Global Pressure Control Equipment Market Based on Component(Valves, Control Heads, Quick Unions, Wellhead Flanges, Adapter Flanges, Christmas Trees), Based on Type(High Pressure, Low Pressure), Based on Application(Onshore, Offshore), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 100569

- Number of Pages: 213

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

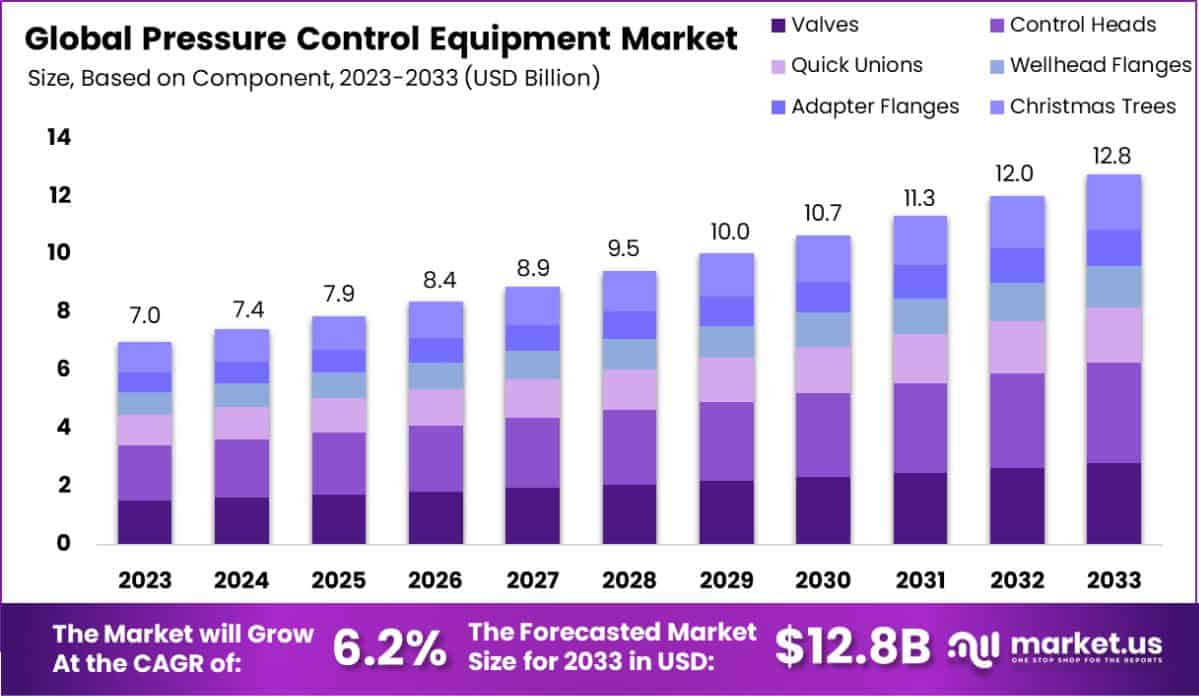

The Global Pressure Control Equipment Market is expected to be worth around USD 12.8 billion by 2033, up from USD 7.0 billion in 2023, growing at a CAGR of 6.2% during the forecast period from 2024 to 2033.

Pressure control equipment consists of devices and assemblies designed to manage and regulate the pressure of fluids, typically in oil and gas drilling operations. These are essential for maintaining optimal performance and safety standards in high-pressure environments, helping to manage the flow and prevent blowouts by sealing the wellbore.

The Pressure Control Equipment Market encompasses the production and distribution of devices essential for managing fluid pressures in oil and gas extraction environments. This market is critical for ensuring operational safety and efficiency in the energy sector, particularly in drilling activities.

The market is growing due to increasing energy demands globally and the expansion of exploratory and drilling activities in tougher, high-pressure environments. Technological advancements are also enabling more precise pressure control, which is crucial for reducing operational risks and enhancing efficiency.

Demand for pressure control equipment is driven by the critical need for safety and regulatory compliance in oil and gas operations. As companies push into more challenging extraction environments, the requirement for reliable and robust pressure management solutions escalates.

The market sees significant opportunities in innovations that offer enhanced safety features and improved environmental compliance. Additionally, as renewable energy technologies evolve, pressure control equipment adapted for these new contexts could expand market reach, tapping into green energy and offshore wind sectors.

The Pressure Control Equipment Market plays a pivotal role in the global oil and gas industry, especially given the rigorous safety standards and operational challenges associated with offshore drilling. Recent data underscores the criticality of robust pressure control systems.

