Global Power Metering Market Size, Share, And Enhanced Productivity By Type (Single Phase, Three Phase, Smart Metering), By Component (Current Transformers, Voltage Transformers, Data Loggers, Communication Modules, Software Solutions), By Technology (Smart Meters, Analog Meters, Digital Meters, Prepaid Meters, Advanced Metering Infrastructure), By Application (Residential, Commercial, Industrial, Utility, Renewable Energy), By End Use (Energy Management, Billing and Revenue Assurance, Load Monitoring, Demand Response, Grid Management), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 173988

- Number of Pages: 228

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

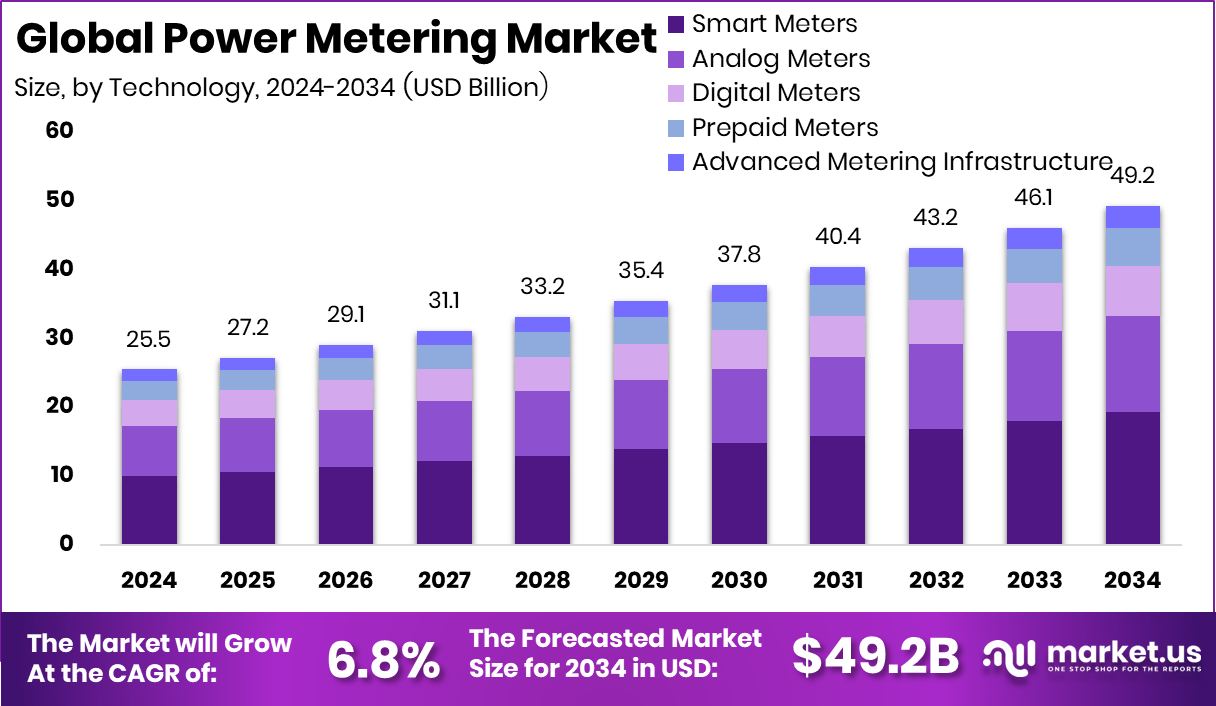

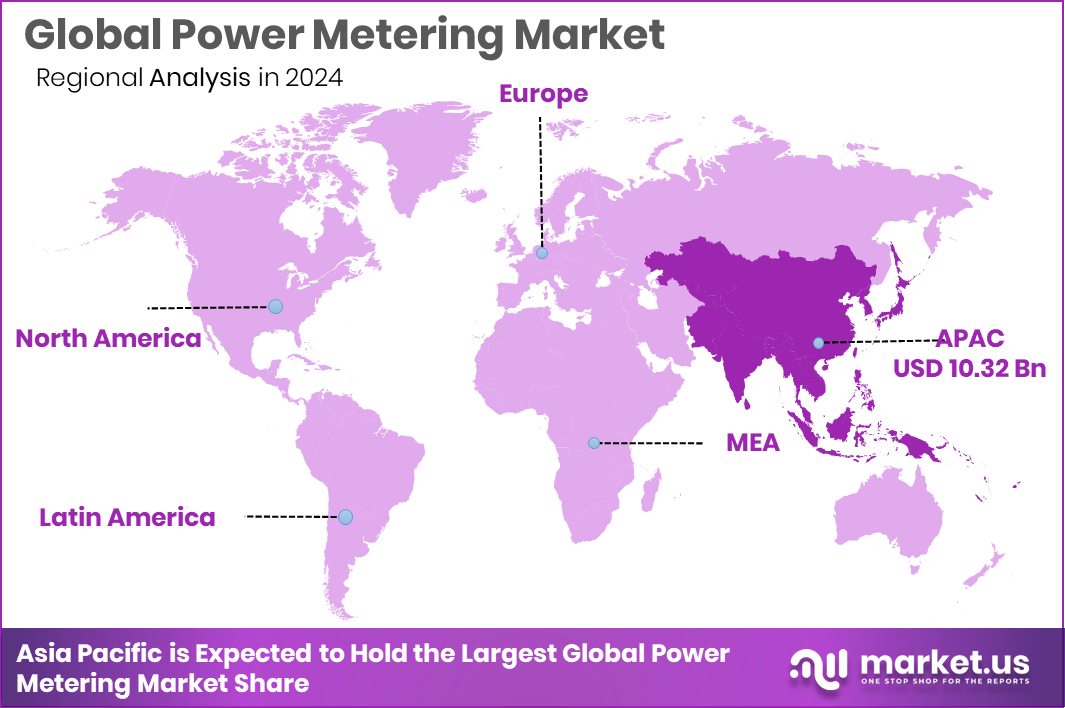

The Global Power Metering Market is expected to be worth around USD 49.2 billion by 2034, up from USD 25.5 billion in 2024, and is projected to grow at a CAGR of 6.8% from 2025 to 2034.Asia Pacific dominates the power metering market with 40.5% share worth USD 10.32 Bn.

Power metering is the process of measuring how much electricity is used, when it is used, and how it flows through a power system. It relies on meters that track voltage, current, energy consumption, and power quality. These measurements help utilities, businesses, and households understand usage patterns, reduce losses, and ensure accurate billing. Modern power metering also supports remote reading, fault detection, and better control of electricity networks, making it an essential part of reliable power supply.

The power metering market refers to the ecosystem around these measurement systems, including devices, software, and services used by utilities and end users. This market supports electricity generation, transmission, and distribution by ensuring transparency and accountability in energy use. As power systems become more complex, metering plays a central role in managing demand, improving efficiency, and supporting fair billing practices across residential, commercial, and industrial users.

