Global Oxygen-Free High Thermal Conductivity (OFHC) Copper Market By Shape Type (Bar, Pipe, Plates, Other Types), By Application (Automotive, Electronics, Industrial, Other Applications), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Feb 2024

- Report ID: 30656

- Number of Pages: 318

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

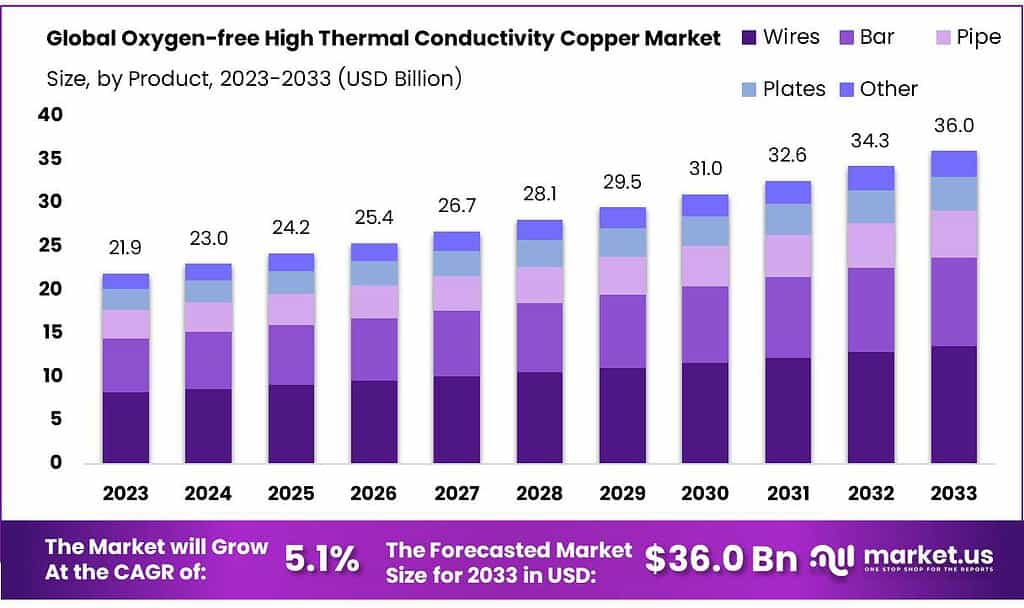

The Oxygen-free High Thermal Conductivity (OFHC) Copper Market size is expected to be worth around USD 36 billion by 2033, from USD 21.9 Bn in 2023, growing at a CAGR of 5.1% during the forecast period from 2023 to 2033.

Oxygen-free High Thermal Conductivity (OFHC) Copper refers to a specific grade of copper that has been refined to achieve high thermal conductivity while minimizing oxygen content. OFHC Copper is produced through a process that involves the removal of oxygen and other impurities to extremely low levels, typically below 0.001%. This high-purity copper variant exhibits excellent thermal conductivity properties, making it particularly suitable for applications where efficient heat transfer is crucial.

The absence of oxygen in OFHC Copper minimizes the formation of copper oxide, enhancing its thermal conductivity. This makes OFHC Copper highly sought after in industries and applications where heat dissipation is a critical factor, such as in the manufacturing of electronic components, heat exchangers, and various high-performance thermal management systems.

Key Takeaways

- Market Growth: OFHC Copper market is set to reach USD 36 billion by 2033, growing at a CAGR of 5.1% from its 2023 valuation of USD 21.9 billion.

- Production Definition: OFHC Copper, with minimal oxygen content (<0.001%), ensures high thermal conductivity, vital for electronics, heat exchangers, and thermal management systems.

- Product Leadership: Wires held a market share of 37.5% in 2023, essential in power distribution, telecommunications, and automotive applications for superior electrical conductivity.

- Purity Dynamics: Ultra-high purity OFHC Copper dominated with a 42.6% market share in 2023, prized for superior thermal conductivity in electronics, aerospace, and telecommunications.

- Application Dominance: Heat exchangers led with a 28.6% share in 2023, showcasing OFHC Copper’s excellence in thermal conductivity crucial for HVAC, automotive, and industrial sectors.

- Global Market Trends: Asia-Pacific (APAC) claimed over 61.5% of the market in 2023, driven by rapid urbanization, construction activities, and a thriving automotive industry.

