Global Preimplantation Genetic Testing Market By Procedure Type (Preimplantation Genetic Screening, Preimplantation Genetic Diagnosis) By Product Type(Reagents and Consumables, Instruments, Software);By Technology(Next Generation Sequencing (NGS), Polymerase Chain Reaction (PCR), Other Technologies)By Application(Chromosomal Abnormalities, Aneuploidy Screening, X-linked Diseases, Other Applications)By End-User(Hospitals, Fertility Centers, Diagnostic Centers,and other) By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: July 2024

- Report ID: 12405

- Number of Pages: 206

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

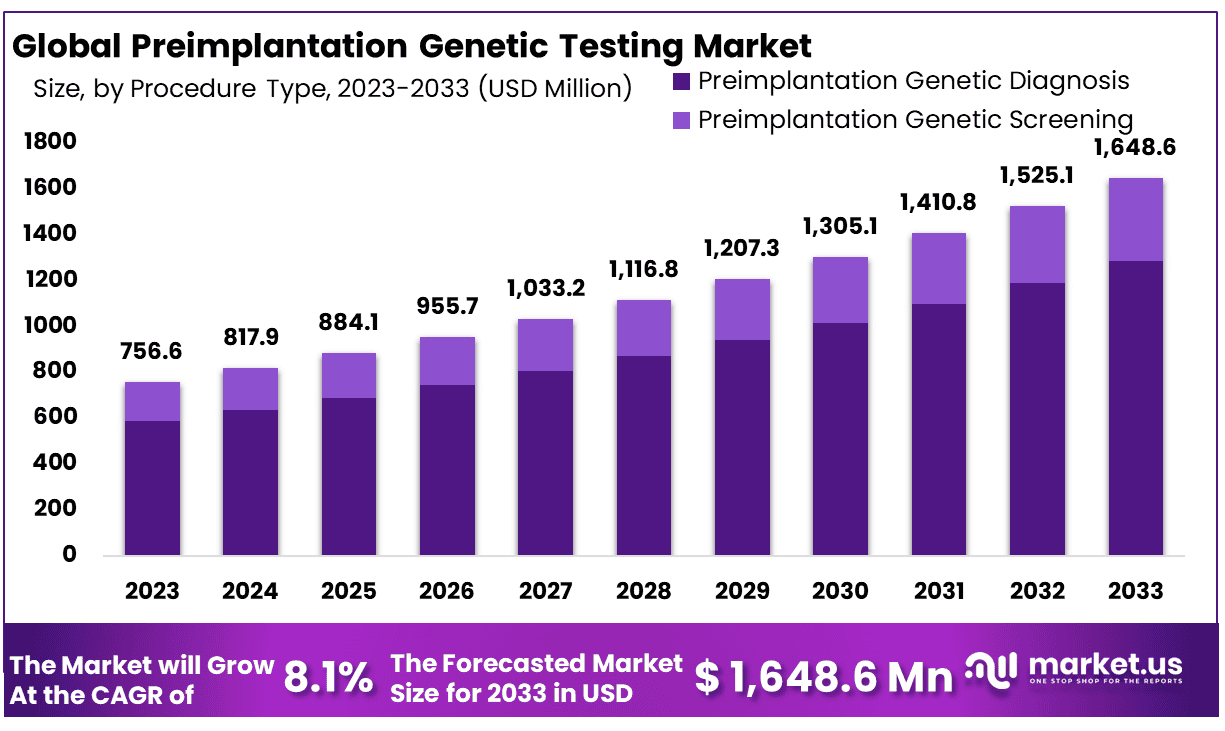

The Global Preimplantation Genetic Testing Market size is expected to be worth around USD 1648.6 Million by 2033 from USD 756.6 Million in 2023, growing at a CAGR of 8.1% during the forecast period from 2024 to 2033.

Preimplantation genetic testing, also referred to as preimplantation genetic diagnosis, involves screening embryos produced through in vitro fertilization for genetic abnormalities prior to being implanted into uteruses. Medical professionals perform this screening test so as to detect genetic flaws within embryos so as to implant only healthy ones into gestationsal sacs – with its primary goal being increasing likelihood of successful pregnancy while decreasing risks passed from parentage through inheritance of genetic conditions and passing them down through offspring.

