Pneumococcal Testing Market By Product Type (Consumables, and Analyzers), By Technology (Enzyme Linked Immunosorbent Assay (ELISA), Western Blot Test, Polymerase Chain Reaction, Immunohistochemistry, Immunofluorescence, and Others), By Application (Immunodiagnostics, Point of Care Testing, and Molecular Diagnostic), By End-user (Hospitals & Clinics, Ambulatory Surgical Centers, and Diagnostic Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162262

- Number of Pages: 286

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

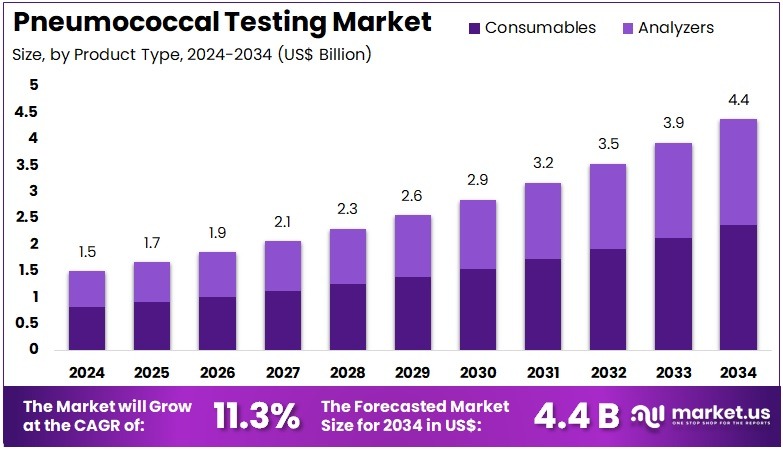

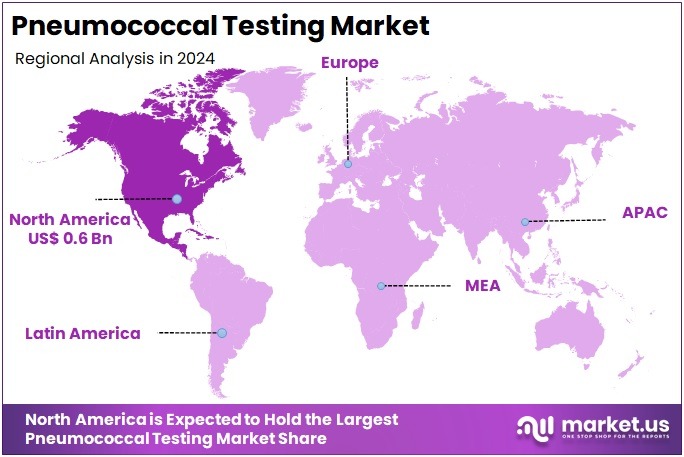

The Pneumococcal Testing Market size is expected to be worth around US$ 4.4 billion by 2034 from US$ 1.5 billion in 2024, growing at a CAGR of 11.3% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 43.2% share and holds US$ 0.6 Billion market value for the year.

Increasing prevalence of invasive pneumococcal diseases drives the Pneumococcal Testing Market, as healthcare providers emphasize rapid pathogen identification to guide antibiotic therapy. Clinicians apply antigen detection assays in emergency departments to confirm Streptococcus pneumoniae in cerebrospinal fluid samples from suspected meningitis cases, enabling swift interventions. These tests support outbreak investigations by identifying serotypes in community-acquired pneumonia, informing public health responses.

Molecular diagnostics, including PCR panels, accelerate results in intensive care units, optimizing sepsis management protocols. In June 2024, Merck & Co., Inc. received FDA approval for its CAPVAXIVE™ 21-valent pneumococcal conjugate vaccine for adults aged 18 and older, targeting prevalent serotypes and strengthening preventive strategies. This development heightens the need for pre-vaccination serotype profiling, presenting opportunities for expanded testing in adult immunization programs.

Growing adoption of vaccination guidelines fuels the Pneumococcal Testing Market, with updated recommendations broadening screening for at-risk groups. Laboratories utilize immunoassay kits for post-vaccination antibody titer monitoring in immunocompromised patients, verifying immune responses to conjugate vaccines. These applications extend to pediatric diagnostics, where urinary antigen tests aid in differentiating bacterial from viral lower respiratory infections in ambulatory settings.

