Global Personalized Retail Nutrition and Wellness Market By Type (Fixed Recommendation, Dietary Supplements & Nutraceuticals, Functional Foods, Traditional Botanicals) Repeat Recommendation (Dietary Supplements & Nutraceuticals, Functional Foods, Traditional Botanicals) Continuous Recommendation (Dietary Supplements & Nutraceuticals, Functional Foods, Traditional Botanicals) Personalized Testing (Dietary Supplements & Nutraceuticals, Functional Foods, Traditional Botanicals) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155234

- Number of Pages: 228

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

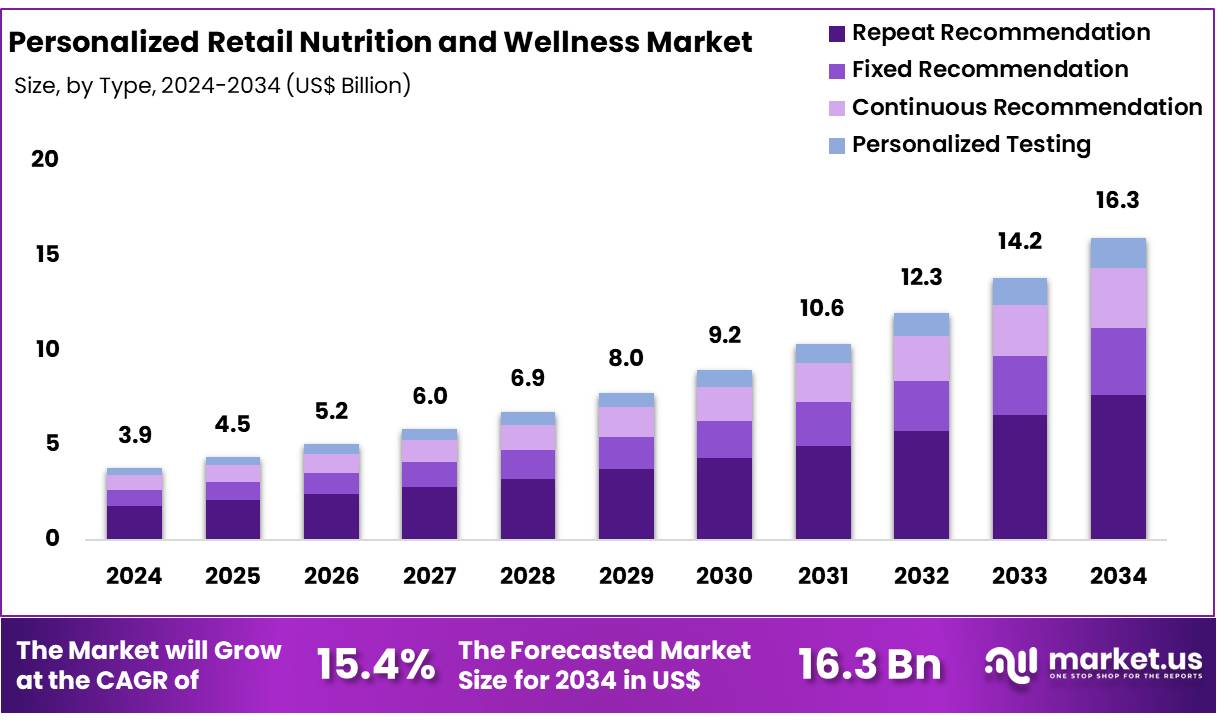

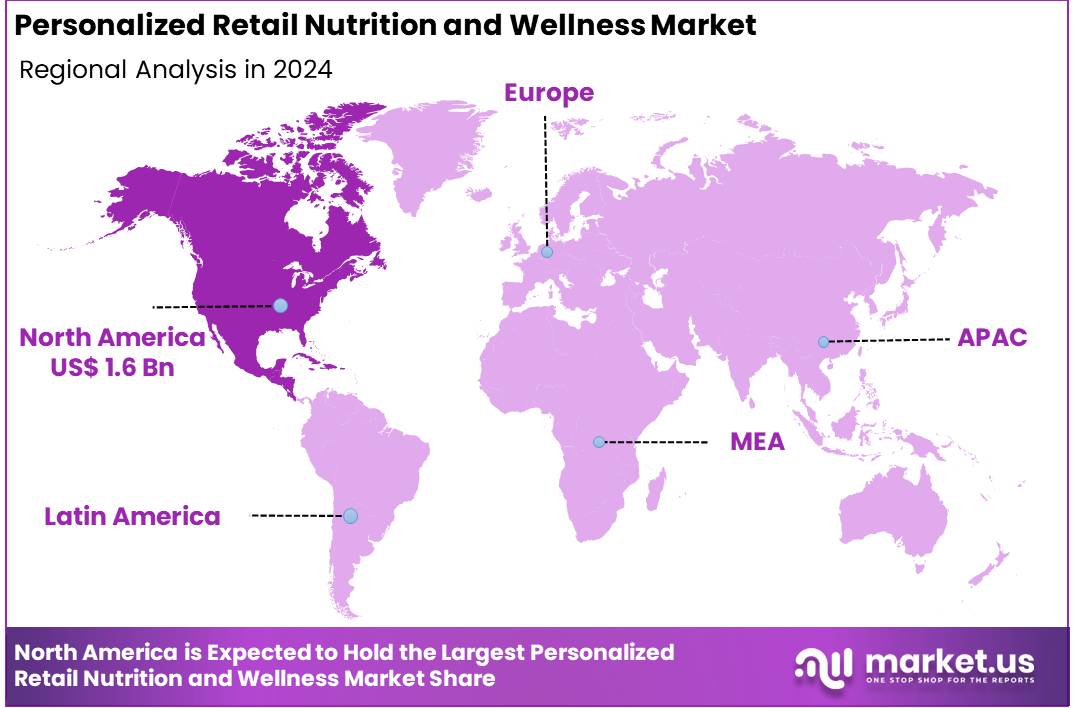

Global Personalized Retail Nutrition and Wellness Market size is expected to be worth around US$ 16.3 Billion by 2034 from US$ 3.9 Billion in 2024, growing at a CAGR of 15.4% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 41.3% share with a revenue of US$ 1.6 Billion.

The market for Personalized Retail Nutrition and Wellness is witnessing accelerated growth, driven by rising consumer demand for tailored health solutions, advancements in digital health technologies, and an increased focus on preventive care. This emerging segment integrates individualized nutrition guidance, DNA-based dietary recommendations, and AI-driven wellness platforms into mainstream retail channels, enabling consumers to make informed health and lifestyle choices directly at the point of purchase.

