Global PC Gaming Accessories Market Size, Share Analysis Report By Product (Gaming Chairs, Controllers, Headsets and Audio Equipment, Keyboards and Mouse, Others), By Distribution Channel (Specialty Stores, Online, Departmental Stores, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 151922

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

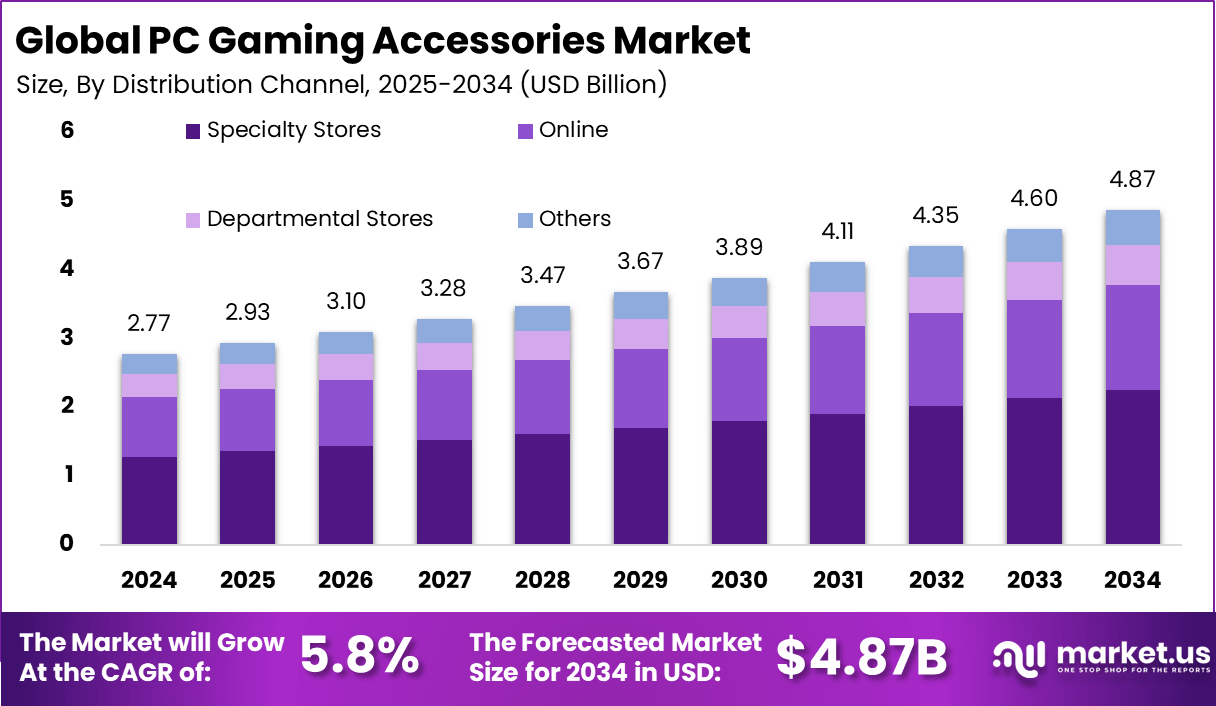

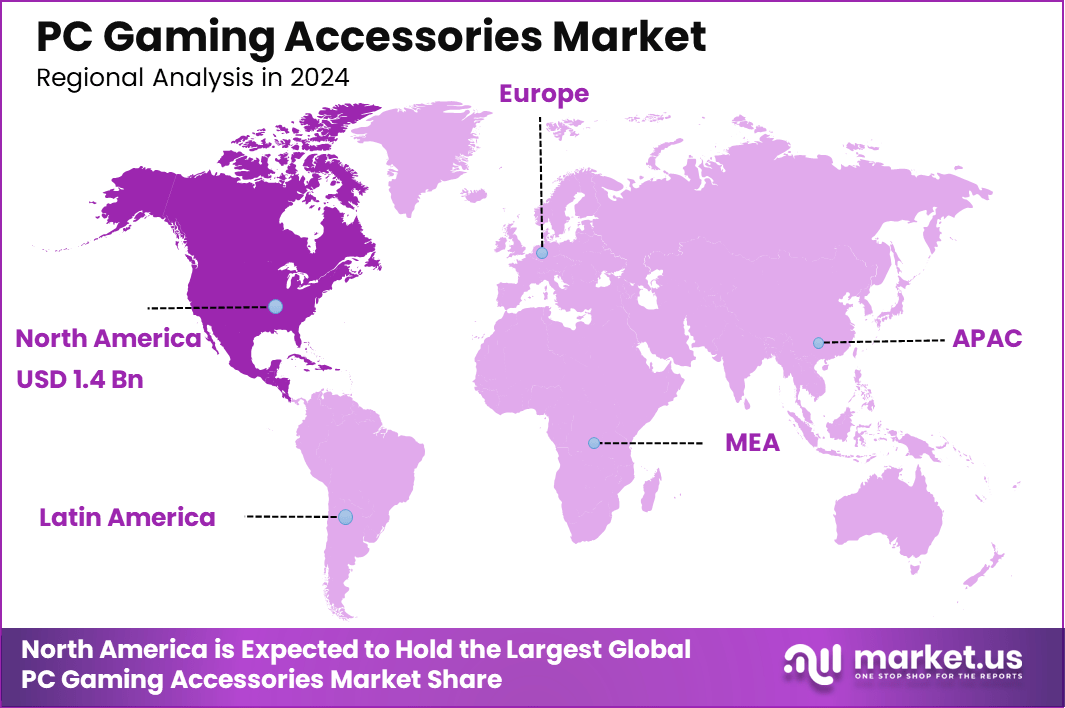

The Global PC Gaming Accessories Market size is expected to be worth around USD 4.87 Billion By 2034, from USD 2.77 billion in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 53.6% share, holding USD 1.4 Billion revenue.

The PC Gaming Accessories market encompasses peripherals used to enhance gaming performance and user experience on desktop computers. These include gaming mice, keyboards, headsets, controllers, mouse pads and other dedicated hardware. The market has expanded in parallel with the increasing popularity of PC gaming and e‑sports, as well as with technological advancements in hardware design.

The top driving factors supporting market growth include strong consumer demand for high‑performance peripherals, fueled by growing esports engagement and remote gaming habits. The integration of wireless technologies, ergonomic design principles, and features like customizable RGB lighting further boosts user appeal. The increasing adoption of technologies has been a key market trend.