Trends toward multiplex platforms integrate pneumococcal detection with other respiratory panels, enhancing efficiency in diagnostic workflows. In October 2024, the ACIP updated its guidance to recommend routine pneumococcal vaccination for all adults aged 50 and above without prior PCV immunization, enlarging the eligible cohort. Such policy shifts drive demand for baseline testing to assess prior exposure, creating avenues for innovative diagnostic solutions in primary care.

Rising innovation in vaccine candidates propels the Pneumococcal Testing Market, as higher-valency options necessitate advanced serotype surveillance. Researchers employ culture-independent methods like next-generation sequencing in clinical trials to characterize pneumococcal strains, supporting vaccine efficacy evaluations. These tests find utility in surveillance networks, tracking antimicrobial resistance patterns in nasopharyngeal swabs from carriers.

Point-of-care lateral flow assays facilitate bedside confirmation of pneumococcal etiology in elderly pneumonia cases, reducing hospitalization delays. In September 2024, Vaxcyte, Inc. announced encouraging Phase I/II results for its 31-valent pneumococcal conjugate vaccine candidate, VAX-31, offering broader serotype coverage for adults. This progress underscores opportunities for integrated testing-vaccination ecosystems, boosting market growth through enhanced precision in disease monitoring.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.5 billion, with a CAGR of 11.3%, and is expected to reach US$ 4.4 billion by the year 2034.

- The product type segment is divided into consumables and analyzers, with consumables taking the lead in 2023 with a market share of 54.2%.

- Considering technology, the market is divided into ELISA, western blot test, polymerase chain reaction, immunohistochemistry, immunofluorescence, and others. Among these, ELISA held a significant share of 41.7%.

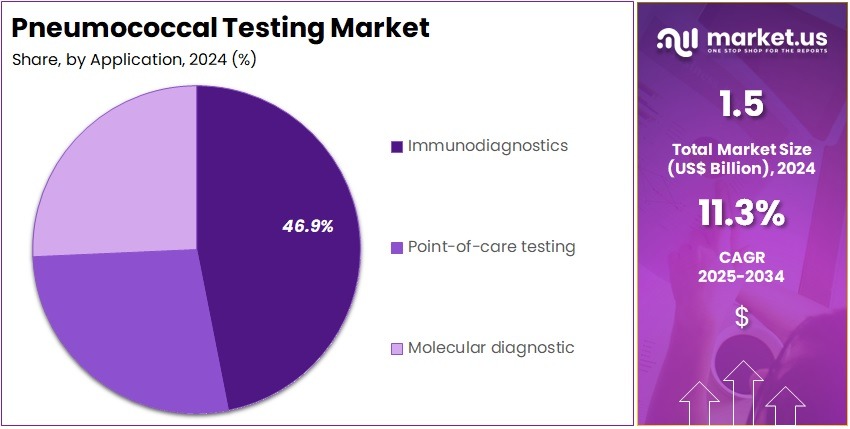

- Furthermore, concerning the application segment, the market is segregated into immunodiagnostics, point of care testing, and molecular diagnostic. The immunodiagnostics sector stands out as the dominant player, holding the largest revenue share of 46.9% in the market.

- The end-user segment is segregated into hospitals & clinics, ambulatory surgical centers, and diagnostic centers, with the hospitals & clinics segment leading the market, holding a revenue share of 51.8%.

- North America led the market by securing a market share of 43.2% in 2023.

Product Type Analysis

Consumables account for 54.2% of the Pneumococcal Testing market and are expected to sustain strong growth due to their recurring demand in diagnostic workflows. These include reagents, test kits, collection materials, and assay substrates, which are essential for routine testing and research applications. Rising awareness of pneumococcal infections, particularly in children and elderly populations, drives consistent use of consumables across hospitals and diagnostic centers.

Manufacturers continue to develop high-quality, standardized consumables that improve accuracy, sensitivity, and throughput, supporting adoption in both large and small laboratories. Government-supported immunization and screening programs contribute to ongoing consumption, particularly in preventive healthcare campaigns. The convenience and scalability of ready-to-use kits for ELISA and PCR applications enhance workflow efficiency in laboratories.

