Power Tool Gears Market Gear type(Bevel gears, Spiral gears, Spur gears, Helical gears, Hypoid gears), Application(Grinding machines, Drills, Hammers, Screws, DC cordless, Screwdrivers), Mode of Operation(Electric power tools, Corded power tools, Corded power tools, Pneumatic Power tools), and by Region and Companies Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: May 2023

- Report ID: 83627

- Number of Pages: 390

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

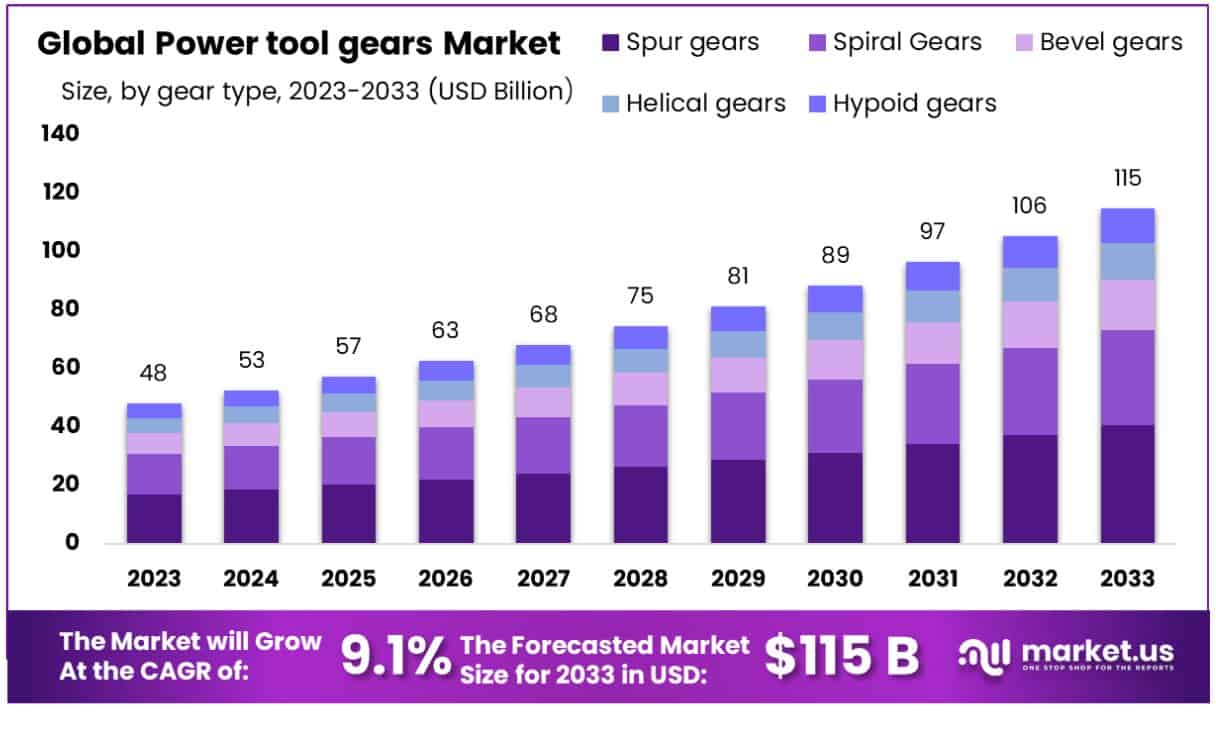

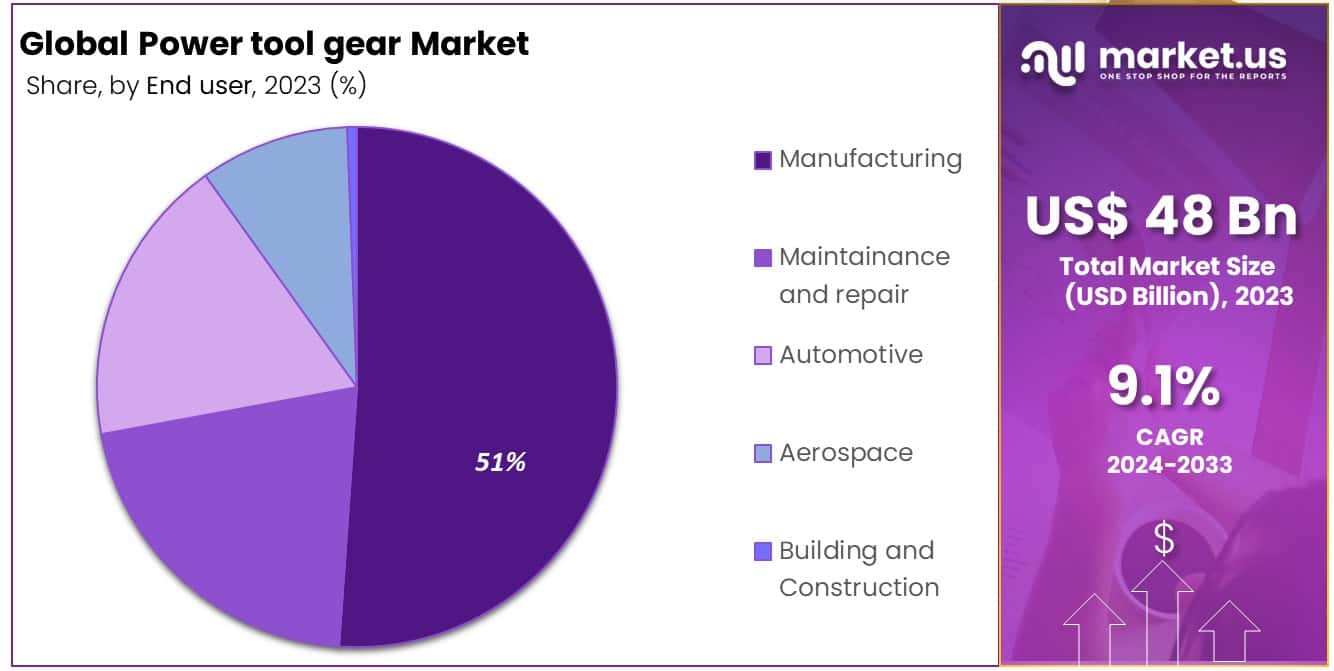

The Global Power Tool Gears Market size is expected to be worth around USD 115 Billion by 2033, from USD 48.0 Billion in 2023, growing at a CAGR of 9.10% during the forecast period from 2024 to 2033.

The Power Tool Gears Market represents a vital segment within the industrial domain, encapsulating the production, distribution, and application of crucial gear components necessary for the operational efficiency of a variety of tools and machinery. This market is distinguished by its relentless pursuit of innovation, motivated by the requirement for superior performance, longevity, and efficiency across multiple sectors including construction, manufacturing, and automotive. The dynamics of this market are significantly influenced by technological advancements, regulatory frameworks, and the changing requirements of end-users. These elements collectively forge opportunities for manufacturers, suppliers, and stakeholders to leverage emerging trends and market demands.

The surge in demand and the escalation in the production of power tool gears in China and India have positioned these nations to cumulatively command nearly 40% of the total market share throughout the assessment period. This significant share is attributed to the robust manufacturing capabilities and expanding industrial bases in these countries, reflecting their growing influence in the global market landscape.

An analysis of the Basis Point Share (BPS) values within the Power Tool Gears market from the first half of 2022 (H1, 2022-Outlook) compared to the projection for the same period reveals a decrement of 9 units. However, when juxtaposed against the first half of 2021 (H1, 2021), the market is anticipated to experience an increment of 24 BPS in the first half of 2022. This fluctuation underscores the market’s volatility and the variable factors influencing its trajectory.

The governments of these developing economies are increasingly investing in construction projects to bolster and advance their infrastructural framework as urbanization intensifies. The consequent demand for power tools, such as electric screwdrivers, grinding machines, saws, and cutters, in building and construction activities is propelling the need for these components, thereby expanding the market’s scope. This trend highlights the direct impact of infrastructural development initiatives on the demand for power tool gears, underscoring the interconnectedness of construction growth and industrial market expansion.

