Global Oncology Blood Testing Market By Test Type (Liquid Biopsy Assays, Tumor Marker Test, NIPT (Non-Invasive Prenatal Testing) Test, Exome-Based Liquid Biopsy, CTC-based Test, CBC Test, and Blood Protein Test), By Application (Lung Cancer, Ovarian Cancer, Melanoma, Gastrointestinal Stromal Tumor (GIST), Colon Cancer, and Breast Cancer), By End-user (Hospitals, Diagnostic Laboratories, and Specialty Clinics), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164207

- Number of Pages: 236

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

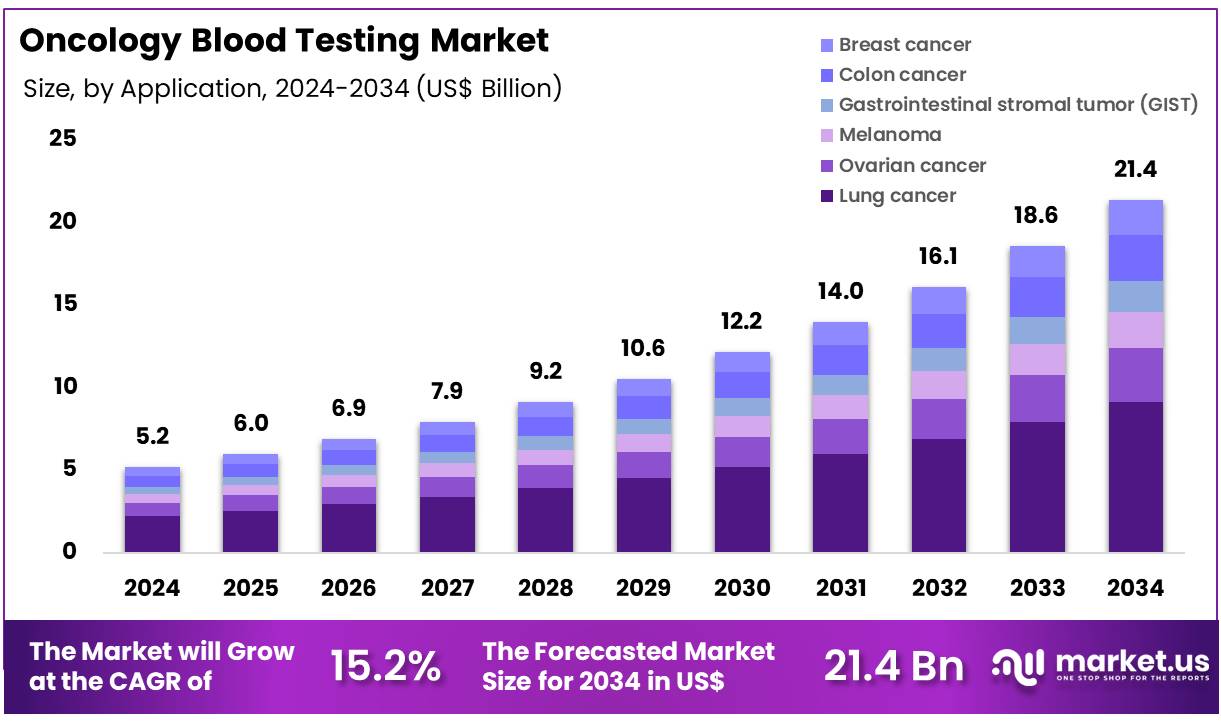

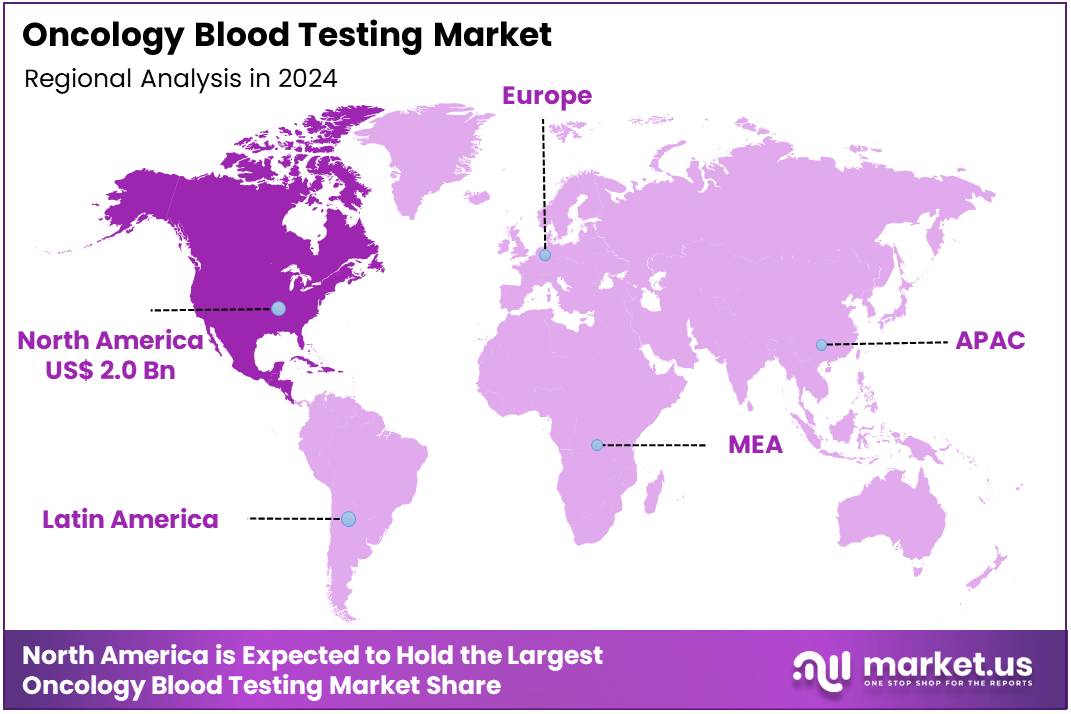

Global Oncology Blood Testing Market size is expected to be worth around US$ 21.4 Billion by 2034 from US$ 5.2 Billion in 2024, growing at a CAGR of 15.2% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.8% share with a revenue of US$ 2.0 Billion.

Increasing demand for non-invasive cancer detection drives the Oncology Blood Testing Market, as clinicians seek reliable alternatives to tissue biopsies. Oncologists apply liquid biopsy assays to identify circulating tumor DNA in peripheral blood, enabling early diagnosis of solid tumors. These tests support treatment selection by detecting actionable mutations like EGFR in lung cancer patients.