One major growth factor is large-scale public and private investment in metering infrastructure. Apraava Energy secured USD 92 Mn from BII and Standard Chartered to support smart meter rollout, while India’s Genus launched a USD 2 Bn smart meter funding platform. These initiatives reflect strong confidence in metering as a foundation for modern power systems.

Demand is rising as governments push to close long-standing metering gaps. The FG secured N700 Bn to deploy 1.1 million meters by December 2025 and expects 3.2 million meters to accelerate nationwide coverage. These efforts aim to improve billing accuracy, reduce losses, and strengthen utility finances.

Clear opportunities are emerging through long-term national programs and private capital participation. Polaris Smart Metering raised USD 100 Mn from I Squared Capital, while the FG and NSIA earmarked N1.3 Trn for the Presidential Metering Initiative. Together, these moves signal sustained opportunities for scaling power metering to support transparent, efficient, and financially stable electricity systems.

Key Takeaways

- The Global Power Metering Market is expected to be worth around USD 49.2 billion by 2034, up from USD 25.5 billion in 2024, and is projected to grow at a CAGR of 6.8% from 2025 to 2034.

- In the Power Metering Market, three-phase systems dominate with a 48.2% share in 2024.

- Communication modules hold a significant 27.5% share in the Power Metering Market by component type.

- Smart meters represent 39.1% of the Power Metering Market by technology, enhancing grid efficiency.

