Global Open Banking APIs Market By Service Type (Account Information Services, Payment Initiation Services, Fund Confirmation Services), By Deployment Mode (Cloud-based, On-premises), By End-User (Banks, FinTechs, Third-Party Providers, Corporates), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan.2026

- Report ID: 175101

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Key Adoption and Usage Statistics

- Drivers Impact Analysis

- Restraint Impact Analysis

- Risk Impact Analysis

- Service Type Analysis

- Deployment Mode Analysis

- End-User Analysis

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Emerging Trends Analysis

- Opportunity Analysis

- Key Market Segments

- Regional Analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

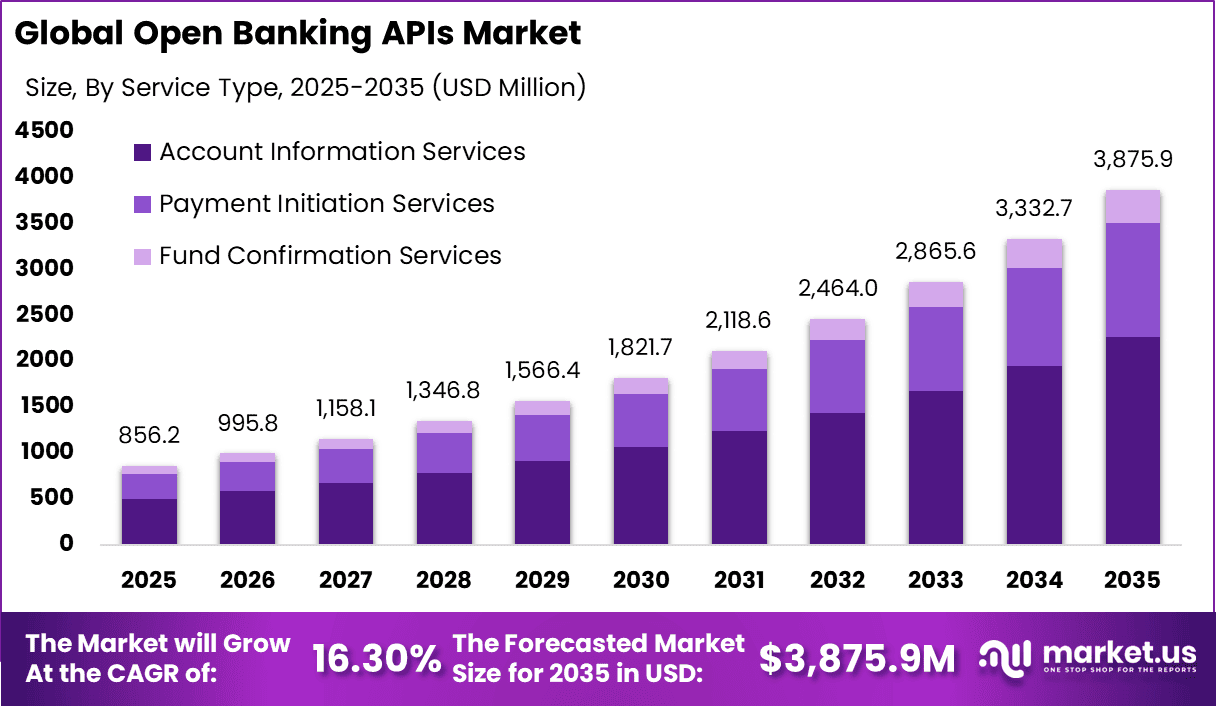

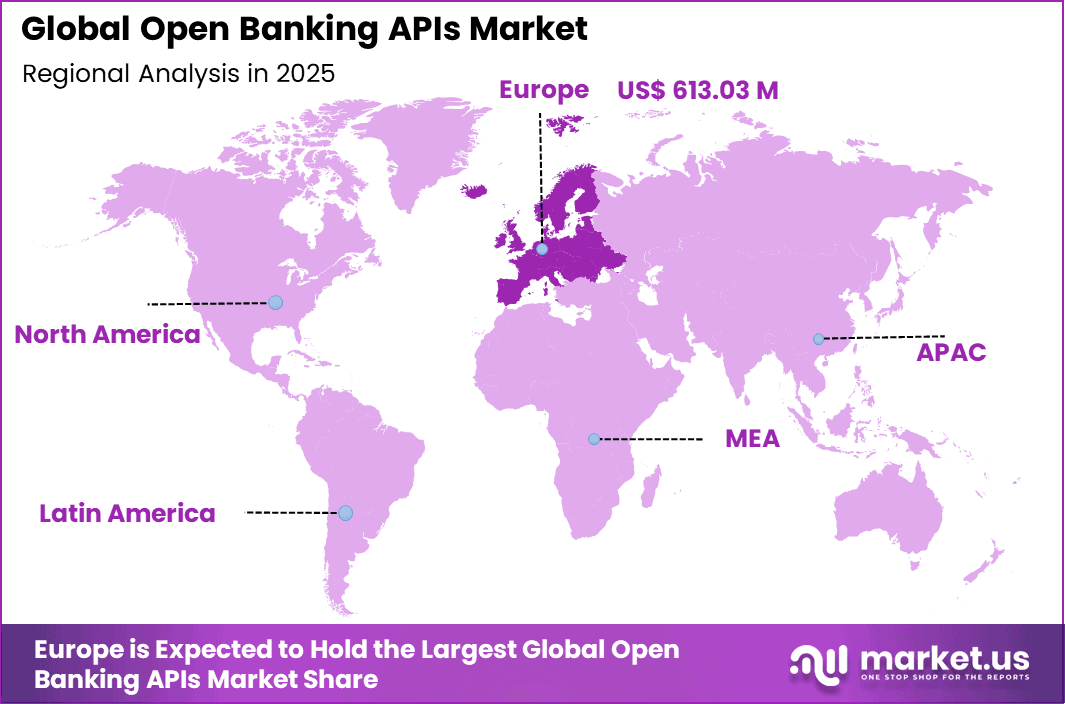

The Global Open Banking APIs Market generated USD 856.2 million in 2025 and is predicted to register growth from USD 995.8 million in 2026 to about USD 3,875.9 billion by 2035, recording a CAGR of 16.30% throughout the forecast span. In 2025, Europe held a dominan market position, capturing more than a 71.6% share, holding USD 613.03 Billion revenue.

The Open Banking APIs market refers to the ecosystem of software interfaces that allow banks and financial institutions to securely share customer data and services with authorized third-party providers when the customer gives consent. These Application Programming Interfaces (APIs) enable real-time access to account information, transaction history, and payment initiation services without requiring manual data entry or insecure practices such as screen scraping.

Open Banking APIs form the technical backbone of modern financial systems that support data sharing, enhanced payments, and digital financial services innovation across multiple platforms and use cases. This market has emerged as a key enabler of digital transformation in financial services, connecting traditional banks, fintech companies, and other service providers through secure API connections.

A major driver of the Open Banking APIs market is the increasing demand for faster, seamless and cost-efficient financial transactions among consumers and businesses. Digital banking behaviours around account aggregation, instant payments, and automated financial services have led institutions to adopt API-first models that support these services with greater reliability and security. This evolution influences how financial data flows between banks and third parties, supporting richer digital experiences.

Demand for Open Banking APIs is anchored in the need for improved customer experiences across digital financial products. Consumers and corporate customers increasingly expect services that integrate multiple accounts, provide instant transaction insights, and support digital and mobile-first payment methods. Open Banking APIs enable these functionalities by offering structured, secure access to real-time banking data and operations.

Top Market Takeaways

- By service type, account information services led the open banking APIs market with 58.4% share, enabling secure access to customer financial data for aggregation and insights.

