Global Octocopter Drone Market Outlook Analysis By Payload (Below 10 kg, 10-20 kg, Above 20 kg), By Drone Type (Consumer/Civil, Commercial, Military), By End User (Delivery & Logistics, Construction, Agriculture, Industrial, Military, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 165299

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

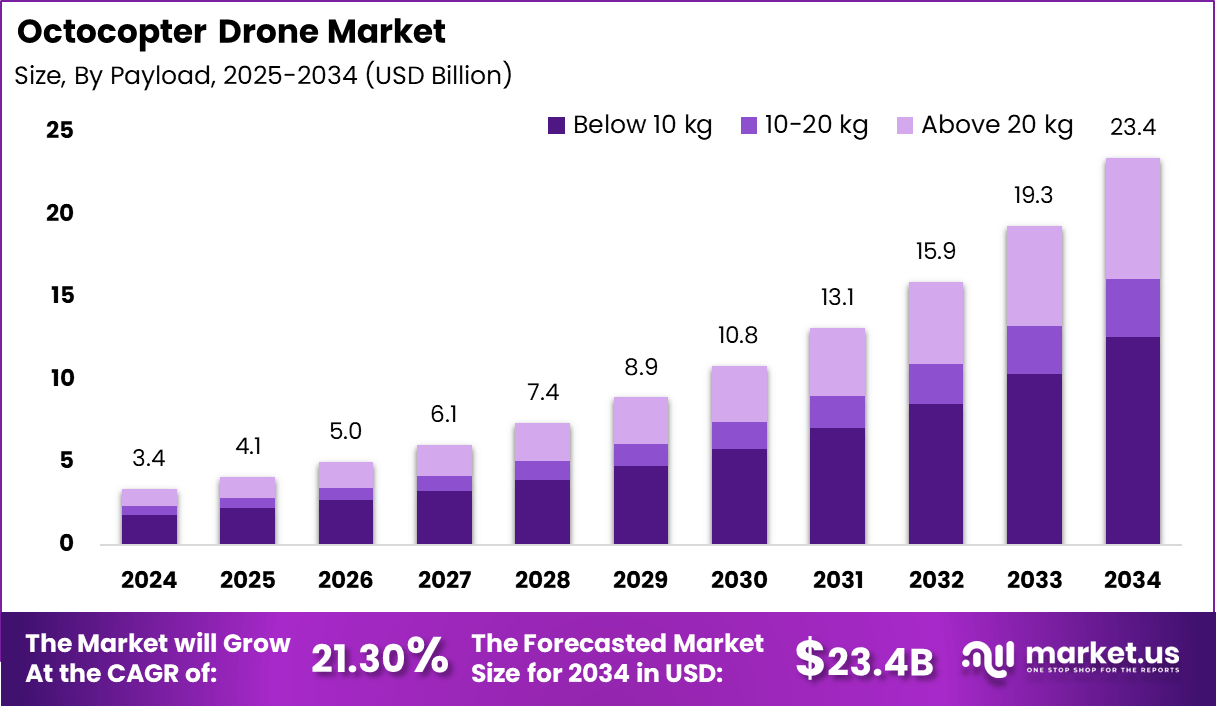

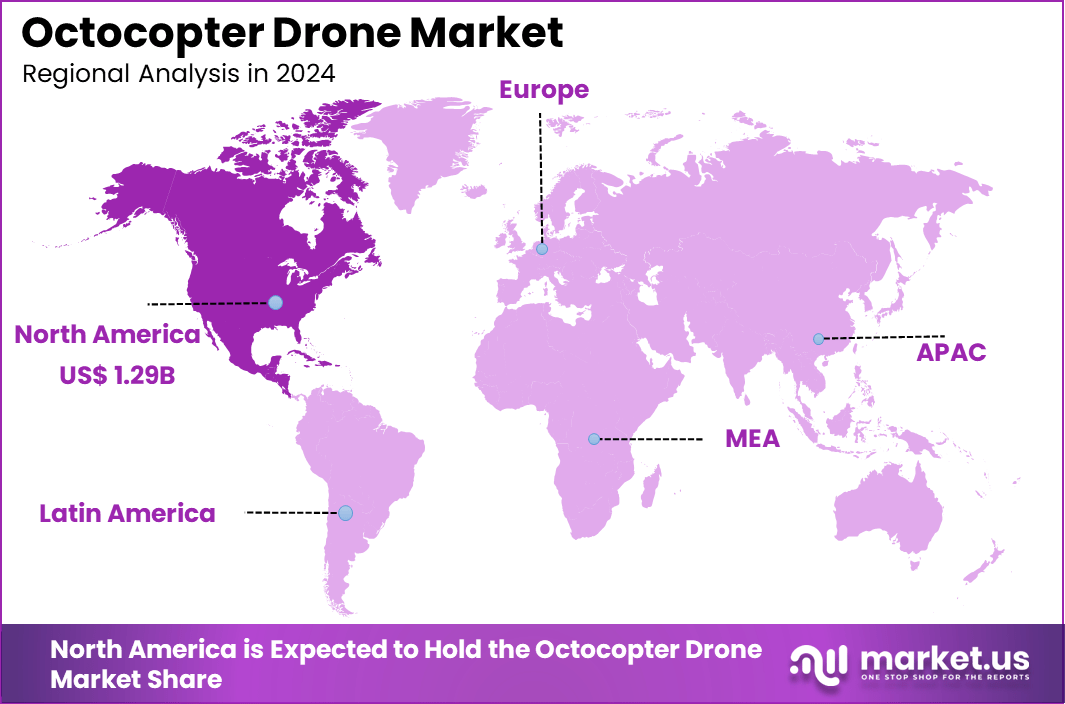

The Global Octocopter Drone Market generated USD 3.4 billion in 2024 and is predicted to register growth from USD 4.1 billion in 2025 to about USD 23.4 billion by 2034, recording a CAGR of 21.30% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 38% share, holding USD 1.29 Billion revenue.

The octocopter drone market has been expanding significantly as companies and institutions deploy drones with eight rotors for specialised applications. The demand for heavier-lift, higher-stability unmanned aerial vehicles (UAVs) has boosted the segment within the broader drone industry. Recent analysis indicates that octocopter models are penetrating commercial, industrial, defence and logistics use cases as organisations seek more capable multirotor platforms.

The growth of this market can be attributed to advancements in propulsion systems, improvements in battery efficiency and rising acceptance of drones for operational tasks. Organisations in energy, logistics, agriculture and inspection activities prefer octocopter models because they can handle heavier payloads. Public sector agencies also create strong momentum through adoption for surveillance, search and rescue and emergency support. These combined factors strengthen the overall demand trajectory.

