Global Oil Storage Market Size, Share Report By Product (Floating Roof, Open Top, Fixed Roof, Others), By Material (Steel, Concrete, Composite Materials, Fiberglass Reinforced Plastic, Polyethylene), By Capacity (Small (less than 10,000 barrels), Medium (10,000-100,000 barrels), Large (over 100,000 barrels)), By Application (Crude Oil, Middle Distillates, Gasoline, Aviation Fuel, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154701

- Number of Pages: 305

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

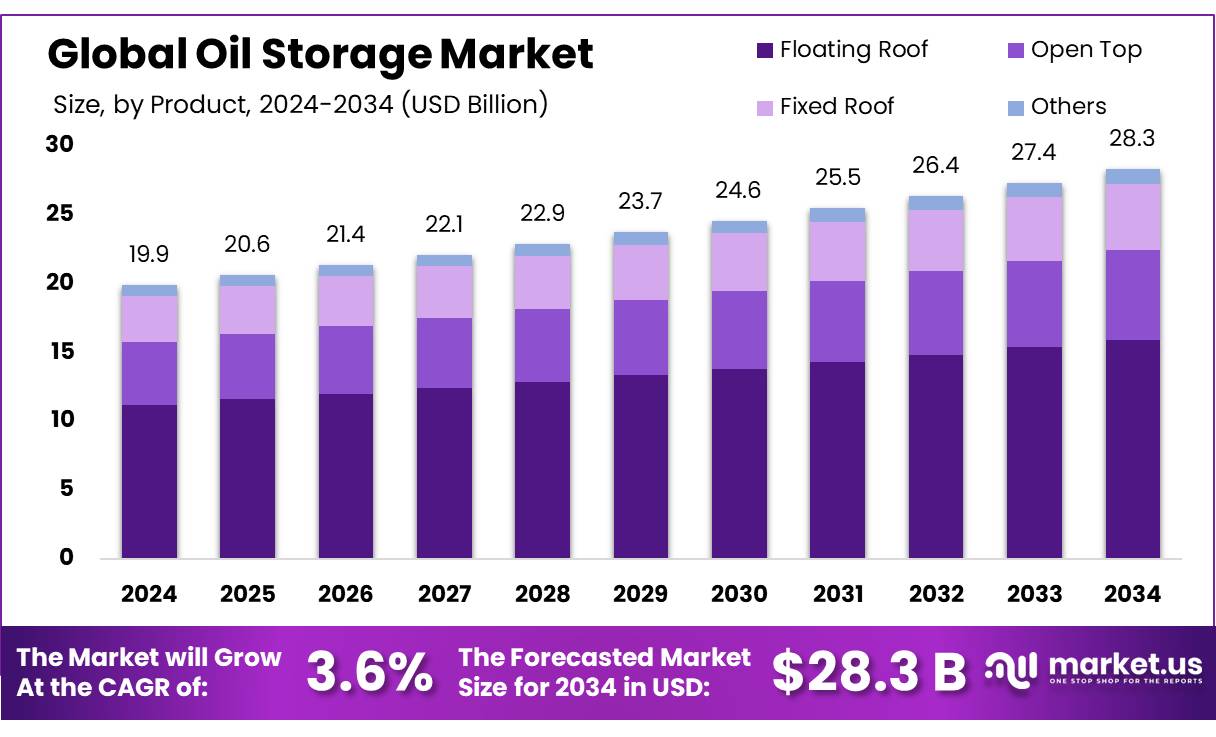

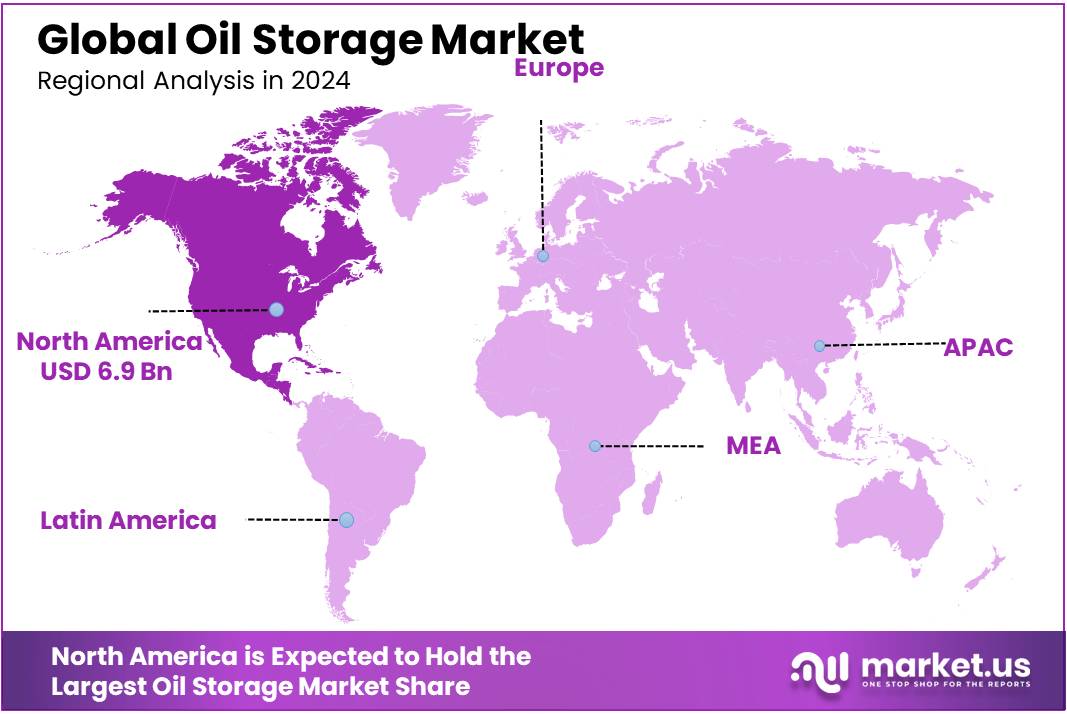

The Global Oil Storage Market size is expected to be worth around USD 28.3 Billion by 2034, from USD 19.9 Billion in 2024, growing at a CAGR of 3.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 34.8% share, holding USD 6.9 Billion in revenue.

Oil storage infrastructure plays a pivotal role in ensuring energy security, particularly as the nation remains the world’s third-largest oil importer, meeting over 80% of its crude oil requirements through imports. The Indian Strategic Petroleum Reserve Limited (ISPRL), a government-owned entity, manages the country’s strategic petroleum reserves (SPR). Currently, India operates three underground storage facilities located in Visakhapatnam, Mangaluru, and Padur, with a combined capacity of 5.33 million metric tonnes (MMT) of crude oil. These reserves are designed to provide a buffer against supply disruptions and price volatility.