The market’s expansion is supported by the proliferation of smart retail formats, wearable devices, and connected health applications that provide real-time dietary tracking and personalized product recommendations. Retailers are increasingly leveraging data analytics and biomarker testing partnerships to offer customized supplements, fortified foods, and lifestyle programs aligned with individual health profiles.

Growing awareness regarding the links between nutrition, chronic disease prevention, and overall well-being has further strengthened adoption. The sector is also benefiting from heightened investment activity and strategic collaborations between retail chains, biotechnology firms, and wellness startups.

According to industry estimates, the global Personalized Retail Nutrition and Wellness market is projected to register robust growth over the next five years, with North America and Europe leading adoption, followed by rapid uptake in Asia-Pacific. Key players are focusing on developing integrated platforms that combine product personalization, subscription models, and in-store experiential health services to enhance consumer engagement.

The evolution of this market reflects a broader shift toward individualized health management, creating significant opportunities for innovation across the retail, nutrition, and wellness value chain.

Key Takeaways

- Market Size: Global Personalized Retail Nutrition and Wellness Market size is expected to be worth around US$ 16.3 Billion by 2034 from US$ 3.9 Billion in 2024.

- Market Growth: The market growing at a CAGR of 15.4% during the forecast period from 2025 to 2034.

- Mainstream Demand: 90% of consumers seek personalized wellness; 57% willing to share health data.

