Global Power Plant Boiler Market Size, Share, And Business Benefits By Type (Pulverized Coal Towers, Circulating Fluidized Bed Boilers, Others), By Capacity (Upto 400 MW, 400-800 MW, Above 800 MW), By Technology (Subcritical, Supercritical, Ultra-supercritical), By Fuel Type (Coal Based, Gas Based, Oil Based, Others), By Application (Power Generation, Industrial Steam, District Heating, Cogeneration, Waste-to-energy), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 154859

- Number of Pages: 233

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

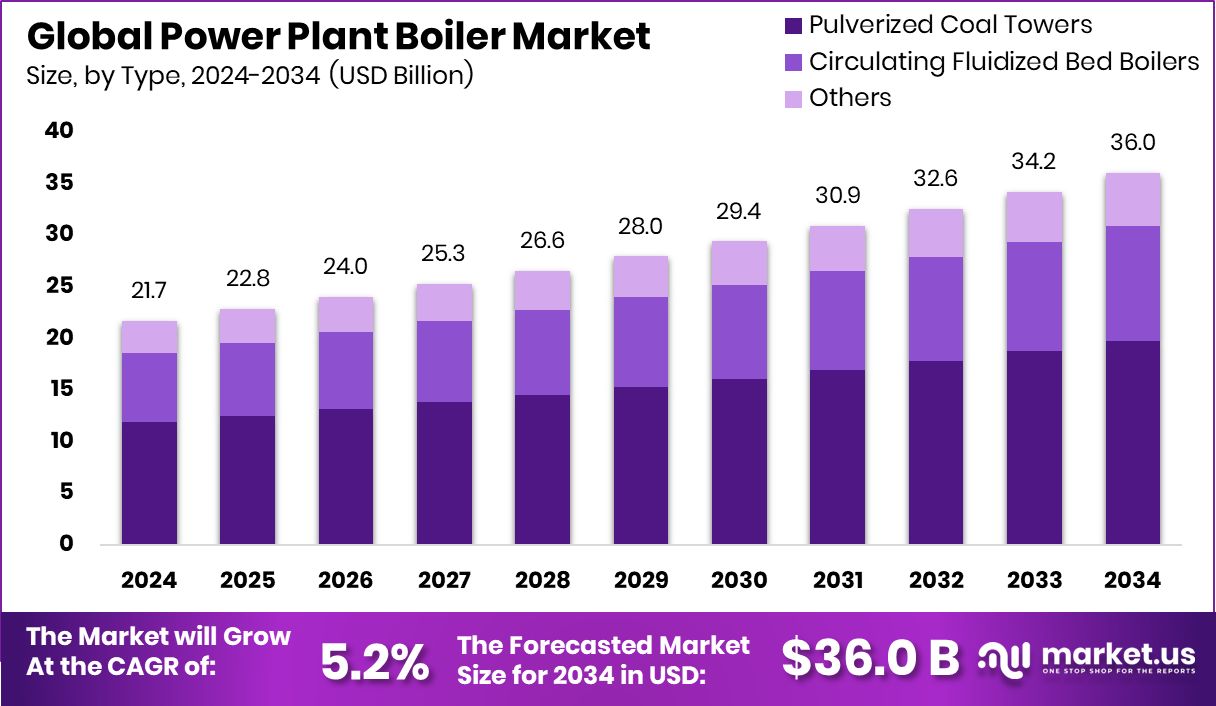

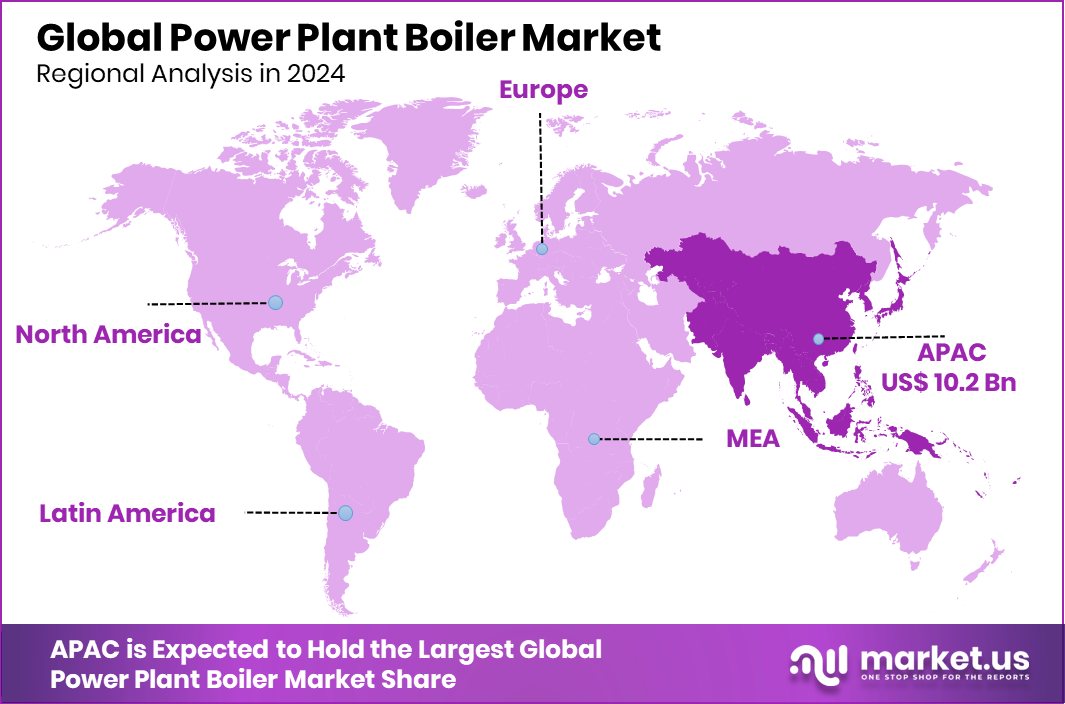

The Global Power Plant Boiler Market is expected to be worth around USD 36.0 billion by 2034, up from USD 21.7 billion in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034. Strong industrial growth in the Asia Pacific supported the USD 10.2 billion market value.

A power plant boiler is a closed vessel designed to generate steam by applying heat energy to water. It is a crucial component in thermal power plants, where steam produced by the boiler drives turbines to generate electricity. These boilers operate under high-pressure and temperature conditions and are built to handle various fuels such as coal, natural gas, biomass, or waste heat. The performance, efficiency, and safety of a power plant largely depend on the design and operational capacity of its boiler system, making it a central part of electricity generation infrastructure.

The power plant boiler market refers to the global demand, production, and installation of industrial-scale boilers used primarily in thermal power generation facilities. This market is driven by the increasing requirement for energy across developing and developed nations alike. As electricity consumption continues to rise, especially in urbanizing and industrializing regions, the demand for reliable power generation equipment, including boilers, has steadily increased.