Continuous technological improvements, including improved stability, shelf life, and compatibility with automated platforms, strengthen the consumables segment. Increasing global disease surveillance and early diagnosis initiatives further reinforce the reliance on consumables. Hospitals and clinics prefer consumables to maintain standardized testing protocols and ensure regulatory compliance. Rising incidence of pneumococcal pneumonia and related infections is projected to sustain market growth for consumables over the coming years.

Technology Analysis

ELISA holds 41.7% of the technology segment and is projected to remain the leading diagnostic technique due to its high sensitivity, specificity, and versatility in detecting pneumococcal antigens or antibodies. ELISA-based assays allow quantitative analysis, enabling precise evaluation of immune response or infection status. The adoption of ELISA is anticipated to grow across hospitals, diagnostic centers, and research laboratories due to its reliability, reproducibility, and ability to process high sample volumes efficiently.

Advancements in automated ELISA platforms improve throughput, reduce human error, and streamline laboratory workflows. ELISA is preferred for routine immunodiagnostics, vaccine efficacy studies, and outbreak monitoring, driving consistent adoption. The technology’s compatibility with multiple sample types, including blood and nasopharyngeal swabs, enhances its applicability. As awareness of pneumococcal diseases increases and vaccination programs expand, demand for ELISA testing is expected to rise.

Integration with laboratory information systems and digital reporting further accelerates adoption. Cost-effectiveness, scalability, and strong regulatory acceptance support ELISA’s position as the primary technology in pneumococcal testing. Continuous innovation in reagents, substrates, and detection methods ensures ELISA remains a dominant choice for clinical and research applications.

Application Analysis

Immunodiagnostics holds 46.9% of the application segment and is expected to grow due to the increasing prevalence of pneumococcal infections and the need for accurate serological testing. Immunodiagnostic assays, including ELISA and immunofluorescence tests, allow for the rapid detection of pneumococcal antigens and antibodies, supporting early diagnosis and treatment. Hospitals and diagnostic laboratories increasingly rely on immunodiagnostics to monitor vaccination response and identify at-risk populations.

Technological innovations, such as multiplex immunoassays and high-throughput automated platforms, are anticipated to enhance testing efficiency and accuracy. Growing preventive healthcare initiatives and immunization programs further drive adoption in clinical settings. The ability of immunodiagnostics to deliver precise, reproducible results supports clinician decision-making in patient care. Integration with electronic health systems improves reporting and monitoring of population-level disease trends.

Rising awareness of pneumococcal disease burden, particularly among children, elderly, and immunocompromised individuals, increases demand for immunodiagnostic solutions. Research and development efforts focusing on novel biomarkers and enhanced assay sensitivity contribute to sustained growth. Hospitals leverage immunodiagnostics for routine screenings, outbreak management, and surveillance programs. The combination of reliability, accuracy, and scalability ensures immunodiagnostics remains a core segment of pneumococcal testing.

End-User Analysis

Hospitals and clinics represent 51.8% of the end-user segment and are projected to remain the primary consumers of pneumococcal testing solutions due to their high patient volume and central role in disease management. These facilities utilize immunoassays, ELISA, and other laboratory tests to diagnose infections, monitor vaccination efficacy, and guide treatment protocols. The rising incidence of pneumococcal pneumonia, meningitis, and invasive diseases in vulnerable populations drives demand in hospital settings.

Hospitals increasingly adopt automated analyzers and integrated laboratory platforms to enhance workflow efficiency and reduce testing errors. Government-supported vaccination campaigns and preventive healthcare programs further reinforce adoption in hospitals. Hospitals also conduct large-scale immunodiagnostic testing for surveillance and epidemiological studies, contributing to steady demand. Integration with electronic medical records improves reporting, patient tracking, and clinical decision-making.

Training of healthcare professionals and standardization of protocols enhance testing reliability. Continuous expansion of hospital infrastructure and outpatient services ensures sustained utilization of pneumococcal testing. The combination of clinical need, high throughput requirements, and technological advancements positions hospitals as the leading end-users in this market.

Key Market Segments

By Product Type

- Consumables

- Analyzers

By Technology

- Enzyme Linked Immunosorbent Assay (ELISA)

- Western Blot Test

- Polymerase Chain Reaction

- Immunohistochemistry

- Immunofluorescence

- Others

By Application

- Immunodiagnostics

- Point of Care Testing

- Molecular Diagnostic

By End-user

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Diagnostic Centers

Drivers

Persistent Burden of Invasive Pneumococcal Disease is Driving the Market

The unyielding incidence of invasive pneumococcal disease has markedly intensified the requirement for advanced testing paradigms within the pneumococcal testing market, facilitating prompt pathogen confirmation and therapeutic guidance. This condition, encompassing bacteremia, meningitis, and severe pneumonia, demands serological and molecular assays to delineate serotypes and inform antimicrobial selections amid rising resistance profiles.

