Global Offshore Lubricants Market Application(Engine Oil, Gear Oil, Grease, Hydraulic Oil, Others), By Industry(Oil and Gas Industry, Offshore Wind Energy Industry, Marine Industry), End-Use(Offshore Rigs, OSVs (Offshore Support Vessels), FPSOs (Floating, Production, Storage and Offloading Vessels), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 31921

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

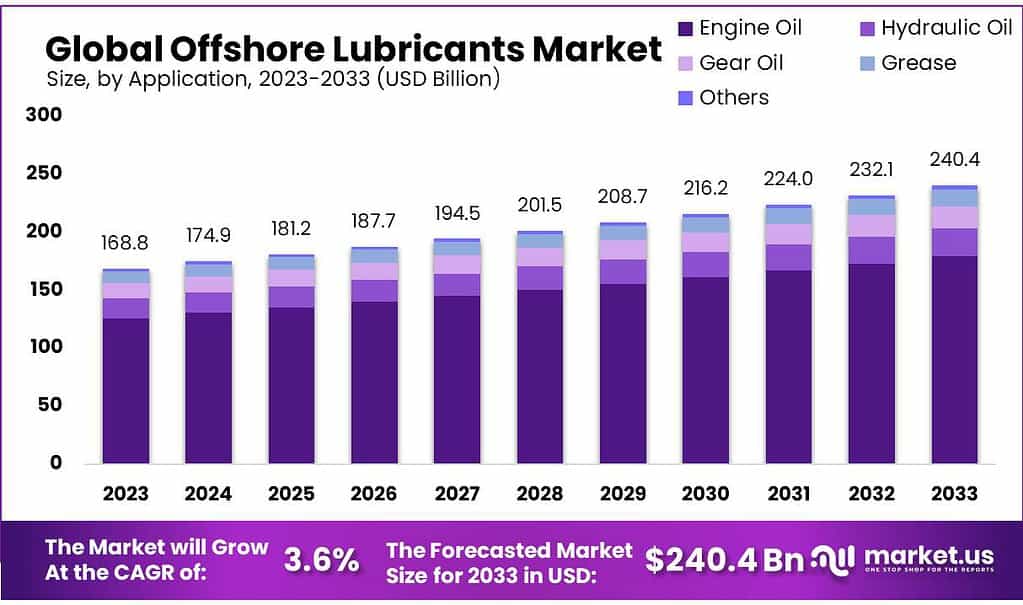

The Offshore Lubricants Market size is expected to be worth around USD 240.4 Billion by 2033, from USD 168.8 Billion in 2023, growing at a CAGR of 3.6% during the forecast period from 2023 to 2033.

Lubricants are used in a variety of offshore applications like turbines, vessel engines, hydraulic equipment, and gearboxes. They help reduce wear and tear on machinery, improve operational efficiency, and make it easier to do business.

The Offshore Lubricants Market refers to the industry involved in the production, distribution, and utilization of specialized lubricants designed for offshore applications. These lubricants are specifically formulated to meet the demanding conditions and challenges present in offshore environments, including oil rigs, platforms, vessels, and other maritime structures. Offshore lubricants play a crucial role in maintaining the optimal performance and longevity of machinery and equipment used in offshore operations.

The Offshore Lubricants Market encompasses a range of products tailored to specific applications, including hydraulic fluids, gear oils, engine oils, and grease. Manufacturers in this market focus on developing high-performance formulations that adhere to stringent environmental and safety standards, ensuring reliable operation and minimal environmental impact in offshore settings.

The market dynamics are influenced by factors such as technological advancements, regulatory requirements, and the overall growth of offshore exploration and production activities in the energy sector.

Key Takeaways

- Striking Growth Projection: Offshore Lubricants Market set to reach USD 240.4 Billion by 2033, marking a robust 3.6% CAGR from its 2023 value of USD 168.8 Billion.

- Tailored Formulations for Offshore Challenges: Focus on high-performance formulations catering to oil rigs, platforms, vessels, with a 74.6% market share held by Engine oil in 2023.

- Variety in Lubricant Offerings: Beyond Engine oil dominance, specialized lubricants include Hydraulic oil, Gear oil, and Grease, addressing unique offshore application needs.

