Global Organ on a Chip Market Analysis By Product Type (Organ-on-a-Chip Devices, Consumables and Accessories, Software and Services), By Organ Type (Heart-on-a-Chip, Liver-on-a-Chip, Lung-on-a-Chip, Kidney-on-a-Chip, Brain-on-a-Chip, Others), By Application (Drug Discovery & Development, Toxicology Research, Disease Modeling, Regenerative Medicine, Others), By End User (Academic & Research Institutes, Pharmaceutical & Biotechnology Companies, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145944

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

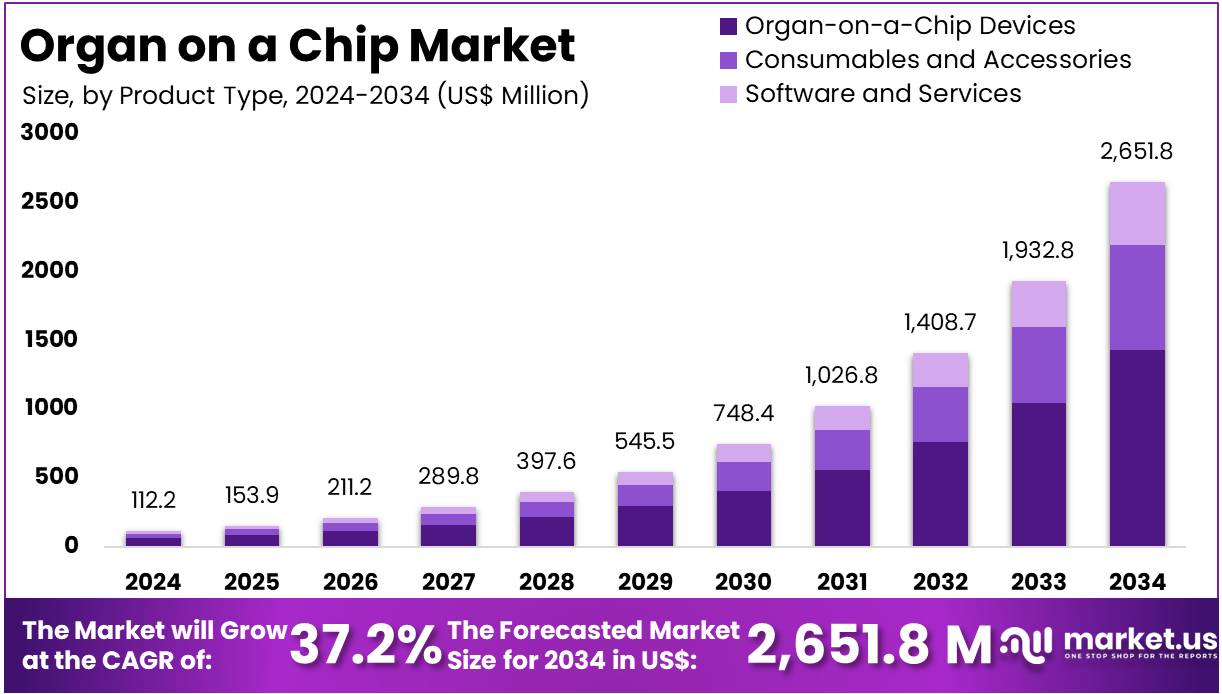

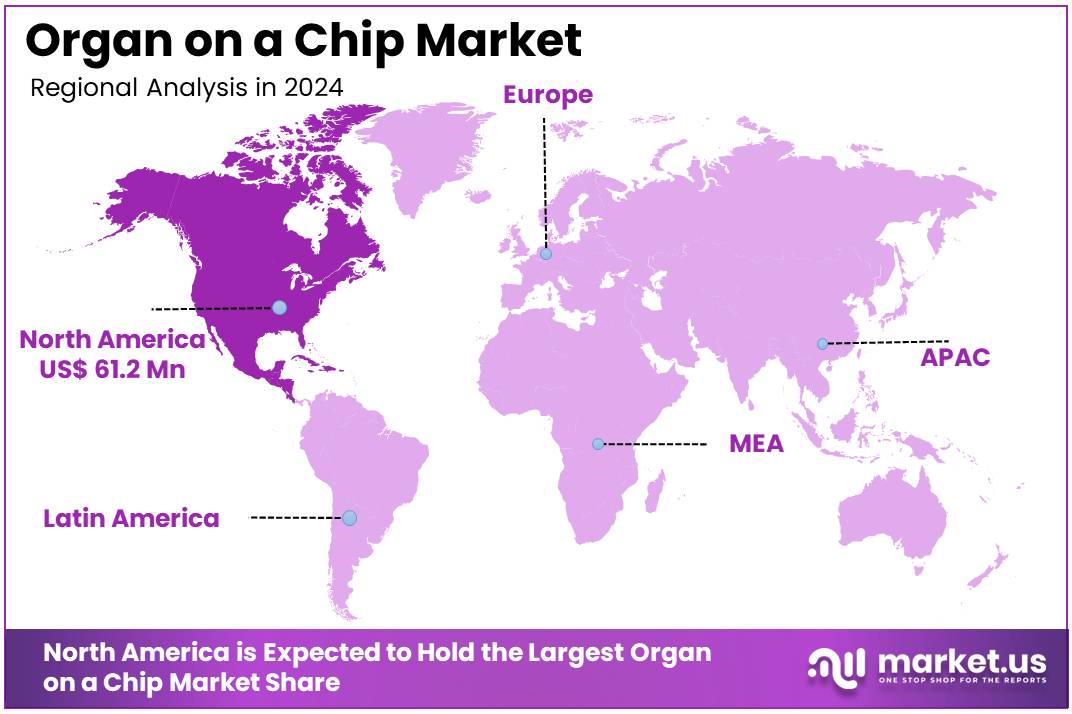

The Global Organ on a Chip Market size is expected to be worth around US$ 2651.8 Million by 2034, from US$ 112.2 Million in 2024, growing at a CAGR of 37.7% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 54.6% share and holds US$ 61.26 Million market value for the year.

The Organ-on-a-Chip (OoC) sector is experiencing rapid growth, driven by a global push for alternatives to animal testing. Traditional animal models often fail to predict human responses accurately. According to industry data, clinical trials face a failure rate of around 90%, with 30% of these failures linked to toxicity issues. OoC technology offers a promising solution by replicating human physiology more precisely, improving the predictive accuracy of preclinical studies.

Technological innovation is a key factor in the development of OoC platforms. Advances in microfluidics, biomaterials, and tissue engineering have enabled the recreation of complex organ functions on microchips. These chips can mimic the microenvironment and biological responses of human organs. For instance, Liver-on-a-Chip systems have shown a sensitivity of 87% and specificity of 100% in predicting drug-induced liver injury (DILI), outperforming traditional animal models, which show only 40% success rates.

