Global Pet Accessories Market Size, Share, Growth Analysis By Product Type (Collars, Leashes & Harnesses, Housing & Bedding, Toys, Feeding & Drinking, Grooming Accessories, Others), By Pet Type (Dog, Cat & Others), By Distribution Channel (Online Retail & Offline Retail), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 144710

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

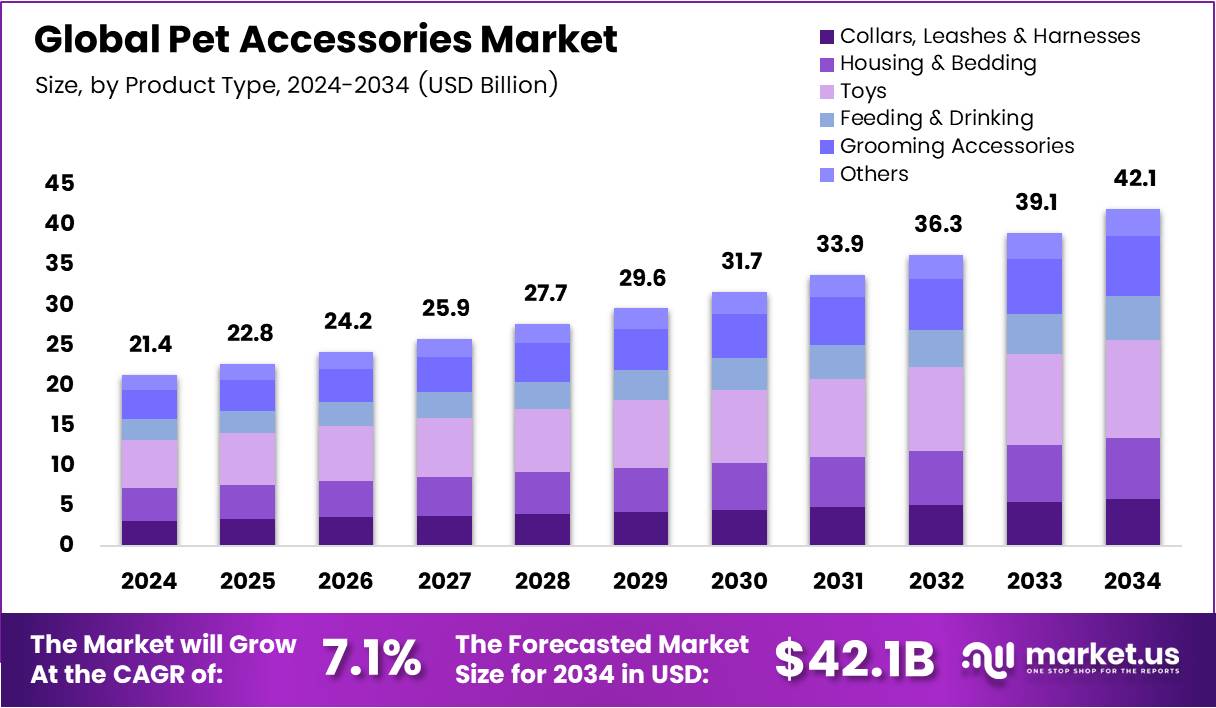

The Global Pet Accessories Market size is expected to be worth around USD 42.05 Billion by 2034, from USD 21.4 Billion in 2024, growing at a CAGR of 7.1% during the forecast period from 2025 to 2034.

The global pet accessories market continues to expand rapidly, driven by rising pet ownership, growing emotional bonding between pets and owners, and increasing willingness to invest in premium products that enhance pet comfort, safety, and well-being. Across regions, consumers are shifting toward more personalized, high-quality accessories—ranging from toys and grooming tools to bedding, apparel, feeders, and smart tech products—reflecting a broader cultural shift toward the humanization of pets.

