Global Off Price Retail Market Size, Share, Growth Analysis By Product Category (Apparel and Footwear, Home Goods, Electronics, Beauty and Cosmetics, Others), By Demographics (Women, Men, Children), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 160042

- Number of Pages: 338

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

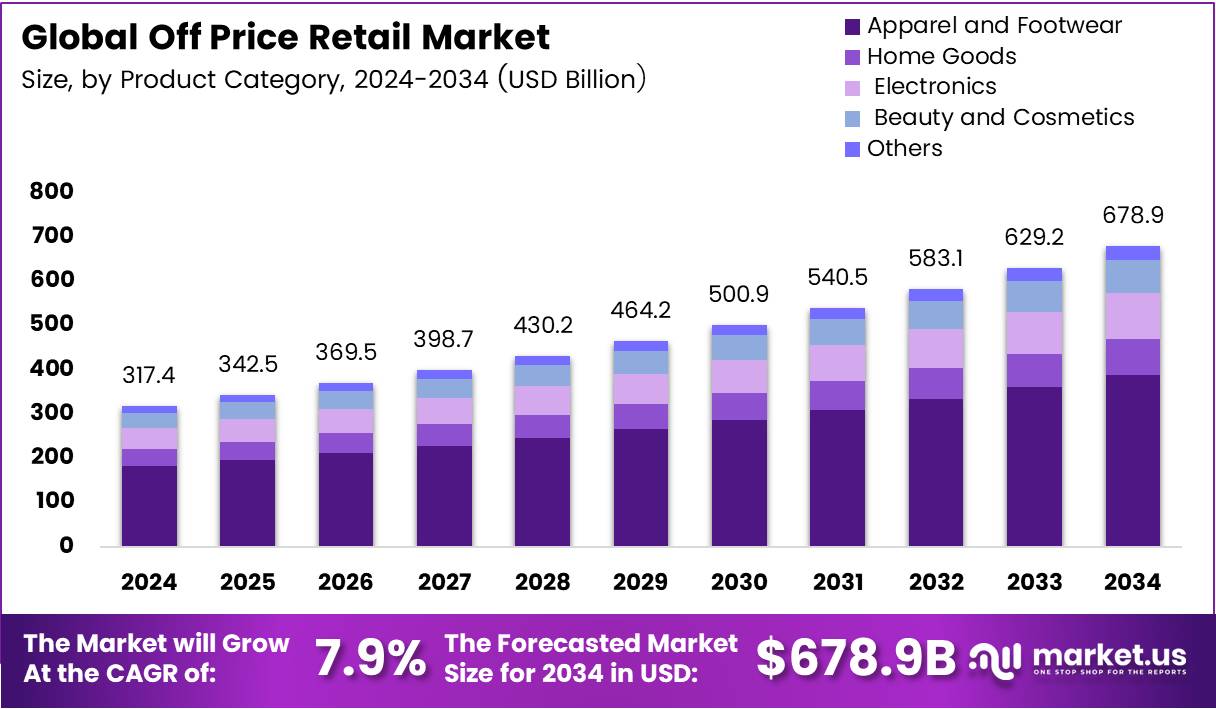

The Global Off Price Retail Market size is expected to be worth around USD 678.9 Billion by 2034, from USD 317.4 Billion in 2024, growing at a CAGR of 7.9% during the forecast period from 2025 to 2034.

The Off-Price Retail sector operates by offering branded merchandise at significantly lower prices than traditional retail. It thrives on sourcing overstock, past-season goods, and excess inventory from manufacturers and retailers. As consumers increasingly seek value and affordability, this business model continues to gain robust traction globally.

Furthermore, the market demonstrates resilience during economic uncertainty, as shoppers trade down from premium to value-driven options. Retailers leverage dynamic inventory cycles, flexible sourcing, and rapid turnover to sustain profitability. This adaptability allows them to align effectively with evolving consumer behavior, emphasizing affordability without compromising product quality or brand perception.

Moreover, increasing digital penetration and omnichannel expansion create new revenue streams. Off-Price Retailers are investing in data analytics and AI-driven inventory systems to enhance assortment planning. With growing consumer trust, the segment is capturing a larger share of discretionary spending, particularly across apparel, footwear, and home goods categories.