Growth in the power plant boiler market can be attributed to the growing emphasis on improving efficiency and reducing emissions. Governments across regions are enforcing stricter environmental norms, pushing utilities and industries to adopt cleaner and more efficient boiler systems. The adoption of supercritical and ultra-supercritical boilers that operate at higher efficiencies is also contributing to market expansion, especially in regions focusing on energy transition. According to an industry report, $1.5 million was awarded for the cleanup of the former Slate Belt coal facility.

The rising integration of renewable energy sources is creating new opportunities for hybrid systems, where conventional boilers operate alongside solar thermal or biomass inputs. This has opened new design and retrofitting possibilities for boiler manufacturers. In addition, aging thermal plants in developed countries are being modernized or replaced, driving fresh demand for advanced boiler technologies.

Key Takeaways

- The Global Power Plant Boiler Market is expected to be worth around USD 36.0 billion by 2034, up from USD 21.7 billion in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034.

- Pulverized coal towers dominate the power plant boiler market, holding a significant 54.8% share globally.

- 400–800 MW capacity boilers lead the segment, capturing 49.1% share due to balanced efficiency.

- Subcritical technology remains widely used in power plant boilers, accounting for a 48.2% market share.

- Coal-based boilers continue to dominate the fuel type segment, holding a strong 69.3% market share.

