Global Penoxsulam Market Size, Share, And Business Benefits By Formulation (Dry Flowable, Soluble Granule), By Crop (Rice, Cereals, Orchards, Olives, Chicory, Others), By Mode of Application (Pre-emergent, Post-emergent), By Application (Agrochemical, Fertilizer, Pharmaceutical, Food Additive, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 156207

- Number of Pages: 345

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

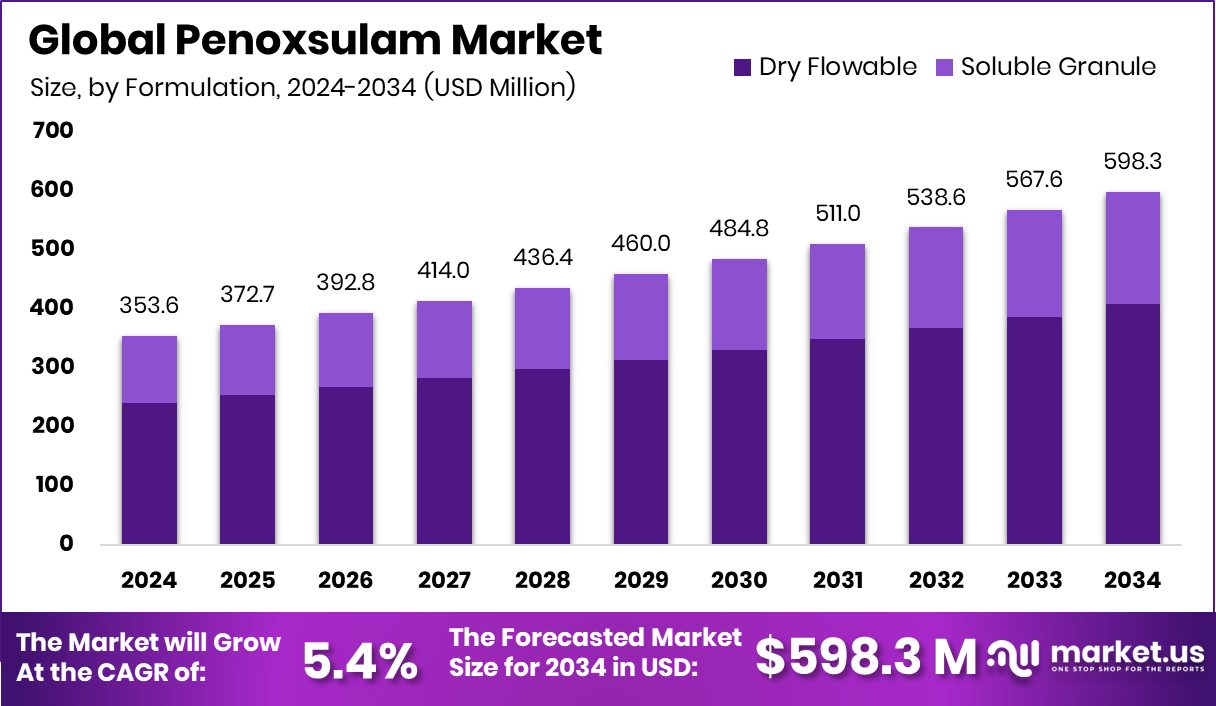

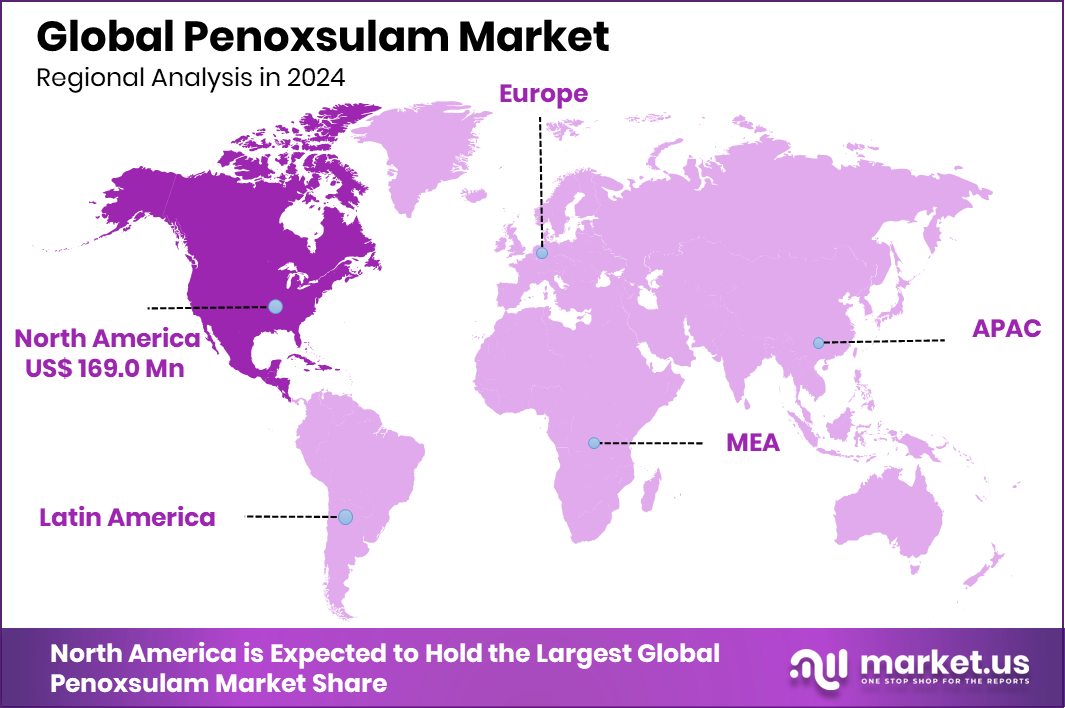

The Global Penoxsulam Market is expected to be worth around USD 598.3 million by 2034, up from USD 353.6 million in 2024, and is projected to grow at a CAGR of 5.4% from 2025 to 2034. With a 47.8% share, USD 169.0 Mn, North America remains the market leader.

Penoxsulam is a selective herbicide widely used in rice cultivation and other crops to control broadleaf weeds, sedges, and certain grasses. It works by inhibiting the plant’s enzyme acetolactate synthase (ALS), which is essential for weed growth. Due to its effectiveness at low application rates and its favorable environmental profile, penoxsulam has become a preferred solution in modern farming practices. Kotak’s investment arm has infused Rs 375 crore into the agrochemical company Cropnosys, highlighting the sector’s growing importance.

The Penoxsulam market represents the global trade, usage, and demand for this herbicide across agricultural sectors. Its adoption is strongly tied to the rising need for sustainable crop protection methods that deliver high yields while minimizing soil and water contamination. In agrifood tech highlights, Cropnosys secured $45 million, alongside Rockstart’s second agrifood fund and Dave Friedberg’s new appointment. With growing emphasis on precision farming, the market has been gradually expanding as farmers seek effective weed control solutions that improve crop health and productivity.

One of the main growth factors for the market is the rising demand for food grains, particularly rice, which remains a staple for billions of people worldwide. Increasing population and shrinking arable land push farmers to rely more on efficient weed management products like penoxsulam to maximize output. Agrochemical giant UPL is set to raise ₹4,200 crore through a rights issue, signaling the continued investment momentum in the agrochemical space.

On the demand side, government support for modern agricultural practices is fueling uptake. Subsidies and awareness campaigns about advanced herbicides are encouraging farmers in Asia, Africa, and Latin America to adopt penoxsulam in large-scale farming. Marking its third deal, Kotak Fund invested $45 million in Cropnosys, underlining the strong investor interest in innovative crop protection companies.

Key Takeaways

- The Global Penoxsulam Market is expected to be worth around USD 598.3 million by 2034, up from USD 353.6 million in 2024, and is projected to grow at a CAGR of 5.4% from 2025 to 2034.

- Dry Flowable formulations dominate the Penoxsulam market with 68.2%, offering efficient handling and better farmer convenience.

- Rice crops account for 52.8% of Penoxsulam use, highlighting its critical role in staple food production.

- Post-emergent application leads with 68.9%, showing Penoxsulam’s effectiveness in controlling weeds after crop establishment.

