Global Cytotoxic Drugs Market Analysis By Type (Branded drugs, Generic drugs), By Drug Class (Antimetabolites, Antitumor antibiotics, Plant alkaloids, Alkylating agents, Other drug classes), By Route of Administration (Oral, Parenteral), By Application (Oncology, Rheumatoid arthritis, Multiple sclerosis, Other applications), By Distribution Channel (Hospital pharmacies, Retail pharmacies, Online pharmacies) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135946

- Number of Pages: 365

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

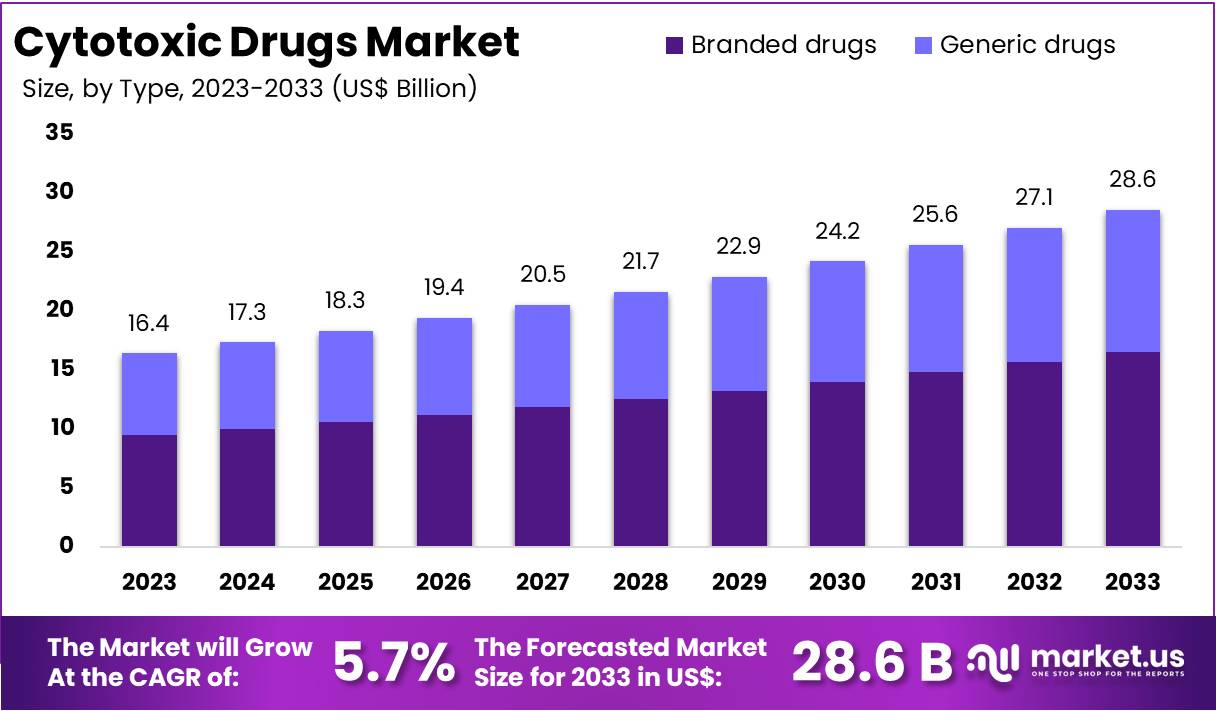

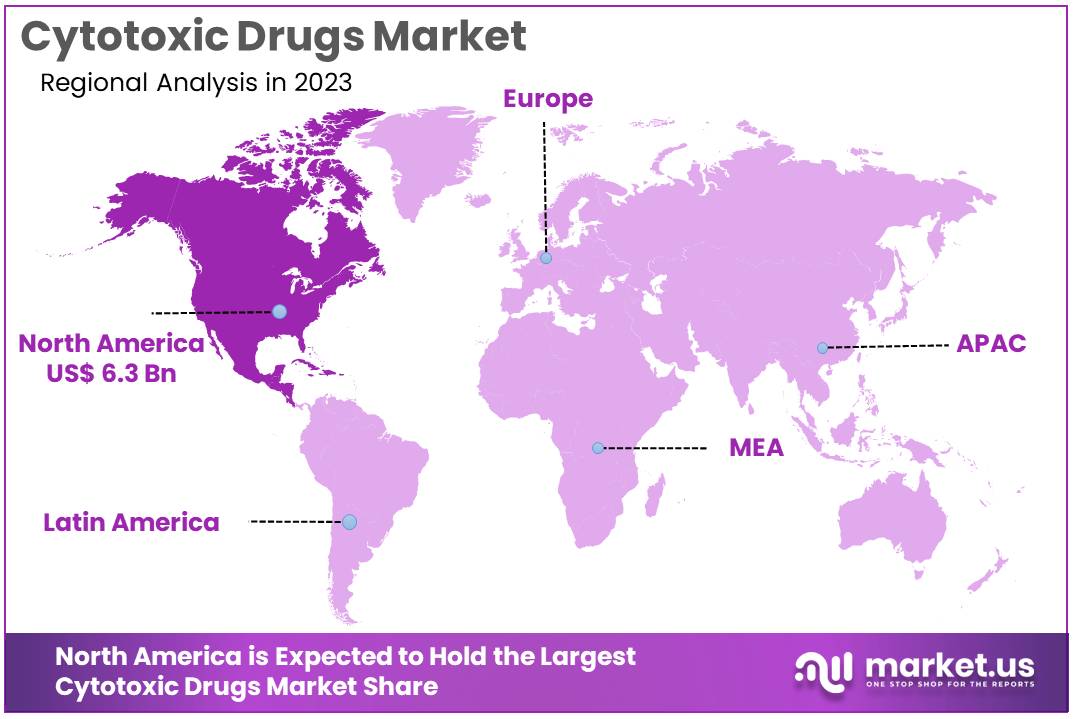

The Global Cytotoxic Drugs Market Size is expected to be worth around US$ 28.6 Billion by 2033, from US$ 16.4 Billion in 2023, growing at a CAGR of 5.7% during the forecast period from 2024 to 2033. North America emerged as the leading region in the Cytotoxic Drugs Market, accounting for 38.6% of the market share, with a valuation of US$ 6.3 billion.

The cytotoxic drugs sector, critical for cancer treatment, is influenced by various factors such as end-use industries, international trade, government regulations, initiatives, investments, and corporate activities. According to healthcare statistics, cytotoxic drugs are primarily used in hospitals, oncology clinics, and research centers to treat cancers like breast, lung, and pancreatic cancers. These drugs play a pivotal role in chemotherapy protocols, reflecting the reliance on advanced treatments in healthcare.