Support from government and regulatory bodies further enhances the sector’s growth. For example, the U.S. National Institutes of Health (NIH) and the National Center for Advancing Translational Sciences (NCATS) have introduced initiatives to promote the use of OoC technologies. These programs aim to establish standardized frameworks and accelerate the adoption of OoC platforms in the drug development pipeline.

The rise of personalized medicine is also contributing to the expanding application of OoC systems. These platforms can be customized to replicate patient-specific physiology. As a result, drug testing becomes more targeted, improving both safety and efficacy. This approach is particularly valuable for designing therapies tailored to individual patient needs, ultimately enhancing treatment outcomes.

Industry adoption is gaining momentum across various sectors. For example, L’Oréal has collaborated with bioprinting specialists to create 3D-printed human skin tissues. This initiative aims to reduce the reliance on animal testing and improve the relevance of cosmetic safety assessments. Such collaborations highlight the broader industry shift toward ethical and efficient testing alternatives.

Emerging markets are playing a crucial role in the global expansion of the OoC sector. According to recent trends, countries like China, India, and Japan are increasing investments in healthcare innovation. Government support in these regions is driving the adoption of OoC technologies, contributing to market diversification and growth on a global scale. The Organ-on-a-Chip sector is thus positioned for sustained advancement, with strong backing from scientific, regulatory, and commercial stakeholders.

Key Takeaways

- The global Organ-on-a-Chip market is projected to reach approximately US$ 2,651.8 million by 2034, rising from US$ 112.2 million in 2024.

- A robust CAGR of 37.7% is anticipated for the Organ-on-a-Chip market during the forecast period spanning 2025 to 2034.

- Organ-on-a-Chip Devices led the product type segment in 2024, accounting for over 54.1% of the total market share globally.