Innovations like wireless connectivity, RGB lighting, mechanical switches, AI‑enhanced software, and IoT‑enabled peripherals have become mainstream. These technologies address user needs for personalization, responsiveness, and interactivity, and are adopted to secure competitive advantages, provide comfort during long gaming sessions, and align with lifestyle personalization trends.

According to the findings from Market.us, The global Esports market is experiencing rapid growth, projected to reach USD 16.7 billion by 2033, rising from USD 2.3 billion in 2023 at a compound annual growth rate (CAGR) of 21.9%. This growth is being driven by increased viewership, competitive gaming tournaments, brand collaborations, and digital monetization models. In 2023, North America emerged as the leading region, securing over 36.3%.

Similarly, the Global E-sports Sponsorship market is forecasted to rise sharply, reaching USD 16.76 billion by 2034, up from USD 1.8 billion in 2024, expanding at a CAGR of 25%. Sponsorships remain a critical revenue stream for esports organizations, with brands seeking high-visibility platforms to engage Gen Z and millennial audiences.

For instance, In June 2024, a strategic collaboration was announced between Razer and Epic Games, reflecting a growing trend of brand partnerships in the PC gaming accessories market. This alliance brought to market Fortnite-themed versions of Razer’s popular products including the Kraken V3 X, DeathAdder V3 Pro, Goliathus Extended Chroma, and BlackWidow V4 X.

