Global Offshore Support Vessel Market Size, Share, And Business Benefits By Type (Anchor Handling Tug Supply (AHTS) Vessels, Platform Supply Vessels (PSVs), Multi-Purpose Support Vessels (MPSVs), Emergency Response and Rescue Vessels (ERRVs), Seismic Vessels, Well Intervention Vessels, Construction Support Vessels, Crew Transfer Vessels (CTVs), Others), By Operation (Shallow Water, Deepwater), By Fuel Type (Diesel-Powered, Gas-Powered), By End-Use (Oil and Gas, Offshore Wind, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 122548

- Number of Pages: 273

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

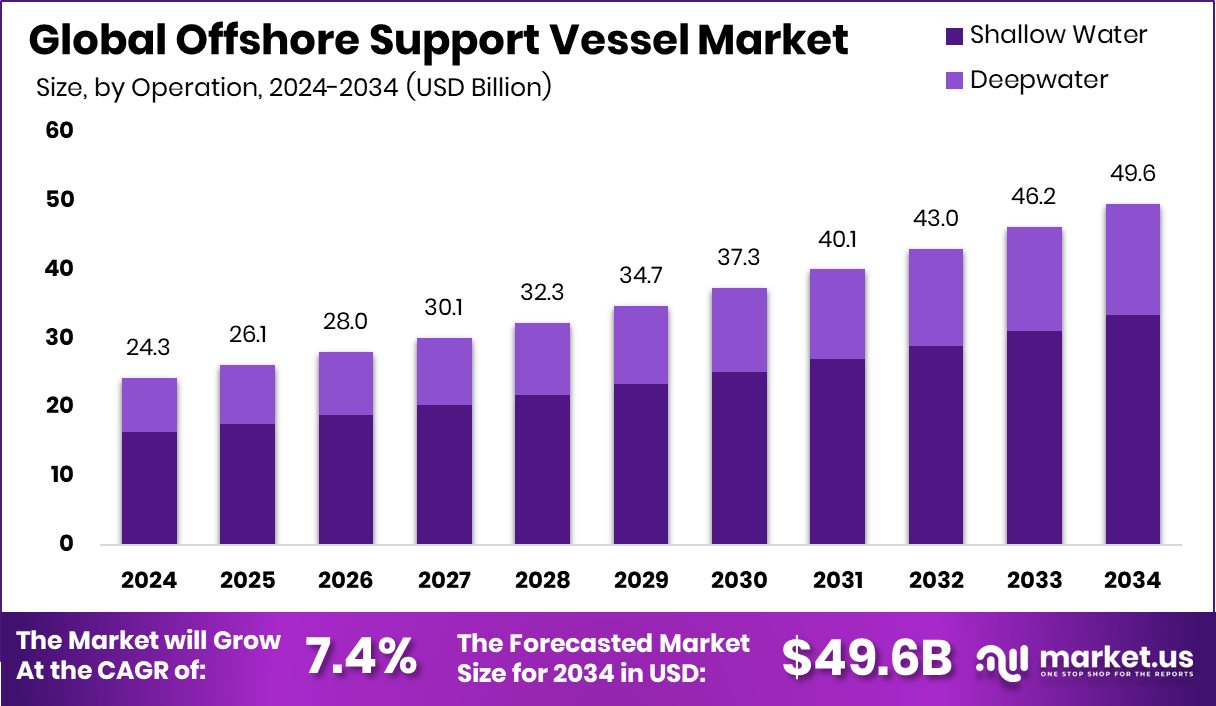

Global Offshore Support Vessel Market is expected to be worth around USD 49.6 billion by 2034, up from USD 24.3 billion in 2024, and grow at a CAGR of 7.4% from 2025 to 2034. Strong offshore drilling activities boosted demand in North America by 43.3%, supporting continuous fleet expansion.

An offshore support vessel (OSV) is a specialized ship designed to provide essential services to offshore oil and gas platforms, wind farms, and other marine infrastructure. These vessels perform a wide range of tasks, such as transporting equipment, personnel, fuel, and supplies to and from offshore facilities. Some OSVs are equipped for specific roles, including anchor handling, platform supply, firefighting, and subsea construction support.

