Global Pet Perfume Market Size, Share, Growth Analysis By Form Type (Spray, Liquid, Oil), By Animal Type (Dogs, Cats, Birds, Others), By Ingredient Type (Non-Alcoholic, Alcoholic), By Sales Channel (Pet Specialty Stores, Supermarkets/Hypermarkets, Pharmacy/Drugstores, Convenience Store, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 166892

- Number of Pages: 285

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

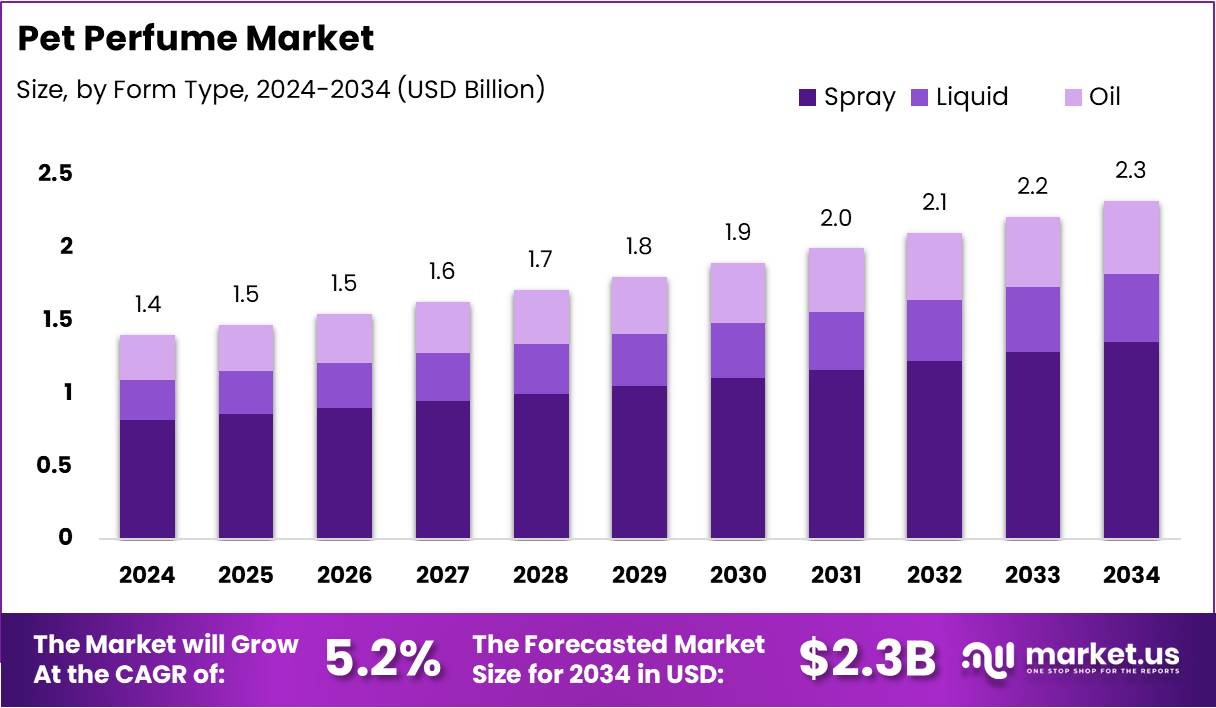

The Global Pet Perfume Market size is expected to be worth around USD 2.3 Billion by 2034, from USD 1.4 Billion in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034.

The pet perfume market reflects a growing segment of the wider pet grooming industry, driven by rising pet humanization and increasing interest in hygiene-focused products. It includes deodorizing sprays and long-lasting fragrances formulated to keep pets fresh while supporting convenient at-home grooming routines for modern pet families.

Moving ahead, growth accelerates as owners adopt wellness-centered grooming habits and seek premium aromatic solutions. Rising disposable incomes and lifestyle upgrades further boost interest in gentle, skin-friendly, and natural fragrance formulations. This shift supports consistent demand for safe, easy-to-use pet perfume products.

Furthermore, opportunities expand as consumers desire odor-control solutions between grooming cycles. Innovations using botanical notes, sensitive-skin bases, and fast-drying mists attract higher engagement. These advancements align with ongoing preferences for clean-label grooming goods within the pet perfume market.

Additionally, regulatory attention toward non-toxic ingredients and safe formulation practices continues to influence product development. Authorities encourage transparency and environmentally responsible components, creating room for compliant, trusted, and well-tested fragrance solutions. This improves consumer confidence in new scent formats.

