Global Passenger Vehicle Telematics Market Size, Share, Growth Analysis By Form Type (Embedded, Tethered, Integrated), By Service (Automatic Crash Notification, Emergency Calling, Navigation, On-Road Assistance, Remote Diagnostics, Vehicle Tracking/Recovery (Fleet Management), Insurance Risk Assessment, Driver Behavior, Billing Services, Others), By Hardware (Telematic Control Unit, Navigation Systems, Communication Devices, Audio/Video Interface, CAN Bus), By Connectivity (Satellite, Cellular), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159224

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

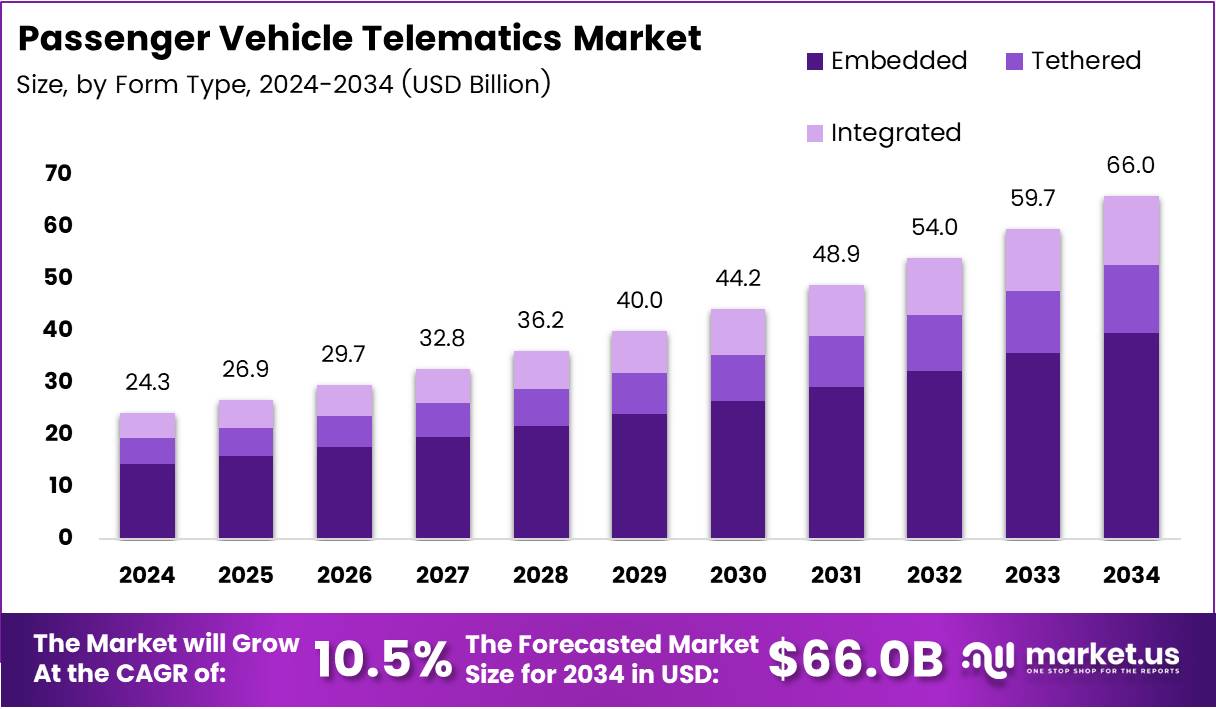

The Global Passenger Vehicle Telematics Market size is expected to be worth around USD 66.0 Billion by 2034, from USD 24.3 Billion in 2024, growing at a CAGR of 10.5% during the forecast period from 2025 to 2034.

The Passenger Vehicle Telematics Market refers to the integration of telecommunications and vehicle systems, providing advanced features such as real-time data monitoring, vehicle diagnostics, and location-based services. This market supports a wide array of applications, including infotainment, navigation, driver assistance systems, and fleet management, revolutionizing how vehicles interact with their drivers and the surrounding infrastructure.

