Global Parenteral Compounding Market By Product Type (Injectable Medications, Injectable Anesthetics, Infusion Solutions and Others), By Application (Pain Management, Hormone Replacement Therapy and Others), By End-User (Adults, Pediatric, Geriatric and Veterinary), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173525

- Number of Pages: 269

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

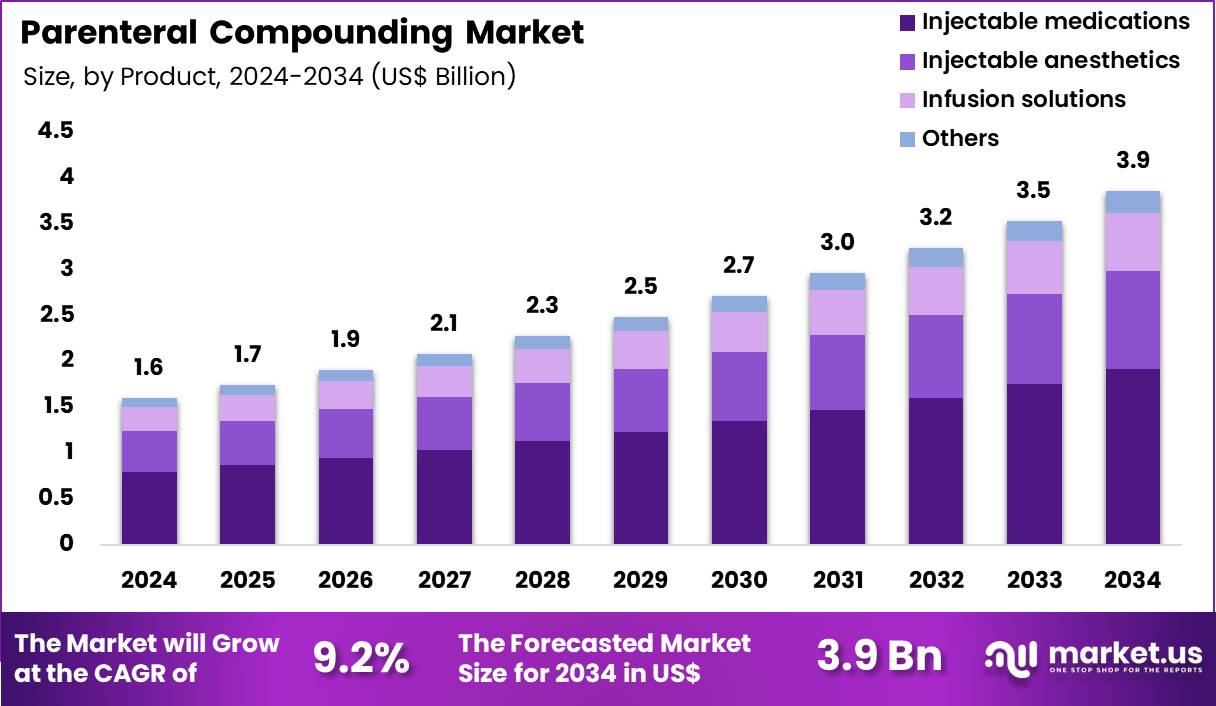

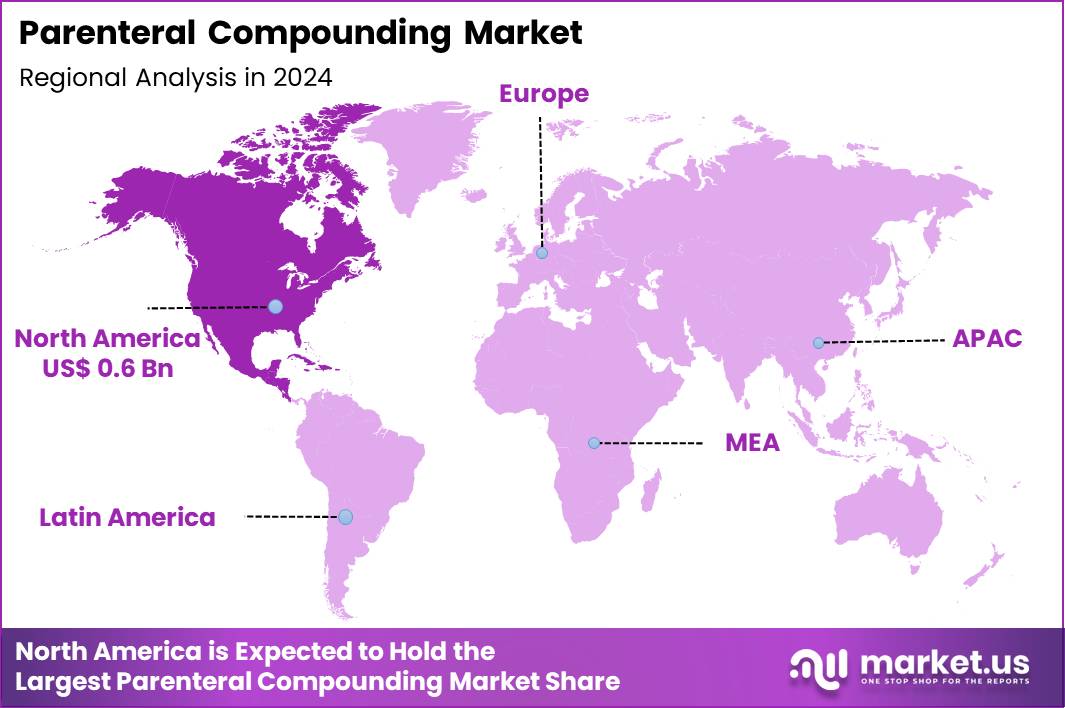

The Global Parenteral Compounding Market size is expected to be worth around US$ 3.9 Billion by 2034 from US$ 1.6 Billion in 2024, growing at a CAGR of 9.2% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.6% share with a revenue of US$ 0.6 Billion.

Growing complexity in biopharmaceutical therapies and the persistent challenge of drug shortages compel healthcare facilities to rely on parenteral compounding services that provide customized sterile injectable preparations tailored to individual patient requirements. Hospital pharmacies increasingly compound total parenteral nutrition solutions to deliver essential nutrients intravenously for patients unable to tolerate enteral feeding due to gastrointestinal disorders or critical illness.

These services support chemotherapy regimens by preparing precise cytotoxic admixtures, ensuring accurate dosing while minimizing exposure risks for oncology patients. Pharmacists compound patient-specific intravenous antibiotics and antimicrobials to address antimicrobial resistance and optimize therapy in infectious disease cases. These preparations facilitate pain management through patient-controlled analgesia infusions, delivering opioids and adjunctive agents for postoperative and chronic pain control.

In December 2024, Novo Holdings secured clearance from the European Commission for its USD 16.5 billion purchase of Catalent, substantially increasing global biologics fill-finish capacity. This expansion influences parenteral compounding by alleviating some manufacturing constraints that typically trigger injectable drug shortages.

At the same time, it reinforces the complementary role of compounders in addressing individualized dosing, temporary supply gaps, and off-label requirements. Together, large-scale manufacturing growth and specialized sterile compounding continue to sustain demand for compliant parenteral compounding solutions.

Compounding facilities capitalize on opportunities to integrate automated compounding devices that enhance precision and reduce human error in preparing complex parenteral admixtures, particularly for neonatal and pediatric patients requiring micro-dosing. Providers develop advanced stability studies for extended beyond-use dating of compounded injectables, broadening applications in home infusion therapy for long-term antibiotic courses and hydration support.

