Global Portland Cement Market Size, Share, And Business Benefits By Type (Ordinary Portland Cement (OPC), Blended Cement, White Cement, Sulphate Resistant Cement, Portland Limestone Cement, Others), By Strength (33 Grade, 43 Grade, 53 Grade), By Additives (Fly Ash, Slag, Limestone, Silica Fume, Gypsum), By Application (Infrastructure Construction, Residential Commercial Buildings, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151029

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

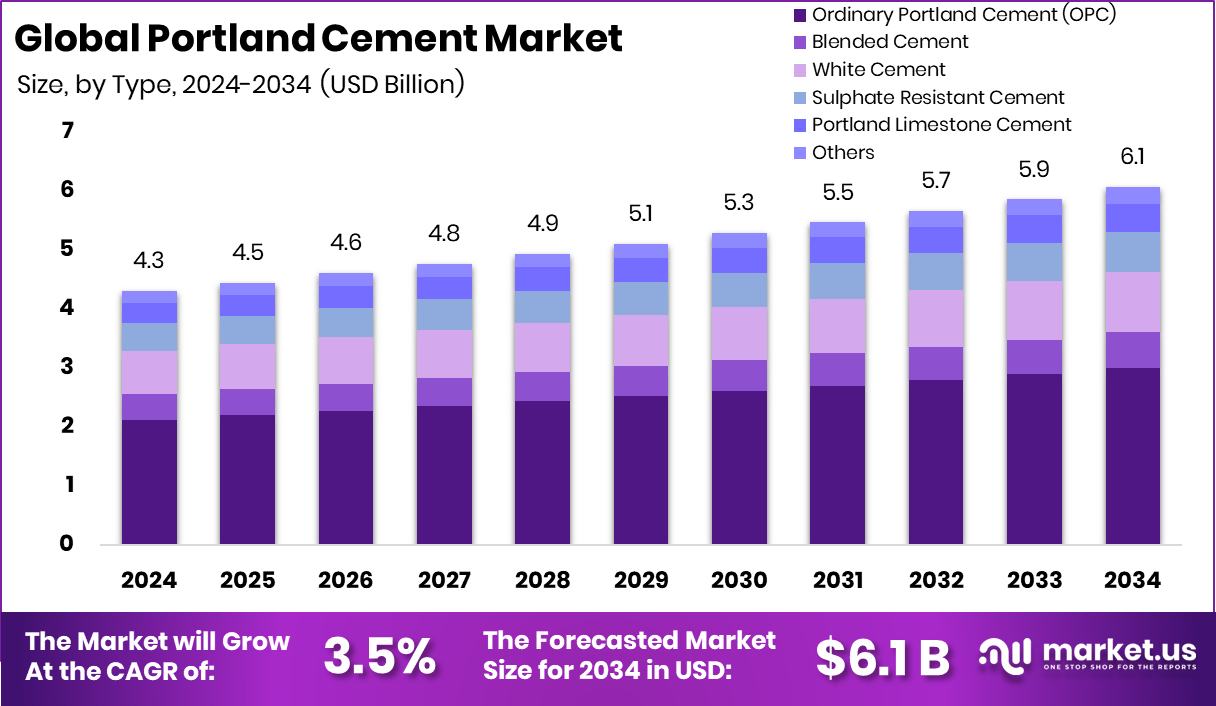

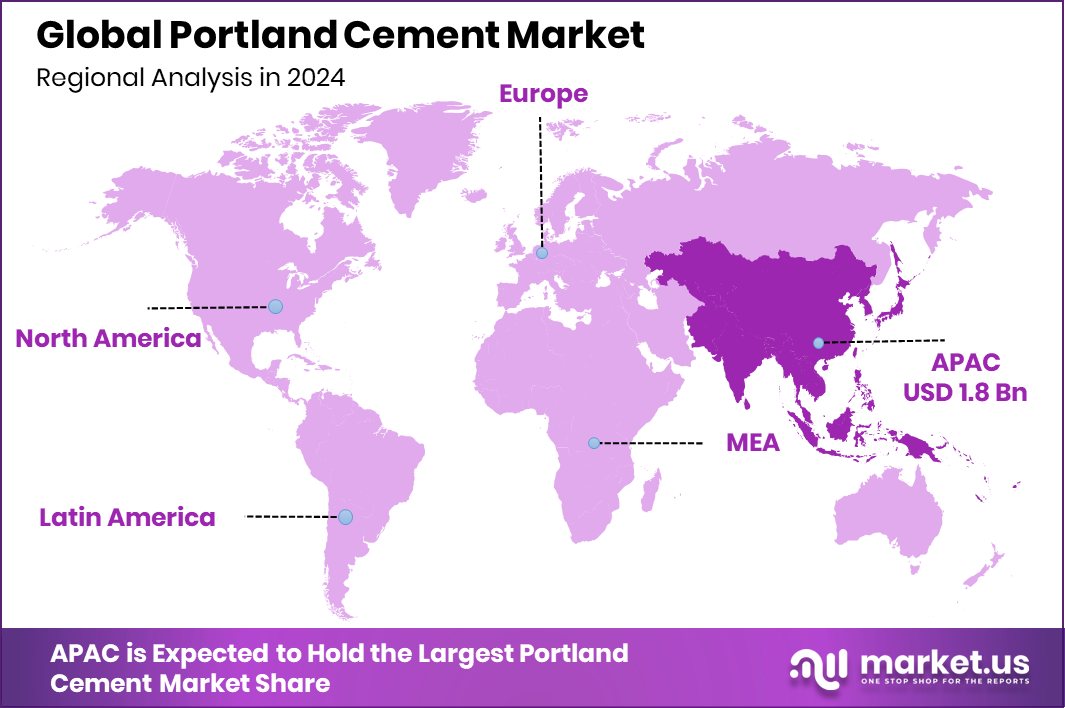

Global Portland Cement Market is expected to be worth around USD 6.1 billion by 2034, up from USD 4.3 billion in 2024, and grow at a CAGR of 3.5% from 2025 to 2034. Strong construction growth in Asia-Pacific drives demand, maintaining its USD 1.8 billion lead.

Portland cement is the most widely used type of cement in construction, made primarily from limestone, clay, and a few other materials that are heated in a kiln and then ground into a fine powder. When mixed with water, it forms a paste that hardens and binds aggregates like sand and gravel into concrete. Its strength, durability, and versatility make it a fundamental material in building roads, bridges, residential housing, and infrastructure projects around the world.

The Portland cement market refers to the global industry involved in the production, distribution, and consumption of this cement type. It plays a vital role in the construction sector, supporting both public and private projects. The market includes cement manufacturers, suppliers, logistics providers, and end-users such as construction firms and contractors. According to an industry report, Furno, a startup focused on reducing carbon emissions in cement manufacturing, has closed an oversubscribed seed funding round of $6.5 million.

Several growth factors drive this market, including the rise in population and the need for housing, transportation systems, and public utilities. Governments investing in infrastructure development also contribute to the increasing demand for Portland cement. Furthermore, emerging economies are witnessing rapid development, fueling the need for long-lasting and cost-effective construction materials. According to an industry report, Terra CO2 has raised US$ 82 million in Series B funding to advance its sustainable cement technology.

Demand remains strong due to the material’s essential role in foundational construction work. As cities expand and new urban projects are planned, a consistent supply and innovations in cement composition to reduce environmental impact is becoming key. This creates a steady flow of business opportunities for players across the supply chain. According to an industry report, Queens Carbon has secured US$ 10 million in seed funding to develop its low-carbon cement solutions.

Key Takeaways

- Global Portland Cement Market is expected to be worth around USD 6.1 billion by 2034, up from USD 4.3 billion in 2024, and grow at a CAGR of 3.5% from 2025 to 2034.

- Ordinary Portland Cement holds 49.4% share, dominating the Portland Cement Market by product type.

- The 43 Grade strength category contributes 38.6%, showing strong demand in the Portland Cement Market.

- Fly Ash additives are used in 34.7% of mixes, influencing sustainability in the Portland Cement Market.

