Global Power Electronic Market By Type (Power Module, Power Discrete, Power IC), By Material (Silicon Carbide, Sapphire, Gallium Nitride, Silicon, Others), By Application(Automotive, Industrial, Consumer Electronics, Aerospace and Defense, ICT, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Feb. 2024

- Report ID: 106573

- Number of Pages: 357

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

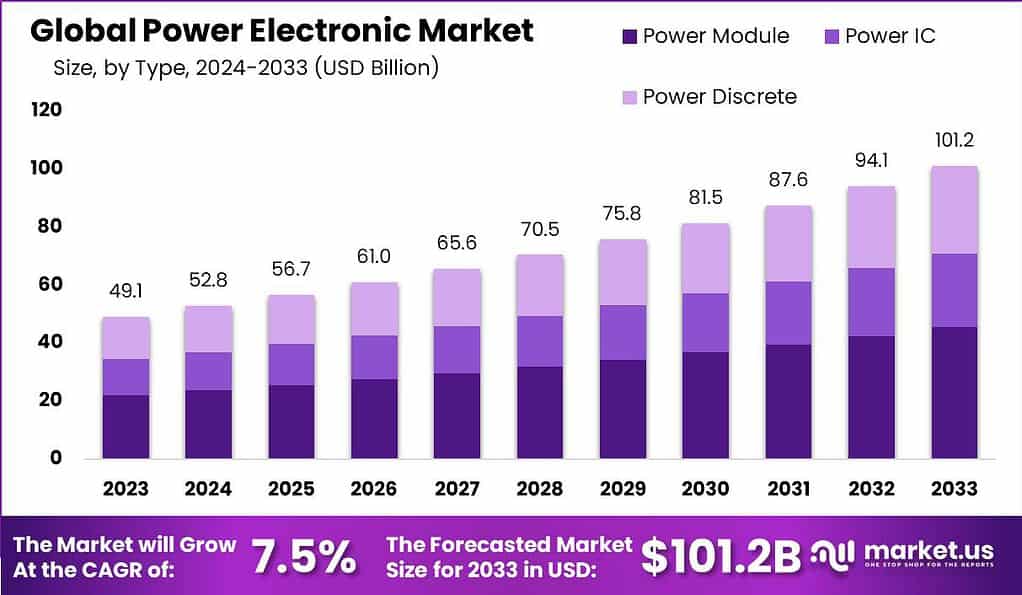

The Global Power Electronic Market is projected to reach a valuation of USD 101.2 billion by 2033 from USD 49.1 Billion in 2023; exhibiting a growth rate (CAGR) of 7.5% during 2024-2033.

Power electronics refers to the technology and devices that are used for the conversion, control, and management of electrical power. It involves the design and application of electronic circuits and systems that can efficiently handle the flow of electrical energy. Power electronic devices such as power converters, inverters, and rectifiers play a crucial role in various applications, including renewable energy systems, electric vehicles, industrial automation, consumer electronics, and power distribution networks.

The power electronics market has witnessed significant growth in recent years, driven by several factors. Firstly, the increasing demand for energy-efficient solutions and the growing emphasis on renewable energy sources have propelled the adoption of power electronic devices. These devices enable the efficient conversion and utilization of electrical power, enabling the integration of renewable energy sources such as solar and wind into the power grid.

Furthermore, the rising adoption of electric vehicles (EVs) has fueled the demand for power electronics. Power electronic devices are essential components in EVs, responsible for managing the energy flow between the battery and the electric motor, as well as facilitating fast charging capabilities. The growing awareness of environmental concerns and government initiatives to reduce carbon emissions have accelerated the adoption of electric vehicles, thereby driving the growth of the power electronics market.

Power electronics have been steadily adopted across energy conversion applications. Their increased usage across numerous vertical markets is greatly driving growth in global power electronics sales. Increased demand for automation technologies and industry 4.0 are major contributors to the expansion of power electronics market. Adopting automated assembly lines or industrial robots are significant market drivers. However, shortages of semiconductors across global markets is hindering market expansion. A rising gap between demand and supply could have detrimental repercussions for global power electronics market during its forecast period.

As electric vehicle usage surges worldwide, so has the Power Electronics Market expanded significantly. Development and shift towards renewable power sources drives this sector as demand rises for portable energy-efficient devices with battery backup power sources such as SiC and GaN products in various fields of application. Businesses in this sector should see significant returns during forecast period due to increasing industrialization of developing countries as well as increased usage of SiC/GaN products across industries.