The primary purpose of power tools is to cut, drill, saw, and polish materials. Many industries, including automotive, construction, aerospace, oil and gas, petrochemical, and others, have been transformed using energy-efficient and handy tools. These tools allow for greater comfort, ease of use, and higher results.

Key Takeaways

- Market Growth: The Global Power Tool Gears Market is projected to reach approximately USD 115 Billion by 2033, growing at a CAGR of 9.10% from 2024 to 2033.

- Segmentation:

- Gear-type: Spur gears held a dominant market position, capturing more than a 35.2% share.

- Application: Grinding machines held a dominant market position, capturing more than a 29.5% share.

- Mode of Operation Analysis: Electric power tools held a dominant market position, capturing more than a 42.9% share.

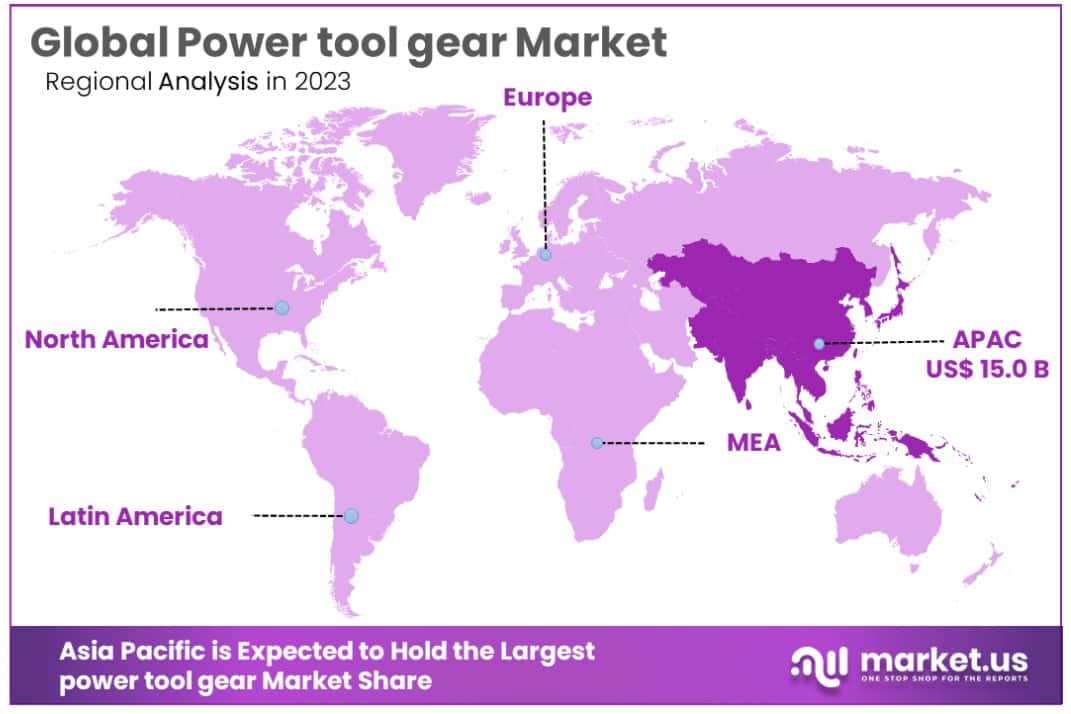

- regional analysis: Asia Pacific emerges as the dominating region in the power tool gears market, capturing a substantial share of approximately 31.4%.

- Key Players: global giants like Makita Corporation, Stanley Black and Decker Inc, and Robert Bosch GmbH dominate the market with their comprehensive range of gear-driven power tools.

Driving Factors

Increasing Demand for Power Tools in the Automotive Industry

The automotive industry’s increasing reliance on power tools for manufacturing and assembly processes significantly boosts the demand for power tool gears. As automotive manufacturers seek to streamline production and enhance efficiency, the use of power tools equipped with advanced gear systems becomes paramount. According to industry reports, the global automotive industry is projected to witness a compound annual growth rate (CAGR) of 3.5% between 2021 and 2026, further fueling the demand for power tool gears.