Research laboratories utilize blood-based proteomics to profile tumor biomarkers, advancing drug discovery. In May 2024, Burning Rock Biotech Limited launched China’s first blood-based pan-cancer study using multi-omics, validating liquid biopsy for comprehensive early detection and profiling. This milestone accelerates market growth by establishing non-invasive testing as a cornerstone in precision oncology.

Growing emphasis on precision medicine creates opportunities in the Oncology Blood Testing Market, as pharmaceutical companies integrate diagnostics into therapeutic development. Hematologists employ blood tests to monitor minimal residual disease in leukemia patients post-therapy, guiding relapse prevention strategies. These assays aid immunotherapy by assessing PD-L1 expression in circulating cells, optimizing checkpoint inhibitor use.

Automated platforms enhance throughput for companion diagnostic development, streamlining regulatory approvals. In July 2024, Biofidelity Ltd. opened its U.S. headquarters, expanding production and distribution of blood-based genetic testing for rapid mutation detection. This strategic move drives market expansion by improving accessibility to affordable, high-precision oncology tools.

Rising innovation in molecular diagnostics propels the Oncology Blood Testing Market, as novel technologies shorten turnaround times for critical results. Pathologists leverage CRISPR-based blood assays to confirm genetic translocations in hematological malignancies, ensuring accurate subtype classification. These tests support longitudinal monitoring of therapy response through serial blood sampling, minimizing patient burden.