These capabilities expand utility in critical care settings, where compounders prepare cardioplegia solutions and dialysis fluids tailored to intraoperative and renal replacement needs. Opportunities arise in outsourcing sterile compounding to 503B facilities that supply batch-prepared injectables to hospitals facing capacity constraints, ensuring continuity during commercial shortages.

Companies advance closed-system transfer devices and robotic systems to improve sterility assurance in high-risk preparations like total parenteral nutrition and hazardous drugs. Firms pursue partnerships with electronic health record vendors to streamline order entry and verification, facilitating seamless workflow in multi-disciplinary parenteral therapy management.

Industry leaders implement real-time monitoring technologies and environmental controls in compounding suites to maintain ISO-compliant conditions, minimizing contamination risks in sterile injectable production. Developers refine quality assurance protocols with enhanced endotoxin testing and particulate matter analysis, elevating safety standards for intravenous preparations across therapeutic categories.

Market participants prioritize training programs that align with updated USP <797> revisions, strengthening operator competency in aseptic technique for parenteral compounding. Innovators introduce modular cleanroom designs that support scalable operations, accommodating fluctuating demands for chemotherapy, antibiotics, and nutritional admixtures.

Companies emphasize risk-based approaches to beyond-use dating and storage conditions, optimizing inventory management in hospital and home care settings. Ongoing advancements focus on digital documentation systems that ensure traceability and compliance, supporting efficient recall processes and regulatory inspections in parenteral compounding operations.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.6 Billion, with a CAGR of 9.2%, and is expected to reach US$ 3.9 Billion by the year 2034.

- The product type segment is divided into injectable medications, injectable anesthetics, infusion solutions and others, with injectable medications taking the lead in 2024 with a market share of 49.6%.

- Considering application, the market is divided into pain management, hormone replacement therapy and others. Among these, pain management held a significant share of 54.3%.