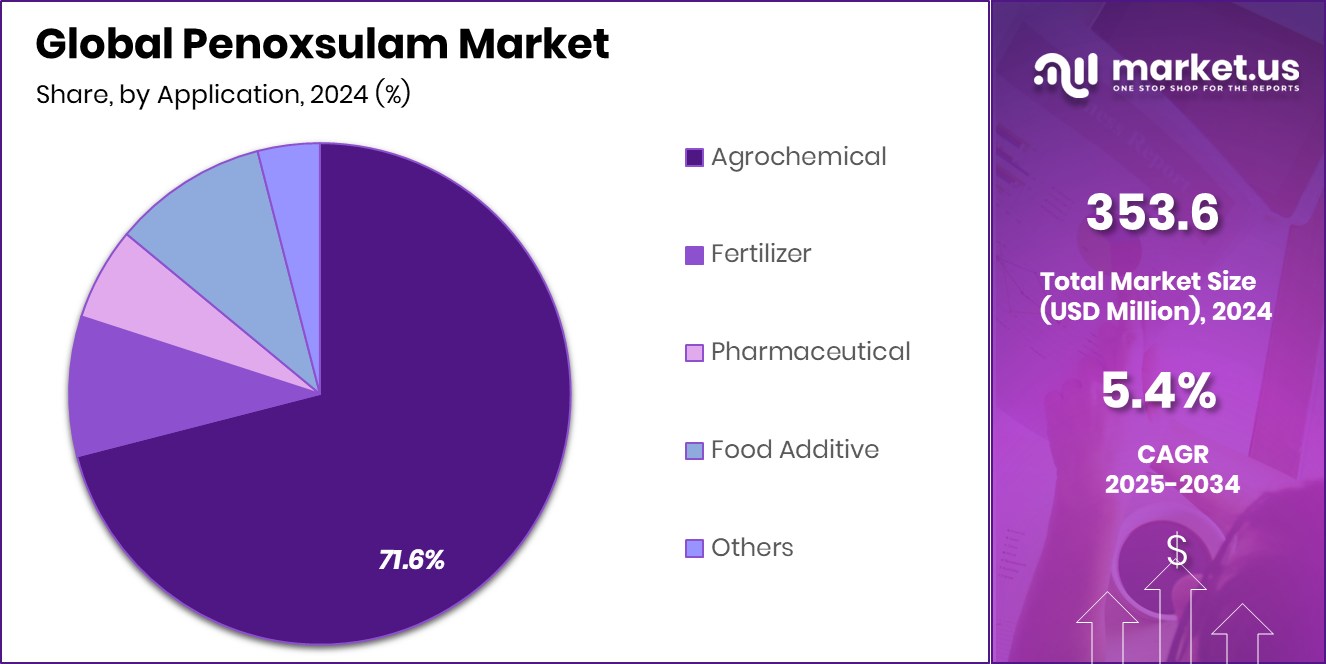

- Agrochemical applications capture 71.6% share, reflecting Penoxsulam’s strong adoption as a trusted crop protection herbicide globally.

- North America’s 47.8% share valued at USD 169.0 Mn reflects strong demand.

By Formulation Analysis

Dry Flowable dominates the Penoxsulam market, holding 68.2% due to efficiency.

In 2024, Dry Flowable held a dominant market position in the By Formulation segment of the Penoxsulam Market, with a 68.2% share. This leadership is largely driven by the strong preference among farmers for dry formulations due to their ease of handling, accurate dosing, and longer shelf stability compared to liquid alternatives.

The formulation’s granular structure allows for better dispersion in water, ensuring uniform coverage across fields, which is especially important in crops like rice, where weed infestation can drastically reduce yields. Its lower bulk density also enables farmers to transport and store the product more conveniently, making it a practical choice in regions with limited infrastructure support.

The dominance of Dry Flowable is further supported by its compatibility with existing spraying equipment, reducing the need for farmers to invest in additional tools. This adaptability has made it more cost-effective for small and medium-scale farmers who are under pressure to maintain profitability while meeting rising food demand.

Additionally, the formulation’s reduced dust generation during mixing improves safety for farm workers and minimizes product wastage. With these advantages, Dry Flowable is expected to retain its leadership in the formulation segment, reinforcing its role as the preferred choice in weed management solutions.

By Crop Analysis

Rice cultivation drives the Penoxsulam market, contributing 52.8% to total demand.

In 2024, rice held a dominant market position in the By Crop segment of the Penoxsulam Market, with a 52.8% share. This dominance is strongly linked to the fact that rice is one of the world’s most widely consumed staple foods, feeding over half of the global population.

Effective weed management is critical in rice cultivation, as weeds compete aggressively for nutrients, sunlight, and water, often resulting in severe yield losses. Penoxsulam, with its proven effectiveness against a broad spectrum of weeds, including sedges and broadleaf species, has become the preferred herbicide in rice farming, particularly in the Asia-Pacific, where rice fields stretch across millions of hectares.

The share held by rice reflects the heavy reliance of farmers on herbicides that deliver consistent results and align with sustainable agricultural practices. With rising population growth and limited arable land, improving rice productivity is a priority for many nations, and the use of penoxsulam helps secure higher yields with reduced crop damage.

Its low application rate, crop safety, and extended residual control make it a cost-effective choice for farmers, further strengthening its role in rice cultivation. Given these factors, rice is expected to remain the leading crop segment driving penoxsulam demand worldwide.

