Patient Engagement Solutions Market By Component [Software & Hardware (Standalone and Integrated), Services (Consulting, Implementation & Training and Others)] By Deployment Mode (On-premise and Cloud) By Application (Health Management, Social and Behavioral Management and Other Applications) By Functionality (Communication, Health Tracking & Insights, Billing & Payments and Other Functionalities) By Therapeutic Area (Health & Wellness, Chronic Disease Management and Other Therapeutic Areas) By End-User (Payers, Providers, Patients and Other End-Users) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 17491

- Number of Pages: 295

- Format:

-

keyboard_arrow_up

Quick Navigation

- Market Overview

- Key Takeaways

- Component Analysis

- Deployment Mode Analysis

- Application Analysis

- Functionality Analysis

- Therapeutic Area Analysis

- End-User Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Challenges

- Market Trends

- Regional Analysis

- Key Regions and Countries

- Market Share & Key Players Analysis

- Recent Developments

- Report Scope

Market Overview

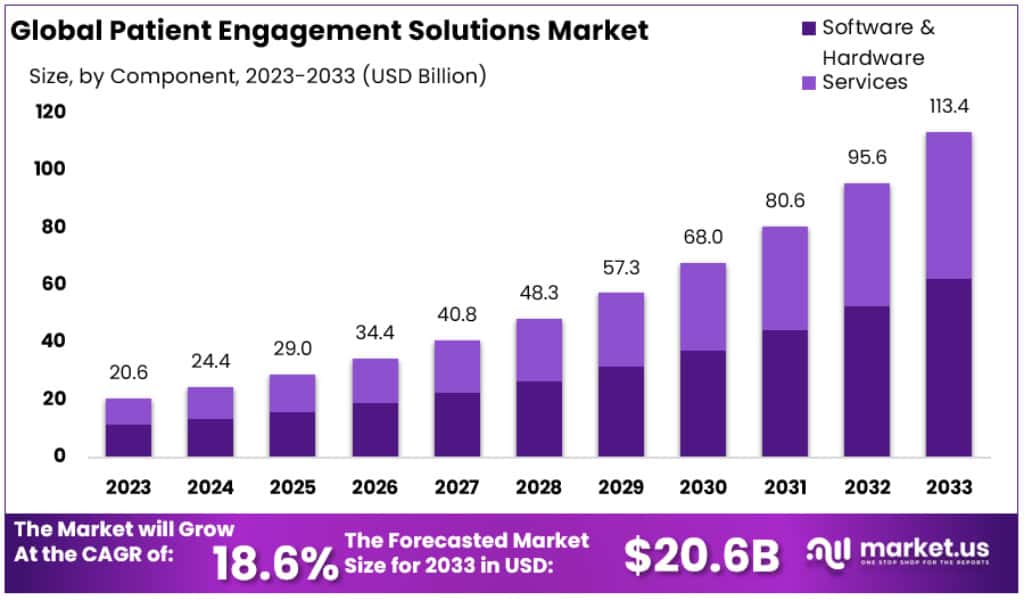

The Global Patient Engagement Solutions Market size is expected to be worth around USD 113.4 billion by 2033, from USD 20.6 billion in 2023, growing at a CAGR of 18.6% during the forecast period from 2023 to 2033.

The healthcare system is complex, owing to the diversity of tasks involved in the delivery of patient care, the diversity of patients, clinicians, and other respective staff, tedious documentation, variations in the physical layout of clinical environments, a lack of regulations, as well as the implementation of latest technologies.

Patients have to schedule appointments, followed by filling up registration forms and thereafter going for doctor visits. All these aforementioned processes are handled manually. This may cause delays/discrepancies in operational processes related to patient data. Patient engagement software solutions facilitate patient data and hospital management.

This software automates appointment management, which in turn eliminates waiting hours for patients. Patient engagement solutions improve patient data management, and can easily handle large volumes of data in an effective way through secure & automated data management systems.

