Global Personal Emergency Response System (PERS) Market By Product Type (Landline, Mobile, and Others), By End-user (Home-based Healthcare, Assisted Living Facilities, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160444

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

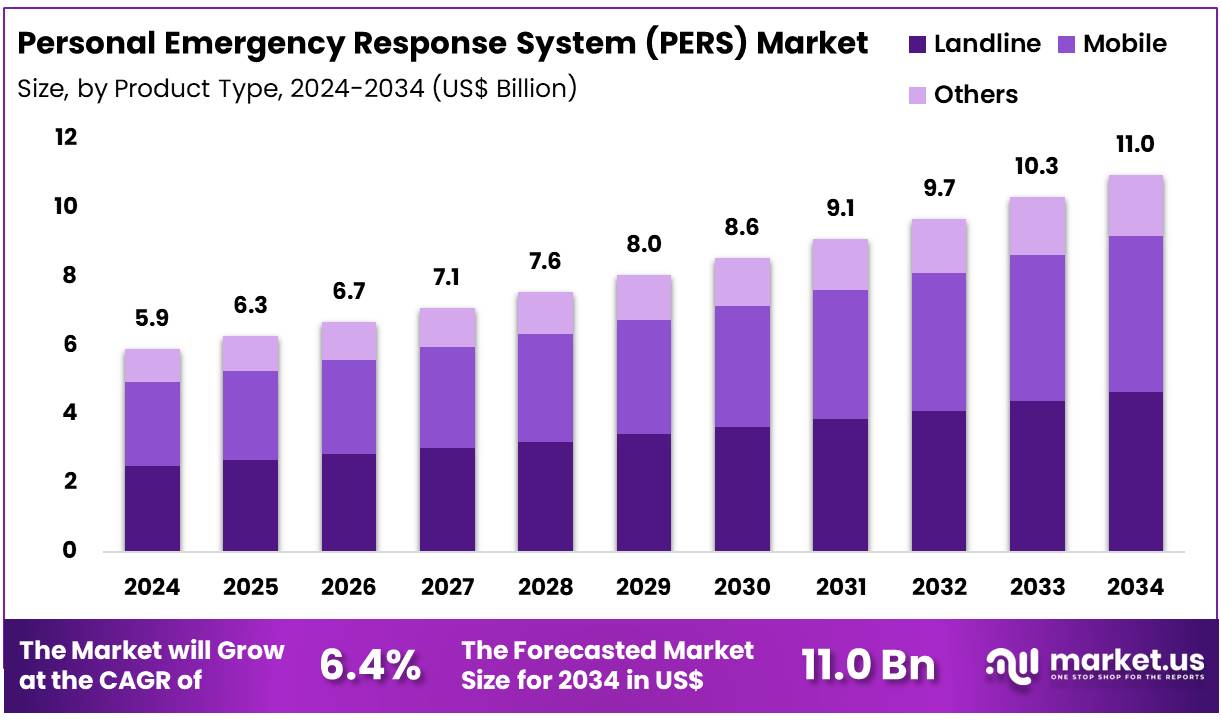

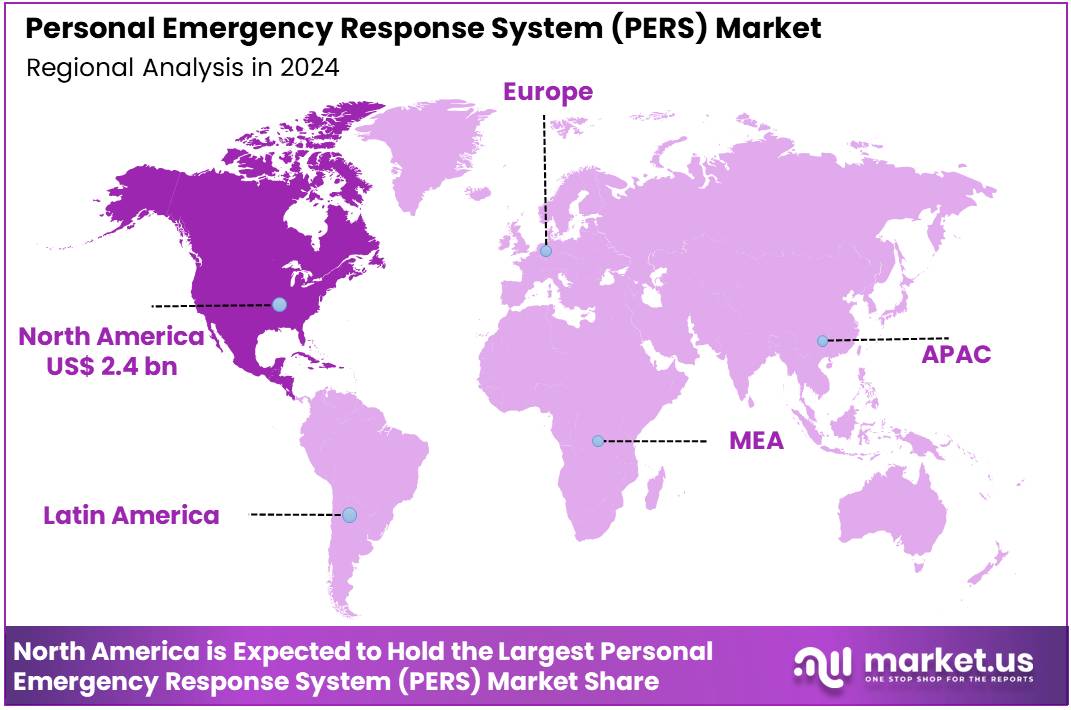

The Global Personal Emergency Response System (PERS) Market size is expected to be worth around US$ 11.0 Billion by 2034 from US$ 5.9 Billion in 2024, growing at a CAGR of 6.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.2% share with a revenue of US$ 2.4 Billion.

Rising aging populations and the increasing prevalence of chronic diseases are driving growth in the personal emergency response system (PERS) market, as healthcare providers prioritize safety for vulnerable individuals. According to the CDC, 28% of adults aged 65 and older reported falling at least once in 2021, which highlights the critical need for reliable emergency response solutions.

Caregivers are increasingly adopting PERS for fall detection, enabling rapid alerts to emergency services for seniors living independently. This demand grows with the rising need for chronic condition monitoring, where systems track vital signs like heart rate in real-time for cardiac patients. Additionally, nursing homes and assisted living facilities integrate PERS for mobility assistance, ensuring timely responses to resident distress calls. These drivers position PERS as essential for enhancing safety and independence across diverse applications.

Growing advancements in wearable technology and IoT integration are creating significant opportunities within the PERS market. Innovators are developing smart wearables that monitor critical health metrics such as glucose levels, supporting diabetes management with automated alerts to caregivers. This technological progress supports community health programs leveraging PERS for post-hospitalization follow-ups, enabling remote check-ins that help reduce readmission rates.