The growth of this market has been fueled by rising consumer demand for connected services and enhanced driving experiences. As more consumers seek smart features in their vehicles, telematics systems have become integral to automakers’ offerings. This trend is expected to continue, with technology advancing to offer even more sophisticated services.

Government investments and regulatory frameworks are further driving market expansion. Many countries are introducing stringent regulations aimed at improving road safety, reducing emissions, and enhancing the overall driving experience. These regulatory measures encourage the adoption of telematics systems, ensuring compliance with safety standards and environmental policies.

According to an industry report, the adoption of telematics across platforms surged by 142% from 2020 to 2023, highlighting the growing significance of these systems in passenger vehicles. The increased consumer interest in connected car features has encouraged automakers to integrate telematics as a standard offering in modern vehicles.

Usage-based insurance (UBI) is another major driver of market growth. In 2024, 35% of consumers enrolled in UBI programs for immediate savings, marking a 21% increase from 2023. This trend demonstrates the rising importance of telematics in the insurance sector, where data-driven insights can lead to cost-effective, personalized offerings for customers.

Key Takeaways

- The Global Passenger Vehicle Telematics Market is projected to reach USD 66.0 Billion by 2034, growing at a CAGR of 10.5% from 2025 to 2034.

- In 2024, Embedded systems lead the By Form Type Analysis segment with a 48.3% market share.

- Automatic Crash Notification services dominate the By Service Analysis segment with a 23.1% market share in 2024.

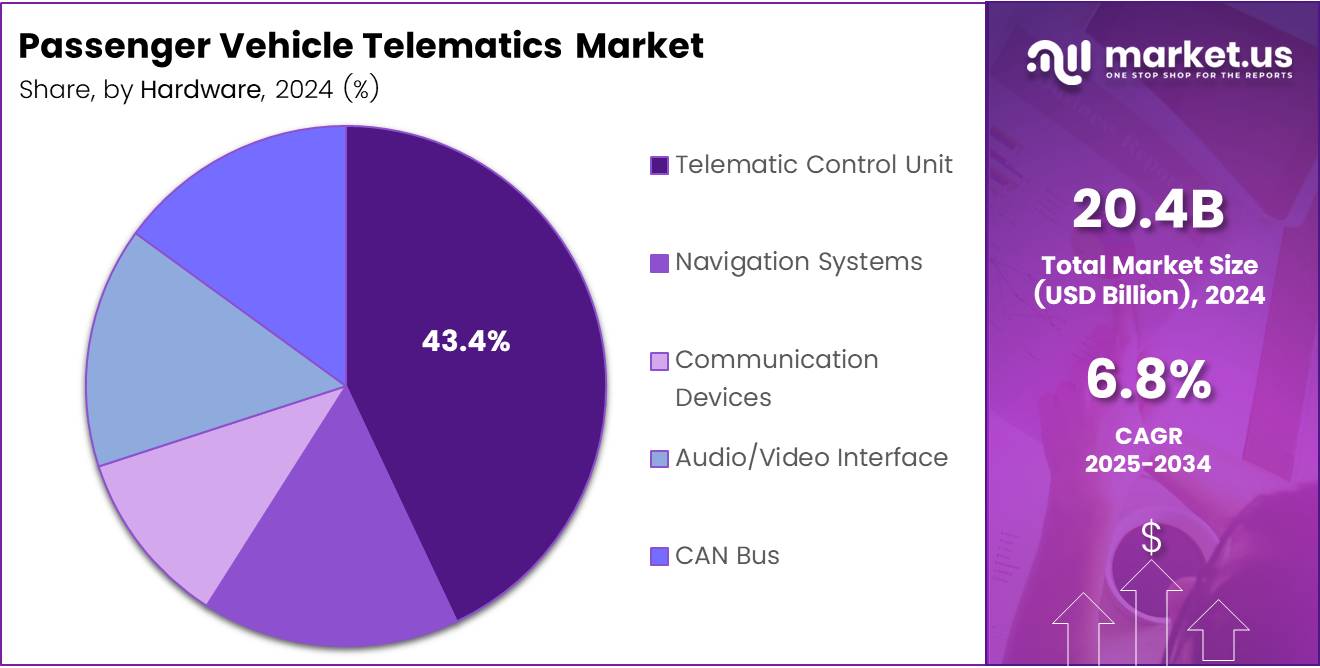

- The Telematic Control Unit holds a 43.4% share in the By Hardware Analysis segment in 2024.