- Tech-Driven Growth: AI, wearables, genomics, and microbiome testing enable tailored nutrition.

- Shifting Diet Trends: High-protein (+39%), high-fiber (+159%), and pre/probiotic beverages (+58%) rising.

- Preventive Health Focus: Increasing use of nutrition to manage and prevent chronic diseases.

- Functional Foods Rise: “Food-as-medicine” and personalized supplement services expanding.

- Challenges: High costs, limited accessibility, and concerns over product claims and processing.

By Type Analysis

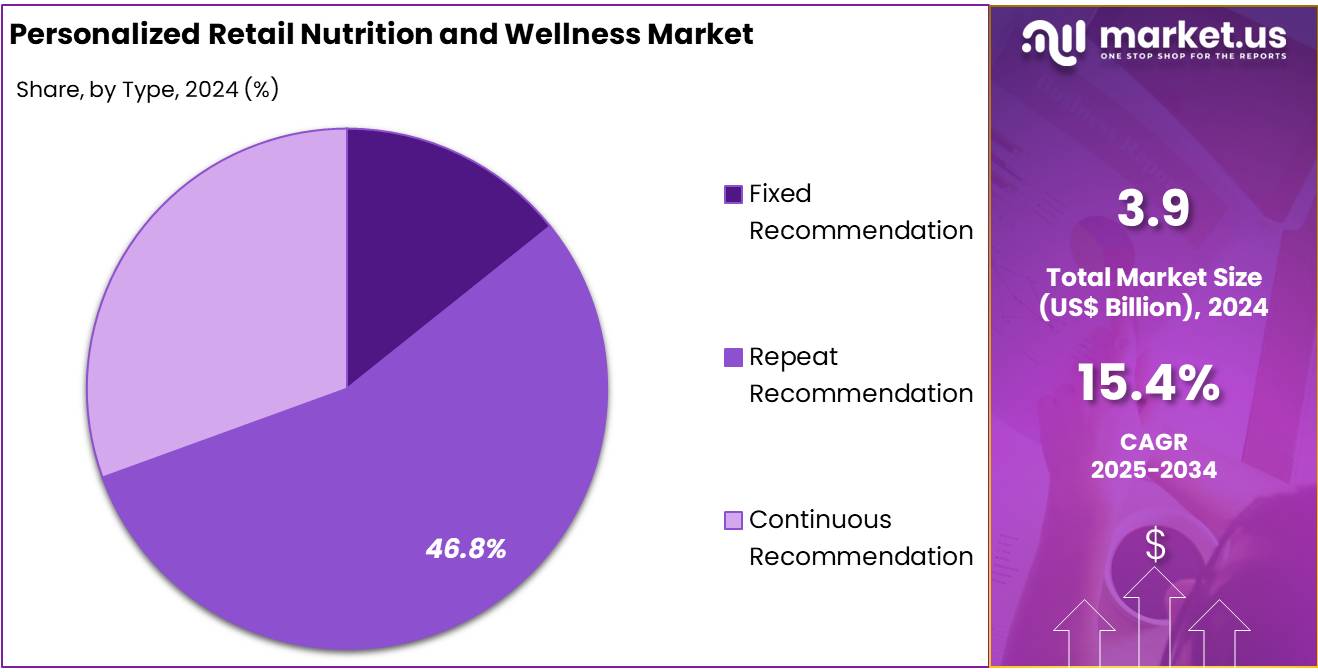

Based on type, the chemotherapy market in 2024 is segmented into Dietary Supplements & Nutraceuticals, Functional Foods, and Traditional Botanicals. Among these, the Repeat Recommendation segment is estimated to dominate, accounting for 46.8% of the total market share in 2024. This dominance can be attributed to the high reliance of oncology patients on repeated chemotherapy cycles as part of standard treatment protocols, supported by physician recommendations and clinical guidelines.