Urbanization, smaller households, and higher disposable incomes have accelerated spending on enrichment products, lifestyle-oriented accessories, and innovative designs that align with modern living. The market is also shaped by evolving consumer preferences toward functional, durable, and aesthetically appealing products that support pets’ physical and mental health. E-commerce growth, influencer marketing, and social media visibility have broadened access to global brands and inspired aspirational purchasing choices.

While offline retail continues to dominate due to the need for tactile evaluation and expert guidance, digital platforms are rapidly increasing their share by offering convenience, product variety, and competitive pricing. At the same time, premiumization and technology integration—such as smart collars, GPS trackers, ergonomic harnesses, and automated feeders—are reshaping consumer expectations and introducing new segments within the market. Despite cost barriers in developing regions, rising middle-class populations and expanding online retail channels are opening new opportunities for market penetration.

Key Takeaways

- The global pet accessories market was valued at US$ 21.4 billion in 2024.

- The global pet accessories market is projected to grow at a CAGR of 7.1% and is estimated to reach US$ 42.05 billion by 2034.

- Between product types, pet toys accounted for the largest market share of 28.1%.

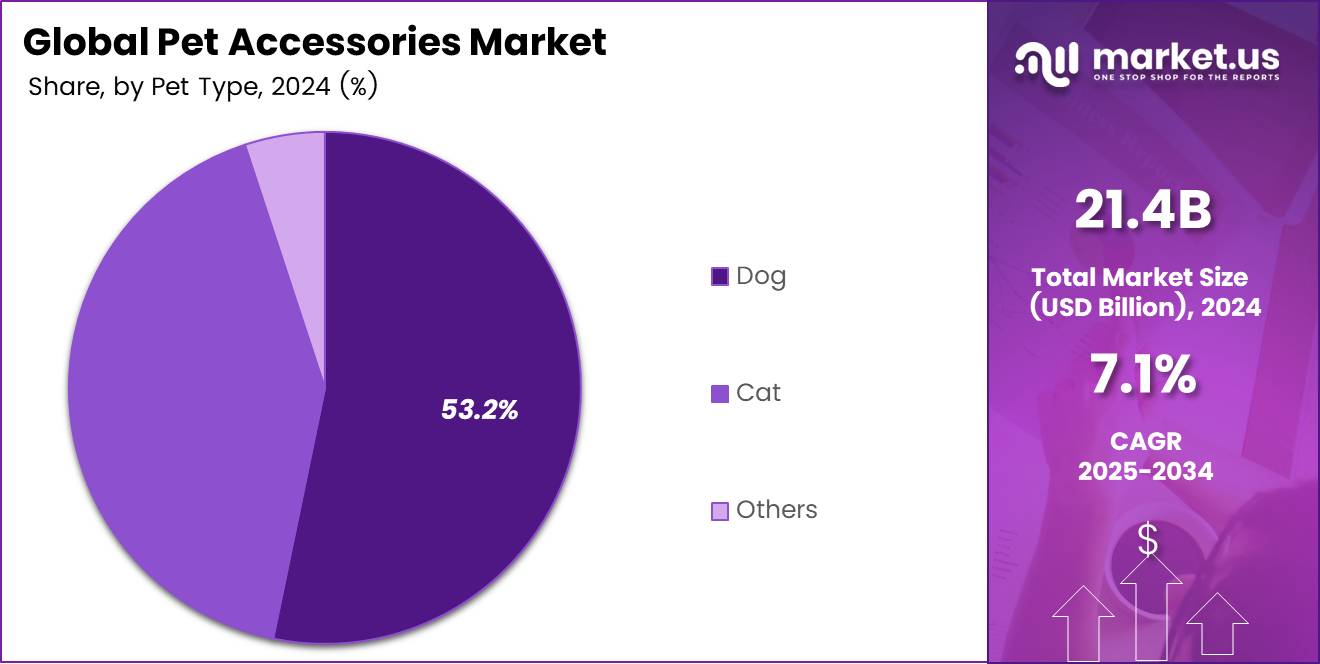

- Among pet types, dogs dominated the market with the largest share of 53.2%.