- Satellite connectivity leads the By Connectivity Analysis segment, accounting for 68.9% of the market share in 2024.

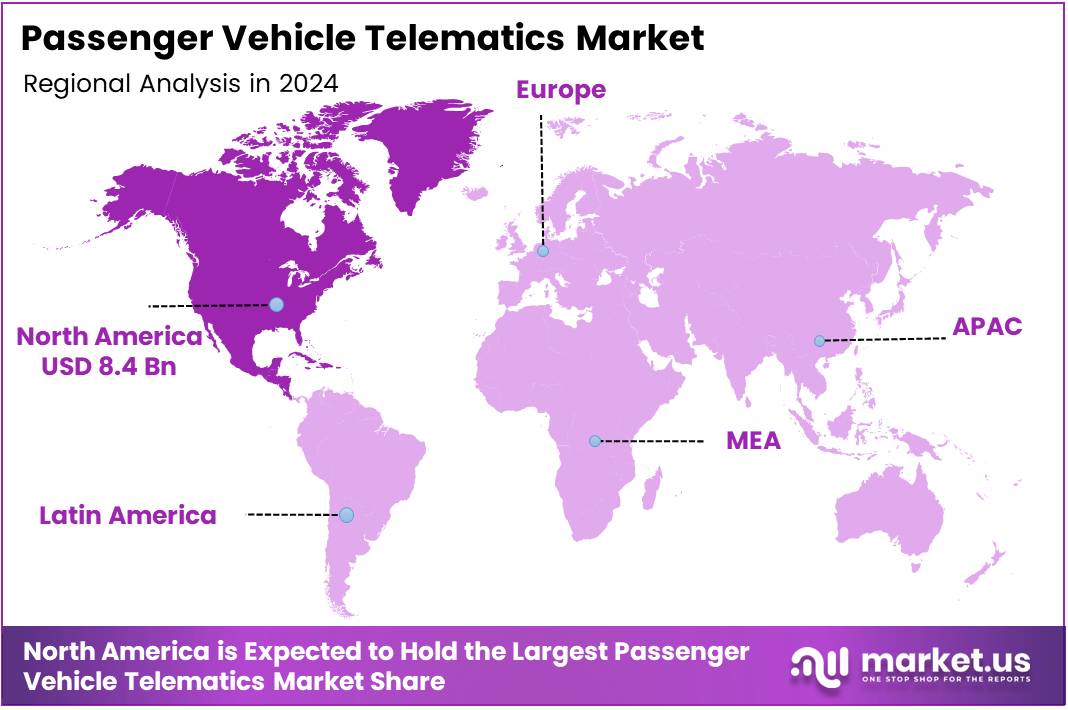

- North America dominates the Passenger Vehicle Telematics market with a 34.9% share, valued at USD 8.4 Billion in 2024.

By Form Type Analysis

In 2024, Embedded held a dominant market position in the By Form Type Analysis segment of Passenger Vehicle Telematics Market, with a 48.3% share.

Embedded systems continue leading the market due to their seamless integration capabilities and enhanced security features. These systems are permanently installed within vehicle architecture, offering superior reliability and performance. Furthermore, embedded solutions provide manufacturers with better control over hardware specifications and software customization, making them increasingly attractive for premium vehicle segments.

Tethered solutions maintain significant market presence by offering cost-effective alternatives for budget-conscious consumers. These systems leverage smartphone connectivity to deliver telematics functionality, requiring minimal hardware investment. Additionally, tethered systems provide flexibility in terms of upgrades and feature additions through mobile applications.

Integrated telematics systems represent the emerging trend toward comprehensive vehicle connectivity solutions. These systems combine multiple functionalities into unified platforms, delivering enhanced user experiences. Moreover, integrated solutions enable automakers to differentiate their offerings through proprietary features and services, driving competitive advantage in the marketplace.

