Global Pervasive Computing Technology Market By Component (Hardware, Software, Services), By Connectivity (Wired, Wireless (Wi-Fi, Bluetooth, Zigbee, NFC (Near Field Communication), Others)), By Application (Location-Based Services, Context-Aware Computing, Wearable Computing, Ambient Intelligence, Smart Homes and Buildings, Other Applications), By End-User (Healthcare, Retail, Transportation and Logistics, Manufacturing, BFSI, Other End-Users), By Region And Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2024-2033

- Published date: March 2024

- Report ID: 116146

- Number of Pages: 326

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

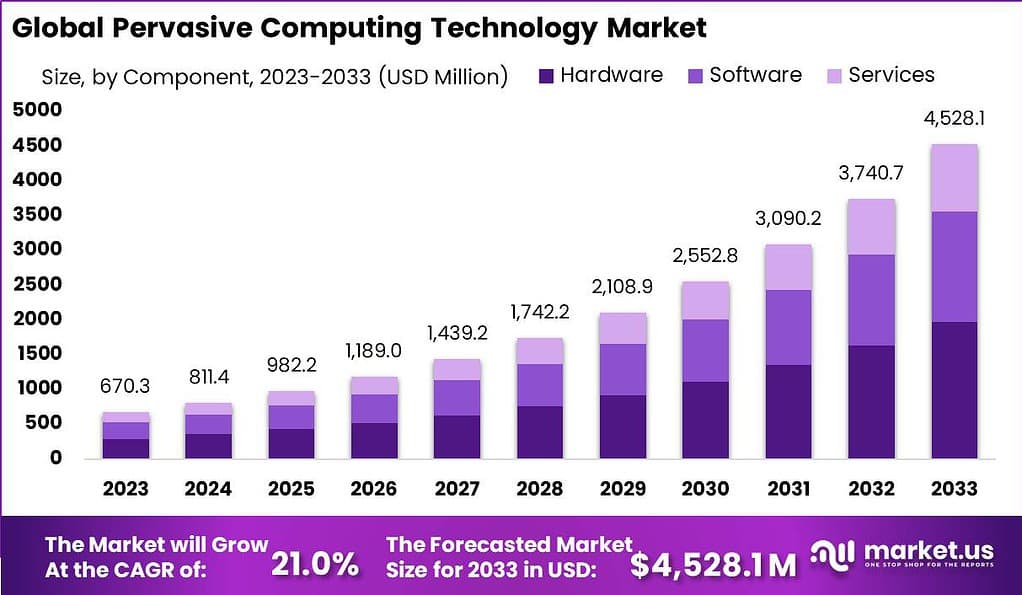

The Global Pervasive Computing Technology Market size is expected to be worth around USD 4,528.1 Million by 2033, from USD 670.3 Million in 2023, growing at a CAGR of 21.0% during the forecast period from 2024 to 2033.

Pervasive computing, also known as ubiquitous computing, refers to the integration of computing technology into the daily lives of individuals, seamlessly blending with the physical environment and enabling constant connectivity. Pervasive computing technologies encompass a wide range of devices, sensors, networks, and software applications that work together to create a pervasive computing ecosystem.

The pervasive computing technology market has witnessed remarkable growth in recent years, revolutionizing the way we interact with and experience the world around us. This innovative field encompasses a wide range of interconnected devices, systems, and services seamlessly integrated into our daily lives. From smart homes and wearable devices to intelligent transportation systems and industrial automation, pervasive computing technology has become an indispensable part of modern society.

One of the key drivers behind the rapid expansion of the pervasive computing technology market is the increasing demand for interconnectedness and convenience. People now expect their devices to seamlessly communicate with each other, creating a network of smart devices that work harmoniously to enhance efficiency and improve our quality of life. This has paved the way for the widespread adoption of Internet of Things (IoT) devices and applications, which enable the seamless exchange of data and enable new opportunities for automation and optimization.

Key Takeaways

- The global pervasive computing technology market is projected to reach a substantial value of USD 4,528.1 Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 21.0% during the forecast period from 2024 to 2033.