Driving factors include global supply volatility, energy security concerns, and policy commitments. The IEA reports that global oil inventories grew by approximately 1.2 million barrels per day in H1 2025, with projected build‑rates of 0.9 mb/d through the rest of 2025, and around 1.1 mb/d in 2026, exerting downward pressure on prices. India’s status as the third‑largest oil importer (importing over 80 % of its oil) motivates policy to diversify sources and bolster storage resilience.

To enhance energy security, the Indian government has approved the establishment of two additional commercial-cum-strategic petroleum reserve facilities with a combined storage capacity of 6.5 MMT at Chandikhol (4 MMT) in Odisha and Padur (2.5 MMT) in Karnataka, under a Public-Private Partnership (PPP) model. Furthermore, plans are underway to develop new strategic reserves at six additional locations, including Bikaner (5.2–5.3 MMT), Mangalore (1.75 MMT expansion), and Bina (capacity under consideration), to bolster the country’s preparedness against potential supply disruptions .

The government’s budget for the fiscal year 2025–26 allocates INR 55.97 billion (approximately USD 646.78 million) to support oil purchases for these strategic reserves. Additionally, INR 1.8 billion is earmarked for operations and maintenance, and INR 3.35 billion for land acquisition and construction of new caverns. These investments underscore India’s commitment to enhancing its oil storage capacity.