Connectivity and emerging technologies are rapidly transforming the relationship between patients and healthcare companies. With the help of these technologies, doctors can easily reach their patients and provide helpful information at the right time. Benefits of patient engagement systems are – enhancing communication between patients as well as their respective healthcare providers, automatic appointment reminders via text/voice messages, etc. These aforementioned factors are anticipated to bolster revenue growth prospects for the global patient engagement solutions market.

Key Takeaways

- The Patient Engagement Solutions Market is projected to reach a value of approximately USD 113.4 billion by 2033.

- In 2023, the market size for Patient Engagement Solutions was USD 20.6 billion.

- The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 18.6% during the forecast period from 2023 to 2033.

- The Software and Hardware segment held more than a 55% market share in 2023.

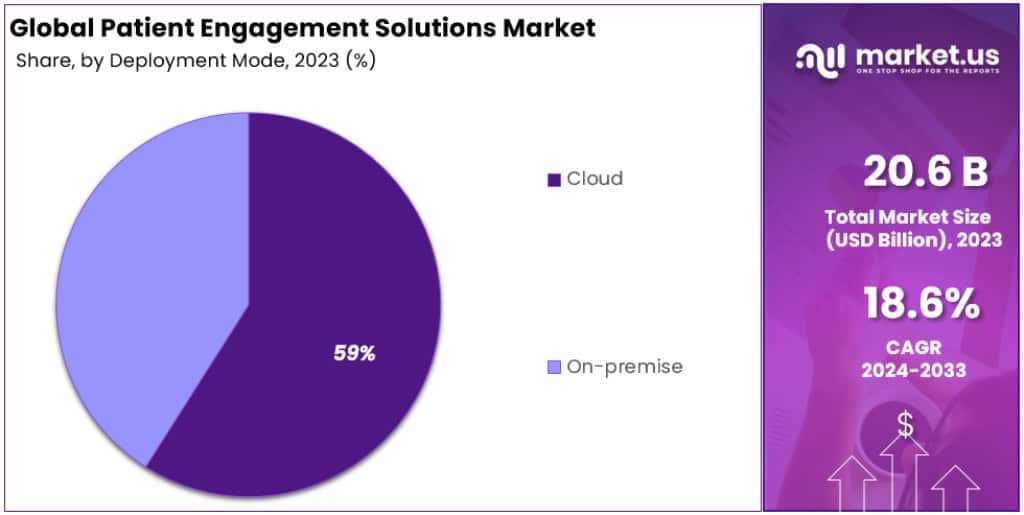

- Cloud deployment held more than a 59% market share in 2023.

- Health Management accounted for over 36% of the market share in 2023.

- Communication functionality captured more than 37% market share in 2023.

- Chronic Disease Management held a dominant market position with over 41% share in 2023.