Moreover, investment interest rises as companies identify potential in premium grooming, natural fragrances, and custom scent blends. Expanding online retail channels and broader grooming product visibility support stronger penetration across diverse pet-owning households seeking easy fragrance options.

In addition, pet ownership trends directly support category expansion. According to a widely referenced U.S. pet ownership survey, 66% of households owned a pet in 2024, indicating strong grooming and fragrance product potential among growing domestic pet populations.

Similarly, companion-animal demographics reinforce long-term demand. A national household study reports that nearly 70 million U.S. households have at least one dog, while 45 million families own a cat. These large groups consistently adopt grooming essentials, including scented freshening products.

Finally, spending patterns highlight solid purchasing behavior. A consumer grooming study indicates 60% of U.S. pet owners buy grooming items, including perfumes. Additionally, fragrance prices remain accessible, ranging from $5 for mass-market options to $50 for premium selections, ensuring broad adoption across the pet perfume market.

Key Takeaways

- Global Pet Perfume Market projected to reach USD 2.3 Billion by 2034, up from USD 1.4 Billion in 2024.

- Market grows at a steady 5.2% CAGR during the forecast period 2025–2034.

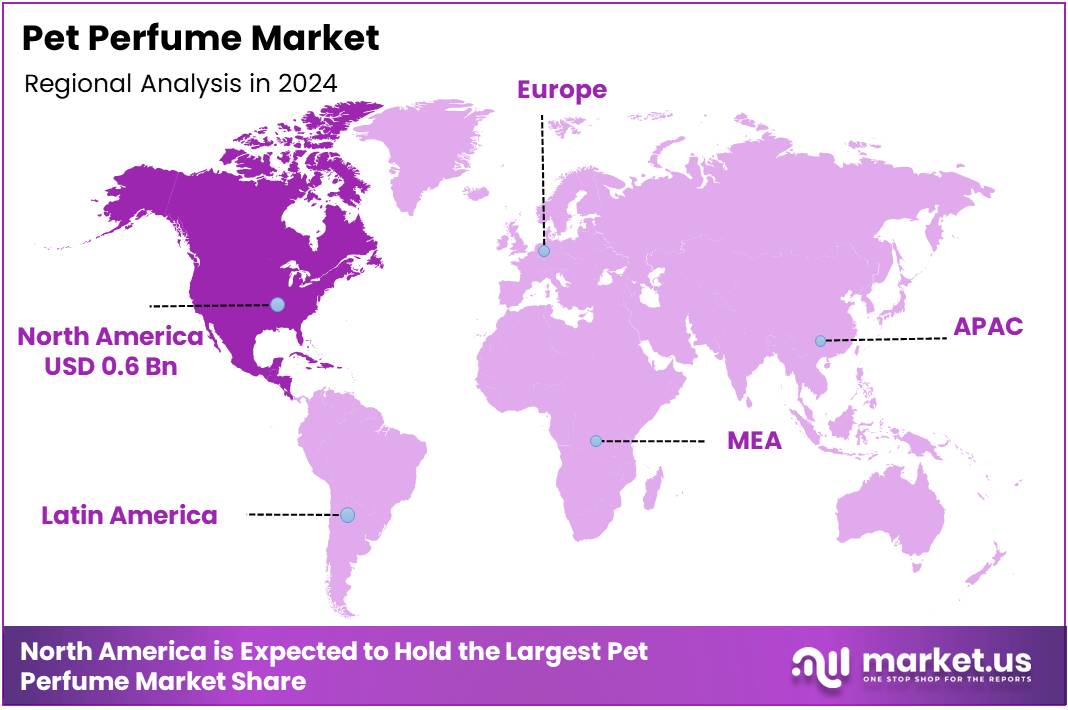

- North America leads with a dominant share of 48.2%, valued at USD 0.6 Billion.

- Spray segment dominates Form Type with a strong share of 58.3% in 2024.

- Dogs lead the Animal Type segment with a significant 67.2% share in 2024.

- Non-Alcoholic category holds the largest Ingredient Type share at 71.7% in 2024.