The offshore support vessel market refers to the global industry that involves the design, manufacturing, deployment, and operation of vessels that assist offshore exploration and production activities. This market is closely tied to developments in offshore oil and gas, renewable energy (especially offshore wind), and deepwater mining. Demand is influenced by exploration activities, offshore infrastructure expansion, and regulatory requirements for safety and environmental protection.

The market growth is primarily driven by the increasing demand for energy and the rising exploration of offshore oil and gas fields. As shallow reserves deplete, deeper and more complex fields are being tapped, requiring advanced support vessels. Additionally, governments are granting new offshore leases, which has directly expanded the need for modern and multi-functional support fleets. According to an industry report, Shuaa Capital secures $300 million in funding to grow the world’s fourth-largest offshore support vessel fleet.

Growing offshore wind energy projects are creating consistent demand for OSVs beyond oil and gas. These vessels are now essential in construction, maintenance, and logistics for offshore turbines. According to an industry report, Alphard Maritime plans to launch a $500 million dedicated shipping investment fund.

According to the U.S. Department of Energy’s National Renewable Energy Laboratory (NREL), the global offshore wind pipeline stood at approximately 453.6 gigawatts (GW) as of the end of 2023, including 104.4 GW from floating wind technologies, which require advanced vessel capabilities for deployment and maintenance.

Key Takeaways

- Global Offshore Support Vessel Market is expected to be worth around USD 49.6 billion by 2034, up from USD 24.3 billion in 2024, and grow at a CAGR of 7.4% from 2025 to 2034.

- In 2024, Anchor Handling Tug Supply vessels led the Offshore Support Vessel Market with 29.3% share dominance.

- Shallow Water operations captured a commanding 67.3% share in the Offshore Support Vessel Market in 2024.