Between 2017 and 2021, a notable 4,633 well control equipment failure events were documented, with a significant concentration of 389 events in 2021 alone, as per the Well Control Equipment Systems Safety Report published by rosap.ntl.bts.gov. This data signals an urgent need for advancements in equipment reliability, particularly in high-risk offshore environments like the Gulf of Mexico.

The statistics further reveal that a majority, 63.5%, of blowout preventer (BOP) days were associated with subsea systems, which were also responsible for 92.7% of reported failure events over the last five years.

These figures not only highlight the substantial dependency on subsea well control equipment but also reflect the significant market demand for innovative solutions that enhance safety and efficiency in these critical operations.

Given this backdrop, the market is ripe for disruptive innovation aimed at increasing the safety and operational efficacy of subsea BOP systems. The opportunity lies in leveraging cutting-edge technology to develop more reliable and efficient pressure control mechanisms, thereby addressing the pressing safety concerns and regulatory compliance needs in offshore drilling operations.

This strategic focus can potentially lead to a substantial growth trajectory for industry players in the Pressure Control Equipment Market.

Key Takeaways

- The Global Pressure Control Equipment Market is expected to be worth around USD 12.8 billion by 2033, up from USD 7.0 billion in 2023, growing at a CAGR of 6.2% during the forecast period from 2024 to 2033.

- In 2023, Control Heads held a dominant market position in the Based on Component segment of the Pressure Control Equipment Market, with a 27.1% share.

- In 2023, High Pressure held a dominant market position in the Based on Type segment of the Pressure Control Equipment Market, with a 61.2% share.

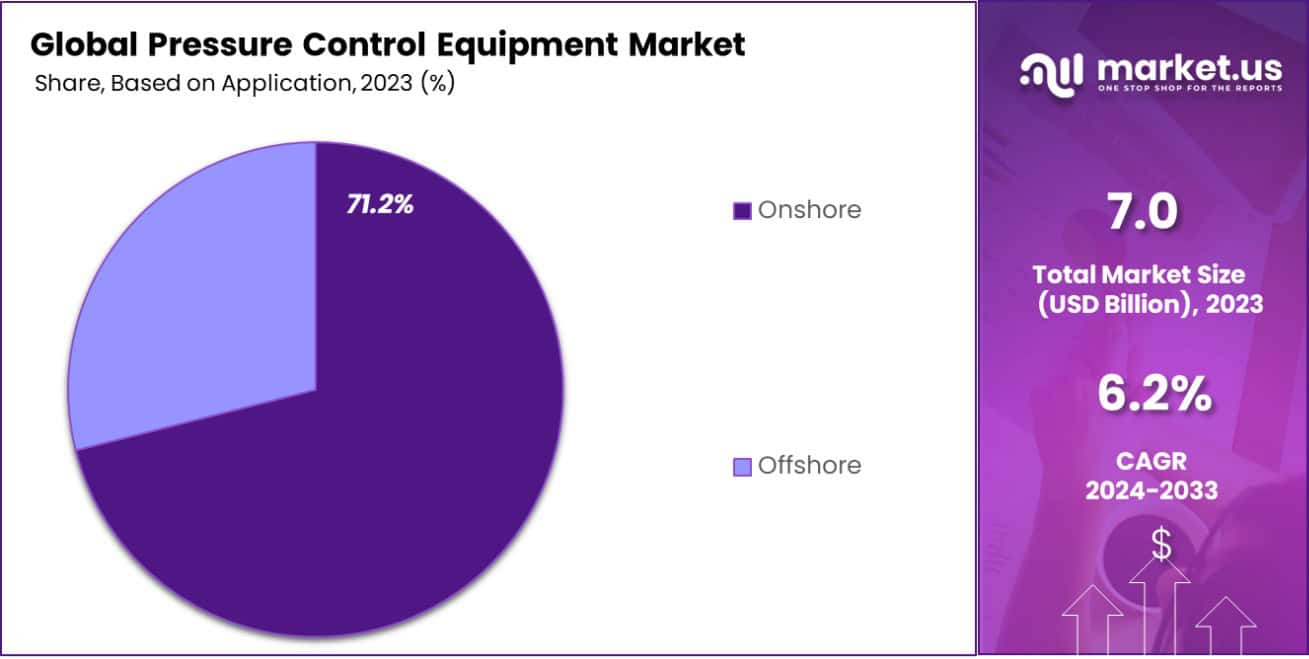

- In 2023, Onshore held a dominant market position in the Based on Application segment of the Pressure Control Equipment Market, with a 71.2% share.