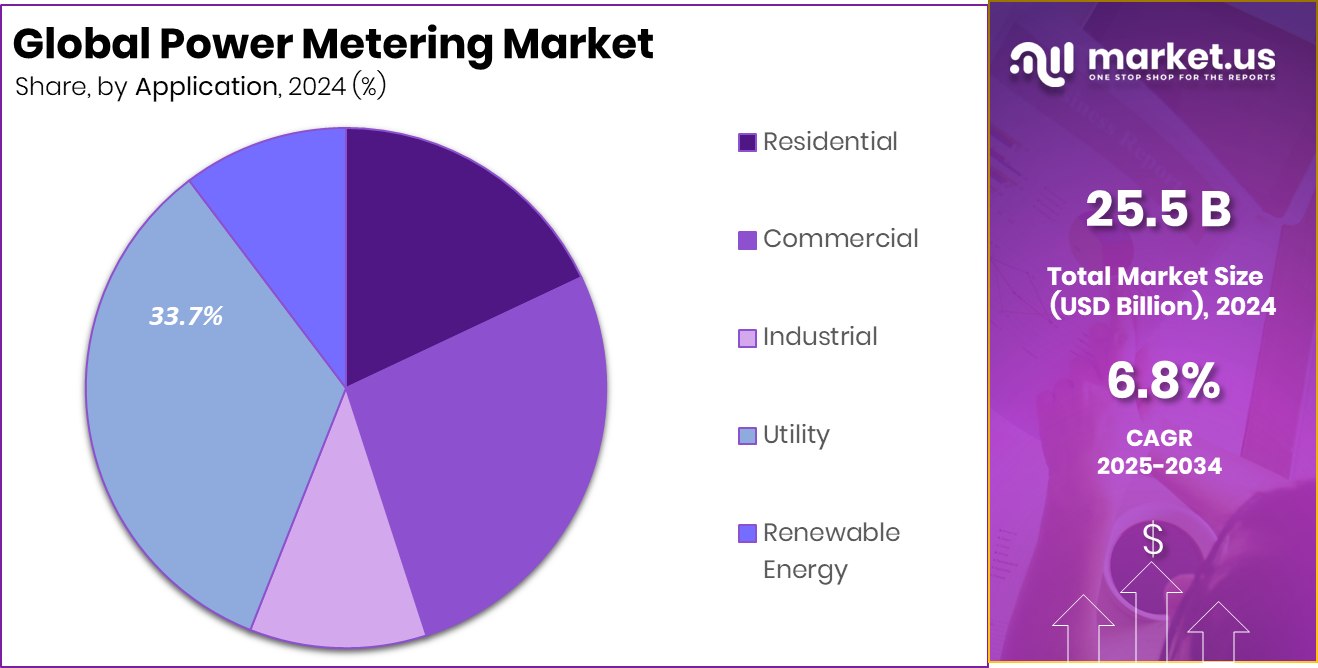

- Utility applications drive the Power Metering Market with a notable 33.7% share in 2024.

- Billing and revenue assurance are the leading end-uses in the Power Metering Market, with 38.8%.

- In Asia Pacific, Power Metering leadership reflects 40.5% share totaling USD 10.32 Bn.

By Type Analysis

In the Power Metering Market, three-phase systems dominate with a 48.2% share.

In 2024, the Power Metering Market saw strong traction for three-phase systems, which accounted for 48.2% of total demand. Three-phase meters are widely used in industrial plants, commercial buildings, and large residential complexes because they measure high loads more accurately and support stable power distribution. Utilities and facility operators prefer these meters as they reduce voltage imbalance issues and improve billing accuracy.

Growing investments in manufacturing, data centers, and electric vehicle charging infrastructure further supported adoption. In addition, grid modernization programs encouraged utilities to replace legacy single-phase meters with advanced three-phase units. Their ability to handle complex load profiles made them essential for monitoring energy efficiency and managing peak demand across high-consumption environments.

By Component Analysis

Communication modules account for 27.5% of the Power Metering Market’s components.

In 2024, the Power Metering Market benefited from rising demand for communication modules, which held a 27.5% share by component. These modules enable real-time data transfer between meters, utilities, and control centers, supporting faster decision-making and remote monitoring. Utilities increasingly rely on communication modules to reduce manual meter reading costs and improve outage response times.

The spread of cellular, RF, and PLC communication technologies helped meters operate reliably across urban and remote regions. As utilities focused on reducing energy losses and improving service reliability, communication modules became central to advanced metering infrastructure deployments. Their role in enabling automated billing, fault detection, and grid analytics strengthened their importance across power networks.

By Technology Analysis

Smart meters represent 39.1% of the technology used in the Power Metering Market.

In 2024, the Power Metering Market was strongly driven by smart meters, which represented 39.1% of adoption by technology. Smart meters provide two-way communication, enabling utilities to track consumption patterns, detect tampering, and manage demand more efficiently.

Governments and utilities promoted smart meter rollouts to support energy conservation and transparency in billing. These meters also empower consumers by offering detailed usage insights, helping households and businesses control electricity costs. Integration with digital platforms and grid management systems further increased their value. As renewable energy sources and distributed generation expanded, smart meters played a key role in balancing loads and supporting flexible energy systems.

