Global Phoropters Market Analysis By Type (Manual, Digital), By End-Use (Specialty Clinics, Hospitals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 26846

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

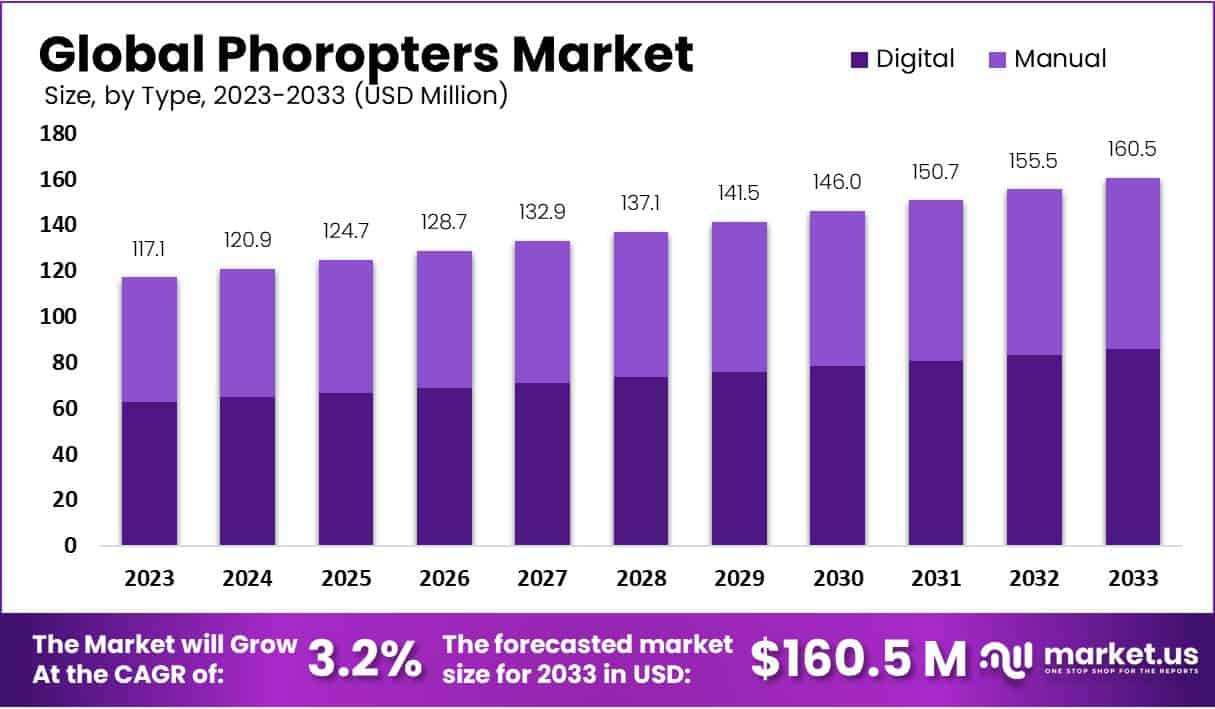

The Phoropters Market Size is projected to reach approximately USD 160.5 million by 2033, up from USD 117.1 million in 2023. This growth is anticipated to occur at a compound annual growth rate (CAGR) of 3.2% from 2024 to 2033.

The increased frequency of eye disorders, the surge in demand for optometric services, and technological improvements in automatic phoropters contribute to the market’s growth. Phoropters are medical device that is used to do ophthalmic testing. They are usually referred to as refractors. Ophthalmologists most regularly use phoropters during eye examinations. They have many lenses that are utilized for the refraction of eyes during vision testing. Phoropters are also used to calculate a person’s vision problems and prescriptions.

Phoropters are innovative devices that instantly assess an individual’s exact vision correction needs. To correct vision, phoropters are used during sight testing to switch several lenses in front of the eyes. Heterophorias, vertical and horizontal vergences, and other characteristics are also measured with phoropters. Batteries of spherical and cylindrical lenses, as well as auxiliary devices like Maddox rods, prisms, and the Jackson Cross-Cylinder, are essential components of phoropters. The prisms of phoropters are also utilized to diagnose and treat eye diseases.

Key Takeaways

- Market Projection: Phoropters Market to reach USD 160.5 million by 2033, with a 3.2% CAGR from 2024 to 2033, up from USD 117.1 million in 2023.