By Service Analysis

In 2024, Automatic Crash Notification held a dominant market position in the By Service Analysis segment of Passenger Vehicle Telematics Market, with a 23.1% share.

Automatic Crash Notification services lead the market due to increasing safety regulations and consumer awareness about emergency response capabilities. These systems automatically detect collisions and notify emergency services, significantly reducing response times. Consequently, insurance companies increasingly mandate these features, driving widespread adoption across vehicle segments.

Emergency Calling services complement crash notification systems by providing direct communication channels between drivers and emergency responders. These services enable manual activation during various emergency situations beyond accidents. Subsequently, regulatory requirements in multiple regions mandate emergency calling capabilities, ensuring consistent market demand.

Navigation services remain fundamental to telematics offerings, providing real-time traffic updates and route optimization. These systems enhance driving efficiency while reducing fuel consumption and travel time. Additionally, advanced navigation features integrate with vehicle systems to provide predictive maintenance alerts and location-based services.

On-Road Assistance services provide comprehensive support for vehicle breakdowns and maintenance issues. These services connect drivers with certified technicians and service providers through telematics platforms. Furthermore, on-road assistance features often include battery monitoring, tire pressure alerts, and remote diagnostic capabilities for proactive maintenance.

Remote Diagnostics enable vehicle health monitoring and predictive maintenance scheduling. These services analyze vehicle performance data to identify potential issues before they result in breakdowns. Moreover, remote diagnostics reduce maintenance costs while improving vehicle reliability and customer satisfaction rates.

Vehicle Tracking/Recovery services focus on fleet management and theft prevention applications. These systems provide real-time location monitoring and vehicle recovery assistance in case of theft. Additionally, fleet operators utilize tracking services for route optimization, driver behavior monitoring, and operational efficiency improvements.

Insurance Risk Assessment services leverage telematics data to evaluate driving behavior and determine insurance premiums. These programs reward safe driving practices with reduced insurance costs. Consequently, usage-based insurance models gain popularity among cost-conscious consumers seeking personalized premium structures.

Driver Behavior monitoring services analyze driving patterns to promote safer driving habits. These systems track acceleration, braking, cornering, and speed patterns to provide feedback to drivers. Subsequently, fleet operators utilize behavior monitoring for driver training programs and risk management initiatives.

Billing Services facilitate automated payment processing for various vehicle-related expenses including tolls, parking, and fuel purchases. These services streamline transaction processes while providing detailed expense tracking capabilities. Furthermore, billing services integrate with fleet management systems to provide comprehensive cost analysis and budgeting tools.

Others category encompasses emerging telematics services including entertainment, social connectivity, and smart city integration features. These services focus on enhancing passenger experience and vehicle connectivity with external infrastructure. Additionally, innovative services continue emerging as technology advances and consumer expectations evolve.

By Hardware Analysis

In 2024, Telematic Control Unit held a dominant market position in the By Hardware Analysis segment of Passenger Vehicle Telematics Market, with a 43.4% share.

Telematic Control Unit dominates the hardware segment as the central processing component for all telematics functions. These units manage data collection, processing, and transmission across various vehicle systems. Moreover, advanced TCUs integrate multiple connectivity options and computing capabilities, making them indispensable for modern telematics implementations.

Navigation Systems represent essential hardware components providing GPS functionality and mapping services. These systems integrate with vehicle displays and audio systems to deliver comprehensive navigation experiences. Additionally, modern navigation hardware incorporates real-time traffic data and predictive routing algorithms for optimal journey planning.

Communication Devices enable connectivity between vehicles and external networks through cellular, satellite, and Wi-Fi technologies. These devices facilitate data transmission for various telematics services and applications. Furthermore, communication hardware continues evolving to support emerging connectivity standards including 5G and vehicle-to-everything protocols.

Audio/Video Interface components provide user interaction capabilities through touchscreens, voice recognition, and multimedia displays. These interfaces enable drivers and passengers to access telematics services safely and conveniently. Subsequently, advanced interface hardware incorporates artificial intelligence and natural language processing for enhanced user experiences.