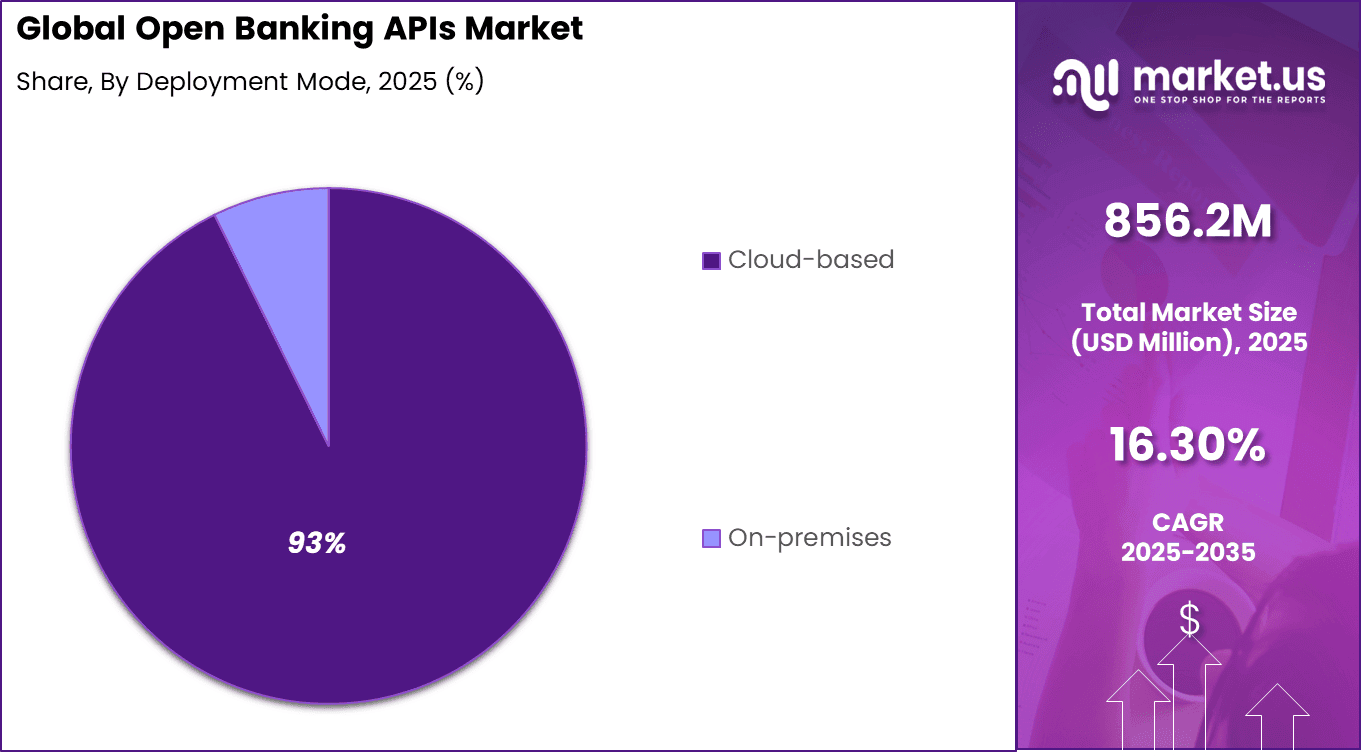

- By deployment mode, cloud-based solutions dominated at 92.7%, providing scalable infrastructure for high-volume API transactions and regulatory compliance.

- By end-user, FinTechs captured 64.8%, leveraging APIs to build innovative payment and lending services on top of traditional bank data.