Rising Adoption of Battery-Powered Power Tools Globally

The widespread adoption of battery-powered power tools represents a transformative trend in the power tool industry, profoundly impacting the demand for power tool gears. Battery-powered tools offer enhanced mobility, convenience, and versatility, driving their popularity among both professionals and DIY enthusiasts worldwide. Research indicates that the global market for cordless power tools is expected to reach $17.46 billion by 2027, reflecting a steady CAGR of 4.8% from 2020 to 2027. This surge in demand underscores the crucial role of power tool gears in facilitating the operation of battery-powered tools.

Reduced Time and Less Manual Effort Offered by Power Wrenches

The advent of power wrenches revolutionizes traditional manual fastening methods, offering significant time savings and reducing manual effort in various industrial applications. Power wrenches equipped with efficient gear mechanisms enable faster and more precise fastening operations, contributing to enhanced productivity and reduced labor costs for end-users. Studies suggest that power wrenches can increase productivity by up to 50% compared to manual alternatives, driving their adoption across industries such as manufacturing, construction, and maintenance.

Growing Construction Industry in Emerging Economies

The booming construction industry in emerging economies represents a lucrative growth opportunity for the power tool gears market. Rapid urbanization, infrastructure development initiatives, and increasing construction activities drive the demand for power tools and associated components, including gears. Emerging economies such as China, India, and Brazil witness substantial investments in residential, commercial, and infrastructure projects, creating a robust market for power tool gears. Market analysts project the global construction market to reach $12.7 trillion by 2024, providing a fertile ground for the expansion of the power tool gears market.

Restraining Factors

Lack of Standardization in the Power Tool Gears Market

The absence of standardized specifications and quality control measures poses a significant challenge to the growth of the power tool gears market. Varying standards across regions and manufacturers result in inconsistencies in product performance, compatibility issues, and concerns regarding safety and reliability. This lack of uniformity complicates procurement decisions for consumers and hampers market expansion efforts. According to industry analyses, the absence of standardization in the power tool industry leads to a fragmented market landscape, inhibiting economies of scale and hindering the adoption of advanced gear technologies.

Increasing Preference for Hand Tools Over Power Tools in Certain Applications

Despite technological advancements in power tool gears, some industries and applications continue to favor traditional hand tools over power tools. Factors such as precision requirements, simplicity of operation, and cost considerations drive this preference for hand tools in specific tasks and environments. In sectors like woodworking, fine craftsmanship, and delicate assembly work, hand tools offer greater control and tactile feedback, outweighing the benefits of power tools. Market research indicates that the global hand tools market is expected to reach $13.6 billion by 2027, reflecting sustained demand despite the prevalence of power tool alternatives.

High Repair and Replacement Components Costs

The high costs associated with repairing and replacing power tool gears and components present a notable restraint to market growth. In cases of mechanical failures, wear and tear, or obsolescence, consumers face substantial expenses for repairs or component replacements, leading to reluctance to adopt or upgrade power tools. Additionally, the complexity of power tool gear assemblies and the need for specialized expertise further escalate repair costs, impacting overall ownership expenses for end-users. Analysts estimate that repair costs can account for up to 50% of the total cost of ownership for power tools, discouraging investment and dampening market expansion efforts.

Gear type Analysis

Spur gears held a dominant market position, capturing more than a 35.2% share. Bevel gears followed closely, representing a substantial segment within the power tool gears market. Bevel gears are widely utilized in applications requiring changes in direction or power transmission between intersecting shafts. Their versatility and efficiency make them indispensable in various industries such as automotive, aerospace, and machinery manufacturing.

Spiral gears emerged as another significant segment, exhibiting steady growth driven by their superior load-bearing capacity and smooth operation. These gears find extensive use in heavy-duty applications where precision and reliability are paramount, contributing to their increasing adoption across industrial sectors.

Helical gears, renowned for their quiet operation and high transmission efficiency, constituted a notable portion of the market share. Their helical teeth design enables smoother engagement and reduced noise levels compared to spur gears, making them ideal for applications demanding minimal vibration and noise emission.

Additionally, Hypoid gears represented a niche yet impactful segment within the power tool gears market. Characterized by their offset shaft orientation and unique tooth geometry, Hypoid gears excel in applications requiring high torque transmission and compact design, particularly in automotive drivetrain systems and industrial machinery.