CAN Bus systems provide internal vehicle communication networks enabling data exchange between various electronic control units. These systems facilitate integration of telematics functions with existing vehicle systems and sensors. Additionally, CAN Bus technology ensures reliable and secure data transmission within vehicle architectures.

By Connectivity Analysis

In 2024, Satellite held a dominant market position in the By Connectivity Analysis segment of Passenger Vehicle Telematics Market, with a 68.9% share.

Satellite connectivity dominates the market due to its global coverage capabilities and reliability in remote areas. These systems provide consistent connectivity regardless of terrestrial network availability, making them ideal for emergency services and fleet operations. Furthermore, satellite technology offers enhanced security features and dedicated bandwidth allocation for critical telematics applications.

Cellular connectivity provides cost-effective solutions for urban and suburban telematics applications. These systems leverage existing mobile network infrastructure to deliver high-speed data transmission and real-time communication capabilities. Additionally, cellular technology benefits from continuous network improvements including 4G and 5G implementations, ensuring future-ready connectivity solutions.

Key Market Segments

By Form Type

- Embedded

- Tethered

- Integrated

By Service

- Automatic Crash Notification

- Emergency Calling

- Navigation

- On-Road Assistance

- Remote Diagnostics

- Vehicle Tracking/Recovery (Fleet Management)

- Insurance Risk Assessment

- Driver Behavior

- Billing Services

- Others

By Hardware

- Telematic Control Unit

- Navigation Systems

- Communication Devices

- Audio/Video Interface

- CAN Bus

By Connectivity

- Satellite

- Cellular

Drivers

Increasing Demand for Telematics Solutions Drives Market Growth

The increasing demand for in-vehicle safety and navigation systems is a significant driver in the Passenger Vehicle Telematics market. Consumers are becoming more conscious of their safety while driving, which has led to the integration of advanced telematics solutions. These systems provide features such as real-time navigation, collision detection, and emergency assistance, enhancing driver and passenger safety.

The adoption of autonomous and connected vehicle technologies is also propelling the market. As automakers continue to develop autonomous vehicles, the need for advanced telematics systems that support vehicle-to-vehicle (V2V) communication and real-time data transfer is growing. These systems are vital for ensuring smooth operations and enabling self-driving functionalities.

Government regulations promoting advanced telematics solutions further boost market growth. Several governments worldwide are mandating the use of telematics for vehicle tracking and safety. These regulations create a significant push for automakers to incorporate telematics solutions into their vehicles, ensuring compliance and improving safety standards.

The rising consumer demand for real-time data and vehicle diagnostics is also a key driver. Consumers increasingly want to monitor their vehicle’s performance, track fuel efficiency, and receive timely maintenance alerts. Telemetry systems allow consumers to access this data instantly, improving vehicle maintenance and reducing downtime.

Restraints

Privacy and Data Security Concerns Restrain Market Growth

Privacy and data security concerns are a major restraint for the Passenger Vehicle Telematics market. As telematics systems collect vast amounts of data, including location and personal information, consumers and regulatory bodies have raised concerns about how this data is protected. With increasing instances of cyberattacks and data breaches, ensuring robust security measures is crucial for the adoption of telematics systems.

Limited infrastructure for advanced telematics in emerging markets also poses a challenge. While developed regions have the infrastructure to support advanced telematics, emerging markets still face obstacles such as insufficient network coverage, lack of awareness, and high costs. These factors delay the adoption of telematics solutions in these regions, limiting market growth potential.

Integration challenges with existing vehicle systems further restrain the market. Many vehicles on the road today were not initially designed to support telematics technology, which means retrofitting older models can be complex and costly. This adds additional barriers for automakers looking to implement telematics systems across their vehicle fleets.

Growth Factors

Expansion of Electric Vehicle Telematics Presents Growth Opportunities

The expansion of electric vehicle telematics offers significant growth opportunities for the Passenger Vehicle Telematics market. As electric vehicles (EVs) become more popular, telematics solutions are crucial for managing battery performance, charging schedules, and energy consumption. The integration of telematics with EVs helps users track their vehicle’s energy usage, enabling more efficient and sustainable driving practices.