Demand continues to rise as industries require drones that can operate safely in complex environments. Octocopters are increasingly selected for missions that involve heavy cameras, LiDAR sensors or specialised industrial equipment. Commercial users also value the ability to fly in challenging wind conditions with reliable flight control. Public sector users generate additional demand because of the stability and redundancy offered by eight-rotor designs.

According to survey, Typical models can carry payloads ranging from 8 kg to 25 kg, with some industrial-grade octocopters supporting up to 100 kg. Flight endurance varies by payload: with no load, flight times can reach 75 minutes, but with a 25 kg payload, endurance drops to about 45 minutes. Advanced models with hybrid power systems can achieve up to 2 hours of flight time.

Ukraine is deploying octocopter drones valued at about USD 100,000 to target and eliminate Russian tanks and artillery systems worth several million dollars, including during night operations. These drones are being used to achieve high-precision strikes, giving Ukrainian forces a cost-effective advantage on the battlefield by destroying far more expensive equipment under limited visibility conditions.

Adoption is supported by technologies such as advanced flight controllers, improved electric motors, long-life batteries and lightweight composite frames. Navigation systems, onboard sensors and obstacle-detection tools have strengthened autonomous performance. Octocopter platforms now integrate real time data transfer, mapping systems and mission-specific payloads, making them suitable for diverse applications ranging from inspection to delivery.

Top Market Takeaways

- By payload, below 10 kg category represents 53.7% of the market. This weight class is optimal for a variety of commercial applications requiring stability and moderate lifting capacity.

