Global Per Diem Nurse Staffing Market Analysis By Type of Healthcare Facility [Hospitals (General Hospitals, Specialty Hospitals), Nursing Homes, Clinics, Others], By Specialty (Medical-Surgical Nursing, Critical Care Nursing, Emergency Department Nursing, Pediatric Nursing, Oncology Nursing, Others), By Shift Timing (Day Shift, Night Shift, Rotating Shifts), By Nurse Experience Level (Entry-Level Nurses, Experienced Nurses, Specialized Nurses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 83841

- Number of Pages: 203

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

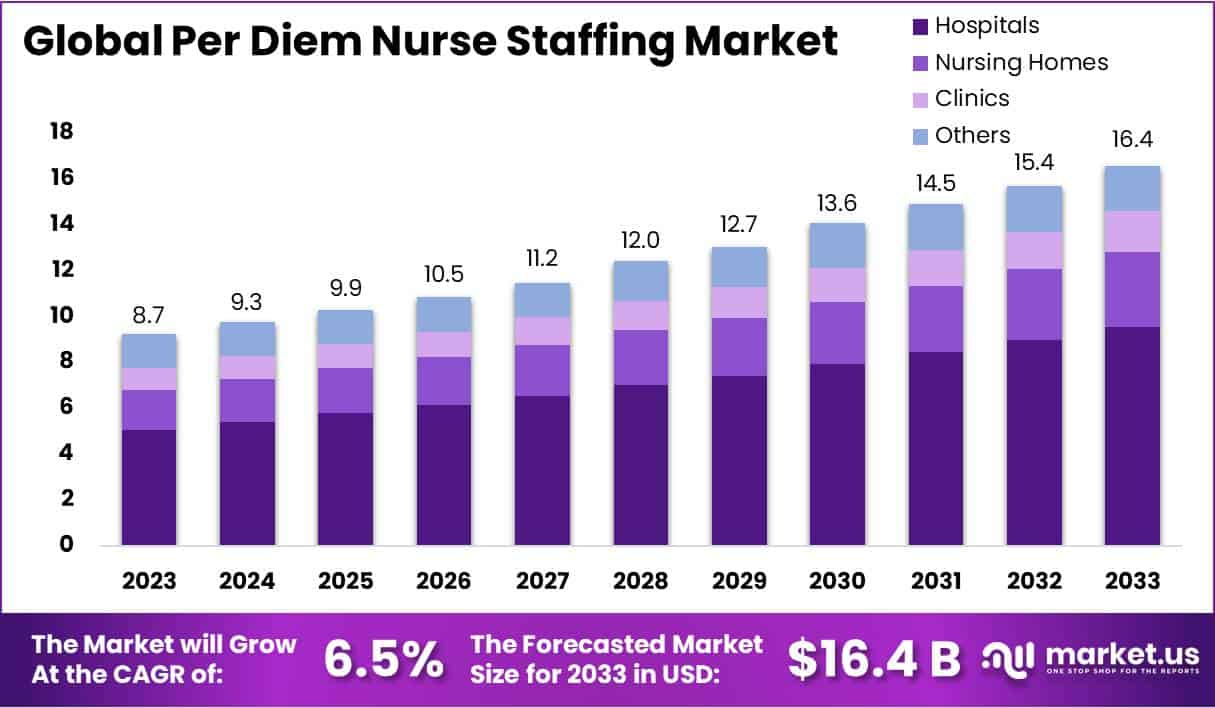

The Per Diem Nurse Staffing Market Size is anticipated to reach approximately USD 16.4 billion by 2033, showing a significant increase from its 2023 valuation of USD 8.7 billion. This growth is projected at a Compound Annual Growth Rate (CAGR) of 6.5% from 2024 to 2033.

“Per Diem” translates to “Per Day” in Latin, reflecting a work arrangement where nurses are essentially on-call. These nurses, often pivotal members of hospital staff, step in during staffing shortages while maintaining full-time positions elsewhere. Nurses play an indispensable part in safeguarding patient wellbeing and providing sufficient medical treatment to those in need.

Healthcare facilities relying on per diem nurses as an approach for meeting ongoing nursing demand have taken to employing them instead of regular shift workers; their flexible scheduling strategy addresses shortages while guaranteeing seamless patient care across hospitals, assisted living facilities and physician offices.