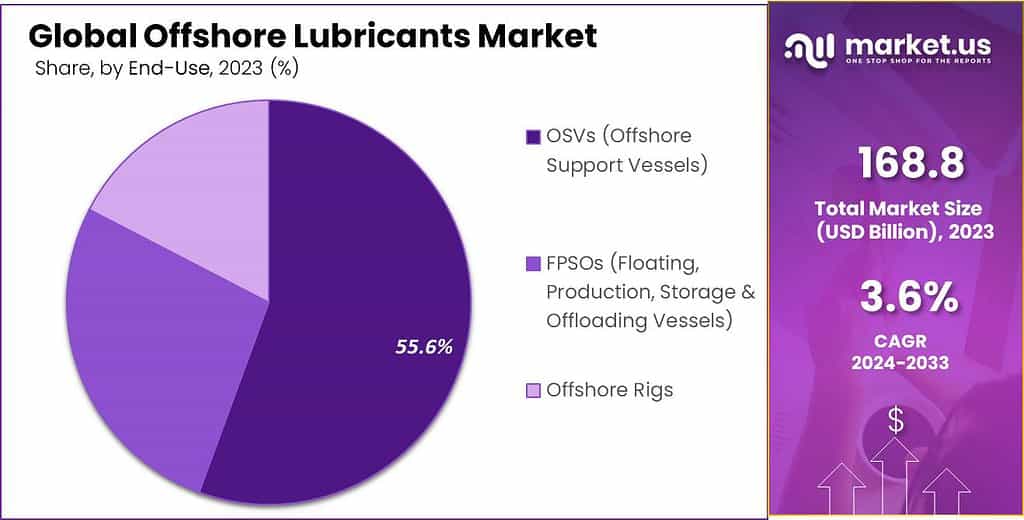

- Sector-Specific Usage: Oil & Gas sector relies on lubricants for machinery efficiency, securing the largest market share of 55.6% for Offshore Support Vessels (OSVs) in 2023.

- Regional Dominance – Asia Pacific: Asia Pacific leads with a 48.6% revenue share in 2023, driven by expanding offshore projects in countries like India, Malaysia, and China.

- North America’s Market Dynamics: North America, with an 18.2% market share in 2023, influenced by stringent regulations, particularly in the Gulf of Mexico, and expected to account for 17.2% by 2032.

Application Analysis

In 2023, Engine Oil stood as the dominant force within the Offshore Lubricants Market, capturing over 74.6% of the market share. Engine oil plays a pivotal role in maintaining and operating engines used offshore, from marine vessels to drilling rigs. Engine oil plays an integral part in reducing friction, heat, and wear within these machinery components – thus assuring smooth performance in challenging offshore environments.

With such an enormous market share firmly entrenched, its use remains indispensable in upholding equipment integrity – further cementing its place as one of the primary lubricant options on offer today. Hydraulic Oil also plays an essential role in the Offshore Lubricants Market, although its market share might not compare to engine oil.

Hydraulic oil plays an integral part in hydraulic systems found on offshore machinery and equipment, enabling power transmission while providing system lubrication despite having a smaller market share. Hydraulic oil plays a significant part in improving overall efficiency and performance despite this smaller share. Gear Oil, Grease, and other segments within the Offshore Lubricants Market also contribute to lubrication needs in specific offshore applications.

While these segments might hold smaller individual shares, they serve critical purposes. Gear oil facilitates smooth gear operation, while grease offers effective lubrication in various offshore equipment components. Their specialized applications cater to specific machinery needs, complementing the broader utilization of engine and hydraulic oils in the offshore sector.

By Industry

Oil & Gas Industry: Oil & Gas sector, offshore lubricants play a critical role in ensuring the efficient and reliable operation of machinery and equipment involved in exploration, drilling, and production activities in offshore environments. Offshore lubricants are utilized in various components, including drilling equipment, offshore platforms, subsea systems, compressors, and engines. These lubricants are designed to withstand extreme conditions, such as high pressures, corrosive environments, and temperature variations, ensuring the longevity and optimal performance of equipment critical to oil and gas operations.