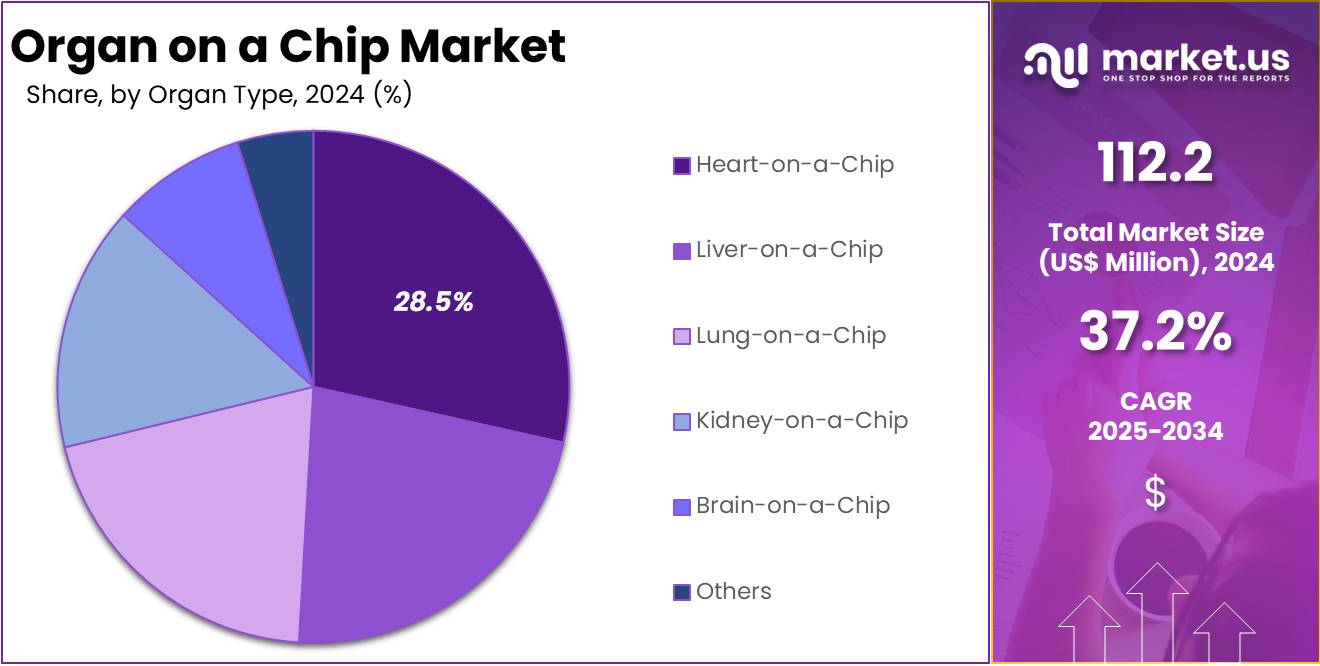

- In the organ type category, Heart-on-a-Chip dominated in 2024, capturing more than 28.5% of the market segment share.

- Drug Discovery & Development emerged as the leading application in 2024, with a market share exceeding 44.2% within the segment.

- Pharmaceutical & Biotechnology Companies were the largest end users in 2024, contributing to over 51.3% of the total market demand.

- North America led the regional landscape in 2024, holding more than a 54.6% market share, equivalent to US$ 61.26 million in value.

Product Type Analysis

In 2024, Organ-on-a-Chip Devices held a dominant market position in the Product Type Segment of Organ on a Chip, capturing more than a 54.1% share. These devices were widely adopted in drug development and disease research. Their ability to mimic organ-level functions with high accuracy was a key driver. Researchers favored them over traditional in vitro methods. Their predictive capabilities improved testing outcomes. This shift supported their growing demand across academic and commercial research settings.

The Consumables and Accessories segment was the next leading contributor to the market. This category included essential items like microfluidic chips, reagents, and culture media. These products were used repeatedly in experiments, creating steady sales. Their demand grew with the expansion of organ-on-a-chip applications. More research institutions and contract research organizations started using these tools. The recurring nature of these items ensured consistent revenue. As the use of organ chips increased, so did the need for associated consumables.

Software and Services formed the smallest but rapidly expanding segment. This category benefited from growing interest in digital tools and data interpretation. Software solutions allowed real-time monitoring and improved experimental accuracy. Artificial intelligence and image analysis tools were also integrated. Customized services, such as chip design and result analysis, gained popularity. These offerings enhanced the functionality of chip systems. As technology adoption increased, more users sought advanced support tools. This trend indicated strong future potential for this segment.