- Among distribution channels, offline retail accounted for the majority of the market share at 62.4%.

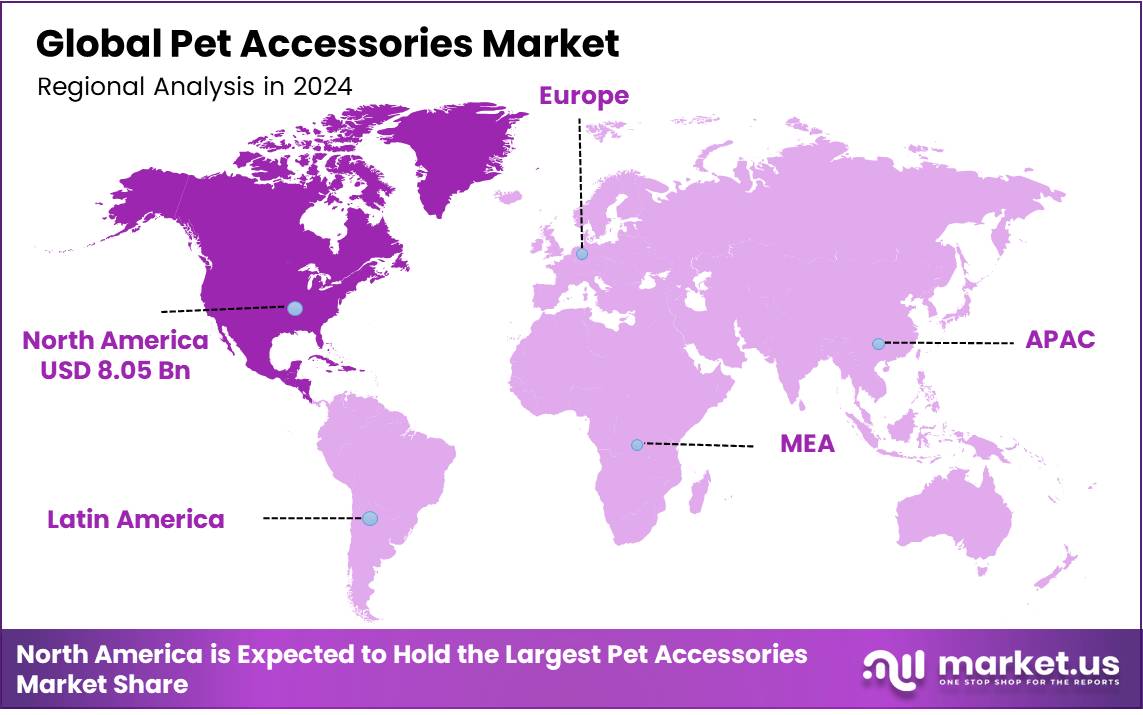

- North America is estimated as the largest market for pet accessories with a share of 37.7% of the market share.

- Asia-Pacific was estimated second largest growing market with a CAGR of 7.8%

Product Type Analysis

Based on type, the market is further divided into collars, leashes & harnesses, housing & bedding, toys, feeding & drinking, grooming accessories, & others. As of 2024, the toys products dominated the Pet Accessories market with an 28.1% share due to the strong humanization of pets and rising awareness of pet mental and physical well-being.

As pet owners increasingly view their animals as family members, they invest more in enrichment products that support exercise, reduce anxiety, and prevent destructive behavior—needs that toys directly fulfill. The surge in single-person households and indoor pet ownership has further driven demand for interactive toys that stimulate pets and compensate for limited outdoor activity.

Additionally, premiumization trends have led to innovative toy designs featuring smart technology, durable materials, and breed-specific functions, encouraging higher spending per pet. Frequent replacement due to wear and tear also drives recurring purchases, making toys a high-volume, fast-moving segment.