By Mode of Application Analysis

Post-emergent application leads in Penoxsulam market, capturing 68.9% overall usage.

In 2024, Post-emergent held a dominant market position in the By Mode of Application segment of the Penoxsulam Market, with a 68.9% share. This leadership is attributed to the effectiveness of post-emergent applications in controlling weeds after they have already germinated, which makes it a practical and reliable solution for farmers.

Since weeds that appear later in the crop cycle can severely hinder plant growth and reduce yields, post-emergent herbicides like penoxsulam are favored for their ability to selectively target and eliminate a broad spectrum of weed species without damaging the crop.

The high adoption of post-emergent mode is also linked to its flexibility, as farmers can assess the weed pressure in their fields before applying, ensuring more precise and cost-effective use of inputs. This reduces wastage and improves return on investment, a crucial factor in regions where farmers operate under tight margins.

Additionally, the strong performance of post-emergent applications in rice cultivation, especially in waterlogged paddy fields, has further reinforced their dominance. With the increasing demand for efficient weed management strategies that support sustainable food production, the post-emergent mode of application is set to maintain its leading role in shaping the demand for penoxsulam in the coming years.

By Application Analysis

The agrochemical segment accounts for a 71.6% share, strengthening the Penoxsulam market.

In 2024, Agrochemical held a dominant market position in the By Application segment of the Penoxsulam Market, with a 71.6% share. This strong presence comes from the widespread use of penoxsulam as a highly effective herbicide in modern agriculture, particularly for staple crops like rice, where weed pressure can drastically cut yields.

Farmers prefer agrochemical applications because they provide reliable, broad-spectrum control over sedges, grasses, and broadleaf weeds, ensuring healthier crop growth and improved productivity. The efficiency of penoxsulam at low dosage levels also makes it cost-effective, as it reduces input costs while delivering higher returns through better harvest outcomes.

The dominance of the agrochemical application is also reinforced by the increasing adoption of advanced farming practices in developing regions, where food security is a growing concern. With populations rising and arable land shrinking, farmers are turning to proven agrochemical solutions to maximize output on limited farmland.

Additionally, the product’s favorable environmental profile and compatibility with integrated weed management strategies make it a trusted choice among growers seeking sustainable yet effective solutions. As governments continue promoting higher-yield farming practices, the agrochemical application of penoxsulam is expected to remain the backbone of its market demand globally.

Key Market Segments

By Formulation

- Dry Flowable

- Soluble Granule

By Crop

- Rice

- Cereals

- Orchards

- Olives

- Chicory

- Others

By Mode of Application

- Pre-emergent

- Post-emergent

By Application

- Agrochemical

- Fertilizer

- Pharmaceutical

- Food Additive

- Others

Driving Factors

Rising Global Rice Demand Boosts Penoxsulam Use

One of the top driving factors for the Penoxsulam market is the rising global demand for rice. As rice remains the primary staple food for more than half of the world’s population, farmers are under constant pressure to improve yields despite challenges like limited farmland and increasing weed infestations. Penoxsulam plays a crucial role here, as it offers reliable control over tough weeds that can significantly reduce crop productivity.

Its effectiveness at low application rates, safety for crops, and long-lasting results make it the preferred herbicide in rice farming. With global rice consumption projected to rise steadily, especially in Asia and Africa, the demand for penoxsulam is set to grow in parallel, strengthening its market position.

Restraining Factors

Stringent Regulatory Policies Limit Herbicide Market Growth

A key restraining factor for the Penoxsulam market is the presence of strict regulatory policies governing the use of chemical herbicides. Many countries are tightening rules around agrochemicals due to concerns over environmental safety, soil health, and water contamination. Farmers in certain regions face restrictions or lengthy approval processes before they can use products like penoxsulam, which slows down adoption.

In addition, increasing global focus on organic and eco-friendly farming practices is pushing some growers to explore alternatives, reducing dependency on chemical herbicides. These regulatory hurdles not only raise compliance costs for manufacturers but also limit market expansion in sensitive regions. As sustainability concerns grow, these rules are expected to remain a challenge for the industry’s growth.

Growth Opportunity

Expanding Sustainable Farming Practices Creates Growth Opportunity

A major growth opportunity for the Penoxsulam market lies in the global shift toward sustainable and efficient farming practices. Farmers are increasingly seeking crop protection solutions that not only deliver high yields but also minimize environmental impact. Penoxsulam fits well into this trend, as it is effective at very low application rates, reduces chemical load in fields, and provides long-lasting weed control.