Organ Type Analysis

In 2024, Heart-on-a-Chip held a dominant market position in the Organ Type segment of the Organ on a Chip market, capturing more than a 28.5% share. This segment has gained popularity due to its accurate simulation of heart tissues and rhythms. Experts believe its role in cardiovascular drug screening and toxicity testing has increased its demand. It is widely used in pharma research due to its precision. This has positioned it as a preferred choice in cardiac-related studies.

The Liver-on-a-Chip segment secured the second-largest share. Analysts point to its role in drug metabolism and detoxification studies as a key growth driver. It helps in assessing liver toxicity, which is crucial during early drug development. Lung-on-a-Chip also showed strong performance. It replicates breathing functions and is useful in respiratory research. Conditions like asthma and COPD have fueled its adoption. Its importance in inhalation toxicity testing continues to rise, particularly in respiratory health studies.

Other organ types such as Kidney-on-a-Chip and Brain-on-a-Chip are gaining attention. Kidney-on-a-Chip is valued for testing drug-induced kidney damage. It supports drug screening for renal clearance and filtration. Brain-on-a-Chip helps in studying neurological functions and disorders. It can mimic the blood–brain barrier, which is vital for brain-targeted drug delivery. The Others category, including skin and gut chips, remains niche but shows potential. Together, these segments support innovation and help expand the applications of organ-on-chip technology.

Application Analysis

In 2024, Drug Discovery & Development held a dominant market position in the application segment of Organ on a Chip, capturing more than a 44.2% share. This segment benefited from the rising need for more accurate drug testing methods. Experts noted that organ-on-chip systems offer better predictions of human responses than traditional models. The demand for faster and cost-effective drug discovery processes further supported this trend. As a result, pharmaceutical companies increasingly adopted these platforms for early-stage development.

Toxicology Research followed as the second-largest segment within the market. Its growth was attributed to the rising demand for safer drugs. Researchers observed that organ-on-chip platforms enabled high-throughput screening of toxic effects. This helped in early identification of harmful compounds and reduced late-stage failures. The improved accuracy in toxicity detection made these systems valuable tools in preclinical testing. Their use in regulatory submissions also supported wider adoption across research institutions and testing laboratories.

Disease Modeling and Regenerative Medicine also gained attention in the market. Disease modeling benefited from the ability to replicate complex human disease environments. This allowed researchers to study disease progression in real-time. Regenerative medicine, on the other hand, saw growth due to the integration of stem cell research. Organ-on-chip systems supported studies in tissue regeneration and organ repair. Other applications, including personalized medicine and environmental testing, showed potential for future expansion as innovation in the field continued.

End User Analysis

In 2024, Pharmaceutical & Biotechnology Companies held a dominant market position in the end user segment of Organ on a Chip, capturing more than a 51.3% share. This growth was supported by the rising need for efficient drug testing platforms. These companies adopted organ-on-chip systems to improve accuracy in drug discovery. The technology helped reduce dependence on animal models. It also enabled faster screening and validation of drug candidates. These benefits led to higher adoption across R&D pipelines.

Academic & Research Institutes represented the second-largest end user group. Their growing interest in advanced cell biology and microfluidic technologies supported market demand. Researchers used organ-on-chip platforms for disease modeling and tissue engineering. These systems allowed better simulation of human organ functions. This helped in generating accurate data for academic publications and government-funded projects. The adoption in universities and public labs continued to grow, especially in biomedical and translational research fields.

The Others segment includes contract research organizations, hospitals, and environmental testing agencies. While smaller in market share, this segment showed steady growth. The flexibility of organ-on-chip platforms made them suitable for varied testing environments. These users applied the technology in toxicity screening, personalized medicine, and biosafety research. Their interest in non-invasive and ethical testing methods added to the market potential. Future growth in this segment is expected as awareness and accessibility increase.