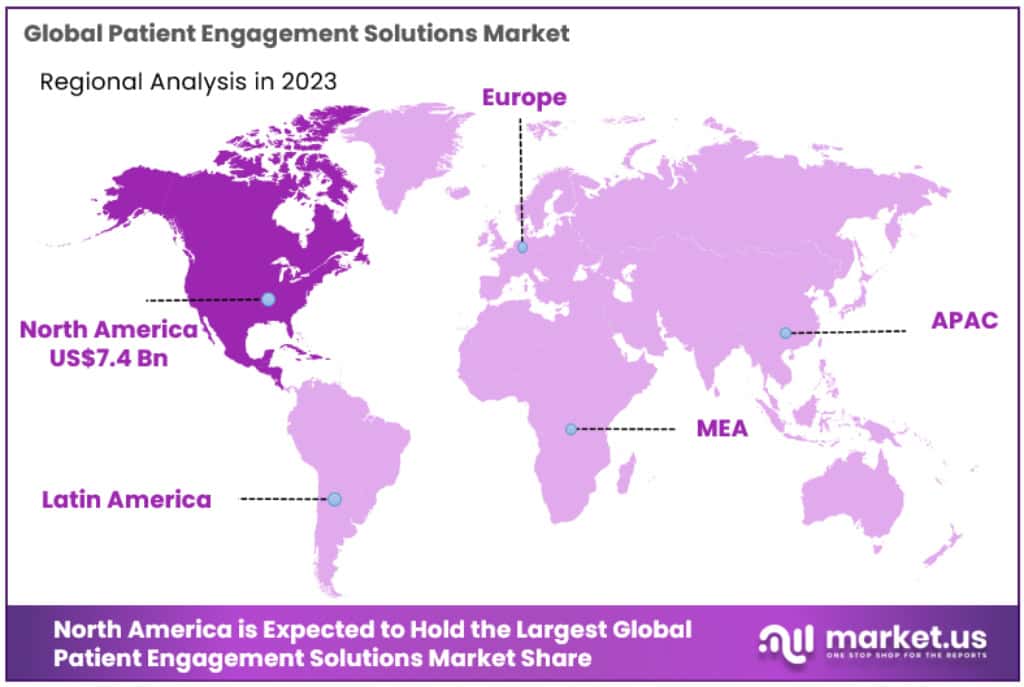

- North America dominated the Patient Engagement Solutions Market with a 36% share, valued at USD 7.4 billion in 2023.

Component Analysis

In 2023, the Software and Hardware segment held a dominant market position in the Patient Engagement Solutions Market, capturing more than a 55% share. This segment is characterized by two key sub-categories: Standalone and Integrated. Standalone software and hardware are distinct systems designed to address specific patient engagement functions. They are often adopted by smaller healthcare providers due to their cost-effectiveness and ease of implementation. Integrated solutions, on the other hand, offer a holistic approach by combining multiple functionalities into a cohesive system. They are preferred by larger organizations seeking comprehensive patient engagement strategies.

The Services segment, another vital component of the market, is further divided into Consulting, Implementation & Training, and Others. Consulting services are crucial for healthcare providers to strategize and optimize their patient engagement solutions, tailoring them to specific organizational needs. Implementation and training services ensure that healthcare staff are well-equipped to utilize these technologies effectively, thereby enhancing patient experiences and engagement. The ‘Others’ category encompasses additional services that support the ongoing operation and maintenance of patient engagement solutions.

These segments collectively contribute to the robust growth and dynamism of the Patient Engagement Solutions Market, with Software and Hardware serving as the cornerstone due to their substantial market share. Each segment addresses distinct needs within the healthcare sector, demonstrating the market’s capacity to cater to a diverse range of requirements and preferences in patient engagement strategies.

Deployment Mode Analysis

In 2023, the Cloud deployment mode held a dominant market position in the Patient Engagement Solutions Market, capturing more than a 59% share. This segment’s growth can be attributed to its flexibility, scalability, and cost-effectiveness. Cloud-based solutions enable healthcare providers to manage patient engagement tools without the need for extensive hardware or IT infrastructure. The ease of access and maintenance, coupled with enhanced data security measures, makes cloud deployment highly attractive.

On the other hand, the On-premise segment caters to healthcare providers preferring direct control over their data and systems. This mode is characterized by solutions installed on the healthcare provider’s own computers and servers. While offering high levels of customization and control, on-premise solutions require significant upfront investment and ongoing maintenance. They remain a viable option for organizations prioritizing data control and having the requisite IT support.

Both deployment modes play crucial roles in the Patient Engagement Solutions Market. The Cloud segment’s larger market share reflects a broader industry trend towards digital and remote-capable solutions, while the On-premise segment continues to serve an important niche for organizations with specific operational preferences. Together, these segments ensure a comprehensive range of options for healthcare providers seeking to enhance patient engagement through technology.

Application Analysis

In 2023, Health Management held a dominant market position in the Patient Engagement Solutions Market, capturing more than a 36% share. This segment primarily focuses on facilitating effective management of patient health, including chronic disease management and wellness programs. The adoption of these solutions is driven by the need for continuous health monitoring and personalized care plans. Health Management solutions are instrumental in improving patient outcomes and reducing healthcare costs, making them a preferred choice for many healthcare providers.