Preimplantation involves different procedures including egg harvesting from either mother or donor eggs then followed by in vitre fertilization followed by in vitreation before final implantation occurs resulting in vitro fertilization followed by in vitreation with final resultant embryo resulting from fertilization followed by in vitre fertilization of resultant embryos during in utero.

Post-fertilization, eggs are subject to screening to detect genetic abnormalities. Viable embryos may be preserved through freezing while nonviable ones must be discarded; implanting healthy embryos is paramount in order to achieve successful pregnancy; preimplantation genetic testing also offers gender selection but this presents ethical concerns; nonetheless many individuals dealing with sexually linked genetic conditions, single gene donors with chromosomal problems seeking pregnancy as well as older women and those experiencing repeated abortions increasingly seek this therapeutic option for infertility issues are turning towards preimplantation genetic testing as a treatment option as an aid against infertility.

Key Takeaways

- Market Size & Growth: Preimplantation Genetic Testing Market size is expected to be worth around USD 1648.6 Million by 2033 from USD 756.6 Million in 2023, growing at a CAGR of 8.1%.

- By Procedure Type: In 2023, Preimplantation Genetic Diagnosis held approximately 78% of market revenue share.

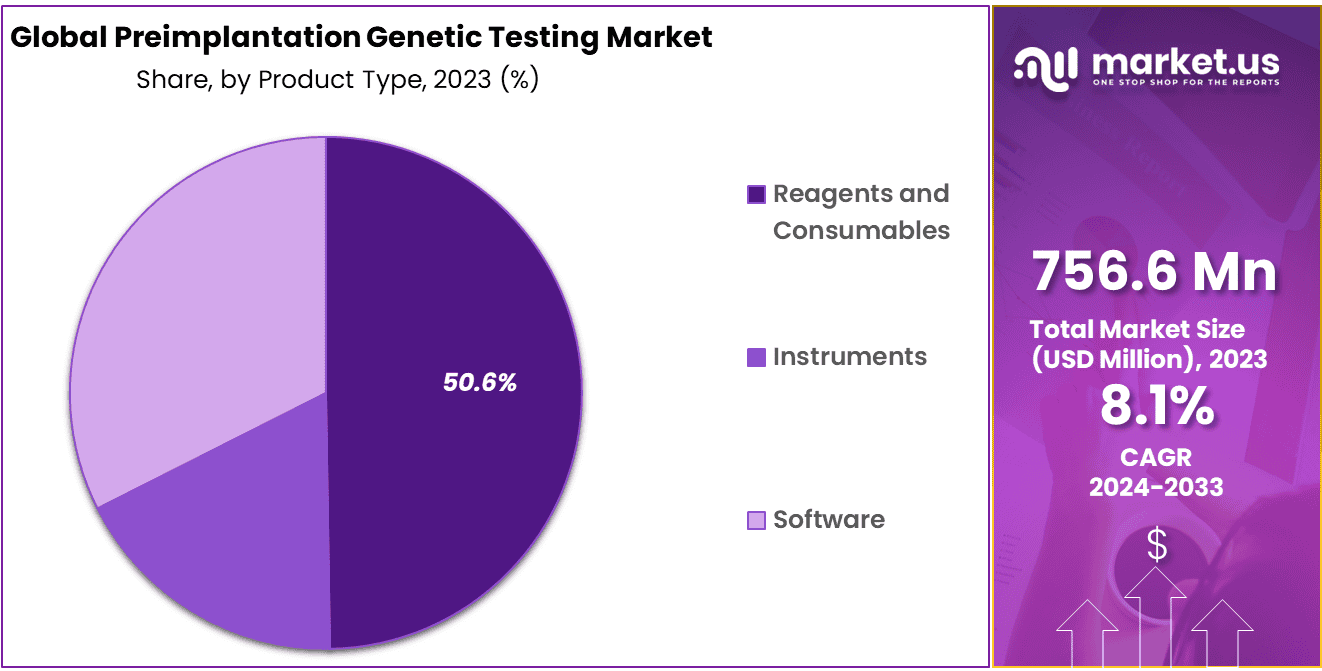

- By Product Type: In 2023, reagent & consumables represented 50.6% of revenue share.