Key Market Segments

By Product Type

- Organ-on-a-Chip Devices

- Consumables and Accessories

- Software and Services

By Organ Type

- Heart-on-a-Chip

- Liver-on-a-Chip

- Lung-on-a-Chip

- Kidney-on-a-Chip

- Brain-on-a-Chip

- Others

By Application

- Drug Discovery & Development

- Toxicology Research

- Disease Modeling

- Regenerative Medicine

- Others

By End User

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

- Others

Drivers

Rising Demand For Alternatives To Animal Testing

The rising demand for alternatives to animal testing is a key driver in the organ-on-a-chip market. Regulatory bodies and ethical organizations are raising concerns about the limitations and moral implications of animal-based research. As a result, the scientific community is seeking innovative models that align with both ethical standards and scientific precision. Organ-on-a-chip technologies are emerging as viable alternatives. These systems help reduce reliance on animal testing while supporting advancements in biomedical research and drug development.

Increased focus on human-relevant testing models is further boosting market growth. Traditional animal models often fail to predict human-specific responses, leading to high drug attrition rates. Organ-on-a-chip platforms simulate human physiological processes more accurately. These microengineered systems replicate the structure and function of human organs on a miniature scale. This allows for better prediction of drug efficacy and toxicity. Consequently, pharmaceutical and biotechnology companies are adopting these technologies in preclinical studies to improve safety and success rates.

Moreover, the integration of advanced technologies is strengthening the adoption of organ-on-a-chip systems. Microfluidics, tissue engineering, and stem cell biology are being combined to enhance model accuracy. These innovations enable dynamic control over the cell microenvironment. This supports more realistic organ simulations. Researchers can model complex diseases and conduct precise drug screening. This technological progress, along with supportive regulatory guidelines, is expected to accelerate the shift towards in vitro testing models. As a result, the organ-on-a-chip market is positioned for sustained growth over the forecast period.

Restraints

High cost and complexity of fabrication

The high cost of microfluidic device fabrication remains a major restraint for market growth. Manufacturing involves specialized equipment and cleanroom environments. These facilities require significant capital investment, which creates a financial barrier for new entrants. Furthermore, the cost of maintaining these facilities adds to the overall expenses. As a result, adoption becomes limited, particularly among organizations with tight budgets. Small and mid-sized enterprises are especially affected. This financial pressure slows down product development and delays commercialization efforts within the sector.

Microfluidic systems require highly sophisticated design and integration processes. These devices must operate with extreme precision to handle fluid volumes at the microscale. The process of developing such high-performance systems involves complex engineering and testing. This technical demand makes it challenging for companies without advanced infrastructure. Additionally, the lack of standardized design protocols adds further complexity. These technical challenges deter smaller research centers and startups. As a result, the technology’s accessibility remains restricted, especially in emerging markets.

Due to the high costs and technological barriers, adoption of microfluidic devices is slow. Smaller research institutions and mid-level biopharmaceutical companies struggle to invest. The limited adoption rate curbs potential market expansion. Companies must also consider the risk of low returns due to uncertain demand. This discourages many from entering the market. Although the technology holds great promise, these restraints hinder rapid growth. To improve adoption, cost-effective manufacturing and simplified integration solutions must be developed. Overcoming these issues is vital for sustained industry growth.

Opportunities

Expansion In Personalized Medicine Applications

The expansion of personalized medicine presents a significant opportunity for organ-on-a-chip (OoC) platforms. By using patient-derived cells, these platforms can replicate individual disease conditions more accurately. This method enables the creation of customized disease models that reflect real patient biology. As a result, the OoC systems can support more predictive and relevant preclinical testing. The shift toward patient-specific models is expected to enhance the precision of research outcomes. This trend is gaining interest among pharmaceutical and biotech companies aiming to reduce failure rates in clinical trials.

Integrating OoC platforms with patient-derived cells allows for more effective drug screening processes. Traditional models often fail to capture individual variability in drug response. However, personalized OoC systems address this gap by mimicking the genetic and physiological conditions of specific patients. This enhances the identification of effective compounds and reduces the risk of adverse effects. Pharmaceutical developers can use these models to test multiple treatment options efficiently. Consequently, drug development pipelines can become more streamlined and cost-effective over time.

Tailored OoC-based disease models also enable the optimization of therapeutic strategies. They provide valuable insights into patient-specific treatment responses before clinical application. This approach supports the goals of precision medicine by improving clinical decision-making. Moreover, it facilitates the development of targeted therapies with higher success rates. The integration of real-time data from personalized chips can guide ongoing treatment adjustments. As adoption increases, this application is likely to gain regulatory interest and industry investment. Thus, it offers a promising pathway for innovation in personalized healthcare.