In addition, government incentives supporting retail modernization and infrastructure upgrades are strengthening operational efficiency. Policies encouraging small business participation and e-commerce integration are further expanding market accessibility. These supportive frameworks encourage investment, streamline logistics, and foster innovation, making the sector an appealing avenue for strategic growth.

Looking ahead, the Off-Price Retail Market is poised for consistent growth driven by evolving shopper preferences and price sensitivity. As inflation impacts spending patterns, value-driven retailing becomes more essential. Retailers adopting sustainable sourcing and transparent discounting practices are likely to attract conscious consumers seeking both affordability and responsibility.

According to an industry report, 67% of U.S. back-to-school shoppers began early by July 2025, the highest since 2018, signaling strong value-seeking behavior. Another industry report noted 4% YoY growth in U.S. core holiday sales to $994.1B in 2024, highlighting budget-conscious spending. Furthermore, 157M consumers shopped on Super Saturday 2024, with 27% purchasing from discount stores—affirming Off-Price Retail’s expanding market influence.

Key Takeaways

- The Global Off Price Retail Market is projected to reach USD 678.9 Billion by 2034, up from USD 317.4 Billion in 2024, registering a CAGR of 7.9% from 2025 to 2034.

- In 2024, Apparel and Footwear dominated the By Product Category segment with a 57.3% share, driven by steady demand for branded yet affordable fashion.

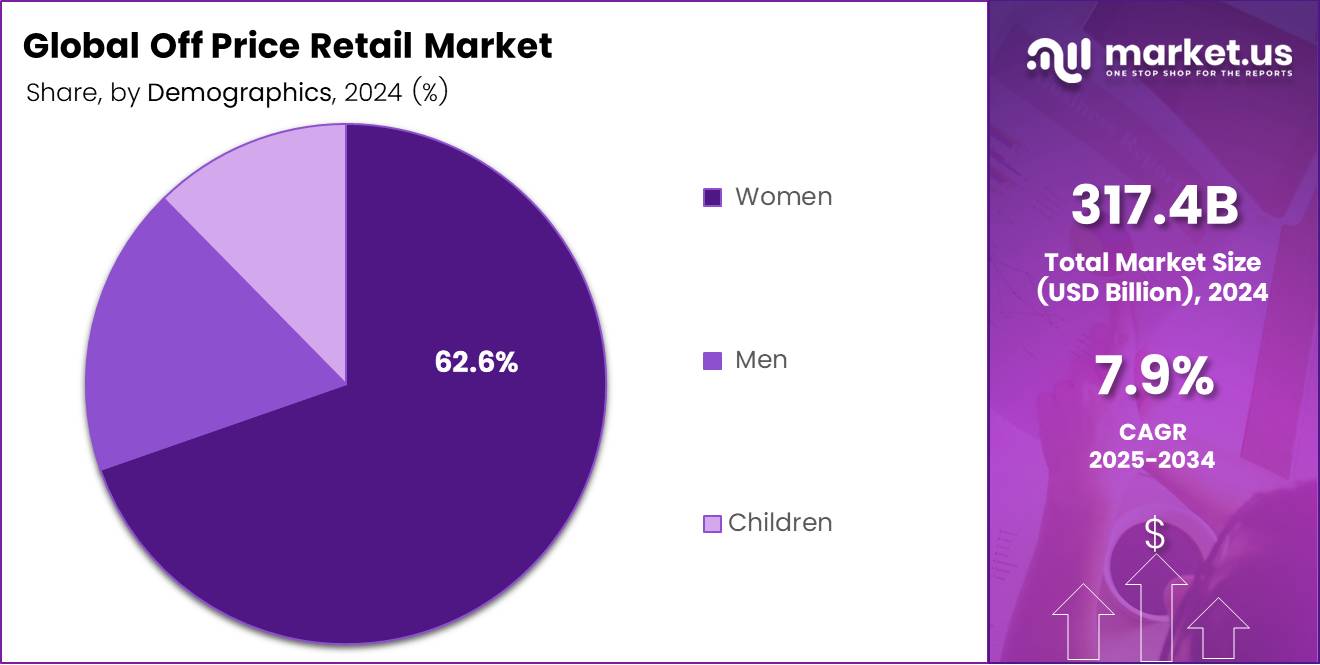

- Women led the By Demographics segment in 2024, accounting for a 62.6% share, reflecting their strong engagement across fashion and lifestyle categories.