- By Technology: Polymerase chain reaction (PCR) held the highest revenue share at 40.6% in 2023

- By Application: Aneuploidy screening dominated the preimplantation genetic testing market in 2023, accounting for 26.8% of its revenue share

- By End-User: The hospital segment accounted for the highest revenue share of around 40% in 2023

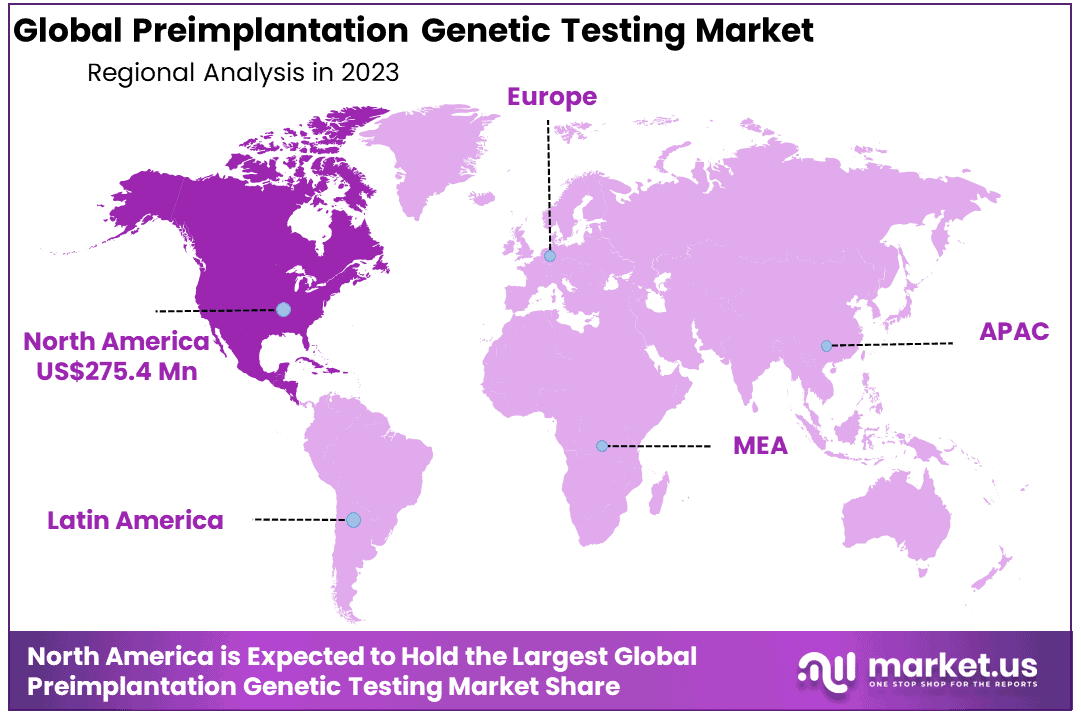

- Regional Analysis: North America secured 36.4% market share and contributed USD 275.4 Million revenue in 2023.

By Procedure Type

In 2023, Preimplantation Genetic Diagnosis held approximately 78% of market revenue share and projected to experience the fastest compound annual growth rate during its forecast period. This segment’s growth can be attributed to increasing awareness among healthcare professionals and consumers regarding genetic testing for specific gene mutations.

This segment’s growth has been propelled by an increased incidence of single gene diseases and translocation cases, coupled with market entities’ effective implementation of Next-Generation Sequencing (NGS) technology. Preimplantation Genetic Diagnosis (PGD) services play an essential role in screening embryos to detect specific gene mutations that contribute to decreased instances of genetic diseases in newborns.

Preimplantation Genetic Screening (PGS) services involve screening embryos for any chromosomal abnormalities. PGS screening services are recommended for couples of advanced reproductive age, multiple In Vitro Fertilization (IVF) cycles and repeated miscarriages, or those experiencing repeated pregnancy loss. Due to continually rising demand and advancements in IVF procedures, PGS services look set for lucrative growth in the forecast period. Furthermore, high capacity laboratories that conduct many IVF processes ensure superior PGS services further fueling this growth segment’s expansion.