Trends toward point-of-care blood testing enable real-time decision-making in emergency oncology settings. In April 2025, ACTREC researchers developed RAPID-CRISPR, detecting acute promyelocytic leukemia in under three hours via blood samples. This breakthrough positions the market for sustained growth by integrating gene-editing into rapid, precise hematological cancer diagnostics.

Key Takeaways

- In 2024, the market generated a revenue of US$ 5.2 billion, with a CAGR of 15.2%, and is expected to reach US$ 21.4 billion by the year 2034.

- The test type segment is divided into liquid biopsy assays, tumor marker test, NIPT (non-invasive prenatal testing) test, exome-based liquid biopsy, CTC-based test, CBC test, and blood protein test, with liquid biopsy assays taking the lead in 2023 with a market share of 39.6%.

- Considering application, the market is divided into lung cancer, ovarian cancer, melanoma, gastrointestinal stromal tumor (GIST), colon cancer, and breast cancer. Among these, lung cancer held a significant share of 42.7%.

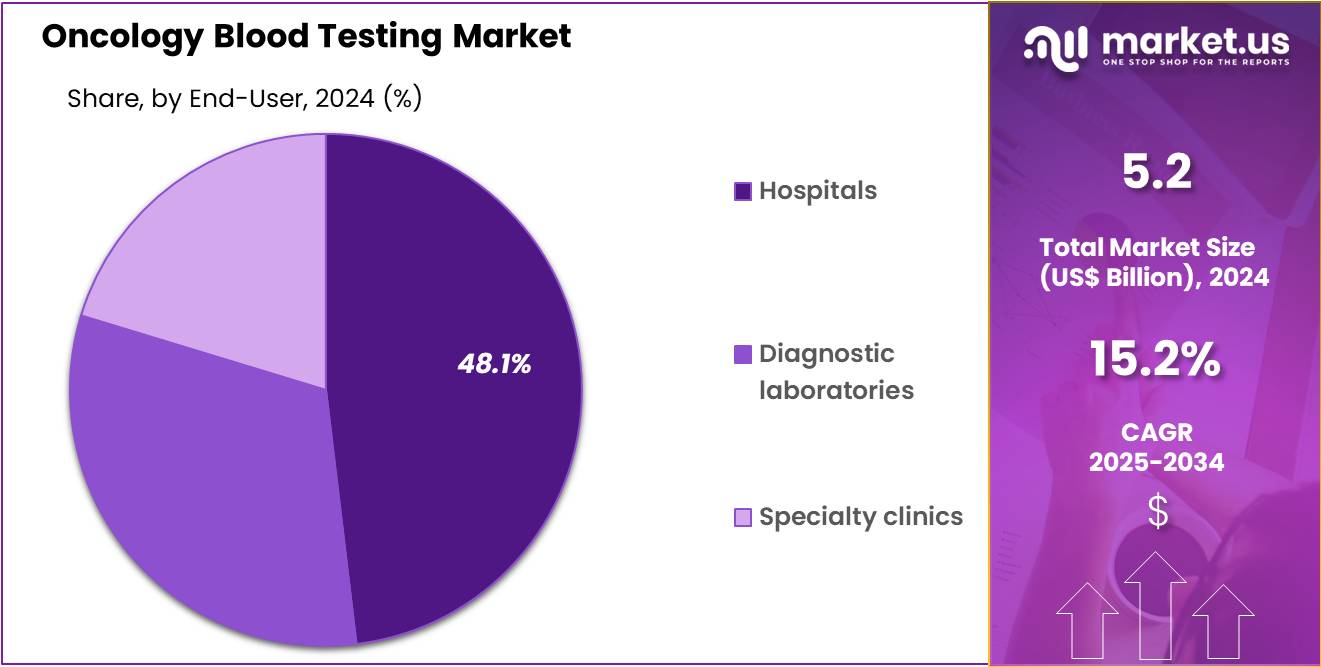

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, diagnostic laboratories, and specialty clinics. The hospitals sector stands out as the dominant player, holding the largest revenue share of 48.1% in the market.