Per diem nurses are instrumental in various scenarios, including covering staffing gaps during bed closures, relieving overworked nursing staff, and maintaining an on-demand schedule for coverage. On average, a per diem nurse commits to 40 to 60 hours per week, accommodating one or more days off within that timeframe to manage their workload effectively.

These healthcare professionals provide invaluable expertise, contributing significantly to the medical field’s adaptability. By acting as a resource for staffing shortfalls, per diem nurses contribute to the uninterrupted care of patients. Their role is critical in sustaining the functionality and responsiveness of healthcare facilities, ensuring that patients receive the attention they require promptly.

Key Takeaways

- Market Growth: Anticipated to reach USD 16.4 billion by 2033, the Per Diem Nurse Staffing Market shows a CAGR of 6.5% from 2024 to 2033.

- Type of Healthcare Facility Dominance: Hospitals hold 68.3% market share in 2023, with General Hospitals and Specialty Hospitals driving demand for per diem nurses.

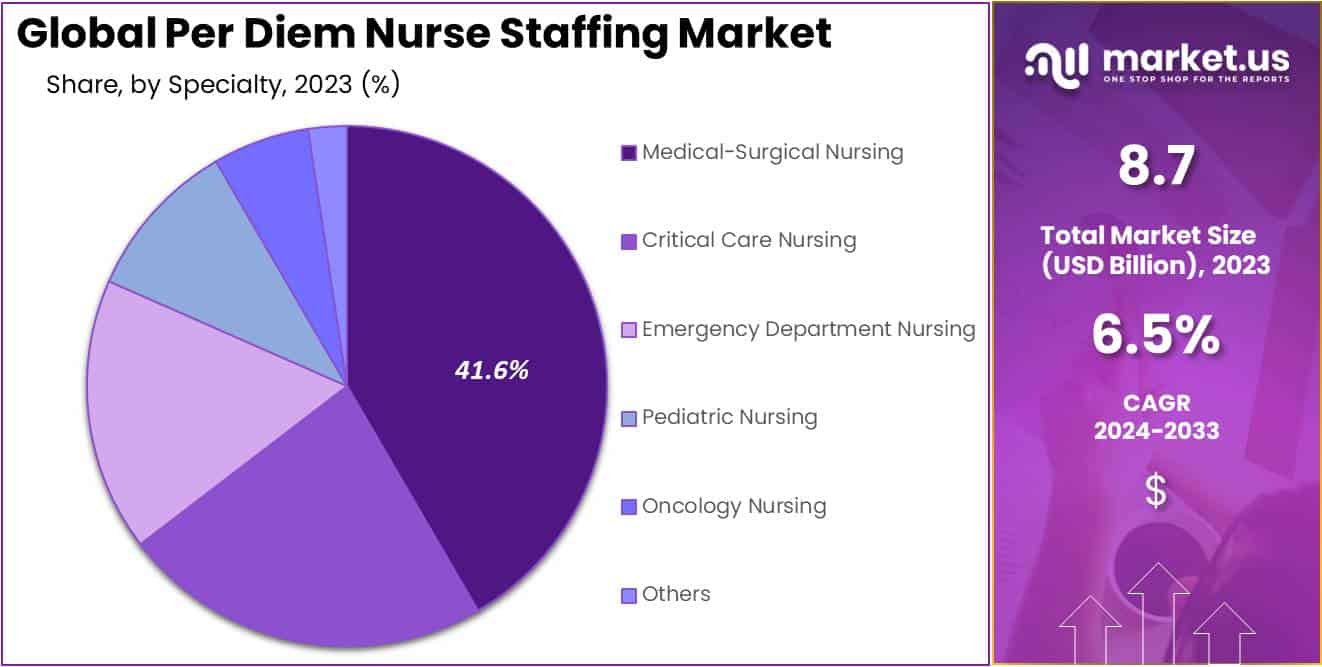

- Specialization Impact: 41.66% market share for Medical-Surgical Nursing in 2023, reflecting strong demand for specialized nursing services.

- Shift Preference: In 2023, 53.2% market share for Rotating Shifts, showcasing adaptability to varying patient needs throughout the day.

- Experienced Workforce: Experienced Nurses secure a robust market position with a share of 43.5% in 2023, addressing diverse healthcare needs.

- Key Market Segments: Segments include Type of Healthcare Facility, Specialty, Shift Timing, and Nurse Experience Level, offering diverse solutions.