The Indian government has recognized the strategic importance of oil storage and has allocated substantial financial resources to support its expansion. In the 2025-26 Union Budget, the government earmarked ₹55.97 billion (approximately $647 million) for the purchase of oil for strategic reserves. Additionally, ₹1.8 billion was allocated for the operation and maintenance of SPRs, and ₹3.35 billion for land acquisition and construction of new caverns. These investments underscore the government’s commitment to enhancing energy security through robust storage infrastructure.

Key Takeaways

- Oil Storage Market size is expected to be worth around USD 28.3 Billion by 2034, from USD 19.9 Billion in 2024, growing at a CAGR of 3.6%.

- Floating Roof tanks held a dominant market position, capturing more than a 56.2% share.

- Steel held a dominant market position, capturing more than a 64.3% share.

- Onshore held a dominant market position, capturing more than a 54.8% share.

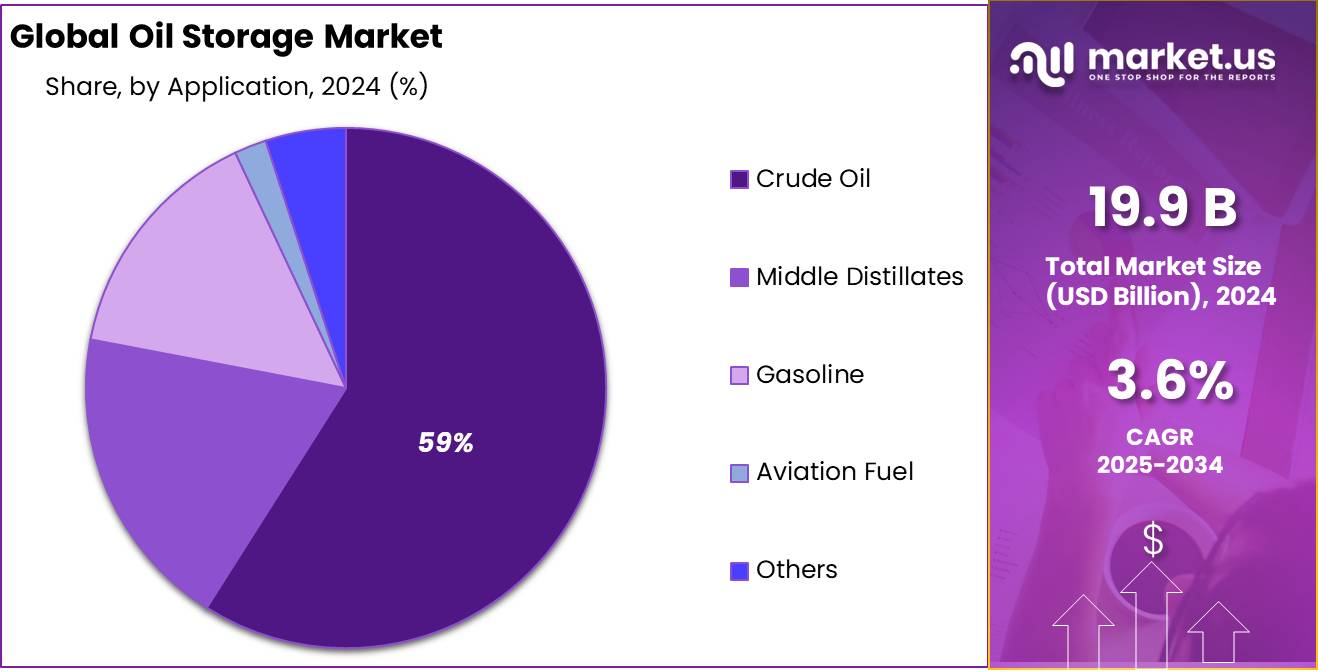

- Crude Oil held a dominant market position, capturing more than a 59.9% share.

- North America held a commanding lead in the global oil storage market, commanding a 34.8% market share, corresponding to approximately USD 6.9 billion.

By Product Analysis

Floating Roof tanks lead the market with 56.2% due to their superior safety and minimal evaporation losses.