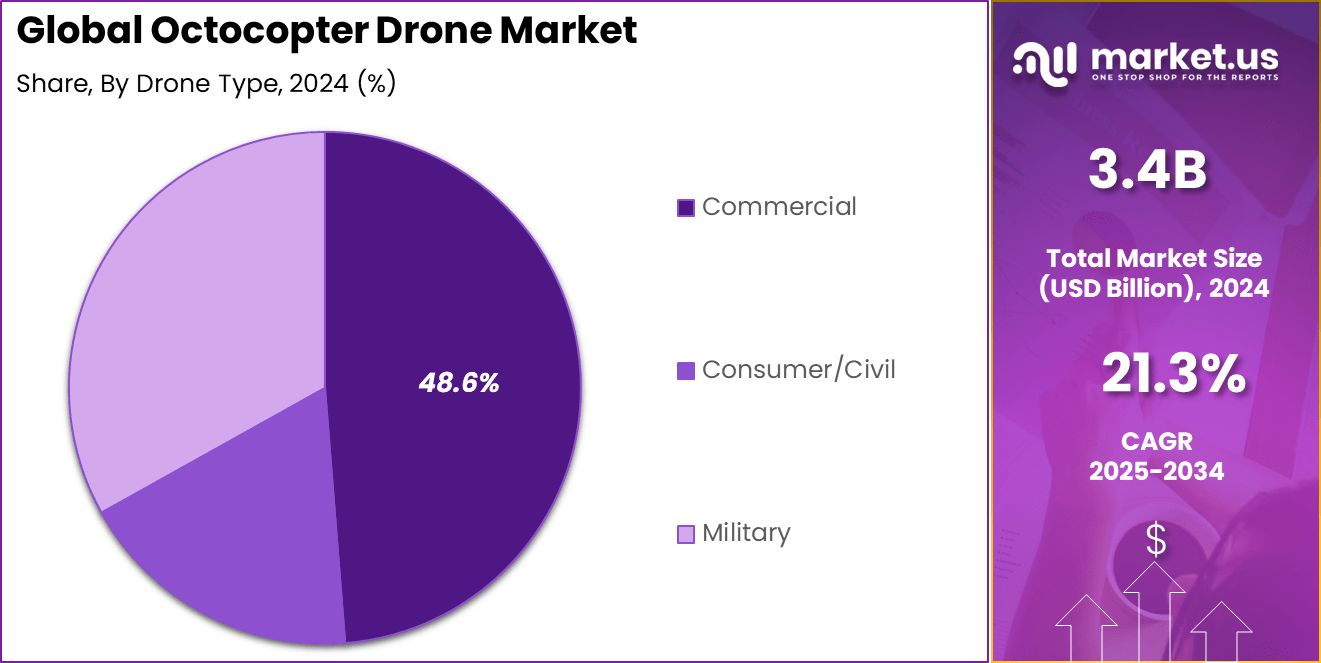

- By drone type, commercial drones account for 48.6% share, driven by demand in sectors such as agriculture, surveillance, delivery, and filmmaking where octocopters provide enhanced flight stability and payload capacity.

- By end-user, delivery and logistics lead with 39.2% share, benefiting from the octocopter’s capacity to carry medium-sized packages with precision in urban and semi-urban environments.

- Regionally, North America holds a significant 38% market share.