- Financial Advantages: Per diem nurse staffing can lower labor costs by 30%, proving its financial feasibility for healthcare institutions.

- Regulatory Challenges: 55% of per diem nurses hold one license, indicating complex regulatory hurdles in the industry.

- Technological Adoption: AI and data analytics enhance efficiency; American Hospital Association emphasizes technology’s role in improving care delivery.

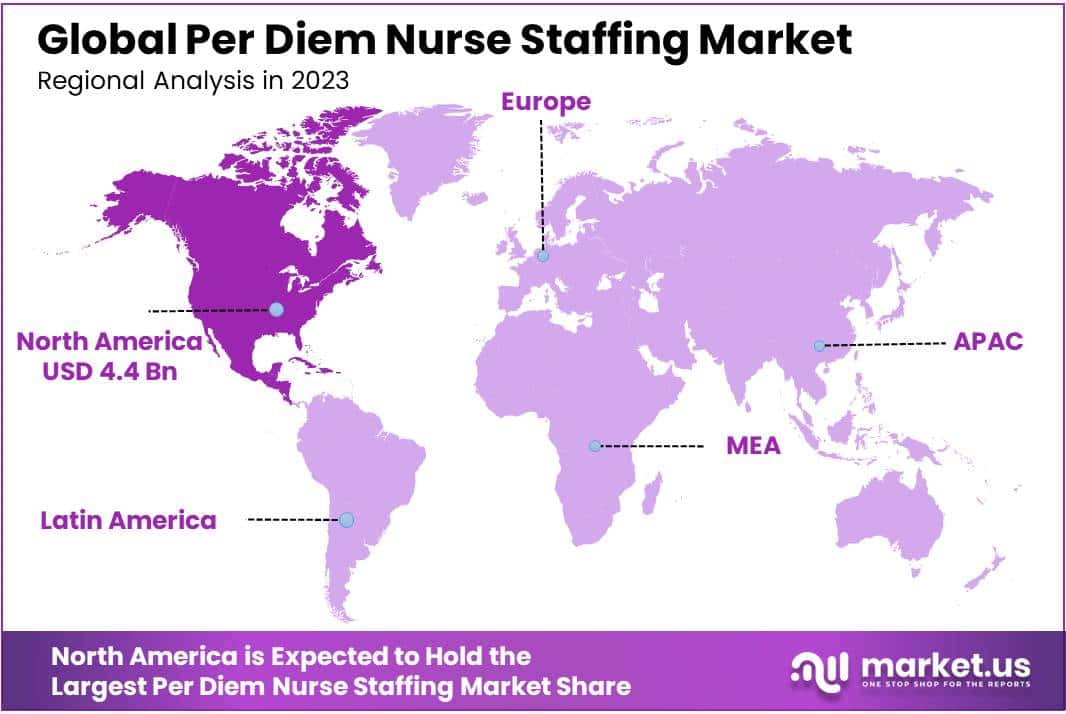

- Regional Dominance: North America leads with a 50.8% market share in 2023, driven by advanced healthcare infrastructure and economic security.

Type of Healthcare Facility Analysis

In 2023 Hospitals segment gained significant market share of 68.3% in Per Diem Nurse Staffing Market. This segment includes various healthcare facilities such as General and Specialty hospitals (such as Pediatric and Cardiac units ). Due to nurse staffing requirements in these settings, per diem solutions proved their invaluable contribution for maintaining optimal healthcare services.

General Hospitals were an integral component of the Hospitals segment and thus played an integral part in driving market dynamics. Their diverse medical offerings and high patient volumes required flexible staffing arrangements requiring per diem nurses as key part of their workforce strategy.

Specialty Hospitals that focus on specialties like Pediatrics and Cardiology helped propel Hospitals’ market standing. Due to the specialized nature of such facilities, nurse staffing must be handled specifically; per diem solutions can then be utilized effectively in meeting patient demand fluctuations efficiently.

Nursing Homes have rapidly emerged as an essential segment in the Per Diem Nurse Staffing Market. These facilities, dedicated to long-term care for senior citizens and those suffering chronic illness, showed an increasing reliance on per diem nurses; its adaptable staffing model perfectly matches up with ever-evolving healthcare requirements in nursing homes.

