Global Oyster Mushroom Market Size, Share, And Industry Analysis Report By Type (Pearl Oyster, Blue Oyster, Golden Oyster, Pink Oyster, Phoenix Oyster, King Oyster), By Form (Fresh, Processed), By Application (Food, Medical), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Specialty Stores, Online Sales Channel, Medical), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 175441

- Number of Pages: 336

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

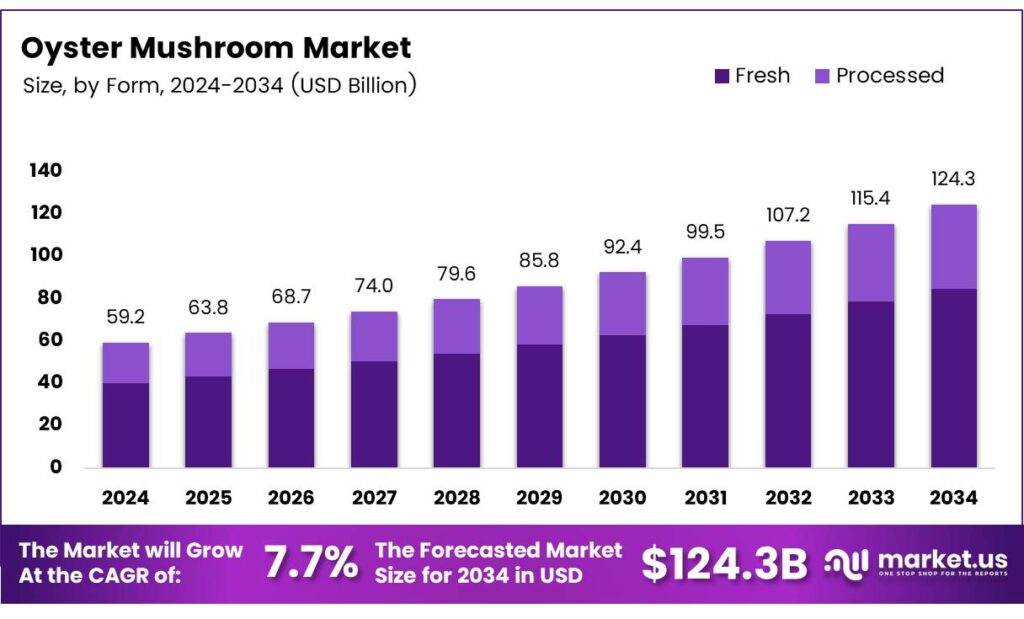

The Global Oyster Mushroom Market size is expected to be worth around USD 124.3 billion by 2034, from USD 59.2 billion in 2024, growing at a CAGR of 7.7% during the forecast period from 2025 to 2034.

The oyster mushroom market is growing steadily as consumers shift toward healthier, plant-based, and clean-label foods. Their quick cooking, versatility, and nutrient profile make them appealing for modern diets. According to the USDA, oyster mushrooms provide just 33 Kcal per 100 g, along with 6 g carbohydrates, 3 g protein, and 0 g fat, supporting low-calorie and low-fat preferences.

Moreover, market growth accelerates as farmers adopt low-investment cultivation systems with high biological efficiency. Oyster mushrooms thrive on agricultural waste, enabling cost-effective production and sustainable scaling. This makes them appealing for small growers and integrated farming models, encouraging rural income generation and strengthening local agri-food ecosystems.

- Oyster mushrooms colonize and fruit between 30–80°F, with optimal fruiting at 50–80°F and maximum potential up to 95°F. Specific strains such as Pleurotus populinus colonize at 70–75°F and fruit at 60–74°F, while Pleurotus ostreatus colonizes at 65–75°F and fruits at 50–68°F, enabling wide geographic production. These biological advantages further strengthen commercial scalability and future market expansion.

One cup (86 grams) of raw Pleurotus ostreatus delivers 28 calories, 5 grams of carbs, 3 grams of protein, less than 1 gram of fat, and 2 grams of fiber, along with 27% DV niacin, 22% DV pantothenic acid, and 8% DV each of folate, choline, potassium, and phosphorus. These nutrients strengthen the mushroom’s positioning as a functional, nutrient-dense ingredient.

Additionally, product innovation expands rapidly, with dehydrated oyster mushrooms, ready-to-cook mixes, and powdered formulations entering mainstream retail formats. Food processors leverage oyster mushrooms for their natural umami profile, enhancing plant-based meats and soups. This ongoing innovation strengthens forward-integration possibilities for growers and boosts value-added revenue streams across global markets.