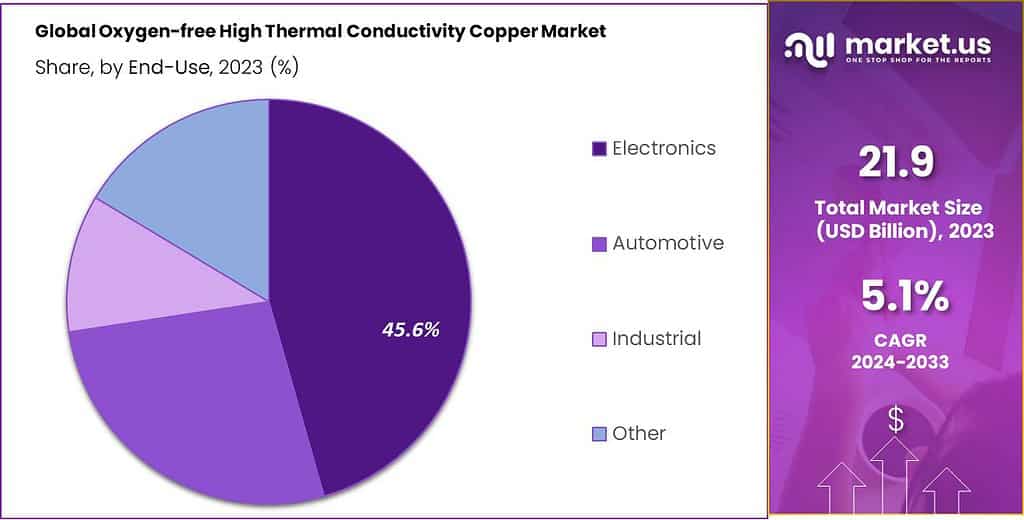

- End-Use Significance: Electronics dominated with a 45.6% share in 2023, highlighting OFHC Copper’s crucial role in electronic components, including PCBs, semiconductors, and connectors.

By Product

In 2023, Wires held a dominant market position, capturing more than a 37.5% share. This segment’s leading position reflects the widespread use of Oxygen-free High Thermal Conductivity (OFHC) Copper wires across various industries and applications. OFHC Copper wires are essential components in electrical and electronic systems, where high conductivity and reliability are paramount.

They are utilized in power distribution, telecommunications, automotive wiring harnesses, and electronic circuitry, among other applications, due to their excellent electrical conductivity and thermal stability. Bar emerged as another significant product segment in the OFHC Copper market in 2023.

OFHC Copper bars find extensive use in electrical grounding systems, busbars, and structural components requiring high conductivity and mechanical strength. Their uniform composition and high purity make them ideal for applications where electrical performance and durability are critical.

The pipe also held a notable market share in 2023, driven by the demand for OFHC Copper piping in plumbing, heating, ventilation, and air conditioning (HVAC) systems. OFHC Copper pipes offer superior corrosion resistance, thermal conductivity, and antimicrobial properties, making them the preferred choice for transporting fluids in residential, commercial, and industrial settings.

Plates represent another key product segment for OFHC Copper, particularly in applications requiring flat surfaces with precise dimensions and high thermal conductivity. OFHC Copper plates find use in heat exchangers, electronic components, and machining fixtures, where their superior thermal and electrical properties contribute to optimal performance and efficiency.

By Purity

In 2023, Ultra-high purity OFHC Copper held a dominant market position, capturing more than a 42.6% share. This segment’s strong performance can be attributed to its superior thermal conductivity properties, making it highly sought after in industries such as electronics, aerospace, and telecommunications. Ultra-high purity OFHC Copper is preferred for applications requiring the highest levels of conductivity and reliability, such as high-frequency antennas and semiconductor manufacturing.

High purity OFHC Copper also witnessed significant growth in 2023, accounting for a notable portion of the market share. This segment appeals to industries where stringent purity requirements are essential, such as medical devices and power generation. High-purity OFHC Copper offers excellent conductivity while meeting specific regulatory standards, driving its adoption in critical applications where performance and safety are paramount.

Standard purity OFHC Copper, although holding a smaller market share compared to the ultra-high and high purity segments, still maintains a significant presence in various industries. This segment caters to applications where absolute purity is not a primary concern but where good electrical conductivity and corrosion resistance are still required.

Industries such as construction, plumbing, and automotive utilize standard purity OFHC Copper for its balance of performance and cost-effectiveness. Looking ahead, the market for Oxygen-free High Thermal Conductivity (OFHC) Copper is expected to continue its growth trajectory, driven by increasing demand from emerging technologies and expanding applications across diverse industries. Innovation in manufacturing processes and material science is likely to further enhance the performance and versatility of OFHC Copper, opening up new opportunities for market expansion across all purity segments.