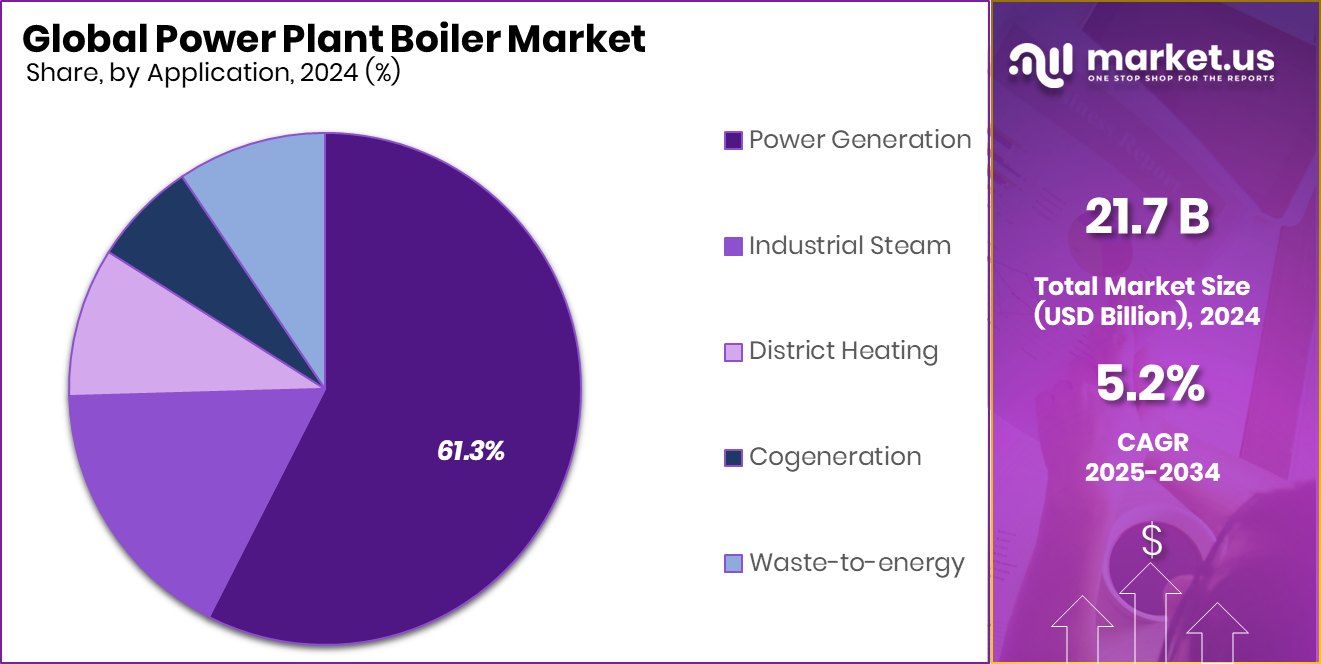

- Power generation applications represent the core demand, contributing 61.3% to the total boiler market size.

- Asia Pacific held a 47.20% share of the global market during the year.

By Type Analysis

Pulverized coal towers dominate the power plant boiler market with 54.8%.

In 2024, Pulverized Coal Towers held a dominant market position in the By Type segment of the Power Plant Boiler Market, with a 54.8% share. This dominance can be attributed to their widespread adoption in large-scale thermal power plants, particularly in regions where coal remains a primary energy source.

Pulverized coal combustion technology is favored for its ability to produce high-temperature steam efficiently, which is essential for driving turbines in base-load power generation. These systems are known for their reliability and ability to support continuous operations, making them a preferred choice for utility-scale electricity generation.

The continued reliance on coal-fired power in several emerging economies further reinforces the strong market position of pulverized coal towers. Additionally, advancements in boiler design, including improved combustion control and emission reduction technologies, have supported their compliance with evolving environmental standards.

Many countries are also focusing on retrofitting older units with updated pulverized coal systems to enhance efficiency and extend operational life. This combination of operational stability, fuel availability, and evolving engineering enhancements has allowed Pulverized Coal Towers to maintain their market leadership, despite global discussions around energy transition.