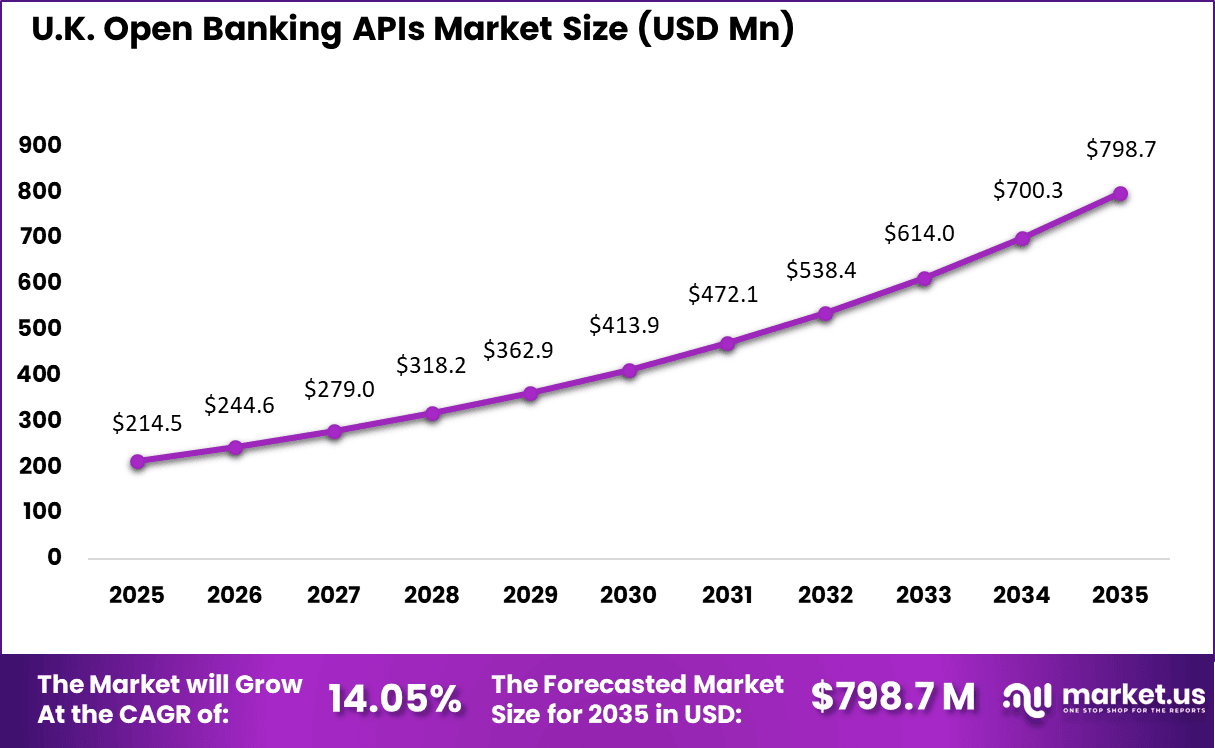

- Europe held 71.6% of the global market, with the UK valued at USD 214.5 million and growing at a CAGR of 14.05%.

Key Adoption and Usage Statistics

- In March 2025, around one in five individuals and small businesses with online banking access in the UK were actively using open banking, reflecting a 40% increase compared with the previous year.

- The global number of open banking users is expected to more than triple between 2025 and 2029, indicating strong and sustained adoption worldwide.

- In March 2025, the UK recorded a peak of 31 million open banking payments, accounting for 7.9% of all Faster Payments. Globally, open banking transaction value is expected to rise from USD 57 billion in 2023 to about USD 330 billion by 2027.

- Global open banking API calls are projected to increase from 137 billion in 2025 to 722 billion by 2029, representing 427% growth. In the UK alone, open banking services were accessed more than 2 billion times via APIs in July 2025.

- Adoption remains high in the US and Europe, with about 52% of US adults using at least one open banking service in 2025, while Asia Pacific is expected to record the fastest growth rate through 2030.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~)% Geographic Relevance Impact Timeline Regulatory mandates for open banking and data sharing +4.2% Europe, UK, Australia Short to medium term Rapid growth of fintech platforms and digital banks +3.6% Europe, North America Medium term Rising demand for API based payments and account aggregation +3.1% Europe, North America, Asia Pacific Medium term Expansion of embedded finance and Banking as a Service models +2.1% North America, Europe Medium to long term Increased enterprise adoption of API driven financial integration +1.3% Global Long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~)% Geographic Relevance Impact Timeline Data privacy and consent management complexity -2.1% Europe, North America Short to medium term Lack of standardization across API frameworks -1.8% North America, Emerging Markets Medium term High integration costs for legacy banking systems -1.6% Europe, Asia Pacific Medium term Limited adoption among smaller financial institutions -1.2% Emerging Markets Medium to long term Consumer trust concerns around data sharing -1.0% Global Short term Risk Impact Analysis

Key Risk Factor Impact on CAGR Forecast (~)% Geographic Relevance Impact Timeline Regulatory uncertainty outside mature open banking regions -2.4% North America, Asia Pacific Medium term Cybersecurity breaches impacting API ecosystems -2.0% Global Short to medium term Dependency on third party fintech platform stability -1.5% Europe, North America Medium term Slower monetization of API based revenue models -1.3% Global Medium to long term Economic downturn reducing fintech investment -1.1% Global Medium term Service Type Analysis

Account information services account for 58.4%, making them the leading service type in the open banking APIs market. These services allow secure access to customer account data with consent. Financial institutions use them to provide aggregated financial views. Transparency improves customer trust and engagement. Data accuracy remains a core requirement.

