Phosphate Fertilizers Market By Product(Triple Superphosphate (TSP), Mono-ammonium Phosphate (MAP), Single Superphosphate (SSP), Di-ammonium Phosphate (DAP), Other Products), Crop Type(Fruits & Vegetables, Oilseeds & Pulses, Cereals & Grains, Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 15067

- Number of Pages: 271

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

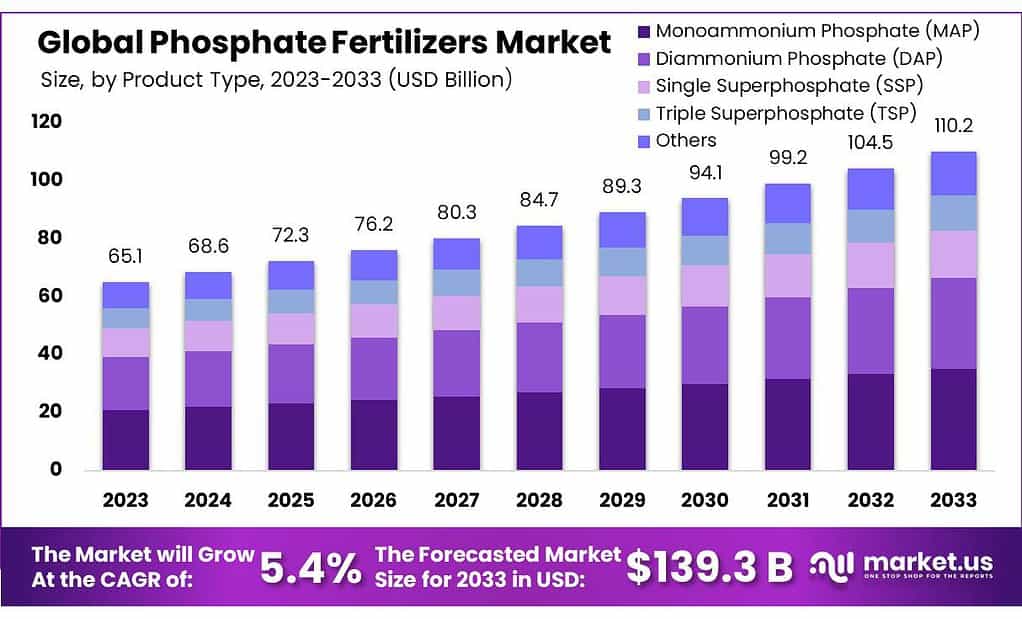

The Phosphate Fertilizers Market size is expected to be worth around USD 110.2 billion by 2033, from USD 65.1 billion in 2023, growing at a CAGR of 5.4% during the forecast period from 2023 to 2033.

This can be explained by the growing demand from farmers for fertilizers that contain essential nutrients, such as potassium and nitrogen. The main areas of application are fruits, cereals, vegetables, and pulses. Phosphorous fertilizers can be used in different grains to encourage root growth, enhance crop quality, and increase stalk strength.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Growth Projection: The Phosphate Fertilizers Market is anticipated to reach approximately USD 110.2 billion by 2033 from USD 65.1 billion in 2023, registering a compound annual growth rate (CAGR) of 5.4% during the forecast period (2023-2033).

- Product Dominance and Impact: Mono-ammonium Phosphate (MAP) led the market in 2023, capturing over 31.9% share due to its well-balanced nutrient profile, fostering robust plant growth, and improving crop yields across various soil types. Its effectiveness in enhancing agricultural productivity contributed significantly to its market dominance.