By Application

In 2023, Heat Exchangers held a dominant market position, capturing more than a 28.6% share. This segment’s leading position can be attributed to the widespread use of Oxygen-free High Thermal Conductivity (OFHC) Copper in heat transfer applications across various industries. Heat exchangers play a vital role in cooling and heating systems in sectors such as HVAC, automotive, and industrial manufacturing.

OFHC Copper’s excellent thermal conductivity and corrosion resistance make it an ideal choice for heat exchanger components, ensuring efficient heat transfer and system performance. Electrical Connectors emerged as another significant application segment in the OFHC Copper market in 2023. With the increasing demand for reliable electrical connections in electronic devices, automotive systems, and power distribution networks, the use of OFHC Copper connectors has grown substantially.

OFHC Copper’s high electrical conductivity and durability make it well-suited for applications where reliable electrical connections are critical for performance and safety.

Waveguides also held a notable market share in 2023, driven by the growing adoption of OFHC Copper in telecommunications, aerospace, and defense applications. Waveguides are essential components for transmitting electromagnetic signals with minimal loss, and OFHC Copper’s low electrical resistance and high purity make it an ideal material for ensuring signal integrity and efficiency in waveguide systems.

Superconductors represent another key application segment for OFHC Copper, particularly in research and scientific applications, as well as in emerging technologies such as magnetic resonance imaging (MRI) and particle accelerators. OFHC Copper’s purity and thermal conductivity properties are essential for maintaining the superconducting state and minimizing energy loss in superconductor systems.

By End-Use

In 2023, Electronics held a dominant market position, capturing more than a 45.6% share. This segment’s significant share reflects the widespread use of Oxygen-free High Thermal Conductivity (OFHC) Copper in various electronic applications. OFHC Copper is essential in the manufacturing of printed circuit boards (PCBs), semiconductor devices, connectors, and other electronic components due to its excellent electrical conductivity, thermal stability, and reliability.

With the increasing demand for electronic devices across consumer electronics, telecommunications, and computing industries, the use of OFHC Copper is expected to continue growing. Automotive emerged as another key end-use segment in the OFHC Copper market in 2023.

OFHC Copper plays a crucial role in automotive electrical systems, including wiring harnesses, connectors, and sensors, where high conductivity and reliability are essential for vehicle performance and safety. Additionally, OFHC Copper’s thermal conductivity properties make it suitable for cooling systems and heat exchangers in electric vehicles (EVs) and hybrid vehicles, contributing to improved efficiency and performance.

The Industrial sector also held a notable market share in 2023, driven by the diverse applications of OFHC Copper in industrial machinery, equipment, and infrastructure. OFHC Copper is utilized in power generation and distribution systems, industrial automation, and HVAC systems, where its high conductivity, corrosion resistance, and durability are valued for ensuring efficient operation and reliability in demanding industrial environments.

Other end-use segments encompass a wide range of applications for OFHC Copper, including aerospace, telecommunications, medical devices, and renewable energy systems. OFHC Copper’s superior properties make it suitable for critical applications such as antennas, waveguides, medical imaging equipment, and solar panels, where high performance and reliability are essential.

Key Market Segmentation

By Product

- Wires

- Bar

- Pipe

- Plates

- Other

By End-Use

- Electronics

- Automotive

- Industrial

- Other

By Purity

- Ultra-high purity OFHC Copper

- High purity OFHC Copper

- Standard purity OFHC Copper

By Application

- Heat Exchangers

- Electrical Connectors

- Waveguides

- Superconductors

- Electronic Components

- Others

Drivers

The increasing demand in the electronics sector plays a significant role. With the rising popularity of electronic devices across consumer electronics, telecommunications, and computing industries, OFHC Copper is indispensable for manufacturing components like printed circuit boards (PCBs), semiconductors, connectors, and other electronic parts due to its exceptional electrical conductivity and thermal stability.

The shift towards automotive electrification is driving demand in the automotive sector. As electric vehicles (EVs) and hybrid vehicles become more prevalent, OFHC Copper’s role in automotive electrical systems, including wiring harnesses, connectors, and sensors, becomes increasingly crucial, contributing to improved vehicle performance and efficiency.

Industrial applications represent a substantial driver for the OFHC Copper market. Industries rely on OFHC Copper for various applications such as power generation and distribution systems, industrial automation, and HVAC systems, thanks to its high conductivity, corrosion resistance, and durability, ensuring efficient operation and reliability in demanding industrial environments.

Technological advancements also play a pivotal role. Innovations in sectors such as telecommunications, aerospace, and renewable energy are driving the demand for high-performance materials like OFHC Copper. Further advancements in material processing and product design are enhancing OFHC Copper’s capabilities and versatility, expanding its applications across diverse industries.