Offshore Wind Energy Industry: The Offshore Wind Energy sector relies on specialized lubricants to address the unique challenges presented by wind turbines located in offshore environments. Offshore lubricants in this industry are used for lubricating the gearbox, yaw and pitch systems, and other moving parts of offshore wind turbines. They are formulated to provide excellent protection against corrosion, water exposure, and extreme weather conditions, contributing to the reliability and efficiency of offshore wind energy operations.

Marine Industry: In the Marine Industry, offshore lubricants are essential for the proper functioning of engines, gear systems, and other machinery on vessels navigating offshore waters. Offshore lubricants find applications in marine engines, propulsion systems, thrusters, and other critical components. They offer corrosion protection, thermal stability, and resistance to water washout, ensuring the smooth operation and longevity of marine equipment in challenging offshore conditions.

End-Use Analysis

Offshore Support Vessels (OSVs) were the top consumers within the Offshore Lubricants Market in 2023, accounting for 55.6%. OSVs play an essential role in supporting offshore activities by ferrying equipment, supplies, and personnel to/from offshore rigs/facilities; their large market share underscores how crucial lubrication is in maintaining smooth performance throughout their demanding tasks in offshore waters.

Offshore Rigs play an important role in the use of lubricants, even though their market share might not have been as prevalent in 2023. Offshore rigs contain various machinery and equipment that require proper lubrication to function optimally, from engines, gears, and other essential components necessary for drilling and production activities at offshore locations to essential engines that power offshore rig operations.

While their market share may be smaller, their significance cannot be disregarded as it remains an essential element in supporting offshore rig operations. FPSOs (Floating Production Storage & Offloading Vessels) play an integral role in the offshore lubricant consumption market; though their market share may be smaller compared to OSVs and offshore rigs.

These multipurpose vessels serve multiple roles including hydrocarbon production, storage and offloading. Lubricants play a pivotal role in keeping engine, propulsion system and machinery efficiency at peak levels for efficient oil processing on these vessels; their continued functionality remains vital to offshore oil and gas operations.

Key Market Segments

Application

- Engine Oil

- Gear Oil

- Grease

- Hydraulic Oil

- Others

By Industry

- Oil & Gas Industry

- Offshore Wind Energy Industry

- Marine Industry

End-Use

- Offshore Rigs

- OSVs (Offshore Support Vessels)

- FPSOs (Floating, Production, Storage & Offloading Vessels)

Drivers

The Offshore Lubricants Market is propelled by several key drivers that underpin its growth and significance within the offshore industry. More and more, people are looking for oil and gas deep under the sea. They go deep to find these resources. To keep the machines and tools working well in these tough places, they need good oils. These oils help the machines work better and last longer, so there’s a bigger need for special oils for these jobs.

The machines and boats used in these offshore jobs need lots of care. Oils help them by making sure there’s less rubbing, damage, and rust in the engines, gears, and other important parts. By ensuring smooth operations and extending equipment lifespan, they remain pivotal in supporting offshore operations and maintenance routines.

The expanding offshore fleet, comprising support vessels, rigs, and FPSOs, also contributes significantly to the market’s growth. As the offshore industry continues to grow, the demand for lubricants to sustain the performance and reliability of these vessels increases proportionally, further boosting market dynamics. New and better oils are made for offshore jobs.

They work well even in tough conditions. They resist rust, flow better, and adapt to harsh environments. These improved oils fit the changing needs of offshore work, making the market grow by providing custom-made solutions. Strict safety rules and protecting the environment are crucial in offshore work. Special oils that follow these rules and still work great are in high demand.

These oils, meeting tough standards while doing a good job and being eco-friendly, are becoming more popular. Overall, these reasons push the market forward by meeting specific needs, keeping work efficient, and following the tough rules of offshore jobs.

Restraints

The Offshore Lubricants Market encounters several challenges that impede its seamless growth and development. Primarily, the high production costs associated with specialized lubricants pose a significant restraint. These lubricants require advanced formulations and technologies, leading to increased manufacturing expenses.

This cost aspect might limit their extensive adoption, especially in markets where cost sensitivity is a concern. Making sure the oils used in offshore work are good for the environment is tough. They need to work well and be eco-friendly. Creating these special oils that meet strict environmental rules while still doing a great job is complex. It might make producing them more expensive, putting extra pressure on companies.