Dietary Supplements & Nutraceuticals are increasingly incorporated alongside chemotherapy regimens to support immune function, reduce treatment-related fatigue, and improve overall patient well-being. Functional Foods are witnessing steady adoption due to their role in enhancing nutritional intake and mitigating side effects such as gastrointestinal discomfort. Traditional Botanicals are gaining recognition, particularly in complementary oncology care, driven by growing consumer interest in natural and plant-based therapies with supportive clinical evidence.

The strong position of the Repeat Recommendation segment reflects the critical role of ongoing therapy adherence in achieving optimal treatment outcomes. This trend is expected to sustain in the forecast period, supported by advances in personalized chemotherapy protocols and patient-centered care models.

Key Market Segments

By Type

- Fixed Recommendation

- Dietary Supplements & Nutraceuticals

- Functional Foods

- Traditional Botanicals

- Repeat Recommendation

- Dietary Supplements & Nutraceuticals

- Functional Foods

- Traditional Botanicals

- Continuous Recommendation

- Dietary Supplements & Nutraceuticals

- Functional Foods

- Traditional Botanicals

- Personalized Testing

- Dietary Supplements & Nutraceuticals

- Functional Foods

- Traditional Botanicals

Driving Factors

The growth of the personalized retail nutrition and wellness market is being driven by increasing consumer demand for tailored health solutions based on genetic, lifestyle, and metabolic data. Advancements in digital health technologies, including AI-driven nutritional recommendations and wearable fitness devices, are enabling real-time tracking and personalization. Rising awareness of preventive healthcare and chronic disease management is further supporting adoption.

Consumers are shifting from generalized dietary advice to individualized programs, seeking optimal health outcomes and improved quality of life. Retailers are responding by integrating personalized product recommendations, nutrition coaching, and in-store health assessments. Additionally, the increasing availability of affordable genetic testing kits and mobile health apps has expanded accessibility, creating a scalable and consumer-friendly ecosystem that accelerates market growth.

Trending Factors

A prominent trend in the personalized retail nutrition and wellness market is the integration of advanced data analytics, artificial intelligence, and machine learning to provide hyper-personalized dietary and supplement recommendations. Retailers are adopting omnichannel strategies, blending online platforms, mobile apps, and in-store experiences to offer seamless personalization. Subscription-based wellness services and curated product bundles are gaining traction, enhancing customer retention and lifetime value. Partnerships between nutrition brands, biotechnology companies, and healthcare providers are increasing, enabling evidence-based recommendations backed by scientific validation.

Furthermore, sustainability and clean-label preferences are influencing personalized product offerings, with consumers demanding organic, plant-based, and allergen-free options. Social media influencers and digital wellness platforms are amplifying awareness, driving engagement, and encouraging adoption among younger, tech-savvy consumers seeking personalized and holistic wellness solutions.

Restraining Factors

The growth of the personalized retail nutrition and wellness market is restrained by concerns regarding data privacy, accuracy, and regulatory compliance. Consumers are increasingly cautious about sharing genetic and health information with retailers due to potential misuse and breaches. The high cost of advanced personalized solutions, including DNA-based testing and premium subscription plans, limits accessibility for price-sensitive segments.

Additionally, the lack of standardized protocols for data collection, analysis, and recommendation validity can undermine trust in personalized programs. Regulatory frameworks for health claims and consumer data protection vary across regions, creating compliance challenges for multinational retailers. The complexity of integrating advanced personalization systems into existing retail operations further increases operational costs. These factors collectively slow widespread adoption despite growing consumer interest in personalized health and nutrition offerings.

Opportunity

Significant growth opportunities exist in expanding personalized retail nutrition and wellness solutions into emerging markets, where rising disposable incomes and urbanization are increasing health-conscious consumer segments. The integration of personalized nutrition with preventive healthcare programs presents potential partnerships with insurers, clinics, and corporate wellness initiatives. Technological advancements in AI, IoT, and biomarker analysis can enable real-time, adaptive nutrition recommendations, improving accuracy and customer engagement.