- The Offline channel captured a leading 72.7% share in 2024, emphasizing consumer preference for in-store experiences and immediate purchases.

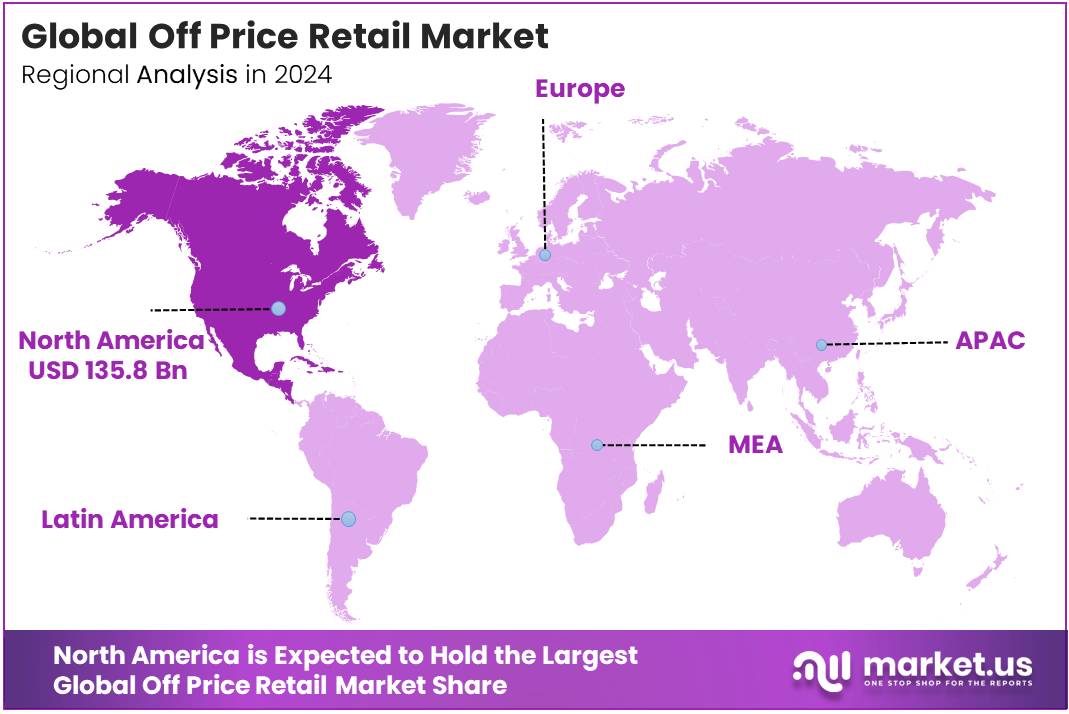

- North America remained the dominant region, holding 42.8% of global revenue, valued at USD 135.8 Billion in 2024.

By Product Category Analysis

Apparel and Footwear dominates with 57.3% due to its widespread appeal and affordability.

In 2024, Apparel and Footwear held a dominant market position in the By Product Category Analysis segment of the Off Price Retail Market, with a 57.3% share. This category remains the cornerstone of off-price retail due to continuous demand for branded yet affordable clothing and shoes.

Consumers are increasingly drawn to value-based fashion offerings that allow them to enjoy quality and style at discounted prices. The consistent introduction of seasonal collections and collaborations further enhances the category’s visibility and drives repeat purchases across various demographics.

Home Goods continue to experience stable growth as consumers seek budget-friendly home décor and furnishings. Off-price retailers provide diverse product assortments, from textiles to kitchen essentials, appealing to households aiming for cost-effective upgrades. The demand is propelled by shifting lifestyle trends, with many customers preferring curated and affordable solutions for home improvement.

Electronics hold a promising share in the off-price market, driven by increased adoption of refurbished and discounted gadgets. Consumers favor these outlets for purchasing branded products at reduced costs, supporting sustainability goals while accessing advanced technology. The segment thrives on limited-time deals and clearance sales, attracting price-sensitive buyers.