Trends

Integration of AI and biosensors in OoC systems

The integration of artificial intelligence (AI) into Organ-on-a-Chip (OoC) systems is emerging as a significant technological trend. AI enables enhanced data analysis and pattern recognition in real-time. Through machine learning algorithms, researchers can automate the interpretation of complex biological responses. This leads to faster insights and improved decision-making. In drug discovery, AI enhances the predictive accuracy of drug interactions. It also reduces time and costs associated with preclinical testing. As a result, the demand for AI-powered OoC platforms is steadily increasing.

Biosensors are being increasingly adopted within OoC platforms to allow continuous real-time monitoring of biological processes. These sensors provide precise detection of biomarkers, chemical signals, and cellular responses. The use of biosensors supports early identification of toxicity and physiological changes. This enhances the sensitivity and reliability of in vitro models. In toxicology studies, biosensors offer valuable insights by capturing subtle variations in tissue responses. The growing need for non-invasive, accurate, and fast testing methods drives the use of biosensors in OoC technologies.

The combined application of AI and biosensing technologies is expected to significantly improve the functionality and scalability of OoC platforms. This integration allows for better data acquisition, automated analysis, and predictive modeling. It also supports the development of high-throughput testing environments. These advancements are especially beneficial for pharmaceutical companies focused on drug screening and personalized medicine. The synergy between AI and biosensors offers a robust, data-driven approach. It is likely to accelerate market adoption and investment in next-generation OoC systems.

US Tariff Impact on ‘Organ on a Chip, Market

The United States’ imposition of tariffs on biotechnology-related imports has affected the “Organ-on-a-Chip” (OoC) market. Many OoC components—such as microfluidic systems, polymers, and sensors—are sourced globally. Tariffs on these items have led to a rise in production costs. Materials like polydimethylsiloxane (PDMS) and silicon wafers are among the key imports impacted. This cost increase has made it difficult for U.S. manufacturers to stay competitive. As a result, companies have faced higher operational expenses, reducing affordability for research institutions and pharmaceutical firms.

These increased tariffs have pressured manufacturers to choose between absorbing the extra costs or passing them on. In many cases, the additional burden has been transferred to customers. This has slowed the short-term expansion of the U.S. OoC market. Price-sensitive segments such as academic labs and early-stage biotech companies have been most affected. In addition to tariffs, global supply chain disruptions and inflation have further constrained the market’s growth. The resulting uncertainty has made planning and investment more difficult for stakeholders.

However, the long-term impact could support domestic resilience. Some U.S. companies have begun investing in local supply chains to reduce foreign dependency. This has led to increased interest in building domestic manufacturing capabilities. Government incentives and policies that encourage onshore production are also being explored. These shifts may help reduce import-related risks and strengthen the overall ecosystem. Over time, this could boost innovation and cost-efficiency in the U.S. OoC industry. Domestic self-sufficiency is likely to become a strategic priority.

Despite current challenges, the U.S. continues to lead in OoC research and development. Strong institutional funding and regulatory backing remain key drivers. The FDA’s support for non-animal testing models is fueling long-term demand. Growth prospects depend on trade policy developments and domestic capacity building. The market is expected to adapt, with innovation offsetting short-term setbacks caused by tariffs.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 54.6% share and holds US$ 61.26 million market value for the year. According to industry observations, this growth has been supported by strong biomedical research capabilities in the region. Leading universities and research centers have driven early adoption of organ-on-a-chip technologies. There is also a growing shift towards non-animal testing methods. This aligns with increasing ethical concerns and regulatory encouragement for alternative models.

Experts have noted that North America’s pharmaceutical industry is playing a key role in market expansion. The adoption of microphysiological systems for drug development is rising rapidly. These systems improve testing accuracy while reducing time and cost. The U.S. Food and Drug Administration’s openness to non-animal models has created a favorable environment. Such regulatory support is believed to have accelerated innovation. As a result, organ-on-a-chip platforms are now more commonly used in preclinical drug research.

Analysts highlight that collaboration is another growth factor in this region. Partnerships between academic institutions and private companies are helping to advance technology. Intellectual property protection is also strong, which encourages investment. In 2024, North America held a dominant market position, capturing more than a 54.6% share and holds US$ 61.26 million market value for the year. Combined with ongoing research funding and favorable policies, the region is expected to maintain its lead. Its innovation ecosystem continues to support the development of next-generation organ-on-a-chip solutions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Organ-on-a-Chip (OoC) market includes several prominent players driving innovation and expanding its application scope. Emulate Inc. is a pioneer in this field, offering its proprietary Human Emulation System for pharmaceutical research and toxicology testing. Through strategic collaborations with pharmaceutical firms and academic institutions, the company has enhanced market adoption. MIMETAS B.V., known for its OrganoPlate® technology, focuses on high-throughput 3D tissue models. Its solutions support nephrotoxicity and oncology research, positioning it strongly in large-scale drug screening applications.