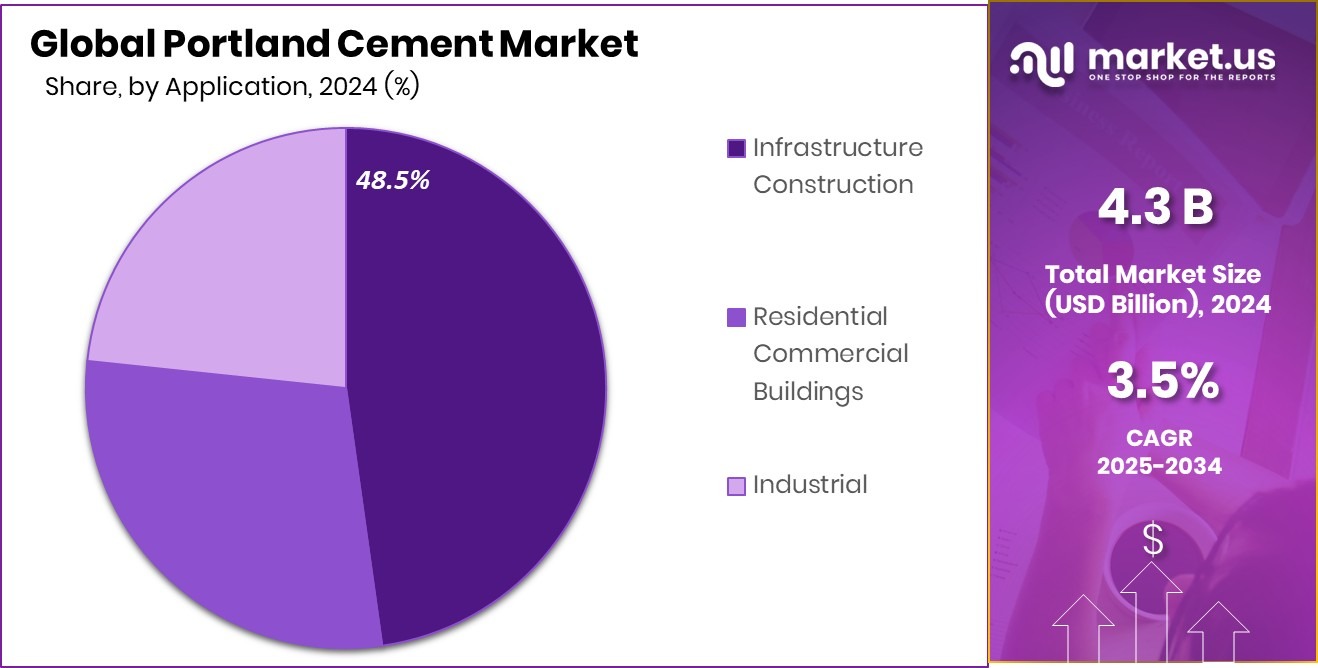

- Infrastructure construction leads with a 48.5% application share, driving growth in the Portland Cement Market.

- The Asia-Pacific accounted for a market value of USD 1.8 billion overall.

By Type Analysis

Ordinary Portland Cement holds a 49.4% share in the global Portland Cement Market.

In 2024, Ordinary Portland Cement (OPC) held a dominant market position in the By Type segment of the Portland Cement Market, with a 49.4% share. This strong performance reflects OPC’s continued preference across a wide range of construction applications, owing to its high strength, durability, and general-purpose utility. OPC is particularly favored in structural works such as buildings, bridges, pavements, and highways, where early strength and reliable performance are crucial.

The 49.4% share signifies a consistent demand pattern driven by the material’s availability and cost-effectiveness. Construction professionals often choose OPC for its uniform setting time and long-standing presence in the industry, which ensures familiarity and trust. The cement’s performance in various climatic conditions and its proven record in infrastructure projects enhance its dominance.

The segment’s lead in 2024 also indicates that, despite the growing awareness around sustainability and alternative materials, traditional choices like OPC still hold ground due to their unmatched practicality in many real-world construction scenarios.

By Strength Analysis

The 43 Grade strength type contributes 38.6% to the Portland Cement Market demand.

In 2024, 43 Grade held a dominant market position in the By Strength segment of the Portland Cement Market, with a 38.6% share. This highlights the continued preference for 43 Grade cement in a range of construction applications that require moderate strength and consistent performance. Commonly used in residential and commercial building projects, 43 Grade cement is known for its adequate compressive strength and versatility in masonry, plastering, and general structural works.

The 38.6% market share underscores its balance between strength, workability, and cost, making it a practical choice for everyday construction needs. Builders and contractors favor 43 Grade cement for its predictable setting time and compatibility with various mixes. Its use in applications where rapid strength gain is not the primary requirement further supports its widespread acceptance.

Moreover, 43 Grade cement is often considered an optimal solution in regions where infrastructure development is steady but cost-efficiency remains a key concern. Its established performance, along with sufficient durability for mid-range structural demands, contributes to its leading position in the strength segment.

By Additives Analysis

Fly ash additive is used in 34.7% of Portland Cement Market products.