Its compatibility with integrated weed management systems makes it a valuable tool for sustainable agriculture, especially in rice-growing regions where food demand continues to rise. As governments promote eco-friendly farming through subsidies and awareness programs, the adoption of penoxsulam is likely to increase, creating strong opportunities for market expansion worldwide.

Latest Trends

Rising Adoption of Precision Farming Drives Herbicide Demand

One of the latest trends in the Penoxsulam market is the rising adoption of precision farming techniques. Farmers are increasingly using modern tools like drones, GPS-guided sprayers, and digital sensors to apply herbicides more accurately and efficiently. This approach reduces wastage, lowers costs, and ensures that chemicals like penoxsulam are applied only where needed, minimizing environmental impact.

With precision farming, post-emergent applications of penoxsulam become even more effective, as farmers can directly target weed-affected areas. The growing focus on technology-driven farming, especially in the Asia-Pacific and North America, is driving this trend forward. As digital agriculture continues to expand globally, the integration of penoxsulam into precision farming practices is expected to strengthen its role in weed management.

Regional Analysis

In 2024, North America held a 47.8% share, worth USD 169.0 Mn.

The Penoxsulam market shows a varied regional performance, with North America emerging as the leading region in 2024. North America accounted for 47.8% of the global market, valued at USD 169.0 million, establishing itself as the dominant regional hub for penoxsulam usage. This strong position is largely driven by the structured agricultural sector in the United States and Canada, where advanced weed management practices are widely adopted.

Farmers in this region benefit from high awareness levels, better access to modern agrochemicals, and strong government support for crop protection innovations. In contrast, Europe demonstrates steady growth with increasing demand for efficient herbicides under strict environmental regulations, while Asia Pacific reflects growing adoption due to its large rice cultivation base.

The Middle East & Africa and Latin America are gradually expanding their market presence as farmers seek reliable solutions for improving yields in challenging climatic and resource conditions. However, North America’s clear lead highlights its capacity to invest in sustainable farming technologies and integrate advanced herbicides into large-scale crop management systems.

With established infrastructure and rising demand for efficient weed control, North America is expected to continue holding a significant share in the global penoxsulam market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Bayer AG continues to hold a strong position by leveraging its extensive crop science portfolio and innovation-driven approach. With a focus on sustainable agriculture, Bayer emphasizes the development of herbicide solutions like penoxsulam that align with integrated weed management practices. The company’s global reach and established distribution channels allow it to maintain steady demand in key agricultural regions, particularly where rice cultivation is significant.

Crystal Crop Protection Ltd. plays a vital role in expanding the availability of penoxsulam across emerging markets. With its deep presence in India’s agricultural sector, the company focuses on offering cost-effective and high-performing herbicide solutions tailored to the needs of farmers. Its strength lies in making advanced crop protection technologies more accessible to small and medium-scale farmers, thereby increasing adoption rates.

Hangzhou Tianlong Biotechnology Co., Ltd represents the growing influence of Chinese agrochemical firms in the global market. By emphasizing large-scale production capacity and competitive pricing, the company contributes to meeting the rising demand for penoxsulam in Asia and other international markets. Its role reflects China’s expanding participation in global agricultural supply chains, ensuring herbicide availability for regions facing high weed pressure.

Top Key Players in the Market

- Bayer AG

- Crystal Crop Protection Ltd.

- Hangzhou Tianlong Biotechnology Co., Ltd

- Nufarm Ltd

- Syngeta AG

- UPL

Recent Developments

- In May 2025, Nufarm reported improved performance in crop protection, strong seed tech results, and strategic progress in managing omega‑3 oils—even though this doesn’t mention Penoxsulam.

- In March 2025, under its new operating structure, Bayer expects to save 800 million euros in 2025, building on nearly 500 million euros in savings achieved previously.

Report Scope

Report Features Description Market Value (2024) USD 353.6 Million Forecast Revenue (2034) USD 598.3 Million CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Formulation (Dry Flowable, Soluble Granule), By Crop (Rice, Cereals, Orchards, Olives, Chicory, Others), By Mode of Application (Pre-emergent, Post-emergent), By Application (Agrochemical, Fertilizer, Pharmaceutical, Food Additive, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Bayer AG, Crystal Crop Protection Ltd. , Hangzhou Tianlong Biotechnology Co., Ltd, Nufarm Ltd, Syngeta AG, UPL Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bayer AG

- Crystal Crop Protection Ltd.

- Hangzhou Tianlong Biotechnology Co., Ltd

- Nufarm Ltd

- Syngeta AG

- UPL