Pet Type Analysis

The global pet accessories market is segmented by pet type into dogs, cats, and other companion animals, with dogs continuing to dominate consumer spending. In 2024, dog accessories accounted for approximately 53.2% of the total market, reflecting the strong global preference for dogs as household pets and the expanding premiumization of dog care products.

Dog owners consistently invest in a wide range of accessories—including collars, harnesses, toys, grooming tools, apparel, travel accessories, and smart pet devices—to enhance comfort, safety, and overall well-being. The rising trend of humanization, where pets are treated as family members, further amplifies spending on high-quality and customized dog products.

Additionally, the growth of urban pet ownership, increasing adoption rates, and social media influence contribute to higher demand for innovative and lifestyle-oriented dog accessories. As a result, the dog segment remains the largest and most influential category within the global pet accessories market.

Distribution Channel Analysis

Offline retail remains the dominant distribution channel in the global pet accessories market, accounting for 62.4% of total sales, owing to the strong consumer preference for in-store product evaluation and immediate purchase satisfaction.

Pet owners often prefer physical retail formats—such as pet specialty stores, supermarkets, hypermarkets, veterinary clinics, and boutique pet shops—because they allow them to assess product quality, size, materials, and fit before buying, which is especially important for accessories such as collars, beds, apparel, grooming tools, and toys.

Additionally, offline stores provide personalized recommendations from trained staff, adding trust and convenience for new or uncertain buyers. Several retailers also enhance customer loyalty through in-store promotions, membership programs, and bundled offers. The tactile shopping experience, combined with the assurance of authenticity and instant product availability, continues to give offline retail a competitive edge despite the growing popularity of e-commerce for pet products.

Key Market Segments

By Type

- Collars, Leashes & Harnesses

- Housing & Bedding

- Beds & Sofas

- Houses

- Carriers & Travel Accessories

- Others

- Toys

- Chew Toys

- Ball & Ball Launcher

- Flying Disk

- Rope & Tug Toys

- Food Dispensing Toys

- Squeaky Toys

- Plush Toys

- Others

- Feeding & Drinking

- At Home

- Feeding Bowls

- Water Bowls

- Automatic Feeders

- Water Fountains & Waterers

- Others

- On-the-Go

- Collapsible Bowls

- Portable Bottles

- Hydration Dispensers

- Travel Food Containers

- Multi-purpose Feeding Kits

- Others

- Grooming Accessories

- Shampoo & Conditioner

- Shear & Trimming Tools

- Comb & Brush

- Nail Care Products

- Others

- Others

By Pet Type

- Dog

- Large Breeds

- Medium Breeds

- Small Breeds

- Cat

- Others

By Distribution Channel

- Online Retail

- E-commerce Platforms

- Company-owned Websites

- Offline Retail

- Pet Specialty Stores

- Supermarkets/Hypermarkets

- Others

Drivers

Rising Pet Ownership and Humanization of Pets Is Driving The Market Growth

The growth of the global pet accessories market is being strongly driven by the twin forces of rising pet ownership and the humanization of pets, both of which have transformed how consumers perceive and care for their companion animals.

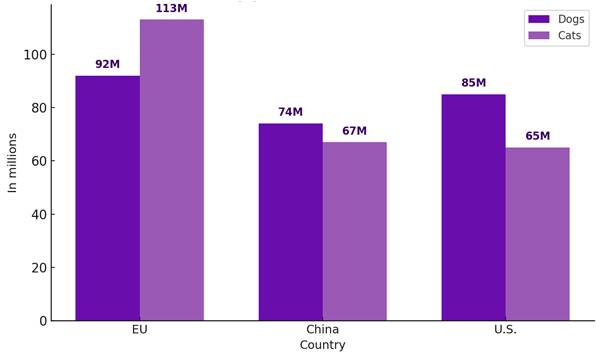

Over the past decade, global pet ownership has reached record highs — currently more than half of the world’s households have at least one pet, and families in the U.S., EU, and China alone own over 500 million dogs and cats. This surge has been propelled by demographic shifts, rising disposable incomes, and lifestyle changes.