Key Takeaways

- The Global Oyster Mushroom Market is projected to reach USD 124.3 billion by 2034, up from USD 59.2 billion in 2024, at a CAGR of 7.7% during 2025 to 2034.

- Pearl Oyster dominates the Type segment with a 37.8% market share in 2025.

- Fresh oyster mushrooms lead the Form segment with a strong 78.3% share.

- Food applications account for the largest share at 88.9% in the Application segment.

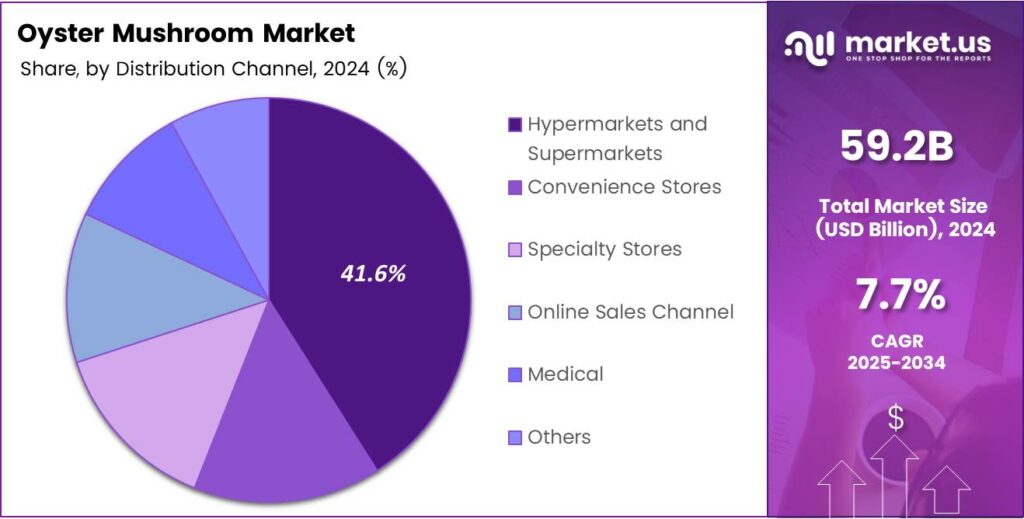

- Hypermarkets and Supermarkets dominate the Distribution Channel segment with 41.6% share.

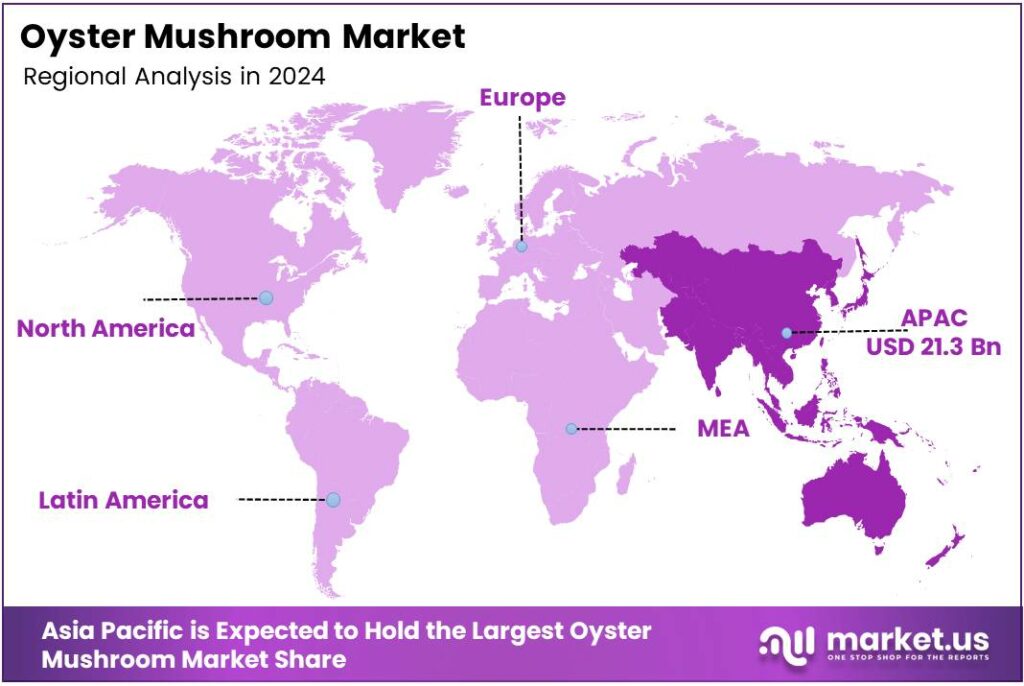

- Asia Pacific remains the leading regional market with 36.1% share, valued at USD 21.3 billion.

