Global Onychomycosis Market By Type (Distal Subungual Onychomycosis, Proximal Subungual Onychomycosis, Total Dystrophic Onychomycosis and White Superficial Onychomycosis), By Treatment (Topical, Oral and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174705

- Number of Pages: 317

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

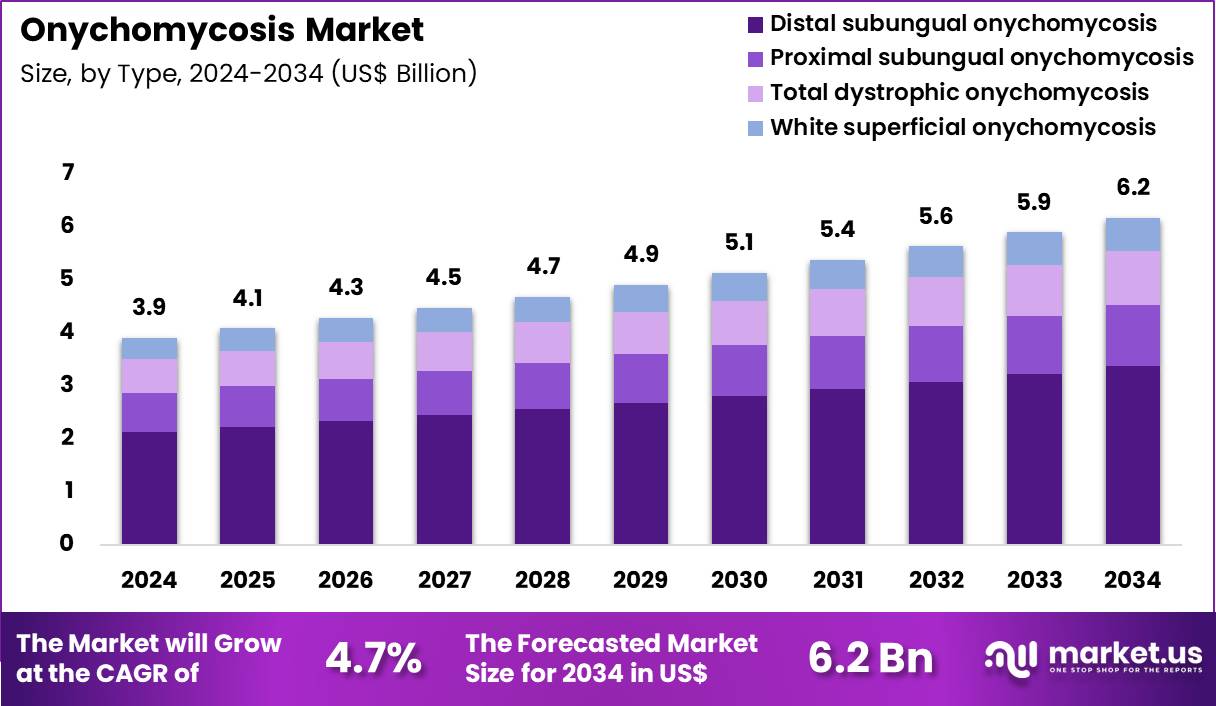

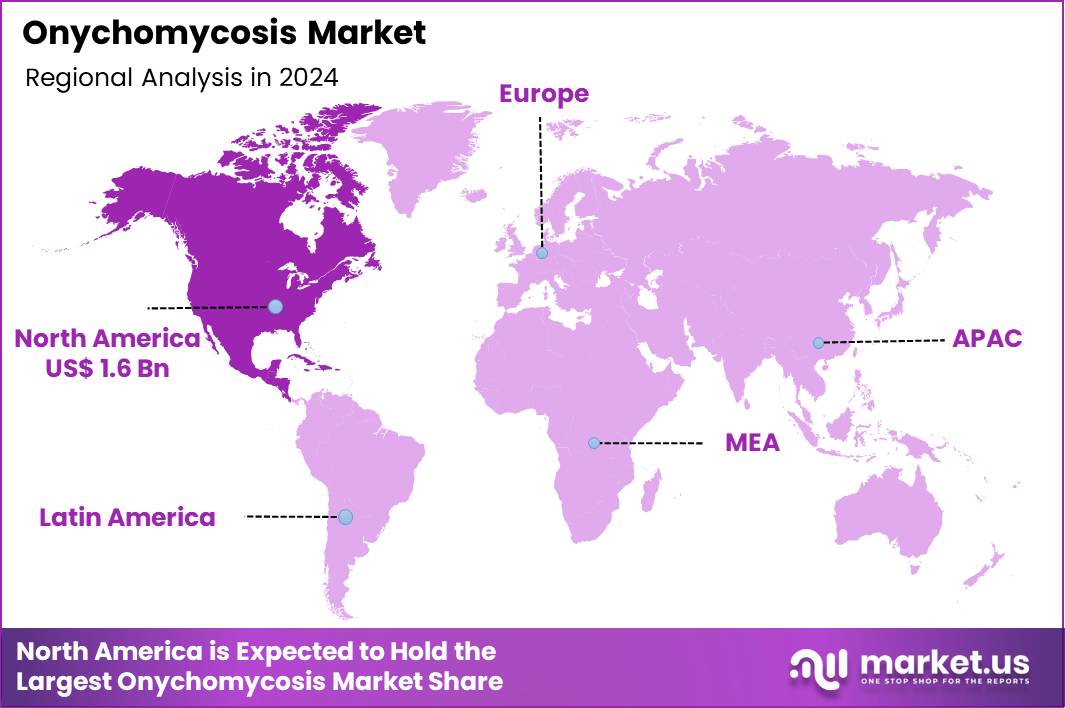

The Global Onychomycosis Market size is expected to be worth around US$ 6.2 Billion by 2034 from US$ 3.9 Billion in 2024, growing at a CAGR of 4.7% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.5% share with a revenue of US$ 1.6 Billion.

Increasing prevalence of onychomycosis, driven by aging populations and rising diabetes rates, compels pharmaceutical companies to innovate treatments that address nail fungal infections effectively. Dermatologists prescribe topical antifungals like ciclopirox and amorolfine to treat mild to moderate cases, allowing patients to apply lacquers or creams directly on affected nails for localized action without systemic side effects.

Clinicians recommend oral therapies such as terbinafine for severe infections involving multiple nails or dermatophyte strains, ensuring deep penetration to eradicate fungi from the nail matrix. Podiatrists utilize laser devices that target fungal cells through heat and light, offering non-invasive options for patients seeking alternatives to medications.

Healthcare providers combine these approaches in hybrid regimens, enhancing cure rates for recalcitrant onychomycosis in immunocompromised individuals. Manufacturers develop medicated nail polishes that disguise discoloration while delivering active ingredients, supporting aesthetic and therapeutic needs in cosmetic dermatology.

Pharmaceutical firms seize opportunities to formulate extended-release oral antifungals that reduce dosing frequency, improving adherence in chronic cases and expanding use among elderly patients. Developers advance nanoparticle-based topicals that enhance drug permeation through thick nails, opening avenues for over-the-counter products in early-stage infections. These innovations facilitate partnerships with telemedicine platforms, where virtual consultations guide self-application for mild symptoms.

Opportunities emerge in biologic agents that modulate immune responses against persistent fungi, targeting resistant strains in high-risk groups. Companies invest in diagnostic kits that integrate with treatments, enabling personalized regimens based on fungal identification. Recent trends emphasize sustainable sourcing of natural antifungals like tea tree oil in hybrid formulations, aligning with consumer preferences for eco-friendly options while sustaining efficacy across diverse infection severities.

Key Takeaways

- In 2024, the market generated a revenue of US$ 3.9 Billion, with a CAGR of 4.7%, and is expected to reach US$ 6.2 Billion by the year 2034.