- The hardware segment holds a dominant position, driven by the essential role hardware plays in implementing pervasive computing solutions and the increasing demand for smart home devices, wearables, and IoT solutions. Hardware captured more than a 43.7% share of the market in 2023.

- Wireless connectivity, including Wi-Fi, Bluetooth, Zigbee, and NFC, dominates the market, capturing more than an 81.3% share in 2023. This dominance is driven by the convenience, flexibility, and scalability it offers across various industries and consumer products.

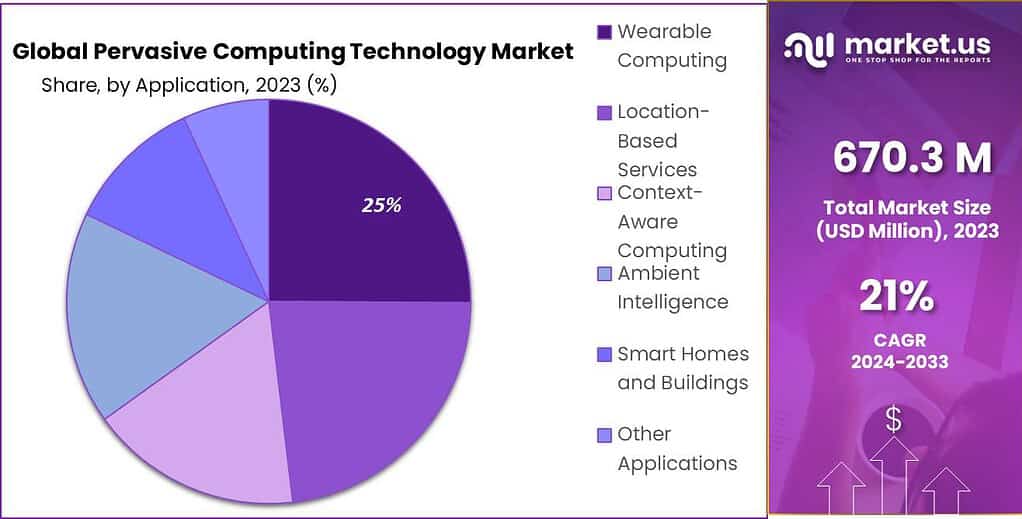

- Wearable computing holds a significant market share, capturing more than a 25.1% share in 2023. It is fueled by increasing consumer interest in health and fitness, professional applications in healthcare and sports, and continuous technological advancements improving device functionality and appeal.

- The healthcare segment commands a significant market share, capturing more than a 20% share in 2023. It is driven by the integration of pervasive computing technologies for real-time health monitoring, remote patient care, and predictive healthcare solutions.