In 2024, Floating Roof tanks held a dominant market position, capturing more than a 56.2% share. The primary reason for this market dominance is their ability to significantly reduce evaporation losses, making them a preferred choice for storing crude oil and petroleum products. These tanks have gained popularity among oil storage facilities due to their effective vapor-control mechanism, enhancing safety standards by minimizing fire hazards. Additionally, Floating Roof tanks help companies comply with stringent environmental regulations, further driving their adoption. This trend is likely to continue into 2025 as industry stakeholders increasingly prioritize environmental sustainability and operational efficiency.

By Material Analysis

Steel dominates with 64.3% owing to its durability and ease of maintenance.

In 2024, Steel held a dominant market position, capturing more than a 64.3% share. This dominance was driven by the material’s unmatched strength, durability, and ability to withstand harsh environmental conditions, which are crucial for safely storing oil. Steel tanks provide excellent resistance against corrosion and leaks, making them a preferred choice for large-scale storage facilities. Additionally, the ease of maintenance and repair of steel tanks has significantly reduced operational downtime, further boosting their popularity. Given these benefits, steel storage solutions are expected to remain the leading choice throughout 2025 as industries continue to seek reliable and cost-effective materials for oil storage.

By Capacity Analysis

Onshore dominates with 54.8% due to large-scale storage capacity and cost-efficiency.

In 2024, Onshore held a dominant market position, capturing more than a 54.8% share. The main reason behind this significant share is the ability of onshore facilities to handle large storage capacities exceeding 100,000 barrels, making them ideal for bulk oil storage. These facilities offer substantial advantages, such as lower construction costs compared to offshore storage and easier access for operations and maintenance. Additionally, onshore storage reduces logistical complexities, enhancing operational efficiency and reliability for oil companies. With growing global demand for oil storage, especially in strategic locations, the market share of onshore storage is likely to remain strong throughout 2025.

By Application Analysis

Crude Oil dominates with 59.9% due to high global consumption and strategic reserves.

In 2024, Crude Oil held a dominant market position, capturing more than a 59.9% share. The primary factor contributing to this dominance is the consistently high global demand for crude oil as an essential energy source. Countries maintain large reserves of crude oil to ensure energy security, especially during times of geopolitical tensions or disruptions in supply. Additionally, crude oil storage facilities play a key role in stabilizing market prices by balancing supply and demand fluctuations. As global economies continue to depend heavily on crude oil, especially emerging nations with increasing energy needs, this segment is expected to sustain its leading position through 2025.

Key Market Segments

By Product

- Floating Roof

- Open Top

- Fixed Roof

- Others

By Material

- Steel

- Concrete

- Composite Materials

- Fiberglass Reinforced Plastic

- Polyethylene

By Capacity

- Small (less than 10,000 barrels)

- Medium (10,000-100,000 barrels)

- Large (over 100,000 barrels)

By Application

- Crude Oil

- Middle Distillates

- Gasoline

- Aviation Fuel

- Others

Emerging Trends

Adoption of Smart Technologies in Oil Storage

A significant trend shaping the oil storage industry is the increasing integration of smart technologies, such as the Internet of Things (IoT), blockchain, and automation systems. These advancements are enhancing the efficiency, safety, and transparency of oil storage operations, particularly in the food sector where maintaining oil quality is paramount.

In response to these demands, companies are adopting smart technologies to monitor and manage oil storage conditions in real-time. For instance, IoT sensors are being used to track temperature, humidity, and oil quality, ensuring that storage conditions meet food safety standards. Blockchain technology is being explored to provide transparent and tamper-proof records of oil storage and handling, which is crucial for traceability and consumer trust.

- Government initiatives are also supporting the adoption of these technologies. For example, the U.S. Department of Energy (DOE) announced in October 2024 that 16 projects were selected as part of a $38 million funding opportunity to advance cross-sector technologies, including those applicable to oil storage. Such investments are expected to accelerate the development and implementation of smart storage solutions.

Drivers

Growth in Global Food Industry Driving Demand for Oil Storage

One of the major driving factors behind the growing demand for oil storage is the increasing consumption of vegetable oils and fats in the food industry. As the global population continues to grow and dietary preferences evolve, there is a rising demand for edible oils, such as palm oil, soy oil, and sunflower oil. The food industry is one of the largest consumers of these oils, and the need for safe and reliable storage solutions has become more critical.