The dominance of account information services is driven by demand for financial visibility. Consumers seek consolidated views of multiple accounts. Service providers rely on standardized APIs for data sharing. Automation improves efficiency and reduces manual handling. This sustains strong adoption of account information services.

Deployment Mode Analysis

Cloud-based deployment holds 93%, reflecting strong preference for scalable API infrastructure. Cloud environments support high transaction volumes. Rapid deployment improves time to market. Centralized management simplifies updates and monitoring. Flexibility remains a key advantage.

Adoption of cloud-based deployment is driven by API-first strategies. Financial services increasingly operate in cloud environments. Cloud platforms support integration with multiple partners. Secure access controls protect sensitive data. This keeps cloud deployment dominant.

End-User Analysis

FinTechs account for 64.8%, making them the largest end-user group. These companies build innovative financial products using APIs. Open banking supports faster service development. Data access enables personalized offerings. Agility remains essential for FinTech operations.

Growth in FinTech adoption is driven by competitive differentiation. APIs allow rapid integration with banks. FinTechs rely on standardized data access. Automation reduces operational friction. This sustains strong FinTech participation.

Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Banking and financial services groups High Medium Europe, North America Strong long term strategic value Fintech platform providers Very High High Europe, North America High growth with innovation upside API infrastructure and SaaS investors High Medium North America Scalable and recurring revenue Private equity firms Medium Medium Global Consolidation and platform roll ups Venture capital investors Very High Very High Europe, North America Best suited for early stage disruption Technology Enablement Analysis

Technology Enabler Impact on CAGR Forecast (~%) Primary Function Geographic Relevance Adoption Timeline Standardized open banking API frameworks +4.0% Regulatory compliance and scale Europe Short term Cloud native API management platforms +3.4% Faster deployment and scalability North America, Europe Medium term AI driven fraud detection and consent analytics +2.7% Risk reduction and trust building North America Medium term API monetization and usage analytics tools +2.2% Revenue optimization Europe, North America Medium to long term Blockchain based data security layers +1.6% Enhanced data integrity Global Long term Emerging Trends Analysis

Open banking APIs are increasingly standardised to support secure and seamless data exchange between financial institutions, third-party providers, and fintech applications. These APIs serve as structured, secure channels for sharing account and transaction data when customers grant consent, facilitating integration with budgeting tools, payment services, and other digital financial products.

A second trend is the expansion of open banking beyond traditional bank data access toward enriched ecosystems that include embedded finance, personalised insights, and credit services. APIs are enabling non-bank entities to offer financial functionality such as payments, lending services, and investment management within their own customer interfaces.

Opportunity Analysis

An important opportunity is the monetisation of API services that drive new digital revenue streams for banks and third-party providers. By exposing APIs, financial institutions can collaborate with fintech firms to build value-added services such as instant payments, personalised financial dashboards, and lending products, creating long-term monetisation potential. This expanded ecosystem can enhance customer engagement and open up new business models.

Another opportunity lies in leveraging open banking APIs to enhance financial inclusion by extending access to digital financial services. In markets like India, open banking initiatives built on APIs and consent-based data sharing are fostering broader participation in digital finance and enabling more flexible credit, payments, and savings tools for underserved users.

Key Market Segments

By Service Type

- Account Information Services

- Payment Initiation Services

- Fund Confirmation Services

By Deployment Mode

- Cloud-based

- On-premises

By End-User

- Banks

- FinTechs

- Third-Party Providers

- Corporates

Regional Analysis

Europe accounted for 71.6% share, reflecting early regulatory leadership and broad implementation of open banking frameworks across the region. Mandatory data sharing regulations have encouraged banks to expose standardized APIs, enabling secure access to account data and payment initiation services.