Import-export activities in cytotoxic drugs are governed by stringent safety and efficacy standards. For example, the U.S. FDA ensures that all imported drugs meet domestic safety, labeling, and quality requirements. Globally, countries like the United States maintain robust regulatory frameworks to monitor drug safety. Export certificates issued by the FDA, averaging 8,500 annually, facilitate access to quality medicines in countries such as Mexico and China, supporting global health initiatives.

Government regulations also shape the cytotoxic drugs market. According to the FDA, compliance with good manufacturing practices (cGMPs) and proper labeling is mandatory. Additionally, foreign drug establishments manufacturing for the U.S. market must register with the FDA. These measures ensure that cytotoxic drugs meet the required safety and effectiveness standards, fostering trust in the pharmaceutical supply chain.

Government initiatives are instrumental in enhancing cancer treatment access. For instance, the FDA’s export certificates enable global availability of high-quality drugs. Such initiatives play a crucial role in addressing the growing burden of cancer worldwide. This regulatory support complements private investments, creating a balanced approach to drug accessibility and innovation.

The pharmaceutical industry’s commitment to innovation is reflected in its substantial investments in research and development. For example, pharmaceutical companies allocate resources to develop new drugs and improve existing formulations. While specific figures are proprietary, the overall investment in the sector highlights the commitment to advancing cancer therapies and maintaining a competitive edge in the global market.