The development of AI-driven telematics solutions is another exciting opportunity. AI can help improve telematics systems by providing predictive maintenance, real-time route optimization, and personalized driver assistance. As AI technologies evolve, telematics systems will become more advanced, offering even more value to consumers and automakers alike.

Growing adoption of over-the-air (OTA) updates presents another key growth factor. Automakers can use OTA updates to remotely upgrade telematics software, adding new features or improving system performance without requiring vehicle visits to the service center. This ease of maintenance and continuous system enhancement is increasingly attractive to both manufacturers and consumers.

Partnerships between telematics providers and automotive manufacturers are further fueling market growth. These collaborations enable the seamless integration of telematics technology into new vehicle models. By working together, telematics providers and automakers can develop advanced, reliable systems that meet the growing demand for connected vehicle solutions.

Emerging Trends

Integration of 5G Connectivity in Telematics Systems Drives Market Growth

The integration of 5G connectivity in telematics systems is one of the key trends shaping the Passenger Vehicle Telematics market. 5G networks provide faster and more reliable data transmission, enabling real-time communication between vehicles and infrastructure. This is crucial for the development of autonomous vehicles and the overall advancement of telematics systems.

The rise in vehicle-to-everything (V2X) communication is also influencing the market. V2X communication allows vehicles to interact with traffic lights, pedestrians, other vehicles, and road infrastructure. This technology is essential for improving traffic safety, reducing congestion, and enabling autonomous driving systems.

A shift toward data-driven subscription models for telematics services is gaining momentum. Consumers are increasingly looking for personalized services and the ability to access data analytics on-demand. This trend is driving telematics providers to offer subscription-based services, where customers can pay for tailored data and vehicle insights, ensuring a more flexible and cost-effective solution.

The emergence of smart cities is influencing telematics adoption. As cities become more connected, the demand for intelligent transportation systems that rely on telematics data is increasing. Telemetry solutions can help improve urban mobility, manage traffic flow, and reduce environmental impact, making them a key component of smart city infrastructure.

Regional Analysis

North America Dominates the Passenger Vehicle Telematics Market with a Market Share of 34.9%, Valued at USD 8.4 Billion

In 2024, North America held a dominant market position in the Passenger Vehicle Telematics market, capturing a 34.9% share valued at USD 8.4 Billion. The region’s dominance is driven by the high adoption of advanced telematics technologies, supported by a well-established automotive industry and strong consumer demand for connected vehicle services. Government regulations and investments in autonomous vehicle technologies further contribute to market growth in North America.

Asia Pacific Passenger Vehicle Telematics Market Trends

Asia Pacific is expected to witness significant growth in the Passenger Vehicle Telematics market. With increasing technological advancements and growing consumer demand for connected services, the region’s market share is poised for rapid expansion. The rise in automotive production, particularly in countries like China, Japan, and India, has accelerated the adoption of telematics systems in passenger vehicles.

Europe Passenger Vehicle Telematics Market Trends

Europe has experienced substantial growth in the Passenger Vehicle Telematics market, driven by stringent government regulations regarding vehicle safety and emissions. The region has seen a steady rise in connected car services, with countries like Germany and the UK leading the adoption of advanced telematics solutions. Consumer demand for real-time vehicle data and fleet management solutions continues to fuel the market in Europe.

Middle East and Africa Passenger Vehicle Telematics Market Trends

The Middle East and Africa market is projected to see moderate growth in the Passenger Vehicle Telematics sector. With increasing infrastructure development and a growing focus on automotive safety, there is an upward trend in telematics adoption, particularly in high-income countries. The region’s strong interest in luxury and high-performance vehicles further supports the demand for advanced telematics systems.

Latin America Passenger Vehicle Telematics Market Trends

Latin America’s market for Passenger Vehicle Telematics is expected to grow at a slower pace compared to other regions. However, rising urbanization and improved connectivity infrastructure are anticipated to boost the adoption of telematics in passenger vehicles. Brazil and Mexico are the leading markets in the region, where demand for real-time data and navigation services is steadily increasing.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Passenger Vehicle Telematics Company Insights

The global Passenger Vehicle Telematics Market is witnessing significant advancements driven by key industry players.