By Product Type

In 2023, reagent & consumables represented 50.6% of revenue and were projected to experience the fastest compound annual growth rate through 2033. PGT’s rising adoption in In Vitro Fertilization (IVF) processes has driven its escalation, leading to over 2.7 million cycles per year and over 500,000 deliveries via IVF yearly – propelling demand for PGT-related consumables such as next-generation sequencing tests such as polymerase chain reaction or fluorescent in-situ hybridization which will continue its upward trajectory in growth over time.

Instruments held a second-largest share in the preimplantation genetic testing market in 2023, as market players continue to focus on developing advanced genetic testing instruments with accurate results. Furthermore, more hospitals and clinics offering IVF services is projected to drive demand for on-site preimplantation genetic testing of pregnancies requiring PGT services.

By Technology

Polymerase chain reaction (PCR) held the highest revenue share at 40.6% in 2023. This is attributable to its wide penetration, cost-effectiveness, and precision; all factors which contributed to its dominant market presence. PCR tests can generate multiple copies of specific genomic segments which increases chances of detecting chromosomal abnormalities within samples; furthermore its specificity and sensitivity make PCR an excellent method for various genetic diagnoses.

Next-Generation Sequencing (NGS) is projected to experience the fastest compound annual growth rate during its forecast period, thanks to its superior accuracy compared with other tests and ability to sequence large amounts of DNA rapidly. Technological advances have expanded NGS’ scope, enabling detection of additional chromosomal abnormalities.

By Application

Aneuploidy screening dominated the preimplantation genetic testing market in 2023, accounting for 26.8% of its revenue share, and is anticipated to show an unprecedented compound annual growth rate throughout its forecast period. Aneuploidy screening techniques are commonly used to evaluate embryo quality during In Vitro Fertilization (IVF). Their projected expansion can be attributed to the rising adoption of such techniques and innovative products entering the market.

HLA Typing was the second-highest market share holder in 2023. This was driven by preimplantation genetic testing, specifically embryo HLA typing for stem cell therapy; HLA typing provides crucial preimplantation genetic tests with higher survival rates compared to transplantation from unrelated donors; thus amplifying HLA testing’s importance in preimplantation genetic testing.

By End-User

The hospital segment accounted for the highest revenue share of around 40% in 2023. High patient inflow, improved healthcare infrastructure, and the presence of public and private hospitals offering IVF services are some of the major factors driving the segment’s growth. Mostly, couples who are seeking fertility treatment go to hospitals for further treatments, because of the highly advanced technology available at hospitals. In addition, the rise in research at hospitals is expected to increase testing rates in hospital settings. Moreover, the hospital segment is projected to experience the fastest growth in the coming years.

The fertility centers segment held the second-largest share of the preimplantation genetic testing industry in 2023. Improvement of healthcare infrastructure in fertility centers and technological advancements in testing services are expected to drive the growth of the segment in the forthcoming years.

Key Market Segments

Procedure Type

- Preimplantation Genetic Screening

- Preimplantation Genetic Diagnosis

Product Type

- Reagents and Consumables

- Instruments

- Software

Technology

- Next Generation Sequencing (NGS)

- Polymerase Chain Reaction (PCR)

- Fluorescent In-Situ Hybridization (FISH)

- Other Technologies

Application

- Chromosomal Abnormalities

- Aneuploidy Screening

- X-linked Diseases

- Embryo Testing

- HLA Typing

- Other Applications

End-User

- Hospitals

- Fertility Centers

- Diagnostic Centers

- Research Centers and Academic Labs

Drivers

Increased Adoption of Assisted Reproductive Technologies (ART)

Preimplantation Genetic Testing (PGT) market growth is being driven by increasing adoption of assisted reproductive technologies such as In Vitro Fertilization (IVF). With increasing numbers of individuals and couples turning to IVF for fertility solutions, PGT becomes an integral component in increasing its success rates; its ability to detect genetic abnormalities prior to implantation contributes significantly to better pregnancy outcomes.