- According to the Food and Agriculture Organization (FAO), global consumption of vegetable oils has been steadily increasing over the years. In 2021, the total global consumption of vegetable oils reached approximately 218 million metric tons. This demand is driven not only by population growth but also by the increased use of oils in processed food products. With rising disposable incomes, especially in emerging markets, more people are shifting to diets that include processed foods, which are often high in fats and oils.

The increased demand for vegetable oils means that companies need to store large quantities of oil in facilities that can ensure both safety and quality. Efficient oil storage solutions are essential for maintaining the integrity of oils, preventing spoilage, and meeting the increasing global demand. This has led to a rise in the construction of specialized oil storage tanks, both in production areas and distribution hubs.

Additionally, government initiatives and regulations around food safety and quality control are supporting this growth. For example, the U.S. Department of Agriculture (USDA) has implemented strict regulations regarding the storage and handling of edible oils, ensuring that they are stored under optimal conditions to maintain their quality. These regulations further contribute to the demand for more sophisticated storage systems in the oil and food industries.

Restraints

High Storage and Maintenance Costs for Oil Storage Facilities

One of the primary restraining factors affecting the oil storage industry is the high costs associated with the construction, maintenance, and operation of oil storage facilities. As demand for vegetable oils increases globally, companies face significant financial challenges in building and maintaining the infrastructure required to store these oils safely and efficiently. These costs are particularly burdensome for smaller players in the food industry, which may lack the financial resources to invest in large-scale storage solutions.

In 2021, the global vegetable oil market saw an estimated consumption of 218 million metric tons, according to the Food and Agriculture Organization (FAO). However, while this increased demand is positive for the industry, it also means that oil storage capacities need to scale accordingly. The cost of constructing large oil storage tanks, especially those with temperature controls to maintain oil quality, can be prohibitive.

On top of construction costs, there are ongoing expenses related to maintaining these facilities. The need for regular inspections, quality checks, and compliance with stringent food safety regulations adds to the financial burden. For instance, the U.S. Food and Drug Administration (FDA) requires regular monitoring of oil storage conditions to prevent contamination and spoilage, which increases operational costs. The U.S. Department of Agriculture (USDA) has also set regulations for the handling and storage of edible oils, which require continuous investments in safety equipment and technology upgrades to meet these standards.

Opportunity

Expansion of Renewable Energy-Based Oil Storage Solutions

One major growth opportunity for the oil storage industry is the integration of renewable energy technologies, particularly solar and wind power, into storage facilities. As global concerns over climate change continue to rise, more industries, including the food sector, are looking for sustainable alternatives to reduce their carbon footprints. This shift is opening up new avenues for oil storage solutions that are not only energy-efficient but also environmentally friendly.

In 2021, global vegetable oil consumption reached approximately 218 million metric tons, as reported by the Food and Agriculture Organization (FAO). With this growing demand for oils comes a greater need for storage solutions that can meet not only the food industry’s needs but also sustainability goals. The energy-intensive nature of oil storage facilities, which often rely on non-renewable sources of power for heating and cooling, presents an opportunity for companies to reduce their environmental impact by incorporating renewable energy.

Government initiatives supporting green energy adoption are accelerating this transition. For example, in the U.S., the Department of Energy (DOE) has been actively promoting the use of renewable energy in industrial sectors, including the food and oil industries. The American Recovery and Reinvestment Act (ARRA) allocated billions of dollars for clean energy projects, including renewable energy for industrial applications. This funding has made it easier for companies to adopt solar and wind energy to power their storage facilities.

Regional Insights

North America dominates with 34.8% share representing USD 6.9 billion market value due to its mature industrial base and strategic infrastructure.

In 2024, North America held a commanding lead in the global oil storage market, commanding a 34.8% market share, corresponding to approximately USD 6.9 billion in regional revenue. This strong position is attributed to the mature oil and gas ecosystem of the continent, underpinned by substantial production from shale basins such as the Permian and Eagle Ford in the United States. The region’s dominance is further reinforced by highly integrated refining clusters and extensive strategic petroleum reserves.

