Global Paper and Paperboard Packaging Market Size, Share, Growth Analysis By Grade (White Lined Chipboard (WLC), Solid Bleached Sulfate (SBS), Coated Unbleached Kraft Paperboard (CUK), Folding Boxboard (FBB), Glassine & Greaseproof Paper, Label Paper, Others), By Type (Corrugated Box, Boxboard, Flexible Paper), By End Use (Food & Beverage, Healthcare, Personal Care, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144198

- Number of Pages: 258

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

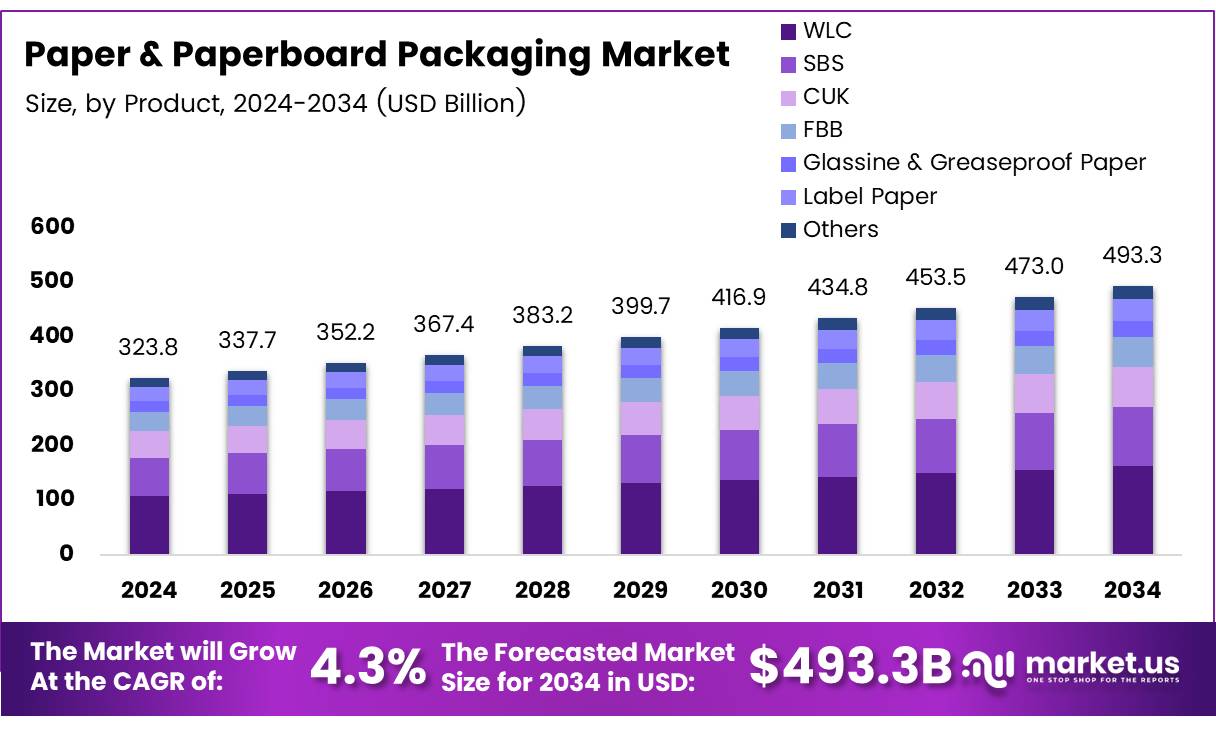

The Global Paper and Paperboard Packaging Market size is expected to be worth around USD 493.3 Billion by 2034, from USD 323.8 Billion in 2024, growing at a CAGR of 4.3% during the forecast period from 2025 to 2034.

The Paper and Paperboard Packaging Market is a vital segment within the global packaging industry. It primarily involves the use of paper and paperboard materials for the packaging of goods, ranging from food and beverages to consumer products and industrial goods.