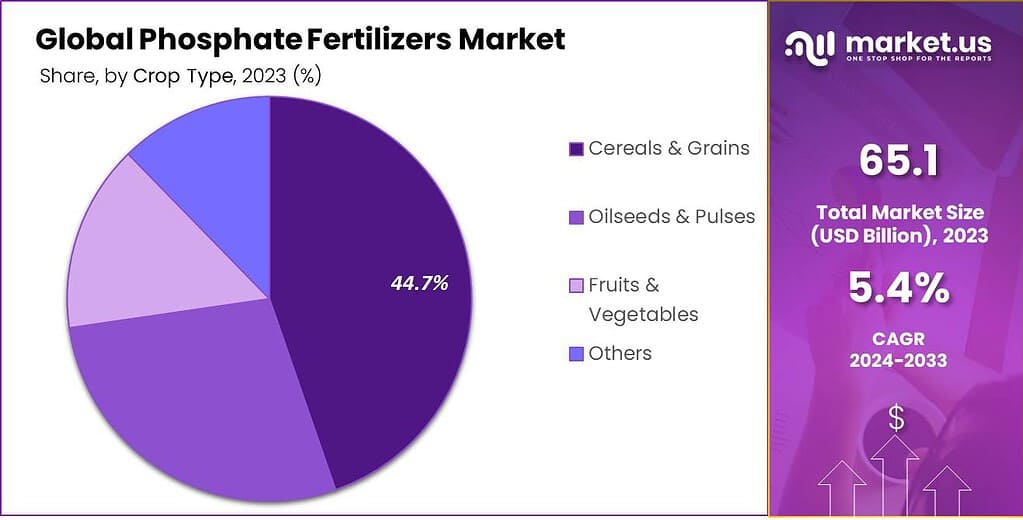

- Crop Type Influence: Cereals and grains held a dominant market share of more than 44.7% in 2023, highlighting the pivotal role of phosphate fertilizers in sustaining the growth and productivity of essential crops like wheat, rice, corn, and various grains. These fertilizers play a critical role in providing necessary nutrients for healthy crop development and improved yields in this segment.

- Drivers for Market Growth: Shifting dietary preferences towards high-value crops like fruits, vegetables, and specialty crops have fueled the demand for phosphate fertilizers. Increased consumption of protein-rich diets and the demand for meat and dairy products have also driven the need for these fertilizers in livestock feed production.

- Environmental Concerns: Extensive use of phosphate fertilizers raises environmental concerns due to nutrient runoff, leading to water contamination, eutrophication, soil degradation, and pH imbalances. Additionally, the energy-intensive production processes contribute to greenhouse gas emissions and climate change, posing challenges for ecosystems and agriculture.

- Opportunities Through Technology: Innovations in fertilizer formulations and precision agriculture technologies present significant opportunities. Advancements aim to create improved phosphate fertilizers that are more readily available to plants, reduce wastage, and minimize environmental impact, including controlled-release fertilizers and precision application methods.