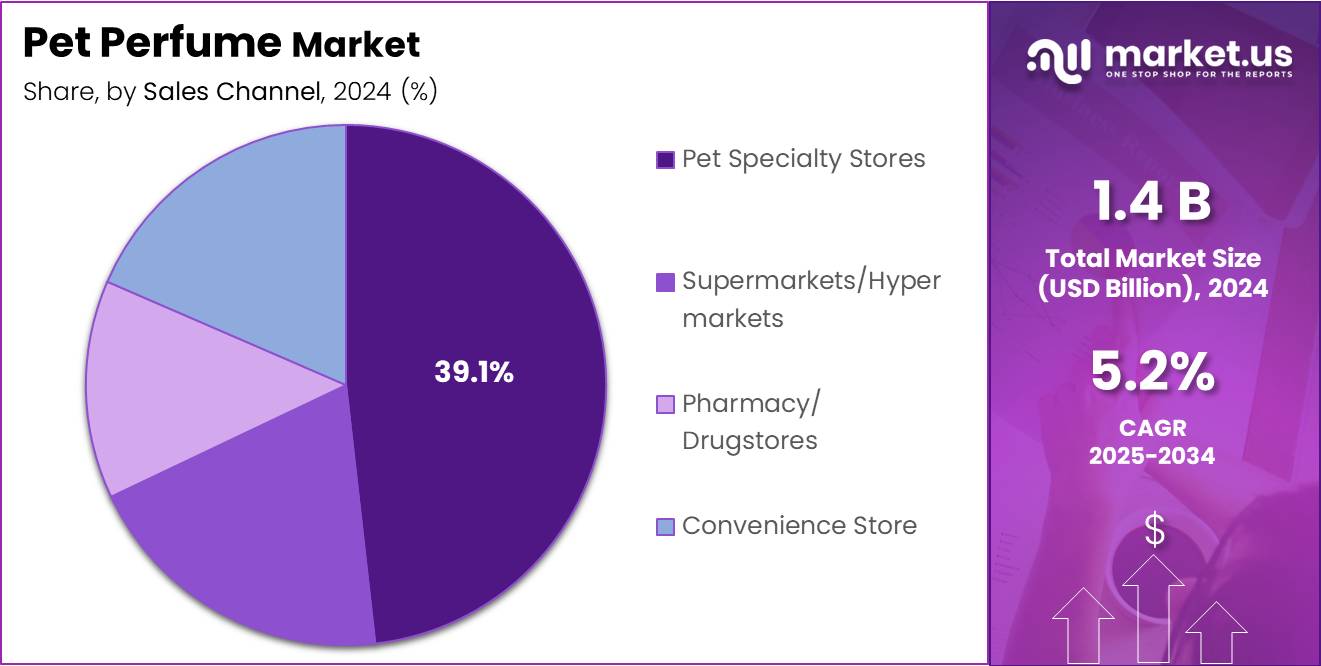

- Pet Specialty Stores remain the top sales channel, capturing 39.1% of the market in 2024.

By Form Type Analysis

Spray dominates with 58.3% due to its convenience and wider consumer trust.

In 2024, Spray held a dominant market position in the By Form Type Analysis segment of the Pet Perfume Market, with a 58.3% share. This format supports quick application and enhances user satisfaction. Moreover, rising pet grooming routines encourages stronger adoption. Thus, spray formats continue gaining stability.

In 2024, Liquid held an emerging position in the By Form Type Analysis segment of the Pet Perfume Market. Consumers increasingly explore liquid variants for deeper fragrance longevity and mild formulation. Additionally, shifting preference toward customizable scents reinforces its demand. Consequently, liquid formats attract premium-oriented pet owners seeking differentiated grooming solutions.

In 2024, Oil showed steady progress in the By Form Type Analysis segment of the Pet Perfume Market. Pet owners select oil-based perfumes for natural ingredients and skin-friendly characteristics. Furthermore, oils offer prolonged moisturization, supporting sensitive skin needs. Hence, oil perfumes gradually expand traction among health-conscious consumers valuing gentler grooming applications.

By Animal Type Analysis

Dogs dominate with 67.2% due to large ownership and frequent grooming.

In 2024, Dogs held a dominant market position in the By Animal Type Analysis segment of the Pet Perfume Market, with a 67.2% share. Expanding dog ownership and rising grooming services drive growth. As a result, dog-specific fragrances gain strong relevance, supporting consistent product penetration worldwide.

In 2024, Cats sustained notable traction in the By Animal Type Analysis segment of the Pet Perfume Market. Cat owners increasingly seek mild and safe fragrance solutions. Moreover, rising awareness toward hygiene reinforces adoption. Therefore, cat-centered perfume variants gain stable visibility, especially among indoor pet households.