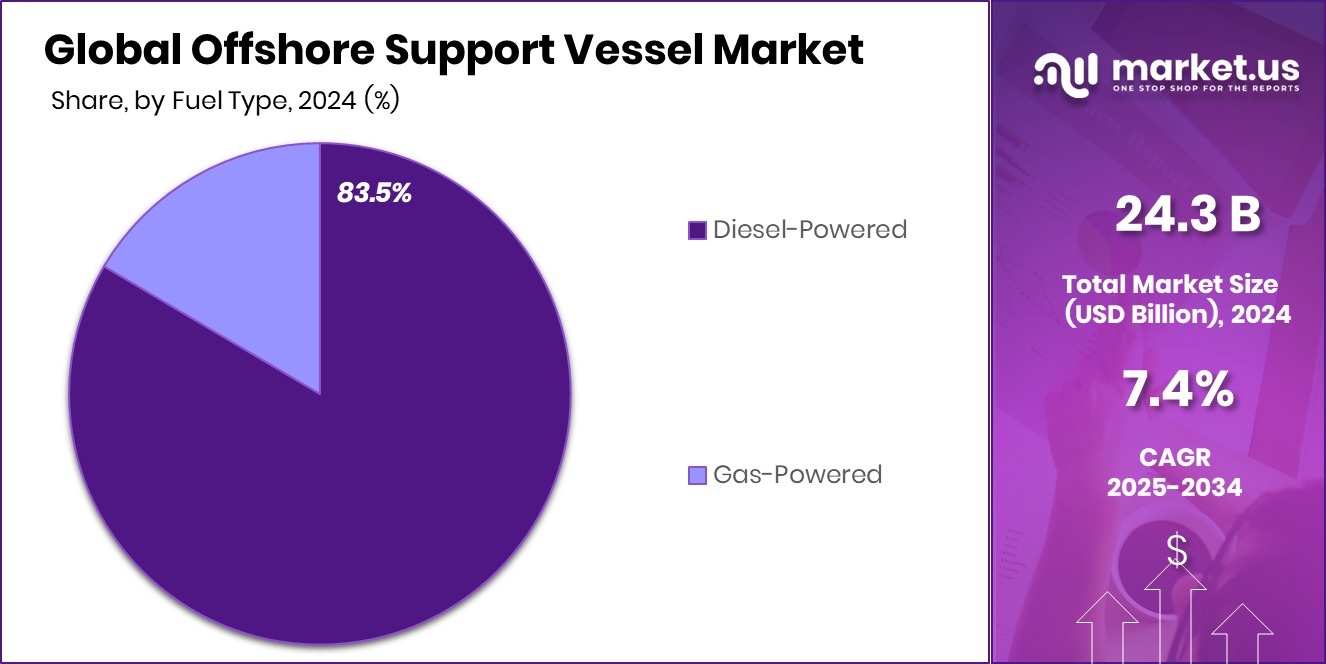

- Diesel-powered vessels accounted for 83.5%, making them the most widely used in the Offshore Support Vessel Market.

- The Oil and Gas sector dominated end-use, securing a 73.4% share in the Offshore Support Vessel Market.

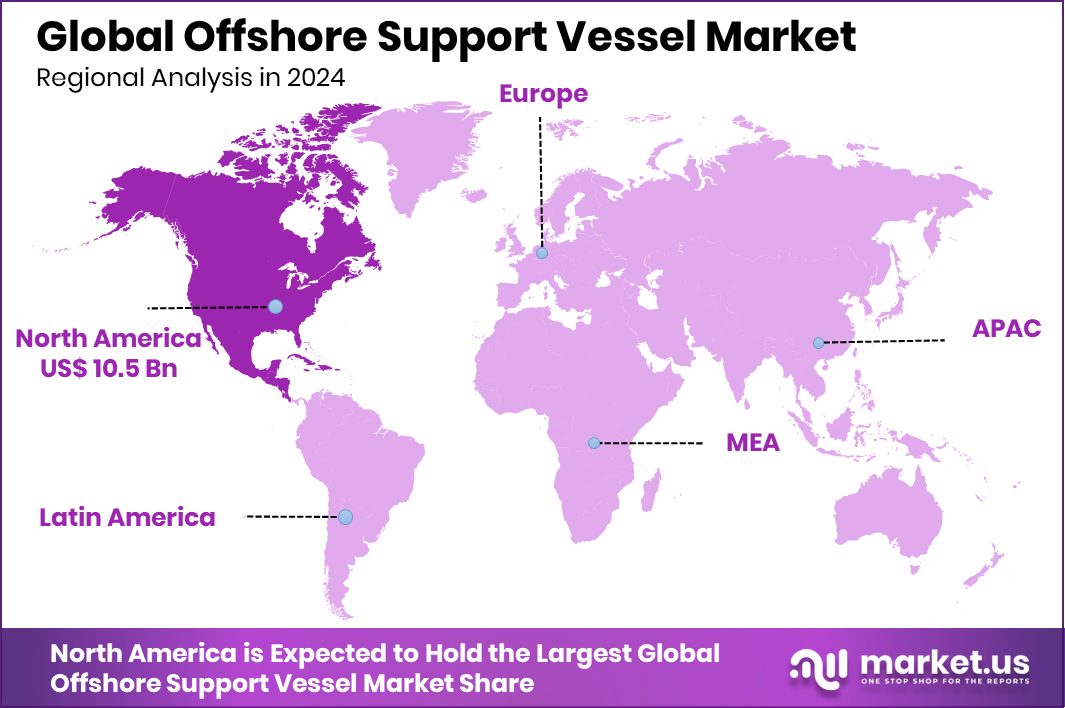

- The North American market reached a total value of USD 10.5 billion in 2024.

By Type Analysis

Anchor Handling Tug Supply (AHTS) Vessels dominate the Offshore Support Vessel Market with a 29.3% share.

In 2024, Anchor Handling Tug Supply (AHTS) Vessels held a dominant market position in the By Type segment of the Offshore Support Vessel Market, with a 29.3% share. This leadership was largely driven by the increasing number of offshore oil and gas drilling operations requiring powerful and versatile vessels capable of managing anchors, towing rigs, and supporting deepwater activities.