In 2024, Fly Ash held a dominant market position in the By Additives segment of the Portland Cement Market, with a 34.7% share. This significant share highlights the increasing use of fly ash as a key additive in cement production, owing to its benefits in improving workability, durability, and long-term strength of concrete. As a fine byproduct of coal combustion in power plants, fly ash is blended with Portland cement to enhance its performance characteristics, particularly in mass concrete structures and large-scale construction.

The 34.7% market share reflects strong industry adoption due to its pozzolanic properties, which allow it to react with calcium hydroxide and form compounds with cementitious value. This not only contributes to strength development over time but also helps in reducing the heat of hydration, making it suitable for projects that require low thermal cracking.

Fly ash also plays a role in promoting resource efficiency, as it utilizes industrial waste that would otherwise require disposal. Its use aligns well with cost-conscious construction practices, without compromising on quality. The dominance of fly ash in the additives segment is supported by its proven compatibility with cement and its established track record in improving performance while maintaining economic and operational efficiency.

By Application Analysis

Infrastructure construction applications dominate with 48.5% in the Portland Cement Market usage.

In 2024, Infrastructure Construction held a dominant market position in the By Application segment of the Portland Cement Market, with a 48.5% share. This substantial share reflects the critical role Portland cement plays in the development of public infrastructure, including roads, highways, bridges, railways, and urban transit systems. The segment’s dominance is driven by the consistent demand for high-strength, durable materials required in long-term infrastructure projects.

The 48.5% market share indicates that a large portion of cement consumption is tied to government and public sector-led construction initiatives aimed at improving transportation networks and civic amenities. Portland cement, known for its reliability and load-bearing properties, is a preferred material in these projects due to its proven ability to meet structural standards and environmental stress demands.

This leading position is also supported by ongoing investment in national and regional development plans that prioritize connectivity, safety, and durability in public works. With large-scale projects often requiring significant volumes of cement, Infrastructure Construction continues to be the most significant application area, sustaining steady demand and positioning the segment at the forefront of the Portland Cement Market in 2024.

Key Market Segments

By Type

- Ordinary Portland Cement (OPC)

- Blended Cement

- White Cement

- Sulphate Resistant Cement

- Portland Limestone Cement

- Others

By Strength

- 33 Grade

- 43 Grade

- 53 Grade

By Additives

- Fly Ash

- Slag

- Limestone

- Silica Fume

- Gypsum

By Application

- Infrastructure Construction

- Residential Commercial Buildings

- Industrial

Driving Factors

Growing Urbanization and Infrastructure Fuel Cement Demand

One of the top driving factors for the Portland Cement Market is the rapid pace of urbanization and infrastructure development around the world. As more people move into cities, the need for housing, roads, bridges, public buildings, and utilities continues to rise. Governments and private developers are investing heavily in expanding transportation systems, water supply networks, and energy infrastructure—all of which rely heavily on Portland cement.

Its strength, durability, and affordability make it the go-to material for these large-scale projects. Whether it’s building new highways or upgrading older structures, the increasing demand for reliable construction materials directly supports the cement market’s growth. This steady need for infrastructure keeps the market active and expanding year after year.

Restraining Factors

Environmental Concerns and Emission Regulations Limit Growth

A major restraining factor for the Portland Cement Market is the growing concern over environmental impact and strict emission regulations. Cement production releases a significant amount of carbon dioxide (CO₂), contributing to global greenhouse gas emissions. As environmental awareness increases, many countries have introduced regulations to reduce industrial emissions.

This puts pressure on cement manufacturers to adopt cleaner technologies, which can be costly and time-consuming. Smaller producers may struggle to comply, affecting overall production capacity. Additionally, public demand for greener building materials is rising, encouraging a shift toward alternatives.

Growth Opportunity

Rising Demand in Emerging Economies Drives Opportunity

A major growth opportunity for the Portland Cement Market lies in the rising demand from emerging economies. Countries in Asia, Africa, and parts of Latin America are witnessing rapid development in infrastructure, urban housing, and industrial projects. With growing populations and improving economic conditions, these regions need new roads, buildings, bridges, and public facilities—most of which require large volumes of cement.

As governments increase spending on construction and modernization, the demand for Portland cement is expected to grow steadily. These markets also offer opportunities for local production, job creation, and investment in new manufacturing facilities. This expansion into fast-developing regions can significantly boost the overall growth of the cement market in the coming years.

Latest Trends

Shift Toward Low-Carbon and Green Cement Solutions

A key recent trend in the Portland Cement Market is the shift toward low-carbon and green cement solutions. Producers are increasingly looking to reduce the carbon footprint of cement by experimenting with alternative raw materials, energy-efficient processes, and additives that lower emissions. This includes blending Portland cement with materials like fly ash or slag, as well as exploring new technologies like carbon capture or kiln fuel switching.