Younger generations, urban residents, and single-person households increasingly adopt pets as companions for emotional support and stress relief. the intersection of emotional bonding, increasing pet ownership, and evolving lifestyles has turned pets into integral family members, fueling sustained global growth in pet accessories. This cultural and economic transformation is positioning the pet accessories industry as one of the most dynamic segments within the broader pet care economy.

Source : HealthforAnimals global animal health association

Increasing Disposable Incomes and Willingness to Spend On Pet Accessories In Urban Areas

The increasing disposable incomes and growing willingness to spend on pet accessories in urban areas are significantly transforming the global pet care landscape. As urbanization accelerates, households in metropolitan regions are experiencing higher purchasing power, coupled with evolving lifestyles that emphasize comfort, convenience, and emotional fulfillment through pet companionship.

Urban dwellers, often characterized by smaller family units, delayed parenthood, and greater emotional attachment to pets, are now viewing their animals as integral family members. This sentiment translates into higher expenditure on premium products that enhance pets’ comfort, style, and well-being.

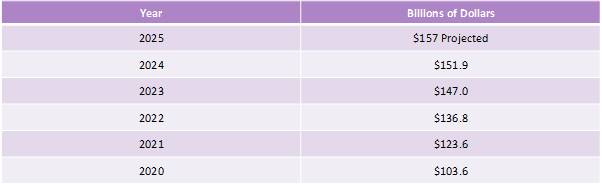

According to the American Pet Products Association (APPA), U.S. pet owners spent a record $136.8 billion in 2022, marking a 10.8% increase from 2021, with $58.1 billion spent on pet food and treats and $31.5 billion on supplies, accessories, and over-the-counter medicines. This upward trend reflects a broader willingness to invest in premium, functional, and aesthetically appealing accessories such as smart collars, orthopedic beds, designer apparel, and eco-friendly toys.

Urban pet owners are particularly drawn to products that combine technology and lifestyle appeal such as GPS trackers, automatic feeders, or ergonomic harnesses — aligning with their own digitally connected, health-conscious routines.

The rise in disposable incomes also allows consumers to prioritize quality over cost, as demonstrated by survey data showing that 81% of buyers consider product quality, followed by 66% focusing on price, and 53% on ingredient or material composition. This shift toward quality-driven consumption underscores the growing sophistication of urban pet markets, where purchasing decisions are increasingly informed by wellness, safety, and sustainability.

Total U.S. Pet Industry Expenditures

Restraints

High Cost of Premium Pet Accessories and Price Sensitivity in Developing Markets May Hamper the Market

One of the key restraints hindering the growth of the global pet accessories market is the high cost of premium products and strong price sensitivity in developing economies. While the market is witnessing an unprecedented rise in pet humanization and demand for quality lifestyle products for pets, affordability remains a critical challenge, especially in regions with lower disposable incomes.

Premium pet accessories such as ergonomic beds, smart collars, designer apparel, and technologically advanced feeders are often priced significantly higher than traditional alternatives due to specialized materials, innovation, and branding. These high production costs, combined with distribution markups and import duties, make them less accessible to average-income consumers.

In developed markets such as the United States, the United Kingdom, and Japan, affluent pet owners are driving premiumization by purchasing high-end, sustainable, or personalized accessories. However, in developing countries across Asia-Pacific, Latin America, and Africa, where consumer spending power is more limited, these products are perceived as luxury goods rather than necessities.

Growth Factors

Expanding Global Reach in Developing Regions Create New Opportunities in Pet Accessories Market

The expanding global reach in developing regions presents one of the most promising opportunities for the pet accessories market, as socioeconomic and cultural transformations redefine how pets are perceived and cared for. Emerging economies across Asia-Pacific, Latin America, the Middle East, and Africa are witnessing rapid urbanization, a growing middle class, and increased disposable incomes—all contributing to a surge in formal pet ownership.