- Type Dominance: Digital phoropters claimed 53.6% market share in 2023, surpassing manual counterparts due to advanced features and seamless integration.

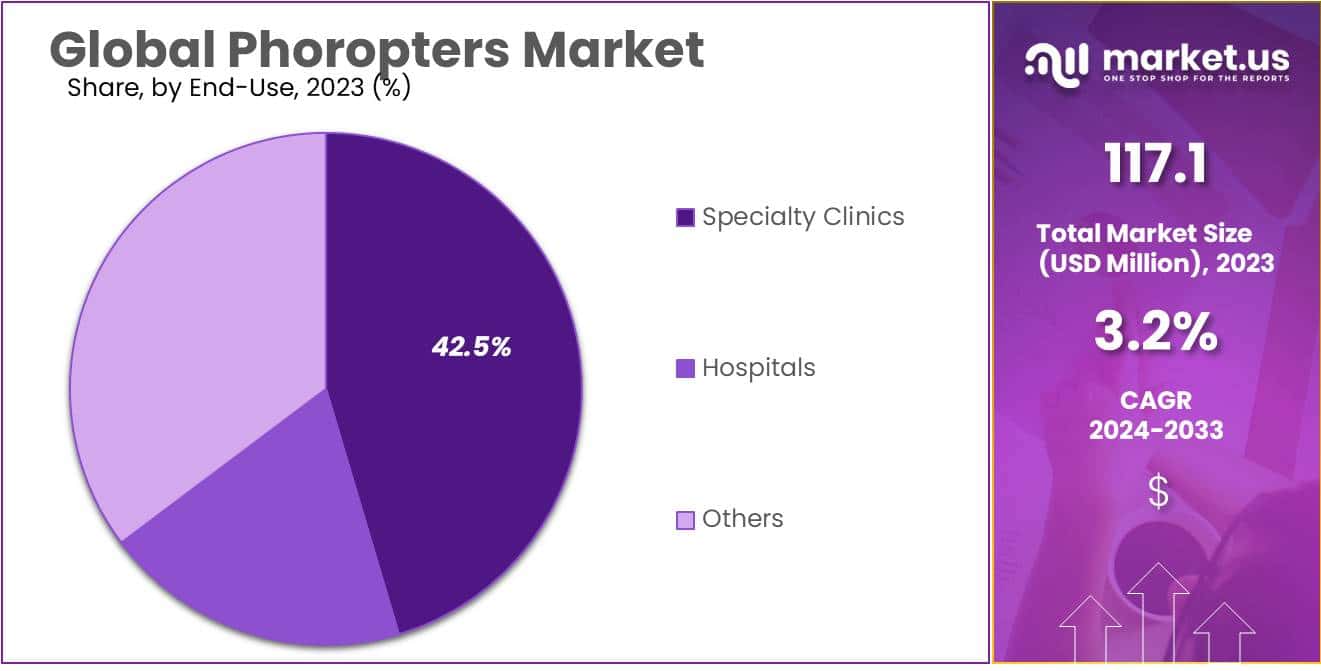

- End-User Landscape: Specialty clinics led in 2023 with a 42.5% market share, emphasizing a preference for specialized healthcare environments in adopting phoropters.

- Drivers of Growth: Key drivers include technological advancements, rising eye disorders, and the growing geriatric population, contributing to increased demand for phoropters.