The mental health sector is also tapping into PERS, with systems offering crisis intervention capabilities for individuals with anxiety disorders through one-touch emergency contacts. In March 2023, SmartCare launched its SmartCall platform, providing real-time data collection with scheduled and on-demand calls to optimize caregiving workflows. These opportunities emphasize the ability of PERS to deliver scalable, connected solutions that cater to a broader spectrum of personalized care needs.

Recent trends in the PERS market highlight seamless communication platforms and strategic partnerships that improve accessibility and user experience. Developers are incorporating voice-activated interfaces to support medication reminders, aiding adherence in elderly users managing multiple prescriptions. In January 2023, FallCall Solutions partnered with HSC Technology Group to expand PERS access for seniors, enhancing emergency response capabilities and boosting service availability.

Mobile app integrations are also becoming popular, providing family caregivers with real-time updates on stroke patient alerts. These innovations signal a dynamic shift toward user-centric, technology-driven emergency response ecosystems, ensuring better care delivery and enhanced accessibility for individuals relying on PERS for critical support.

Key Takeaways

- In 2024, the market generated a revenue of US$ 5.9 Billion, with a CAGR of 6.4%, and is expected to reach US$ 11.0 Billion by the year 2034.

- The product type segment is divided into landline, mobile, and others, with landline taking the lead in 2023 with a market share of 42.4%.