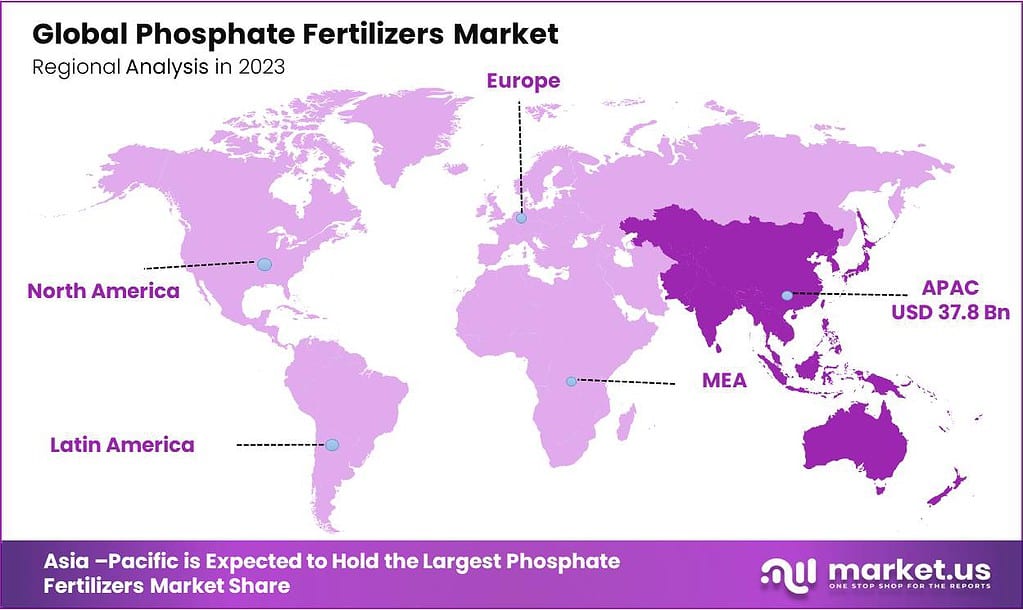

- Regional Insights: APAC held the largest revenue share (over 58.7% in 2023) due to increased food production demands, especially in countries like India with a strong agricultural base. Europe followed, expecting a CAGR of 6% over the forecast period due to high agricultural production, particularly in countries like Germany and France.

- Major Market Players: Notable companies in the phosphate fertilizers market include Eurochem Group AG, Nutrien Ltd., Yara International ASA, Israel Chemicals Ltd., and others. These players are focusing on acquisitions, agreements, and technological advancements to strengthen their market presence and cater to evolving agricultural demands.

Product Analysis

In 2023, the Phosphate Fertilizers market saw Monoammonium Phosphate (MAP) taking the lead, capturing a significant share of over 31.9%. This dominance was attributed to MAP’s well-balanced nutrient profile, offering both nitrogen and phosphorus in a favorable ratio. Its effectiveness in improving crop yields across different types of soil and agricultural techniques has made it a preferred choice among farmers and growers worldwide.

The versatile application of MAP in various agricultural practices has solidified its position as a go-to phosphate fertilizer, contributing significantly to its market dominance. MAP’s popularity lies in its ability to foster robust plant growth, thereby enhancing agricultural productivity.

Its balanced nutrient composition makes it an efficient choice for supporting crop development and meeting the nutritional requirements of various plants. This widespread recognition and acceptance of MAP’s efficacy have propelled its market standing, reflecting its pivotal role in modern agricultural practices and its substantial share in the Phosphate Fertilizers market.

Crop Type

In 2023, the Phosphate Fertilizers market was strongly influenced by Cereals and grains, capturing a dominant share of more than 44.7%. This sector’s reliance on phosphate fertilizers is pivotal for sustaining the growth and productivity of essential crops like wheat, rice, corn, and various grains.

The substantial market position held by Cereals & Grains signifies the critical role played by phosphate fertilizers in supporting the global production of these fundamental food staples. The preference for phosphate fertilizers in the Cereals and grains segment is attributed to their ability to provide essential nutrients crucial for healthy crop development.

These fertilizers aid in enhancing soil fertility and ensuring adequate phosphorus levels necessary for robust plant growth and improved yields in cereal and grain cultivation. The dominance of this segment in the phosphate fertilizer market underscores its significance in meeting the demands of the world’s staple food crops, reflecting the pivotal role played by these fertilizers in global agriculture.

Key Market Segments

By Product

- Triple Superphosphate (TSP)

- Mono-ammonium Phosphate (MAP)

- Single Superphosphate (SSP)

- Di-ammonium Phosphate (DAP)

- Other Products

Crop Type

- Fruits & Vegetables

- Oilseeds & Pulses

- Cereals & Grains

- Other Applications

Drivers

The shifting dietary preferences toward higher-value crops like fruits, vegetables, and specialty crops have fueled the demand for phosphate fertilizers. These crops demand higher nutrient inputs for optimal growth and yield, and phosphate fertilizers play a critical role in providing these essential nutrients. This facilitates higher productivity and quality in these crops, aligning with evolving dietary habits.