Corporate activities like mergers and acquisitions significantly influence the pharmaceutical landscape. For example, Amgen acquired Horizon Therapeutics plc for $27.8 billion in October 2023. This strategic move expands Amgen’s portfolio, particularly in rare disease treatments, supporting its revenue growth and enhancing capabilities in inflammation and rare diseases.

Beyond cancer, the global prevalence of psoriasis underscores the importance of effective treatments. According to the Global Psoriasis Atlas, over 60 million people are affected globally, including 8 million in the United States. Nearly 30% of these individuals develop psoriatic arthritis. Psoriasis significantly impacts quality of life, with 60% of patients reporting challenges in daily activities, work, and social interactions.

Neurological conditions are another major healthcare concern. A study by Health Data in 2021 found that 3.4 billion individuals, representing 43% of the global population, live with neurological disorders. These conditions are now the leading cause of ill health, accounting for 443 million years of healthy life lost. Regional disparities persist, with over 80% of neurological deaths occurring in low- and middle-income countries, highlighting a pressing need for equitable healthcare access.

Key Takeaways

- In 2023, branded drugs dominated the Cytotoxic Drugs Market type segment, holding a significant 57.8% market share due to their widespread adoption.

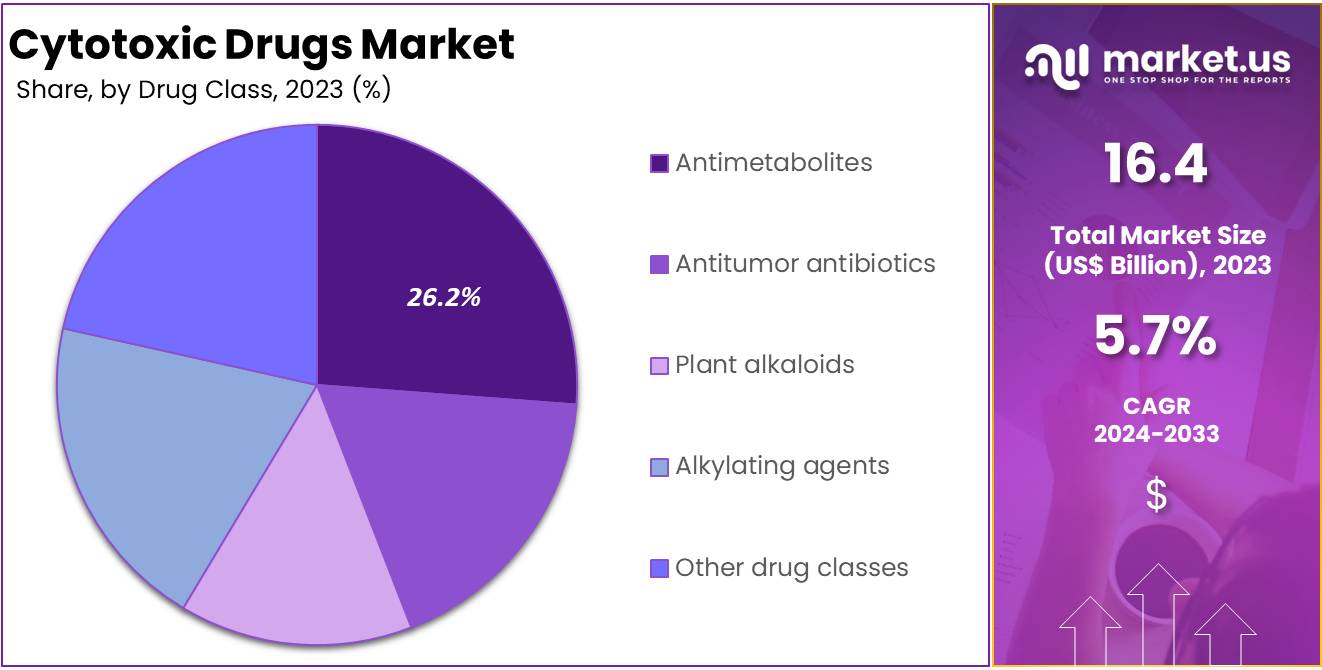

- The antimetabolites drug class captured 26.2% of the Cytotoxic Drugs Market in 2023, establishing itself as the leading segment in this category.