Beauty and Cosmetics is gaining momentum as consumers explore high-end brands at reduced prices. Off-price retailers stock popular skincare, makeup, and personal care items, catering to the growing demand for affordable luxury. This segment benefits from rising beauty consciousness and frequent product turnover, ensuring a fresh assortment.

Others include niche categories like sporting goods and accessories that collectively enhance the product mix. Though smaller in scale, they contribute to customer retention by offering variety and convenience. These segments often appeal to deal-seekers who value affordability without compromising on quality.

By Demographics Analysis

Women dominate with 62.6% due to higher fashion and lifestyle spending.

In 2024, Women held a dominant market position in the By Demographics Analysis segment of the Off Price Retail Market, with a 62.6% share. Female shoppers drive substantial sales due to their active participation in fashion, beauty, and home décor categories.

Off-price stores attract them with trend-oriented collections, seasonal discounts, and premium brands at accessible prices. The segment’s success also stems from evolving shopping preferences and growing awareness about smart buying, where women seek quality and variety within budget-friendly ranges.

Men represent a significant growth segment as fashion awareness continues to rise among male consumers. They increasingly prefer off-price retail outlets for purchasing apparel, footwear, and accessories from premium labels at discounted prices. This shift is fueled by convenience, style-consciousness, and expanding product assortments designed specifically for men’s evolving wardrobe needs.

Children form a consistent contributor to the market, primarily driven by parental spending on value-based clothing and essentials. Off-price retailers cater to this segment with durable, branded apparel at affordable prices, supporting families’ growing needs. Seasonal promotions and back-to-school collections further enhance this segment’s recurring demand across global markets.

By Distribution Channel Analysis

Offline dominates with 72.7% due to strong in-store experience and consumer trust.

In 2024, Offline held a dominant market position in the By Distribution Channel Analysis segment of the Off Price Retail Market, with a 72.7% share. Brick-and-mortar stores continue to attract consumers seeking hands-on experiences, immediate purchases, and personalized assistance.

Physical outlets showcase wide assortments, allow product trials, and build brand trust through direct engagement. Moreover, strategic store locations and immersive layouts strengthen customer loyalty and drive repeat footfall, particularly in urban and suburban markets.

Online distribution is expanding rapidly due to growing digital adoption and convenience-driven shopping. E-commerce platforms enable consumers to access diverse deals, compare prices, and purchase anytime, anywhere.

Off-price retailers leverage websites and apps to display real-time discounts, exclusive collections, and limited-time offers, fostering an omnichannel shopping experience that complements offline presence.

Key Market Segments

By Product Category

- Apparel and Footwear

- Home Goods

- Electronics

- Beauty and Cosmetics

- Others

By Demographics

- Women

- Men

- Children

By Distribution Channel

- Offline

- Online

Drivers

Rising Consumer Demand for Affordable Branded Products Drives Market Growth

The Off-Price Retail Market is witnessing strong growth as more consumers seek affordable access to premium and branded products. Rising living costs and inflationary pressures have led shoppers to prioritize value while maintaining quality standards. This shift has expanded the customer base for off-price retailers offering top brands at discounted prices.

The rapid expansion of multi-channel retail formats has further supported market growth. Many off-price retailers are now blending physical stores with digital channels, providing customers flexibility to shop anytime. This omnichannel approach enhances convenience and attracts both value-conscious and digitally savvy buyers.

Additionally, surplus inventory from premium brands has significantly boosted product availability. Luxury and fashion brands often face overproduction, and off-price retailers provide an efficient channel to sell excess stock without hurting full-price brand positioning. This ensures a steady flow of new, desirable merchandise at reduced rates.

Lastly, there’s a noticeable shift toward value-oriented shopping behavior, especially among younger consumers. Millennials and Gen Z prefer brands that offer smart deals and fashion flexibility over exclusivity. This trend reinforces the long-term relevance of off-price retailing as consumers continue to balance aspiration with affordability.

Restraints

Limited Product Consistency and Assortment Challenges Restrict Market Expansion

One of the major challenges in the Off-Price Retail Market is limited product consistency. Since inventory largely depends on surplus or unsold stock, product availability varies frequently, making it difficult to guarantee repeat purchases or customer loyalty.