- The type segment is divided into distal subungual onychomycosis, proximal subungual onychomycosis, total dystrophic onychomycosis and white superficial onychomycosis, with distal subungual onychomycosis taking the lead with a market share of 54.6%.

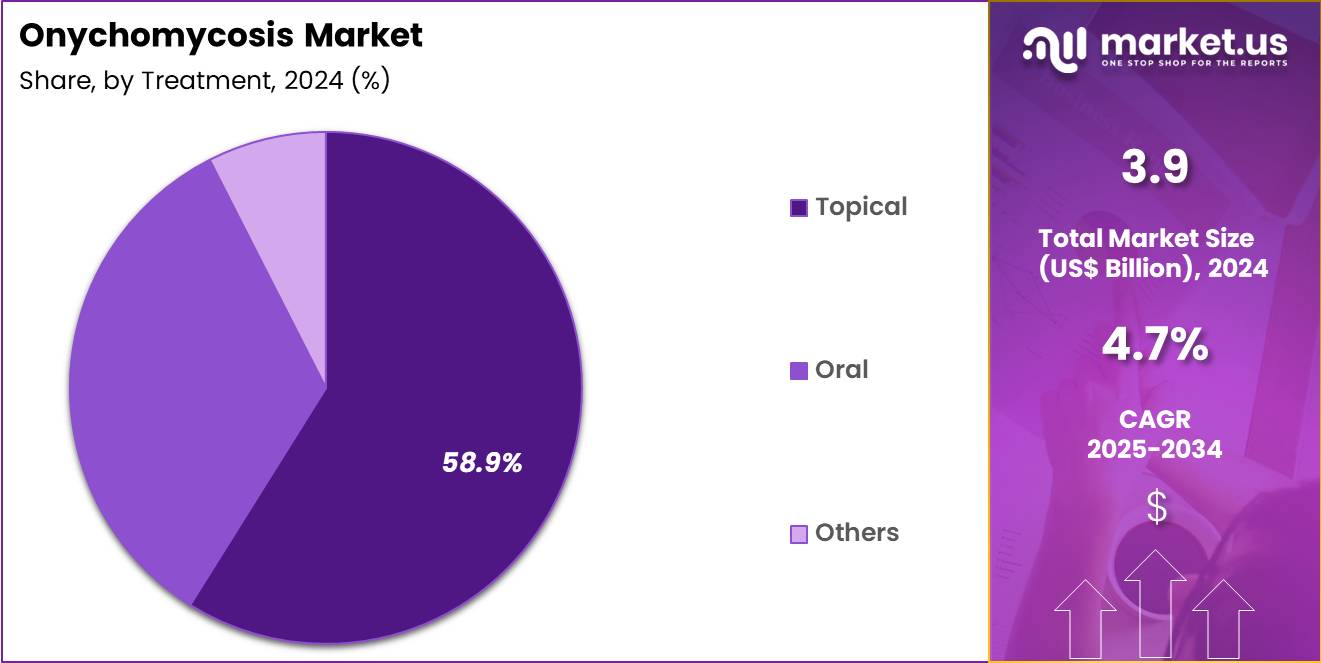

- Considering treatment, the market is divided into topical, oral and others. Among these, topical held a significant share of 58.9%.

- North America led the market by securing a market share of 41.5%.

Type Analysis

Distal subungual onychomycosis accounted for 54.6% of growth within the type category and represents the most prevalent presentation in the Onychomycosis market. High exposure of toenails to moist environments increases susceptibility to distal fungal invasion. The condition frequently affects adults and elderly populations, expanding the patient pool. Early-stage presentation encourages clinical diagnosis and treatment initiation.

Dermatologists routinely identify distal involvement during routine foot and nail examinations. Lifestyle factors such as occlusive footwear and sports activity increase incidence rates. Comorbidities including diabetes and peripheral vascular disease raise infection risk. Patients often seek treatment due to cosmetic concerns and discomfort. High recurrence awareness supports repeat treatment demand. Screening during podiatry visits improves detection rates.