By Capacity Analysis

The capacity range 400–800 MW holds 49.1% of the market share today.

In 2024, 400–800 MW held a dominant market position in the By Capacity segment of the Power Plant Boiler Market, with a 49.1% share. This capacity range is widely preferred in both newly constructed and upgraded thermal power stations due to its balanced output efficiency and grid compatibility.

Boilers within this capacity bracket are well-suited for base-load power generation, offering an optimal scale for high-efficiency operations without the excessive complexity or investment costs associated with ultra-large units. Their technical suitability for a wide range of thermal fuels, including coal and biomass blends, also supports broader adoption across diverse power generation strategies.

The 400–800 MW segment continues to be a strategic choice for utilities aiming to meet increasing electricity demand while maintaining operational flexibility. Power plants in this capacity range can effectively serve medium-to-large urban and industrial regions, ensuring a stable power supply without significant oversizing.

Moreover, their adaptability in retrofitting scenarios adds to their attractiveness for upgrading older thermal facilities. The 49.1% market share in 2024 underlines the segment’s practical alignment with ongoing infrastructure investments and policy frameworks that prioritize balanced generation capacity, emission compliance, and long-term asset reliability.

By Technology Analysis

Subcritical technology leads with 48.2% in global boiler demand.

In 2024, Subcritical held a dominant market position in the By Technology segment of the Power Plant Boiler Market, with a 48.2% share. The continued preference for subcritical technology reflects its extensive deployment across existing thermal power infrastructure, particularly in regions where mature coal-based plants remain central to electricity generation.

Subcritical boilers operate at relatively lower pressure and temperature compared to advanced technologies, making them less complex and more cost-effective to install and maintain. This has supported their strong presence in both operational plants and replacement projects where economic feasibility is a key consideration.

The 48.2% market share highlights the entrenched role of subcritical systems, especially in power markets that prioritize proven technology with reliable performance history. Many developing regions continue to favor subcritical boilers due to their simpler design, well-established operational procedures, and readily available components.

Furthermore, the ability to retrofit and upgrade these systems with emission control technologies ensures that they remain compliant with tightening environmental norms while retaining their core structure. Subcritical technology’s dominance in 2024 also reflects the slower pace of transition in some economies, where legacy systems continue to deliver the bulk of grid power and investment in newer, more complex technologies is still progressing gradually.

By Fuel Type Analysis

Coal-based systems account for 69.3% of boiler installations worldwide.

In 2024, Coal Based held a dominant market position in the By Fuel Type segment of the Power Plant Boiler Market, with a 69.3% share. This significant share reflects the ongoing reliance on coal as a primary fuel source for power generation, especially in countries where coal reserves are abundant and energy demand remains high.

Coal-based boilers are preferred for their ability to support base-load operations and deliver continuous power generation at scale. Their established infrastructure, coupled with decades of operational familiarity, continues to make them a cornerstone of thermal power systems.

Despite growing environmental concerns, coal-based boilers maintain a leading market share due to their critical role in meeting electricity needs in regions where alternatives are still in transition. The existing network of coal-fired plants, many of which are integrated with subcritical or pulverized coal boiler technologies, underpins the dominance of this segment.

The 69.3% market share in 2024 also suggests that while cleaner energy technologies are emerging, coal remains entrenched in the power mix due to cost factors, energy security considerations, and the inertia of long-established utility models. This segment continues to serve as the backbone of power generation in several economies, ensuring a reliable supply amid evolving energy strategies.

By Application Analysis

Power generation applications capture 61.3% of the boiler market segment.

In 2024, Power Generation held a dominant market position in the By Application segment of the Power Plant Boiler Market, with a 61.3% share. This strong position reflects the fundamental role of boilers in thermal power plants, where steam is produced to drive turbines for electricity generation.

The demand for continuous, large-scale power supply across industrial, commercial, and residential sectors continues to support the widespread installation of boilers specifically designed for power generation. Their integration into national grids makes them a central component of energy infrastructure, particularly in countries dependent on thermal sources.