Tissue Dynamics develops physiologically relevant in-vitro models using stem cell-derived tissues. It specializes in liver and cardiac OoC platforms. Its systems integrate real-time biosensing, which improves the accuracy of early-stage drug development. Organovo Holdings, Inc., traditionally known for 3D bioprinting, now develops advanced liver tissue models for disease research. The company combines biofabrication with microfluidic systems. This hybrid approach enables platforms that replicate complex biological functions, increasing its value within preclinical testing and drug discovery processes.

AxoSim Technologies stands out with its CNS-focused OoC models. Its Nerve-on-a-Chip® and BrainSim® platforms support predictive neurotoxicity and neurological disease research. The company collaborates with pharmaceutical firms to boost neurodrug development accuracy. Other key players include TissUse GmbH, CN Bio Innovations, Nortis Inc., and Hesperos Inc. These firms focus on multi-organ chips, disease modeling, and personalized medicine. Their global partnerships and advanced product offerings have strengthened market competition. As a result, technological progress and innovation have been further accelerated in the organ-on-a-chip industry.

Market Key Players

- Emulate Inc.

- MIMETAS

- Tissue Dynamics

- Organovo

- AxoSim Technologies

- ChipSights

- Allevi (3D Bioprinting Solutions)

- Bio-Techne (ACEA Biosciences)

- SynVivo

- Fluicell

- Haplogen GmbH

- Nortis Inc.

- Biogelx

- Xona Microfluidics

- Kirkstall Ltd.

- Others

Recent Developments

- In June 2023: Emulate was reported to have launched the Chip-A1, a next-generation Organ-on-a-Chip platform designed to broaden its utility in cancer and cosmetics research. According to available information, this advanced chip enables the modeling of complex 3D tissues—such as tumor microenvironments and skin with improved features, including the ability to simulate thicker tissues and facilitate direct compound dosing. Additionally, the Chip-A1 is said to support the integration of immune cells or bacteria, thereby enhancing the physiological relevance of preclinical models.

- In October 2024: Nortis was acquired by Quris-AI, a Bio-AI company focused on drug safety prediction. This acquisition integrated Nortis’s advanced Kidney-on-Chip technology into Quris-AI’s platform to enhance drug safety and efficacy predictions. The Kidney-on-Chip models, recognized by the NIH’s National Center for Advancing Translational Sciences, are expected to improve renal toxicity assessments and pharmacokinetic predictions in drug development processes. The collaboration also continues Nortis’s partnerships with regulatory bodies like the FDA and research institutes to advance kidney disease research.

Report Scope

Report Features Description Market Value (2024) US$ 112.2 Million Forecast Revenue (2034) US$ 2651.8 Million CAGR (2025-2034) 37.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Organ-on-a-Chip Devices, Consumables and Accessories, Software and Services), By Organ Type (Heart-on-a-Chip, Liver-on-a-Chip, Lung-on-a-Chip, Kidney-on-a-Chip, Brain-on-a-Chip, Others), By Application (Drug Discovery & Development, Toxicology Research, Disease Modeling, Regenerative Medicine, Others), By End User (Academic & Research Institutes, Pharmaceutical & Biotechnology Companies, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Emulate Inc., MIMETAS, Tissue Dynamics, Organovo, AxoSim Technologies, ChipSights, Allevi (3D Bioprinting Solutions), Bio-Techne (ACEA Biosciences), SynVivo, Fluicell, Haplogen GmbH, Nortis Inc., Biogelx, Xona Microfluidics, Kirkstall Ltd., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Emulate Inc.

- MIMETAS

- Tissue Dynamics

- Organovo

- AxoSim Technologies

- ChipSights

- Allevi (3D Bioprinting Solutions)

- Bio-Techne (ACEA Biosciences)

- SynVivo

- Fluicell

- Haplogen GmbH

- Nortis Inc.

- Biogelx

- Xona Microfluidics

- Kirkstall Ltd.

- Others