The Social and Behavioral Management segment also plays a critical role in the market. This segment addresses the social and behavioral aspects of patient care, including mental health and lifestyle choices. These solutions are designed to encourage healthier behavior and support patients in managing their own health. As awareness of the importance of mental health and lifestyle choices in overall health increases, the demand for these solutions is expected to grow.

Other Applications in the Patient Engagement Solutions Market encompass a diverse range of functionalities, including medication adherence, appointment scheduling, and patient education. This segment caters to the varied needs of healthcare providers and patients, offering tailored solutions that extend beyond traditional health management.

Together, these segments demonstrate the multifaceted nature of the Patient Engagement Solutions Market. Health Management remains a key driver due to its significant impact on patient outcomes and healthcare efficiency. However, the growing emphasis on holistic patient care is gradually expanding the market’s scope to include Social and Behavioral Management and Other Applications, each addressing unique aspects of patient engagement.

Functionality Analysis

In 2023, the Communication functionality held a dominant market position in the Patient Engagement Solutions Market, capturing more than a 37% share. This segment includes tools and platforms that facilitate effective communication between healthcare providers and patients. The emphasis on improving patient-provider interactions, timely information sharing, and enhancing overall patient experience has driven the growth of this segment. Solutions in this category range from messaging and notification systems to telehealth platforms, all aimed at bridging the communication gap in healthcare.

Health Tracking & Insights is another significant segment. It focuses on monitoring patient health data and providing actionable insights to both patients and healthcare providers. This functionality supports proactive health management, including tracking of vital signs, symptom logging, and personalized health recommendations. The increasing emphasis on preventive care and personalized medicine has bolstered the demand for these solutions.

The Billing & Payments segment addresses the financial aspects of healthcare. It simplifies the process of billing, insurance claims, and payments for both providers and patients. By streamlining these processes, this segment reduces administrative burdens and improves the financial experience for patients, which is essential in a patient-centered healthcare model.

Other Functionalities in the market cover a wide range of additional services, including prescription management, and patient education. These functionalities complement the core segments by addressing the diverse needs of healthcare providers and patients.

Therapeutic Area Analysis

In 2023, Chronic Disease Management held a dominant market position in the Patient Engagement Solutions Market, capturing more than a 41% share. This segment is pivotal in addressing the growing prevalence of chronic diseases such as diabetes, heart disease, and respiratory conditions. Solutions in this area focus on regular monitoring, patient education, and adherence to treatment plans. The emphasis on managing chronic conditions effectively to reduce hospital readmissions and improve patient outcomes has significantly contributed to the growth of this segment.

Health & Wellness is another key segment. It encompasses solutions that promote general health maintenance, preventive care, and wellness practices. These solutions aim to engage individuals in maintaining a healthy lifestyle, encompassing aspects like nutrition, physical activity, and mental well-being. The rising awareness of preventive healthcare and the importance of maintaining a healthy lifestyle have spurred the demand for solutions in this segment.

Other Therapeutic Areas in the Patient Engagement Solutions Market cover a broad spectrum of healthcare needs beyond chronic disease management and general wellness. These include areas such as post-operative care, maternal health, pediatric care, and elder care. This segment caters to the specific needs of diverse patient populations, highlighting the market’s ability to adapt and provide tailored solutions across various healthcare scenarios.

End-User Analysis

In 2023, Providers held a dominant market position in the Patient Engagement Solutions Market, capturing more than a 46% share. This segment includes hospitals, clinics, and other healthcare facilities that use patient engagement solutions to improve care delivery and patient outcomes. The focus on enhancing patient experience, streamlining clinical workflows, and improving health outcomes has driven the adoption of these solutions among providers.

