Global Perchloroethylene Market Size, Share, And Business Benefits By Grade (Reagent Grade, Industrial Grade), By Application (Refrigerants, Dry Cleaning, Vapor Degreaser, Extractant, Cooling Agents, Others), By End Use Industry (Textile, Automotive, Aerospace, Construction, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 149725

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

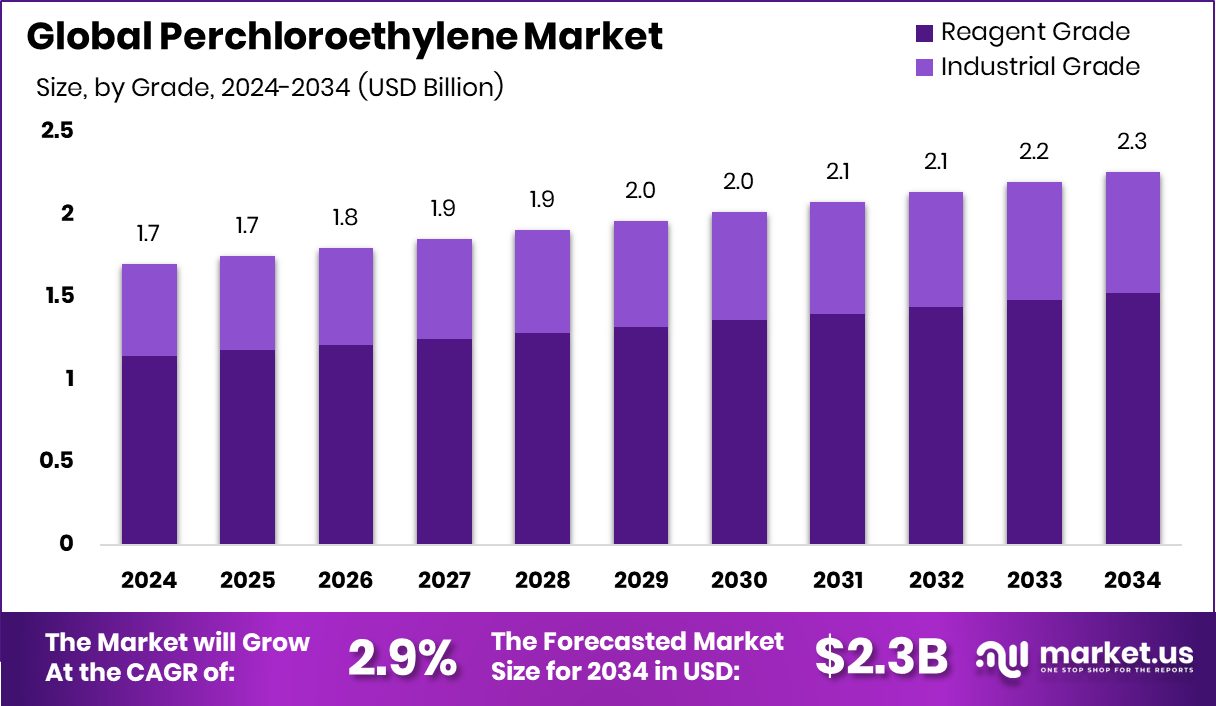

The Global Perchloroethylene Market is expected to be worth around USD 2.3 billion by 2034, up from USD 1.7 billion in 2024, and grow at a CAGR of 2.9% from 2025 to 2034. Strong industrial activity in Asia-Pacific continues driving perchloroethylene demand at 45.2% share.

Perchloroethylene, also known as tetrachloroethylene, is a colorless, non-flammable liquid commonly used as a solvent. It has a sweet odor and is most widely recognized for its use in dry cleaning and metal degreasing applications. This chemical also finds usage in the production of fluorocarbons and serves as an intermediate in chemical synthesis. Due to its stability and ability to dissolve greases, oils, and waxes, perchloroethylene remains a preferred choice in various industrial operations.

The perchloroethylene market is primarily driven by demand from the textile and automotive sectors. The growth in industrial cleaning and metal finishing industries supports the market, especially in developing countries where manufacturing activities are expanding. Urbanization and increasing consumer demand for dry-cleaned garments also contribute to the consistent need for this solvent, particularly in commercial laundry setups.