Mild-to-moderate severity favors outpatient management. Distal localization allows easier topical penetration compared to proximal disease. Public awareness campaigns improve recognition of early symptoms. Growing access to dermatology services increases diagnosis volumes. The condition often presents as a first fungal nail infection, driving initial therapy uptake.

Chronic progression encourages long-term management strategies. Improved diagnostic tools support accurate classification. Treatment guidelines prioritize distal cases for early intervention. High prevalence in community settings sustains consistent demand. The segment is projected to remain dominant due to widespread occurrence and early clinical presentation.

Treatment Analysis

Topical treatment represented 58.9% of growth within the treatment category and stands as the leading therapeutic approach in the Onychomycosis market. Clinicians increasingly recommend topical therapies for mild-to-moderate infections. Favorable safety profiles support use without systemic monitoring. Patients prefer topical solutions due to lower risk of drug interactions. Long-term therapy suitability strengthens adherence in chronic cases.

Improved formulations enhance nail penetration and antifungal efficacy. Prescription and OTC availability improves access across regions. Topical treatments support use in patients with hepatic or renal concerns. Dermatology guidelines emphasize topical-first strategies for limited nail involvement. Combination use with mechanical debridement improves outcomes. Pediatric and elderly patients benefit from non-systemic options. Cosmetic formulations improve patient acceptance.

Extended treatment duration increases cumulative product consumption. Home-based application supports convenience and continuity. Innovations in lacquer and solution delivery improve performance. Growing awareness of oral antifungal side effects shifts preference toward topical care. Teledermatology supports remote prescription of topical agents.

Recurrence management relies heavily on topical maintenance therapy. Retail and pharmacy distribution strengthens uptake. Cost considerations favor topical use in many healthcare systems. The segment is anticipated to retain dominance due to safety, accessibility, and expanding formulation advancements.

Key Market Segments

By Type

- Distal subungual onychomycosis

- Proximal subungual onychomycosis

- Total dystrophic onychomycosis

- White superficial onychomycosis

By Treatment

- Topical

- Oral

- Others

Drivers

Increasing prevalence of onychomycosis is driving the market.

Onychomycosis, a fungal infection affecting the nails, has seen a rise in cases due to factors such as aging populations and chronic conditions like diabetes. This increase is prompting greater demand for effective antifungal therapies across various demographics. The condition primarily impacts toenails but can also affect fingernails, leading to discomfort and aesthetic concerns that motivate patients to seek treatment.

Healthcare providers are increasingly diagnosing the infection through advanced methods, contributing to market expansion. Global awareness campaigns by organizations emphasize early intervention, further boosting the need for pharmaceutical solutions. Immunocompromised individuals are particularly susceptible, expanding the patient pool requiring specialized care.

Diagnostic improvements, such as molecular testing, have enhanced detection rates, driving up prescription volumes. Pharmaceutical companies are investing in research to address this growing burden, fostering innovation in drug development.

The economic impact of untreated infections, including secondary complications, underscores the necessity for accessible treatments. According to a 2024 study published in the Journal of Fungi, the prevalence of onychomycosis is estimated at 4% globally, with a disproportionate burden among special populations.

Restraints

Antifungal resistance is restraining the market.

The emergence of resistance to common antifungal agents poses significant challenges to effective onychomycosis management. Traditional treatments like terbinafine are losing efficacy against certain strains, complicating therapeutic choices. Patients may require prolonged or alternative regimens, increasing treatment costs and durations. Healthcare providers face difficulties in achieving complete cures, leading to higher recurrence rates.

Resistance mechanisms in fungi, such as genetic mutations, limit the utility of established drugs. Regulatory bodies are monitoring this issue closely to guide clinical practices. Limited options for resistant cases can deter investment in new formulations by pharmaceutical firms. Public health initiatives aim to promote judicious use of antifungals to mitigate resistance spread.