By Application Analysis

Utilities hold a 33.7% share in the Power Metering Market’s applications.

In 2024, the Power Metering Market remained dominated by the utility application segment, which captured 33.7% of total usage. Utilities rely on power meters to monitor grid performance, manage distribution losses, and ensure accurate billing across large customer bases. Rising electricity demand and aging grid infrastructure pushed utilities to invest in advanced metering solutions.

Power meters also support compliance with regulatory standards related to energy efficiency and emissions reduction. With growing integration of renewable power and decentralized energy resources, utilities required precise measurement tools to maintain grid stability. This continued need for visibility and control sustained strong demand from utility operators worldwide.

By End Use Analysis

Billing and revenue assurance applications contribute to 38.8% of the market’s end-use.

In 2024, the Power Metering Market saw significant demand from billing and revenue assurance, accounting for 38.8% by end use. Accurate metering is critical for utilities to prevent revenue leakage caused by energy theft, faulty meters, or billing errors. Advanced power meters help utilities validate consumption data and improve customer trust through transparent billing.

Automated data collection reduces disputes and speeds up revenue cycles. As electricity tariffs became more dynamic, precise measurement supported time-of-use pricing and fair cost allocation. Utilities increasingly viewed billing and revenue assurance as a strategic priority, reinforcing sustained investment in reliable and accurate power metering solutions.

Key Market Segments

By Type

- Single Phase

- Three Phase

- Smart Metering

By Component

- Current Transformers

- Voltage Transformers

- Data Loggers

- Communication Modules

- Software Solutions

By Technology

- Smart Meters

- Analog Meters

- Digital Meters

- Prepaid Meters

- Advanced Metering Infrastructure

By Application

- Residential

- Commercial

- Industrial

- Utility

- Renewable Energy

By End Use

- Energy Management

- Billing and Revenue Assurance

- Load Monitoring

- Demand Response

- Grid Management

Driving Factors

Rising Renewable Investments Drive Advanced Power Metering

Strong growth in renewable energy projects is a key driving factor for the Power Metering Market. When renewable capacity expands, accurate power measurement becomes essential to manage variable generation and grid stability. This momentum is visible as IREDA shares surged 4% following strong Q3 profit and revenue growth, reflecting confidence in clean energy financing and infrastructure readiness.

In parallel, Juniper Green Energy raised Rs 2,039 Cr in debt from NaBFID, HSBC, DBS, and a Barclays-led consortium, enabling faster development of large renewable assets. As new solar and wind plants connect to grids, utilities require advanced meters to track generation, losses, and consumption precisely. These investments indirectly accelerate demand for reliable power metering systems across transmission and distribution networks

Restraining Factors

Policy Complexity And Funding Focus Shift Slow Deployment

A major restraining factor for the Power Metering Market is the diversion of attention and funding toward broader renewable and storage projects. Spain launched over €1.3bn in calls for renewables and energy storage, channeling capital primarily into generation capacity rather than grid-level measurement upgrades.

Similarly, the Scottish National Investment Bank backed Renewco with £20 million to accelerate renewable projects, again prioritizing energy production. While these initiatives strengthen clean energy supply, they can delay investments in metering infrastructure. Utilities may postpone meter upgrades as capital is absorbed by generation-focused programs, slowing the pace of modern power metering deployment despite growing grid complexity.

Growth Opportunity

Massive Clean Energy Finance Creates Metering Expansion Opportunity

The Power Metering Market has a clear growth opportunity tied to record renewable investments. Global renewable energy investment reached USD 807 billion in 2024, signaling large-scale grid expansion worldwide. At the same time, national ambitions are rising, as highlighted by the statement that mobilizing finance is key to achieving 500 GW renewable energy capacity by 2030, shared by Union Minister Pralhad Joshi.

Such scale cannot function without accurate energy measurement. New generation assets, storage systems, and transmission lines require precise metering for balancing, billing, and compliance. This creates long-term opportunities for advanced power metering solutions aligned with expanding clean energy systems.

Latest Trends

Funding Volatility Reshapes Power Metering Adoption Trends

Recent trends show how funding uncertainty is influencing the Power Metering Market. Constant Energy received THB 300 million in green funding from HSBC to support solar and renewable growth in Thailand, reinforcing demand for modern metering in supported projects.