Traditionally, pets in these regions were kept for utility purposes such as guarding or pest control, but today, they are increasingly viewed as companions and family members, mirroring trends long seen in Western markets. This attitudinal shift is opening vast new consumer segments for pet accessories ranging from basic collars and leashes to premium beds, clothing, and smart tracking devices.

The rising exposure to global lifestyles through digital media, influencer marketing, and e-commerce platforms is also expanding awareness of pet wellness and luxury, fueling aspirational consumption patterns in these markets. Furthermore, the penetration of e-commerce and direct-to-consumer channels is enabling global and regional brands to overcome traditional barriers like limited retail infrastructure and distribution inefficiencies.

Emerging Trends

Technology Integration in Pet Care

The integration of technology in the pet care industry has become one of the most transformative trends reshaping the global pet accessories market, driving innovation, personalization, and convenience for pet owners. As pets are increasingly treated as family members, consumers are turning to smart, connected products that ensure their companions’ health, safety, and well-being while fitting seamlessly into modern lifestyles.

The rise of the Internet of Things (IoT) and artificial intelligence (AI) has introduced a new generation of intelligent pet accessories that go far beyond traditional collars, feeders, or toys. These technologies allow pet owners to monitor, interact with, and care for their pets remotely — providing peace of mind and reinforcing the emotional bond between humans and animals.

IoT-enabled devices such as smart feeders, GPS trackers, and health-monitoring collars are gaining significant traction. Automatic feeders can dispense precise portions of food based on an animal’s diet plan, while GPS and activity trackers monitor location, movement, and even sleep patterns, enabling owners to detect early signs of health issues or behavioral changes.

Geopolitical Impact Analysis

China Export Effect on the EU Market & US Tariff Impacting The Pet Accessories Market.

The imposition of U.S. tariffs has significantly disrupted the global pet accessories market, raising import costs and putting pressure on manufacturers, retailers, and consumers. Since the U.S. relies heavily on low-cost Asian—especially Chinese—production, tariffs have inflated supply chain expenses, prompting companies to either absorb losses or pass higher prices to consumers. With inventory buffers expected to deplete by mid-2025, retail prices are projected to rise sharply, intensifying financial strain for pet owners, many of whom already struggle with essential expenses. As a result, consumers are reducing discretionary purchases or shifting to budget brands.

Meanwhile, U.S. producers lack the capacity to replace imports due to higher domestic production costs. Chinese and Asian exporters are diversifying into new markets and relocating manufacturing to countries such as Vietnam and Indonesia to bypass tariff barriers. If tariffs continue, long-term effects may include supply chain restructuring, reduced innovation, and declining affordability across the global pet accessories industry.

Regional Analysis

North America Held the Largest Share of the Global Pet Accessories Market.

North America held the largest share of the global pet accessories market at 37.7% due to its deeply entrenched pet ownership culture, high disposable income, and strong humanization trends that position pets as integral members of households. The region has one of the highest pet ownership rates globally—especially in the U.S., where more than two-thirds of households own at least one pet—driving continuous demand for premium accessories such as smart collars, orthopedic beds, grooming tools, travel gear, toys, and fashion products.

Consumers increasingly seek high-quality, durable, and aesthetically appealing accessories that enhance pet comfort, safety, and lifestyle, fueling growth across both traditional retail and e-commerce channels. North America is also a hub for innovation, with companies introducing tech-enabled accessories, sustainable materials, and personalized pet products.

The strong presence of leading brands, advanced distribution networks, and widespread adoption of subscription-based pet accessory services further reinforce market dominance. Additionally, rising spending on pets—driven by growing awareness of pet wellness and emotional well-being—supports continuous market expansion. Together, these factors create a mature, premium-driven, and innovation-led ecosystem that enables North America to maintain its leading share in the global pet accessories market.