AHTS vessels are particularly favored for their robust design and multipurpose capabilities, allowing them to operate in harsh and remote marine environments. Their ability to provide both anchor handling and supply logistics gives them a strategic advantage over other vessel types that perform limited functions. In regions with deepwater drilling and floating production systems, AHTS vessels continue to be the preferred choice due to their reliability in managing large subsea infrastructure.

The demand also remains strong in mature offshore fields, where maintenance and repositioning of equipment are ongoing. As offshore exploration continues in deeper and more complex environments, the operational flexibility and high bollard pull capacity of AHTS vessels are expected to sustain their relevance.

By Operation Analysis

Shallow Water operations lead the Offshore Support Vessel Market at 67.3% share.

In 2024, Shallow Water held a dominant market position in the By Operation segment of the Offshore Support Vessel Market, with a 67.3% share. This dominance is mainly attributed to the continued reliance on mature shallow water oil fields and the cost-efficiency associated with operating in such environments.

Shallow water operations typically require lower capital investment and are easier to access compared to deeper offshore zones, making them favorable for oil and gas companies looking to maintain output while controlling exploration costs. Offshore support vessels operating in these areas are generally more compact and cost-effective, optimized for shorter distances and lighter cargo loads.

Their operational agility, combined with lower maintenance and fuel costs, has helped reinforce the demand in this segment. In addition, many national oil companies and regional operators continue to focus on shallow reserves due to established infrastructure and faster turnaround times.

These factors collectively ensured that shallow water operations captured the majority of the offshore vessel deployment in 2024. As global energy needs remain steady and operational risks are evaluated conservatively, shallow water remains a practical and strategic choice, reflected in its dominant market share during the year.

By Fuel Type Analysis

Diesel-powered vessels accounted for 83.5% of the Offshore Support Vessel Market in 2024.

In 2024, Diesel-Powered held a dominant market position in the By Fuel Type segment of the Offshore Support Vessel Market, with an 83.5% share. This high share reflects the widespread adoption of diesel engines due to their established performance reliability, cost-effectiveness, and compatibility with heavy-duty marine operations.

Diesel-powered vessels are widely preferred in offshore environments because they deliver the necessary power for towing, anchor handling, and cargo transportation under demanding sea conditions. Their proven durability and global availability of diesel fuel contribute to their operational continuity, especially in remote offshore regions where alternative fuel infrastructure is limited.

Furthermore, diesel propulsion systems are easier to maintain and have well-developed servicing networks, reducing downtime for operators. The dominance of this segment in 2024 also indicates that, despite the industry’s gradual shift toward cleaner propulsion technologies, diesel continues to be the most practical and widely used option for most offshore operations.

The strong market presence of diesel-powered vessels highlights the sector’s dependence on proven propulsion technologies for both shallow and deepwater applications. This ongoing preference solidified diesel’s position as the leading fuel type in offshore support vessel operations throughout the year.

By End-Use Analysis

The oil and gas industry held a 73.4% share in the Offshore Support Vessel Market.

In 2024, Oil and Gas held a dominant market position in the By End-Use segment of the Offshore Support Vessel Market, with a 73.4% share. This commanding position is primarily driven by the consistent global demand for hydrocarbon energy, which continues to rely heavily on offshore exploration and production activities.

Offshore support vessels play a critical role in the oil and gas sector by ensuring the timely transport of equipment, personnel, and supplies to rigs and production platforms, as well as performing anchor handling, maintenance, and emergency services. The large market share in 2024 reflects the scale and intensity of operations within offshore oil fields, particularly in regions where established infrastructure and production investments are already in place.

Operators prioritize reliable and cost-effective vessel support to maintain production levels and meet global energy needs. Additionally, as many offshore projects extend into deeper waters or require more frequent servicing, the demand for dependable vessel support remains high.

The oil and gas industry’s operational reliance on such vessels has therefore cemented its dominant role within the offshore support vessel market during the year, with no signs of immediate displacement in terms of end-use preference.