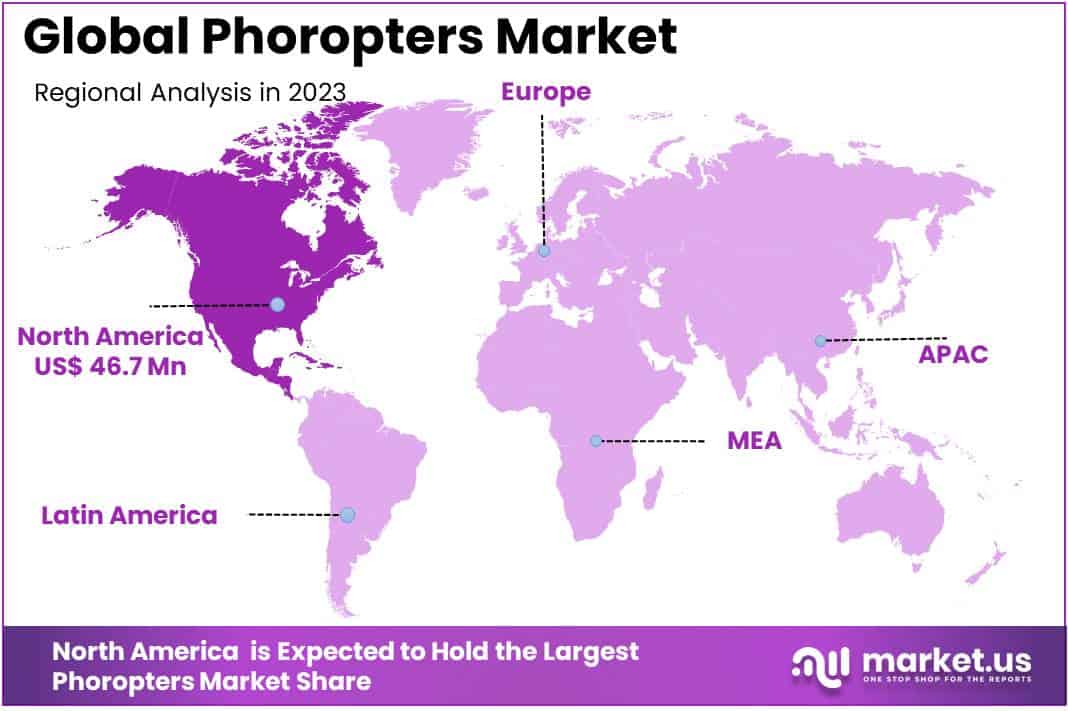

- North America Leadership: In 2023, North America dominated with a 39.9% market share and USD 46.7 million value, driven by technology adoption, robust infrastructure, and strategic collaborations.

- Restraints Impact: High initial costs, limited reimbursement policies, maintenance challenges, and global supply chain disruptions act as restraints, affecting phoropters market dynamics.

- Strategic Opportunities: Emerging markets offer growth opportunities, teleophthalmology integration is promising, customization drives adoption, and collaborations for research and development fuel innovation in phoropter technology.

Type Analysis

In 2023, the digital phoropters segment emerged as the frontrunner in the market, securing a dominant position with an impressive share of over 53.6%. This cutting-edge technology has swiftly gained favor among consumers and practitioners alike, signaling a significant shift in the eyecare industry.

Digital phoropters, equipped with advanced features and precision, have become the preferred choice for eye examinations. Their user-friendly interfaces and seamless integration with digital platforms have streamlined the diagnostic process, enhancing the overall patient experience. Optometrists and ophthalmologists appreciate the efficiency and accuracy offered by digital phoropters, making them an indispensable tool in modern eye clinics.

On the other hand, manual phoropters, while still relevant, have witnessed a gradual decline in market share. Traditional in their design, these devices rely on manual adjustments and lack the sophisticated capabilities of their digital counterparts. Despite their enduring presence, manual phoropters are increasingly seen as outdated, prompting many professionals to transition to the more technologically advanced digital alternatives.

End-User Analysis

In 2023, the specialty clinics segment emerged as a frontrunner in the phoropters market, boasting a commanding market share of over 42.5%. This signifies a substantial preference for specialized healthcare settings when it comes to the adoption of phoropters.

Hospitals, a pivotal player in the healthcare landscape, also played a significant role in the market. They secured a considerable share, contributing to the overall growth of the phoropters market. Their commitment to comprehensive patient care and diagnostics has made them a crucial end-user in the utilization of phoropters.

Other segments, encompassing various healthcare facilities and providers, also made noteworthy strides in embracing phoropter technology. These diverse entities, ranging from smaller clinics to outpatient facilities, collectively added to the expanding footprint of phoropters in the healthcare domain.

As the market continues to evolve, the prominence of specialty clinics, hospitals, and other healthcare settings in adopting phoropters highlights the versatile nature of these devices across various medical environments. This dynamic landscape suggests a growing recognition of the importance of precise and efficient vision diagnostics, with different end-users contributing to the overall advancement of the phoropters market.

Key Market Segments

Type

- Manual

- Digital

End-Use

- Specialty Clinics

- Hospitals

- Others

Drivers

Technological Advancements

The Phoropters market is driven by continuous technological advancements, introducing cutting-edge features that enhance precision in eye examinations. Innovations such as digital refractive technology and integration with electronic health records improve efficiency and accuracy in vision assessments, contributing to the market’s growth.