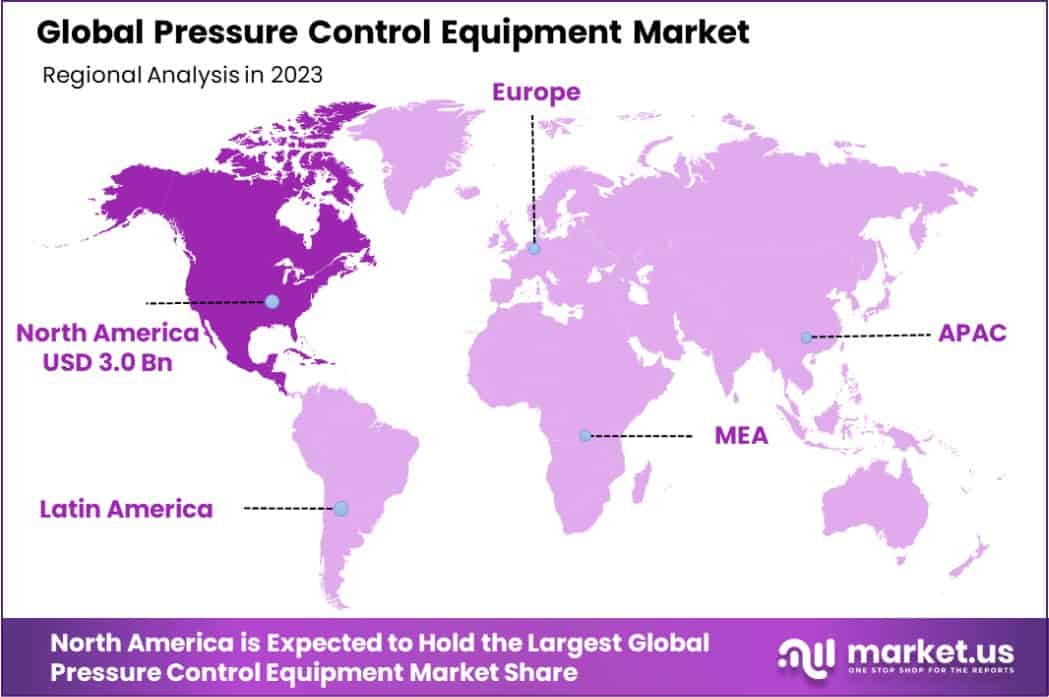

- North America dominated a 44.1% market share in 2023 and held USD 3.0 Billion in revenue from the Pressure Control Equipment Market.

Based on Component Analysis

In 2023, Control Heads held a dominant market position in the Based on Component segment of the Pressure Control Equipment Market, commanding a 27.1% share. This segment includes valves, control heads, quick unions, wellhead flanges, adapter flanges, and Christmas trees.

Control heads are critical in managing the flow and pressure within the oil and gas extraction systems, particularly in scenarios requiring precise control and safety.

Their prominence in the market can be attributed to their essential role in enhancing operational efficiency and safety across both onshore and offshore drilling operations.

The substantial market share of control heads is reflective of the ongoing technological advancements that improve their functionality and reliability, making them indispensable in modern extraction processes.

Additionally, the increase in drilling activities in challenging environments, such as deepwater and ultra-deepwater locations, further drives the demand for reliable control heads.

These components are crucial for ensuring the integrity and safety of high-pressure operations, thereby continuing to bolster their adoption and market growth within the broader pressure control equipment landscape.

Based on Type Analysis

In 2023, High Pressure held a dominant market position in the Based on Type segment of the Pressure Control Equipment Market, with a 61.2% share. This segment encompasses both high and low-pressure equipment, with high-pressure systems particularly crucial in demanding environments such as deepwater drilling and unconventional resource extraction.

The significant share of high-pressure systems underscores their essential role in ensuring safety and operational efficiency in such challenging conditions.

High pressure equipment is designed to manage and control extreme pressures encountered during the drilling and extraction processes, preventing blowouts and ensuring the integrity of wellbores. The need for these systems is increasingly critical as the industry pushes into more complex and high-pressure reservoirs to meet global energy demands.

The robust market share of high-pressure systems reflects their indispensability in maintaining operational continuity and adherence to stringent safety standards.

As exploration and production activities continue to explore deeper geological formations, the reliance on high-pressure equipment is expected to remain strong, driving sustained growth and innovation in this market segment.

Based on Application Analysis

In 2023, Onshore held a dominant market position in the Based on Application segment of the Pressure Control Equipment Market, with a 71.2% share. This segment includes both onshore and offshore applications, with onshore operations commanding the larger portion due to their extensive range and the higher number of onshore drilling activities globally.