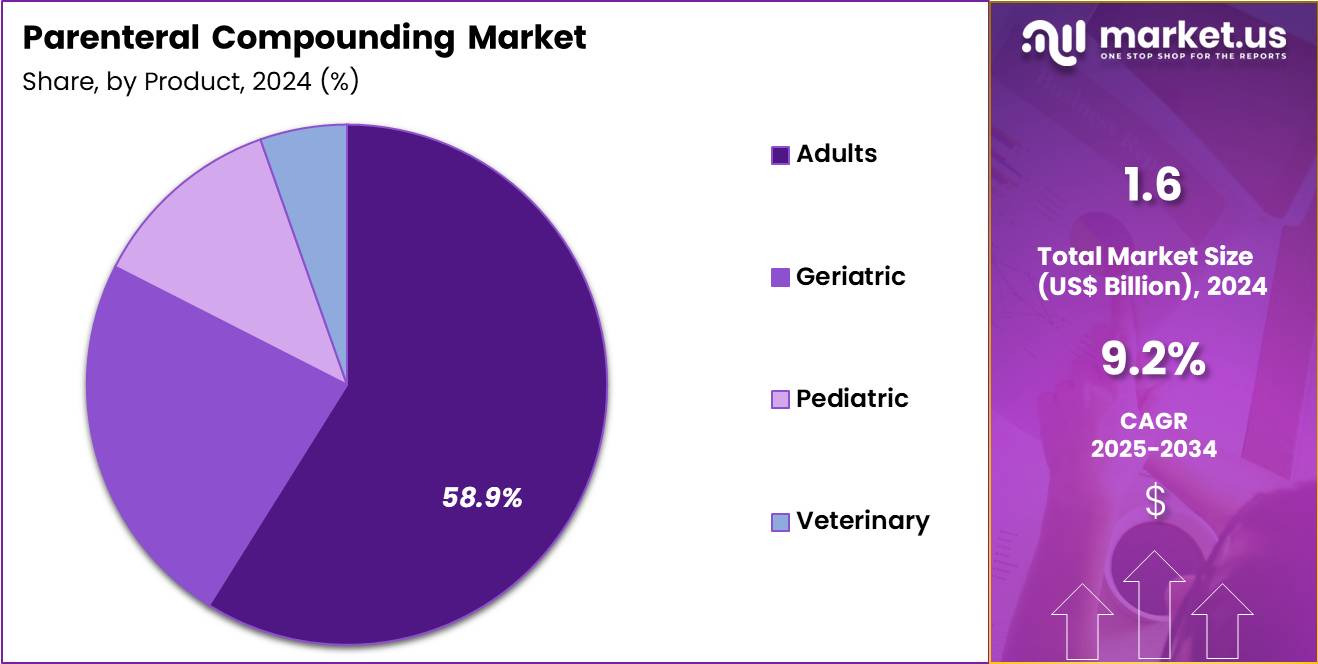

- Furthermore, concerning the end-user segment, the market is segregated into adults, pediatric, geriatric and veterinary. The adults sector stands out as the dominant player, holding the largest revenue share of 58.9% in the market.

- North America led the market by securing a market share of 38.6% in 2024.

Product Type Analysis

Injectable medications accounted for 49.6% of growth within product type and represent the core of the Parenteral Compounding market. Healthcare providers increasingly rely on compounded injectables to address drug shortages and dosage customization needs. Hospitals demand patient-specific formulations that commercial manufacturers do not supply.

Injectable compounding supports sterile, preservative-free, and allergen-free preparations for sensitive patients. Rising complexity of chronic and acute conditions increases demand for tailored injectable therapies. Clinicians prefer compounded injectables for precise dosing and concentration control. Oncology, critical care, and specialty clinics contribute to sustained utilization. Regulatory emphasis on sterile compounding standards improves trust in compounded injectables.

Outsourcing by hospitals to specialized compounding pharmacies supports volume growth. Injectable medications align with emergency and inpatient treatment protocols. Manufacturers invest in cleanroom infrastructure to scale production. Improved stability and compatibility testing strengthens clinical confidence. Customized injectables reduce medication waste and improve outcomes. Growing reliance on infusion-based therapies supports demand.

Short shelf-life commercial injectables encourage localized compounding. Healthcare systems prioritize continuity of care through compounded injectables. Advanced aseptic techniques improve safety profiles. The segment is expected to maintain leadership due to clinical necessity. Demand remains strong across hospital and specialty care settings. Overall growth reflects customization, supply reliability, and therapeutic precision.

Application Analysis

Pain management captured 54.3% of growth within application and stands as the leading driver of parenteral compounding demand. Chronic pain prevalence among adult populations increases reliance on injectable pain therapies. Compounded analgesics support individualized combinations and concentrations. Clinicians prefer parenteral pain solutions for rapid onset and controlled delivery.

Post-surgical and interventional pain treatments drive consistent usage. Pain clinics increasingly adopt compounded injectables for refractory cases. Reduced tolerance development supports customized regimens. Compounding enables alternative formulations during commercial drug shortages. Multimodal pain strategies increase demand for injectable blends. Hospitals rely on compounded pain medications for anesthesia adjuncts. Outpatient pain management expansion supports volume growth.

Personalized dosing improves patient comfort and compliance. Regulatory oversight strengthens standardized compounding practices. Aging populations contribute to sustained pain management needs. Sports injuries and trauma cases support acute demand. Injectable pain therapies integrate well with procedural care.

Physicians emphasize precision dosing to minimize side effects. Compounded injectables address unmet pain control requirements. The segment is anticipated to grow with chronic disease incidence. Overall dominance reflects clinical reliance and therapeutic effectiveness.

End-User Analysis

Adults represented 58.9% of growth within end-user categories and remain the largest consumer group in the Parenteral Compounding market. Adult patients account for the majority of hospital admissions and outpatient procedures. Chronic disease burden among adults drives demand for customized injectable therapies. Compounded parenterals support oncology, cardiology, and pain management treatments in adults. Lifestyle-related conditions increase reliance on injectable medications.