Market Trends

Below are the primary market trends observed within the power electronics sector:

- Emergence of Electric Vehicles: Electric vehicles have become more widely adopted due to their many advantages over gasoline-powered ones, including lower emissions and operating costs. Electric cars utilize power electronics devices in various components such as motor drives, battery management systems and charging systems – increasing demand is for these hybrid vehicles is growing as more consumers realize these vehicles offer substantial cost and environmental savings advantages over gasoline alternatives.

- Growth of renewable energy: Renewable Energy Sources Are Expanding: Renewable energy sources like solar and wind power have become an ever-increasing part of global energy mix, using power electronics devices for components of their systems including inverters, turbines and battery energy storage solutions.

- Rising Demand for Energy Efficiency: Energy efficiency has become an increasing focus for both businesses and individuals worldwide, and power electronics devices provide valuable assistance in improving energy efficiency by decreasing power consumption while improving power system performance.

Type Analysis

The leading segment in the Power Electronic Market by type is Power Module. These integrated devices combine various power electronics components like transistors, diodes and capacitors into one package for reduced size and weight as well as increased efficiency, increased reliability and easier design and assembly processes. This offers several benefits that benefit designers as well as end users of power modules.

Power modules have become an indispensable component in many different fields, including electric vehicles, renewable energy systems, industrial automation and consumer electronics. Their use is projected to grow further over time with increasing adoption of electric vehicles and renewable energy solutions.

Material Analysis

Silicon dominated the global power electronics market in 2022 in terms of revenue and is projected to remain so throughout its forecast period, thanks to its widespread application across various end use applications and as the preferred substrate for producing semiconductor wafers used for low power applications. This result can be explained by extensive use of silicon in power electronics production for various end use applications; along with being widely preferred as the ideal material to construct them on.

Conversely, sapphire is projected to emerge as one of the most lucrative segments during this forecast period, thanks to its growing use in various products like smartwatches, LED lights and optical wafers.

Application Analysis

Aerospace and defense sectors dominated the global power electronics market in 2022 in terms of revenue, and are expected to maintain this status through to the forecast period. Aerospace & Defense industries’ increased adoption of power electronics for use across applications like cabin lighting, flight control, communications, power drive controls, navigations systems among many others is driving its growth significantly. These industries invest heavily on developing compact low weight cost effective equipment while simultaneously strengthening surveillance communications & commands which has resulted in its exponential expansion resulting in significant market expansion for this segment.

Automotive is expected to experience rapid expansion during this forecast period due to increasing consumer interest in electric and hybrid vehicles, along with rising disposable income levels and environmental awareness in developed regions like Europe and North America driving their adoption. Therefore, rapidly developing automotive sector will bolster power electronics market growth over time.

Drivers

The following are some of the key market drivers in the power electronics market:

- Government support for electric vehicles and renewable energy: Governments around the globe have implemented policies, programs, incentives and grants designed to encourage adoption of electric vehicles and renewable energy systems – this support driving an increase in power electronics device purchases.

- Technological advancements: Power electronics technology is ever evolving, with new devices and materials constantly emerging to produce more reliable devices that increase efficiency. Technological innovations: As power electronics evolves further into its present state, more efficient power electronics products become available that deliver enhanced functionality to users.

- Increasing demand for industrial automation and consumer electronics: These industries represent some of the fastest-growing segments globally and heavily depend on power electronics devices to maintain efficiency and growth.

Restraints

The following are some of the key market restraints in the power electronics market:

- High cost of power electronics devices: Power electronics devices can be expensive, especially those made with advanced materials like silicon carbide and gallium nitride. Their expense may present some companies with an entry barrier.

- Lack of skilled workers: Due to being such a young industry, power electronics is plagued with an acute talent gap resulting from its recent rapid development and subsequent lack of skilled employees needed for expansion purposes. Companies may find expanding production more challenging as a result.

- Complex manufacturing processes: Manufacturing power electronics devices is an intricate process requiring special tools and knowledge, and may make entry to the market challenging for newcomers.

Market Challenges

The following are some of the key market challenges in the power electronics market:

- Meeting the increasing demand for electric vehicles: Electric vehicle sales are projected to surge exponentially over the coming years; unfortunately, however, current supplies of power electronics devices do not match this growth, potentially leading to shortages and price hikes in power electronics components.