In contrast, the U.S. decision to cancel USD 13 billion in green energy funds and USD 24 billion in renewable project cancellations this year highlight growing volatility. This uneven funding landscape is pushing utilities to be more selective and data-driven. As a result, smarter, more efficient metering solutions are increasingly favored to maximize performance from limited and uncertain project pipelines.

Regional Analysis

Asia Pacific Power Metering Market reached 40.5% share, valued at USD 10.32 Bn.

The Power Metering Market shows clear regional variation, led by Asia Pacific, which dominates with a 40.5% share, valued at USD 10.32 Bn. This leadership reflects large-scale grid expansion, rapid urbanization, and widespread adoption of advanced metering across utilities and industrial users. Strong electricity demand growth and ongoing modernization of transmission and distribution networks further reinforce Asia Pacific’s position as the most influential regional market.

North America follows with steady demand driven by grid reliability requirements, replacement of aging infrastructure, and continued focus on accurate consumption measurement. Europe maintains stable growth as utilities emphasize efficiency, regulatory compliance, and digital grid management across developed power systems.

In Middle East & Africa, market development is supported by expanding power networks and the need to improve billing accuracy and loss reduction in utility operations. Meanwhile, Latin America shows gradual adoption, supported by distribution upgrades and efforts to improve transparency in electricity consumption measurement. Together, these regional dynamics highlight Asia Pacific’s clear dominance while other regions contribute consistent, structurally driven demand.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Schneider Electric SE continues to play a defining role in the global Power Metering Market through its strong focus on digital energy management and grid intelligence. The company’s portfolio emphasizes accuracy, reliability, and integration with broader energy management systems. Its ability to align power metering with automation, software, and services allows utilities and large energy users to improve visibility across electrical networks. Schneider Electric’s strategic positioning around efficiency and data-driven decision-making reinforces its long-term relevance as power systems become more complex and distributed.

Eaton Corporation plc brings a practical, application-focused approach to power metering. In 2024, Eaton’s strength lies in combining metering hardware with protection and power quality solutions. This integrated approach supports utilities, commercial facilities, and industrial users seeking dependable measurement alongside system safety. Eaton’s emphasis on resilient electrical infrastructure aligns well with growing needs for load monitoring, fault detection, and operational continuity, especially in mission-critical environments where power reliability directly impacts productivity and costs.

Siemens AG remains a key innovator by embedding power metering into broader digital grid and industrial automation ecosystems. Its solutions support detailed energy monitoring while enabling seamless connectivity with smart grids and industrial control systems. Siemens’ focus on digitalization and system interoperability strengthens its competitive position, allowing customers to link metering data with analytics, automation, and long-term infrastructure planning.

Top Key Players in the Market

- Schneider Electric SE

- Eaton Corporation plc

- Siemens AG

- General Electric Company

- Honeywell International Inc.

- Landis+Gyr AG

- Itron Inc.

- Kamstrup A/S

- Wasion Group Holdings Limited

Recent Developments

- In July 2025, Schneider announced it would acquire the remaining 35% stake in Schneider Electric India Private Limited (SEIPL), strengthening its role in one of its largest markets and enabling faster deployment of energy management technologies across India and Asia.

- In March 2025, Eaton completed the purchase of Fibrebond Corporation, a company that makes pre-integrated modular power enclosures used in data centers, industrial sites, utilities, and communication networks. This move expands Eaton’s electrical infrastructure portfolio by adding rugged, ready-to-install enclosures, which complement power monitoring and distribution systems.

Report Scope

Report Features Description Market Value (2024) USD 25.5 Billion Forecast Revenue (2034) USD 49.2 Billion CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Single Phase, Three Phase, Smart Metering), By Component (Current Transformers, Voltage Transformers, Data Loggers, Communication Modules, Software Solutions), By Technology (Smart Meters, Analog Meters, Digital Meters, Prepaid Meters, Advanced Metering Infrastructure), By Application (Residential, Commercial, Industrial, Utility, Renewable Energy), By End Use (Energy Management, Billing and Revenue Assurance, Load Monitoring, Demand Response, Grid Management) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Schneider Electric SE, Eaton Corporation plc, Siemens AG, General Electric Company, Honeywell International Inc., Landis+Gyr AG, Itron Inc., Kamstrup A/S, Wasion Group Holdings Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Schneider Electric SE

- Eaton Corporation plc

- Siemens AG

- General Electric Company

- Honeywell International Inc.

- Landis+Gyr AG

- Itron Inc.

- Kamstrup A/S

- Wasion Group Holdings Limited