The market’s primary drivers include the increasing demand for sustainable, eco-friendly packaging solutions and the rise of e-commerce, which has led to greater demand for shipping materials. Paperboard packaging, in particular, is favored for its versatility, recyclability, and biodegradability, which make it a preferred alternative to plastic.

The market’s growth is being shaped by the increasing consumer awareness of environmental issues, coupled with growing demand for renewable and recyclable materials. This trend is expected to drive innovation and adoption in the coming years.

The paper and paperboard packaging industry is experiencing strong growth, driven by rising environmental concerns and an increasing focus on sustainability.

According to Vision hunters, more than 80% of paper and board packaging materials are recycled in Europe, underscoring the market’s commitment to sustainability. This provides a significant opportunity for companies to innovate in packaging solutions that are both eco-friendly and cost-efficient.

In the United States, the American Forest & Paper Association (AF&PA) reported that 65-69% of paper available for recovery was recycled in 2023, highlighting the country’s ongoing efforts to increase paper recycling rates.

Governments worldwide are increasingly investing in the development of circular economies and green technologies to promote sustainable packaging. Policies such as extended producer responsibility (EPR) and packaging waste regulations are encouraging companies to adopt recyclable and renewable materials. The recycling rate of paper and cardboard packaging is impressive, with 70.6% of paper and cardboard packaging being recycled annually, according to Businesswaste.

This demonstrates a growing commitment to reducing environmental footprints and enhancing recycling infrastructures. With continued government support and evolving regulations, the paper and paperboard packaging industry is well-positioned to capture more market share as both businesses and consumers shift toward sustainable practices.

Key Takeaways

- The global paper and paperboard packaging market is projected to reach USD 493.3 billion by 2034, growing at a CAGR of 4.3% from 2025 to 2034.

- In 2024, White Lined Chipboard (WLC) dominated the market in the By Grade Analysis segment.