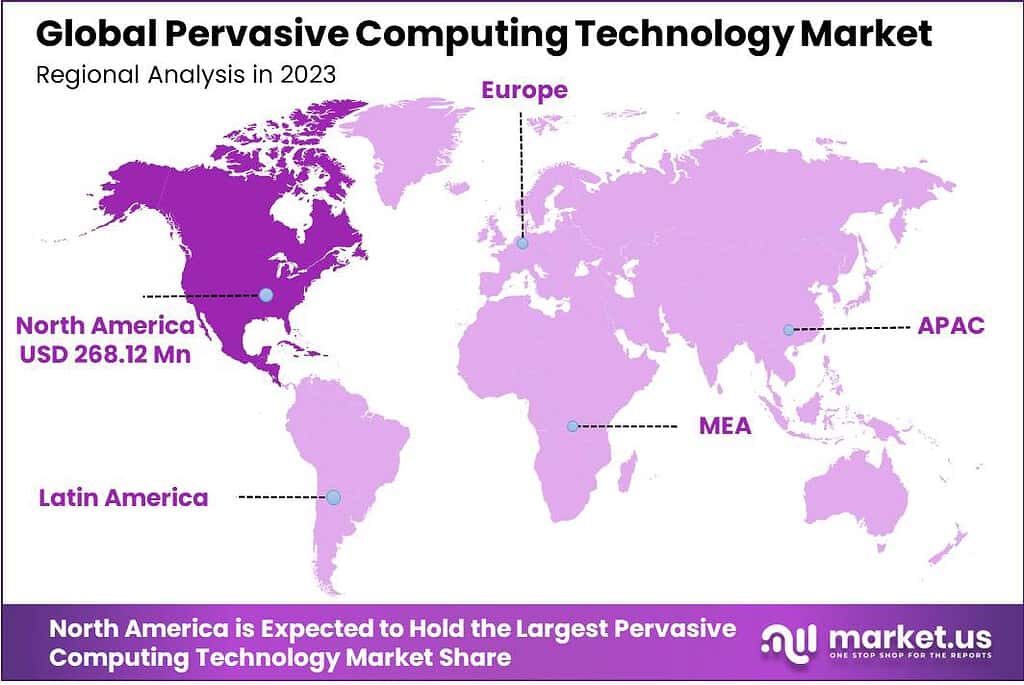

- North America leads the market, capturing more than a 40% share in 2023. This dominance is attributed to its robust technological infrastructure, presence of leading tech companies, strong emphasis on research and development, and high consumer readiness to adopt new technologies.

- In 2023, the adoption of pervasive computing solutions in the healthcare sector grew by over 50%, driven by the need for remote patient monitoring and telehealth services.

- The use of pervasive computing in smart home and building automation systems grew by over 40% in 2023, enabling improved energy efficiency, security, and convenience.

- Investment in pervasive computing startups and research surpassed $2 billion in 2023, with companies exploring applications in areas like retail, transportation, and manufacturing.

- Major tech companies like Google, Amazon, and Apple invested heavily in pervasive computing technologies in 2023, aiming to develop seamless and ubiquitous computing experiences.

- Over 60% of enterprises reported using pervasive computing solutions for asset tracking, inventory management, and supply chain optimization in 2023.

- The use of pervasive computing in environmental monitoring and sustainability initiatives grew by over 60% in 2023, driven by the need for real-time data collection and analysis.

Component Analysis

In 2023, the Hardware segment held a dominant market position within the Pervasive Computing Technology Market, capturing more than a 43.7% share. This predominance can be attributed to the essential role hardware plays as the foundational component in the implementation of pervasive computing solutions.

Hardware components such as sensors, actuators, and embedded systems are crucial for the development and deployment of smart devices and environments. The increasing demand for smart home devices, wearable technologies, and IoT solutions has significantly driven the growth of the hardware segment. These technologies require robust and efficient hardware to collect, process, and transmit data seamlessly, making hardware a critical factor in the expansive reach of pervasive computing.

Moreover, advancements in microelectronics and semiconductor technologies have led to the miniaturization of hardware components, enhancing their integration into everyday objects and environments without intrusiveness. This technological progression has enabled the development of more sophisticated and energy-efficient hardware solutions, further fueling the segment’s growth.

The rise in consumer expectations for smarter, faster, and more reliable devices has necessitated continuous innovation in hardware technologies, ensuring their leading position in the market. The investment in research and development by key market players has also propelled the hardware segment forward, as companies strive to meet the evolving needs of the pervasive computing market.

The dominance of the hardware segment is also reflective of its impact on the cost structure of pervasive computing solutions. High initial investment in hardware can account for a significant portion of the overall cost, but the benefits of increased efficiency, automation, and enhanced user experiences justify these expenditures.

Connectivity Analysis

In 2023, the Wireless segment held a dominant market position within the Pervasive Computing Technology Market, capturing more than an 81.3% share. This significant lead can be attributed to the widespread adoption of wireless technologies, including Wi-Fi, Bluetooth, Zigbee, and NFC (Near Field Communication), across various industries and consumer products.

The convenience of wireless connectivity, which allows for seamless communication between devices without the need for physical connections, has driven its preference over wired alternatives. Furthermore, the proliferation of IoT (Internet of Things) devices and smart home systems has significantly contributed to the demand for wireless solutions, enabling users to control and monitor their devices remotely with ease.