Payers, comprising insurance companies and other healthcare financing entities, also form a significant segment. They utilize patient engagement solutions to manage claims processing, customer service, and wellness programs. By engaging with patients directly, payers aim to reduce healthcare costs and improve patient satisfaction. This segment is increasingly adopting technology to streamline operations and offer value-added services to their customers.

Patients as end-users represent a growing segment. This includes individuals actively using patient engagement platforms for managing their health. Solutions in this category empower patients with tools for health tracking, accessing medical records, and communicating with healthcare providers. The shift towards patient-centered care and the increasing use of digital health tools by patients contribute to the growth of this segment.

Other End-Users in the market encompass a variety of stakeholders, including corporate employers, government bodies, and pharmaceutical companies. These entities leverage patient engagement solutions for diverse purposes such as employee health programs, public health initiatives, and drug adherence programs.

Key Market Segments

Component

- Software & Hardware

- Standalone

- Integrated

- Services

- Consulting

- Implementation & Training

- Others

Deployment Mode

- On-premise

- Cloud

Application

- Health Management

- Social and Behavioral Management,

- Other Applications

Functionality

- Communication

- Health Tracking & Insights

- Billing & Payments

- Other Functionalities

Therapeutic Area

- Health & Wellness

- Chronic Disease Management

- Other Therapeutic Areas

End-User

- Payers

- Providers

- Patients

- Other End-Users

Drivers

- Government Initiatives and Regulations: Governments worldwide are implementing measures to promote patient-centric care. For instance, the CARES Act in the US, with a funding of USD 2 million, expanded Medicare cover for COVID-19 and telehealth services. Such initiatives are boosting the demand for patient engagement solutions.

- Rising Prevalence of Chronic Diseases: Chronic diseases are increasing globally. The CDC reports that up to 6.1 million Americans suffer from atrial fibrillation, a number expected to double by 2030. This rise necessitates enhanced patient engagement solutions.

- Increased Healthcare Expenditure: Healthcare spending is on the rise, with the UK government spending GBP 277 billion in a recent year, up 7.4% from the previous year. This increase in spending supports the adoption of patient engagement software.

Restraints

- Data Security Concerns: The security of patient health data is a major barrier. Concerns about data breaches and privacy violations are slowing the acceptance and implementation of patient engagement programs.

Opportunities

- Adoption of New Technology: Technological advancements could save up to USD 220 billion in administrative costs annually, according to McKinsey. New tools like biometric authentication and digital engagement solutions offer promising growth prospects.

Challenges

- High Deployment Costs: The maintenance and updates of healthcare IT systems can be costly, often requiring additional training for healthcare professionals. This high cost of ownership is a significant challenge for many healthcare institutions.

Market Trends

- Growth of Web-based and Cloud-based Services: With the shift to digital, web-based, and cloud-based services are expected to see significant growth. Initiatives like the NHS’s move to Microsoft’s Azure Cloud in the UK are examples of this trend.

- Impact of COVID-19: The pandemic has accelerated the adoption of digital solutions in healthcare. For instance, France saw a tenfold increase in teleconsultations, showing a shift towards digital patient engagement.

- Mobile Applications: The use of mobile apps in healthcare is rising, aiding in the market’s expansion, especially in managing chronic diseases and improving patient engagement.

- Government Support: Initiatives like France’s ‘My Health 2022’ plan, which includes electronic health records and telemedicine, are driving market growth.

Regional Analysis

In 2023, North America dominates the Patient Engagement Solutions Market, holding a 36% share with a market value of USD 7.4 Billion. The region’s leadership in the market can be attributed to several factors:

- Government Support and Healthcare Spending: In the United States, healthcare spending reached approximately USD 3.9 trillion in 2020, or 18.8% of the GDP. Government regulations and initiatives, such as the CARES Act, have bolstered the market by expanding Medicare coverage and supporting digital health solutions.

- Advanced Healthcare Infrastructure: North America’s advanced healthcare infrastructure, coupled with a significant presence of key market players, drives the adoption of patient engagement solutions. Investments in mHealth and Electronic Health Records (EHR) further enhance this growth.