Clinics specializing in outpatient services also played a vital role in shaping market landscape. Clinics’ demand for per diem nurses stemmed from needing flexible staffing arrangements in order to accommodate various patient loads and services offered within them.

Also contributing to market dynamism were other healthcare facilities outside the traditional hospital and nursing home settings such as ambulatory surgical centers, urgent care facilities and community health centers, which increasingly implemented per diem nurse staffing solutions to meet their operational demands.

Specialty Analysis

In 2023, Medical-Surgical Nursing segment clearly hold dominant position and commanding over 41.66% market share by Specialty segment in Per Diem Nurse Staffing industry and showing exceptional growth over its predecessor years. This segment represents strong market demand for professional nurses within various healthcare environments and settings.

Critical Care Nursing was another notable segment in the market and contributed significantly to its overall landscape. Thanks to their indispensable role in caring for critically ill patients, Critical Care Nurses garnered increased traction on an individual basis as this segment demonstrated growing need for skilled critical care nurses on an everyday basis.

Emergency Department Nursing was also an essential factor in driving market dynamics, making a noticeable impactful statement about industry dynamics and needs. As emergency healthcare services continue to advance rapidly, so too did demand for reliable nursing staff at emergency departments – further emphasizing its significance within per diem nurse staffing markets.

Pediatric Nursing quickly emerged as an influential market segment with a noticeable market share. Due to the special care necessary for pediatric patients, skilled nurses became necessary for meeting their unique healthcare requirements – ultimately contributing to increased per diem nurse staffing needs and overall growth within this market.

Oncology Nursing quickly made itself known in the market, showing an increasing need for cancer-care nurses on an hourly basis. This segment represented a general trend toward specialization within nursing workforce to address specific patient populations or medical conditions.

Per diem nurse staffing markets play an integral part in diversifying service offerings to healthcare facilities, meeting their diverse and ever-evolving requirements for staffing needs. Specialty segments within per diem nurse staffing markets play a pivotal role in diversifying these service offerings by covering diverse specialization areas of nursing. Together these segments contributed depth to market thereby meeting diverse and ever-evolving healthcare facility demands for staff.

Shift Timing Analysis

In 2023, the Per Diem Nurse Staffing Market displayed a notable dominance in the Rotating Shifts segment, securing a substantial market share of over 53.2%. This segment’s prominence can be attributed to its adaptability, as healthcare facilities increasingly recognize the importance of maintaining a flexible workforce to meet varying patient needs throughout different times of the day.

The Day Shift segment also played a significant role, contributing to the overall market dynamics. With its emphasis on providing healthcare services during regular working hours, the Day Shift segment accounted for a substantial portion of the market, reflecting the traditional staffing patterns in healthcare settings.

Night Shift, while holding a slightly smaller share compared to the other segments, maintained a crucial position in the Per Diem Nurse Staffing Market. Recognizing the demand for 24/7 healthcare services, the Night Shift segment served as an essential component, ensuring continuous patient care during nighttime hours.

Diverse shift preferences illustrate the complexity of healthcare staffing requirements. More healthcare facilities are turning to rotating shifts as an approach for meeting both optimal patient care and staff well-being goals simultaneously – showing their dedication in providing an atmosphere which accommodates changing requirements both from healthcare staffers and patients.

Understanding each shift segment’s characteristics is paramount for stakeholders seeking to navigate the ever-evolving market of Per Diem Nurse Staffing. Allocation of resources across Day Shift, Night Shift and Rotating Shifts should remain key considerations when looking at ways to optimize operational efficiencies while still ensuring high-quality patient care is delivered all around.

Nurse Experience Level Analysis

In 2023, the Per Diem Nurse Staffing Market showcased a notable dominance in the Experienced Nurses segment, securing a robust market position with a commanding share of over 43.5%. This segment, comprised of seasoned healthcare professionals with substantial practical knowledge, played a pivotal role in steering the market dynamics.

Experienced Nurses, recognized for their seasoned expertise and proficiency, emerged as the frontrunners in meeting the dynamic demands of healthcare staffing. Their extensive on-the-job experience positions them as reliable assets in addressing the diverse needs of healthcare facilities.

Simultaneously, the Entry-Level Nurses segment made noteworthy strides, representing a burgeoning force within the Per Diem Nurse Staffing Market. This segment, consisting of fresh graduates and early-career professionals, contributed to the market’s vitality by infusing new talent and energy.