The advancement in wireless technology has not only facilitated enhanced data transfer speeds but also ensured improved security protocols, making wireless connections more reliable and safe for users. The development of energy-efficient wireless technologies has also played a crucial role in their adoption, as devices can now operate longer on battery power, reducing the need for frequent charging.

The flexibility and scalability offered by wireless connectivity solutions have enabled their integration into a wide range of applications, from industrial automation and healthcare monitoring to consumer electronics and automotive systems. This versatility has further cemented the wireless segment’s leading position in the pervasive computing technology market.

Application Analysis

In 2023, the Wearable Computing segment held a dominant market position within the Pervasive Computing Technology Market, capturing more than a 25.1% share. This prominence is largely due to the increasing consumer interest in health and fitness, which has spurred the demand for wearable devices such as smartwatches, fitness trackers, and health monitoring gadgets. These devices offer users the ability to track their physical activity, monitor vital signs in real-time, and even receive personalized health insights, contributing significantly to the segment’s growth.

Additionally, the integration of advanced technologies like artificial intelligence (AI) and machine learning (ML) has enhanced the functionality of wearable devices, making them more attractive to consumers seeking comprehensive health and wellness tools.

The expansion of wearable computing is also driven by its utility in professional sectors, including healthcare, where wearables are being utilized for patient monitoring and in sports, for performance optimization. The convenience of having important information accessible directly from one’s wrist and the ability to seamlessly connect with other smart devices have cemented wearables’ position in the pervasive computing ecosystem.

Furthermore, continuous technological advancements in battery life, user interface (UI), and design have made wearables more appealing to a broader audience, fostering the segment’s market dominance. Looking ahead, the wearable computing segment is poised for further growth, propelled by ongoing innovations and the development of new applications that extend beyond fitness and health monitoring.

With the emergence of augmented reality (AR) and virtual reality (VR) technologies, wearable devices are beginning to offer more immersive experiences, opening up new possibilities for entertainment, education, and professional training. As manufacturers continue to focus on enhancing the durability, connectivity, and range of functionalities of wearable devices, the segment is expected to maintain its leading position in the pervasive computing technology market, reflecting the growing integration of technology into everyday life.

End-User Analysis

In 2023, the Healthcare segment held a dominant market position in the pervasive computing technology market, capturing more than a 20% share. This commanding lead can be attributed to several critical factors that underscore the healthcare industry’s increasing reliance on pervasive computing technologies.

The integration of these technologies into healthcare systems is primarily driven by the urgent need for efficient patient care, remote monitoring, and streamlined operations. Pervasive computing, including IoT devices, wearable technology, and smart sensors, has been instrumental in transforming patient care by enabling real-time health monitoring, enhancing patient engagement, and improving the accuracy of diagnostics.

The adoption of pervasive computing technologies in healthcare is also propelled by the growing demand for telehealth and telemedicine solutions, especially in the wake of the global health challenges posed by the COVID-19 pandemic. The necessity for remote patient monitoring and virtual consultations has seen a significant uptick, driving healthcare providers to invest heavily in advanced technologies to meet these demands.

Furthermore, the application of data analytics and AI in processing the vast amounts of data generated by these devices offers unparalleled insights into patient health, facilitating personalized treatment plans and predictive healthcare. This trend is evidenced by substantial investments in healthcare IT infrastructure, aimed at integrating these technologies to enhance operational efficiency, patient outcomes, and satisfaction.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Connectivity

- Wired

- Wireless

- Wi-Fi

- Bluetooth

- Zigbee

- NFC (Near Field Communication)

- Others

By Application

- Location-Based Services

- Context-Aware Computing

- Wearable Computing

- Ambient Intelligence

- Smart Homes and Buildings

- Other Applications

By End-User

- Healthcare

- Retail

- Transportation and Logistics

- Manufacturing

- BFSI

- Other End-Users

Driver

Integration of AI and IoT in Healthcare

The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) within the healthcare sector stands as a significant driver for the pervasive computing technology market. This synergy enhances patient care quality and operational efficiency by enabling advanced data analytics, real-time monitoring, and personalized treatment plans.