Increased consumption of protein-rich diets leads to greater demand for meat and dairy products, driving livestock production. Livestock feed, which relies heavily on phosphate fertilizers for production purposes, requires large amounts of these fertilizers to meet animal industry expansion demands for more yield of feed crops, further driving up demand for these fertilizers.

Additionally, as the trend toward nutrient-dense diets grows, there’s a heightened demand for crops with specific nutrient profiles. Phosphate fertilizers contribute significantly to meeting these nutritional requirements by enhancing plant growth and nutrient content. This rising demand for nutrient-rich crops aligns with the role of phosphate fertilizers in optimizing plant development, thus catering to evolving dietary needs and preferences.

Restraints

The extensive use of phosphate fertilizers poses environmental concerns, primarily due to nutrient runoff. When excess nutrients, particularly phosphorus, from these fertilizers wash into water bodies like streams, lakes, and seas, it can lead to water contamination and eutrophication. This process triggers excessive algal growth, reducing oxygen levels and harming aquatic life.

Misapplying phosphate fertilizers can contribute to soil degradation and pH imbalances, harming both agricultural productivity and soil health in the long run. Furthermore, producing such phosphate fertilizers requires energy-intensive processes that produce greenhouse gas emissions; indirectly contributing to climate change which hurts ecosystems and agriculture practices.

Environmental concerns related to phosphate fertilizers underline their need for improved management practices, effective utilization, and sustainable alternatives to minimize their negative impacts on water bodies, soil health, and the overall environment.

Opportunities

Technology innovation presents significant opportunities in the realm of phosphate fertilizers. Advancements in fertilizer formulations can lead to the creation of improved phosphate fertilizers that are more readily available to plants, reducing wastage and minimizing nutrient runoff. These innovations might pave the way for controlled-release phosphate fertilizers, gradually releasing nutrients over an extended period. This controlled release aligns nutrient availability with plant demand, thereby decreasing the likelihood of nutrient leaching.

Furthermore, developments in precision agriculture technologies, such as GPS, drones, and satellite imagery, offer farmers the ability to apply fertilizers precisely to specific areas of their fields. This precision in fertilizer application optimizes nutrient utilization efficiency, ensuring that the nutrients are utilized where and when they are needed the most. Such technological advancements hold promise in enhancing the effectiveness of phosphate fertilizers while minimizing their environmental impact, presenting a notable opportunity for the agriculture sector.

Challenges

Environmental Concerns: Excessive use of phosphate fertilizers leads to excessive runoff of nutrients into our waterways and subsequent pollution and eutrophication of aquatic habitats, harming aquatic life while creating challenges in maintaining quality water supplies. This has devastating repercussions for maintaining water quality standards.

Soil Degradation: Improper use of phosphate fertilizers contributes to soil degradation by altering its pH level and negatively affecting health and fertility, ultimately reducing agricultural productivity while creating long-term soil quality issues.

Energy-Intensive Production: Phosphate fertilizer production uses considerable energy, leading to increased greenhouse gas emissions that contribute to climate change by harming ecosystems and agriculture practices.

Nutrient Wastage: Improper use of phosphate fertilizers can result in wasted nutrients being runoff into streams, diminishing their effectiveness and potentially posing environmental harm.

Compliance Issues: Manufacturers and users of phosphate fertilizers face an ongoing challenge in adapting to new environmental regulations and meeting evolving compliance standards, while still meeting effective agricultural practices. Doing so requires constant adaptation and investment.

Technological Limitations: While technology provides many opportunities, its integration into agriculture presents its own set of obstacles. Limited access to sophisticated precision agriculture tools and resources prevents optimal and precise application of phosphate fertilizers.

Regional Analysis

APAC had the largest revenue share at over 58.7% in 2023. This is due to increased food production and growing demand for food products, such as rice or vegetables from Asia Pacific’s import-dependent countries. Indian agriculture is the backbone of the economy.