Key Insight Summary

- The market is projected to grow from USD 2.77 billion in 2024 to USD 4.87 billion by 2034, expanding at a CAGR of 5.8%, driven by increasing engagement in PC gaming and the demand for high-performance accessories.

- North America led the market with a 53.6% share in 2024, generating approximately USD 1.4 billion in revenue, supported by a strong gamer base and rising eSports influence.

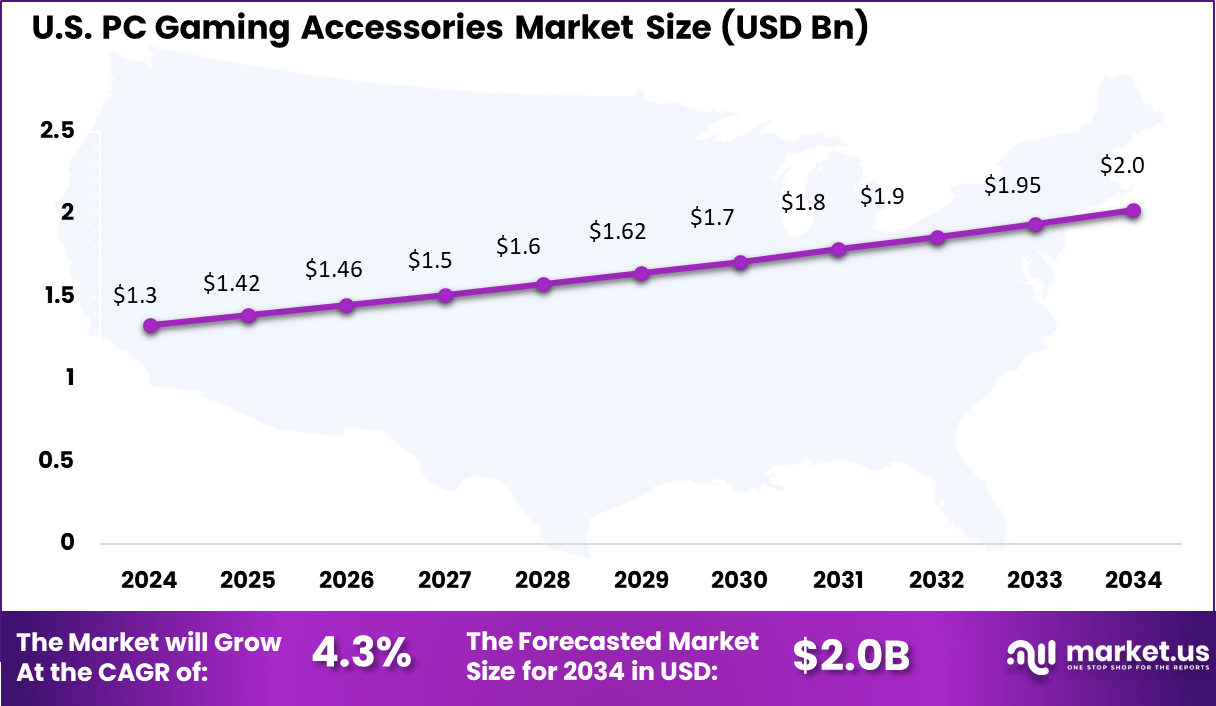

- The United States accounted for USD 1.33 billion and is expected to grow at a CAGR of 4.3%, backed by premium hardware adoption and a growing number of competitive gamers.