The significant share of onshore applications highlights the ongoing demand for pressure control equipment in traditional oil and gas extraction areas, which remain pivotal to meeting the world’s energy needs.

Onshore drilling environments, while typically less extreme than their offshore counterparts, still require robust pressure control systems to manage the operational complexities and safety requirements of modern extraction techniques.

The dominance of onshore applications is further supported by the lower cost of operations and easier accessibility compared to offshore settings, making it a more attractive option for many operators.

As the industry continues to innovate and improve the efficiency and safety of onshore drilling operations, the demand for advanced pressure control equipment in these settings is expected to sustain, if not increase, reinforcing the sector’s significant market share.

Key Market Segments

Based on Component

- Valves

- Control Heads

- Quick Unions

- Wellhead Flanges

- Adapter Flanges

- Christmas Trees

Based on Type

- High Pressure

- Low Pressure

Based on Application

- Onshore

- Offshore

Drivers

Pressure Control Equipment Market Drivers

The demand for pressure control equipment is primarily driven by the escalating need for safety and efficiency in oil and gas operations. As exploration and production extend into more challenging environments, such as deepwater locations, the complexities of managing high pressures and preventing blowouts increase.

This necessity is further compounded by stringent safety regulations, which mandate the use of advanced equipment to safeguard both personnel and environments. Additionally, the global increase in energy consumption prompts the expansion of drilling service activities, boosting the need for reliable pressure control solutions.

These factors collectively enhance market growth, emphasizing the critical role of these systems in maintaining operational integrity and regulatory compliance in the energy sector.

Restraint

Market Constraints: Pressure Control Equipment

One major restraint in the Pressure Control Equipment Market is the high cost of advanced pressure control systems. These technologies are essential for ensuring safety and efficiency in oil and gas operations, particularly in challenging environments like deepwater drilling.

However, their development and implementation involve significant investment in research, design, and compliance testing, which can deter adoption among companies, especially smaller or budget-conscious operators. Additionally, the volatility of oil prices can impact the financial stability of these companies, making them hesitant to invest in expensive new technologies.

This price sensitivity is crucial in regions where cost management is as important as operational safety, potentially slowing down market growth.

Opportunities

Growth Opportunities in the Pressure Control Market

The Pressure Control Equipment Market is poised for growth opportunities driven by the increasing adoption of automation and digital technologies in the oil and gas industry.

As operations become more complex and remote, the integration of IoT and real-time data monitoring in pressure control systems offers significant potential to enhance safety, operational efficiency, and decision-making processes.

This technological advancement not only improves the responsiveness of pressure control equipment but also extends its functionality and effectiveness in extreme conditions.

Additionally, the shift towards renewable energy sources and the exploration of new energy frontiers, such as offshore deepwater and shale reserves, opens up further opportunities for market expansion, providing a robust demand for innovative pressure control solutions.

Challenges

Operational Challenges in the Pressure Equipment Market

The Pressure Control Equipment Market faces several challenges, primarily related to the environmental and operational risks associated with oil and gas extraction.

handling extreme pressures and hostile conditions in offshore and unconventional extraction sites demands highly reliable and durable equipment. However, the frequent updates in safety regulations and standards necessitate continuous modifications and upgrades to existing systems, adding to operational complexities and costs.

Additionally, the market is impacted by the cyclical nature of the oil and gas industry, where fluctuating oil prices can drastically affect investment in new technologies and equipment. These factors create a challenging environment for market players, requiring constant innovation and adaptability to maintain competitiveness and compliance.

Growth Factors

Key Growth Drivers for Pressure Control

The Pressure Control Equipment Market is primarily driven by the ongoing need for enhanced safety and operational efficiency in the oil and gas industry. As global energy demands increase, there is a corresponding rise in drilling activities, especially in challenging environments like deepwater and ultra-deepwater locations.

This expansion necessitates robust pressure control systems to manage high-pressure wells safely. Moreover, advancements in technology are enabling the development of more sophisticated and reliable equipment, which can handle the complexities of modern extraction methods more effectively.

Regulatory pressures also play a significant role, as stricter safety standards require operators to invest in the latest equipment to ensure compliance. These factors together foster substantial growth in the demand for pressure control equipment across the industry.

Emerging Trends

Emerging Trends in Pressure Control Market

The Pressure Control Equipment Market is witnessing significant trends that are shaping its future. A prominent trend is the integration of digital technologies, such as the Internet of Things (IoT), which enhances the functionality and efficiency of pressure control systems through real-time monitoring and predictive maintenance.

This shift towards digitalization helps in preempting equipment failures and optimizing performance, particularly in remote and harsh drilling environments. Additionally, there’s a growing emphasis on developing eco-friendly and sustainable equipment to align with global environmental standards and reduce the ecological footprint of drilling operations.