Also, creating new and better oils for offshore jobs might not keep up with the fast improvements in offshore machines. This might stop the development of oils that perfectly match the newest machinery, affecting how well they work. Meeting strict safety and environmental regulations poses another hurdle.

Developing lubricants that comply with these standards without compromising performance requires significant investment in research and development, adding complexities to market dynamics. Market consolidation poses a formidable threat. A situation in which there are fewer suppliers could restrict consumer choices and diminish competitive pricing options, potentially impacting accessibility and variety within the market.

Addressing such restraints requires significant investments in research and development to produce cost-effective, eco-friendly lubricants that comply with stringent regulations while meeting evolving offshore operations needs.

Opportunities

The Offshore Lubricants Market holds promising opportunities for growth and advancement. Firstly, there’s a significant chance of developing eco-friendly lubricants. Creating oils that meet strict environmental rules while working effectively opens doors to new markets. These environmentally conscious solutions appeal to industries and customers looking for sustainable options, presenting a growth niche.

Another key opportunity lies in aligning lubricant innovations with advancements in offshore machinery. Tailoring lubricants to suit the latest equipment with improved qualities like resistance to corrosion and adaptability to harsh conditions is crucial. Developing specialized oils that match the evolving needs of the industry boosts growth by addressing specific challenges in offshore operations.

Expanding the range of specialized lubricants for different offshore applications also offers growth potential. Making oils that fit certain machines, like engines and gears, helps a lot in offshore work. This helps cover different needs, making the oils useful in more ways for offshore jobs. Looking into how to make oils that work well but don’t cost a lot is a good chance.

Finding ways to create these special oils that work great and are not too expensive can attract more customers who have been worried about high prices before. Working together with others in the industry is a good move. When companies team up, they bring together their skills, tools, and reach in the market.

This helps introduce new and better oils, making them available to more people. By using these chances to create new things, work together, and meet what the industry needs, the Offshore Lubricants Market can offer more, adapt to changes, and get more customers in the offshore business.

Challenges

The Offshore Lubricants Market faces several challenges that impact its growth and adaptability. Firstly, aligning lubricants with stringent environmental regulations poses a significant hurdle. Creating oils that meet these strict rules while ensuring they work well can be tough and costly. Striking this balance between effectiveness and eco-friendliness remains a key challenge for manufacturers.

Keeping up with the rapid advancements in offshore machinery presents a challenge. Innovating lubricants to match the latest equipment specifications might lag, impacting their effectiveness. This discrepancy in the pace of technological changes could affect the performance of oils tailored to the newest machinery.

The high production costs associated with specialized lubricants pose a restraint. These oils require advanced technologies, leading to increased manufacturing expenses. This cost aspect might limit their widespread use, especially in markets where cost considerations are crucial. Meeting stringent safety and environmental regulations in offshore operations also adds complexity.

Developing lubricants that comply with these standards without compromising performance demands continuous investment in research and development, further increasing production complexities. Market competition and the potential for market consolidation might restrict choices for consumers.

A scenario with fewer suppliers could limit the variety and competitive pricing options, impacting market accessibility. Addressing these challenges requires significant investment in research and development to create cost-effective, environmentally friendly lubricants that meet stringent regulations while fulfilling the dynamic needs of offshore operations.

