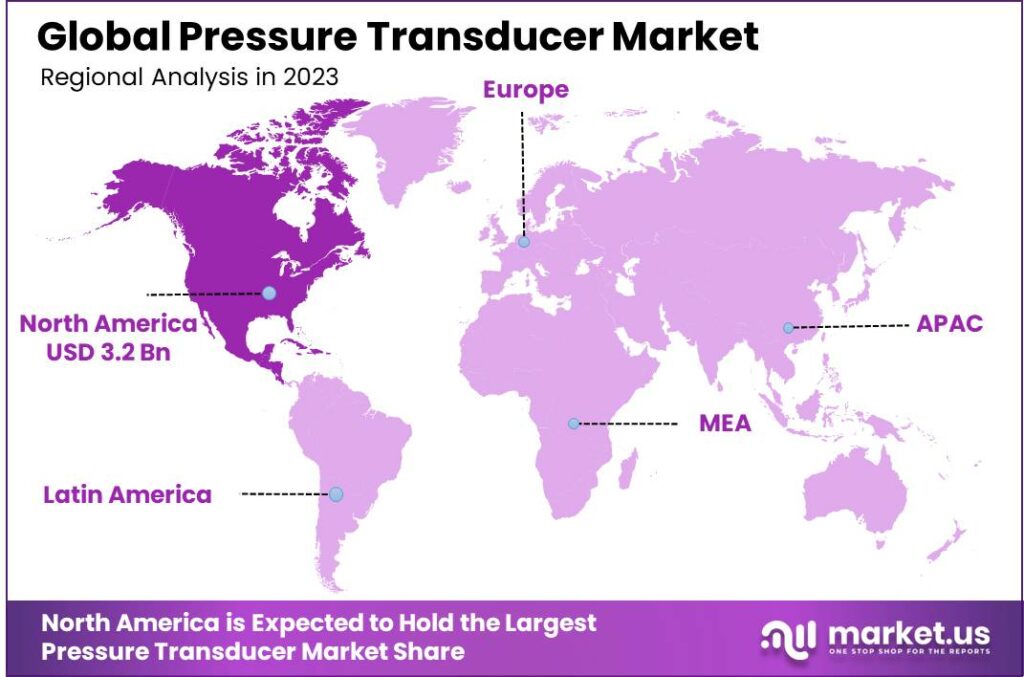

The Global Pressure Transducer Market size is expected to be worth around USD 25.3 Billion By 2033, from USD 8.9 Billion in 2023, growing at a CAGR of 11.00% during the forecast period from 2024 to 2033. In 2023, North America dominated the global pressure transducer market, accounting for over 36.1% of the share. The region generated revenues of approximately USD 3.2 billion.

A pressure transducer, often referred to as a pressure transmitter, is a device that converts pressure into an analog electrical signal. The conversion of pressure into an electrical signal is achieved by the physical deformation of strain gages which are bonded into the diaphragm of the pressure transducer and wired into a Wheatstone bridge configuration.

The pressure transducer market is growing rapidly, fueled by the need for highly precise devices by industries to meet strict regulatory standards and enhance system responsiveness. This demand is also driven by the rise of automation and smart systems, where accurate pressure measurements are essential for optimal performance.

Additionally, technological advancements are enhancing the accuracy, durability, and reliability of pressure transducers, broadening their application scope. The rise in the use of sophisticated control systems across various sectors also propel the demand for these sensors. Moreover, the ongoing trend towards digitalization and IoT integration is fostering innovations in how pressure sensors are utilized, further stimulating market growth.

The market’s popularity is also on the rise, influenced by the growing emphasis on industrial safety and environmental regulations. Companies are adopting pressure transducers to comply with these regulations, driving widespread adoption. Moreover, the rise of IoT and wireless technologies has enhanced the popularity of these devices, as they can now be integrated into broader monitoring networks, providing real-time data remotely.

Market opportunities are expanding as IoT integration and advancements in materials science open new development pathways. Manufacturers are exploring innovative materials and designs to improve the durability and efficiency of pressure transducers, especially in harsh environments. Furthermore, the growth of industries like renewable energy and biotechnology offers additional opportunities for these essential sensors.

The market is set for continued growth, fueled by technological advancements and rising industrial demands. MEMS technology is enabling the development of smaller, energy-efficient transducers, driving miniaturization and cost reduction. This shift is opening new applications and markets, paving the way for pressure transducers to become more integrated into both industrial and consumer sectors.