By Type Analysis

The Pearl Oyster dominates with a 37.8% share, thanks to its strong availability and higher consumer acceptance.

In 2025, Pearl Oyster held a dominant market position in the By Type segment of the Oyster Mushroom Market, with a 37.8% share. This type stays highly preferred because it grows quickly, tastes mild, and fits many cooking styles. Its broader farming network continues driving consistent demand across regions.

Blue Oyster mushrooms show steady growth as consumers appreciate their bright color and rich flavor. They appeal strongly to chefs and home cooks who seek gourmet options. Their rising use in stir-fries and specialty dishes helps widen market acceptance, even though their share remains below the leading Pearl Oyster category.

Golden Oyster mushrooms attract attention for their vibrant appearance and buttery texture. Consumers choose them for premium dishes, while restaurants use them for garnish and flavor enhancement. Although limited shelf life restricts reach, ongoing interest in exotic varieties keeps Golden Oyster relevant in the expanding specialty mushroom market.

Pink Oyster, Phoenix Oyster, and King Oyster varieties continue gaining niche popularity. Pink Oyster draws demand for its unique color, Phoenix Oyster finds use in fast-cooking recipes, and King Oyster benefits from its meat-like texture. Together, they serve diverse culinary needs and support broader category expansion despite smaller market shares.

By Form Analysis

Fresh Oyster Mushrooms dominate with 78.3% due to high consumer preference for natural and minimally processed products.

In 2025, Fresh mushrooms held a dominant market position in the By Form segment of the Oyster Mushroom Market, with a strong 78.3% share. Consumers favor freshness for nutrition, taste, and versatility. The growing farm-to-table trend further supports rising purchases across households and food service channels.

Processed oyster mushrooms continue to develop demand in canned, dried, or frozen formats. Their longer shelf life makes them suitable for export markets and busy consumers. Although their share remains lower than that of fresh mushrooms, processed forms are gaining preference due to convenience and year-round availability in retail stores.

By Application Analysis

Food Applications dominate with 88.9% as oyster mushrooms remain a staple in meals, snacks, and restaurant dishes.

In 2025, Food applications held a dominant market position in the By Application segment of the Oyster Mushroom Market, with a significantly high 88.9% share. Their taste, affordability, and nutritional value drive wide usage in soups, curries, snacks, and gourmet dishes worldwide, strengthening their culinary relevance.

Medical applications continue expanding as mushrooms gain recognition for immune-supporting and antioxidant properties. Extracts from oyster mushrooms appear in supplements and wellness formulations. Although smaller in volume, this segment experiences steady interest from health-focused consumers and herbal product manufacturers.

Other applications include animal feed and mushroom-based powdered ingredients. Their usage remains limited but gradually increases as researchers explore additional benefits. These applications support niche demand and diversify overall market consumption beyond traditional food and medicinal uses.

By Distribution Channel Analysis

Hypermarkets and Supermarkets dominate with 41.6% because shoppers prefer accessible, fresh, and well-stocked retail formats.

In 2025, Hypermarkets and Supermarkets held a dominant market position in the By Distribution Channel segment of the Oyster Mushroom Market, with a 41.6% share. These outlets offer a wide variety of fresh produce, diverse products, and quality assurance. Their extensive reach ensures steady sales across urban and semi-urban regions.

Convenience Stores maintain regular demand due to quick access and availability of small-quantity packs. They serve daily shoppers who prefer fast purchases and local options. Although smaller in assortment than supermarkets, their role grows in residential areas and busy commercial zones.

Specialty Stores attract consumers seeking organic, exotic, or premium mushroom varieties. These stores often provide higher-quality selections and expert guidance. Their importance is rising among health-focused buyers and culinary enthusiasts who prioritize freshness and unique flavors.

Online Sales Channel, Medical, and Others segments collectively support additional distribution needs. Online platforms appeal to customers valuing doorstep delivery and subscription models. Medical channels distribute processed forms for health uses, while other outlets help reach remote locations, ensuring broader market accessibility.