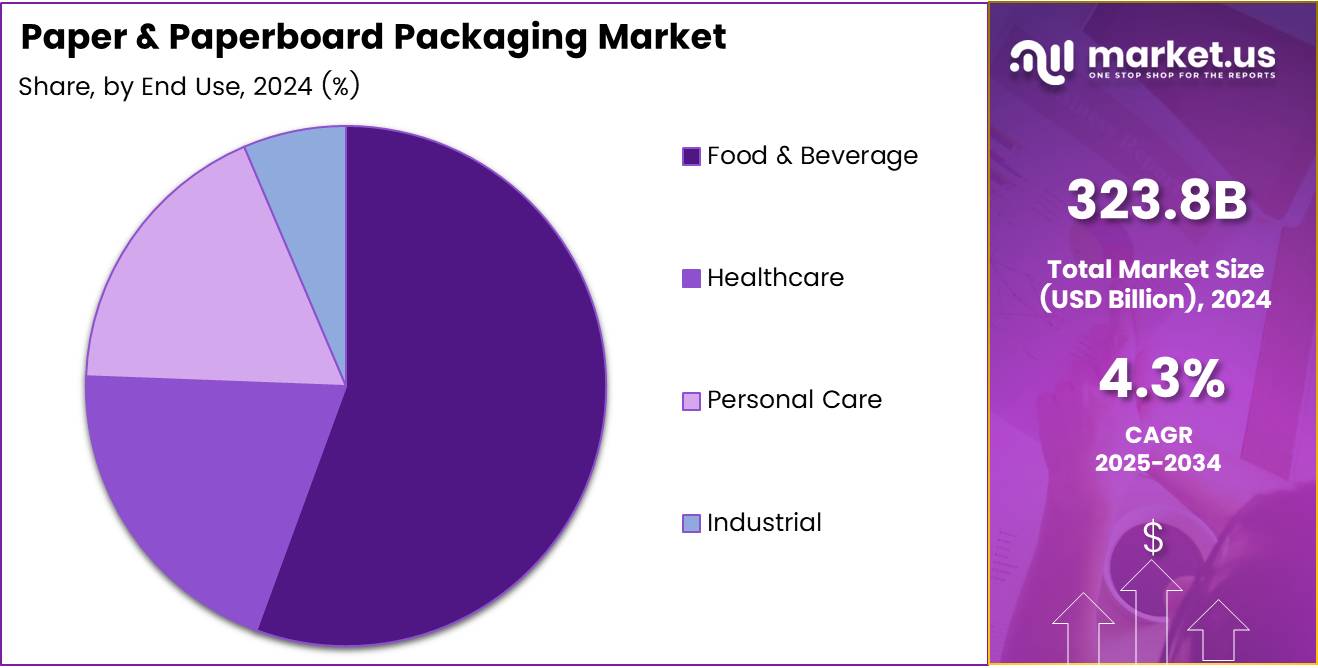

- The Food & Beverage sector led the market in the By End Use Analysis segment in 2024, driven by demand for sustainable packaging.

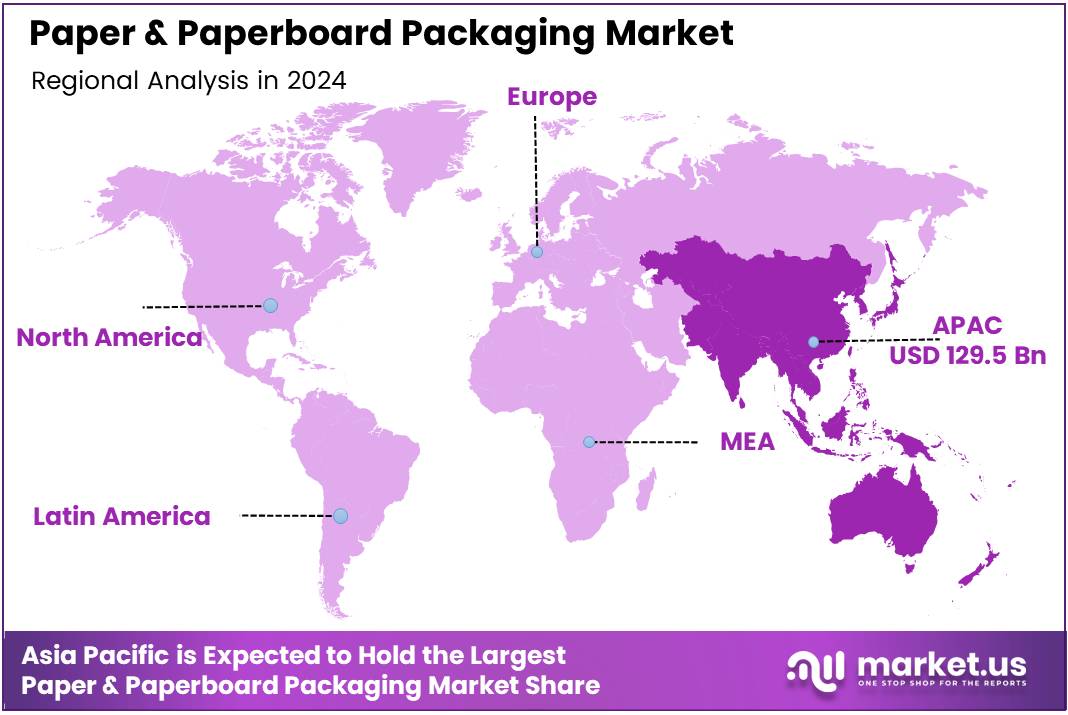

- Asia Pacific holds the largest market share (40.1%), valued at USD 129.5 billion, in the global paper and paperboard packaging market.

Grade Analysis

White Lined Chipboard (WLC) Leads By Grade Analysis in Paper and Paperboard Packaging Market in 2024 with a Significant Share

In 2024, White Lined Chipboard (WLC) held a dominant market position in the By Grade Analysis segment of the Paper and Paperboard Packaging Market, capturing a substantial market share.

WLC’s widespread use in consumer goods packaging, including food and beverages, has been driven by its excellent printability, versatility, and cost-effectiveness. The material is favored for its ability to provide a high-quality finish while remaining environmentally friendly, which appeals to sustainability-conscious businesses.