- North America led the market by securing a market share of 38.8% in 2023.

Test Type Analysis

Liquid biopsy assays hold 39.6% of the Oncology Blood Testing market and are expected to dominate due to their ability to provide minimally invasive, real-time tumor monitoring. These assays detect circulating tumor DNA (ctDNA), circulating tumor cells (CTCs), and exosomes, offering comprehensive molecular insights without the need for tissue biopsies. Increasing demand for precision oncology and early cancer detection drives adoption across hospitals and diagnostic centers.

Liquid biopsy assays enable longitudinal disease tracking, guiding therapy adjustments and resistance monitoring. The growing clinical validation of assays like Guardant360, FoundationOne Liquid CDx, and Roche’s AVENIO ctDNA platforms reinforces trust among oncologists. Advancements in next-generation sequencing (NGS) technologies enhance assay sensitivity, enabling detection of rare mutations in early-stage cancers.

Government initiatives supporting cancer screening and reimbursement for blood-based diagnostics are anticipated to boost adoption. Pharmaceutical companies increasingly use liquid biopsies for clinical trial monitoring and companion diagnostics. The rise in personalized therapy development and non-invasive monitoring solutions supports sustained growth. As clinical guidelines evolve to incorporate liquid biopsy testing, this segment is projected to expand rapidly across major oncology centers worldwide.

Application Analysis

Lung cancer dominates the Oncology Blood Testing market with a 42.7% share, driven by the high global prevalence and clinical urgency of early detection. Blood-based diagnostic tests play a crucial role in identifying actionable mutations such as EGFR, ALK, KRAS, and ROS1, which are critical for targeted therapy decisions. The rising adoption of liquid biopsy and tumor marker assays in non-small cell lung cancer (NSCLC) improves treatment precision and patient outcomes.

National screening programs in the US, Europe, and Asia increasingly emphasize early-stage detection using non-invasive tests. Integration of blood-based molecular diagnostics with AI-based analytics enhances predictive accuracy. Pharmaceutical companies leverage oncology blood testing for patient stratification in immunotherapy and targeted therapy trials.

The expansion of reimbursement coverage for liquid biopsy-based lung cancer testing supports accessibility. Collaborations between hospitals and diagnostic labs accelerate test validation and clinical application. Growing clinical evidence linking blood-based markers to survival outcomes strengthens market confidence.

Technological advancements in multiplex biomarker panels and low-variant detection further support adoption. As clinical oncology moves toward precision diagnostics, lung cancer remains the leading application for oncology blood testing.

End-User Analysis

Hospitals account for 48.1% of the end-user segment and are projected to remain dominant due to their central role in cancer diagnosis, treatment monitoring, and post-therapy surveillance. The integration of oncology blood testing into hospital-based diagnostic pathways enhances speed and clinical coordination between oncologists, pathologists, and laboratory specialists. Hospitals increasingly adopt liquid biopsy and tumor marker assays to guide personalized treatment strategies and monitor disease progression.

Large tertiary hospitals and cancer institutes implement in-house molecular diagnostics laboratories, reducing turnaround times for test results. Rising hospital participation in clinical trials accelerates the adoption of advanced blood-based diagnostics. Collaborations with biotech and diagnostic firms facilitate the deployment of FDA-approved and CE-marked assays in clinical workflows.

The use of hospital-based biobanks for validating novel biomarkers drives innovation in test development. Hospitals benefit from government-funded cancer screening programs and public health initiatives aimed at early detection. Integration with electronic medical records (EMRs) ensures seamless data sharing and real-time patient monitoring.

As cancer burden grows and multidisciplinary care expands, hospitals are anticipated to remain the core environment for oncology blood testing, supporting both clinical and research advancements.