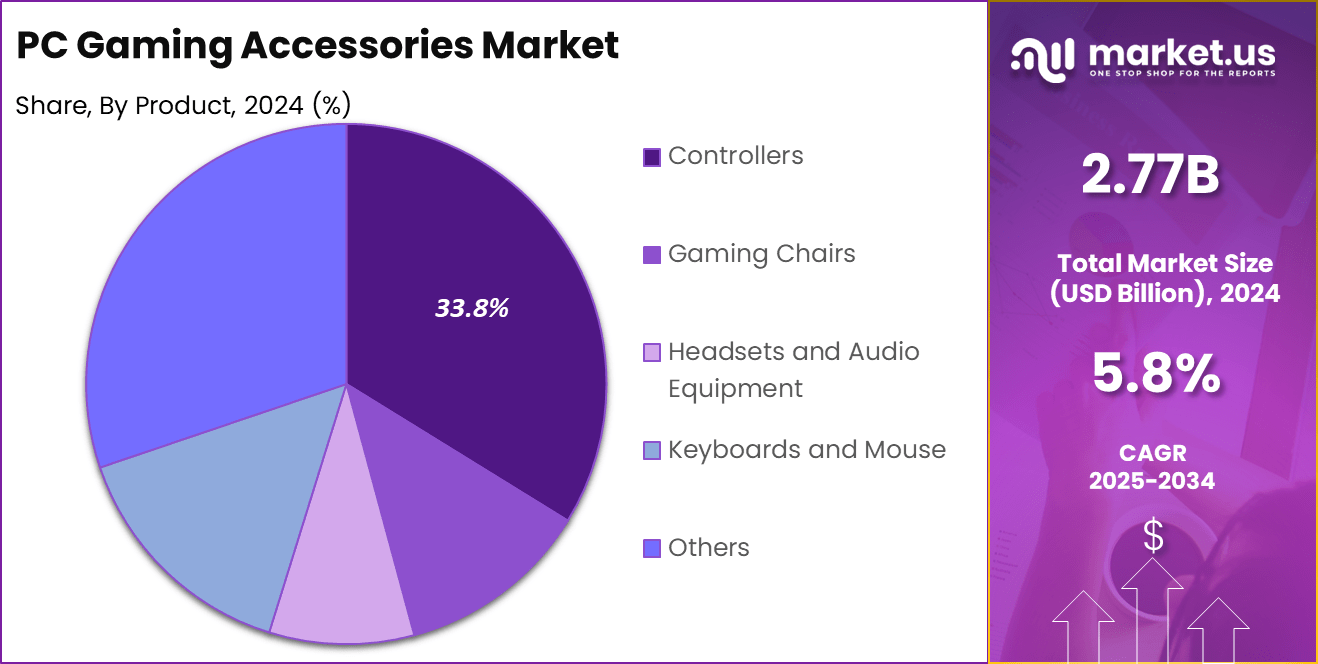

- Among products, controllers dominated with a 33.8% share, reflecting the popularity of versatile gameplay setups and enhanced user control preferences across PC platforms.

- Specialty stores led the distribution landscape with a 46.3% share, as gamers continue to rely on expert advice, physical trials, and niche offerings found in dedicated gaming outlets.

US Market Size

The U.S. PC Gaming Accessories Market was valued at USD 1.3 Billion in 2024 and is anticipated to reach approximately USD 2.0 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 4.3% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than a 53.6% share and generating roughly USD 1.4 Billion in revenue. This preeminence can be attributed to a deeply entrenched gaming culture, high disposable incomes, and mature markets. The region benefits significantly from strong broadband access, advanced esports infrastructure, and early adoption of cutting‑edge technologies, which collectively drive consumer investment in premium gaming peripherals.

North America’s leadership can also be attributed to its innovation ecosystem. Major manufacturers and influencers operate in close synergy, allowing rapid iteration on design, ergonomics, and wireless technologies. This ecosystem has accelerated the adoption of AI‑enhanced audio, smart sensors, and cross‑platform compatibility.

By Product Analysis

In 2024, the Controllers segment held a dominant market position, capturing more than a 33.8% share. This leadership was driven by the increasing popularity of cross-platform gaming and the growing compatibility of controllers with PCs.

Their plug-and-play functionality, ergonomic design, and familiarity with console-style gameplay made them a preferred choice among a wide base of casual and professional gamers. As more multiplayer and competitive titles adopted full controller support, the demand for responsive and customizable controllers surged significantly.