The 61.3% market share held by the Power Generation segment also indicates the ongoing necessity of boiler systems in addressing the base-load energy requirements of expanding economies. In many regions, these systems form the backbone of centralized power facilities, ensuring grid stability and consistent output.

With aging plants undergoing refurbishment and new capacity being added in response to growing electricity demand, boilers tailored for power generation remain in active deployment. Their ability to operate across a range of capacities and fuel types also adds to their adaptability in power generation scenarios, reinforcing their leading position in this application segment for the year 2024.

Key Market Segments

By Type

- Pulverized Coal Towers

- Circulating Fluidized Bed Boilers

- Others

By Capacity

- Upto 400 MW

- 400-800 MW

- Above 800 MW

By Technology

- Subcritical

- Supercritical

- Ultra-supercritical

By Fuel Type

- Coal Based

- Gas Based

- Oil Based

- Others

By Application

- Power Generation

- Industrial Steam

- District Heating

- Cogeneration

- Waste-to-energy

Driving Factors

Rising Electricity Demand Drives Boiler Installations

One of the key driving factors for the power plant boiler market is the continuous rise in electricity demand across both developing and developed countries. As urban populations grow and industrial activities expand, the need for stable and large-scale power generation is increasing rapidly. Boilers are essential equipment in thermal power plants, as they produce the steam required to run turbines that generate electricity.

In many fast-growing economies, the pressure to expand electricity access has led to new power plant projects and upgrades to existing facilities. This rising demand directly boosts the requirement for high-capacity and efficient boiler systems. Countries are also focusing on grid stability, which further supports investment in large-scale, boiler-based thermal generation infrastructure.

Restraining Factors

Strict Environmental Rules Limit Boiler Expansion Plans

One of the main factors holding back the growth of the power plant boiler market is the increasing number of strict environmental rules around the world. Governments are pushing for cleaner energy solutions to reduce air pollution and carbon emissions. Since many power plant boilers run on coal and other fossil fuels, they are often linked to high emissions of greenhouse gases.

New regulations require power plants to lower these emissions, which can increase costs due to the need for pollution control technologies or upgrades. In some regions, approval for new coal-based boiler projects is being delayed or rejected altogether. These rules make it harder for companies to invest in traditional boiler systems, slowing down market growth.

Growth Opportunity

Modernizing Old Plants Creates New Boiler Demand

A major growth opportunity in the power plant boiler market comes from the need to upgrade and modernize aging thermal power plants. Many power stations around the world, especially in developed countries, were built decades ago and now require replacement or improvement of outdated boiler systems. These older boilers are often less efficient and produce more emissions.

Replacing them with modern, high-efficiency boilers not only improves performance but also helps meet current environmental standards. Governments and utility companies are investing in such modernization projects to extend plant life, reduce maintenance costs, and increase energy output. This creates strong demand for advanced boiler technologies and services, opening up new opportunities for growth in the global boiler market.

Latest Trends

Shift Toward Supercritical Boilers Gains Speed

One of the latest trends in the power plant boiler market is the growing use of supercritical and ultra-supercritical boiler technologies. These advanced systems operate at much higher pressure and temperature than traditional subcritical boilers, allowing them to produce more electricity using less fuel. This makes them more efficient and better for the environment, as they release fewer emissions per unit of energy generated.

Many countries are now choosing these advanced boilers for new power plants or upgrading older systems to improve performance and meet environmental goals. The shift reflects a broader move toward cleaner and more cost-effective power generation, especially in areas where coal and thermal energy will still play a role shortly.

Regional Analysis

In the Asia Pacific, the Power Plant Boiler Market reached USD 10.2 billion in 2024.

In 2024, Asia Pacific emerged as the dominant region in the Power Plant Boiler Market, capturing a substantial 47.20% share, which translated to a market value of approximately USD 10.2 billion. This leadership is supported by high electricity demand, rapid industrialization, and ongoing power infrastructure investments across countries such as China, India, and Southeast Asia.

The region continues to rely heavily on thermal power generation, thereby driving steady demand for new and replacement boiler systems. In contrast, North America and Europe maintained moderate shares, influenced by aging thermal assets and a gradual shift toward renewable energy sources, which have somewhat limited new installations. However, these regions still exhibit activity in retrofitting and upgrading existing plants to meet stricter emission standards.