Adults require flexible dosing due to comorbidities and treatment complexity. Hospitals prioritize adult-focused compounding services to manage high patient volumes. Occupational injuries and surgical interventions contribute to sustained demand. Adult populations benefit from personalized formulations that reduce adverse reactions. Infusion centers increasingly serve adult chronic care patients.

Healthcare providers emphasize individualized therapy to improve outcomes. Adult patients demonstrate higher utilization of pain and specialty injectables. Compounding pharmacies tailor formulations for long-term adult care plans. Rising access to advanced healthcare supports utilization growth. Adults dominate clinical trial enrollments requiring compounded injectables.

Treatment adherence improves with customized dosing. Urban healthcare infrastructure supports adult patient concentration. The segment is projected to grow alongside aging working populations. Adult care remains central to hospital compounding strategies. Overall dominance reflects population size and therapeutic complexity.

Key Market Segments

By Product Type

- Injectable Medications

- Injectable Anesthetics

- Infusion Solutions

- Others

By Application

- Pain Management

- Hormone Replacement Therapy

- Others

By End-user

- Adults

- Pediatric

- Geriatric

- Veterinary

Drivers

Increasing drug shortages is driving the market

The parenteral compounding market is driven by the increasing drug shortages, which necessitate compounding to provide essential sterile medications when commercial supplies are unavailable. Healthcare providers rely on compounding pharmacies to fill gaps in parenteral drug availability, ensuring patient access to critical therapies. Regulatory agencies like the FDA acknowledge the role of compounding in addressing supply disruptions, supporting market growth through policy adjustments.

Pharmaceutical manufacturers face production challenges, leading to more reliance on compounding for intravenous solutions. Clinical settings, such as hospitals, utilize compounded parenterals to maintain treatment continuity for conditions requiring injectable drugs. Global supply chain issues exacerbate shortages, boosting demand for compounding services in various regions.

Academic research on drug availability highlights the importance of compounding in public health responses. Patient care benefits from compounded alternatives that prevent treatment delays. Economic impacts from shortages justify investment in compounding infrastructure. The U.S. Food and Drug Administration reported that the number of new drug shortages decreased every year since 2022, but active shortages and their average duration increased during this period.

Restraints

Strict regulatory oversight and enforcement is restraining the market

The parenteral compounding market is restrained by strict regulatory oversight and enforcement, which impose rigorous standards on outsourcing facilities to ensure product safety and quality. Manufacturers must comply with detailed guidelines for sterile compounding, increasing operational complexities and costs. Regulatory agencies conduct frequent inspections, leading to potential suspensions or corrective actions for non-compliant facilities.

Pharmaceutical firms face challenges in maintaining GMP standards for parenteral products, deterring market entry for smaller players. Clinical practices are impacted by enforcement actions that disrupt supply of compounded drugs. Global harmonization of standards remains incomplete, creating barriers for international operations. Academic analyses of regulatory impacts underscore the need for enhanced compliance training.

Patient safety priorities result in cautious adoption of compounded parenterals. Economic burdens from fines and recalls associated with enforcement limit market expansion. The U.S. Food and Drug Administration issued an immediately-in-effect guidance on Temporary Policies for Compounding Certain Parenteral Drug Products in October 2024, reflecting ongoing oversight due to supply issues.

Opportunities

Growth in outsourcing facilities for sterile compounding is creating growth opportunities

The parenteral compounding market offers growth opportunities through the growth in outsourcing facilities dedicated to sterile compounding, which provide scalable solutions for customized injectable medications. Developers can expand services to meet demands for high-risk sterile products, addressing gaps in commercial manufacturing. Regulatory frameworks encourage the establishment of outsourcing facilities with enhanced quality controls.

Healthcare systems benefit from outsourced compounding for specialized therapies in oncology and nutrition. Pharmaceutical partnerships focus on collaborating with facilities to ensure compliant production of parenterals. Clinical applications broaden with facilities enabling rapid response to drug shortages. Global market entry for outsourcing services aligns with healthcare infrastructure development.