The segment also benefited from innovations such as adaptive triggers, haptic feedback, and wireless connectivity. These features improved gameplay precision and immersion, making controllers more appealing for both action-packed genres and simulation-based experiences.

Additionally, many PC gamers who also owned consoles preferred a unified gaming experience using the same hardware. As a result, the controller’s role as a versatile and performance-oriented device helped it maintain its market leadership in the gaming accessories segment throughout the year.

By Distribution Channel Analysis

In 2024, the Specialty Stores segment held a dominant market position, capturing more than a 46.3% share. This leadership can be credited to the ability of specialty outlets to offer tailored experiences and knowledgeable guidance, which resonates with serious gamers seeking performance-optimized gear.

These stores provide hands-on evaluation, allowing customers to test the tactile feel of a mouse or the surround sound of a headset before purchase. Such experiential engagement drives higher conversion rates and fosters consumer trust, reinforcing specialty stores as the preferred channel in this category.

Specialty stores also benefit from curated product assortments and focused in-store promotion that cater specifically to the enthusiast gaming demographic. Store personnel, often enthusiasts themselves, deliver expert advice on the nuances of DPI settings, switch types, or latency differences.

This high-touch interaction supports the premium positioning of products and encourages upselling of advanced peripherals. Additionally, local events, demo stations, and loyalty programmes elevate the customer journey, further reinforcing the segment’s dominance despite the growing online convenience.

Key Market Segments

By Product

- Controllers

- Gaming Chairs

- Headsets and Audio Equipment

- Keyboards and Mouse

- Others

By Distribution Channel

- Specialty Stores

- Online

- Departmental Stores

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trend Analysis

Increased Cross‑Platform Compatibility

The growth of multi-device gaming has led to a trend wherein accessories designed for seamless interoperability across PC, console, and mobile platforms are gaining traction. Consumers now expect devices such as mice, keyboards, and headsets to function interchangeably, regardless of the gaming platform.

As a result, the accessory market is witnessing an uptick in products featuring dual-mode wireless technology, multi-device pairing, and platform-agnostic software. This trend is also supported by the rise of cloud and mobile gaming, pushing for accessories that cater to hybrid gaming sessions. Such capabilities enhance consumer convenience and strengthen brand differentiation in a crowded marketplace.

Key Strategic Insights Overview

Analysis Type Key Insight Emerging Trend VR/AR-ready accessories are gaining momentum as immersive gameplay grows. Driver Competitive and immersive gaming boosts demand for precision peripherals. Restraint High prices restrict uptake in cost-sensitive regions. Opportunity Mobile/cloud gaming expansion opens new accessory segments. Challenge Component shortages and supply disruptions hinder production and reliability. Driver Analysis

Demand for Immersive and High‑Performance Peripherals

The expansion of the PC gaming community – driven by competitive esports, VR, and streaming – has elevated the demand for precision-focused hardware. Gamers now prefer peripherals with high-DPI sensors, mechanical key switches, 3D audio, and haptic feedback. These high-performance features are considered essential for accurate input and immersive experience.

This demand has prompted manufacturers to invest in R&D for advanced technologies such as surround-sound ecosystems and professional-calibre performance tuning. Consequently, consumer spending on peripherals is being increasingly directed toward premium products, which supports market expansion. The driver effect is reinforced by a consumer base that values consistency of experience and competitive advantage in gaming setups.

Restraint Analysis

Compatibility Discrepancies and Consumer Preference Variance

Despite advances in technology, limited cross-compatibility remains a major hindrance to market penetration. Many high-end controllers or headsets are designed for a specific operating system or device, which creates barriers for gamers who engage across platforms. This fragmentation reduces overall product appeal and decreases purchase frequency.

Additionally, consumer preferences create conflicting demands: wireless options are favored for convenience, while wired devices are preferred for latency-sensitive gameplay. About 48% of gamers reportedly still choose wired equipment due to fears of performance degradation via wireless latency. These conflicting demands increase complexity in product design and slow adoption of innovative solutions across the board.