Key Market Segments

By Type

- Pearl Oyster

- Blue Oyster

- Golden Oyster

- Pink Oyster

- Phoenix Oyster

- King Oyster

By Form

- Fresh

- Processed

By Application

- Food

- Medical

- Others

By Distribution Channel

- Hypermarkets and Supermarkets

- Convenience Stores

- Specialty Stores

- Online Sales Channel

- Medical

- Others

Emerging Trends

Growing Popularity of Meat Substitutes Fuels Market Trends

A key trend shaping the Oyster Mushroom Market is the rising use of mushrooms as meat substitutes. Their texture makes them suitable for plant-based meat, burgers, and ready-to-cook products. Consumers looking for clean-label ingredients prefer oyster mushrooms because they are natural, minimally processed, and nutritious.

- Another strong trend is home-based mushroom cultivation. DIY mushroom-growing kits are becoming popular, allowing consumers to grow fresh produce at home. USDA groups oyster mushrooms with specialty mushrooms – shiitake, oyster, and other exotics. USDA reported specialty mushroom value of sales at $95.0 million, up 10% from the prior season.

Technology adoption is rising as farms use controlled-environment systems to improve yield and quality. These modern methods ensure a consistent supply throughout the year. Sustainability is also influencing buying behaviour. Oyster mushroom farming uses agricultural waste as substrate, making it an eco-friendly choice.

Drivers

Rising Preference for Healthy and Plant-Based Foods Boosts Oyster Mushroom Demand

The Oyster Mushroom Market is growing mainly because more consumers are choosing healthier and plant-based foods. Oyster mushrooms are rich in protein, vitamins, and antioxidants, making them a natural fit for this shift toward nutritious eating. The rising awareness about immune-supportive foods.

Oyster mushrooms contain beta-glucans, which support immunity, encouraging consumers to include them in their daily diet. This trend is especially visible in urban households. Growing vegetarian and vegan populations also push demand higher. Oyster mushrooms offer a similar texture and are widely used in plant-based dishes, boosting sales.

Their easy cultivation and low production cost motivate farmers to expand production. Small-scale growers benefit from quick crop cycles, helping supply meet rising market demand. The foodservice industry, including restaurants and meal-kit companies, increasingly uses oyster mushrooms because of their flavour and versatility.

Restraints

Limited Cold Chain Infrastructure Restricts Market Expansion

A major restraint for the Oyster Mushroom Market is the lack of strong cold chain facilities. Oyster mushrooms spoil quickly, making storage and transportation difficult for producers and retailers. Small farmers often face losses because they cannot maintain ideal temperatures after harvest. This limits their ability to supply distant markets and reduces overall market efficiency.

- Another challenge is the high sensitivity of oyster mushrooms to humidity and handling. Minor fluctuations can affect product quality, causing inconsistency in supply. ICAR’s mushroom, one Pleurotus strain, reached a peak biological efficiency of 133.5 kg per 100 kg of dry paddy straw substrate at a centre in Sikkim.

Market awareness is still low in many developing regions. Consumers unfamiliar with oyster mushrooms may avoid purchasing them, slowing market penetration. Additionally, price fluctuations due to inconsistent supply create instability for both farmers and buyers. These limitations collectively hold back the market’s full growth potential.

Growth Factors

Expanding Demand for Functional and Medicinal Mushrooms Creates New Opportunities

A major growth opportunity lies in the rising demand for functional and medicinal foods. Oyster mushrooms are known for their antioxidant, anti-inflammatory, and cholesterol-lowering benefits, attracting health-conscious consumers. Food manufacturers are introducing mushroom-based snacks, powders, and supplements, opening new revenue streams.

There is also an increasing scope in organic oyster mushroom farming. Consumers who prefer chemical-free foods create a strong demand for certified organic produce. Export opportunities are growing as international markets recognise oyster mushrooms for their quality and nutrition.

Countries with a favourable climate and low production costs can expand into global markets. Investment in mushroom processing, such as drying, canning, and packaging, can further support long-term growth by reducing spoilage and improving product shelf life. These value-added products help the market grow beyond fresh mushroom sales.

Regional Analysis

Asia Pacific Dominates the Oyster Mushroom Market with a Market Share of 36.1%, Valued at USD 21.3 Billion

Asia Pacific leads the global oyster mushroom market, driven by large-scale cultivation, strong household consumption, and the rising popularity of plant-based diets. The region’s dominance, accounting for 36.1% of the market and valued at USD 21.3 billion, is supported by favorable agro-climatic conditions and well-established farming practices. Increasing demand across China, India, and Southeast Asia continues to reinforce the Asia Pacific’s leadership in both production and consumption.