AI algorithms can predict patient outcomes, optimize treatment protocols, and automate administrative tasks, thereby reducing human error and operational costs. IoT devices facilitate continuous health monitoring and data collection, ensuring timely interventions and improved patient engagement.

This technological convergence supports the shift towards preventive healthcare models, significantly reducing long-term healthcare costs and improving patient outcomes. The ongoing advancements in AI and IoT technologies, coupled with their increasing adoption in healthcare, promise substantial growth potential for the pervasive computing technology market.

Restraint

Data Security and Privacy Concerns

Data security and privacy concerns present a substantial restraint in the pervasive computing technology market, particularly in sectors dealing with sensitive information, such as healthcare and banking. The widespread deployment of IoT devices and other pervasive computing technologies raises significant issues regarding the vulnerability of these systems to cyberattacks and data breaches.

The collection, transmission, and storage of large volumes of personal data pose risks of unauthorized access and misuse, potentially leading to severe financial and reputational damage for organizations. Additionally, the lack of standardization in data protection laws across different regions complicates compliance efforts, further inhibiting market growth. Addressing these concerns requires substantial investments in cybersecurity measures, which may deter some organizations from fully embracing pervasive computing technologies.

Opportunity

Smart Cities and Urban Development

The development of smart cities presents a lucrative opportunity for the expansion of the pervasive computing technology market. These urban areas, enhanced with digital technologies, aim to improve the quality of life, sustainability, and economic development. Pervasive computing technologies, such as IoT sensors, smart grids, and intelligent transportation systems, are integral to building interconnected and efficient urban infrastructures.

These technologies enable real-time data collection and analysis, facilitating better decision-making in areas like traffic management, energy distribution, and public safety. As governments and private entities invest in smart city projects globally, the demand for pervasive computing technologies is expected to rise significantly. This trend not only drives market growth but also opens avenues for innovation in urban management and services.

Challenge

Interoperability and Standardization

Interoperability and standardization pose significant challenges in the pervasive computing technology market. The diversity of devices, platforms, and protocols results in compatibility issues, hindering seamless communication and data exchange between different systems. This lack of interoperability impedes the development of integrated solutions and limits the potential benefits of pervasive computing technologies.

Furthermore, the absence of industry-wide standards complicates the deployment and scaling of these technologies across different sectors and geographical regions. Addressing these challenges requires collaborative efforts from industry stakeholders to develop and adopt universal standards and protocols. Overcoming interoperability and standardization barriers is crucial for unlocking the full potential of pervasive computing technologies and fostering innovation and growth in the market

Regional Analysis

In 2023, North America held a dominant market position in the pervasive computing technology sector, capturing more than a 40% share. The demand for Pervasive Computing Technology in North America was valued at US$ 268.12 Million in 2023 and is anticipated to grow significantly in the forecast period.

This significant market share can be attributed to several key factors. Firstly, the region’s robust technological infrastructure, particularly in the United States and Canada, provides a solid foundation for the adoption and development of pervasive computing technologies. These technologies, which encompass the integration of computing capabilities into everyday objects and environments, find fertile ground in North America’s highly digitalized society.

Additionally, the presence of leading technology companies, which are pioneering innovations in IoT, AI, and cloud computing, further propels the region to the forefront of the pervasive computing market. These companies not only contribute to technological advancement but also to the ecosystem necessary for pervasive computing to thrive, including advanced research facilities and a competitive talent pool.

Moreover, North America’s market leadership is bolstered by its strong emphasis on research and development, supported by both public and private investments. The region’s commitment to R&D has led to groundbreaking advancements in pervasive computing applications across various sectors such as healthcare, retail, and smart homes.