Key Takeaways

- The Global Pressure Transducer Market is projected to reach approximately USD 25.3 Billion by 2033, growing from USD 8.9 Billion in 2023, with a CAGR of 11.00% during the forecast period from 2024 to 2033.

- In 2023, the Piezoresistive Strain Gauge segment led the market, accounting for more than 60.5% of the total share in the pressure transducer market.

- The Absolute Pressure segment also held a significant market position in 2023, capturing more than 41.8% of the market share.

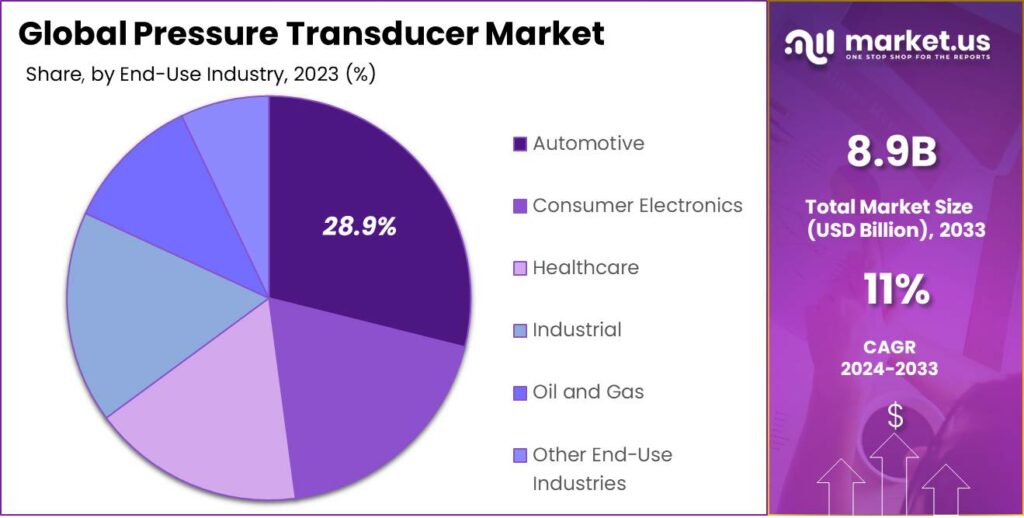

- The Automotive sector dominated the pressure transducer market in 2023, with a share of over 28.9%.

- North America was the leading region in the global pressure transducer market in 2023, holding more than 36.1% of the market share, with revenues reaching USD 3.2 billion.

Impact of AI on Pressure Transducer Market

The integration of artificial intelligence (AI) is significantly influencing the growth and capabilities of the pressure transducer market. AI enhances the precision and flexibility of pressure transducers, enabling real-time data processing, predictive maintenance, and improved overall performance.

This technological advancement is not only elevating the functionality of these devices but is also driving their adoption across various industries, such as automotive, consumer electronics, and healthcare, where precision and efficiency are paramount.

AI’s role in this market extends to enhancing sensor capabilities in detecting and responding to environmental conditions, which is critical in industries like automotive and aerospace. For instance, the development of AI-based systems like the Smart Alarm System by Infineon Technologies AG incorporates AI or machine learning with pressure sensors to improve event detection and response

Moreover, the market is benefiting from the increased adoption of IoT and smart manufacturing techniques, which integrate AI with pressure transducers to bolster their efficiency and functionality. These innovations are making significant inroads in sectors that require rigorous monitoring and control systems, ensuring that the pressure transducers developed are not only more capable but also more adaptable to the needs of modern industries.

Technology Analysis

In 2023, the Piezoresistive Strain Gauge segment held a dominant market position, capturing more than a 60.5% share of the pressure transducer market. This segment’s prominence is primarily due to the reliability and cost-effectiveness of piezoresistive strain gauge technology in measuring pressure.

These transducers are highly favored in critical applications across various industries such as automotive, aerospace, and healthcare, where precise pressure measurement is crucial. The technology’s ability to provide accurate and consistent readings even under harsh conditions contributes to its widespread adoption.

The leading position of the Piezoresistive Strain Gauge segment is further supported by its extensive application range. This technology is well-suited for both static and dynamic pressure measurements, making it versatile for different uses from industrial automation to consumer electronics.

For instance, In May 2024, BCM Sensor achieved a significant advancement in the field of pressure measurement technologies. They introduced the “Model 500G Piezoresistive Gauge Pressure Sensors”, a product that leverages the innovative use of SE206 silicon strain gauge chips. These chips are uniquely bonded using a glass sintering technique that enhances the sensor’s durability and reliability under varied environmental conditions.