Key Market Segments

By Test Type

- Liquid Biopsy Assays

- Tumor Marker Test

- NIPT (Non-Invasive Prenatal Testing) Test

- Exome-Based Liquid Biopsy

- CTC- based Test

- CBC Test

- Blood Protein Test

By Application

- Lung Cancer

- Ovarian Cancer

- Melanoma

- Gastrointestinal Stromal Tumor (GIST)

- Colon Cancer

- Breast Cancer

By End-user

- Hospitals

- Diagnostic Laboratories

- Specialty Clinics

Drivers

Increasing Prevalence of Cancer is Driving the Market

The growing number of cancer diagnoses around the world has greatly boosted the oncology blood testing market, since these blood assays provide a less invasive way to spot tumors early, track disease progression, and select appropriate treatments for various cancers. Such tests, which include circulating tumor DNA evaluations and protein indicators, allow for repeated sampling without the dangers of tissue removal, enabling prompt adjustments in care. This factor is especially strong in common cancers like those of the lung and colon, where ctDNA analysis pinpoints treatable genetic changes to direct specific drugs.

Medical professionals are adding these to standard procedures, from checking high-risk groups to assessing how well therapies work in later stages. The need rises with changing population patterns, like older age groups, requiring broad-reaching methods for large-scale monitoring. Health officials stress their importance in lowering death rates via quick actions, leading to more spending on testing facilities.

The Centers for Disease Control and Prevention noted 1,918,030 new cancer diagnoses in the United States during 2022, emphasizing the need for effective blood screening methods. This number shows the pressing requirement, as blood tests in oncology help stop advancement by ongoing checks. New multi-target kits simplify finding variations, handling different tumor features.

From a financial view, using them streamlines treatment routes, avoiding expensive invasive steps. Worldwide standards set common levels, encouraging fair use in developing areas. This rise in cases not only increases test numbers but also strengthens blood testing’s place in cancer care sequences. In total, it encourages improvements in full biomarker systems, matching diagnostics to treatment progress.

Restraints

Challenges in Regulatory Approval and Coverage is Restraining the Market

Strict processes for regulatory approval and uneven coverage policies keep slowing the oncology blood testing market, postponing use in clinics and restricting access to new tests. Blood assays need detailed proof of accuracy and usefulness, often facing long FDA checks that extend creation periods for makers. This issue hits new methods like broad cancer detection kits hardest, where proof shortages block classification as lab diagnostics.

Insurers differ in requirements, wanting proof of value for money, creating differences with Medicare’s area-based decisions changing by location. Makers handle repeated filings, shifting funds from improvement to review checks. These holdups keep older tissue methods in favor, blocking wider acceptance.

The Centers for Medicare & Medicaid Services recorded $8.4 billion spent on clinical lab tests under Medicare Part B in 2022, but oncology blood assays met tight coverage limits despite more tests overall. These money rules show overall limits, as fixed rates curbed growth. Doctors hesitate due to unrepaid costs, choosing proven options over fresh blood methods.

Calls for uniform rules move slowly, blocked by lack of long-term results data. These approval obstacles not only reduce output but also weaken the market’s change-making ability. As a result, they require joint efforts to balance new ideas with control needs.

Opportunities

Establishment of NCI’s Cancer Screening Research Network is Creating Growth Opportunities

Setting up specialized study groups has opened wide chances for the oncology blood testing market, setting up trials for multi-cancer spotting to test blood methods in forward-looking groups. Such groups, centered on ctDNA and protein signs, use government money to gather varied samples, filling holes in early proof for less-represented groups. Chances appear in funded checks for spread-out systems, allowing growth with rising check needs.

Government-company links support rule matching, funding growth to include all-cancer kits. This official support fixes spotting shortfalls, placing blood tests as preventives for late stages. Money for leading studies speeds buying, varying to combined gene processes. The National Cancer Institute started the Cancer Screening Research Network in 2024, supporting eight teams to check new screening techs including blood multi-cancer tests. This start sets copyable patterns, with trial sign-ups expecting more reagent needs in study setups.