- Developing new technologies for emerging applications: Power electronics applications continue to expand into emerging areas like smart grids and energy storage systems, necessitating development of innovative new technologies to fulfill these emerging applications’ requirements.

- Reducing the cost of power electronics devices: Power electronics devices can be prohibitively expensive, especially those made using advanced materials like silicon carbide and gallium nitride. There is an urgent need to reduce their prices in order to make them accessible for more customers.

Market Opportunities

- Increased Demand for Energy Efficiency: Energy efficiency has become a priority for both businesses and consumers worldwide, creating new opportunities for power electronics devices that help increase energy efficiency by decreasing power consumption or optimizing power systems performance. Power electronics devices may help businesses and consumers address this growing concern with improved energy consumption by using devices to control consumption or enhance system performance – creating opportunities that should present themselves over time.

- Development of New Technologies for Emerging Applications: With power electronics applications such as smart grids and energy storage systems rapidly evolving, new opportunities arise for power electronics firms who develop technologies suitable for these emerging applications.

- Expanding Power Electronics Market Into New Geographies: As China and India experience explosive economic development, their power electronics markets are experiencing phenomenal growth. Expanding these markets further into other geographies offers new opportunities for power electronics companies.

Market Segmentation

By Type

- Power Module

- Power Discrete

- Power IC

By Material

- Silicon Carbide

- Sapphire

- Gallium Nitride

- Silicon

- Others

By Application

- Automotive

- Industrial

- Consumer Electronics

- Aerospace & Defense

- ICT

- Others

Region Analysis

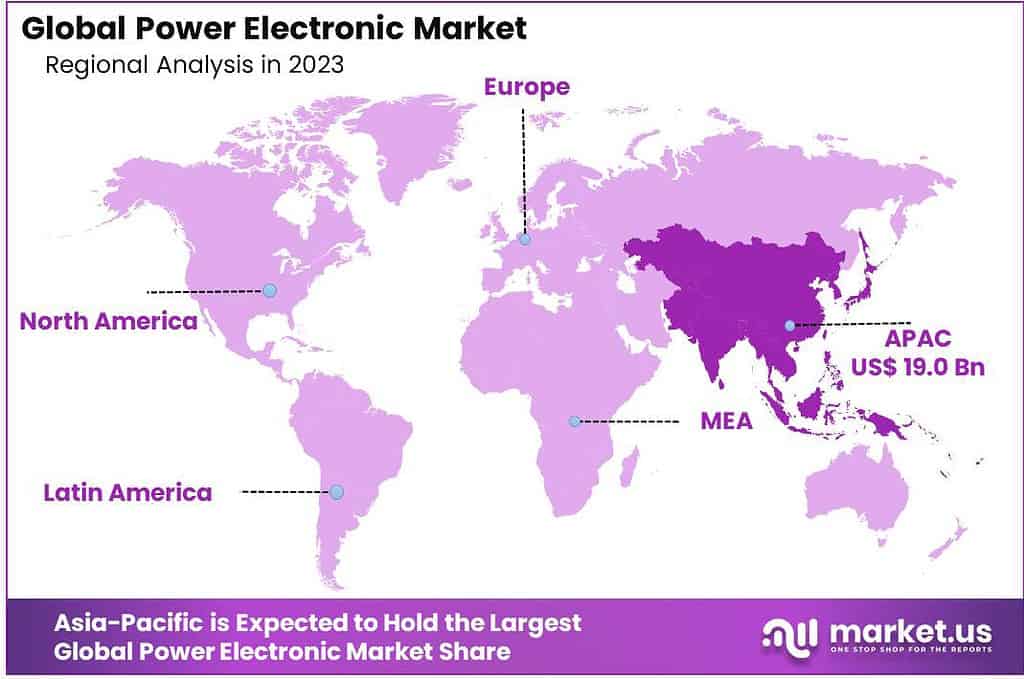

In 2023, APAC (Asia-Pacific) held a dominant market position in the power electronic market, capturing more than a 38.7% share. This region’s leading position can be attributed to several key factors. Firstly, APAC has experienced rapid industrialization and urbanization, resulting in increased demand for power electronic devices across various sectors. The growth of manufacturing industries, infrastructure development, and the rising need for energy-efficient solutions have contributed to the high adoption of power electronic devices in APAC.