Healthcare protocols increasingly mandate confirmatory diagnostics in emergency and inpatient arenas, where delays exacerbate mortality risks in vulnerable populations. This driver is accentuated by epidemiological shifts post-vaccination eras, necessitating surveillance for non-vaccine serotypes that evade conjugate protections.

Public health mandates for enhanced laboratory capacities further propel investments in high-throughput platforms, optimizing outbreak responses. The integration of rapid antigen detection with culture-independent methods streamlines workflows, reducing empirical therapy durations.

The Centers for Disease Control and Prevention estimated 27,770 cases of invasive pneumococcal disease and 3,230 associated deaths in the United States for 2022, underscoring the clinical imperative for vigilant diagnostic infrastructures. This caseload metric, derived from active bacterial core surveillance, illustrates the sustained pressure on testing resources despite immunization advances.

Manufacturers are prioritizing multiplex formats to profile co-pathogens, enhancing differential diagnostics in polymicrobial scenarios. Economically, accurate testing averts escalation to intensive care, justifying allocations for reagent stockpiles. Inter-agency collaborations refine serotyping algorithms, bolstering national reference laboratories. This disease persistence not only amplifies procedural demands but also aligns diagnostics with antimicrobial stewardship imperatives.

Restraints

Stringent Regulatory Requirements for Diagnostic Assay Validation is Restraining the Market

Rigorous oversight on the approval and commercialization of pneumococcal diagnostic kits continues to encumber market fluidity, prolonging pathways from bench to bedside amid evolving pathogen dynamics. Agencies mandate exhaustive analytical and clinical validations to affirm sensitivity across serovariant spectra, diverting developer resources toward compliance rather than iteration. This restraint is compounded by harmonization gaps between jurisdictions, complicating multinational rollouts and inflating harmonization expenditures.

Smaller innovators, constrained by validation timelines, defer launches, ceding ground to entrenched entities with established dossiers. The emphasis on post-market pharmacovigilance further burdens operations, as real-world performance monitoring strains logistical frameworks. Variability in acceptance criteria for multiplex assays exacerbates discordance, risking rejections for marginal discrepancies.

Economic repercussions include deferred revenues, curtailing R&D reinvestments in emerging modalities. Stakeholder forums advocate streamlined risk-tiering, yet consensus eludes amid safety priorities. These validation rigors not only temper innovation velocity but also perpetuate disparities in diagnostic equity across regions.

Opportunities

Integration of Multiplex Respiratory Panels is Creating Growth Opportunities

The assimilation of pneumococcal detection within syndromic multiplex panels has unveiled expansive avenues for the testing market, enabling holistic profiling of lower respiratory threats in consolidated workflows. These platforms, fusing nucleic acid amplification for Streptococcus pneumoniae with influenza and RSV targets, expedite syndromic triages in overburdened facilities. Opportunities flourish in ambulatory extensions, where cartridge-based systems democratize access beyond tertiary hubs, curtailing referral dependencies.

Pharmaceutical alignments bundle diagnostics with stewardship algorithms, fostering value-capture through outcome-linked reimbursements. This consolidation mitigates single-pathogen silos, optimizing antibiotic initiations amid co-infection complexities. Government-backed sentinel expansions incentivize panel adoptions, subsidizing validations for endemic variants.

The BioFire FilmArray Respiratory Panel, integrated with pneumococcal assays, supported over 500,000 U.S. clinical evaluations in 2023, reflecting scalability in syndromic diagnostics. This utilization benchmark validates throughput gains, with projections for broader insurer incorporations.

Innovations in lyophilized reagents enhance shelf-life for remote stockpiles, bridging infrastructural voids. As climate variabilities heighten seasonal surges, versatile panels promise epidemiological resilience. These syndromic evolutions not only diversify test repertoires but also entrench the market within integrated infectious disease architectures.