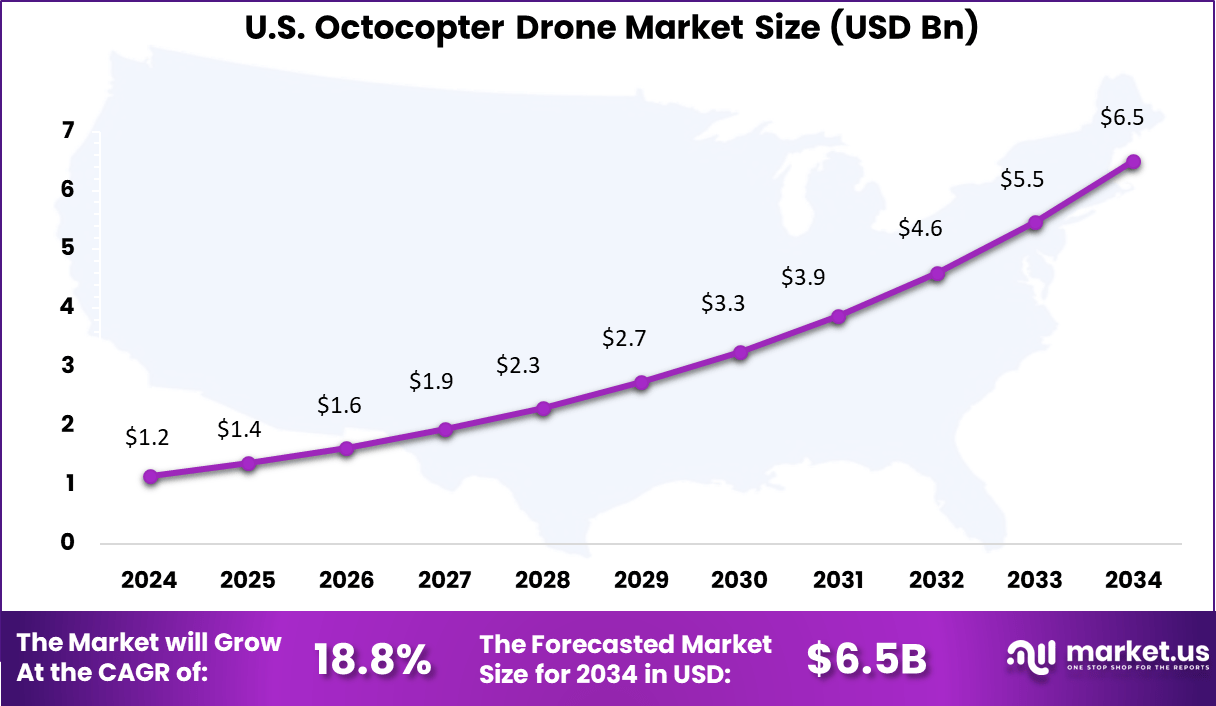

- The U.S. market size is approximately USD 1.16 billion in 2025.

- The market is growing at a CAGR of 18.8%, propelled by rapid growth in e-commerce, advancements in drone tech such as AI-based navigation and battery efficiency, and regulatory facilitation for commercial drone operations.

- Key trends include increasing adoption of electric propulsion, autonomous flight control, and integration with AI and computer vision systems to enable advanced analytics and real-time decision-making.

- North America leads in innovation and commercial deployment, supported by investments from technology firms, favorable regulations, and growing demand in logistics, agriculture, and inspection services.