Furthermore, APAC is home to some of the world’s largest electronics manufacturing hubs, including China, Japan, South Korea, and Taiwan. These countries have a strong presence in the power electronic market, with a focus on producing high-quality components, semiconductors, and power electronic devices. The availability of a robust supply chain, technological expertise, and favorable government policies supporting the growth of the electronics industry have propelled APAC to the forefront of the power electronic market.

Moreover, APAC is witnessing significant growth in renewable energy installations, particularly in countries like China and India. The integration of renewable energy sources into the power grid requires efficient power electronic devices for energy conversion, grid stabilization, and energy management. The increasing deployment of solar and wind power projects in APAC has driven the demand for power electronic devices, further contributing to the region’s market dominance.

Additionally, the growing consumer electronics market in APAC, along with rising disposable incomes and technological advancements, has stimulated the demand for power electronic devices in the region. The high adoption of smartphones, laptops, televisions, and other consumer electronics drives the need for efficient power management and battery charging solutions, creating a significant market opportunity for power electronic devices.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the landscape of the Power Electronic Market witnessed significant activity, with key players such as ABB Ltd., Infineon Technologies AG, Toshiba Corporation, Texas Instruments Incorporated, STMicroelectronics N.V., Mitsubishi Electric Corporation, Renesas Electronics Corporation, Fuji Electric Co., Ltd., Danfoss Group, Eaton Corporation plc, ROHM Co., Ltd., Analog Devices, Inc., and various others, playing pivotal roles in shaping its trajectory. These companies, renowned for their technological prowess and innovative solutions, collectively drove the evolution of power electronics, facilitating advancements across diverse sectors.

ABB Ltd., a global leader in power and automation technologies, continued to demonstrate its commitment to sustainable energy solutions, contributing to the proliferation of renewable energy sources and smart grid technologies. Infineon Technologies AG, with its focus on semiconductor solutions, remained at the forefront of enabling efficient power management and control systems, essential for enhancing energy efficiency and reducing environmental impact.

Top Market Leaders

- ABB Ltd.

- Infineon Technologies AG

- Toshiba Corporation

- Texas Instruments Incorporated

- STMicroelectronics N.V.

- Mitsubishi Electric Corporation

- Renesas Electronics Corporation

- Fuji Electric Co., Ltd.

- Danfoss Group

- Eaton Corporation plc

- ROHM Co., Ltd.

- Analog Devices, Inc.

- Other Key Players

Recent Developments

- May 2023: Toshiba Electronics Europe recently unveiled an all-new 150V N-channel power MOSFET using their advanced U-MOS X-H Trench process – TPH9R00CQ5 specifically tailored towards use with switching power supplies designed for communication base stations or industrial uses.

- May 2023: Vishay Intertechnology, Inc. announced the introduction of seventeen Gen 3 650V SiC Schottky diodes featuring a Merged PIN Schottky (MPS) design. Boasting high surge current robustness along with low forward voltage drop, capacitive charge, and reverse leakage current; Vishay Semiconductors devices provide increased efficiency and reliability when applied in switching power designs.

Report Scope

Report Features Description Market Value (2023) USD 49.1 Bn Forecast Revenue (2033) USD 101.2 Bn CAGR (2024-2033) 7.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Power Module, Power Discrete, Power IC), By Material (Silicon Carbide, Sapphire, Gallium Nitride, Silicon, Others), By Application(Automotive, Industrial, Consumer Electronics, Aerospace and Defense, ICT, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape ABB Ltd., Infineon Technologies AG, Toshiba Corporation, Texas Instruments Incorporated, STMicroelectronics N.V., Mitsubishi Electric Corporation, Renesas Electronics Corporation, Fuji Electric Co. Ltd., Danfoss Group, Eaton Corporation plc, ROHM Co. Ltd., Analog Devices Inc., Other Key Players, , Customization Scope Customization for segents, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ABB Ltd.

- Infineon Technologies AG

- Toshiba Corporation

- Texas Instruments Incorporated

- STMicroelectronics N.V.

- Mitsubishi Electric Corporation

- Renesas Electronics Corporation

- Fuji Electric Co., Ltd.

- Danfoss Group

- Eaton Corporation plc

- ROHM Co., Ltd.

- Analog Devices, Inc.

- Other Key Players