Impact of Macroeconomic / Geopolitical Factors

Developers in the pneumococcal testing market are navigating economic pressures and global supply constraints, which are slowing the rollout of advanced antigen assays and prompting a focus on securing critical reagents. International trade tensions and shipping disruptions are restricting access to essential diagnostic enzymes, increasing validation timelines and operational costs for labs with cross-border collaborations. To adapt, companies are partnering with domestic enzyme suppliers and implementing stricter quality assurance measures to speed regulatory approvals.

Rising concern over antibiotic-resistant pneumococcal strains is attracting government funding for point-of-care diagnostics, particularly in community health clinics. Tariffs on imported testing materials are further straining budgets, especially in smaller or rural facilities. In response, manufacturers are investing in U.S.-based production hubs, deploying advanced biomarker detection, and optimizing assay workflows. These combined efforts are reinforcing resilience in the market while supporting long-term innovation and wider adoption of pneumococcal testing solutions.

Latest Trends

FDA Approval of CAPVAXIVE Pneumococcal Vaccine is a Recent Trend

The licensure of Merck’s CAPVAXIVE has signified a pivotal inflection in pneumococcal diagnostics during 2024, compelling recalibrations in serotype surveillance to track vaccine-mediated shifts. This 21-valent conjugate formulation targets emergent strains, necessitating adjunctive testing to monitor residual invasive burdens and breakthrough incidences. The trend underscores a convergence of vaccinology and diagnostics, where post-licensure assays refine immunogenicity correlates and efficacy endpoints.

Clinical infrastructures are adapting with enhanced genotyping for non-covered serogroups, informing iterative formulations. This development accelerates pharmacovigilance integrations, linking test outputs to immunization registries for real-time analytics. The endorsement validates Phase 3 demonstrations of robust antibody titers across adult demographics, influencing global tender specifications.

The Food and Drug Administration approved CAPVAXIVE for active immunization against invasive pneumococcal disease and pneumonia in adults aged 18 years and older on June 17, 2024. This clearance, predicated on four pivotal trials encompassing vaccine-naïve and experienced cohorts, anticipates serotype displacement tracking via molecular diagnostics. Subsequent implementations forecast guideline assimilations, elevating panel multiplexity for conjugate evaluations. The progression envisions AI-enhanced variant calling, prognosticating herd effects. This vaccinal milestone not only refines serosurveillance acuity but also galvanizes synergies between immunoprophylaxis and diagnostic precision.

Regional Analysis

North America is leading the Pneumococcal Testing Market

In 2024, North America captured a 43.2% share of the global pneumococcal testing market, fueled by escalating respiratory infection burdens and updated immunization strategies that mandate serotype identification to evaluate vaccine efficacy in pediatric and elderly populations. Laboratories enhanced capabilities with multiplex PCR panels to differentiate Streptococcus pneumoniae from viral mimics in community-acquired pneumonia cases, enabling targeted antibiotic stewardship and reducing empirical broad-spectrum usage by 20% in hospital protocols.

The Advisory Committee on Immunization Practices’ expanded recommendations for PCV20 and PCV21 in adults aged 50 and older drove surveillance testing in outpatient networks, aligning with efforts to monitor non-vaccine serotype emergence post-PCV13 era. Institutional expansions in point-of-care antigen detection kits facilitated rapid diagnostics in emergency departments, correlating with federal grants for infectious disease preparedness amid seasonal flu overlaps.

Demographic vulnerabilities, such as higher incidences among immunocompromised individuals, sustained demand for urine-based assays, supporting equitable access through subsidized programs in underserved communities. These evolutions exemplified the region’s dedication to integrated diagnostic and preventive frameworks. The Centers for Disease Control and Prevention estimated 27,770 invasive pneumococcal disease cases in the United States in 2022, with an incidence rate of 8.3 per 100,000 population.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Regional authorities in Asia Pacific project the pneumococcal testing sector to advance during the forecast period, as strategic allocations prioritize rapid diagnostics to combat pneumonia burdens in densely settled agrarian economies. Governments in India and Indonesia channel resources toward subsidized PCR kits, equipping district hospitals to identify serotypes in high-risk pediatric admissions from malnourished cohorts. Diagnostic enterprises ally with national institutes to develop affordable urine antigen tests, anticipating earlier interventions for bacteremic episodes in monsoon-prone areas.