Furthermore, Specialized Nurses carved a distinctive niche in the market landscape, offering expertise in specific healthcare domains. These skilled professionals demonstrated a unique ability to cater to specialized healthcare requirements, bolstering the overall adaptability and responsiveness of the Per Diem Nurse Staffing Market.

Key Market Segments

Type of Healthcare Facility

- Hospitals

- General Hospitals

- Specialty Hospitals (e.g., Pediatric, Cardiac)

- Nursing Homes

- Clinics

- Others

Specialty

- Medical-Surgical Nursing

- Critical Care Nursing

- Emergency Department Nursing

- Pediatric Nursing

- Oncology Nursing

- Others

Shift Timing

- Day Shift

- Night Shift

- Rotating Shifts

Nurse Experience Level

- Entry-Level Nurses

- Experienced Nurses

- Specialized Nurses

Drivers

Increasing Healthcare Demand

Healthcare services are seeing unprecedented demand surge due to an aging population and rise in chronic diseases, according to statistics released by the World Health Organization. According to this projection, between 2015-2050 the proportion of global population over 60 will nearly double from 12% to 22% requiring adaptable workforce solutions such as per diem nurses to accommodate fluctuating patient volumes while maintaining responsive and efficacious patient care services within healthcare system.

Financial Advantages of Per Diem Nurse Staffing

Per diem nurse staffing offers healthcare institutions facing budgetary restrictions or seasonal fluctuations in patient admissions a financially feasible solution to managing labor costs more effectively. By employing per diem nurses, these institutions can effectively control labor expenses. Staff expenses only occur as required, sparing financial institutions from having to maintain full-time staff during periods with low patient volumes and maintaining quality care standards. According to reports by Healthcare Financial Management Association, healthcare facilities that adopt flexible staffing models like per diem nursing can lower labor costs by as much as 30% using this cost-saving method proving its viability and cost effectiveness.

Restraints

Navigating Regulatory Complexities

The per diem nurse staffing industry encounters many regulatory obstacles. Every region often imposes its own licensure prerequisites and compliance standards, creating an onerous administrative workload and hindering smooth incorporation of temporary staff into healthcare facilities. A survey from National Council of State Boards of Nursing suggests this: 55% hold one license while 45% possess multiple, which illustrates just how complex regulatory hurdles they must navigate to get staff hired and placed.

Limited Benefits

Per diem nursing positions typically provide less comprehensive benefits compared to their full-time counterparts, including health insurance, retirement savings plans and paid leave. This lack of substantial incentives such as health insurance or pension savings plans makes retaining proficient talent difficult; according to The American Nurses Association benefits play an essential part of job selection for 78% of nurses! Without sufficient incentives per diem nurse workforce quality could decrease drastically and interrupt continuity and effectiveness of healthcare environments.

Opportunities

Enhancing Efficiency through Technological Adoption

Technology innovations within staffing platforms, specifically artificial intelligence (AI) and data analytics capabilities are disrupting per diem nurse staffing industries in rapid fashion. These technologies automate and refine the matching process between nurses with available shifts, significantly decreasing administrative workloads while optimizing staffing efficiency.

The American Hospital Association recognizes the significance of technology in healthcare staffing, noting its role in improving care delivery and operational efficiencies. Companies investing in innovative staffing solutions stand to outpace competitors by providing more agile and responsive staffing services. Implementation of such technologies should not just be seen as a trend; rather it promises enhanced growth opportunities within an ever-evolving healthcare market.

Rising Demand for Specialized Nursing Services

Per diem nurse staffing stands to benefit greatly from an increasing demand for specialty healthcare services, particularly as medical advances create demand for nurses possessing unique talents and abilities. Per diem nurse staffing offers tremendous opportunities for growth in this rapidly expanding industry. Critical care and oncology settings have experienced sharp spikes in demand for highly trained nurses; per diem staffing agencies that specialize in these domains can capitalize on this surge by recruiting highly specialized nursing professionals on short notice.

American Nurses Association highlights an increasing demand for specialized nursing roles due to an aging population and increase in chronic health conditions as key drivers. Agencies meeting these specific requirements will likely experience tremendous expansion and diversification; according to projections by the Bureau of Labor Statistics, registered nurses could experience an impressive ~9% employment surge between 2020-2030 demonstrating this sector’s vast opportunities.