Another concern is the high dependence on excess inventory from manufacturers and brands. If production levels drop or brands become more efficient in stock planning, the supply of discounted merchandise may decline, impacting profitability and assortment diversity.

Inventory management and supply chain complexities also pose restraints. Off-price retailers must handle unpredictable product inflows, frequent assortment changes, and quick turnover requirements. Inefficiencies in these operations can result in stock mismatches, markdown losses, or delayed availability.

Furthermore, brand dilution concerns among luxury manufacturers remain a key restraint. Many high-end labels are cautious about selling through discount channels, fearing that frequent markdowns may erode brand exclusivity. This hesitation limits collaboration opportunities and product variety within the off-price ecosystem.

Growth Factors

Integration of AI and Data Analytics for Dynamic Pricing Creates Growth Pathways

The integration of AI and data analytics offers significant opportunities for off-price retailers. Smart tools can analyze real-time demand, optimize pricing, and enhance stock rotation efficiency, ensuring better profitability while maintaining customer satisfaction.

Emerging markets with price-sensitive consumer bases also present strong expansion potential. As disposable incomes grow, shoppers in these regions are eager for branded products at affordable rates, creating room for new market entrants and regional partnerships.

Collaborating with luxury brands for exclusive off-price collections can further elevate customer interest. Limited-edition launches and curated deals help maintain a sense of novelty and attract aspirational buyers seeking premium experiences at lower costs.

The adoption of sustainable and resale-based off-price models is another promising path. Consumers increasingly value eco-conscious shopping, and reselling unsold or returned items supports circular fashion goals while enhancing brand credibility and customer trust.

Emerging Trends

Surge in Online Off-Price Retail Platforms and Flash Sales Shape Market Trends

A growing number of consumers are turning to online off-price retail platforms, driven by convenience and variety. Flash sales and time-limited deals encourage impulse buying and help clear inventory rapidly while offering exciting discounts to shoppers.

Discount fashion events and pop-up stores are gaining traction as experiential retail concepts. These temporary formats generate buzz, attract diverse audiences, and allow retailers to test new markets with minimal investment.

The market is also witnessing an increased focus on sustainable overstock liquidation. Retailers are embracing eco-friendly liquidation strategies, ensuring unsold items are repurposed or sold responsibly, aligning with consumer expectations for environmental accountability.

Finally, social media’s rising influence in bargain shopping has transformed consumer engagement. Platforms like Instagram and TikTok promote discount finds, influencer reviews, and flash deals, helping off-price retailers build digital visibility and drive traffic through engaging, trend-led content.

Regional Analysis

North America Dominates the Off Price Retail Market with a Market Share of 42.8%, Valued at USD 135.8 Billion

North America holds the dominant position in the global Off Price Retail Market, capturing 42.8% of total revenue, valued at USD 135.8 Billion. The region’s leadership stems from a strong culture of value-based shopping and a mature retail ecosystem. Consumers increasingly seek premium brands at discounted prices, while major retailers expand off-price formats both online and in-store to meet evolving shopper expectations.

Europe Off Price Retail Market Trends

Europe continues to show steady growth in off-price retail, supported by rising demand for sustainable and affordable luxury products. Consumers are turning toward discount outlets as economic pressures reshape spending habits. The growing popularity of outlet malls and cross-border e-commerce platforms further strengthens Europe’s position as a key market for off-price retail expansion.

Asia Pacific Off Price Retail Market Trends

Asia Pacific is emerging as a fast-growing region, fueled by a rapidly expanding middle class and digital retail penetration. Urban consumers, particularly in markets like China, Japan, and South Korea, are embracing branded goods at lower prices. E-commerce-driven discount channels and pop-up retail stores are becoming major growth enablers in this region.

Middle East and Africa Off Price Retail Market Trends

The Middle East and Africa region is gradually embracing the off-price retail concept as consumer awareness grows. Shoppers in urban centers increasingly seek affordable access to global brands. Expansion of international retail chains and adoption of omnichannel strategies are enhancing accessibility and driving steady growth across key cities.