Academic collaborations refine processes to improve facility efficiency. Patient access improves with outsourced options providing personalized dosages. The U.S. Food and Drug Administration’s guidance on compounding parenteral drugs in 2024 creates avenues for facilities to operate under temporary policies during supply disruptions.

Impact of Macroeconomic / Geopolitical Factors

Expanding global economies channel investments into specialized healthcare solutions, boosting the parenteral compounding market through greater demand for customized injectable therapies. Leaders pursue partnerships in high-growth areas, where increasing patient volumes for chronic conditions enhance revenue streams. Yet, persistent inflationary trends worldwide elevate ingredient and facility expenses, constraining scalability for mid-tier compounders in emerging territories.

Unstable geopolitical climates in supply-critical regions block access to vital sterile components, prolonging fulfillment cycles for international distributors. Strategists overcome these barriers by reallocating resources to secure zones, which strengthens contingency planning and diversifies vendor portfolios. Active US tariffs, now at 100% on branded pharmaceutical imports from select nations as of late 2025, impose heavy financial strains on foreign-reliant operations.

Regional players harness this policy to intensify local compounding infrastructures, generating employment and advancing quality controls at home. Pioneering regulatory alignments and digital tracking tools steadily fortify the industry’s foundation, paving the way for accelerated adoption and profitable horizons.

Latest Trends

Implementation of temporary compounding policies due to supply disruptions is a recent trend

In 2024, the parenteral compounding market has exhibited a prominent trend toward the implementation of temporary compounding policies to address supply disruptions in intravenous solutions. Regulatory agencies have issued guidance allowing compounding under specific conditions to mitigate shortages. Healthcare providers are adapting protocols to incorporate compounded parenterals for critical care needs.

Pharmaceutical stakeholders are collaborating on policy compliance to ensure safe production during disruptions. Clinical practices are prioritizing compounded alternatives to maintain treatment continuity. Global supply issues have prompted similar policy adjustments in various regions. Academic research is evaluating the impact of these policies on product quality.

Patient care is supported by temporary measures enabling access to essential drugs. Ethical considerations are ensuring equitable distribution during policy implementation. The U.S. Food and Drug Administration issued the Temporary Policies for Compounding Certain Parenteral Drug Products guidance on October 11, 2024, in response to supply disruptions.

Regional Analysis

North America is leading the Parenteral Compounding Market

In 2024, North America held a 38.6% share of the global parenteral compounding market, bolstered by surging requirements for customized intravenous formulations in hospitals and home care settings, where chronic illnesses and drug shortages necessitated tailored nutrient admixtures and pain management solutions. Healthcare facilities expanded reliance on 503B outsourcing facilities to produce sterile injectables compliant with Current Good Manufacturing Practices, addressing gaps in commercial supply for pediatric and oncology patients.

Regulatory updates from the Food and Drug Administration emphasized risk-based oversight, encouraging investments in automated compounding technologies that enhance precision and reduce contamination hazards. Aging demographics intensified demands for compounded electrolytes and antibiotics, while telehealth integrations facilitated remote monitoring of infusion therapies.

Pharmaceutical collaborations refined aseptic techniques for high-risk preparations, optimizing stability for extended administration protocols. Supply networks fortified access to USP-grade ingredients, supporting scalability in high-volume compounding centers. Collaborative quality assurance programs tracked adverse events, fostering trust in these essential services. The U.S. Food and Drug Administration reported that 90 firms registered as outsourcing facilities in fiscal year 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Industry experts project notable escalation in parenteral compounding practices across Asia Pacific over the forecast period, as burgeoning healthcare infrastructures confront escalating needs for individualized injectables amid chronic disease epidemics. Clinicians prioritize customized IV admixtures for malnutrition management, adapting compositions to regional dietary deficiencies in densely populated urban areas.