Usage Statistics and Adoption Rates

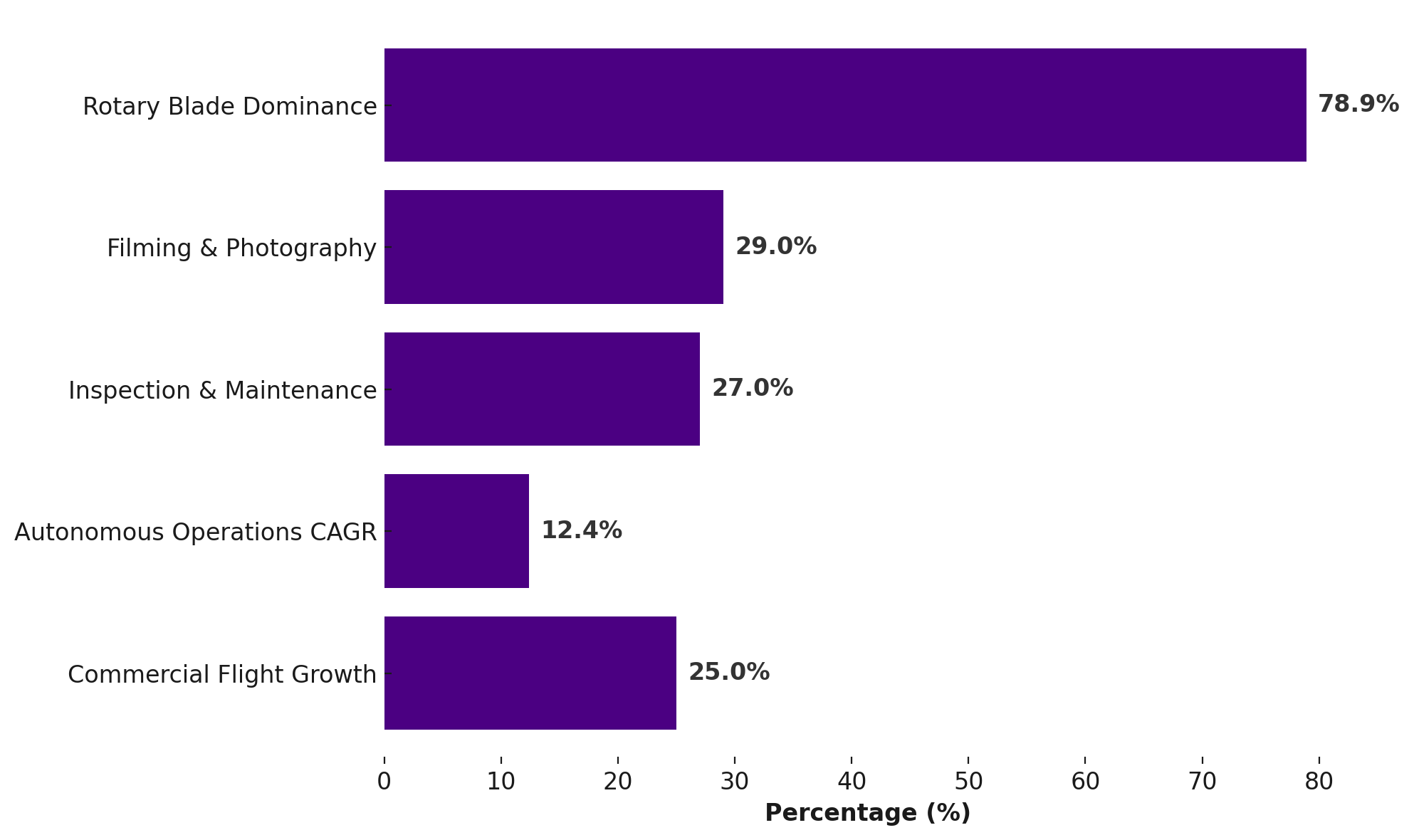

- Rotary blade dominance: Rotary blade drones, including octocopters, accounted for more than 78.9% of global revenue in 2024. Their strong market position is supported by their stability, precise maneuvering, and ability to hover, which makes them ideal for inspection and close-range monitoring.

- Filming and photography: This application held the largest share at over 29.0% in 2024. Demand continues to grow in professional fields such as real estate, media production, and event coverage, where drones deliver high-quality aerial imaging at lower operational costs.

- Inspection and maintenance: Drone deployment for infrastructure inspection is expanding across sectors. The power and utility segment led the drone analytics market in 2024 with over 27% of global revenue, reflecting the need for reliable monitoring of grids, pipelines, and transmission lines.

- Autonomous operations: Fully autonomous drones represent the fastest-growing operating segment. This segment is expected to expand at a CAGR of 12.4% from 2025 to 2030, supported by advancements in AI and machine learning that enable scaled, unassisted missions.

- Increased flights: Global commercial drone activity continues to rise. The total number of commercial drone flights increased by 25% in 2024, reaching 19.5 million flights, which highlights rapid growth in operational usage across multiple industries.

By Payload

Octocopter drones with a payload capacity below 10 kg make up 53.7% of the market. This segment is popular because it covers a wide range of commercial and industrial applications, from aerial photography to light cargo delivery. These drones are easier to operate and maintain, making them accessible for small businesses and individual users who need reliable, agile platforms for routine tasks.

The below 10 kg payload class is also favored for its versatility. Many users find these drones suitable for tasks like surveying, inspection, and short-range deliveries, where heavy lifting is not required. Their compact size and lower operational costs make them a practical choice for a variety of sectors, including agriculture, media, and logistics.

By Drone Type

Commercial octocopter drones account for 48.6% of the market. These drones are designed for professional use in industries such as agriculture, construction, media, and logistics. Their robust build and advanced features allow them to handle demanding tasks, from site surveys to high-definition aerial filming.

Commercial models are preferred for their reliability, flight stability, and ability to carry specialized equipment. Businesses invest in these drones to improve efficiency, reduce costs, and access hard-to-reach areas. The growing demand for automation and data-driven solutions is driving the adoption of commercial octocopters across multiple sectors.

By End User

In 2024, Delivery and logistics make up 39.2% of octocopter drone end users. This segment is expanding rapidly as companies seek faster, more efficient ways to transport goods, especially in urban and remote areas. Octocopters are well-suited for last-mile delivery, medical supply transport, and e-commerce fulfillment due to their payload capacity and flight stability.

The logistics industry values octocopters for their ability to reduce delivery times and lower operational costs. As regulations become more supportive and technology advances, more companies are integrating drones into their supply chains. This trend is especially strong in regions with high demand for rapid delivery services.