Key Market Segments

By Type

- Anchor Handling Tug Supply (AHTS) Vessels

- Platform Supply Vessels (PSVs)

- Multi-Purpose Support Vessels (MPSVs)

- Emergency Response and Rescue Vessels (ERRVs)

- Seismic Vessels

- Well Intervention Vessels

- Construction Support Vessels

- Crew Transfer Vessels (CTVs)

- Others

By Operation

- Shallow Water

- Deepwater

By Fuel Type

- Diesel-Powered

- Gas-Powered

By End-Use

- Oil and Gas

- Offshore Wind

- Others

Driving Factors

Rising Offshore Oil Exploration Boosting Vessel Demand

One of the main driving factors for the offshore support vessel market is the increasing offshore oil and gas exploration activities. As onshore reserves become limited or more expensive to extract, energy companies are turning to offshore fields, especially in areas like the North Sea, the Gulf of Mexico, and Southeast Asia. These offshore projects require reliable transportation and logistical support, which is provided by offshore support vessels.

The vessels help move equipment, supplies, and workers to and from the platforms, and also assist in anchoring and towing operations. With countries aiming to increase domestic energy production and reduce imports, offshore exploration is expected to grow, directly pushing the need for support vessels in these high-activity areas.

Restraining Factors

High Operating Costs Limit Vessel Market Growth

One major restraining factor for the offshore support vessel market is the high cost of operating and maintaining these vessels. These ships are built with powerful engines and specialized equipment, which require regular maintenance, a skilled crew, and a large amount of fuel, mainly diesel, which adds to expenses. Insurance, repairs, and port fees further increase overall operating costs.

When oil prices fall or exploration slows down, many companies reduce spending, including vessel operations. As a result, smaller operators especially face financial pressure, which can lead to fewer contracts and lower utilization rates. These high costs make it difficult for companies to invest in new vessels or upgrade their fleets, which slows down the growth of the overall market.

Growth Opportunity

Offshore Wind Energy Creating New Vessel Demand

A key growth opportunity for the offshore support vessel market comes from the fast-growing offshore wind energy sector. Many countries are investing heavily in renewable energy, and large wind farms are being built in oceans and seas. These projects need vessels to transport workers, turbines, tools, and cables to the wind farm locations.

Offshore support vessels that were earlier used mainly for oil and gas are now being used for wind energy tasks. This shift is opening a new market for vessel operators. As more offshore wind farms are planned across Europe, Asia, and North America, the need for support vessels is expected to increase. This creates a steady and long-term growth path for the vessel industry beyond fossil fuels.

Latest Trends

Digital Automation Enhancing Vessel Efficiency and Safety

A leading trend in the offshore support vessel market is the adoption of digital automation technologies. Vessel operators are increasingly integrating systems like remote monitoring, real-time data analytics, and autopilot navigation to improve efficiency and safety at sea. These tools enable precise route planning, fuel optimization, and early detection of equipment faults.

Additionally, digital tools support predictive maintenance, helping avoid unexpected breakdowns and costly downtime. As regulatory standards tighten and clients demand higher transparency, automation offers clear advantages in compliance and performance. By embracing digital transformation, the offshore support vessel sector is poised to enhance its operational capabilities, reduce costs, and strengthen its competitive edge.

Regional Analysis

In 2024, North America led the offshore support vessel market with a 43.3% share.

In 2024, North America held the dominant position in the global Offshore Support Vessel Market, accounting for 43.3% of the total share and generating a market value of USD 10.5 billion. This dominance is primarily supported by the strong offshore oil and gas activities in the Gulf of Mexico, where continuous exploration and production efforts drive consistent vessel demand.

The region also benefits from established maritime infrastructure and favorable regulatory environments that support fleet operations. In Europe, the market remains active due to ongoing maintenance and servicing needs across mature offshore platforms, especially in the North Sea.

The Asia Pacific region shows steady activity driven by energy development in coastal waters, while Middle East & Africa rely on offshore fleets to support large-scale energy projects. Latin America maintains a modest share, mainly attributed to ongoing exploration in deepwater zones.

While all regions contribute to the market landscape, North America’s combination of operational scale, investment, and resource access places it firmly at the forefront of the global offshore support vessel market in 2024, both in terms of revenue and deployment share. The region’s leadership reflects the high demand for logistics and support solutions in active offshore production zones.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Tidewater Inc. continued to strengthen its global presence in the offshore support vessel (OSV) market by focusing on fleet modernization and operational efficiency. With a strong base of high-specification vessels, Tidewater maintained a key role in supporting offshore oil and gas logistics, especially in mature and deepwater fields. The company’s focus on optimizing fuel consumption and crew performance supported cost-effective vessel deployment across active exploration regions.