- The oral route of administration led the Cytotoxic Drugs Market in 2023, accounting for a dominant 68.9% market share.

- Hospital pharmacies secured the top position in the distribution channel segment of the Cytotoxic Drugs Market in 2023, holding a 40.7% share.

- North America was the leading region for the Cytotoxic Drugs Market in 2023, with a 38.6% share and a market value of US$ 6.3 billion.

Type Analysis

In 2023, the Branded drugs segment held a dominant market position in the Type Segment of the Cytotoxic Drugs Market. It captured more than a 57.8% share. This portion of the market benefits significantly from established brand loyalty and the high efficacy associated with branded medications. Patients and healthcare providers often opt for these drugs due to their proven effectiveness and comprehensive clinical testing history.

The preference for branded drugs stems from their reliability and the trust that healthcare professionals place in their clinical benefits. These drugs are typically the first choice for treatment, offering patients confidence in their therapeutic outcomes. The strong market share of branded drugs underscores their importance in patient care and treatment protocols.

On the other hand, the Generic drugs segment plays a vital role by providing cost-effective alternatives. These generics are pivotal in enhancing accessibility to treatments, particularly in regions with limited healthcare budgets. The availability of generics is set to increase as patents on key cytotoxic drugs expire, which will introduce more competitive pricing and availability in the market.

As the market adjusts to these changes, stakeholders are keeping a close eye on the evolving dynamics between branded and generic drugs. They are particularly vigilant about patent expirations and regulatory shifts, which could significantly alter market strategies. This vigilance is crucial for maintaining a competitive edge and fostering innovation within the Cytotoxic Drugs Market.

Drug Class Analysis

In 2023, the Antimetabolites segment held a dominant position in the drug class segment of the Cytotoxic Drugs Market, capturing over a 26.2% share. These drugs mimic the essential building blocks of DNA and RNA. They are mainly used in combating cancers like leukemia and ovarian cancer. Their targeted action disrupts cancer cell growth, contributing significantly to their market lead.

Antitumor antibiotics represent another vital market segment. Unlike regular antibiotics, these interact directly with DNA to block cancer cell replication. They are primarily used against cancers like leukemia, playing a key role in combination therapies. Their ability to inhibit cancer cell growth enhances their importance in the market.

The Plant Alkaloids segment includes drugs derived from natural plant sources. These drugs block cell division, which is crucial in treating various cancers, including lung and breast cancers. Their mechanism involves halting the cell cycle, preventing cancer cells from progressing. This segment is known for its effectiveness in cases where traditional treatments might be inadequate.

Alkylating agents and other drug classes also play significant roles. Alkylating agents are renowned for adding alkyl groups to DNA, treating brain tumors and lymphomas by blocking DNA replication. The ‘Other Drug Classes’ segment encompasses a broad range of cytotoxic drugs that target specific cancer mutations, offering innovative treatment options and supporting market growth.

Route of Administration Analysis

In 2023, the Oral segment held a dominant market position in the Route of Administration Analysis Segment of the Cytotoxic Drugs Market, capturing more than a 68.9% share. This high percentage underscores the preference for oral cytotoxic medications. These drugs are favored for their ease of administration and patient compliance. They are typically used in the home setting, which can reduce hospital stays and associated healthcare costs.

On the other hand, the Parenteral route, which includes intravenous and other non-oral methods of administration, is essential for drugs that are not suitable for oral intake. This route is crucial for immediate drug action or when the drug’s properties do not allow for effective absorption through the digestive system. While less convenient than oral medications, parenteral administration remains critical for specific therapeutic needs and conditions.

Both administration routes are vital for delivering effective treatment across various cancer types, playing significant roles in oncology. However, the simplicity and non-invasive nature of oral medications continue to drive their dominance in the market.

Application Analysis

In the cytotoxic drugs market, the oncology segment stands out significantly, primarily utilized in chemotherapy to target and disrupt the growth of rapidly dividing cancer cells. This segment’s expansion is driven by the rising global cancer prevalence and advancements in drug formulations. Concurrently, cytotoxic drugs have a pivotal role in treating severe rheumatoid arthritis by modulating the immune response and reducing inflammation. Developments in autoimmune disease research have enabled more targeted and effective treatments, enhancing patient outcomes.