New ways to keep samples stable improve practicality, easing far-off gathering issues. As linked databases grow, result studies sharpen focus, opening result-tied income. These group growths not only raise test ranges but also weave the market into strong public health structures.

Impact of Macroeconomic / Geopolitical Factors

Rising inflation and limited funding are challenging developers in the oncology blood testing market, leading them to delay expansions in circulating tumor DNA platforms while focusing on improving plasma extraction processes within tighter precision medicine budgets. Trade tensions between the U.S. and China, along with shipping disruptions across the Mediterranean, are slowing the supply of specialized nucleic acid purification tools, extending performance testing and raising regulatory costs for global biomarker studies.

To overcome these barriers, some innovators are collaborating with purification specialists in Utah, adopting stricter quality standards that speed up FDA approvals and attract oncology-focused grants. The growing number of blood cancer cases is driving research funding toward integrated genomic profiling solutions, supporting broader adoption in hematology departments.

Meanwhile, new tariffs on imported pharmaceutical products are increasing the cost of sequencing consumables and calibration kits, reducing affordability for academic labs and occasionally delaying international research partnerships. In response, companies are leveraging federal development incentives to establish assembly facilities in New York, developing multiplexed variant detection systems and strengthening expertise in automated sample preparation.

Latest Trends

FDA Clearance of Guardant Health’s Shield Assay is a Recent Trend

Official approval of wide cancer spotting tests has marked a key step forward in oncology blood testing in 2024, focusing on ctDNA methylation checks for colon cancer screening in normal-risk adults. Guardant Health’s Shield assay, looking at 21 gene methylation spots, reaches 83% sensitivity for colon cancer and 90% specificity for serious growths, giving a no-pain choice over scope exams. This approval shows a move to large-group systems, fitting symptom-free people 45 and up without exam unease.

Control checks prove its strength, speeding rule additions despite follow-through problems. This ability fits prevention needs, linking results to next-step plans for scope checks. The system fixes follow issues, focusing on setups tough to group differences. The Food and Drug Administration cleared Guardant Health’s Shield blood assay for colon cancer screening on July 29, 2024, as the first liquid biopsy for normal-risk adults.

These steps speed development lines, as rivals improve similar forms for all-cancer uses. Watchers expect insurer additions, raising its place in country plans. Long-term checks prove fewer mismatches, improving value studies. The path sees more target adds, foreseeing growth-to-cancer shifts. This blood change not only boosts screening fairness but also matches walk-in health ideas.

Regional Analysis

North America is leading the Oncology Blood Testing Market

The market in North America is anticipated to have held a 38.8% share of the global oncology blood testing landscape in 2024, advanced by FDA clearances for liquid biopsy tools that detect circulating tumor DNA noninvasively for colorectal cancer surveillance in individuals aged 45 and above, minimizing invasive methods and boosting compliance in routine checkups.

Labs broadened NGS panel usage for mutations like EGFR and ALK in lung cancer cases, allowing customized kinase inhibitor treatments that extend progression-free survival up to 18 months in late-stage patients amid evolving immunotherapies. SEER data from the National Cancer Institute informed targeted studies, linking with federal funding to rectify inequities among African American and Hispanic groups. Breakthrough Device designations hastened approvals for ctDNA recurrence tracking in breast oncology, matching Medicare extensions for elevated-risk monitoring.

Rising cancer rates by 2% yearly in younger demographics heightened need for multi-gene serum assays in general practice. These elements positioned the region as a leader in serum-based cancer precision. The FDA cleared three IVDs for colorectal screening in 2024, featuring Guardant Shield for blood-based early identification.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The market in Asia Pacific is projected to expand during the forecast period, as state-led programs enhance blood-based diagnostics to tackle mounting colorectal and lung cancer loads in city-dwelling communities. Leaders in China and Japan invest in NGS reagents, outfitting major hospitals to map KRAS variants in advanced patients from polluted areas. Testing companies team with local facilities to confirm ctDNA methods, estimating better grading for liver tumors in virus-prevalent zones.