Despite the dominance of Spur gears, the market landscape reflects a diverse array of gear types catering to distinct industry needs and preferences. Each segment offers unique advantages and applications, contributing to the overall growth and dynamism of the power tool gears market.

Application Analysis

Grinding machines held a dominant market position, capturing more than a 29.5% share. Grinding machines are essential tools in various industries for precision machining, surface finishing, and material removal processes. Their versatility and efficiency make them indispensable in sectors such as manufacturing, automotive, and aerospace, driving their significant market presence.

Following closely, Drills emerged as another substantial segment within the power tools market. Drills are fundamental tools for boring holes and fastening operations in diverse materials, catering to the needs of professionals and DIY enthusiasts alike. Their widespread use across construction, woodworking, and metalworking industries contributes to their notable market share.

Hammers represented a significant portion of the market, reflecting their essential role in driving nails, breaking objects, and demolition tasks. Their robust construction and ergonomic designs make them indispensable in construction, renovation, and maintenance applications, sustaining their market presence.

Screws, indispensable for fastening and joining materials, constituted a notable segment within the power tools market. The ubiquitous use of screws across various industries, including furniture assembly, construction, and electronics manufacturing, underscores their importance and market demand.

Additionally, DC cordless tools and Screwdrivers represented niche yet impactful segments within the power tools market. DC cordless tools offer enhanced mobility and convenience, catering to professionals and hobbyists seeking portability and freedom from corded constraints. Screwdrivers, essential for driving and removing screws with precision, find widespread use in assembly, repair, and maintenance tasks across multiple industries.

Despite the dominance of Grinding machines, the market landscape reflects a diverse array of power tool segments, each catering to specific applications and industry requirements. This diversity underscores the dynamic nature of the power tools market, driven by innovation, technological advancements, and evolving end-user preferences.

Mode of Operation Analysis

Electric power tools held a dominant market position, capturing more than a 42.9% share. Electric power tools represent a versatile and efficient solution for various applications across industries such as construction, manufacturing, and automotive. Their widespread adoption is driven by factors such as ease of use, portability, and compatibility with a wide range of accessories and attachments.

Corded power tools emerged as another substantial segment within the power tools market. Despite the growing popularity of cordless alternatives, corded power tools continue to hold a significant market share, particularly in applications requiring continuous power supply and prolonged usage. Their reliability and consistent performance make them indispensable in industrial settings and professional workshops.

Additionally, Cordless power tools constituted a notable portion of the market share, reflecting the increasing demand for mobility and convenience among end-users. Cordless tools offer freedom from power cords, enabling users to work in remote locations or tight spaces without constraints. The advancements in battery technology have further enhanced the runtime and performance of cordless power tools, driving their adoption across various industries.

Pneumatic Power tools represented a niche yet impactful segment within the power tools market. Also known as air-powered tools, pneumatic tools utilize compressed air for operation, offering high power-to-weight ratios and durability. Their widespread use in automotive repair, metalworking, and construction applications underscores their importance and market demand among professionals seeking robust and reliable tools.

Despite the dominance of Electric power tools, the market landscape reflects a diverse array of power tool segments, each catering to specific applications and user preferences. This diversity underscores the dynamic nature of the power tools market, driven by technological advancements, innovation, and evolving industry requirements.

Key Market Segments

Gear type

- Bevel gears

- Spiral gears

- Spur gears

- Helical gears

- Hypoid gears

Application

- Grinding machines

- Drills

- Hammers

- Screws

- DC cordless

- Screwdrivers

Mode of Operation

- Electric power tools

- Corded power tools

- Corded power tools

- Pneumatic Power tools

Growth Opportunities

Increasing demand for power tools in various industries such as construction, woodworking, and metalworking:

The surge in demand for power tools across sectors like construction, woodworking, and metalworking presents a significant growth opportunity for the power tool gears market. Industry reports indicate a steady increase in construction activities worldwide, with the global construction market expected to reach $12.7 trillion by 2024, driving the need for efficient and durable power tool gear solutions.