Emerging Trends

Trends Description Advanced Autonomy Octocopters are increasingly using AI-driven navigation to avoid obstacles and plan missions with minimal human input. This allows for safer, longer flights in complex environments like infrastructure inspection and mapping. Modular Payloads The ability to quickly swap out sensors and equipment makes octocopters more versatile. Users can reconfigure drones for different missions such as surveying, delivery, or surveillance, without needing multiple units. Hybrid Power Systems New models are adopting hybrid power sources, combining batteries with fuel cells or solar panels. This extends flight time and supports heavier payloads, making octocopters more practical for demanding operations. Enhanced Safety Features Manufacturers are prioritizing safety with features like emergency landing protocols and real-time monitoring. These improvements help organizations deploy drones in sensitive environments with greater confidence. Integration with IoT and Data Analytics Octocopters are now linked to IoT networks and analytics platforms, enabling real-time data collection and analysis. This is valuable in agriculture, logistics, and emergency response, where timely insights are critical. Growth Factors

Factors Description Rising Demand for Aerial Solutions Industries such as agriculture, construction, and logistics are increasingly relying on octocopters for tasks like mapping, inspection, and delivery. Their ability to carry heavy payloads and operate in challenging environments is driving adoption. Regulatory Support Governments are updating airspace rules to make it easier to deploy drones commercially. Clearer regulations and new drone corridors are lowering barriers to entry and encouraging wider use. Technological Advancements Improvements in battery life, flight control, and sensor technology are making octocopters more reliable and efficient. These innovations are expanding their use cases and reducing operational costs. Focus on Sustainability There is a growing push for electric propulsion and recyclable materials in drone manufacturing. This aligns with broader environmental goals and appeals to organizations looking to reduce their carbon footprint. Customization and Support Companies are offering tailored solutions and strong after-sales support, making it easier for organizations to adopt octocopters for specific needs. This flexibility is helping to drive market growth and competition. Key Market Segments

By Payload

- Below 10 kg

- 10–20 kg

- Above 20 kg

By Drone Type

- Consumer/Civil

- Commercial

- Military

By End User

- Delivery & Logistics

- Construction

- Agriculture

- Industrial

- Military

- Others

Regional Analysis

North America accounted for a commanding 38% share of the octocopter drone market, driven by increasing demand across agriculture, defense, cinematography, infrastructure, and logistics sectors. The region benefits significantly from advanced drone manufacturing capabilities and supportive regulatory environments, particularly in the U.S., where technology innovations in AI, LiDAR, and GPS enhance operational reliability and precision.

The commercial value of the octocopter drone market in the U.S. was approximately USD 1.16 billion, reflecting rapid adoption in both public and private sectors. These drones, known for their stability and higher payload capacity, are preferred for complex and mission-critical operations such as precision agriculture, emergency responses, and aerial filming.

Focusing on the U.S., the octocopter drone market is experiencing robust growth, with an anticipated CAGR of 18.8% fueled by expanding applications in defense, commercial surveillance, and last-mile delivery. The Federal Aviation Administration’s evolving drone regulations have facilitated commercial operations, encouraging adoption among public safety agencies and commercial enterprises.

U.S. companies lead technological advancements by integrating AI-based flight autonomy, advanced sensor suites, and extended endurance capabilities, positioning the country as a global hub in octocopter innovation. Strong collaboration between government bodies, academia, and industry players continues to drive R&D efforts, ensuring that the U.S. remains at the forefront of this growing market segment.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Demand for High Payload and Flight Stability

A key driver for the octocopter drone market is the growing demand for aerial platforms capable of carrying heavier payloads while maintaining flight stability. Octocopters, with their eight rotors, offer superior redundancy and control compared to quadcopters, making them ideal for commercial uses such as agriculture, logistics, cinematography, and infrastructure inspection. Their ability to carry advanced sensors, cameras, or delivery loads efficiently drives adoption in sectors requiring precision and reliability.

The ongoing advancements in battery technology, autonomous navigation, and AI flight controls have increased octocopters’ flight duration and operational range. These improvements, combined with rising government investments in drone-based infrastructure and regulatory support, position octocopters as essential tools in modern aerial applications, fueling market growth.

Restraint

Regulatory Ambiguity and High Costs

Despite their benefits, octocopter drones face restraints due to regulatory uncertainties and high acquisition costs. Many countries lack clear UAV regulations, especially concerning airspace access, privacy protections, and commercial operations. This ambiguity complicates drone deployment and increases compliance costs, limiting market expansion in certain regions.

Additionally, octocopters generally have higher procurement and maintenance costs compared to smaller drones. The expense, combined with a shortage of qualified drone operators and technical support personnel, particularly affects small to medium businesses, restricting market penetration and adoption pace.