In 2024, Birds showed steady adoption in the By Animal Type Analysis segment of the Pet Perfume Market. Owners prefer light, non-irritating fragrances aligned with bird sensitivities. Additionally, specialty grooming products grow in niche markets. Thus, the bird segment maintains measured growth.

In 2024, Others showcased consistent presence in the By Animal Type Analysis segment of the Pet Perfume Market. This includes rabbits and small mammals who require delicate formulations. Growing small-pet ownership strengthens segment expansion. Hence, brands diversify offerings to meet emerging hygiene needs.

By Ingredient Type Analysis

Non-Alcoholic dominates with 71.7% due to its safer and pet-friendly formulation.

In 2024, Non-Alcoholic held a dominant market position in the By Ingredient Type Analysis segment of the Pet Perfume Market, with a 71.7% share. Increasing concern for pet skin sensitivity drives preference for safer compositions. Subsequently, non-alcoholic variants witness strong brand adoption and expanding consumer acceptance.

In 2024, Alcoholic maintained selective adoption in the By Ingredient Type Analysis segment of the Pet Perfume Market. Some consumers prefer stronger scent retention, supporting steady usage. Additionally, evolving formulations enhance mildness. Therefore, alcoholic perfumes remain relevant among users seeking long-lasting fragrance effects.

By Sales Channel Analysis

Pet Specialty Stores dominate with 39.1% due to product variety and expert recommendations.

In 2024, Pet Specialty Stores held a dominant market position in the By Sales Channel Analysis segment of the Pet Perfume Market, with a 39.1% share. These stores offer curated choices and expert guidance, encouraging confident purchasing. As a result, strong visibility and trust drive continuous market preference.

In 2024, Supermarkets/Hypermarkets captured growing traction in the By Sales Channel Analysis segment. Widening shelf availability and convenient shopping environments support higher consumer engagement. Moreover, improved product placement strategies boost visibility. Thus, these stores sustain balanced market penetration.

In 2024, Pharmacy/Drugstores maintained steady participation in the By Sales Channel Analysis segment. Customers recognize pharmacies for trusted health-related options. Additionally, rising demand for safe grooming products enhances adoption. Consequently, drugstores continue strengthening their relevance among cautious buyers.

In 2024, Convenience Store showed gradual expansion in the By Sales Channel Analysis segment. Quick accessibility and impulse buying behavior reinforce sales. Furthermore, small-format stores increasingly stock essential grooming products. Hence, convenience stores maintain a progressive outlook.

In 2024, Others represented diverse buying pathways in the By Sales Channel Analysis segment. This includes online retailers and boutique outlets gaining broader visibility. Growing digital engagement supports adoption. Therefore, alternate channels continually improve market reach.

Key Market Segments

By Form Type

- Spray

- Liquid

- Oil

By Animal Type

- Dogs

- Cats

- Birds

- Others

By Ingredient Type

- Non-Alcoholic

- Alcoholic

By Sales Channel

- Pet Specialty Stores

- Supermarkets/Hypermarkets

- Pharmacy/Drugstores

- Convenience Store

- Others

Drivers

Growing Grooming Frequency Among Urban Pet Owners Drives Market Growth

The pet perfume market is primarily driven by the rising grooming frequency among urban pet owners. As more households treat pets like family members, spending on grooming essentials continues to increase. This trend encourages owners to adopt products that keep pets clean, fresh, and comfortable. As a result, pet perfumes are becoming a regular part of grooming routines rather than an occasional purchase.

Additionally, the expansion of online pet-care and specialty e-commerce platforms is improving product visibility and accessibility. These digital channels allow owners to explore a wider variety of fragrances, compare options, and receive doorstep delivery. This convenience encourages repeat purchases, especially in urban areas where online shopping dominates daily buying behavior.

Furthermore, the increasing influence of social media on pet lifestyle purchases is strengthening market adoption. Pet owners often get inspired by trending grooming practices, influencer recommendations, and brand promotions across digital platforms. This visibility builds stronger awareness of pet perfumes, making them a preferred choice for enhancing pets’ hygiene and overall appearance. Together, these factors create a strong and steady demand for pet perfume products across key markets.