The use of cytotoxic drugs in managing multiple sclerosis highlights their importance in suppressing immune system attacks on the nervous system. This application is crucial for treating progressive types of the disease, which are often resistant to other treatments. The segment benefits from the increasing diagnosis rates and the ongoing need for potent therapeutic options, ensuring sustained growth within this market niche.

Beyond their primary applications, cytotoxic drugs are increasingly employed in the management of severe autoimmune conditions like psoriasis and lupus, as well as certain aggressive kidney diseases. As research progresses, the understanding of cytotoxic mechanisms expands, suggesting potential applications across a wider spectrum of diseases. This segment is poised for growth as it explores new therapeutic frontiers, offering hope for conditions previously deemed untreatable with conventional methods.

Distribution Channel Analysis

In 2023, the Hospital pharmacies segment held a dominant market position in the Distribution Channel Analysis segment of the Cytotoxic Drugs Market, capturing more than a 40.7% share. This segment’s lead is attributed to its pivotal role in chemotherapy administration and ongoing patient management. Hospital pharmacies are essential for the precise handling and dosage of cytotoxic drugs, which are crucial in cancer treatment protocols.

These facilities are well-equipped to meet the strict guidelines required for the storage and disposal of these potent medications. Retail pharmacies also contribute significantly to the market. They provide easy access to medications for patients undergoing outpatient treatment. This is vital for maintaining continuity in cancer care outside of hospital settings.

Online pharmacies have seen a rise in patient preference due to their convenience and the growing adoption of digital health services. These platforms allow patients to receive their medications discreetly at home, which is particularly beneficial for those in long-term treatment. Online pharmacies often provide competitive pricing and additional patient support services.

Overall, each distribution channel uniquely enhances the availability and efficacy of cytotoxic drug treatments. They cater to different patient needs and adhere to specific care standards, ensuring comprehensive support throughout the treatment process.

Key Market Segments

By Type

- Branded drugs

- Generic drugs

By Drug Class

- Antimetabolites

- Antitumor antibiotics

- Plant alkaloids

- Alkylating agents

- Other drug classes

By Route of Administration

- Oral

- Parenteral

By Application

- Oncology

- Rheumatoid arthritis

- Multiple sclerosis

- Other applications

By Distribution Channel

- Hospital pharmacies

- Retail pharmacies

- Online pharmacies

Drivers

Increasing Prevalence of Cancer

The increasing incidence of cancer worldwide is a significant driver for the cytotoxic drugs market. These drugs play a crucial role in chemotherapy by targeting and eliminating rapidly multiplying cancer cells. As the prevalence of cancer rises, so does the demand for effective treatment options. Cytotoxic drugs are integral to managing this disease, which remains a major health challenge globally.

Cytotoxic drugs are specifically designed to interfere with cell division, which is a hallmark of cancer. By targeting these fast-growing cells, the drugs prevent the proliferation of cancer throughout the body. This mechanism of action makes them vital in the arsenal against various forms of cancer, contributing to their sustained demand in the healthcare sector.

The global health landscape sees cancer as one of the top health issues, necessitating continuous advancements in treatment methodologies. Cytotoxic drugs have been at the forefront of chemotherapy for decades. Their effectiveness in reducing tumor growth rates underscores their importance in cancer treatment protocols, thereby driving market growth.

As research continues and the global burden of cancer grows, the development of more effective cytotoxic drugs is critical. This ongoing need propels the pharmaceutical industry to invest in new research and development initiatives. Such investments aim to enhance the efficacy and reduce the side effects of these drugs, further stimulating market growth and offering hope to cancer patients worldwide.

Restraints

High Toxicity and Side Effects

The primary challenge facing the cytotoxic drugs market is the high toxicity associated with these medications. Cytotoxic drugs, designed to kill or inhibit the growth of cancer cells, often affect healthy cells as well. This broad impact can lead to significant side effects for patients, such as severe nausea and hair loss. These adverse effects highlight a critical limitation in the use of these drugs, especially in treatments where patient quality of life is a priority.