Increasing Eye Disorders

The rising prevalence of eye disorders globally acts as a significant driver for the Phoropters market. With an escalating number of individuals experiencing refractive errors and vision-related issues, the demand for advanced diagnostic tools like Phoropters is on the upswing, supporting market expansion.

Growing Geriatric Population

The expanding elderly population, prone to age-related eye conditions, propels the demand for Phoropters. As the geriatric demographic grows, there is a heightened need for comprehensive eye examinations, positioning Phoropters as indispensable tools in addressing age-associated vision challenges.

Rising Awareness and Eye Care Initiatives

Increasing awareness about the importance of regular eye check-ups and proactive eye care initiatives positively impact the Phoropters market. Public health campaigns and educational efforts encourage individuals to undergo thorough eye examinations, fostering the adoption of advanced diagnostic equipment like Phoropters for precise vision assessments.

Restraints

High Initial Costs

The Phoropters market faces a challenge due to the high initial costs associated with acquiring advanced models. This cost factor can act as a restraint, particularly for smaller healthcare facilities and optometry practices, limiting their ability to invest in state-of-the-art Phoropter technology.

Limited Reimbursement Policies

The absence or limitations in reimbursement policies for eye examinations and associated equipment pose a constraint on the Phoropters market. This can deter healthcare providers from investing in high-end Phoropters, impacting the overall market growth.

Maintenance and Calibration Challenges

Phoropters require regular maintenance and precise calibration for accurate results. The complexity of maintenance procedures and the need for skilled technicians can pose challenges for end-users, affecting the market’s growth potential.

Global Supply Chain Disruptions

The Phoropters market is susceptible to global supply chain disruptions, impacting the timely availability of components and finished products. Events such as pandemics and geopolitical uncertainties can create obstacles in the procurement process, affecting market dynamics.

Opportunities

Emerging Markets Penetration

The Phoropters market holds significant growth opportunities in untapped emerging markets. As these regions witness increased healthcare infrastructure development and rising awareness about eye health, there is a potential for market players to expand their presence and capture new opportunities.

Teleophthalmology Integration

Integration of Phoropters with teleophthalmology platforms presents a promising growth avenue. The demand for remote healthcare services has surged, and Phoropters equipped for teleconsultations can cater to patients in remote locations, expanding the market’s reach and accessibility.

Customization and Personalization

Offering customized and personalized Phoropter solutions tailored to specific user needs can unlock growth opportunities. Customization options that cater to diverse patient preferences and requirements can set market players apart, driving increased adoption and customer loyalty.

Collaborations for Research and Development

Collaborations between market players and research institutions can fuel innovation in Phoropter technology. Joint efforts in research and development can lead to the creation of advanced features and functionalities, opening doors to new growth prospects in the market.

Trends

Shift towards Digital Refraction

A notable trend in the Phoropters market is the increasing shift towards digital refraction technology. Digital Phoropters offer enhanced precision, speed, and patient comfort, aligning with the industry’s trend towards digitization in diagnostic processes.

Integration with Electronic Health Records (EHR)

Phoropters are increasingly being integrated with electronic health records, streamlining data management and enhancing the overall efficiency of eye care practices. This trend aligns with the broader healthcare industry’s emphasis on seamless information flow and interoperability.

Rise of Portable Phoropters

A growing trend is the development and adoption of portable Phoropters. These compact and lightweight devices cater to the evolving needs of mobile healthcare services and telemedicine, providing flexibility and convenience in conducting eye examinations.

Focus on Sustainable and Eco-Friendly Designs

Market players are embracing eco-friendly designs and materials in Phoropter manufacturing, reflecting the industry’s commitment to sustainability. This trend resonates with the increasing emphasis on environmentally conscious practices across various sectors, influencing purchasing decisions in the Phoropters market.

Regional Analysis

In 2023, North America emerged as the frontrunner in the Phoropters Market, commanding a substantial market share of over 39.9% and boasting a market value of USD 46.7 million for the year. This dominant position can be attributed to several key factors that delineate the regional dynamics of the Phoropters Market.

North America’s leading market position can be largely attributed to its proactive adoption of cutting-edge technologies in the field of ophthalmic equipment. The region has been quick to integrate advanced features in phoropters, catering to the growing demand for precision and efficiency in eye examinations. This technological edge has propelled North America to the forefront of the global market.