The United States alone houses the world’s largest emergency crude reserve, the Strategic Petroleum Reserve (SPR), with a capacity of up to 727 million barrels and actual stocks of 403 million barrels as of July 2025. This reserve system underpins North America’s energy resilience and underscores the critical need for large-scale oil storage infrastructure.

Key storage hubs such as Cushing, Oklahoma—the delivery point for West Texas Intermediate (WTI) contracts—hold over 90 million barrels of accessible tank storage. In Louisiana, the Louisiana Offshore Oil Port (LOOP) utilizes salt‑dome caverns with a cumulative capacity of approximately 50 million barrels to support marine offloading and refinery feed.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Koninklijke Vopak is a Dutch headquartered independent tank storage operator serving energy and industrial markets worldwide. It operates terminals that store chemicals, gases, LNG, crude oil, diesel, jet fuel, vegoils and biofuels through a network of gas, industrial, chemical and oil terminals. In fiscal 2024, core profit (proportional EBITDA) rose by 9% to €1.17 billion, driven by strong demand and terminal utilization across global hubs. The company affirmed its 2025 guidance toward €1.15–1.20 billion in EBITDA, reflecting confidence in infrastructure resilience across energy markets.

Oiltanking GmbH, part of Marquard & Bahls AG, is a global logistics provider operating over 45 terminals in about 20 countries. Its core focus includes storage and handling of petroleum products, chemicals and gases. In 2022, Oiltanking launched Advario as a subsidiary, handling petrochemicals, gases and sustainable feedstocks. With total terminal capacity exceeding 18.5 million m³ and throughput of around 155 million tonnes in 2019, the company is positioned for integrated energy infrastructure expansion in response to transition trends.

Buckeye Partners is a U.S.-based midstream logistics company that owns over 6,000 miles of pipeline and operates more than 115 liquid petroleum products terminals. Its aggregate storage capacity exceeds 118 million barrels across key regions (East Coast, Midwest, Gulf Coast, and Caribbean). The Buckeye Bahamas Hub is among the largest western-hemisphere marine terminals with capacity above 26 million barrels, supporting blending, heating, and bunkering operations. Buckeye serves refiners, traders, and distributors with integrated transport and terminal services.

Top Key Players Outlook

- Vitol Tank Terminals International BV (VTTI)

- Koninklijke Vopak NV

- Oiltanking GmbH

- Buckeye Partners, L.P.

- Columbian Steel Tank

- Anson

- Ascent Industries

- ElixirPro Engineering Solutions

- ERGIL

- Fisher Tank

- LF Manufacturing

Recent Industry Developments

In 2024, Koninklijke Vopak reported robust performance across its global oil storage terminals, achieving proportional EBITDA of €1,170 million, up 9 % from 2023 (€1,154 million), while maintaining a high occupancy rate of 93 %—a clear signal of strong demand across key oil and gas markets.

In 2024, Buckeye Partners, L.P. delivered solid performance in oil storage, with its storage asset utilization rising to nearly 70%, up from around 64% in 2023.

Report Scope

Report Features Description Market Value (2024) USD 19.9 Bn Forecast Revenue (2034) USD 28.3 Bn CAGR (2025-2034) 3.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Floating Roof, Open Top, Fixed Roof, Others), By Material (Steel, Concrete, Composite Materials, Fiberglass Reinforced Plastic, Polyethylene), By Capacity (Small (less than 10,000 barrels), Medium (10,000-100,000 barrels), Large (over 100,000 barrels)), By Application (Crude Oil, Middle Distillates, Gasoline, Aviation Fuel, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Vitol Tank Terminals International BV (VTTI), Koninklijke Vopak NV, Oiltanking GmbH, Buckeye Partners, L.P., Columbian Steel Tank, Anson, Ascent Industries, ElixirPro Engineering Solutions, ERGIL, Fisher Tank, LF Manufacturing Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Vitol Tank Terminals International BV (VTTI)

- Koninklijke Vopak NV

- Oiltanking GmbH

- Buckeye Partners, L.P.

- Columbian Steel Tank

- Anson

- Ascent Industries

- ElixirPro Engineering Solutions

- ERGIL

- Fisher Tank

- LF Manufacturing