Solid Bleached Sulfate (SBS) follows closely as another strong contender in the market due to its premium quality, smooth surface, and white appearance, making it ideal for high-end packaging applications.

Coated Unbleached Kraft Paperboard (CUK), known for its robustness, is primarily used in the packaging of heavy-duty products, including industrial goods. Folding Boxboard (FBB) also holds a notable position, especially in the packaging of high-quality consumer products, such as cosmetics and pharmaceuticals.

End Use Analysis

Food & Beverage Leads Paper and Paperboard Packaging Market by End Use Analysis in 2024

In 2024, the Food & Beverage sector held a dominant position in the By End Use Analysis segment. This remarkable share can be attributed to the high demand for eco-friendly and sustainable packaging solutions, driven by consumer preference for environmentally conscious packaging materials in the food and beverage industry.

Paper and paperboard are widely used for packaging a variety of products, including beverages, snacks, and ready-to-eat meals, offering benefits such as recyclability and reduced carbon footprint compared to plastic alternatives.

The Healthcare sector followed closely, contributing to the growing demand for paper-based packaging for pharmaceutical products, medical devices, and personal care items. As regulations around sustainability tighten, healthcare companies are increasingly opting for paper and paperboard packaging solutions that are both functional and environmentally responsible.

Personal Care and Industrial segments also exhibited substantial growth, fueled by the rising need for packaging in cosmetics, hygiene products, and industrial goods. Both sectors are adopting sustainable packaging solutions to align with growing consumer and regulatory demands for greener alternatives.

Key Market Segments

By Grade

- White Lined Chipboard (WLC)

- Solid Bleached Sulfate (SBS)

- Coated Unbleached Kraft Paperboard (CUK)

- Folding Boxboard (FBB)

- Glassine & Greaseproof Paper

- Label Paper

- Others

By Type

- Corrugated Box

- Boxboard

- Flexible Paper

By End Use

- Food & Beverage

- Healthcare

- Personal Care

- Industrial

Drivers

Growing Demand for Sustainable Packaging Drives Paper and Paperboard Packaging Growth

The paper and paperboard packaging market is witnessing significant growth, primarily driven by the increasing demand for sustainable packaging. As consumers and industries become more environmentally conscious, there is a clear shift towards eco-friendly packaging solutions, and paperboard offers a recyclable and biodegradable alternative to traditional materials like plastic.

The rise of e-commerce is another major factor, with online retail continuing to expand rapidly. As more products are shipped and delivered, the need for secure and reliable packaging has increased, making paperboard a preferred choice due to its strength and versatility.

Additionally, paperboard packaging is a cost-effective option, providing businesses with an affordable solution without compromising on quality or safety. For many companies, this affordability makes it an attractive choice, particularly in industries where packaging costs are a key concern.

Furthermore, consumers are increasingly opting for products packaged in materials that align with their environmental values. This growing preference for eco-friendly products has led businesses to adopt paperboard packaging as a way to meet consumer expectations and enhance their brand image.

As these trends continue, the paper and paperboard packaging market is expected to grow steadily, offering opportunities for businesses to innovate and capitalize on the demand for sustainable packaging solutions.

Restraints

Competition from Alternative Materials Limits Paperboard Packaging Growth

The paper and paperboard packaging market faces significant competition from alternative materials like plastic and glass. These materials offer advantages such as better strength, versatility, and protective qualities, making them preferable in certain applications.

For example, plastic packaging can be more durable, waterproof, and lightweight, making it suitable for products that require long shelf life or enhanced protection during transportation. Glass, while heavier, provides a premium feel and maintains the integrity of certain sensitive products.

Due to these superior qualities, many industries are increasingly opting for plastics and glass packaging instead of paperboard, especially in sectors like food, beverages, and electronics. This shift has posed a challenge for paperboard packaging, limiting its overall market growth.

Additionally, as plastic continues to evolve with more sustainable options, its appeal further intensifies, further drawing attention away from paperboard solutions. Despite the efforts made by the paperboard industry to promote eco-friendly benefits, its relative fragility and lack of versatility in comparison to alternative materials remain key challenges.