Opportunity

Expansion in Agriculture, Logistics, and Emergency Services

The octocopter drone market holds significant opportunities across diverse sectors such as precision agriculture, logistics, and emergency response. In agriculture, octocopters enable precise application of fertilizers and pesticides, increasing productivity while reducing waste. In logistics, their payload capacity supports efficient last-mile delivery, especially in hard-to-reach areas and urban environments.

Emergency services benefit from octocopters through rapid assessment, search and rescue operations, and medical supply delivery to disaster zones. Growing interest from e-commerce companies and defense agencies further amplifies opportunities as octocopters contribute to automation and resilience across industries.

Challenge

Technical Constraints and Public Perception

A major challenge in the octocopter drone market lies in managing the technical limitations related to battery life and flight endurance. Carrying heavier payloads demands increased power, which can reduce operational time and range. Optimizing this balance without compromising performance requires ongoing research and innovation in lightweight materials and energy-efficient systems.

Public concerns around noise pollution, safety hazards, and potential misuse also challenge market growth. Negative perceptions and resistance from communities can result in stricter regulations and operational restrictions. Addressing these challenges involves not only technological advancements but also transparent communication, safety assurances, and community engagement.

Competitive Analysis

Octocopters, characterized by their eight-rotor configuration, are favored for their superior stability, payload capacity, and flight redundancy, making them indispensable in commercial, industrial, and defense sectors. Key applications driving this market include aerial surveillance, precision agriculture, infrastructure inspection, logistics, cinematography, and emergency response.

Leading players in the market include DJI, Intel, Draganfly, XDynamics, Alta Drone, Harris Aerial, Skyfront, Hexadrone, Vulcan UAV, Airstoc, SteadiDrone, Sky-Hero, and others. DJI maintains a dominant position with its extensive product portfolio like the Matrice and Agras series designed for agriculture and industrial use. Intel leverages its AI and sensor fusion expertise to provide high-precision drones like the Falcon 8+ for infrastructure inspection and utility surveys.

The market growth is supported by technological advancements such as improved battery life, AI-powered autonomous navigation, 5G connectivity, modular payload capabilities, and hybrid propulsion systems. Regionally, North America leads due to mature regulatory frameworks and high adoption in defense and agriculture, while Asia-Pacific is the fastest-growing market, driven by China’s manufacturing dominance, government initiatives, and expanding applications in smart farming and urban logistics

Top Key Players in the Market

- Aerial Photography Inc.

- XDynamics

- Alta Drone

- Draganfly

- Intel

- Airstoc

- Hexadrone

- Skyfront

- Vulcan UAV

- Harris Aerial

- SteadiDrone

- Sky-Hero

- Others

Recent Developments

- October 2025, XTI Aerospace acquired Drone Nerds, one of the largest drone distributors and service providers in the United States, for approximately $40 million. This move strengthens XTI’s position in the UAS market and expands its enterprise drone solutions portfolio. The acquisition is expected to boost XTI’s recurring revenue and operational footprint, especially as the U.S. government pushes for domestic drone development and restricts Chinese drone imports.

- September 2025, DJI launched a new octocopter model, the DJI Flip, targeting professional aerial photography and cinematography. The Flip features a compact folding design, carbon fiber spokes, a three-axis gimbal, and a 1/1.3-inch 4K60 sensor. With a quoted flight time of 31 minutes and advanced safety features like full-coverage propeller guards and auto-braking 3D infrared sensors, the Flip is positioned as a user-friendly, high-performance option for both commercial and creative users.

Report Scope

Report Features Description Market Value (2024) USD 3.4 Bn Forecast Revenue (2034) USD 23.4 Bn CAGR(2025-2034) 21.30% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Payload (Below 10 kg, 10-20 kg, Above 20 kg), By Drone Type (Consumer/Civil, Commercial, Military), By End User (Delivery & Logistics, Construction, Agriculture, Industrial, Military, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Aerial Photography Inc., XDynamics, Alta Drone, Draganfly, Intel, Airstoc, Hexadrone, Skyfront, Vulcan UAV, Harris Aerial, SteadiDrone, Sky-Hero, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Aerial Photography Inc.

- XDynamics

- Alta Drone

- Draganfly

- Intel

- Airstoc

- Hexadrone

- Skyfront

- Vulcan UAV

- Harris Aerial

- SteadiDrone

- Sky-Hero

- Others