Trends

Telehealth Integration in Per Diem Nurse Staffing

The per diem nurse staffing market has undergone dramatic change with the addition of telehealth services into it, driven by rising acceptance for virtual healthcare and its rapid advancement. Telehealth adoption has dramatically altered how healthcare delivery occurs. Per diem nurses have emerged as integral parts of telehealth initiatives, providing remote patient care while increasing healthcare system flexibility.

According to data released by the American Hospital Association (AHA), ~76% of U.S. hospitals use telehealth technology as part of patient and consulting practitioner engagement – underscoring its increasing significance. This change not only meets patient demands for remote services but also positions per diem nurses as key contributors in modern healthcare models. Telehealth services are expected to grow with projections predicting an exponential surge in consultations within several years.

Work-Life Balance in Per Diem Nursing

Over recent years, there has been an evident shift in the per diem nursing staffing market towards prioritizing work-life balance, likely as a response to healthcare professionals seeking flexible work arrangements. Per diem roles offer inherent flexibility when it comes to scheduling needs; something many nurses find vital.

According to research by the American Nurses Association (ANA), over half of nurses cite flexible work hours as being key elements for job satisfaction. Staffing agencies and healthcare institutions have responded to this market trend by offering flexible scheduling options and remote work options, making per diem nursing roles more appealing for qualified nursing professionals. Such adaptation has created a sustainable positive trend within the market which may ultimately increase job satisfaction and retention among per diem nurses.

Regional Analysis

In 2023, North America emerged as the leading region in the Per Diem Nurse Staffing Market, establishing a dominant market position with a substantial 50.8% share. The region exhibited a robust market presence, underpinned by a market value of USD 4.4 billion for the year. Several factors contributed to North America’s prominence in the Per Diem Nurse Staffing Market, reflecting a combination of economic, demographic, and healthcare industry dynamics.

North America’s advanced healthcare infrastructure has had a profound effect on its per diem nurse staffing market growth. Modern medical facilities and systems requiring flexible staffing solutions like per diem nurse staffing in order to meet changing patient demands require per diem nurse staffing solutions in order to keep pace with growing needs and ensure optimal care services for each individual patient.

North American healthcare regulations mandate facilities maintain certain staffing ratios and quality standards, making per diem nurse staffing an indispensable solution to meet compliance while managing workforce variance and providing high quality patient care.

Due to North America’s rapidly aging population, skilled nursing services and per diem nurse staffing have seen increased demand in North America. Per diem nurse staffing offers an ideal flexible solution that meets evolving demographic demands, further expanding this lucrative market.

Economic security and increased healthcare investment across North America has created an ideal climate for the rapid expansion of per diem nursing staffing services. Healthcare organizations seek out cost-efficient staffing solutions such as per diem staffing to support operations more cost effectively – offering this as an attractive per diem staffing alternative option to them.

Finally, the global COVID-19 pandemic underscored the significance of having an adaptable healthcare workforce. North America responded promptly and effectively during this crisis while medical workers were desperately required for emergency situations; as a result, per diem nurse staffing services have rapidly grown within North America during such times of distress.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Per Diem Nurse Staffing Market is comprised of an ecosystem of key players with each offering unique capabilities to address healthcare provider demands for per diem nursing staffing solutions. Cross Country Healthcare, HealthTrust Workforce Solutions, Maxim Healthcare Group, Supplemental Health Care and other key players are seen as market leaders through their expansive networks and strategic approaches for meeting healthcare provider staffing requirements with reliable per diem nursing staff.

At present, this market emphasizes flexibility and responsiveness; companies tailor solutions specifically for meeting short-term staffing requirements. Companies offering key player services ensure healthcare facilities can quickly access qualified nursing professionals – this collective effort benefits healthcare providers as well as those employed as per diem nursing staff members; in time the adaptability and innovation displayed by key participants will have an increasingly important influence over per diem nurse staffing in general.

Market Key Players

- Cross Country Healthcare

- Health Trust Workforce Solutions

- Maxim Healthcare Group

- Supplemental Health Care

- Accountable Healthcare Staffing

- AMN Healthcare

- Nurse Staffing LLC

- GHR Healthcare

- Interim HealthCare Inc.