Restraints

One primary restraint is the relatively high cost associated with OFHC Copper compared to other materials. The production process involves stringent purification methods, leading to higher manufacturing costs. This cost factor may limit its adoption, particularly in price-sensitive industries. The availability of raw materials, specifically high-purity copper, is another concern. Any disruptions in the supply chain, such as shortages or price volatility, can impact production and availability, posing challenges for manufacturers and end-users alike.

Processing challenges also present a hurdle. The production and processing of OFHC Copper require specialized equipment and expertise due to its high purity requirements. Maintaining purity throughout the manufacturing process can be challenging and may result in production delays or quality issues. OFHC Copper faces competition from alternative materials and alloys. These alternatives may offer advantages in terms of cost, availability, or specific application requirements, posing a challenge to widespread adoption.

Opportunities

The Oxygen-free High Thermal Conductivity (OFHC) Copper market presents several opportunities for growth and innovation. One significant area is the increasing demand within the electronics industry. With the proliferation of electronic devices, OFHC Copper is in high demand for applications such as printed circuit boards (PCBs), semiconductors, and connectors due to its excellent electrical conductivity and thermal stability.

Another opportunity lies in automotive applications, particularly with the rise of electric vehicles (EVs) and hybrid vehicles. OFHC Copper plays a crucial role in automotive electrical systems, contributing to improved vehicle performance and efficiency. As the automotive industry continues to transition towards electrification, the demand for OFHC Copper is expected to grow significantly.

Industrial applications also offer promising opportunities for OFHC Copper. Industries rely on OFHC Copper for power generation and distribution systems, industrial automation, and HVAC systems due to its high conductivity, corrosion resistance, and durability. As industrial automation and smart infrastructure projects continue to expand, the demand for OFHC Copper is likely to increase further.

Advancements in technology, such as 5G telecommunications networks, renewable energy systems, and medical devices, present new avenues for OFHC Copper applications. OFHC Copper’s superior properties make it suitable for critical applications in these sectors, driving demand for high-performance materials.

Challenges

Navigating the Oxygen-free High Thermal Conductivity (OFHC) Copper market comes with its set of challenges, necessitating a strategic approach to overcome them effectively. One significant challenge is the cost associated with OFHC Copper production.

The stringent purification process required to remove impurities leads to higher manufacturing costs, potentially limiting its adoption in cost-sensitive industries. Another challenge lies in the availability of raw materials. OFHC Copper relies on high-purity copper, and any disruptions in the supply chain can impact production and availability, posing challenges for manufacturers and end-users alike.

Processing challenges also present hurdles. The production and processing of OFHC Copper require specialized equipment and expertise due to its high purity requirements. Maintaining purity throughout the manufacturing process can be challenging and may result in production delays or quality issues.

OFHC Copper faces competition from alternative materials and alloys that may offer advantages in terms of cost, availability, or specific application requirements, posing a challenge to widespread adoption.