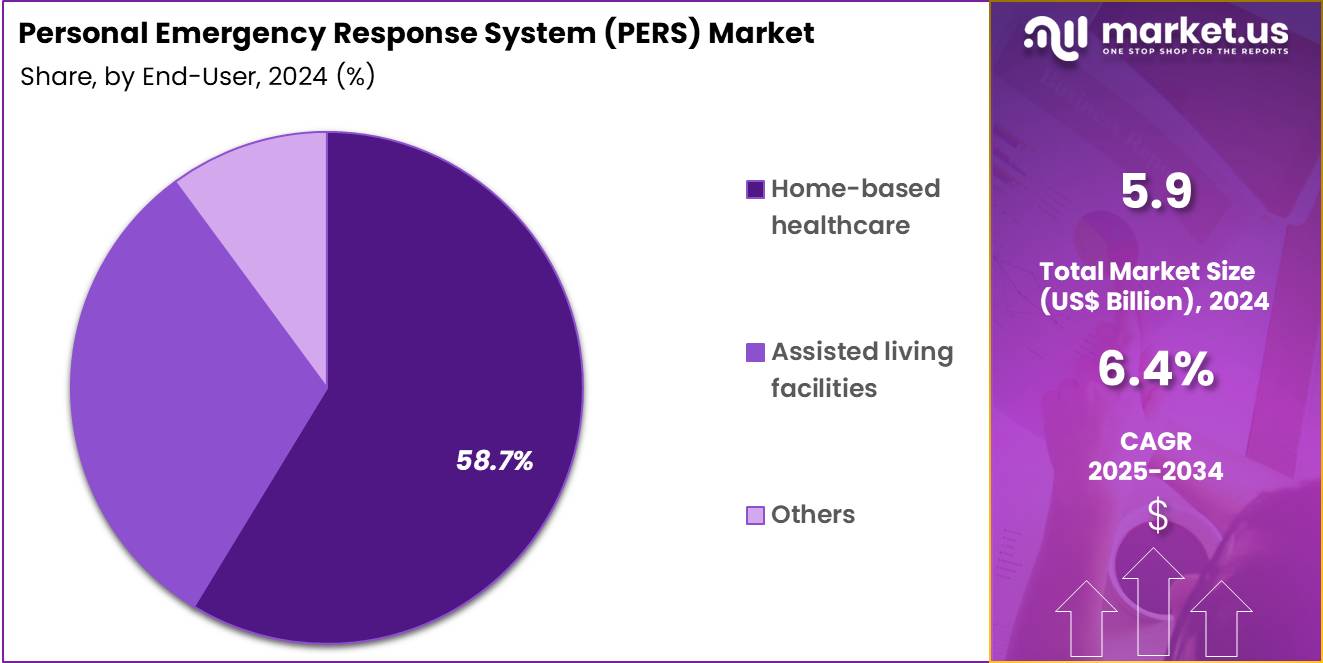

- Considering end-user, the market is divided into home-based healthcare, assisted living facilities, and others. Among these, home-based healthcare held a significant share of 58.7%.

- North America led the market by securing a market share of 41.2% in 2023.

Product Type Analysis

Landline-based personal emergency response systems (PERS) hold 42.4% of the market share and are expected to continue to dominate due to their strong presence in home-based healthcare applications. Landline PERS are commonly used in households where users may not have access to mobile networks, particularly in rural or less-connected areas. Their affordability and reliability have been key drivers in maintaining this segment’s strong performance.

These systems are particularly preferred by older adults and individuals with health conditions, as they offer a simple, dependable means of alerting caregivers or emergency services in case of an emergency. The rising aging population, combined with the increasing demand for non-invasive healthcare solutions, is expected to support the ongoing dominance of landline-based systems. Furthermore, improvements in landline infrastructure in remote areas and the growing adoption of home-based healthcare services are likely to enhance market growth for this segment.

End-User Analysis

Home-based healthcare, which accounts for 58.7% of the market, is expected to be the fastest-growing end-user segment in the PERS market. The demand for home-based healthcare is anticipated to increase as more individuals prefer aging in place and receiving medical care in the comfort of their homes. With the rising prevalence of chronic diseases, such as heart disease, diabetes, and dementia, home-based healthcare provides a solution for continuous monitoring and immediate access to medical care when needed.

PERS in home-based healthcare settings enable elderly individuals and those with chronic conditions to call for help in emergencies, providing peace of mind to both patients and their families. The growing shift toward telemedicine, coupled with increasing healthcare costs, has made home-based healthcare more attractive.

Additionally, government support and initiatives promoting aging in place and home care services are likely to contribute to the segment’s growth. The continuous advancements in wearable health devices integrated with PERS are expected to further accelerate the demand for home-based systems.