- CareerStaff Unlimited

Recent Developments

- In October 2023, GHR Healthcare made an aggressive move by purchasing StaffPro Nursing. Their acquisition aimed to expand GHR Healthcare’s per diem nurse staffing market presence throughout western US states like California and Nevada by broadening GHR Healthcare’s per diem nurse staffing presence there; simultaneously broadening and strengthening hospital and skilled nursing facility services as a result of it.

- In September 2023, AMN Healthcare entered into an alliance with VERA RCM to allow AMN nurses to utilize VERA’s revenue cycle management (RCM) services for administrative tasks and reimbursement processes; ultimately enhancing AMN Healthcare by offering more attractive compensation solutions and making its service more appealing for per diem nurses.

- In July 2023, Maxim Healthcare Group took an impressive leap forward by unveiling their groundbreaking nurse app “MaximGo.” This revolutionary app allowed nurses to book per diem shifts directly with healthcare facilities without using traditional staffing agencies; giving nurses more freedom over their schedules while potentially disrupting markets through its more direct approach and user-friendliness.

- In June 2023, Cross Country Healthcare invested in Accolade, an AI-powered nurse scheduling platform developed for healthcare facilities and per diem nurses alike. Accolade used artificial intelligence to optimize nurse scheduling by matching nurses based on skills, experience, preferences etc. Additionally, Accolade sought to increase efficiency within healthcare facilities through streamlining automation process for scheduling process.

Report Scope

Report Features Description Market Value (2023) USD 8.7 Bn Forecast Revenue (2033) USD 16.4 Bn CAGR (2024-2033) 6.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type of Healthcare Facility (Hospitals (General Hospitals, Specialty Hospitals (e.g., Pediatric, Cardiac)), Nursing Homes, Clinics, Others), By Specialty (Medical-Surgical Nursing, Critical Care Nursing, Emergency Department Nursing, Pediatric Nursing, Oncology Nursing, Others), By Shift Timing (Day Shift, Night Shift, Rotating Shifts), By Nurse Experience Level (Entry-Level Nurses, Experienced Nurses, Specialized Nurses) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Cross Country Healthcare, Health Trust Workforce Solutions, Maxim Healthcare Group, Supplemental Health Care, Accountable Healthcare Staffing, AMN Healthcare, Nurse Staffing LLC, GHR Healthcare, Interim HealthCare Inc., CareerStaff Unlimited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Per Diem Nurse Staffing market in 2023?The Per Diem Nurse Staffing market size is USD 8.7 billion in 2023.

What is the projected CAGR at which the Per Diem Nurse Staffing market is expected to grow at?The Per Diem Nurse Staffing market is expected to grow at a CAGR of 6.5% (2024-2033).

List the segments encompassed in this report on the Per Diem Nurse Staffing market?Market.US has segmented the Per Diem Nurse Staffing market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type of Healthcare Facility the market has been segmented into Hospitals (General Hospitals, Specialty Hospitals (e.g., Pediatric, Cardiac)), Nursing Homes, Clinics, Others. By Specialty the market has been segmented into Medical-Surgical Nursing, Critical Care Nursing, Emergency Department Nursing, Pediatric Nursing, Oncology Nursing, Others. By Shift Timing the market has been segmented into Day Shift, Night Shift, Rotating Shifts. By Nurse Experience Level the market has been segmented into Entry-Level Nurses, Experienced Nurses, Specialized Nurses.

List the key industry players of the Per Diem Nurse Staffing market?Cross Country Healthcare, Health trust Workforce Solutions, Maxim Healthcare Group, Supplemental Health Care, Accountable Healthcare Staffing, AMN Healthcare, Nurse Staffing LLC, GHR Healthcare, Interim HealthCare Inc., CareerStaff Unlimited, and other key players.

Which region is more appealing for vendors employed in the Per Diem Nurse Staffing market?North America is expected to account for the highest revenue share of 50.8% and boasting an impressive market value of USD 4.4 billion. Therefore, the Per Diem Nurse Staffing industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Per Diem Nurse Staffing?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Per Diem Nurse Staffing Market.

Per Diem Nurse Staffing MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample

Per Diem Nurse Staffing MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Cross Country Healthcare

- Health Trust Workforce Solutions

- Maxim Healthcare Group

- Supplemental Health Care

- Accountable Healthcare Staffing

- AMN Healthcare

- Nurse Staffing LLC

- GHR Healthcare

- Interim HealthCare Inc.

- CareerStaff Unlimited