Growth Factors

Expansion in Emerging Markets Fuels Growth in Paper and Paperboard Packaging

The paper and paperboard packaging market is experiencing notable growth due to the rapid industrialization in emerging markets. As these regions develop economically, there is a marked rise in consumer demand for packaged goods, which drives the need for effective and efficient packaging solutions. This shift is especially visible in countries in Asia-Pacific, Latin America, and parts of Africa, where growing populations and changing consumer behaviors are pushing the demand for packaged products.

Additionally, innovation in paperboard designs has created more opportunities, with new materials offering enhanced strength, moisture resistance, and better consumer appeal. This advancement meets the needs of diverse industries, particularly in the food and beverage sector, where the growing demand for packaged ready-to-eat meals and drinks creates a strong market for paperboard packaging.

Moreover, the integration of digital printing technology has transformed packaging aesthetics, enabling more personalized, detailed, and attractive designs.

These trends not only boost consumer interest but also help brands differentiate their products in a competitive market. Overall, these factors combine to provide significant growth opportunities for the paper and paperboard packaging industry, driven by both innovation and increased demand across emerging markets.

Emerging Trends

Smart Packaging Enhances Consumer Engagement in the Paperboard Market

The paper and paperboard packaging market is experiencing several key trends that are shaping its future. One prominent trend is the rise of smart packaging, where technology like QR codes, NFC chips, and RFID tags are integrated into packaging. This allows brands to engage consumers more interactively, offering digital experiences, product details, or promotional content.

Another notable trend is minimalist and functional packaging, as consumers today are drawn to clean, simple designs that focus on functionality. This approach not only appeals to modern aesthetics but also helps brands communicate efficiency and sustainability. Additionally, the demand for premium paperboard packaging is increasing, particularly for luxury items such as high-end cosmetics and beverages.

These premium packages use high-quality paperboard materials, helping brands convey exclusivity and sophistication. Finally, the trend towards sustainable sourcing is gaining momentum, with more companies seeking paperboard sourced from responsibly managed forests. As sustainability becomes a priority, consumers and businesses alike are pushing for transparent, eco-friendly practices within the packaging supply chain.

These trends reflect a broader shift toward more innovative, sustainable, and consumer-friendly packaging solutions, indicating significant growth and evolution in the paper and paperboard packaging sector.

Regional Analysis

Asia Pacific leads the Paper and Paperboard Packaging Market with 40.1% share and USD 129.5 billion value

The global paper and paperboard packaging market is experiencing robust growth, driven by increasing demand across various regions, including North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Among these regions, Asia Pacific holds a dominant position, accounting for 40.1% of the market share, valued at USD 129.5 billion.

This dominance is attributed to the region’s rapid industrialization, a booming e-commerce sector, and increased demand for sustainable packaging solutions. Countries like China and India are major contributors, with their expanding manufacturing and packaging industries. The growing environmental awareness in Asia Pacific has also led to a surge in the adoption of recyclable and biodegradable paper packaging materials, further fueling market growth.

Regional Mentions:

North America is another significant player in the paper and paperboard packaging market, holding a substantial share due to the region’s strong industrial base and high consumption of packaged goods. The U.S. market is particularly influential, driven by the food and beverage industry’s demand for sustainable packaging options and government initiatives promoting eco-friendly materials.

In Europe, sustainability and regulatory frameworks are key drivers of market growth. The European Union’s stringent packaging regulations are pushing companies to shift towards paper-based packaging, and countries like Germany, the UK, and France are leading the charge.

Latin America and the Middle East & Africa are emerging regions for paper and paperboard packaging, with the Latin American market showing growth due to increasing urbanization and the rise of consumerism. However, the market share in these regions remains relatively smaller compared to the dominant players in Asia Pacific and North America, with growth expected to continue as economic conditions improve.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global Paper and Paperboard Packaging Market continues to be shaped by key players who are driving innovation, sustainability, and operational efficiency. Smurfit Kappa Group Plc stands out as one of the leading companies, leveraging its strong global presence and focus on sustainable packaging solutions, which are increasingly in demand as companies and consumers become more eco-conscious.