Expansion of the industrial sector and increasing adoption of power tools across various end-use industries

The expanding industrial sector, fueled by technological advancements and infrastructure development initiatives, propels the adoption of power tools across various end-use industries. With manufacturing processes becoming increasingly automated and efficient, the demand for precision-engineered power tool gears to optimize performance and productivity is on the rise. This trend is reflected in market analyses forecasting a compound annual growth rate (CAGR) of 4.8% for the global cordless power tools market, reaching $17.46 billion by 2027.

Integration of artificial intelligence into power tool gears to predict maintenance needs and enhance user experience

The integration of artificial intelligence (AI) into power tool gears signifies a paradigm shift in product development, enabling predictive maintenance capabilities and enhanced user experiences. AI-driven algorithms analyze operational data to anticipate maintenance needs, minimizing downtime and maximizing tool longevity. This innovation aligns with the growing emphasis on smart manufacturing and Industry 4.0 initiatives, driving adoption among industrial users seeking optimized efficiency and cost savings.

Trending Factors

moving towards sustainable and energy-efficient power tool gears, shaping the future of the industry

A prominent trend shaping the future of the power tool gears market is the shift towards sustainable and energy-efficient solutions. With growing environmental concerns and stringent regulations, manufacturers are increasingly prioritizing the development of eco-friendly power tool gears. This trend aligns with the broader sustainability initiatives across industries, driving demand for gear components that minimize energy consumption and reduce carbon footprint. Market analysis indicates a rising adoption of advanced materials and design technologies aimed at enhancing the energy efficiency of power tool gears, fostering a more sustainable approach to industrial operations.

Power tool gears are being designed with lightweight and compact features to improve portability

Another notable trend in the power tool gears market is the emphasis on lightweight and compact designs to enhance portability and ease of use. Manufacturers are integrating innovative design features and materials to reduce the weight and size of power tool gears without compromising performance or durability. This trend is particularly relevant in applications where maneuverability and flexibility are paramount, such as construction sites, manufacturing facilities, and maintenance operations. By leveraging lightweight and compact gear solutions, end-users benefit from increased mobility, reduced fatigue, and improved productivity, driving the adoption of power tools across diverse industries.

Regional Analysis

Asia Pacific emerges as the dominating region in the power tool gears market, capturing a substantial share of approximately 31.4%. The region’s burgeoning industrial sector, rapid urbanization, and infrastructure development projects drive robust demand for power tools and associated components. With key manufacturing hubs in countries like China, Japan, and India, Asia Pacific serves as a vital market for power tool gears, supported by factors such as low labor costs, favorable government policies, and expanding industrialization initiatives. As a result, Asia Pacific is poised to maintain its dominance in the global power tool gears market, with sustained growth anticipated in the coming years.

In North America, the power tool gears market exhibits steady growth driven by robust industrialization, technological innovation, and infrastructure development initiatives. The region benefits from a mature market landscape characterized by a high adoption rate of advanced power tools across industries such as automotive, construction, and manufacturing. Market analysis reveals that North America accounted for a substantial share of the global power tool gears market, with a notable emphasis on quality, precision, and reliability. The presence of key market players and favorable government regulations further bolster market growth. According to industry data, North America is projected to maintain its prominent position, with a market share of approximately 25% by 2025.

In Europe, the power tool gears market demonstrates resilience amidst economic fluctuations, driven by sustained investments in infrastructure projects, automotive manufacturing, and industrial automation. The region’s stringent regulatory frameworks and focus on sustainability contribute to the adoption of energy-efficient power tools equipped with advanced gear technologies. Market research indicates that Europe holds a significant share of the global power tool gears market, with key players leveraging technological advancements to enhance product offerings and maintain competitiveness. By 2023, Europe is expected to retain its market share of around 22%, reflecting steady growth and innovation within the region.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the realm of power tool gears, several esteemed manufacturers stand out for their precision engineering and dedication to quality. The Porite Group boasts a stellar reputation for its precision manufacturing capabilities, producing a diverse array of automotive and industrial components, including gears tailored for power tools. Similarly, Zhejiang Oliver Manufacturing Gear Co., Ltd, a prominent player in China’s manufacturing landscape, is renowned for its production of high-quality power tool gears, serving both domestic and international markets with excellence.