Diagnostic delays exacerbate the problem, as inappropriate initial treatments foster resistant populations. According to the Centers for Disease Control and Prevention, the first known U.S. cases of terbinafine-resistant Trichophyton indotineae infections were reported in 2023, with updates highlighting ongoing concerns in 2024.

Opportunities

Development of novel topical therapies is creating growth opportunities.

Innovative topical formulations offer targeted delivery with reduced systemic side effects, appealing to patients wary of oral medications. These advancements address unmet needs in populations with contraindications to systemic drugs. Enhanced penetration technologies improve drug efficacy against nail fungi. Pharmaceutical pipelines include new agents designed for better patient compliance through easier application.

Regulatory approvals facilitate market entry for these therapies, expanding treatment options. Collaborative research between academia and industry accelerates development timelines. Topical solutions are particularly beneficial for mild to moderate cases, broadening accessibility. Cost-effective generics of newer topicals can increase market penetration in diverse regions.

Patient education on proper use enhances outcomes, supporting sustained demand. In January 2024, the U.S. Food and Drug Administration approved the Investigational New Drug application for VTR-297, a topical antifungal candidate from Vanda Pharmaceuticals for onychomycosis treatment.

Impact of Macroeconomic / Geopolitical Factors

Global economic expansions allocate resources to dermatological care advancements, propelling the onychomycosis market through heightened patient access to antifungal therapies in affluent societies. Executives leverage population aging trends to promote topical and oral treatments, which sustains consistent sales growth amid improved diagnostic capabilities.

Regrettably, pervasive worldwide inflation elevates expenses for active ingredients and packaging materials, prompting producers to confront profitability challenges in competitive pricing arenas. Deepening geopolitical tensions in API-exporting nations obstruct reliable ingredient flows, compelling distributors to navigate inventory shortages across international networks.

Forward-thinking leaders counter these obstacles by establishing diversified sourcing arrangements in stable locales, which refines logistical efficiency and unlocks potential for collaborative gains. Current US tariffs on imported pharmaceuticals from key suppliers impose additional cost layers, complicating market dynamics for foreign-dependent entities serving North American consumers.

Native manufacturers seize this momentum to expand U.S.-based operations, which fosters innovation in drug delivery and aligns with domestic health priorities. Continuous progress in laser-assisted and combination therapies steadfastly fortifies the sector’s outlook, ensuring resilient expansion and enhanced treatment efficacy for global patients.

Latest Trends

Emergence of terbinafine-resistant strains is a recent trend.

Recent years have witnessed a shift in fungal pathogen profiles, necessitating updated treatment protocols. Terbinafine, a frontline oral antifungal, is facing reduced effectiveness against evolving strains. This trend is prompting clinicians to consider combination therapies or alternatives. Surveillance data indicate geographic variations in resistance patterns, influencing regional prescribing habits. Pharmaceutical efforts are focusing on next-generation antifungals to counteract this issue.

Diagnostic tools incorporating susceptibility testing are gaining traction for personalized medicine. Public health alerts emphasize monitoring and reporting of resistant cases. Resistance is linked to environmental and agricultural antifungal use, highlighting interconnected factors. Research into resistance mechanisms is guiding novel drug design. According to the Centers for Disease Control and Prevention, rising terbinafine-resistant strains, including Trichophyton rubrum and Trichophyton indotineae, were noted with the first U.S. cases in 2023 and updates in 2024.

Regional Analysis

North America is leading the Onychomycosis Market

In 2024, North America held a 41.5% share of the global onychomycosis market, driven by rising incidences of nail fungal infections linked to diabetes and immunosuppression, prompting increased adoption of topical and oral antifungals like terbinafine and efinaconazole in dermatology practices for effective management of toenail and fingernail cases.

Dermatologists expanded prescriptions for laser therapies and combination regimens to address resistant strains, supported by clinical guidelines emphasizing early intervention to prevent complications in elderly and obese populations. Innovations in nail lacquer formulations improved penetration and compliance, aligning with regulatory focus on over-the-counter options for mild cases.