Regional Analysis

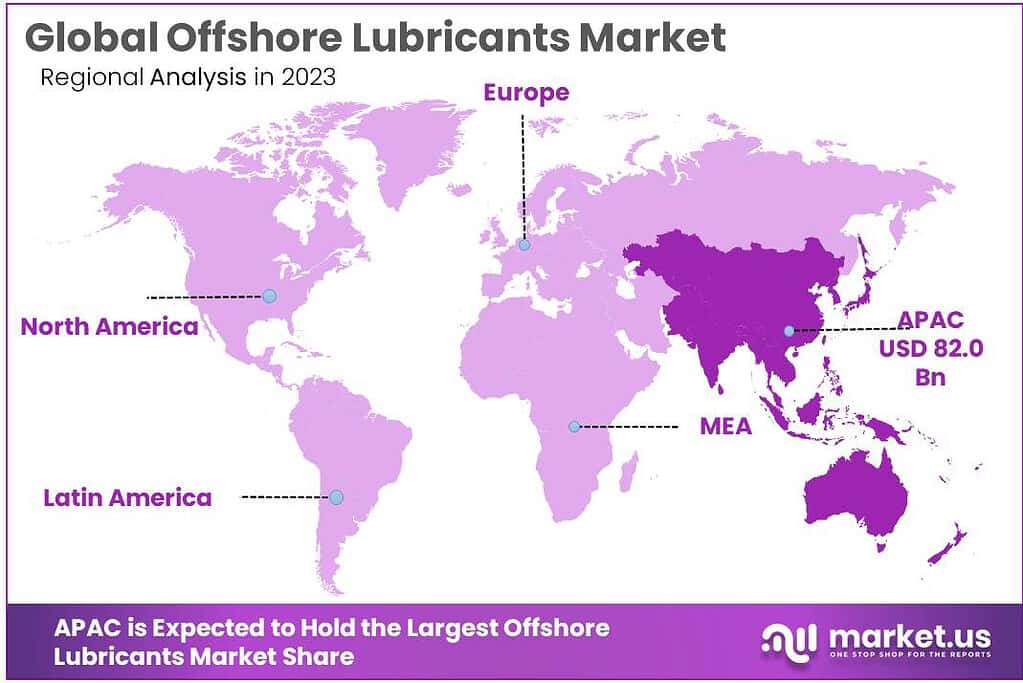

The report examines the regional markets of North America, Europe, Asia Pacific, and the Middle East. Asia Pacific (APAC) had the largest revenue share at over 48.6% in 2023. The region’s growth is expected to be driven by the expansion of offshore projects in India (Indonesia), Malaysia (Malaysia), and China over the forecast period.

Economic growth has also facilitated greater maritime trade. This has led to a substantial increase in sea traffic in recent times. This is expected to increase offshore lubricant demand across the Asia Pacific.

The Asia Pacific was closely followed by North America. This country accounted for an 18.2% overall market share in 2023. North America is characterized by strict regulations from the U.S. EPA concerning marine lubricants. This will be driven by the growth of the region’s offshore activities in the Gulf of Mexico. North America is expected to account for 17.2% by 2032.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

The four largest companies in the global offshore lubricants industry share, Chevron ExxonMobil, and Royal Dutch Shell, accounted for 46%. Many independent producers account for 1/3 rd the market share. Total S.A. has a strong global presence as well as Sinopec, British Petroleum, and Sinopec.

Distribution companies have the advantage of earning profit margins that can’t be attributed to distributors. This direct marketing is typically done via factory sales outlets or centers. Major suppliers and distributors of oil include Lynx Marine (Bruke Lubricants), Tropic Oil (Crown Oil), and Lynx Marine (Lynx Marine).

For industry players to remain competitive, technology innovation, product development, and production optimization are essential. Integrated players, which are involved in the production of raw materials and base oils as well as lubricants, are also abundant.

Key Market Players

- BP plc

- Royal Dutch Shell

- ExxonMobil

- Chevron Corporation

- Total S.A.

- Sinopec Limited

- Gulf Oil Marine Limited

- Lukoil Oil Company

- British Petroleum

- Idemitsu Kosan

- JXTG Nippon

- Oil & Energy Corp.

- Aegean Castrol

Recent Developments

Frequently Asked Questions (FAQ)

What is the Size of Offshore Lubricants Market?Offshore Lubricants Market size is expected to be worth around USD 240.4 Billion by 2033, from USD 168.8 Billion in 2023

What is the CAGR for the Offshore Lubricants Market?The Offshore Lubricants Market is expected to grow at a CAGR of 3.6% during 2023-2033.Who are the key players in the Offshore Lubricants market?BP plc, Royal Dutch Shell, ExxonMobil, Chevron Corporation, Total S.A., Sinopec Limited, Gulf Oil Marine Limited, Lukoil Oil Company, British Petroleum, Idemitsu Kosan, JXTG Nippon, Oil & Energy Corp., Aegean Castrol.

-

-

- BP plc

- Royal Dutch Shell

- ExxonMobil

- Chevron Corporation

- Total S.A.

- Sinopec Limited

- Gulf Oil Marine Limited

- Lukoil Oil Company

- British Petroleum

- Idemitsu Kosan

- JXTG Nippon

- Oil & Energy Corp.

- Aegean Castrol