Technological advancements in material science and microfabrication have also played a significant role in the growth of the Piezoresistive Strain Gauge segment. Innovations such as the development of silicon-based strain gauges have improved the sensitivity and durability of these sensors, boosting their performance in extreme environments.

Economic factors also contribute to the dominance of the Piezoresistive Strain Gauge segment. The production process for piezoresistive strain gauges has become more cost-effective due to advancements in manufacturing techniques, which has lowered the barriers to entry for new players and expanded the market.

Pressure Type Analysis

In 2023, the Absolute Pressure segment held a dominant market position within the pressure transducer market, capturing more than a 41.8% share. Absolute pressure transducers are crucial for their ability to provide accurate pressure readings that are not influenced by fluctuations in ambient atmospheric pressure.

This attribute makes them particularly valuable in applications where precision is paramount, such as in scientific research and high-tech manufacturing processes. The stability and reliability of these sensors in delivering true pressure readings ensure their extensive deployment across critical sectors.

The leading status of the Absolute Pressure segment can also be attributed to its essential role in industries like aerospace and automotive. In these sectors, absolute pressure transducers are used for monitoring engine health, fuel system pressures, and cabin pressurization. Their ability to operate effectively under varying environmental conditions ensures safety and efficiency, which are critical in these applications.

For instance, In April 2023, Continental took a significant step by initiating the production of Tire Pressure Monitoring Systems (TPMS) for passenger vehicles at their facility in Bengaluru, India. This strategic move not only taps into the growing automotive market in Asia but also aligns with the increasing global demand for automotive safety technologies. The system that Continental is producing provides crucial, real-time data on tire conditions, including motion detection, temperature, and pressure, thereby enhancing driver safety and vehicle efficiency.

These transducers are integral in IoT systems for environmental monitoring, HVAC systems, and smart grids where precise pressure data is necessary for system optimization and predictive maintenance. As IoT applications continue to expand, the demand for absolute pressure transducers is expected to surge, reinforcing their market dominance.

End-Use Industry Analysis

In 2023, the Automotive segment held a dominant position in the Pressure Transducer market, capturing more than a 28.9% share. This leadership can be attributed to the critical role that pressure transducers play in automotive manufacturing and maintenance.

These devices are essential for monitoring and controlling fluid pressures, which is vital for the effective operation of vehicle hydraulic systems, fuel systems, and oil pressures. As automotive manufacturers continue to innovate with more advanced and efficient vehicle technologies, the demand for precise and reliable pressure measurement solutions has surged, further bolstering this segment’s market share.

The Consumer Electronics sector also utilizes pressure transducers, although its market share is less pronounced compared to Automotive. In consumer electronics, these devices are primarily used in smartphones and wearable technologies to enhance features like GPS tracking and altitude detection. However, the lower market penetration in this sector is due to the limited scope of application and the smaller size of components, which often require specialized, miniaturized pressure sensors.

For instance, In June 2024, Baker Hughes introduced three innovative sensor technologies – T5MAX Transducer, HygroPro XP, and XMTCpro. These advancements are set to revolutionize the energy and industrial sectors, particularly in hydrogen applications. The T5MAX Transducer excels in gas measurement, while the HygroPro XP focuses on moisture control, and the XMTCpro enhances flow monitoring.

Healthcare is another significant end-use industry for pressure transducers. These devices are critical for various medical equipment such as blood pressure monitors, respiratory machines, and infusion pumps. The need for high precision and reliability in medical measurements drives the demand in this sector. Nonetheless, the complex regulatory environment and the need for extensive certification processes slightly hamper the faster adoption of new technologies in healthcare compared to the automotive sector.

Key Market Segments

By Technology

- Piezoresistive Strain Gauge

- Capacitance

- Other Technologies

By Pressure Type

- Gauge Pressure

- Absolute Pressure

- Differential Pressure

By End-Use Industry

- Consumer Electronics

- Healthcare

- Industrial

- Automotive

- Oil and Gas

- Other End-Use Industries

Driver

The Automation Imperative in Industry

As industries gravitate towards automation, the importance of pressure transducers has soared, primarily due to their role in enhancing operational efficiency and safety. These devices are integral to the automation ecosystem, providing critical pressure data that helps maintain and optimize processes.