Growing Awareness of and Innovations in Genetic Testing Technologies

Growing awareness among healthcare professionals and prospective parents about the benefits of genetic testing is driving its rise as an assessment tool. Technological advancements like Next-Generation Sequencing (NGS), Polymerase Chain Reaction (PCR), and Fluorescent In-Situ Hybridization (FISH), have enhanced accuracy and efficiency of PGT; becoming reliable methods of assessing embryo health. Trend: PGT adoption as reliable evaluation method has seen rapid increase over time.

Trend

An Aneuploidy Screening Boom and Expanded PGT Applications

One trend in the PGT market to watch out for is aneuploidy screening’s growing prevalence in IVF embryo quality evaluation, in line with increasing precision of fertility treatments. Furthermore, PGT applications are expanding beyond traditional genetic disorders to HLA typing for stem cell therapy to provide more holistic knowledge of embryonic health.

Integrating Artificial Intelligence (AI) Into Genetic Analysis

AI in genetic analysis represents a noteworthy trend. AI applications are now being employed to analyze vast datasets generated by genetic testing, making more precise and efficient identification of genetic abnormalities possible. Not only does this speed up analysis but it also aids with selecting healthy embryos for implantation more quickly. But this approach comes at a price there may be potential restrictions due to AI usage within genetic analysis itself.

Restraint

Ethical and Societal Concerns

Ethical and societal concerns surrounding genetic testing and manipulation of embryos present a major challenge to widespread adoption of PGT technologies. Concerns such as selecting specific traits for designer babies and disposing nonviable embryos generate controversy and often resist widespread implementation of these technologies.

Cost-Intensive Nature of PGT Procedures

Preimplantation Genetic Testing procedures can be prohibitively expensive, making them inaccessible for some individuals or couples. PGT involves advanced technologies and expertise which may incur higher expenses; thus limiting adoption in regions with limited financial resources or inadequate insurance coverage.

Opportunity

Expanding Applications of Personalized Medicine

One promising application of PGT lies in personalized medicine, with genetic testing technologies progressing and opening up opportunities for personalized treatments that match individual’s genetic makeup based on personalized healthcare interventions tailored specifically for them. PGT allows healthcare providers to identify genetic markers associated with diseases or conditions for more targeted care delivery.

Concentration on Male Infertility and Sperm Genetic Testing

There is an increasing opportunity in PGT’s landscape for male infertility and sperm genetic testing. While PGT traditionally focused on evaluating embryo genetic health, there has been increasing recognition of its value when applied to testing sperm quality and integrity – thus providing opportunities for creating advanced techniques to address male infertility comprehensively.

Regional Analysis

North America secured 36.4% market share and contributed USD 275.4 Million revenue to the global preimplantation genetics diagnosis (PGD) market in 2023, The rise of North America can be attributed to increasing healthcare expenditures coupled with an expanding population in this industry sector.

Massachusetts, Columbia and New Jersey stand out with high rates of births that resulted from assisted reproductive technology; this underlines their involvement and success with PGD solutions.

Key Regions and Countries

North America

- The US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Player Analysis

Industry players are taking steps to expand their presence across regional markets through various strategies, including the introduction of new products, acquisitions and collaborations. These endeavors should lead to improved product development capabilities, operational efficiencies and expanded market reach for those involved companies.

Key Market Players

- Quest Diagnostics Incorporated

- Natera, Inc.

- COOPER SURGICAL, INC.

- Genea Pty Limited.

- Invitae Corporation

- Laboratory Corporation of America Holdings

- Thermo Fisher Scientific Inc.

- Bioarray S.L.

- Illumina, Inc.

- F. Hoffmann-La Roche Ltd

Recent Developments

- Quest Diagnostics Incorporated (May 2024): Quest Diagnostics announced the acquisition of a leading genetic testing lab, enhancing its capabilities in preimplantation genetic testing (PGT). The acquisition aims to expand their portfolio of reproductive health services and improve the accuracy and accessibility of genetic testing for IVF procedures.