- In 2021, pet owners in the United States spent $123.6 billion on their pets, with $34.3 billion allocated specifically to veterinary care and related products, excluding over-the-counter medicines. Particularly, more than half of all animal health products sold in 2021 were intended for pets—marking a significant shift from 2017, when livestock products still accounted for the majority of sales.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Pet Accessories Company Insights

Product Innovation, Eco-Friendly, and Expansion are The Key Strategies Of Major Players Of the Pet Accessories Market.

Major players in the pet accessories market are adopting strategies focused on product innovation, such as smart, eco-friendly, and premium accessories; global supply chain diversification to reduce tariff and cost risks; and expansion into emerging markets to capture rising pet ownership.

Companies are also leveraging e-commerce and omnichannel distribution, investing in brand differentiation, and forming strategic partnerships with retailers and pet service providers. Additionally, sustainability initiatives and personalized, design-driven products are becoming increasingly central to competitive positioning.

Top Key Players in the Market

- Central Garden & Pet Company

- Fluff & Tuff, Inc.

- KONG Company

- Petsport USA, Inc.

- Cosmic Pet LLC

- Resco

- Spectrum Brands

- Pet Parents LLC

- Petco Animal Supplies, Inc.

- Coastal Pet Products

- The Hartz Mountain Corporation

- Ancol Pet Products Limited

- Kanine

- Hagen Group

- West Paw Inc.

- PetIQ, Inc.

- World 4 Pets

- Garmin Ltd.

- Other Key Players

Recent Developments

- In October 2024: PetIQ, Inc. completed its acquisition by Bansk Group in an all-cash transaction valued at $1.5 billion. Shareholders received $31.00 per share, and PetIQ’s Nasdaq listing ended upon deal closing. The company became privately held while its executive team continued independent operations. This acquisition delivered significant value to shareholders and would help accelerate PetIQ’s mission of providing affordable pet healthcare. Bansk Group’s leaders, Chris Kelly and Bart Becht, said they planned to use their consumer brand expertise to strengthen PetIQ’s marketing, innovation, and growth through strategic investments and acquisitions.

- In January 2024: Garmin has introduced the Alpha XL, a cutting-edge vehicle-mounted navigator designed for hunting enthusiasts. This all-in-one device features a 10” touchscreen and integrates advanced navigation with dog tracking and training capabilities. Paired with compatible Garmin dog collars, Alpha XL allows users to monitor and command up to 20 dogs directly from the display. It includes satellite imagery, multi-GNSS support, and hunt metrics to assess each dog’s performance. Built for rugged terrain, it offers portable use for up to two hours off the dock. Alpha XL eliminates the need for handheld trackers, making it a powerful pet accessory for outdoor adventures.

Report Scope

Report Features Description Market Value (2024) USD 21.4 Billion Forecast Revenue (2034) USD 42.05 Billion CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Collars, Leashes & Harnesses, Housing & Bedding, Toys, Feeding & Drinking, Grooming Accessories, Others), By Pet Type (Dog, Cat & Others), By Distribution Channel (Online Retail & Offline Retail) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Central Garden & Pet Company, Fluff & Tuff, Inc., KONG Company, Petsport USA, Inc., Cosmic Pet LLC, Resco, Spectrum Brands, Pet Parents LLC, Petco Animal Supplies, Inc., Coastal Pet Products, The Hartz Mountain Corporation, Ancol Pet Products Limited, Kanine, Hagen Group, West Paw Inc., PetIQ, Inc., World 4 Pets, Garmin Ltd., FitBarkInc., PetPaceLtd. & Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Central Garden & Pet Company

- Fluff & Tuff, Inc.

- KONG Company

- Petsport USA, Inc.

- Cosmic Pet LLC

- Resco

- Spectrum Brands

- Pet Parents LLC

- Petco Animal Supplies, Inc.

- Coastal Pet Products

- The Hartz Mountain Corporation

- Ancol Pet Products Limited

- Kanine

- Hagen Group

- West Paw Inc.

- PetIQ, Inc.

- World 4 Pets

- Garmin Ltd.

- Other Key Players