The well-established and robust healthcare infrastructure in North America has played a pivotal role in sustaining the demand for phoropters. The presence of sophisticated healthcare facilities and a high level of awareness among healthcare practitioners and patients regarding the importance of regular eye check-ups has fueled the market growth in the region.

The escalating prevalence of vision disorders, coupled with an aging population in North America, has contributed significantly to the increased adoption of phoropters. As the region grapples with a higher incidence of conditions such as myopia, hyperopia, and astigmatism, the demand for precise diagnostic tools like phoropters has surged.

North America has witnessed a surge in strategic collaborations and partnerships between key market players, fostering innovation and product development. The collaborative efforts of manufacturers, healthcare institutions, and research organizations have led to the introduction of advanced phoropter models, consolidating the region’s position as a leader in the global market.

The regulatory environment in North America is conducive to the growth of the phoropters market, with stringent quality standards and compliance measures ensuring the safety and efficacy of these medical devices. This regulatory framework has instilled confidence among end-users, further propelling the adoption of phoropters in the region.

The economic stability and high disposable income levels in North America have also played a pivotal role in driving the market for phoropters. Consumers in the region are more willing to invest in advanced healthcare technologies, contributing to the overall market expansion.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the ever-evolving Phoropters Market, Topcon, Nidek, Reichert, and Zeiss are pivotal players influencing industry dynamics. Topcon’s prominence stems from its state-of-the-art technologies and precision instruments, earning trust with user-friendly designs.

Nidek, a key contributor, emphasizes research and development, providing reliable and efficient phoropters widely embraced by eye care professionals. Reichert’s focus on optical innovation has established its reputation for delivering high-quality products enhancing diagnostic capabilities.

Zeiss, a stalwart in optics, extends its influence to phoropters with celebrated precision and clarity. Alongside these leaders, other significant contributors collectively shape a competitive landscape, fostering innovation and driving advancements.

Market Key Players

- PTopcon

- Nidek

- Reichert

- Zeiss

- Rexxam

- Essilor

- Huvitz

- Marco

Recent Developments

- In October 2023, big eyewear company EssilorLuxottica bought most of SightCall, a smart vision testing startup. They want to make eye care better using AI and telemedicine, especially in areas where it’s hard to get eye help.

- In November 2023, Topcon, a top eye equipment maker, launched a cool device. It’s the KR-8900 Auto Retinoscope, and it makes checking your eyes faster and less likely to make mistakes. This helps busy eye clinics.

- In December 2023, German optics company Zeiss and eye software maker Optisoft joined forces. They’re making software in the cloud for phoropters. This means better data handling, easy teamwork between eye doctors, and even checking patients from far away.

- In December 2023, Vision-E and Phorotech, two big phoropter makers, teamed up. Now, they’re one company called “EyeTech Solutions.” This should make even better phoropters and push more changes in the eye tool market.

Report Scope

Report Features Description Market Value (2023) USD 117.1 Mn Forecast Revenue (2033) USD 160.5 Mn CAGR (2024-2033) 3.2% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type the market has been segmented into Manual, Digital. By End-Use the market has been segmented into Specialty Clinics, Hospitals, Others. Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape PTopcon, Nidek, Reichert, Zeiss, Rexxam, Essilor, Huvitz, Marco Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Phoropters market in 2023?The Phoropters market size is USD 117.1 Million in 2023.

What is the projected CAGR at which the Phoropters market is expected to grow at?The Phoropters market is expected to grow at a CAGR of 3.2% (2024-2033).

List the segments encompassed in this report on the Phoropters market?Market.US has segmented the Phoropters market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type the market has been segmented into Manual, Digital. By End-Use the market has been segmented into Specialty Clinics, Hospitals, Others.

List the key industry players of the Phoropters market?PTopcon, Nidek, Reichert, Zeiss, Rexxam, Essilor, Huvitz, Marco

Which region is more appealing for vendors employed in the Phoropters market?North America is expected to account for the highest revenue share of 39.9% and boasting an impressive market value of USD 46.7 Million. Therefore, the Phoropters industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Phoropters?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Phoropters Market.

-

-

- US Ophthalmic

- Essilor

- Reichert Inc.

- Rocket Medical plc.

- Nidek Co. Ltd

- AMETEK Inc.

- Briot USA Inc.

- Huvitz co., ltd.

- Carl Zeiss AG

- Rexam Co. LTD

- reichert, inc.

- luneau technology USA Inc.

- Other Key Market Players