Another significant side effect of cytotoxic drugs is immunosuppression. By targeting rapidly dividing cells, these drugs not only attack cancer cells but also impair the body’s immune responses. This reduction in immune capability exposes patients to a higher risk of infections and can complicate recovery from both cancer and treatment side effects. The severity of these impacts varies but remains a constant concern.

The drawbacks of cytotoxic drugs have catalyzed a shift toward more targeted therapies and personalized medicine approaches. These newer treatments aim to minimize side effects by focusing on specific cellular targets associated with cancer, thereby sparing normal, healthy cells. This specificity not only reduces toxicity but also enhances the effectiveness of the treatment, tailoring it to individual genetic profiles and disease characteristics.

As a result of these advancements, the demand for broad-spectrum cytotoxic drugs is experiencing a potential decline. Healthcare providers and patients are increasingly opting for safer and more effective treatment options that promise better outcomes with fewer side effects. This trend is reshaping the market landscape, steering it towards more innovative and patient-centric solutions that address the limitations of traditional cytotoxic therapies.

Opportunities

Advances in Drug Delivery Systems

Opportunity in advanced drug delivery systems presents a promising avenue in healthcare, particularly in improving the administration of cytotoxic drugs. These drugs, essential in cancer treatment, often come with severe side effects due to their aggressive nature. The development of innovative delivery mechanisms aims to mitigate these effects, making treatments not only more bearable for patients but potentially more effective as well.

One significant advancement is the use of nanoparticle carriers. These tiny particles can be engineered to deliver drugs directly to cancer cells, minimizing damage to healthy tissues. This targeted approach helps in reducing the side effects associated with cytotoxic drugs, thereby improving patient comfort and compliance.

Furthermore, these advanced delivery systems enhance the efficacy of the drugs themselves. By ensuring that a higher concentration of the drug directly reaches the cancer cells, these systems increase the likelihood of successful treatment outcomes. This targeted method not only makes the drugs more effective but also may reduce the quantity of drugs needed, potentially lowering treatment costs.

The integration of such technologies into clinical practice is anticipated to broaden the applicability of cytotoxic drugs. As these advanced systems become more refined, they promise to revolutionize treatment protocols, leading to wider usage and acceptance of cytotoxic drugs across different patient demographics. This progression marks a significant stride towards more personalized and efficient cancer therapy.

Trends

Combination Therapies

The cytotoxic drugs market is evolving with the increasing adoption of combination therapies. This approach integrates cytotoxic drugs with other cancer treatments, such as immunotherapy and targeted agents. Such strategies are primarily aimed at enhancing the effectiveness of treatment regimens. By using multiple therapeutic methods, healthcare providers can address a broader range of cancer cell behaviors and resistance mechanisms.

Combination therapies represent a critical advancement in oncology. They are designed to combat the issue of drug resistance, a common challenge with traditional chemotherapy. When cancer cells become resistant, they no longer respond to standard treatments, making the disease harder to manage. By combining cytotoxic drugs with other types of cancer therapies, the effectiveness of the treatment is significantly improved, leading to better patient outcomes.

These therapies are particularly valuable in treating various cancer types. Each type of cancer responds differently to treatment, and the flexibility of combination therapies allows for tailored treatment plans. This personalized approach ensures that patients receive the most effective combination of drugs for their specific type of cancer, thereby increasing the likelihood of a positive response to the treatment.

The trend towards combination therapies in the cytotoxic drugs market underscores a shift towards more personalized and effective cancer treatment solutions. As research continues and more is understood about the interactions between different therapies, the use of combination therapies is expected to grow. This not only enhances therapeutic efficacy but also offers new hope to patients battling complex and resistant forms of cancer.

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 38.6% share and holds US$ 6.3 billion market value for the year. This substantial market presence can be attributed to advanced healthcare infrastructure and aggressive investment in oncology research. The region’s commitment to developing and fast-tracking the approval of innovative cytotoxic therapies has propelled its market leadership. High per capita healthcare spending and strategic collaborations between biotechnology firms and research institutions also contribute to sustained growth.