Latin America Off Price Retail Market Trends

Latin America is witnessing a rise in off-price retailing due to inflationary pressures and increased preference for value-driven shopping. Countries such as Brazil and Mexico are seeing more consumers turn to outlet stores and discount chains. Despite economic challenges, local partnerships and adaptive retail models are supporting gradual market expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Off Price Retail Company Insights

In 2024, the global Off-Price Retail Market witnessed significant expansion driven by value-conscious consumers and strategic brand positioning by leading players. Key participants leveraged digital integration, omnichannel formats, and localized assortments to enhance accessibility and customer engagement across markets.

TJX Companies Inc. continued to dominate the off-price retail landscape with a strong global footprint and a well-diversified product portfolio. Its focus on sourcing agility and efficient supply chain management enabled it to deliver branded products at competitive prices, sustaining steady growth across the U.S., Canada, and Europe.

Ross Stores Inc. strengthened its market position through aggressive store expansion and operational efficiency. The company’s emphasis on apparel and home categories at discounted pricing attracted middle-income consumers, while its regional penetration strategy improved accessibility and brand visibility in suburban markets.

Burlington Stores Inc. maintained robust growth by enhancing its merchandising strategy and leveraging data analytics for demand forecasting. Its focus on lean inventory management and a reduced reliance on e-commerce allowed it to optimize store-level assortments and drive in-store traffic amid changing consumer behaviors.

Nordstrom Rack benefited from its parent company’s premium brand equity while appealing to value-driven shoppers seeking designer labels at lower costs. The retailer’s integration of online and in-store experiences, including flexible returns and curbside pickup, improved customer convenience and loyalty.

Collectively, these players capitalized on consumer demand for affordable fashion, balancing price competitiveness with brand aspiration. Their strategic adaptability to supply dynamics, inventory flow, and evolving consumer expectations underscores their pivotal role in shaping the future trajectory of the global Off-Price Retail Market.

Top Key Players in the Market

- TJX Companies Inc.

- Ross Stores Inc.

- Burlington Stores Inc.

- Nordstrom Rack

- Marshalls, DSW

- Macy’s Backstage

- Saks OFF 5TH

- Stein Mart Inc.

- Sierra Trading Post

- Off Broadway Shoe Warehouse

- Bealls Outlet

- Gabriel Brothers Inc.

Recent Developments

- In August 2024, The TJX Companies announced a strategic move to acquire a 35% equity stake in UAE-based Brands For Less for approximately $360 million. This investment strengthens TJX’s footprint in international off-price retail markets and expands its Middle East presence.

- In March 2024, Beyond, the parent of Overstock and Bed Bath & Beyond, acquired the intellectual property and brand assets of Zulily for $4.5 million (excluding liabilities). The deal bolsters Beyond’s strategy to scale its off-price e-commerce operations and diversify its digital retail portfolio.

- In December 2024, the Nordstrom family and El Puerto de Liverpool agreed to a $6.25 billion all-cash deal to take Nordstrom private. The privatization includes Nordstrom Rack, signaling major restructuring across both full-price and off-price segments.

- In 2024, Hudson’s Bay Co., parent of Saks, completed a $2.7 billion acquisition of Neiman Marcus Group. The merger unites Saks, Saks Off 5th, and Neiman Marcus under the Saks Global umbrella, consolidating luxury and off-price retail.

Report Scope

Report Features Description Market Value (2024) USD 317.4 Billion Forecast Revenue (2034) USD 678.9 Billion CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Category (Apparel and Footwear, Home Goods, Electronics, Beauty and Cosmetics, Others), By Demographics (Women, Men, Children), By Distribution Channel (Offline, Online) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape TJX Companies Inc., Ross Stores Inc., Burlington Stores Inc., Nordstrom Rack, Marshalls, DSW, Macy’s Backstage, Saks OFF 5TH, Stein Mart Inc., Sierra Trading Post, Off Broadway Shoe Warehouse, Bealls Outlet, Gabriel Brothers Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- TJX Companies Inc.

- Ross Stores Inc.

- Burlington Stores Inc.

- Nordstrom Rack

- Marshalls, DSW

- Macy's Backstage

- Saks OFF 5TH

- Stein Mart Inc.

- Sierra Trading Post

- Off Broadway Shoe Warehouse

- Bealls Outlet

- Gabriel Brothers Inc.