The Middle East & Africa market is showing gradual expansion, mainly driven by increasing electricity needs in urban centers and investments in grid stability projects. Latin America’s market remains comparatively smaller, but opportunities exist in modernizing outdated power generation infrastructure.

While all regions contribute to the market, Asia Pacific leads in terms of capacity addition and value, reflecting its central role in global energy production trends and the continued relevance of boiler-based thermal power generation across developing economies in the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Babcock & Wilcox Enterprise continued to demonstrate strong engineering expertise and legacy positioning within the power plant boiler market. Its reputation for delivering reliable and durable boiler systems underpins its sustained relevance in both retrofit and new-build projects. Given market preferences for tried-and-tested technologies, the firm’s emphasis on service quality and technical support reinforced its competitive strength.

Meanwhile, Dongfang Electric Corporation maintained its prominence through aggressive capacity expansion and strategic alignment with energy infrastructure growth in Asia. The company’s deep market penetration and vertically integrated approach—covering equipment manufacturing through to plant construction—provided it with an advantageous value capture model. This approach supported its ability to meet rising boiler demand in high-growth regions efficiently.

Doosan Heavy Industries & Construction asserted its market position by focusing on technology adaptability and project diversity. With experience spanning coal, gas, and biomass boiler systems, the firm was positioned to respond to evolving sectoral demands and retrofit requirements. Its engineering flexibility and turnkey project delivery contributed to stable opportunities in both developed and developing power markets.

Finally, General Electric capitalized on its innovation-driven reputation and global service network. The company’s access to advanced materials and monitoring technology allowed it to offer high-efficiency boiler solutions, aligning with utilities’ growing demands for performance optimization. Its vast after-sales service ecosystem and digital integration of performance monitoring helped retain existing clients and secure long-term contracts.

Top Key Players in the Market

- Babcock & Wilcox Enterprise

- Dongfang Electric Corporation

- Doosan Heavy Industries & Construction

- General Electric

- Mitsubishi Hitachi Power Systems

- Siemens

- IHI Corporation

- John wood Group

- Bharat Heavy Electrical Limited

- Thermax

- Andritz Group

- Sumitomo Heavy Industries

- Valmet

- Harbin Electric

Recent Developments

- In March 2025, Dongfang Boiler (a division of Dongfang Electric) initiated a tender for the procurement and construction of a hydrogen production electrolyzer production line in Ziyang. The project’s budget is approximately 10 million yuan and involves design, manufacturing, installation, commissioning, and maintenance training.

- In March 2024, B&W’s Thermal division secured contracts worth approximately USD 24 million to design, manufacture, and supply three industrial boilers and related equipment for petrochemical facilities in the Middle East and Central Asia.

Report Scope

Report Features Description Market Value (2024) USD 21.7 Billion Forecast Revenue (2034) USD 36.0 Billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Pulverized Coal Towers, Circulating Fluidized Bed Boilers, Others), By Capacity (Upto 400 MW, 400-800 MW, Above 800 MW), By Technology (Subcritical, Supercritical, Ultra-supercritical), By Fuel Type (Coal Based, Gas Based, Oil Based, Others), By Application (Power Generation, Industrial Steam, District Heating, Cogeneration, Waste-to-energy) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Babcock & Wilcox Enterprise, Dongfang Electric Corporation, Doosan Heavy Industries & Construction, General Electric, Mitsubishi Hitachi Power Systems, Siemens, IHI Corporation, John wood Group, Bharat Heavy Electrical Limited, Thermax, Andritz Group, Sumitomo Heavy Industries, Valmet, Harbin Electric Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Power Plant Boiler MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Power Plant Boiler MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Babcock & Wilcox Enterprise

- Dongfang Electric Corporation

- Doosan Heavy Industries & Construction

- General Electric

- Mitsubishi Hitachi Power Systems

- Siemens

- IHI Corporation

- John wood Group

- Bharat Heavy Electrical Limited

- Thermax

- Andritz Group

- Sumitomo Heavy Industries

- Valmet

- Harbin Electric