Demand has been driven by strong participation from fintech firms, payment providers, and financial institutions seeking to improve customer experience and competition. Widespread adoption of API standards has supported interoperability and accelerated development of new financial products.

Europe vs North America Regional Comparison

Parameter Europe North America Market maturity Highly mature Rapidly developing Regulatory environment Strong and mandatory Fragmented and evolving Adoption drivers Compliance led adoption Innovation and fintech led API standardization High Moderate Revenue concentration Very high Moderate but expanding Growth momentum Stable and sustained Faster acceleration The UK market reached USD 214.5 Mn and is projected to grow at a 14.05% CAGR, reflecting strong institutional support and active fintech participation. The UK has been among the earliest adopters of open banking, with standardized API frameworks enabling secure data sharing between banks and third party providers. Adoption has been driven by demand for improved payment efficiency, account visibility, and personalized financial services.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

Leading API aggregation and connectivity providers such as Plaid, Tink, and TrueLayer play a central role in enabling secure access to bank data. Their APIs support account information, transaction data, and payment initiation. Strong compliance with PSD2 and similar regulations supports trust. Yapily and Token strengthen real-time payment use cases. Demand is driven by fintech innovation and digital banking growth.

Specialized data and enrichment providers such as Salt Edge, Bud Financial, and Finicity focus on data categorization, identity, and risk insights. MX Technologies and Envestnet Yodlee support large financial institutions with scalable data access. These players emphasize data accuracy, consent management, and analytics. Adoption is strong among lenders, personal finance apps, and wealth platforms.

Enterprise integration and platform vendors such as Apigee, Axway, and IBM enable banks to expose and manage APIs securely. Temenos and SAP embed open banking within core systems. Other vendors expand regional reach and interoperability. This competitive landscape supports secure, scalable, and regulation-ready open banking ecosystems.

Top Key Players in the Market

- Plaid

- Tink

- TrueLayer

- Yapily

- Token

- Salt Edge

- Bud Financial

- Finicity

- MX Technologies

- Envestnet Yodlee

- Apigee

- Axway

- IBM

- Temenos

- SAP

- Others

Future Outlook

Growth in the Open Banking APIs market is expected to remain strong as financial institutions and fintech firms expand data sharing and digital services. APIs are being used to enable secure access to account information, payments, and financial insights with customer consent.

Rising demand for personalized financial products and regulatory support for open banking frameworks are driving adoption. Over time, improved security standards, wider API coverage, and cross industry integration are likely to strengthen trust and expand use cases.

Recent Developments

- In 2025, Envestnet sold Yodlee to STG in June, a data aggregation powerhouse for open finance, closing Q3 for focused growth. Yodlee keeps serving banks like Citi with OAuth APIs. It bolsters US open banking push amid CFPB rules.

- In 2025, Salt Edge teamed with Serbia’s Saga in April 2025 to roll open banking compliance hubs, prepping local banks for PSD2 deadlines in May. They launched bulk payments via PSD2 APIs in December 2025, automating mass payouts for fintechs. This expands their 46-country network into Balkans.

Report Scope

Report Features Description Market Value (2025) USD 856.2 Mn Forecast Revenue (2035) USD 3,875.9 Mn CAGR(2025-2035) 16.30% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Service Type (Account Information Services, Payment Initiation Services, Fund Confirmation Services), By Deployment Mode (Cloud-based, On-premises), By End-User (Banks, FinTechs, Third-Party Providers, Corporates), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035 Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Plaid, Tink, TrueLayer, Yapily, Token, Salt Edge, Bud Financial, Finicity, MX Technologies, Envestnet Yodlee, Apigee, Axway, IBM, Temenos, SAP, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Plaid

- Tink

- TrueLayer

- Yapily

- Token

- Salt Edge

- Bud Financial

- Finicity

- MX Technologies

- Envestnet Yodlee

- Apigee

- Axway IBM

- Temenos SAP Others