In terms of demand, the market has seen steady usage in both traditional and emerging applications. While regulatory concerns around environmental and health impacts exist, the chemical continues to be used under controlled conditions in many regions. Countries with lenient regulations or established industrial infrastructure still see high consumption, especially where alternatives are either costlier or less effective.

Opportunity lies in the development of improved recycling methods and closed-loop systems that minimize emissions and worker exposure. Innovations in solvent recovery and equipment upgrades could make perchloroethylene more acceptable in markets with tightening environmental standards.

Key Takeaways

- The Global Perchloroethylene Market is expected to be worth around USD 2.3 billion by 2034, up from USD 1.7 billion in 2024, and grow at a CAGR of 2.9% from 2025 to 2034.

- Reagent grade Perchloroethylene held a 67.4% share due to its purity and strong industrial solvent demand.

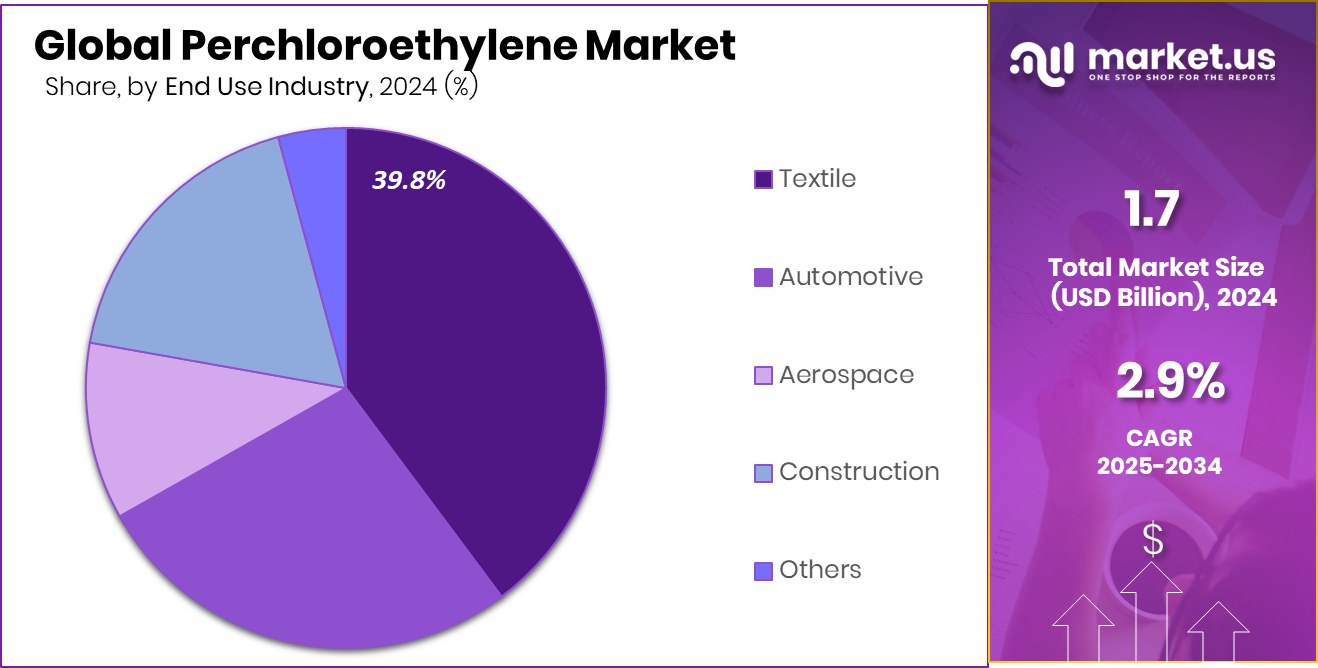

- Refrigerants accounted for 39.8% of the Perchloroethylene market, driven by chemical stability and cooling performance.

- The textile industry contributed a 34.7% share, using Perchloroethylene extensively in dry cleaning and fabric treatment applications.