- Natera, Inc.(June 2024): Natera launched a new advanced PGT solution named Empower, designed to offer more precise and comprehensive genetic screening for IVF. Empower includes innovative technology for detecting genetic abnormalities, aiming to improve embryo selection and pregnancy outcomes.

- COOPER SURGICAL, INC.(April 2024): Cooper Surgical introduced its latest PGT platform, Genesis Plus, featuring enhanced automation and higher throughput capabilities. The new product is expected to streamline lab workflows and provide more reliable results, supporting clinics in delivering better reproductive health services.

- Genea Pty Limited (March 2024): Genea Pty Limited completed the merger with a prominent fertility clinic network, aiming to integrate advanced PGT services across its clinics. This merger is set to improve access to high-quality genetic testing and personalized fertility treatment plans for patients.

- Invitae Corporation (February 2024): Invitae Corporation acquired a cutting-edge PGT technology firm, strengthening its position in the reproductive genetics market. The acquisition will enable Invitae to offer more sophisticated and accurate genetic testing solutions, supporting better outcomes in IVF treatments.

Report Scope

Report Features Description Market Value (2023) USD 756.6 Million Forecast Revenue (2033) USD 1648.6 Million CAGR (2024-2033) 8.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Procedure Type-(Preimplantation Genetic Screening, Preimplantation Genetic Diagnosis) By Product Type-(Reagents and Consumables, Instruments, Software);By Technology-(Next Generation Sequencing (NGS), Polymerase Chain Reaction (PCR), Fluorescent In-Situ Hybridization (FISH), Other Technologies);By Application-(Chromosomal Abnormalities, Aneuploidy Screening, X-linked Diseases, Embryo Testing, HLA Typing, Other Applications);By End-User-(Hospitals, Fertility Centers, Diagnostic Centers, Research Centers and Academic Labs) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Quest Diagnostics Incorporated, Natera, Inc., COOPER SURGICAL, INC., Genea Pty Limited., Invitae Corporation, Laboratory Corporation of America Holdings, Thermo Fisher Scientific Inc., Bioarray S.L., Illumina, Inc., F. Hoffmann-La Roche Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Preimplantation Genetic Testing (PGT)?PGT is a laboratory procedure performed during In Vitro Fertilization (IVF) to screen embryos for genetic abnormalities before implantation.

How big is the Preimplantation Genetic Testing Market?The global Preimplantation Genetic Testing Market size was estimated at USD 756.6 Million in 2023 and is expected to reach USD 1648.6 Million in 2033.

What is the Preimplantation Genetic Testing Market growth?The global Preimplantation Genetic Testing Market is expected to grow at a compound annual growth rate of 8.1%. From 2024 To 2033.

Who are the key companies/players in the Preimplantation Genetic Testing Market?Some of the key players in the Preimplantation Genetic Testing Markets are Quest Diagnostics Incorporated, Natera, Inc., COOPER SURGICAL, INC., Genea Pty Limited., Invitae Corporation, Laboratory Corporation of America Holdings, Thermo Fisher Scientific Inc., Bioarray S.L., Illumina, Inc., F. Hoffmann-La Roche Ltd

Why is PGT Important in Assisted Reproductive Technologies (ART)?PGT enhances the success of ART by identifying genetically healthy embryos, reducing the risk of genetic disorders, and improving overall pregnancy outcomes.

What Technologies are Commonly Used in PGT?Common technologies include Next-Generation Sequencing (NGS), Polymerase Chain Reaction (PCR), and Fluorescent In-Situ Hybridization (FISH).

What Drives the Growth of the PGT Market?Increasing adoption of assisted reproductive technologies, growing awareness about genetic testing, and advancements in testing technologies contribute to the market's growth.

Preimplantation Genetic Testing MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Preimplantation Genetic Testing MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Quest Diagnostics Incorporated

- Natera, Inc.

- COOPER SURGICAL, INC.

- Genea Pty Limited.

- Invitae Corporation

- Laboratory Corporation of America Holdings

- Thermo Fisher Scientific Inc.

- Bioarray S.L.

- Illumina, Inc.

- F. Hoffmann-La Roche Ltd