Oversight agencies in South Korea and the Philippines pioneer portable multiplex devices, positioning rural outposts to detect non-vaccine strains without urban transfers. National programs estimate fusing testing data with immunization registries, streamlining follow-up for recurrent otitis media in indigenous groups.

Local innovators refine fluorescence-based assays, coordinating with continental surveillance to track resistance patterns in urban migrants. These pursuits establish a robust infrastructure for outbreak mitigation. The UNICEF recorded over 1,400 pneumonia cases per 100,000 children globally in 2022, with South Asia exhibiting 2,500 cases per 100,000, underscoring the imperative for enhanced testing in the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading players in the pneumococcal diagnostics market are expanding rapidly by launching high-speed molecular assays capable of identifying serotypes in under an hour, enabling clinicians to select targeted antibiotics amid rising resistance concerns. Companies are merging with specialized assay developers to broaden their portfolios, integrating multiplex panels that detect co-infections and streamline outbreak response. Investments in point-of-care analyzers emphasize portability, robust design, and app integration for real-time data sharing.

Firms also partner with vaccination programs to combine testing with public health surveillance, securing endorsements from global health authorities. Expansion into high-burden regions across Africa and Eastern Europe is accompanied by tender negotiations and efficacy-based contracts with local laboratories, ensuring sustainable adoption and long-term collaborations.

Bio-Rad Laboratories, Inc., headquartered in Hercules, California, designs life science and clinical diagnostic solutions used globally for precise pathogen detection. Its BioPlex platform enables multiplex immunoassays for pneumococcal antigens alongside other respiratory markers, improving workflow efficiency.

The company invests heavily in R&D, focusing on automation to boost throughput and reduce manual labor in clinical laboratories. Under CEO Norman D. Schwartz, Bio-Rad operates in over 30 countries, maintaining regulatory compliance and high-quality standards. By engaging with reference networks and validating assays, the firm strengthens evidence-based disease management protocols, reinforcing its position as a leading contributor to global pneumococcal surveillance and diagnostics.

Recent Developments

- In January 2025: Quest Diagnostics partnered with Walmart to launch consumer-initiated laboratory testing through QuestDirect™. This offering allows individuals to access the same high-quality lab tests typically ordered by healthcare providers via a convenient, consumer-friendly platform, expanding patient access and engagement in personal health management. This collaboration enhances the reach of diagnostic services and drives growth in the direct-to-consumer laboratory testing market.

- In December 2024: Quidel Corporation signed a definitive agreement to acquire Ortho, a leading global in vitro diagnostics company, for approximately US$6.0 billion through a combination of cash and newly issued shares. This strategic acquisition strengthens Quidel’s product portfolio, expands its global market presence, and accelerates innovation and adoption in the in vitro diagnostics space.

Top Key Players in the Pneumococcal Testing Market

- Thermo Fisher Scientific Inc.

- Abbott Laboratories

- Hoffmann-La Roche Ltd

- Becton, Dickinson and Company (BD)

- bioMérieux SA

- Hologic Inc.

- Bio-Rad Laboratories Inc.

- Meridian Biosciences Inc.

- Quest Diagnostics

- Quidel Corporation

Report Scope

Report Features Description Market Value (2024) US$ 1.5 billion Forecast Revenue (2034) US$ 4.4 billion CAGR (2025-2034) 11.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Consumables, and Analyzers), By Technology (Enzyme Linked Immunosorbent Assay (ELISA), Western Blot Test, Polymerase Chain Reaction, Immunohistochemistry, Immunofluorescence, and Others), By Application (Immunodiagnostics, Point of Care Testing, and Molecular Diagnostic), By End-user (Hospitals & Clinics, Ambulatory Surgical Centers, and Diagnostic Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc., Abbott Laboratories, F. Hoffmann-La Roche Ltd, Becton, Dickinson and Company (BD), bioMérieux SA, Hologic Inc., Bio-Rad Laboratories Inc., Meridian Biosciences Inc., Quest Diagnostics, Quidel Corporation. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pneumococcal Testing MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Pneumococcal Testing MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific Inc.

- Abbott Laboratories

- Hoffmann-La Roche Ltd

- Becton, Dickinson and Company (BD)

- bioMérieux SA

- Hologic Inc.

- Bio-Rad Laboratories Inc.

- Meridian Biosciences Inc.

- Quest Diagnostics

- Quidel Corporation