In sectors like manufacturing, oil and gas, chemical processing, and automotive, pressure transducers contribute to machinery regulation, minimizing downtime and honing product quality. Their ability to integrate into automated systems for real-time data collection supports predictive maintenance strategies and reduces the risk of unexpected failures. This trend towards automated solutions underscores a robust driver for the growing demand in the pressure transducer market.

Restraint

The Cost Barrier in Advanced Pressure Transducers

Despite their critical role in industrial applications, the adoption of advanced pressure transducers is hindered by their high costs. These high-end models, known for precision and digital outputs, are often unaffordable for small and medium-sized enterprises (SMEs) operating on tight budgets.

The significant financial outlay for these sophisticated devices, along with the expertise required for calibration and installation, escalates operational expenses. This financial strain can discourage organizations from investing in comprehensive monitoring systems, thus restraining market growth, especially among cost-sensitive sectors.

Opportunity

Expanding Horizons with Multivariable Pressure Transducers

The surge in demand for multivariable pressure transducers is reshaping the market landscape. These innovative devices measure differential pressure, static pressure, and temperature simultaneously, delivering a holistic view of system performance with just one instrument.

This capability not only streamlines system architecture by reducing the need for multiple sensors but also significantly enhances process efficiency. Key industries such as oil and gas, chemical processing, and power generation are reaping the benefits of these transducers for better control and monitoring of intricate operations.

The push towards smarter manufacturing and Industry 4.0 underscores the growing importance of multivariable transducers, marking a lucrative opportunity for market players to innovate and capture emerging needs.

Challenge

Navigating Market Pressures from Unorganized Sectors

The pressure transducer market is also navigating turbulence caused by unorganized and gray market players. These entities disrupt the market dynamics by offering low-cost alternatives that often compromise on quality and reliability. Their presence instigates fierce price wars, forcing established manufacturers to lower prices, which can dilute profit margins and curtail investments in innovation and development.

Customers lured by cheaper prices may face increased operational failures and maintenance issues, tarnishing the industry’s overall reputation. For mainstream players, the strategy to counteract this challenge lies in emphasizing superior product quality, innovative solutions, and exceptional after-sales support to distinguish themselves from competitors and sustain their market position.

Emerging Trends

One notable trend is the integration of advanced materials like nanomaterials and flexible substrates. These materials enhance sensor accuracy and reliability, enabling new applications and improving overall sensor performance.

Another development is the miniaturization of sensors. Smaller, more compact sensors are easier to integrate into various systems, especially in industries like healthcare and consumer electronics, where space is limited.

Additionally, the development of implantable pressure transducers is gaining traction, particularly in medical applications like continuous intraocular pressure monitoring for glaucoma patients. These devices allow for early diagnosis and more effective treatment.

Business Benefits

Pressure transducers offers several business benefits, enhancing operational efficiency, safety, and cost-effectiveness. In manufacturing, for instance, they help maintain optimal pressure levels in equipment, ensuring consistent product quality and reducing waste. In the oil and gas industry, they monitor pipeline pressures to prevent leaks and ensure efficient transport of resources.

Pressure transducers provide real-time data that can trigger automatic shutdowns or alerts when pressure levels exceed safe limits, preventing accidents and equipment damage. For example, in chemical processing plants, they help in monitoring reactor pressures to avoid hazardous situations.

Modern pressure transducers often come equipped with digital interfaces, allowing for seamless integration into data acquisition systems. This integration facilitates real-time data analysis, enabling businesses to make informed decisions quickly. In the automotive industry, for example, pressure transducers monitor tire and engine oil pressures, providing data that enhances vehicle performance and safety.

Regional Analysis

In 2023, North America held a dominant market position in the global pressure transducer sector, capturing more than a 36.1% share with revenues reaching USD 3.2 billion.

This significant market share is primarily driven by the advanced industrial and technological landscape of the region, particularly in the United States and Canada, where there is a high adoption of automation and control systems across various sectors including automotive, aerospace, and manufacturing.

The leadership of North America in the pressure transducer market is also bolstered by substantial investments in research and development. These investments facilitate ongoing technological advancements in sensor technology, improving their accuracy, reliability, and range of applications. The presence of major global players in the region who are continually innovating and expanding their product portfolios contributes heavily to the market growth and dominance.

Furthermore, regulatory policies in North America that mandate the use of pressure transducers in critical safety and environmental monitoring applications significantly drive the demand in this region. For instance, stringent standards for emissions and safety in the automotive and industrial sectors boost the integration of advanced sensing technologies, including pressure transducers.