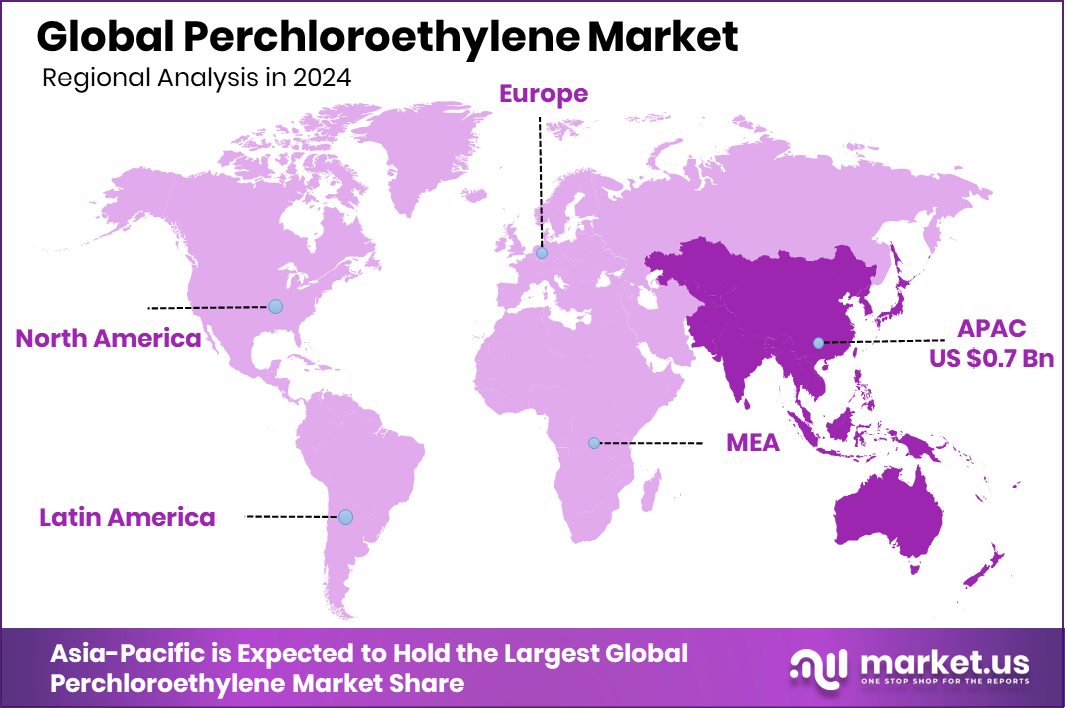

- The Asia-Pacific region recorded a perchloroethylene market value of USD 0.7 billion overall.

By Grade Analysis

Reagent grade dominates the perchloroethylene market with a 67.4% share globally.

In 2024, Reagent Grade held a dominant market position in the By Grade segment of the Perchloroethylene Market, with a 67.4% share. This strong share reflects its widespread application in laboratories, research institutions, and high-precision industrial processes that demand high-purity solvents. Reagent grade perchloroethylene is favored for its consistent chemical composition and performance reliability, making it essential for analytical testing, quality control, and specialized chemical synthesis.

The demand for reagent grade is further supported by increasing investments in research and development activities across pharmaceuticals, chemicals, and material sciences. Institutions and industrial labs continue to rely on high-grade solvents to maintain accuracy and repeatability in experiments and formulations. Additionally, growing focus on environmental testing and compliance has reinforced the need for reliable solvents with minimal impurities.

Reagent grade also benefits from stricter purity standards set by end-users, ensuring repeat purchases and long-term demand stability. As industries seek greater precision and quality in operations, the preference for high-purity chemicals like reagent-grade perchloroethylene is expected to continue.

By Application Analysis

Refrigerants lead application use, contributing 39.8% to the perchloroethylene market share.

In 2024, Refrigerants held a dominant market position in the By Application segment of the Perchloroethylene Market, with a 39.8% share. This leadership is largely attributed to the compound’s role as a key intermediate in the synthesis of hydrofluorocarbon and hydrochlorofluorocarbon refrigerants. As global demand for air conditioning and refrigeration systems continues to rise, especially across residential, commercial, and industrial sectors, so does the need for base chemicals like perchloroethylene in refrigerant production.