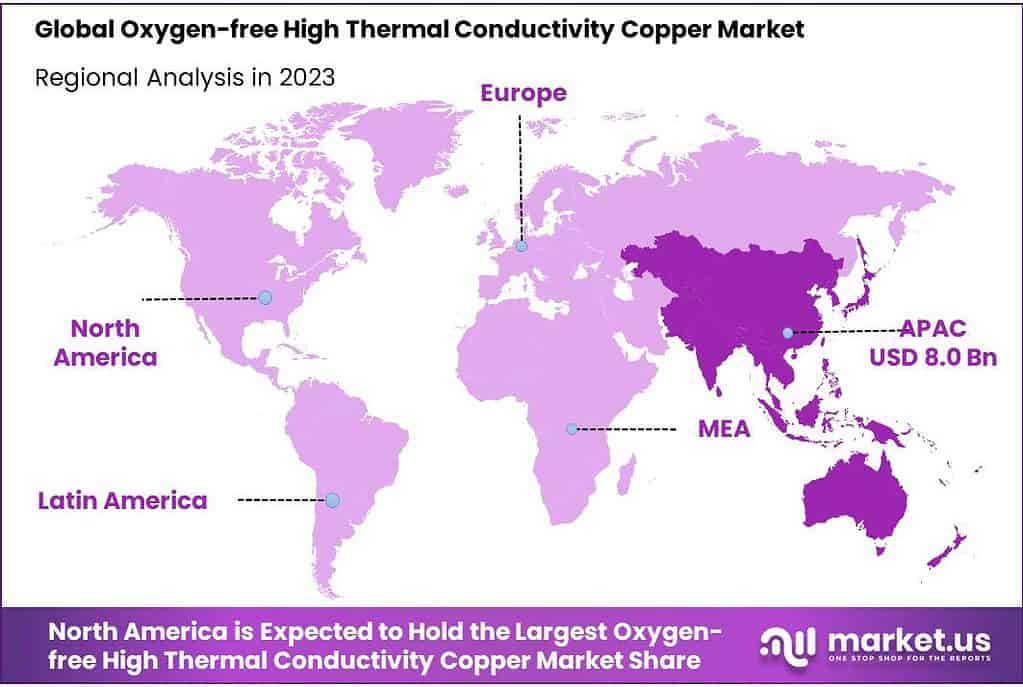

Regional Analysis

In 2023, the global Oxygen-free High Thermal Conductivity (OFHC) Copper market exhibited notable dynamics, with Asia-Pacific (APAC) taking the lead with an impressive revenue share of over 61.5%. The dominance of APAC can be attributed to rapid urbanization, robust construction activities, and a thriving automotive industry. Notably, countries like China and India witnessed substantial growth in residential and commercial building projects, driving the demand for OFHC Copper.

The automotive manufacturing hubs in the region significantly contributed to the consumption of OFHC Copper in the Automotive & Transportation sector. As energy efficiency and safety gain prominence in APAC, OFHC Copper has become integral to these developments.

Additionally, the region’s expanding solar energy sector has further boosted the demand for OFHC Copper, particularly in solar panels and collectors. The convergence of these factors establishes APAC as a major player in the global OFHC Copper market, and its dominance is expected to persist with the ongoing expansion of infrastructure and industrialization.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The global market for Oxygen-free High Thermal Conductivity (OFHC) Copper is characterized by the dominance of key players operating on a global scale. Industry leaders such as Asahi Glass, Saint-Gobain, and Nippon Sheet Glass command significant market shares, leveraging their extensive operations across diverse geographical regions.

These companies possess robust global presences and offer diverse product portfolios tailored for sectors such as construction, automotive, and solar energy.

While Japanese companies, including Asahi Glass and Nippon Sheet Glass, maintain a stronghold in the Asian market, the European manufacturer Saint-Gobain enjoys popularity in both mature and emerging markets.

Additionally, American giants PPG Industries and Guardian Industries have secured prominent positions among leading OFHC Copper suppliers due to substantial investments in technology and capacity expansions. These companies are strategically increasing their focus on value-added products like electrochromic and high-performance glass to meet evolving market demands.

Top Market Key Players

- Sam Dong

- Freeport-McMoRan

- Hitachi Metals Neomaterials Ltd.

- Mitsubishi Materials Corporation

- Aviva Metals

- National Bronze & Metals

- Copper Braid Products

- Farmer’s Copper Ltd.

- Heyco Metals Inc.

- Haviland Enterprises Inc.

- Millard Wire & Specialty Strip Co.

- Hussey Copper Ltd.

- Zhejiang Libo Holding Group

- KGHM Polska Miedz SA

- KME Germany GmbH

Recent Development

2023 Sam Dong: Invested in expanding OFHC copper production capacity in Ohio and South Korea. * Developed new high-purity OFHC copper wire for electric vehicle applications. * Partnered with leading magnet wire manufacturers to increase market reach.

Report Scope

Report Features Description Market Value (2023) US$ 21.9 Bn Forecast Revenue (2032) US$ 36 Bn CAGR (2023-2032) 5.1% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2023-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Wires, Bar, Pipe, Plates, Other), By End-Use(Electronics, Automotive, Industrial, Other), By Purity(Ultra-high purity OFHC Copper, High purity OFHC Copper, Standard purity OFHC Copper), By Application(Heat Exchangers, Electrical Connectors, Waveguides, Superconductors, Electronic Components, Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Sam Dong, Freeport-McMoRan, Hitachi Metals Nanomaterials Ltd., Mitsubishi Materials Corporation, Aviva Metals, National Bronze & Metals, Copper Braid Products, Farmer’s Copper Ltd., Heyco Metals Inc., Haviland Enterprises Inc., Millard Wire & Specialty Strip Co., Hussey Copper Ltd., Zhejiang Libo Holding Group, KGHM Polska Miedz SA, KME Germany GmbH Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Oxygen-free High Thermal Conductivity (OFHC) Copper MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Oxygen-free High Thermal Conductivity (OFHC) Copper MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Mitsubishi Materials Corporation

- KGHM Polska Miedz SA

- Southwire Company

- LLC

- Pan Pacific Copper Co. Ltd.

- Copper Braid Products

- Farmer’s Copper Ltd.

- Sam Dong Co. Ltd.