Key Market Segments

By Product Type

- Landline

- Mobile

- Others

By End-user

- Home-based Healthcare

- Assisted Living Facilities

- Others

Drivers

Aging Demographics is driving the market

The substantial and continuing growth of the elderly population globally is the most significant driver for the Personal Emergency Response System (PERS) market, as these systems are primarily designed for older adults who wish to maintain independent living. As the baby-boom generation transitions into the senior age bracket, the pool of potential PERS users expands dramatically, creating a persistent and escalating demand for at-home safety solutions. This demographic shift is not a temporary fluctuation but a long-term structural change in population composition across developed nations.

The increasing life expectancy further contributes to this growth, as more people are living longer with age-related health issues such as chronic illnesses, mobility challenges, and an elevated risk of accidents. In the United States alone, the population aged 65 and older grew by 3.1% to reach 61.2 million from 2023 to 2024, according to the US Census Bureau. This consistent growth in the target demographic directly correlates with a rising need for devices that can quickly summon help in an emergency, ensuring peace of mind for seniors and their caregivers. The desire among a majority of older adults to “age in place”—that is, to live independently in their own homes for as long as possible further solidifies the essential nature of PERS devices in modern elder care.

Restraints

High Cost of Devices and Subscription Services is restraining the market

The significant initial investment and recurring subscription fees associated with Personal Emergency Response Systems (PERS) serve as a notable restraint on market expansion, particularly for potential users on fixed or limited incomes. While the long-term cost of a PERS is substantially lower than institutional care, the immediate financial burden of purchasing a device and committing to a monthly service plan can be prohibitive for many elderly individuals.

The hardware itself, especially for advanced mobile Personal Emergency Response Systems (mPERS) with features like GPS and fall detection, can be expensive, and the subscription plans vary widely but add a continuous expense to a senior’s budget. This cost sensitivity is a major barrier to wider adoption, despite the proven benefits of these systems in preventing serious injury or death. Furthermore, a substantial portion of the elderly population relies on government-funded healthcare programs like Medicare, which historically has not provided comprehensive coverage for PERS devices, treating them as non-medical or convenience items.

In fact, a 2024 survey indicated that the national annual median cost of a semi-private room in a nursing home was US$111,325, whereas a PERS subscription might only cost a fraction of that, yet the lack of direct coverage for the device itself makes the upfront expenditure a critical point of resistance for budget-conscious seniors. The need for greater subsidy or inclusion in long-term care insurance policies must be addressed for the market to reach its full potential.

Opportunities

Integration of Telehealth and Remote Monitoring is creating growth opportunities

The ongoing trend of integrating Personal Emergency Response Systems (PERS) with broader telehealth and Remote Patient Monitoring (RPM) platforms presents a substantial growth opportunity, transforming the device from a mere emergency button into a comprehensive health management tool. By incorporating biometric sensors, vital sign tracking, and seamless data transmission capabilities, modern PERS devices can offer proactive health insights, rather than only reactive emergency alerts. This evolution allows healthcare providers to remotely monitor chronic conditions, track adherence to care plans, and intervene before a crisis occurs, offering a powerful value proposition beyond simple fall detection.

The increasing governmental acceptance and reimbursement for remote monitoring services further fuels this opportunity, incentivizing both providers and consumers to adopt integrated systems. For example, the Centers for Medicare & Medicaid Services (CMS) has continued to expand Medicare telehealth flexibilities, including the ability for patients to receive non-behavioral/mental health care in their home through at least September 30, 2025, which facilitates the use of remote-monitoring-enabled PERS devices. This policy shift supports the convergence of emergency response with preventative care, positioning PERS as a core component of the rapidly expanding home healthcare ecosystem. This integration expands the market’s reach beyond the frail elderly to include individuals with chronic diseases, post-operative patients, and those requiring long-term care management.

Impact of Macroeconomic / Geopolitical Factors

Persistent inflationary dynamics and climbing interest expenses burden operators in the elder alert device sector, compelling them to absorb elevated sourcing outlays and postpone enhancements to wireless connectivity protocols. Intensifying bilateral trade skirmishes and instability in semiconductor supply corridors from East Asia impede timely acquisitions of microchips and sensors, inflating operational latencies and exposing firms to currency volatility in cross-continental dealings.