The concentration of major pharmaceutical companies in North America, particularly in the U.S., boosts the regional market. These companies are pioneers in introducing advanced cytotoxic drugs, which are pivotal in treating various cancers. Their ongoing efforts in R&D activities are supported by significant government and private funding, which enhances the development pipeline of effective treatments. Furthermore, the presence of a robust regulatory framework ensures the rapid approval and distribution of new therapies, maintaining market vitality.

Looking forward, the North American cytotoxic drugs market is poised for continued expansion. Increasing cancer prevalence and the rising demand for potent therapeutic options are key growth drivers. Additionally, public and private healthcare sectors are increasingly advocating for personalized medicine, which relies heavily on cytotoxic drugs for targeted cancer therapy. As technological advancements in drug delivery systems evolve, they are expected to further enhance the efficacy and reduce the side effects of these treatments, thereby reinforcing the region’s market dominance.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Amgen Inc. leads in the cytotoxic drugs market, focusing on innovative oncology products that effectively target various cancers. Their global strategy ensures widespread availability of their therapies. Similarly, Bristol-Myers Squibb is recognized for its robust cytotoxic drug portfolio, aimed at inhibiting cancer cell growth. Their commitment to advancing clinical trials underscores a focus on developing groundbreaking treatments that meet critical healthcare needs.

Eli Lilly and Company invests heavily in cancer research, producing cytotoxic drugs that address diverse cancer types. Their dedication to enhancing patient care is evident in their continuous research efforts. Likewise, F. Hoffmann-La Roche Ltd. excels with its tailored oncology treatments, enhancing survival rates and quality of life for patients globally through innovative therapies.

Fresenius Kabi AG champions affordability and quality in cancer care by providing generic cytotoxic drugs. They are expanding their reach to ensure a stable drug supply. The market also includes other key players who enrich the sector by pushing for innovations in cytotoxic drug development. This collective effort helps meet therapeutic demands worldwide, maintaining competitive market dynamics.

Market Key Players

- Amgen Inc.

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd.

- Fresenius Kabi AG

- Merck & Co. Inc.

- Novartis AG

- Pfizer Inc.

- Sanofi

- Teva Pharmaceutical Industries Ltd.

Recent Developments

- In October 2024: Eli Lilly has initiated a significant investment of $4.5 billion to establish the Lilly Medicine Foundry. This facility is designed to enhance the company’s drug manufacturing capabilities, specifically focusing on clinical trial medicines, which include various cytotoxic and other molecular therapies. This strategic development aims to optimize manufacturing processes and expand capacity, thus accelerating the development and availability of new cytotoxic drugs.

- In May 2024: Amgen received FDA approval for IMDELLTRA™ (tarlatamab-dlle), a novel T-cell engager therapy for treating extensive-stage small cell lung cancer (ES-SCLC) in patients showing disease progression after platinum-based chemotherapy. This first-in-class DLL3-targeting therapy demonstrated an objective response rate of 40% and a median duration of response of 9.7 months in pivotal clinical trials. This approval highlights Amgen’s ongoing innovation in addressing aggressive cancers.

Report Scope

Report Features Description Market Value (2023) US$ 16.4 Billion Forecast Revenue (2033) US$ 28.6 Billion CAGR (2024-2033) 5.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Branded drugs, Generic drugs), By Drug Class (Antimetabolites, Antitumor antibiotics, Plant alkaloids, Alkylating agents, Other drug classes), By Route of Administration (Oral, Parenteral), By Application (Oncology, Rheumatoid arthritis, Multiple sclerosis, Other applications), By Distribution Channel (Hospital pharmacies, Retail pharmacies, Online pharmacies) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Amgen Inc., Bristol-Myers Squibb Company, Eli Lilly and Company, F. Hoffmann-La Roche Ltd., Fresenius Kabi AG, Merck & Co. Inc., Novartis AG, Pfizer Inc., Sanofi, Teva Pharmaceutical Industries Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amgen Inc.

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd.

- Fresenius Kabi AG

- Merck & Co. Inc.

- Novartis AG

- Pfizer Inc.

- Sanofi

- Teva Pharmaceutical Industries Ltd.