Agero Inc stands out with its strong focus on providing connected vehicle solutions, particularly through its emergency assistance and roadside services. The company’s expertise in telematics and its commitment to improving driver safety contribute to its leadership in the sector.

Continental AG is another major player, offering a range of telematics solutions that enhance vehicle connectivity, including infotainment, navigation, and safety systems. Its broad product portfolio and focus on integrating advanced technologies in autonomous and electric vehicles position Continental as a strong contender in the telematics space.

Fleet Complete, known for its fleet management and telematics solutions, is rapidly expanding its presence in the passenger vehicle telematics market. By providing real-time tracking, driver behavior analytics, and fleet optimization, the company is capitalizing on the growing demand for connected vehicle technologies, particularly in the commercial vehicle segment.

Geotab Inc, with its data-driven solutions, is revolutionizing the telematics market by offering robust vehicle tracking and fleet management services. Its platform enables advanced data analytics for fleet performance, predictive maintenance, and driver safety, helping businesses streamline operations and optimize fleet management.

These companies are helping shape the market through innovation and technological advancements, meeting the growing demand for smart vehicle solutions. Their contributions are expected to drive market growth, particularly in areas of vehicle safety, connectivity, and real-time data analytics.

Top Key Players in the Market

- Agero Inc

- Continental AG

- Fleet Complete

- Geotab Inc

- LG Electronics

- MiX Telematics

- Octo Telematics

- OnStar Corporation

- Qualcomm Incorporated

- Verizon Connect

Recent Developments

- In Jun 2025, Vela acquired Redd, a leading asset management solution provider, expanding its capabilities in the asset management sector to enhance service offerings. The acquisition is set to strengthen Vela’s market position with Redd’s advanced technology and customer base.

- In Jan 2025, Netradyne raised $90 million in Series D funding, which will be utilized to enhance its AI-powered fleet management and safety solutions. The funding round, led by prominent investors, signals strong market confidence in Netradyne’s growth potential.

- In Feb 2024, Haomo.ai raised $14 million in Series B funding, aimed at accelerating the development of its autonomous driving technologies. This funding is crucial for Haomo.ai as it continues to push the boundaries of autonomous vehicle innovation.

- In Apr 2023, LightMetrics secured $8.5 million in a funding round to scale its video telematics platform, which provides real-time insights for fleet management and driver safety. The investment is expected to fuel the company’s growth and broaden its customer base.

- In Mar 2024, Targa Telematics unveiled new post-acquisition fleet solutions, enhancing its capabilities in fleet management and telematics. This move is part of Targa’s strategic efforts to strengthen its market position following recent acquisitions.

- In Feb 2025, Karma Automotive acquired assets and key personnel from connected vehicle pioneer Airbiquity, bolstering its connected vehicle capabilities. This acquisition enables Karma Automotive to integrate Airbiquity’s expertise into its vehicle platforms for improved connectivity solutions.

Report Scope

Report Features Description Market Value (2024) USD 24.3 Billion Forecast Revenue (2034) USD 66.0 Billion CAGR (2025-2034) 10.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form Type (Embedded, Tethered, Integrated), By Service (Automatic Crash Notification, Emergency Calling, Navigation, On-Road Assistance, Remote Diagnostics, Vehicle Tracking/Recovery (Fleet Management), Insurance Risk Assessment, Driver Behavior, Billing Services, Others), By Hardware (Telematic Control Unit, Navigation Systems, Communication Devices, Audio/Video Interface, CAN Bus), By Connectivity (Satellite, Cellular) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Agero Inc, Continental AG, Fleet Complete, Geotab Inc, LG Electronics, MiX Telematics, Octo Telematics, OnStar Corporation, Qualcomm Incorporated, Verizon Connect Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Passenger Vehicle Telematics MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Passenger Vehicle Telematics MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Agero Inc

- Continental AG

- Fleet Complete

- Geotab Inc

- LG Electronics

- MiX Telematics

- Octo Telematics

- OnStar Corporation

- Qualcomm Incorporated

- Verizon Connect