Oji Holdings Corporation and Nippon Paper Industries Co. Ltd, both Japanese giants, maintain a dominant position in the Asian market with their broad product portfolios and robust production capabilities. Their emphasis on high-quality, environmentally friendly paper and paperboard solutions positions them for sustained growth in the market.

Clearwater Paper Corporation and International Paper Company, two prominent U.S.-based players, are continuously expanding their product range and adopting advanced technologies to improve manufacturing efficiency and sustainability.

Clearwater’s emphasis on cost-effective production and paper-based products aligns with the growing consumer preference for sustainable materials. International Paper, on the other hand, remains a major player through its diversified offerings and robust supply chain networks.

European players such as Mondi Group, DS Smith Plc, and WestRock Company are not only advancing their product innovation but are also committed to improving recyclability and reducing waste in their packaging solutions.

Shandong Bohui Paper Company Ltd, a key player in China, is gaining traction in the market due to its competitive pricing and expanding production capacity, while ITC Ltd and Svenska Cellulosa Aktiebolaget (SCA) lead in sustainable packaging and forest management practices, appealing to eco-conscious industries.

Top Key Players in the Market

- Smurfit Kappa Group Plc

- Oji Holdings Corporation

- Nippon Paper Industries Co. Ltd

- Clearwater Paper Corporation

- International Paper Company

- Shandong Bohui Paper Company Ltd

- Mondi Group

- ITC Ltd

- DS Smith Plc

- WestRock Company

- South Africa Pulp and Paper Industries Ltd

- Svenska Cellulosa Aktiebolaget (SCA)

Recent Developments

- In Feb 2025, Pulpex raised $78 million in a Series D funding round to accelerate the production of its sustainable paper-based bottles, aiming to revolutionize packaging for consumer goods.

- In Feb 2025, Pulpex also announced a £62 million Series D investment to scale its innovative paper-based bottle production, reinforcing its commitment to environmentally friendly alternatives.

- In Jun 2024, ReLeaf Paper secured €10.5 million in funding to expand its production of sustainable paper made from agricultural waste, aiming to reduce reliance on traditional paper production methods.

- In Oct 2024, pharmaceutical packaging startup Sorich raised $1 million in seed funding to develop and commercialize innovative, eco-friendly packaging solutions for the pharmaceutical industry.

- In Dec 2024, Movopack secured $2.5 million in funding to advance its sustainable ecommerce packaging solutions, focused on reducing plastic waste and enhancing the environmental footprint of online shopping.

Report Scope

Report Features Description Market Value (2024) USD 323.8 Billion Forecast Revenue (2034) USD 493.3 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (White Lined Chipboard (WLC), Solid Bleached Sulfate (SBS), Coated Unbleached Kraft Paperboard (CUK), Folding Boxboard (FBB), Glassine & Greaseproof Paper, Label Paper, Others), By Type (Corrugated Box, Boxboard, Flexible Paper), By End Use (Food & Beverage, Healthcare, Personal Care, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Smurfit Kappa Group Plc, Oji Holdings Corporation, Nippon Paper Industries Co. Ltd, Clearwater Paper Corporation, International Paper Company, Shandong Bohui Paper Company Ltd, Mondi Group, ITC Ltd, DS Smith Plc, WestRock Company, South Africa Pulp and Paper Industries Ltd, Svenska Cellulosa Aktiebolaget (SCA) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Paper and Paperboard Packaging MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Paper and Paperboard Packaging MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Smurfit Kappa Group Plc

- Oji Holdings Corporation

- Nippon Paper Industries Co. Ltd

- Clearwater Paper Corporation

- International Paper Company

- Shandong Bohui Paper Company Ltd

- Mondi Group

- ITC Ltd

- DS Smith Plc

- WestRock Company

- South Africa Pulp and Paper Industries Ltd

- Svenska Cellulosa Aktiebolaget (SCA)