These efforts aim to make the product greener and better for the environment without sacrificing performance. Customers—especially in progressive regions—are also showing interest in “greener” concrete for new projects. As environmental concerns gain more attention, embracing such sustainable innovations becomes a practical way to stay competitive and meet future construction standards while protecting our planet.

Regional Analysis

In 2024, Asia-Pacific led the Portland Cement Market with a 42.9% share.

In 2024, the Asia-Pacific region held a dominant position in the Portland Cement Market, accounting for 42.9% of the total market share with a valuation of USD 1.8 billion. This leadership is driven by rapid urbanization, ongoing infrastructure development, and population growth across key countries in the region.

Large-scale residential and industrial construction projects continue to fuel cement consumption, making Asia-Pacific the most active and high-demand market. North America and Europe followed, supported by steady investment in infrastructure maintenance and residential renovations. While their growth is moderate, both regions continue to adopt cement solutions for roadways, bridges, and commercial buildings.

The Middle East & Africa region is witnessing increasing demand due to urban expansion and new government-funded infrastructure initiatives, though on a smaller scale. Latin America shows gradual development, with pockets of construction activity in urban centers. However, overall market contribution remains modest compared to other regions.

The Asia-Pacific region’s dominant 42.9% share and USD 1.8 billion value clearly reflect its central role in shaping the global Portland Cement Market, backed by high-volume usage and continuous investment in construction and urban growth. This strong regional performance continues to drive the momentum of the global market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, key players such as UltraTech Cement, Cemex, and LafargeHolcim continued to shape the global Portland Cement Market through strategic operations, capacity expansions, and a strong focus on sustainable practices. Each company demonstrated distinct strengths while navigating industry challenges, such as emission regulations, raw material costs, and shifting market demand.

UltraTech Cement maintained a firm position, particularly in Asia, by leveraging its vast production capacity and extensive distribution network. Its adaptability in meeting domestic and international demand, especially in infrastructure and large-scale construction, helped sustain its influence in the market.

Cemex remained a key player with a broad global footprint, especially in the Americas. The company continued to focus on operational efficiency and digital integration in cement production and logistics. Its efforts to reduce carbon emissions and optimize supply chains reflect a forward-thinking approach, helping it stay resilient amid changing environmental and economic conditions.

LafargeHolcim, with its well-established global presence, emphasized innovation and circular construction solutions. Its active shift toward sustainable building materials, along with its investments in recycling and alternative fuels, positioned it as a leader in the market’s transition phase.

Top Key Players in the Market

- UltraTech Cement

- Cemex

- LafargeneHolcim

- Anhui Conch Cement

- Shree Cement

- Buzzi Unicem

- VICAT

- CRH

- HeidelbergCement

- Taiheiyo Cement

- Italcementi Group

- Siam Cement Group

Recent Developments

- In December 2024, the company announced the sale of its nearly 84% stake in Lafarge Africa (Nigeria) to China’s Huaxin Cement in a deal valued at approximately USD 1 billion. This signals Holcim’s strategy to streamline its portfolio and focus on core, high-growth markets.

- In April 2024, Cemex agreed to sell its cement and quarry operations in the Philippines to DMCI Holdings for approximately USD 306 million, as part of a portfolio rebalancing strategy.

Report Scope

Report Features Description Market Value (2024) USD 4.3 Billion Forecast Revenue (2034) USD 6.1 Billion CAGR (2025-2034) 3.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Ordinary Portland Cement (OPC), Blended Cement, White Cement, Sulphate Resistant Cement, Portland Limestone Cement, Others), By Strength (33 Grade, 43 Grade, 53 Grade), By Additives (Fly Ash, Slag, Limestone, Silica Fume, Gypsum), By Application (Infrastructure Construction, Residential Commercial Buildings, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape UltraTech Cement, Cemex, LafargeneHolcim, Anhui Conch Cement, Shree Cement, Buzzi Unicem, VICAT, CRH, HeidelbergCement, Taiheiyo Cement, Italcementi Group, Siam Cement Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- UltraTech Cement

- Cemex

- LafargeneHolcim

- Anhui Conch Cement

- Shree Cement

- Buzzi Unicem

- VICAT

- CRH

- HeidelbergCement

- Taiheiyo Cement

- Italcementi Group

- Siam Cement Group