Another emerging trend is the increasing investment in R&D to produce more adaptable and resilient systems capable of withstanding extreme conditions, further driving innovation in this field.

Regional Analysis

In 2023, the Pressure Control Equipment Market saw significant activity across various regions, with North America emerging as the dominant player, capturing 44.1% of the global market and generating revenues of USD 3.0 billion.

This prominent market share can be attributed to the extensive oil and gas exploration and production activities in the region, particularly in the United States and Canada, where there is a high demand for advanced pressure control solutions to manage the complexities of both onshore and offshore operations.

Europe and Asia Pacific also showed substantial market engagement, driven by increasing energy demands and the development of new oil and gas fields, particularly in emerging economies such as China and India. However, these regions still trail behind North America in terms of market share and technological adoption.

Meanwhile, the Middle East & Africa, and Latin America are gradually expanding their market presence, fueled by the exploration of new reserves and the modernization of their oil and gas infrastructure.

These regions are focusing on adopting cutting-edge technologies to enhance their operational efficiencies and safety standards, presenting a significant growth opportunity for the pressure control equipment market in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Pressure Control Equipment Market, three key players, Brace Tool, Schlumberger Limited, and National Oilwell Varco, have significantly influenced the market dynamics in 2023.

Brace Tool specializes in designing and smart manufacturing specialized downhole equipment for the oil and gas industry. In 2023, Brace Tool continued to innovate within the pressure control sector by introducing advanced downhole tools that offer enhanced reliability and performance in extreme conditions.

Their focused approach to custom solutions and their agility in responding to specific field requirements have helped them maintain a strong position in niche markets.

Schlumberger Limited, as a leading provider of technology and services in the energy sector, has consistently driven the market forward with its comprehensive range of pressure control solutions.

In 2023, Schlumberger’s investment in research and development led to the introduction of new, more efficient pressure management systems, which are crucial for improving safety and efficiency in increasingly complex drilling environments.

Their global footprint and robust supply chain have allowed them to effectively meet the rising global demand and maintain their market leadership.

National Oilwell Varco (NOV) is known for its engineering prowess and broad portfolio of products that cater to all aspects of oil and gas drilling operations. In 2023, NOV expanded its pressure control offerings by incorporating more automated and digital technologies, which help operators reduce downtime and optimize performance.

NOV’s strategy of integrating smart technologies into their pressure control equipment is a response to the industry’s growing emphasis on safety and operational data analytics.

Overall, these companies are not only advancing their technological capabilities but are also strategically positioning themselves to take advantage of emerging market trends such as digitalization and automation in the oil and gas industry.

Top Key Players in the Market

- Baker Hughes

- Hunting PLC

- Control Flow, Inc.

- Brace Tool

- Schlumberger Limited

- National Oilwell Varco

- TIS Manufacturing

- Weatherford International plc

- Lee Specialties

- Emerson Electric Co.

- IKM Pressure Control AS

- Other Key Players

Recent Developments

- In June 2024, Control Flow, Inc. received significant funding to develop a next-generation valve system that promises to improve operational safety in high-pressure environments. The funding will also support expanded production capabilities.

- In March 2024, Hunting PLC acquired a smaller competitor specializing in advanced pressure control solutions. This strategic move aims to broaden their market reach and enhance their technological offerings in the pressure control sector.

- In January 2024, Baker Hughes expanded its pressure control portfolio by launching a new line of digitally enhanced BOP systems. These systems are designed to increase the safety and efficiency of oil and gas operations by integrating real-time monitoring capabilities.

Report Scope

Report Features Description Market Value (2023) USD 7.0 Billion Forecast Revenue (2033) USD 12.8 Billion CAGR (2024-2033) 6.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Based on Component(Valves, Control Heads, Quick Unions, Wellhead Flanges, Adapter Flanges, Christmas Trees), Based on Type(High Pressure, Low Pressure), Based on Application(Onshore, Offshore) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Baker Hughes, Hunting PLC, Control Flow, Inc., Brace Tool, Schlumberger Limited, National Oilwell Varco, TIS Manufacturing, Weatherford International plc, Lee Specialties, Emerson Electric Co., IKM Pressure Control AS, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pressure Control Equipment MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

Pressure Control Equipment MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Baker Hughes

- Hunting PLC

- Control Flow, Inc.

- Brace Tool

- Schlumberger Limited

- National Oilwell Varco

- TIS Manufacturing

- Weatherford International plc

- Lee Specialties

- Emerson Electric Co.

- IKM Pressure Control AS

- Other Key Players