It employs half of the workforce and contributes around 17% of the country’s GDP. India is home to many important crops, including wheat, rice, pulses, and spices.

India is one of Asia’s fastest-growing agro-based markets. The market’s demand is expected to increase during the forecast period. Europe was the second-largest regional segment in terms of revenue in 2021. This market is expected to expand at a CAGR of 6% over the forecast period.

This is due to the high level of agricultural production in the region. Germany is the fourth-largest agricultural producer in the region. France is the sixth largest, accounting for almost 1/3 of all the EU’s agricultural land.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The market is fragmented due to the presence of many manufacturers of fertilizers, particularly in agriculture-dependent countries. The market is undergoing a shift in focus as the agrochemical demands are increasing. EuroChem Group has signed an agreement with Serra do Salitren to acquire a phosphate plant in Brazil in August 2021. This acquisition is expected to strengthen the company’s ability to produce and distribute crop nutrients.

Market Key Players

- Eurochem Group AG

- Eurochem Group AG

- Nutrien Ltd.

- Yara International ASA

- Israel Chemicals Ltd.

- Coromandel International Ltd.

- The Mosaic Co.

- S.A OCP

- Gayatri Fertiplants International Pvt. Ltd

- Indorama Corporation

- Rama Phosphates Ltd.

- Silverline

Recent Development

In February 2022, PhosAgro announced the launch of a new regional company, PhosAgro-Sibir. The company is part of PhosAgro and provides direct supplies of a wide range of mineral fertilizers to agricultural producers in the Siberian and Far Eastern Federal Districts.

In December 2020, PhosAgro-Region and Exact Farming signed a cooperation agreement on the development of digital services for Russian customers of PhosAgro’s mineral fertilizers. The companies plan to jointly develop applications for remote monitoring, for evaluating and improving the performance of mineral nutrition systems based on PhosAgro products, and for developing and distributing agronomic expertise.

Report Scope

Report Features Description Market Value (2023) USD 65.1 Billion Forecast Revenue (2033) USD 110.2 Billion CAGR (2023-2032) 5.4% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product(Triple Superphosphate (TSP), Mono-ammonium Phosphate (MAP), Single Superphosphate (SSP), Di-ammonium Phosphate (DAP), Other Products), Crop Type(Fruits & Vegetables, Oilseeds & Pulses, Cereals & Grains, Other Applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Eurochem Group AG, Nutrien Ltd., Yara International ASA, Israel Chemicals Ltd., Coromandel International Ltd., The Mosaic Co., S.A OCP, Gayatri Fertiplants International Pvt. Ltd, Indorama Corporation, Rama Phosphates Ltd., Silverline Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What Are Phosphate Fertilizers?Phosphate fertilizers are types of fertilizers that contain phosphorus, a crucial nutrient for plant growth. They are derived from phosphate rock and used to enhance soil fertility by providing plants with phosphorus, which is essential for root development, flowering, and seed formation.

Where Are Phosphate Fertilizers Used?They are used in agriculture and horticulture to enhance soil fertility and promote plant growth. They're applied to a wide range of crops, from grains like corn and wheat to fruits, vegetables, and even in gardening.

What Are the Benefits of Phosphate Fertilizers?Improved Crop Yield: Phosphorus is essential for energy transfer within plants, aiding in photosynthesis and overall growth. Root Development: It encourages strong root systems, which in turn enhances nutrient uptake and plant resilience. Seed and Fruit Formation: Phosphorus supports flower and fruit development, contributing to better-quality produce.

Phosphate Fertilizers MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample

Phosphate Fertilizers MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Eurochem Group AG

- Potash Corp. of Saskatchewan Inc.

- Agrium Inc.

- CF Industries Holdings Inc.

- Yara International ASA

- Coromandel International Ltd.

- Israel Chemicals Ltd.

- The Mosaic Co.

- Other Key Players