Maersk Supply Service A/S remained prominent due to its ability to offer specialized marine services and complex offshore operations. In 2024, the company emphasized integrated marine project solutions, aligning vessel services with customer needs in offshore construction, decommissioning, and renewables support. This flexibility in vessel application allowed Maersk Supply to operate efficiently across multiple regions, keeping fleet utilization high throughout the year.

Bourbon leveraged its extensive global footprint and multipurpose fleet to serve a wide spectrum of offshore tasks. In 2024, Bourbon focused on safety, digital technologies, and client-driven operations, ensuring strong vessel availability across Africa, Asia, and Latin America. The company’s adaptable business model allowed it to manage demand fluctuations while maintaining service consistency.

Seacor Marine Holdings Inc. continued to serve key offshore markets by providing technologically advanced vessels designed for harsh environments. In 2024, Seacor concentrated on reducing its environmental footprint through hybrid propulsion systems and data-driven fleet management. This approach helped meet operational goals while aligning with emerging industry sustainability standards.

Top Key Players in the Market

- Tidewater Inc.

- Maersk Supply Service A/S

- Bourbon

- Seacor Marine Holdings Inc.

- Solstad Offshore ASA

- Deltamarin Ltd

- Edison Chouest Offshore LLC

- Swire Pacific Limited

- Harvey Gulf International Marine LLC

- Hornbeck Offshore Services Inc.

- POSH (Singapore) Limited

- DOF Group

- Grupo CBO

- Havila Shipping ASA

- Nam Cheong Limited

- Vroon Group

- Other Key Players

Recent Developments

- In June 2025, Tidewater announced a private offering of USD 650 million in unsecured senior notes due 2030. Proceeds are earmarked for refinancing its existing secured term loans and redeeming bonds maturing in 2026 and 2028. This move is intended to strengthen the company’s capital structure while maintaining financial flexibility in the OSV sector.

- In July 2024, Maersk Supply Service spun off a new entity called Maersk Offshore Wind, dedicated to installation services in the offshore wind sector. This venture is based on its innovative “Maersk WIV” (wind installation vessel) concept, designed to reduce turbine installation time by approximately 30 %

Report Scope

Report Features Description Market Value (2024) USD 24.3 Billion Forecast Revenue (2034) USD 49.6 Billion CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Anchor Handling Tug Supply (AHTS) Vessels, Platform Supply Vessels (PSVs), Multi-Purpose Support Vessels (MPSVs), Emergency Response and Rescue Vessels (ERRVs), Seismic Vessels, Well Intervention Vessels, Construction Support Vessels, Crew Transfer Vessels (CTVs), Others), By Operation (Shallow Water, Deepwater), By Fuel Type (Diesel-Powered, Gas-Powered), By End-Use (Oil and Gas, Offshore Wind, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Tidewater Inc., Maersk Supply Service A/S, Bourbon, Seacor Marine Holdings Inc., Solstad Offshore ASA, Deltamarin Ltd, Edison Chouest Offshore LLC, Swire Pacific Limited, Harvey Gulf International Marine LLC, Hornbeck Offshore Services Inc., POSH (Singapore) Limited, DOF Group, Grupo CBO, Havila Shipping ASA, Nam Cheong Limited, Vroon Group, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Offshore Support Vessel MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Offshore Support Vessel MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Tidewater Inc.

- Maersk Supply Service A/S

- Bourbon

- Seacor Marine Holdings Inc.

- Solstad Offshore ASA

- Deltamarin Ltd

- Edison Chouest Offshore LLC

- Swire Pacific Limited

- Harvey Gulf International Marine LLC

- Hornbeck Offshore Services Inc.

- POSH (Singapore) Limited

- DOF Group

- Grupo CBO

- Havila Shipping ASA

- Nam Cheong Limited

- Vroon Group

- Other Key Players