North America showcases steady growth as consumers increasingly prefer organic, clean-label, and protein-rich food options. The market benefits from expanding specialty mushroom farms, growing interest in meat alternatives, and the rising availability of gourmet mushrooms in retail outlets. Increased awareness of the nutritional benefits of oyster mushrooms is further driving regional adoption.

Europe’s market is supported by a long tradition of mushroom consumption, strong organic food culture, and advanced cultivation technologies. Rising demand for sustainable and low-calorie ingredients is encouraging higher oyster mushroom adoption. Additionally, European consumers’ shift toward flexitarian and plant-forward diets continues to strengthen market growth across the region.

The Middle East & Africa region is gradually expanding due to increasing urbanization, diversification of dietary habits, and growing awareness of nutrient-dense foods. Limited local production has opened opportunities for controlled-environment farming systems. Rising interest in affordable and healthy protein sources is also contributing to market development in major cities.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Monterey Mushrooms, Llc is likely to stay a scale-driven leader in 2025, using its broad cultivation footprint and retail relationships to keep oyster mushrooms visible beyond specialty shelves. The company’s advantage is consistency—steady volumes, standardized grading, and dependable cold-chain execution that large buyers expect. The main watch-out is margin pressure as labor, substrate, and energy costs fluctuate, making efficiency upgrades and yield optimization critical.

Nammex stands out more on value-added positioning than on fresh volume, with an emphasis that typically aligns with extracts, functional formats, and ingredient-led demand. In 2025, that puts it in a good spot as shoppers and brands look for clean-label, wellness-friendly mushroom inputs. The key execution point is tightening traceability and quality documentation, because ingredient customers reward reliability and penalize variability.

The Mushroom Company is well placed to benefit from the “everyday gourmet” trend, where oyster mushrooms are marketed as a meat alternative and a flavor-forward cooking ingredient. Analysts would expect continued focus on merchandising, pack formats, and foodservice penetration to drive repeat purchases. The differentiator will be how well it balances supply stability with product freshness, especially in high-turn retail programs.

Banken Champignons B.V brings a European production and quality mindset that can translate into premium positioning and strong compliance credibility in 2025. From a market perspective, it can win on specification control, retailer standards, and dependable batch quality for both fresh and processed channels. Growth will hinge on distribution partnerships and cost control, given competitive price points in mainstream mushroom aisles.

Top Key Players in the Market

- Monterey Mushrooms, LLC

- Nammex

- The Mushroom Company

- Banken Champignons B.V.

- OKECHAMP SA

- Mushroom Direct

- Neelai Mushrooms

- Lone Star Mushrooms

- The Ellijay Mushroom

- Windy City Mushroom

Recent Developments

- In 2025, Monterey Mushrooms expanded its product offerings in the specialty mushroom category, including oyster mushrooms. The company unveiled a new specialty mushroom line featuring oyster mushrooms alongside varieties like lion’s mane, king trumpet, maitake, and shiitake, packaged in sustainable top-seal formats to enhance shelf life and appeal to retailers.

- In 2024, Nammex, a supplier of organic mushroom extracts including those from oyster varieties, has focused on innovation in functional ingredients and quality assurance. The company launched ErgoGold, a 1:1 extract from golden oyster mushrooms (Pleurotus citrinopileatus) with verified ergothioneine levels, positioned as an antioxidant-rich ingredient for supplements and functional foods.

Report Scope

Report Features Description Market Value (2024) USD 59.2 Billion Forecast Revenue (2034) USD 124.3 Billion CAGR (2025-2034) 7.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Pearl Oyster, Blue Oyster, Golden Oyster, Pink Oyster, Phoenix Oyster, King Oyster), By Form (Fresh, Processed), By Application (Food, Medical, Others), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Specialty Stores, Online Sales Channel, Medical, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Monterey Mushrooms, LLC, Nammex, The Mushroom Company, Banken Champignons B.V., OKECHAMP SA, Mushroom Direct, Neelai Mushrooms, Lone Star Mushrooms, The Ellijay Mushroom, Windy City Mushroom Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Monterey Mushrooms, LLC

- Nammex

- The Mushroom Company

- Banken Champignons B.V.

- OKECHAMP SA

- Mushroom Direct

- Neelai Mushrooms

- Lone Star Mushrooms

- The Ellijay Mushroom

- Windy City Mushroom