Enterprises counter these headwinds by forging alliances with Midwest-based fabricators, streamlining logistics and embedding redundancy into core architectures. Demographic swells in senior cohorts channel amplified funding toward proactive wellness tools, invigorating subscription uptakes across assisted living networks. Moreover, the US universal 10% import tariff, activated in April 2025, amplifies acquisition expenses for overseas-sourced pendants and docking units, eroding competitive edges for budget-oriented providers and fostering hesitancy in volume commitments from institutional buyers.

Such levies strain collaborative R&D with foreign tech partners, occasionally derailing firmware updates aligned with evolving safety standards. Visionary leaders, however, harness policy rebates to invigorate onshore prototyping labs, catalyzing breakthroughs in voice-biometric interfaces and spawning roles in quality assurance pipelines. Leading innovator LogicMark achieved US$9.9 million in 2023 revenue, reflecting a 17% dip from 2022 amid service transitions yet signaling adaptive resilience. These trajectories ultimately empower a fortified, innovation-led domain primed for enduring prosperity.

Latest Trends

Advanced Wearable Technologies and Fall Detection is the recent trend

A prominent and recent trend in the Personal Emergency Response System (PERS) market is the significant shift toward advanced wearable technologies, specifically the integration of highly sophisticated and reliable automatic fall detection capabilities into discreet mobile devices.

Newer PERS devices, often miniaturized into smartwatches or compact pendants, leverage multi-sensor technology, including accelerometers and gyroscopes, combined with enhanced algorithms to accurately differentiate between a genuine fall and normal daily activities, such as sitting down quickly. This technological leap addresses one of the major historical limitations of traditional PERS the reliance on the user to manually press a button after a fall, which is often impossible in cases of unconsciousness or severe injury.

The development of mPERS (mobile PERS) devices that incorporate these advanced features and operate using cellular and GPS technology offers users true freedom, extending protection beyond the home and into the wider community. This focus on mobility and accuracy is demonstrated by the fact that the mobile PERS (mPERS) sub-segment held a revenue of approximately 46% of the US medical alert systems market in 2024, showcasing strong user preference and adoption. This trend not only improves user safety and quality of life but also broadens the market’s appeal to a more active, tech-savvy older adult demographic who prefers a less intrusive and more versatile device.

Regional Analysis

North America is leading the Personal Emergency Response System (PERS) Market

In 2024, North America commanded a 41.2% share of the global personal emergency response system (PERS) market, impelled by demographic pressures from an expanding senior cohort vulnerable to isolation and mobility challenges, alongside technological leaps in wearable connectivity. Providers expanded offerings of GPS-enabled pendants and smart home integrations to deliver instantaneous alerts, curtailing response times during solitary living scenarios and aligning with caregiver preferences for proactive oversight.

Federal initiatives through the Administration for Community Living promoted subsidized devices for low-income elders, fostering equitable distribution in suburban enclaves where family proximity wanes. Innovations in fall-detection algorithms, powered by machine learning, heightened device sensitivity to subtle gait irregularities, preempting injuries before escalation. Reimbursement expansions under Medicare Advantage plans incentivized adoption, particularly for chronic condition sufferers prone to cardiac events.

Collaborative deployments in assisted living facilities streamlined monitoring infrastructures, reducing operational silos and enhancing resident autonomy. Economic evaluations affirmed long-term fiscal benefits from diminished hospital diversions, attracting institutional buy-ins for fleet-wide implementations. These convergences underscored the region’s proactive stance on elder safety paradigms. The Centers for Disease Control and Prevention documented an unintentional fall death rate of 69.9 per 100,000 population among adults aged 65 and older in 2023, with rates for men at 74.2 and women at 65.9.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts anticipate the Asia Pacific personal emergency response system sector to burgeon during the forecast period, as policymakers intensify focus on elder-centric safety nets amid swift societal transitions. Authorities in Japan and South Korea channel funds into subsidized alert networks, arming community centers with voice-activated consoles to safeguard against urban disorientation risks.

Device manufacturers ally with telecom giants to embed 5G capabilities, projecting seamless integration for remote diagnostics in archipelago communities. Regional task forces advance culturally attuned interfaces, equipping migrant caregivers with multilingual dispatch protocols to bridge linguistic divides. Governments project scaling mobile variants for nomadic pastoralists, mitigating isolation in expansive terrains through satellite linkages.