The use of perchloroethylene in refrigerants remains critical due to its stability and effectiveness in chemical reactions required to produce cooling agents. Despite increasing regulatory pressure in some regions to shift toward low-global-warming-potential alternatives, many countries with growing HVAC infrastructure still rely on traditional refrigerants, thereby sustaining perchloroethylene consumption.

Furthermore, the expansion of cold chain logistics, particularly in food storage and pharmaceutical transportation, has kept refrigerant production high, indirectly driving demand for perchloroethylene. Its chemical properties and compatibility with current manufacturing setups make it difficult to replace immediately, reinforcing its 39.8% market share in 2024.

By End Use Industry Analysis

The textile industry drives demand, accounting for 34.7% of perchloroethylene market consumption.

In 2024, Textile held a dominant market position in the By End Use Industry segment of the Perchloroethylene Market, with a 39.8% share. This leading position is primarily driven by the chemical’s extensive use in dry cleaning processes, where it acts as a highly effective solvent for removing oil-based stains and dirt from fabrics without causing damage. The textile industry’s ongoing reliance on dry cleaning, particularly in commercial laundry operations and professional garment care services, has sustained high demand for perchloroethylene.

Perchloroethylene remains the preferred choice in this sector due to its strong cleaning efficiency, fabric compatibility, and reusability through solvent recovery systems. As urban populations grow and consumer preferences shift toward professional clothing care, the textile industry continues to depend on reliable and fast cleaning solutions, thereby supporting the use of this solvent.

Additionally, the steady flow of uniforms, formalwear, and specialty fabrics into commercial dry cleaning systems ensures consistent perchloroethylene usage. While some alternative solvents are being introduced in specific regions, their adoption is still limited, especially in cost-sensitive markets.

Key Market Segments

By Grade

- Reagent Grade

- Industrial Grade

By Application

- Refrigerants

- Dry Cleaning

- Vapor Degreaser

- Extractant

- Cooling Agents

- Others

By End Use Industry

- Textile

- Automotive

- Aerospace

- Construction

- Others

Driving Factors

Growing Use in Dry Cleaning Applications Worldwide

One of the main reasons behind the strong demand for perchloroethylene is its widespread use in dry cleaning. It is known for effectively removing oil, grease, and dirt from clothes without damaging the fabric. Many commercial laundries and dry cleaning businesses still rely heavily on this chemical because it gives reliable and consistent results.

As more people in cities prefer professional garment cleaning, especially for suits, uniforms, and delicate clothing, the need for perchloroethylene continues to rise. Despite some efforts to shift to alternative solvents, many businesses still use perchloroethylene due to its cost-effectiveness and cleaning power.

Restraining Factors

Health and Environmental Concerns Limit Its Use

A major factor holding back the perchloroethylene market is the growing concern about its impact on health and the environment. Long-term exposure to this chemical has been linked to health issues such as dizziness, headaches, and, in some cases, even liver and kidney problems. Because of these risks, several countries have introduced strict rules on how it can be used and disposed of.

Environmental agencies have also raised concerns about its presence in soil and groundwater, especially near dry cleaning sites. These issues have led to tighter safety standards and pushed some industries to look for safer alternatives. As a result, these regulations and health risks are slowing down its usage in certain regions and limiting market growth.

Growth Opportunity

Rising Demand in Developing Industrial Regions Globally

A key growth opportunity for the perchloroethylene market lies in its rising demand from developing countries. Many of these regions are experiencing fast industrial growth, especially in sectors like textiles, automotive, and metal processing. In such places, perchloroethylene is still widely used because it is effective, affordable, and easy to handle with existing systems.

Unlike in some developed countries where strict regulations limit its use, developing regions often have more flexible rules. This allows industries to continue using perchloroethylene without major restrictions. As these countries build more factories, dry cleaning businesses, and metal cleaning units, the need for this chemical is expected to grow, making developing markets an important opportunity for future expansion.

Latest Trends

Shift Towards Eco-Friendly Alternatives in Cleaning

A notable trend in the perchloroethylene market is the increasing move towards environmentally friendly cleaning solutions. This shift is primarily driven by growing awareness of the health and environmental risks associated with perchloroethylene use.