Restraints

Regulatory Challenges Around Pet-Safe Fragrance Ingredients

The pet perfume market faces noticeable restraints due to strict rules governing pet-safe fragrance ingredients. Regulators demand high testing standards to ensure formulas do not harm pets, which increases development costs for manufacturers. As a result, brands move slowly when launching new products, affecting overall market expansion. These tighter rules also limit creativity in fragrance design, making it harder for companies to innovate quickly.

Additionally, concerns about allergic reactions among sensitive breeds create another major restraint. Many pet owners worry about skin irritation, breathing issues, or discomfort caused by artificial scents. This fear reduces purchase confidence, especially among owners of pets with known sensitivities. Manufacturers must therefore invest in hypoallergenic formulas, which can be expensive and time-consuming to produce.

Furthermore, limited awareness about safe usage adds to consumer hesitation. Pet owners often lack clear guidance on how frequently perfumes should be applied or what ingredients to avoid. This uncertainty slows adoption, particularly in emerging markets. Together, these factors create barriers that restrict market growth, even as demand for grooming products increases.

Growth Factors

Rising Adoption of Organic and Chemical-Free Pet Fragrances Drives Market Growth

The shift toward organic and chemical-free pet fragrances is opening strong growth opportunities for market players. Pet owners are becoming more aware of safe grooming choices, leading to higher demand for natural formulas. This trend encourages brands to develop gentle, plant-based scents that reduce irritation and support daily grooming use. As awareness grows, this segment is expected to attract more first-time buyers.

Additionally, the rise of pet grooming subscription services and home-care kits is creating new long-term revenue channels. These subscription models help brands maintain customer loyalty while offering convenient, at-home grooming solutions. Monthly or quarterly bundles that include pet fragrances are becoming popular among busy pet owners, further pushing product adoption.

Moreover, increasing retail visibility in specialty pet boutiques is amplifying market reach. These stores often focus on premium and niche products, making them ideal for promoting high-quality or natural pet perfumes. Their curated assortments help brands showcase unique fragrances directly to engaged pet parents. As boutique retail networks expand, they provide a valuable platform for brands to strengthen positioning and attract new consumer segments.

Emerging Trends

Growing Demand for Long-Lasting, Hypoallergenic Pet Sprays Drives Market Trends

The Pet Perfume Market is witnessing strong traction as pet owners increasingly prefer human-grade fragrance profiles for their pets. This trend reflects a shift toward premium grooming experiences, where scents inspired by popular personal perfumes help pets smell fresh and feel more pampered. As a result, manufacturers are introducing safer and cleaner formulas that match human fragrance standards.

In addition, demand for long-lasting and hypoallergenic pet sprays is rising as consumers seek products that offer extended freshness without causing irritation. Pet owners, especially in urban areas, are becoming more aware of ingredient safety and choosing mild, vet-approved scents. This is encouraging brands to focus on gentle formulations and longer wear performance.

Another key trend is the increasing popularity of breed-specific scent formulations. Pet owners now look for products tailored to different coat types, grooming needs, and natural odor patterns. This personalization trend is driving innovation, as companies develop targeted solutions that enhance the grooming experience for various breeds.

Together, these factors highlight a shift toward premium, safe, and specialized fragrances, positioning the Pet Perfume Market for continued growth.

Regional Analysis

North America Pet Perfume Market Leads with a Market Share of 48.2%, Valued at USD 0.6 Billion

North America held the dominant position in the global pet perfume market, capturing 48.2% share and generating around USD 0.6 Billion in revenue. The region benefits from high pet ownership, strong spending on premium grooming, and rising humanization trends. Consumers increasingly prefer safe, long-lasting, and natural pet fragrances, supporting steady market expansion. The presence of advanced retail channels and strong awareness further reinforces regional growth.

Europe Pet Perfume Market Trends

Europe continues to show steady demand for pet perfumes driven by growing interest in luxury pet-care routines. Increasing adoption of natural and eco-friendly products supports market momentum across major economies. Strong regulatory frameworks encourage brands to focus on safe, pet-friendly ingredients. The rising number of grooming salons also contributes to consistent product uptake.

Asia Pacific Pet Perfume Market Trends

Asia Pacific is witnessing rapid growth supported by expanding pet ownership and rising disposable income among urban households. Pet grooming awareness is increasing, especially in emerging markets, creating strong opportunities for premium and mid-range fragrances. Online platforms are driving wider adoption, making pet perfumes more accessible to younger, digitally active consumers.