Economic stability and increasing emphasis on quality in sectors like healthcare, where precise monitoring is vital, are driving the growth of the pressure transducer market in North America. The rapid adoption of advanced devices for patient monitoring highlights the region’s market leadership.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the landscape of the pressure transducer market, Honeywell International Inc. stands out as a prominent leader. Renowned for their innovative approach, Honeywell’s pressure transducers are distinguished by their reliability and precision. These devices are widely used across various industries, including aerospace, automotive, and manufacturing, due to their robust performance in harsh environments.

Another significant player in the pressure transducer market is ABB Group. ABB’s expertise in automation and electrical technologies lends itself well to the development of advanced pressure transducer systems that are integral to industrial processes. Their products are celebrated for their accuracy and durability, making them a preferred choice for critical applications in sectors like energy, utilities, and transportation.

Siemens AG also commands a strong presence in the pressure transducer market with its comprehensive range of sensor and automation technologies. Siemens pressure transducers are known for their precision engineering and adaptability across various applications, from simple machinery to complex process industries.

Top Opportunities Awaiting for Players

The pressure transducer market is witnessing a surge of most promising opportunities for market players:

- Automotive Sector: The automotive industry remains a significant driver of demand for pressure transducers. These devices are crucial for enhancing vehicle efficiency, safety, and meeting stringent emission standards. They are extensively used for monitoring engine parameters and improving the safety features like tire pressure monitoring systems.

- Wireless Technology: There is a growing trend towards wireless pressure sensors, which are favored for their portability, safety, and cost-effectiveness. The adoption of wireless technology is expanding in industrial automation, consumer products, and other sectors, offering new growth avenues for the market.

- Industrial Applications: The industrial sector is anticipated to experience rapid growth. Pressure sensors are increasingly used for monitoring process flows and are critical in applications requiring precise measurements such as in transmissions and oil & gas equipment.

- Consumer Electronics and IoT: The rising integration of pressure sensors in consumer electronics and smart devices is opening up new markets. These sensors are becoming indispensable in smart home systems, wearables, and other IoT devices, which require sophisticated monitoring and control functions.

- Healthcare Applications: The medical field also presents lucrative opportunities for the use of pressure transducers, particularly in sophisticated diagnostic and monitoring equipment. This sector’s demand is driven by the growing need for accurate health monitoring systems.

Top Key Players in the Market

- Honeywell International Inc.

- ABB Group

- Siemens AG

- Schneider Electric SE

- Emerson Electric Co.

- Yokogawa Electric Corporation

- Omega Engineering, Inc.

- TE Connectivity

- AMETEK, Inc.

- Sensata Technologies, Inc.

- Other Key Players

Recent Developments

- In May 2024, Parker Hannifin, a global leader in motion and control technologies, introduced the SCP09 pressure sensor with an OEM pin configuration. This sensor is designed to meet the needs of hydraulic applications, offering reliability and versatility. With its advanced features, the SCP09 aims to enhance performance, improve durability, and cater to a wide range of industrial requirements.

- In April 2023, Continental has commenced the production of Tire Pressure Monitoring Systems (TPMS) for passenger vehicles at its Bengaluru facility in India. This advanced technology ensures drivers receive precise real-time data on tire pressure, temperature, and motion detection, enhancing safety and vehicle performance.

Report Scope

Report Features Description Market Value (2023) USD 8.9 Bn Forecast Revenue (2033) USD 25.3 Bn CAGR (2024-2033) 11.00% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (Piezoresistive Strain Gauge, Capacitance, Other Technologies), By Pressure Type (Gauge Pressure, Absolute Pressure, Differential Pressure), By End-Use Industry (Consumer Electronics, Healthcare, Industrial, Automotive, Oil and Gas, Other End-Use Industries) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Honeywell International Inc., ABB Group, Siemens AG, Schneider Electric SE, Emerson Electric Co., Yokogawa Electric Corporation, Omega Engineering, Inc., TE Connectivity, AMETEK, Inc., Sensata Technologies, Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pressure Transducer MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

Pressure Transducer MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Honeywell International Inc.

- ABB Group

- Siemens AG

- Schneider Electric SE

- Emerson Electric Co.

- Yokogawa Electric Corporation

- Omega Engineering, Inc.

- TE Connectivity

- AMETEK, Inc.

- Sensata Technologies, Inc.

- Other Key Players