As a result, industries are exploring and adopting alternative solvents that are less harmful and more sustainable. This transition is evident in the dry cleaning sector, where businesses are investing in new technologies and processes that reduce or eliminate the need for perchloroethylene.

The adoption of these eco-friendly alternatives not only addresses regulatory concerns but also aligns with consumer preferences for greener products and services. As this trend continues, it is expected to reshape the market dynamics, encouraging innovation and the development of safer, more sustainable cleaning solutions.

Regional Analysis

In 2024, Asia-Pacific led the perchloroethylene market with a 45.2% share.

In 2024, Asia-Pacific emerged as the dominant region in the global perchloroethylene market, accounting for 45.2% of the total market share and reaching a valuation of USD 0.7 billion. This strong performance is attributed to the region’s expanding textile and industrial cleaning sectors, particularly in countries like China and India, where demand for dry cleaning and metal degreasing applications continues to rise.

The widespread use of perchloroethylene in manufacturing and processing activities further strengthens its market position in the region. North America and Europe also contributed significantly to the global perchloroethylene market, supported by established industrial infrastructure and regulated usage in chemical synthesis and refrigerant manufacturing. However, stricter environmental regulations in these regions have somewhat moderated their growth pace.

Meanwhile, the Middle East & Africa and Latin America represent emerging markets with gradual adoption, primarily driven by industrial development and localized demand. These regions are expected to see steady uptake due to the ongoing need for cost-effective and efficient solvents.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

OxyChem’s commitment to quality is evident in its adherence to ASTM D4376-15 standards for vapor degreasing grade perchloroethylene. The company’s distribution capabilities, including shipments in tank cars, tank trucks, and drums, ensure a reliable supply to various industries. Additionally, OxyChem has been proactive in addressing environmental concerns, as demonstrated by its cleanup action plan for contamination sites, reflecting its dedication to regulatory compliance and environmental stewardship.

Olin Corporation continued to be a key player in the perchloroethylene market in 2024, leveraging its extensive experience in chlorinated organics. The company offers technical-grade perchloroethylene, catering to diverse industrial needs. Olin emphasizes responsible usage through its end-use guidelines, advising against applications that may lead to environmental contamination or overexposure. This approach underscores Olin’s commitment to product stewardship and safety. Financially, Olin reported a net income of $102 million in Q1 2024, a 22% increase from the previous year, indicating robust performance across its chemical segments.

Westlake Chemical Corporation demonstrated its versatility in the perchloroethylene market by offering multiple grades tailored to specific applications, including dry cleaning, degreasing, and catalyst regeneration in petroleum refining. The company’s ability to provide specialized grades positions it as a flexible supplier meeting varied industry demands.

Top Key Players in the Market

- Occidental Chemical

- Olin Corporation

- Westlake Chemical Corporation

- AGC Kanto

- Denka Banner

- Paari Chem Resources

- Befar Group

- Xinlong Group Zhejiang

Recent Developments

- In April 2025, Denka announced the cancellation of its project to mass-produce low-carbon acetylene. This decision followed the dissolution of its U.S.-based partner, Transform Materials LLC. The project aimed to develop a more sustainable method for producing acetylene, a key raw material in chloroprene rubber manufacturing.

- In March 2025, Xinlong Group participated in the 25th China International Agricultural Chemicals and Plant Protection Exhibition (CAC2025) held in Shanghai. This event brought together numerous agrochemical enterprises to promote advancements in agricultural science and technology.

Report Scope

Report Features Description Market Value (2024) USD 1.7 Billion Forecast Revenue (2034) USD 2.3 Billion CAGR (2025-2034) 2.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Reagent Grade, Industrial Grade), By Application (Refrigerants, Dry Cleaning, Vapor Degreaser, Extractant, Cooling Agents, Others), By End Use Industry (Textile, Automotive, Aerospace, Construction, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Occidental Chemical, Olin Corporation, Westlake Chemical Corporation, AGC Kanto, Denka Banner, Paari Chem Resources, Befar Group, Xinlong Group Zhejiang Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Occidental Chemical

- Olin Corporation

- Westlake Chemical Corporation

- AGC Kanto

- Denka Banner

- Paari Chem Resources

- Befar Group

- Xinlong Group Zhejiang