Local innovators refine bio-sensor arrays for early hypothermia alerts, synchronizing with national welfare grids for automated welfare checks. These maneuvers cultivate a tapestry of vigilant, inclusive guardianship frameworks. The United Nations Economic and Social Commission for Asia and the Pacific estimated the population aged 60 and older at 670 million in 2022, comprising 14.3% of the total regional populace.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading enterprises in the senior safety monitoring field accelerate their trajectory by unveiling GPS-enabled wearables that incorporate voice-activated alerts and proactive health checks, catering to aging demographics seeking autonomy. They orchestrate alliances with telehealth networks and insurance providers to bundle monitoring services, easing integration into care plans and unlocking reimbursement streams.

Innovators channel capital into sensor fusion advancements, crafting devices with ambient environmental scans to preempt hazards like wandering or inactivity. They consolidate market footing via buyouts of regional service outfits, harmonizing operations for nationwide coverage and operational synergies.

Executives pursue footholds in Latin America and Southeast Asia, refining interfaces for multilingual support and adapting to varying connectivity landscapes. Furthermore, they pioneer tiered service contracts that embed predictive wellness coaching, cultivating user retention and diversifying income beyond hardware sales.

Lifeline Systems, Inc., established in 1974 in Boston, Massachusetts, by gerontologists Andrew and Susan Dibner, pioneered the medical alert industry with its inaugural in-home response pendant, revolutionizing emergency access for vulnerable populations. The firm, acquired by Connect America in 2021 with Philips retaining an equity interest, delivers a spectrum of at-home and mobile safety solutions, including AutoAlert fall detection and On the Go GPS trackers, to millions across the US Lifeline commits to continual refinement through user feedback loops, embedding seamless app connectivity for family notifications and care coordination.

Leadership emphasizes ethical monitoring protocols, ensuring 24/7 response centers staffed by trained responders prioritize rapid dispatch. The company engages with senior living operators to customize deployments, enhancing resident confidence in independent routines. Lifeline fortifies its foundational role by evolving from basic alarms to intelligent ecosystems that align with holistic aging-in-place imperatives.

Top Key Players

- VR

- Tunstall Group

- Rescue Alert

- Medical Guardian LLC

- LogicMark

- Lifeline

- Life Alert Emergency Response, Inc

- GreatCall

- Bay Alarm Medical

- AlertONE Services Inc

Recent Developments

- In 2025, LogicMark launched the Guardian Alert 911 Plus, a next-generation wearable personal emergency communication device equipped with 4G LTE connectivity and automated fall detection. This innovation is designed to significantly improve response times and ensure reliable communication for seniors and other vulnerable individuals, especially in mobile and home settings, addressing critical needs in personal safety and emergency preparedness.

- In 2024, Medical Guardian, a leading provider in the personal emergency response sector, acquired MobileHelp’s B2B division, Clear Arch Health. This strategic acquisition aimed to expand Medical Guardian’s reach in the remote patient monitoring and mobile personal emergency response systems (PERS) market. By enhancing its MGEngage360 platform with advanced location tracking and real-time monitoring capabilities, the move solidified Medical Guardian’s position as a leader in providing integrated, comprehensive safety solutions for healthcare providers and their patients.

- In May 2023, HandsFree Health unveiled a new addition to its personal emergency response (PERS) product lineup, introducing a hands-free emergency response speaker. This device enhances the company’s offerings, which already include smartwatches and pendants, by providing users with an easy-to-use, secure communication tool for emergencies. It is specifically designed to offer peace of mind for seniors and individuals with specific health concerns, ensuring rapid and dependable alerts in emergency situations.

Report Scope

Report Features Description Market Value (2024) US$ 5.9 Billion Forecast Revenue (2034) US$ 11.0 Billion CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Landline, Mobile, and Others), By End-user (Home-based Healthcare, Assisted Living Facilities, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape VR, Tunstall Group, Rescue Alert, Medical Guardian LLC, LogicMark, Lifeline, Life Alert Emergency Response, Inc, GreatCall, Bay Alarm Medical, AlertONE Services Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Personal Emergency Response System (PERS) MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Personal Emergency Response System (PERS) MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- VR

- Tunstall Group

- Rescue Alert

- Medical Guardian LLC

- LogicMark

- Lifeline

- Life Alert Emergency Response, Inc

- GreatCall

- Bay Alarm Medical

- AlertONE Services Inc