Retailers can leverage big data analytics to develop targeted loyalty programs, personalized marketing, and cross-selling opportunities. Increasing consumer preference for digital convenience supports the development of mobile-based wellness ecosystems, combining product recommendations, meal planning, and fitness tracking. Furthermore, the shift towards sustainable, ethical, and plant-based products aligns with personalization trends, offering differentiation for retailers and brands in competitive markets.

Regional Analysis

North America is projected to dominate the personalized retail nutrition and wellness market in 2024, accounting for an estimated 41.3% share. This leadership is attributed to the region’s advanced healthcare infrastructure, high consumer awareness of preventive health, and widespread adoption of digital health technologies.

The presence of major market players, coupled with robust investment in AI-driven nutrition platforms, supports rapid innovation and market penetration. High disposable incomes and a strong culture of fitness and wellness further fuel demand for personalized solutions. Additionally, favorable regulatory frameworks and increasing integration of genetic testing in retail wellness programs strengthen North America’s market position.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The personalized retail nutrition and wellness market is characterized by the presence of diverse players offering customized dietary solutions, wellness products, and digital health platforms. Market participants compete through innovation in personalized product formulations, integration of AI-driven nutritional assessments, and data analytics to enhance consumer engagement.

Strategic collaborations with healthcare professionals, fitness experts, and technology providers are increasingly employed to expand service portfolios. Competitive differentiation is achieved through advanced biomarker analysis, genetic testing, and subscription-based wellness programs. Strong emphasis is placed on R&D to develop tailored functional foods, nutraceuticals, and supplements addressing individual health goals.

Geographic expansion strategies target emerging markets with rising disposable incomes and health awareness. The competitive landscape remains dynamic, driven by technological advancements, evolving consumer preferences, and increasing adoption of preventive healthcare solutions.

Market Key Players

- Nature’s Lab

- Cargill

- Nature’s Bounty

- Bayer AG

- PlateJoy LLC

- Better Therapeutics Inc.

- Viome Life Sciences, Inc.

- Noom, Inc.

- Savor Health

- Nutrigenomix

- DNAfit

Recent Developments

- Nature’s Bounty In mid- 2025, several new supplements were introduced, including Advanced Menopause Relief, Ultra Collagen Booster, Advanced Vital Heart, Superfoods Plus Energy, and Prebiotic + Postbiotic + Probiotic Gummies.

- Bayer AG In 2025, Bayer advanced AI-driven product development and launched a “healthy-aging” ecosystem integrating dietary supplements, a companion wellness app, and a biological age test.

- Better Therapeutics Inc. Operations were wound down in early 2024; its assets were acquired by Click Therapeutics to accelerate digital therapeutics targeting obesity and cardiometabolic disease.

- Noom, Inc.In 2025, Noom launched a microdose GLP-1 weight-loss program priced at US$119/month; additionally, AI Body Scan personal health reports and the Noom Vibe community were introduced.

Report Scope

Report Features Description Market Value (2024) US$ 3.9 Billion Forecast Revenue (2034) US$ 16.3 Billion CAGR (2025-2034) 15.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Fixed Recommendation, Dietary Supplements & Nutraceuticals, Functional Foods, Traditional Botanicals) Repeat Recommendation (Dietary Supplements & Nutraceuticals, Functional Foods, Traditional Botanicals) Continuous Recommendation (Dietary Supplements & Nutraceuticals, Functional Foods, Traditional Botanicals) Personalized Testing (Dietary Supplements & Nutraceuticals, Functional Foods, Traditional Botanicals) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Nature’s Lab, Cargill, Nature’s Bounty, Bayer AG, PlateJoy LLC, Better Therapeutics Inc., Viome Life Sciences, Inc., Noom, Inc., Savor Health, Nutrigenomix, DNAfit Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Personalized Retail Nutrition and Wellness MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Personalized Retail Nutrition and Wellness MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Nature's Lab

- Cargill

- Nature's Bounty

- Bayer AG

- PlateJoy LLC

- Better Therapeutics Inc.

- Viome Life Sciences, Inc.

- Noom, Inc.

- Savor Health

- Nutrigenomix

- DNAfit