Opportunity Analysis

Integration of Sustainable Materials and Ergonomic Design

The growing emphasis on sustainability presents a viable opportunity for accessory manufacturers to differentiate their offerings. Consumers are increasingly prioritizing eco-friendly materials, recyclable packaging, and energy-efficient designs. Introducing sustainably manufactured mice, keyboards, and headsets could enhance brand reputation and align with broader environmental trends.

In parallel, extended gaming sessions have elevated demand for ergonomic accessories. The market for chairs, desks, and wrist-support devices tailored to long-duration gameplay is expanding. Manufacturers can capitalize on this trend by integrating ergonomic principles into product design, promoting improved user comfort and reduced repetitive strain – a value proposition likely to appeal strongly to professional gamers, streamers, and productivity-focused consumers.

Challenge Analysis

Balancing Innovation with Cost and Latency Requirements

PC gaming accessory developers face the challenge of incorporating bleeding-edge features – like haptic feedback, RGB customization, modular components – while managing production costs. High-end features inevitably raise retail prices, which may alienate budget-conscious gamers. Striking a balance between innovation and affordability is essential to maintain broad market appeal.

Simultaneously, any added wireless or software functionality must avoid introducing input lag. Performance latency remains a top concern among serious gamers, necessitating rigorous testing and optimization. Companies must invest in specialized engineering to ensure high-frequency polling, low latency, and high durability, all while preserving cost efficiencies. Failure in this balance may reduce competitive viability and slow product adoption.

Key Player Analysis

Logitech G and Razer Inc. are key leaders in the PC gaming accessories market, known for delivering premium-quality products with advanced features such as high-DPI sensors, mechanical switches, and customizable lighting. Their strong focus on innovation and brand identity has helped build loyal user bases, especially among competitive gamers and streamers.

Corsair, SteelSeries, and HyperX continue to strengthen their positions by offering reliable, performance-oriented accessories across headsets, keyboards, and mice. These companies are recognized for blending functionality with affordability, which has led to increased adoption among casual and professional gamers alike.

Thrustmaster, Turtle Beach, ASUS, Xbox, and MSI play strategic roles by focusing on niche segments and platform integration. Thrustmaster leads in racing and flight simulation, while Turtle Beach dominates in gaming audio. ASUS, Xbox, and MSI emphasize ecosystem compatibility and hardware synergy, helping drive user engagement across PC and console platforms.

Top Key Players Covered

- Logitech G

- Razer Inc.

- Corsair

- SteelSeries

- HyperX

- Thrustmaster

- Turtle Beach

- ASUS

- Xbox

- Micro-Star INT’L CO., LTD

- Others

Recent Developments

- In Sep 2024, Corsair closed the acquisition of the Fanatec Sim Racing brand from Endor AG, moving decisively into the sim racing accessories market. This positions Corsair as a leader in premium, end-to-end sim racing hardware, a segment experiencing rapid growth as e-sports and simulation racing communities expand.

- In Sep. 2024, At RazerCon 2024, Razer launched the Razer Freyja, the world’s first HD haptic gaming cushion, and the Kraken V4 Pro headset. They also teased a special project for their 20th anniversary in 2025, signaling ongoing innovation and anticipation in the market.

Report Scope

Report Features Description Market Value (2024) USD 2.77 Bn Forecast Revenue (2034) USD 4.87 Bn CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product (Gaming Chairs, Controllers, Headsets and Audio Equipment, Keyboards and Mouse, Others), By Distribution Channel (Specialty Stores, Online, Departmental Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Logitech G, Razer Inc., Corsair, SteelSeries, HyperX, Thrustmaster, Turtle Beach, ASUS, Xbox, Micro-Star INT’L CO., LTD, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  PC Gaming Accessories MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

PC Gaming Accessories MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Logitech G

- Razer Inc.

- Corsair

- SteelSeries

- HyperX

- Thrustmaster

- Turtle Beach

- ASUS

- Xbox

- Micro-Star INT'L CO., LTD

- Others