National authorities subsidize facility upgrades with robotic mixers, equipping public hospitals to handle surges in antibiotic shortages during monsoon-related outbreaks. Biotech developers innovate preservative-free solutions through local sourcing, tailoring them to tropical stability challenges for neonatal care. Regional health coalitions validate compounding protocols through joint audits, ensuring adherence to international sterility norms in emerging markets.

Pharmaceutical manufacturers forge partnerships for technology localization, bridging gaps in oncology infusion preparations for aging cohorts. Community training modules empower pharmacists on safe handling, extending services to remote clinics facing logistical constraints. The International Diabetes Federation estimates that 215 million people in the Western Pacific Region have diabetes.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Parenteral Compounding market drive growth by expanding sterile capacity, automation, and closed-system technologies that improve accuracy and reduce contamination risk for complex injectables. Companies increase demand by aligning offerings with oncology, critical care, and personalized medicine needs where customized dosing adds clear clinical value.

Commercial strategies prioritize long-term contracts with hospitals and health systems, supported by rapid turnaround, formulary alignment, and reliability assurances. Innovation efforts focus on workflow digitization, environmental monitoring, and advanced quality controls that meet tightening regulatory expectations.

Market expansion targets regions centralizing IV admixture services and outsourcing to improve efficiency and safety. Fresenius Kabi operates as a leading participant with a global sterile manufacturing footprint, deep expertise in injectable therapies, and integrated services that support consistent, compliant parenteral preparation at scale.

Top Key Players

- Wedgewood Pharmacy

- Piramal Pharma Solutions

- Nephron Pharmaceuticals Corporation

- ICU Medical, Inc.

- Grifols, S.A.

- Fresenius Kabi AG

- Baxter International Inc.

- Braun Melsungen AG

- Avella Specialty Pharmacy

- Ajinomoto Bio-Pharma Services

Recent Developments

- In March 2025, Novo Nordisk indicated that it may pursue legal measures against pharmacies preparing imitation versions of its injectable weight-management therapy, raising concerns around intellectual property protection and patient safety. This stance alters the parenteral compounding landscape by discouraging large-scale copy production and shifting demand toward strictly compliant sterile compounding activities. As regulatory attention intensifies, hospitals and clinicians increasingly depend on accredited facilities that focus on shortage-related, patient-specific injectable formulations, reinforcing the role of high-standard parenteral compounding services.

- During March 2025, Sycamore Partners revealed plans to acquire Walgreens in a transaction valued at USD 10 billion, a move that could reposition the pharmacy chain under private ownership. This potential restructuring supports the parenteral compounding market by creating room for longer-term investments in specialized clinical services rather than short-term financial performance. With greater flexibility, Walgreens may strengthen infusion capabilities, collaborate more closely with healthcare providers, and broaden access to customized injectable preparations in outpatient and specialty care environments.

Report Scope

Report Features Description Market Value (2024) US$ 1.6 Billion Forecast Revenue (2034) US$ 3.9 Billion CAGR (2025-2034) 9.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Injectable Medications, Injectable Anesthetics, Infusion Solutions and Others), By Application (Pain Management, Hormone Replacement Therapy and Others), By End-User (Adults, Pediatric, Geriatric and Veterinary Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Wedgewood Pharmacy, Piramal Pharma Solutions, Nephron Pharmaceuticals Corporation, ICU Medical, Inc., Grifols, S.A., Fresenius Kabi AG, Baxter International Inc., B. Braun Melsungen AG, Avella Specialty Pharmacy, Ajinomoto Bio-Pharma Services. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Parenteral Compounding MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Parenteral Compounding MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Wedgewood Pharmacy

- Piramal Pharma Solutions

- Nephron Pharmaceuticals Corporation

- ICU Medical, Inc.

- Grifols, S.A.

- Fresenius Kabi AG

- Baxter International Inc.

- Braun Melsungen AG

- Avella Specialty Pharmacy

- Ajinomoto Bio-Pharma Services