- Technology Adoption and Awareness: The region’s high adaptability to innovative technologies and increasing public awareness about health contribute to its leading position in the market. Initiatives by major companies, like the collaboration between IBM and Wipro for hybrid cloud offerings, support this trend.

- Europe’s Position: Holding the second-largest market share, Europe benefits from publicly funded systems such as the NHS in the U.K., which aims for digital transformation in healthcare, including the adoption of EHRs.

- Growth in Asia-Pacific: The Asia-Pacific region is expected to grow rapidly, with a forecasted growth rate of 19% during the analysis period. This growth is fueled by the increasing internet and smartphone penetration, large patient populations, and improvements in healthcare infrastructure. Economic development in countries like India and China also supports this growth.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Key Players

- Allscripts Healthcare, LLC

- Orion Health

- Cerner Corporation

- McKesson Corporation

- IBM

- Wolters Kluwer N.V.

- Greenway Health, LLC

- CureMD Healthcare

- Nuance Communications, Inc.

- Solutionreach, Inc.

- And Other Key Players

Recent Developments

- July 2023: Allscripts Healthcare introduced Engage, a new patient engagement platform. This platform offers a secure, unified access point for patients to view their health data, book appointments, communicate with healthcare providers, and manage their healthcare needs.

- July 2023: Orion Health announced a partnership with Google Cloud. This collaboration aims to enhance patient engagement by integrating Orion Health’s platform with Google Cloud’s AI and ML capabilities, offering a more tailored and predictive experience for patients.

- August 2023: Cerner Corporation launched HealtheLife, a new patient engagement app. This app presents a personalized summary of patients’ health records, medications, and lab results, along with features for scheduling appointments, messaging healthcare providers, and tracking health goals.

- August 2023: McKesson Corporation declared the acquisition of Aprima Medical Software, known for its practice management and patient engagement solutions. This acquisition aims to broaden McKesson’s range of patient engagement offerings and improve connections between healthcare providers and patients.

- September 2023: IBM initiated a new project to boost patient engagement using AI and ML. This project focuses on developing AI and ML-based tools to assist healthcare providers in identifying patients at risk of hospital readmission, creating customized care plans, and elevating patient satisfaction.

- September 2023: Wolters Kluwer N.V. introduced Carestream Patient Engagement, a novel patient engagement solution. This solution provides a personalized overview of patients’ medical history, medications, and lab results, and includes functionalities for appointment scheduling, provider communication, and healthcare management.

- October 2023: CureMD Healthcare launched CureMD Engage, their new patient engagement platform. This platform offers patients a personalized view of their health records, medications, and test results, and includes features for appointment booking, communication with healthcare providers, and healthcare management.

Report Scope

Report Features Description Market Value (2023) USD 20.6 Billion Forecast Revenue (2033) USD 113.4 Billion CAGR (2023-2032) 18.6% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component [Software & Hardware (Standalone and Integrated), Services (Consulting, Implementation & Training and Others)] By Deployment Mode (On-premise and Cloud) By Application (Health Management, Social and Behavioral Management and Other Applications) By Functionality (Communication, Health Tracking & Insights, Billing & Payments and Other Functionalities) By Therapeutic Area (Health & Wellness, Chronic Disease Management and Other Therapeutic Areas) By End-User (Payers, Providers, Patients and Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Allscripts Healthcare, LLC, Orion Health, Cerner Corporation, McKesson Corporation, IBM, Wolters Kluwer N.V., Greenway Health, LLC, CureMD Healthcare, Nuance Communications, Inc. Solutionreach, Inc.And Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Patient Engagement Solutions MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample

Patient Engagement Solutions MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Allscripts Healthcare, LLC

- Orion Health

- Cerner Corporation

- McKesson Corporation

- IBM

- Wolters Kluwer N.V.

- Greenway Health, LLC

- CureMD Healthcare

- Nuance Communications, Inc.

- Solutionreach, Inc.

- And Other Key Players