For instance, the adoption of wearable devices for health monitoring and smart home technologies for energy management exemplifies the integration of pervasive computing into daily life, enhancing efficiency and convenience for users. The market is also driven by a high level of consumer readiness to adopt new technologies, underpinned by a culture that embraces innovation.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the pervasive computing technology market, the role of key players is crucial in driving innovation, shaping market trends, and influencing the adoption of these technologies across various sectors. These entities range from established technology giants to innovative startups, each contributing their unique solutions and platforms to the ecosystem. This analysis provides an overview of some of the key players, highlighting their contributions and strategic initiatives that underpin the growth and evolution of the pervasive computing market.

Top Market Leaders

- E-Tron CO., Ltd

- Hewlett-Packard

- Fujitsu Laboratories of America, Inc.

- Tata Consultancy Services Limited.

- Intel Corporation

- IBM Corporation

- Cisco Systems, Inc.

- Hewlett Packard Enterprise (HPE)

- Ubiquitous Computing Technology Corporation

- Other Key Players

Recent Developments

1. Tata Consultancy Services Limited (TCS):

- Throughout 2023, TCS offered its “IoT Activate” suite, aiding businesses in crafting and implementing IoT solutions, crucial for pervasive computing.

- In October 2023, TCS unveiled its “Edge AI Services” platform, empowering businesses to utilize AI at network edges, enhancing pervasive computing capabilities.

2. Intel Corporation:

- In January 2023, Intel launched its “3rd Gen Xeon Scalable processors”, optimized for AI, cloud, and high-performance computing, supporting demanding pervasive computing applications.

- Intel announced plans in August 2023 to acquire Tower Semiconductor, boosting its production of chips for IoT devices, a move that reinforces its influence in the pervasive computing realm.

3. IBM Corporation:

- IBM formed a partnership with Samsung in September 2023 to innovate in edge computing solutions, vital for the advancement of pervasive computing.

- IBM consistently funded R&D in AI, blockchain, and other pivotal technologies throughout 2023, aiming to drive progress in pervasive computing.

Report Scope

Report Features Description Market Value (2023) USD 670.3 Mn Forecast Revenue (2033) USD 4,528.1 Mn CAGR (2024-2033) 21% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software, Services), By Connectivity (Wired, Wireless (Wi-Fi, Bluetooth, Zigbee, NFC (Near Field Communication), Others)), By Application (Location-Based Services, Context-Aware Computing, Wearable Computing, Ambient Intelligence, Smart Homes and Buildings, Other Applications), By End-User (Healthcare, Retail, Transportation and Logistics, Manufacturing, BFSI, Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape E-Tron CO. Ltd, Hewlett-Packard, Fujitsu Laboratories of America Inc., Tata Consultancy Services Limited., Intel Corporation, IBM Corporation, Cisco Systems Inc., Hewlett Packard Enterprise (HPE), Ubiquitous Computing Technology Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is pervasive computing?Pervasive computing refers to the integration of computing technology into everyday objects and environments, enabling seamless communication, data processing, and interaction without explicit user intervention.

How big is Pervasive Computing Technology Market?The Global Pervasive Computing Technology Market size is expected to be worth around USD 4,528.1 Million by 2033, from USD 670.3 Million in 2023, growing at a CAGR of 21.0% during the forecast period from 2024 to 2033.

What are the key drivers of the pervasive computing technology market?Key drivers include the increasing adoption of IoT devices, growing demand for connected and smart solutions, advancements in wireless communication technologies, and the proliferation of mobile devices.

What are the challenges associated with pervasive computing adoption?Challenges include concerns regarding data privacy and security, interoperability issues among different devices and platforms, scalability of infrastructure, and the need for standardization.

Which region is expected to hold the highest share in the Pervasive Computing Technology Market?In 2023, North America held a dominant market position in the pervasive computing technology sector, capturing more than a 40% share.

Pervasive Computing Technology MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Pervasive Computing Technology MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- E-Tron CO., Ltd

- Hewlett-Packard

- Fujitsu Laboratories of America, Inc.

- Tata Consultancy Services Limited.

- Intel Corporation

- IBM Corporation

- Cisco Systems, Inc.

- Hewlett Packard Enterprise (HPE)

- Ubiquitous Computing Technology Corporation

- Other Key Players