Demographic factors, including higher rates of pedicures and communal activities, amplified infection spread, leading to integrated screening in primary care. Pharmaceutical firms refined diagnostic kits with PCR accuracy, facilitating broader use in outpatient clinics. Collaborative awareness campaigns boosted patient seeking treatment, bridging gaps in underserved communities.

Supply adaptations ensured antifungal availability compliant with biosafety norms in pharmacies. The Centers for Disease Control and Prevention estimates that onychomycosis affects around 14% of the general population and is especially common in older adults.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Stakeholders forecast vigorous progression in onychomycosis therapies across Asia Pacific throughout the forecast period, as humid climates and dense populations exacerbate fungal spread amid urbanization. Clinicians integrate systemic antifungals into treatment protocols for severe nail infections, adapting regimens to diabetic cohorts in high-prevalence zones.

National health bodies subsidize laser devices for public clinics, equipping them to handle recurrent cases from occupational exposures. Biotech innovators customize topical azoles with enhanced efficacy, suiting regional genetic susceptibilities in immunocompromised patients. Cross-national research groups evaluate combination approaches through studies, optimizing outcomes for pediatric infections in tropical areas.

Pharmaceutical manufacturers localize production of ciclopirox variants, ensuring affordability for rural facilities. Policy initiatives promote hygiene education campaigns, empowering communities in peripheral regions facing diagnostic delays. The Global Burden of Disease study documented that Asia ranked first in fungal skin disease-related incidence with 883,292,233 cases in 2021, highlighting the significant burden including onychomycosis.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Onychomycosis market drive growth by expanding topical and oral treatment portfolios that improve penetration, shorten treatment duration, and enhance patient adherence. Companies increase adoption through clinician education and consumer awareness initiatives that encourage early diagnosis and consistent therapy completion.

Commercial strategies focus on broad retail availability, prescription channel strength, and digital marketing to reach patients seeking convenient treatment options. Innovation priorities include novel antifungal molecules, improved formulations, and combination approaches that address resistance and recurrence.

Market expansion targets regions with rising aging populations, diabetes prevalence, and heightened foot health awareness. Bausch Health operates as a prominent participant through its dermatology-focused portfolio, established antifungal brands, and strong distribution capabilities that support sustained growth in fungal nail infection management.

Top Key Players

- Novartis AG

- Pfizer Inc.

- Bayer AG

- Merz Pharma GmbH & Co. KGaA

- Galderma SA

- LEO Pharma A/S

- Valeant Pharmaceuticals (Bausch Health)

- Tarsus Pharmaceuticals

- Sandoz (Novartis)

- Amneal Pharmaceuticals

Recent Developments

- In February 2024, Moberg Pharma AB, through its Swedish marketing partner Allderma AB, launched MOB-015 under the brand name Terclara. Strong uptake and interest from pharmacies drive the onychomycosis market by confirming high unmet demand for effective topical therapies. Commercial traction at the pharmacy level increases treatment accessibility, raises disease awareness, and supports higher prescription and OTC conversion rates for fungal nail infections.

- In January 2024, Vanda Pharmaceuticals received FDA approval for its investigational new drug application to evaluate VTR-297 for onychomycosis. This regulatory milestone drives the onychomycosis market by expanding the clinical pipeline and reinforcing R&D momentum in antifungal therapies. Progression of novel candidates into clinical evaluation signals continued innovation, attracting investment and supporting long-term growth through diversified treatment options.

Report Scope

Report Features Description Market Value (2024) US$ 3.9 Billion Forecast Revenue (2034) US$ 6.2 Billion CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Distal Subungual Onychomycosis, Proximal Subungual Onychomycosis, Total Dystrophic Onychomycosis and White Superficial Onychomycosis), By Treatment (Topical, Oral and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Novartis AG, Pfizer Inc., Bayer AG, Merz Pharma GmbH & Co. KGaA, Galderma SA, LEO Pharma A/S, Valeant Pharmaceuticals, Tarsus Pharmaceuticals, Sandoz, Amneal Pharmaceuticals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-