Middle East & Africa Pet Perfume Market Trends

The Middle East & Africa region is experiencing gradual market development with increasing acceptance of modern pet-care practices. Higher spending on pet hygiene among affluent consumers is supporting demand. Expanding specialty retail formats and improving awareness of pet grooming contribute to market growth, although adoption levels remain varied across countries.

Latin America Pet Perfume Market Trends

Latin America shows growing interest in pet perfumes due to rising pet ownership and increasing attention to pet hygiene. Urban consumers are driving demand for affordable yet quality fragrances. The expansion of grooming centers and e-commerce availability is boosting accessibility. Economic improvements and lifestyle changes further support the region’s upward trajectory.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Pet Perfume Company Insights

In 2024, the global Pet Perfume Market showed steady growth driven by rising premiumization in pet grooming, increasing hygiene awareness among owners, and expanding retail visibility. The market landscape was shaped significantly by a mix of emerging lifestyle-driven grooming brands and established fragrance specialists entering the pet segment with safer, long-lasting formulations.

Mipuchi continued to strengthen its premium positioning through natural, alcohol-free formulations inspired by human luxury fragrances. Its focus on clean-label scents and global branding helped the company gain strong traction among urban pet owners seeking high-quality grooming essentials.

Captain Zack expanded its footprint by emphasizing dermatologically tested and veterinary-approved ingredients. Its dedicated product lines for sensitive-skin pets allowed it to capture strong demand in developing markets where pet skin concerns are rising.

Odo-Rite gained visibility through eco-friendly and non-toxic deodorizing solutions tailored for everyday pet hygiene. Its affordability and focus on odor-neutralizing technology positioned the brand well among mass-market consumers seeking safe, home-friendly products.

Alpha Aromatics leveraged its expertise in fragrance creation to offer customized scent solutions for pet brands worldwide. Its ability to formulate long-lasting, hypoallergenic fragrance bases supported growing collaborations with private-label grooming companies.

Petveda strengthened its niche through Ayurvedic, plant-based perfume blends targeted at wellness-driven pet owners. The brand benefited from rising interest in holistic pet care and natural grooming rituals.

Pets Empire expanded its value-driven perfume range with diverse fragrance options catering to large-volume retail channels.

Bodhi Dog continued to grow through gentle, family-safe scents aligned with its natural product philosophy.

Earth Bath maintained trust through biodegradable, cruelty-free fragrance mists that appeal to eco-conscious consumers.

South Barks focused on grooming-centric fragrances supporting professional salon usage.

Nature’s Miracle sustained demand through odor-control expertise, bridging pet hygiene with functional scent solutions.

Top Key Players in the Market

- Mipuchi

- Captain Zack

- Odo-Rite

- Alpha Aromatics

- Petveda

- Pets Empire

- Bodhi Dog

- Earth Bath

- South Barks

- Nature’s Miracle

Recent Developments

- In August 2024, Dolce & Gabbana introduced Fefé, a luxury alcohol-free perfume for dogs, offering a premium grooming experience.

This launch strengthened the brand’s presence in the emerging luxury pet-care segment. - In October 2025, TurnKey Collections launched Toto Pet Fragrance, a vet-approved formula designed to mask odors and soothe pet fur and skin.

The product marked the company’s expansion into functional pet wellness fragrances. - In October 2024, TropiClean expanded its grooming line with a Watermelon range, adding a deodorizing spray for cats and dogs.

This extension enhanced its fruity-fresh segment and targeted demand for natural-scent products. - In August 2025, Groomer’s Choice Pet Products acquired Showseason Animal Products, a well-known grooming brand for shampoos, conditioners, sprays, and colognes.

Report Scope

Report Features Description Market Value (2024) USD 1.4 Billion Forecast Revenue (2034) USD 2.3 Billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form Type (Spray, Liquid, Oil), By Animal Type (Dogs, Cats, Birds, Others), By Ingredient Type (Non-Alcoholic, Alcoholic), By Sales Channel (Pet Specialty Stores, Supermarkets/Hypermarkets, Pharmacy/Drugstores, Convenience Store, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Mipuchi, Captain Zack, Odo-Rite, Alpha Aromatics, Petveda, Pets Empire, Bodhi Dog, Earth Bath, South Barks, Nature’s Miracle Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Mipuchi

- Captain Zack

- Odo-Rite

- Alpha Aromatics

- Petveda

- Pets Empire

- Bodhi Dog

- Earth Bath

- South Barks

- Nature's Miracle