Supervisory groups in India and South Korea back serum biopsy systems, enabling local clinics to follow EGFR shifts without tissue sampling. Countrywide efforts estimate merging serum findings into health databases, hastening precision drugs for ALK-rearranged lung tumors in transient laborers.

Area specialists develop combined panels, aligning with monitoring systems to observe PIK3CA changes in breast survivors. These actions create a flexible route for tailored cancer care. The International Agency for Research on Cancer calculated 607,339 fresh colorectal cases in Eastern Asia during 2022.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Oncology Blood Testing Market drive growth by launching liquid biopsy panels for circulating tumor DNA detection, enabling non-invasive recurrence monitoring and personalized therapy selection. They partner with immunotherapy firms to validate biomarkers, speeding companion diagnostic approvals. Companies invest in multiplex flow cytometry for immune profiling in blood cancers.

Leaders acquire genomic specialists to combine NGS with proteomics for comprehensive tumor insights. They expand in Europe and Asia-Pacific, integrating tests into cancer care pathways via registries and reimbursement. Additionally, they offer subscription bioinformatics for data analysis, building clinician ties and recurring revenue.

Guardant Health, Inc., founded in 2012 in Palo Alto, California, pioneers blood-based genomic testing with its FDA-approved Guardant360 CDx panel analyzing over 500 genes for targeted therapies. CEO Helmy Eltoukhy leads operations in over 40 countries, focusing on early screening like Shield for colorectal cancer. The firm partners with pharma to advance biomarkers, transforming cancer management through innovative, non-invasive diagnostics.

Top Key Players

- Guardant Health

- Foundation Medicine

- Exosome Diagnostics

- Roche

- Bio‑Techne

- Illumina

- NeoGenomics

- Adaptive Biotechnologies

- Quest Diagnostics

- Abbott Laboratories

Recent Developments

- In January 2025, Adaptive Biotechnologies partnered with NeoGenomics to improve blood cancer monitoring through integrated molecular testing. By combining Adaptive’s clonoSEQ MRD assay with NeoGenomics’ clinical assessment services, the collaboration enhances precision in tracking disease progression and treatment response, reinforcing the role of blood-based diagnostics in personalized oncology care.

- In July 2024, Thermo Fisher Scientific collaborated with the National Cancer Institute (NCI) on the myeloMATCH precision medicine trial. This initiative uses next-generation sequencing (NGS) for genetic biomarker discovery in leukemia and myelodysplastic syndromes, showcasing the expanding role of blood-based NGS assays in guiding targeted cancer therapies and advancing clinical research.

Report Scope

Report Features Description Market Value (2024) US$ 5.2 Billion Forecast Revenue (2034) US$ 21.4 Billion CAGR (2025-2034) 15.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Test Type (Liquid Biopsy Assays, Tumor Marker Test, NIPT (Non-Invasive Prenatal Testing) Test, Exome-Based Liquid Biopsy, CTC-based Test, CBC Test, and Blood Protein Test), By Application (Lung Cancer, Ovarian Cancer, Melanoma, Gastrointestinal Stromal Tumor (GIST), Colon Cancer, and Breast Cancer), By End-user (Hospitals, Diagnostic Laboratories, and Specialty Clinics) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Guardant Health, Foundation Medicine, Exosome Diagnostics, Roche, Bio‑Techne, Illumina, NeoGenomics, Adaptive Biotechnologies, Quest Diagnostics, Abbott Laboratories. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Oncology Blood Testing MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Oncology Blood Testing MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Guardant Health

- Foundation Medicine

- Exosome Diagnostics

- Roche

- Bio‑Techne

- Illumina

- NeoGenomics

- Adaptive Biotechnologies

- Quest Diagnostics

- Abbott Laboratories