Meanwhile, global giants like Makita Corporation, Stanley Black and Decker Inc, and Robert Bosch GmbH dominate the market with their comprehensive range of gear-driven power tools. Makita Corporation, known for its durability and performance, offers an extensive lineup of gear-driven tools celebrated for their innovative features. Stanley Black and Decker Inc., with brands like Stanley, DeWalt, and Craftsman under its umbrella, caters to professionals and DIY enthusiasts alike, providing a diverse array of gear-driven tools for various applications.

Emerson Electric Co., Ltd, Rochester Gear, and Precision Gears further enrich the market with their specialized expertise in gear manufacturing. Emerson Electric specializes in gear components for industrial applications, while Rochester Gear and Precision Gears focus on precision gear manufacturing, delivering custom solutions tailored to meet the specific needs of various industries, including power tools. Together, these manufacturers shape the landscape of the power tool gears market, driving innovation and reliability to new heights.

Market Key Players

- Porite group

- hGears

- Zhejiang Oliver manufacturing gear Co, ltd

- Makita Corporation

- Stanley Black and Decker Inc

- Robert Bosch Gmbh

- Emerson Electric Co.ltd

- Rochester Gear

- Precision gears

- Power transmission engineering

Recent Developments

- In February 2023 DEWALT, the Stanley Black & Decker brand is announcing an expansion to the TOUGHSYSTEM(r) 2.0 storage line-up by introducing three new products: the Adaptor, Deep Compact Toolbox, and 3-Drawer Toolbox – providing users with better access to storage modules from other brands and easy accessibility to the tools. The brand new TOUGHSYSTEM(r) 2.0 adaptor (DWST08017) lets users build a custom and flexible storage solution with increased compatibility

- In March 2023 Hilti has announced an alliance with Canvas, an engineering robotics firm that has created a robotic wall-sealing solution that will empower individuals to build in exciting innovative ways. This collaboration brings together experts in the field of intelligent robotics for job sites who share a similar goal: the use of robotics can unlock the potential that is not being explored and open a new world of safety and productivity for skilled tradesmen.

Report Scope

Report Features Description Market Value (2023) USD 48.0Billion Forecast Revenue (2033) USD 115 BillionBillion CAGR (2024-2033) 9.10% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Gear type(Bevel gears, Spiral gears, Spur gears, Helical gears, Hypoid gears), Application(Grinding machines, Drills, Hammers, Screws, DC cordless, Screwdrivers), Mode of Operation(Electric power tools, Corded power tools, Corded power tools, Pneumatic Power tools) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Porite group, hGears, Zhejiang Oliver manufacturing gear Co, ltd,, Makita Corporation, Stanley Black and Decker Inc, Robert Bosch Gmbh, Emerson Electric Co.ltd, Rochester Gear, Precision gears, Power transmission engineering Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the projected size of the Power Tool Gears MarketThe Global Power Tool Gears Market is projected to reach approximately USD 115 Billion by 2033, growing at a CAGR of 9.10% from 2024 to 2033.

Name the major industry players in the Power Tools Market.Porite group, hGears, Zhejiang Oliver manufacturing gear Co, ltd,, Makita Corporation, Stanley Black and Decker Inc, Robert Bosch Gmbh, Emerson Electric Co.ltd, Rochester Gear, Precision gears, Power transmission engineering

List the segments encompassed in this report on the Power Tools Market?Gear type(Bevel gears, Spiral gears, Spur gears, Helical gears, Hypoid gears), Application(Grinding machines, Drills, Hammers, Screws, DC cordless, Screwdrivers), Mode of Operation(Electric power tools, Corded power tools, Corded power tools, Pneumatic Power tools)

-

-

- Porite Group

- hGears

- Zhejiang Oliver manufacturing Gear Co. Ltd.

- Zhejiang Fore Intelligent Technology Co. Ltd.

- Stanley Black & Decker Inc.

- Snap-on Incorporated, Techtronic Industries Co. Ltd.

- Robert Bosch GmbH

- Makita Corporation

- Emerson Electric Co. Ltd., etc.