Global Ocean Robotics Market Size, Share Analysis Report By Product Type (Autonomous Underwater Vehicles, Remotely Operated Vehicles, Unmanned Surface Vehicles, Others), By Application (Oil & Gas, Defense & Security, Scientific Research, Environmental Monitoring, Others), By End-User (Commercial Sector, Military & Defense, Research & Academia, Government Agencies), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153400

- Number of Pages: 397

- Format:

-

keyboard_arrow_up

Quick Navigation

Ocean Robotics Market Size

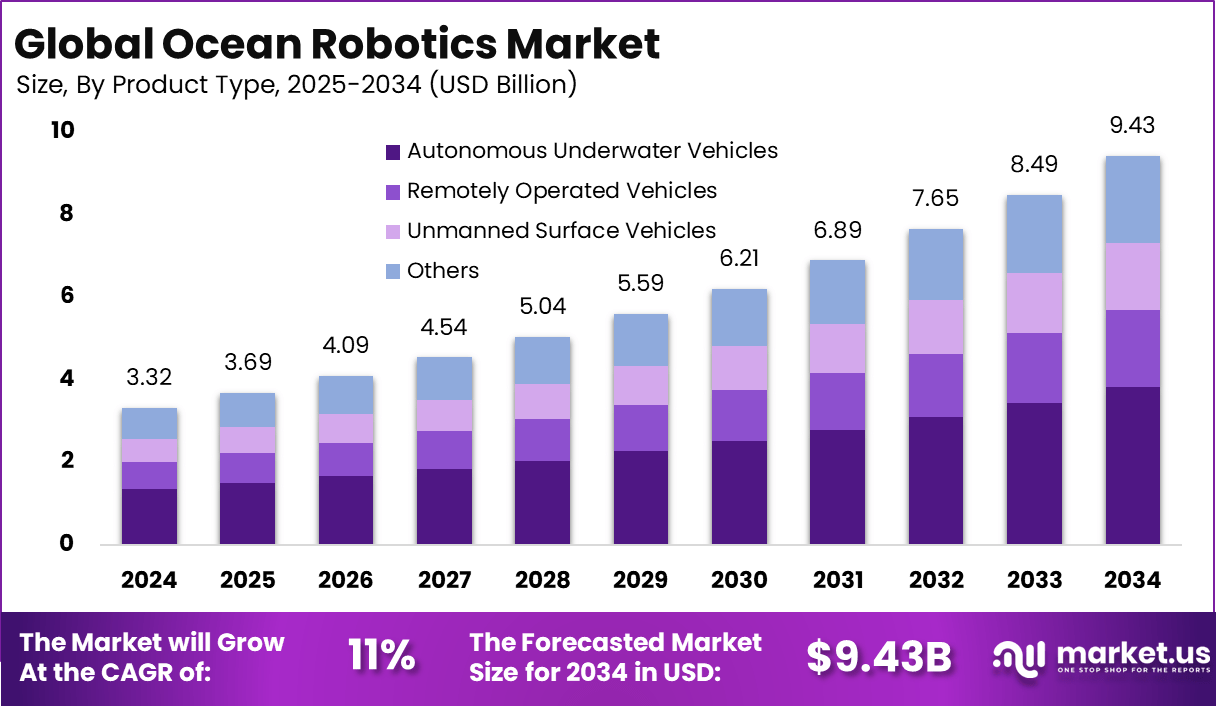

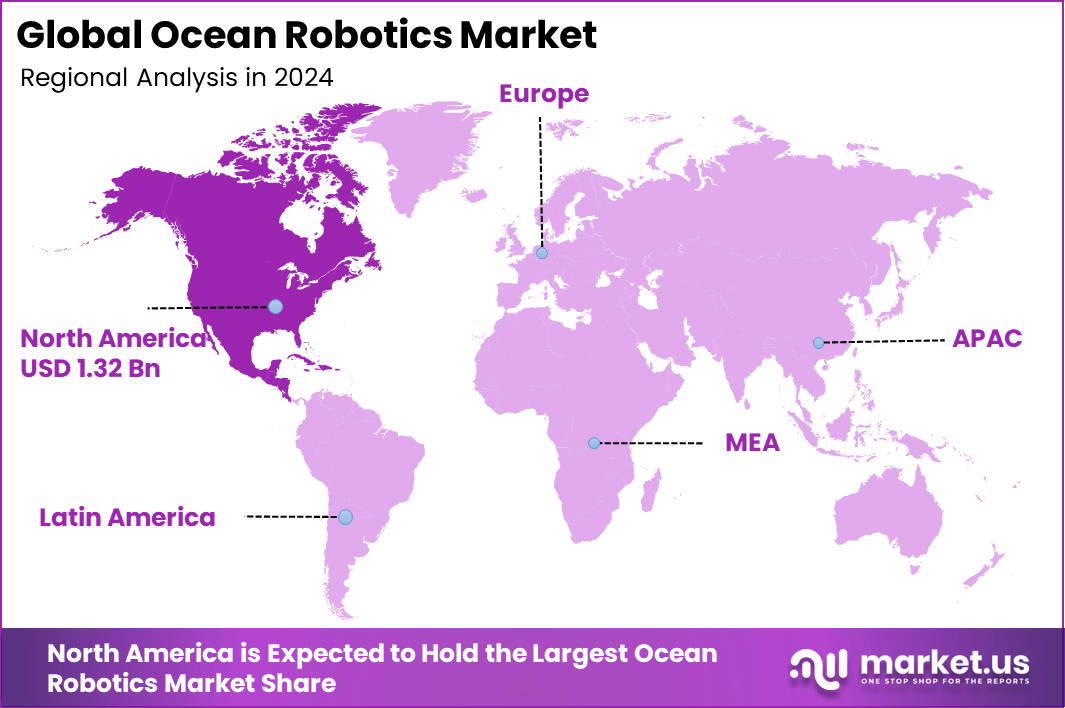

The Global Ocean Robotics Market size is expected to be worth around USD 9.43 billion by 2034, from USD 3.32 billion in 2024, growing at a CAGR of 11% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 40% share, holding USD 1.32 billion in revenue.

The market for ocean robotics is driven by the increasing demand for advanced underwater exploration, surveillance, and data collection technologies. Key factors include the need for efficient offshore oil and gas infrastructure inspection, growing concerns over marine pollution, and the rise in autonomous solutions for defense applications.

Technological advancements in AI, machine learning, and sensor technologies further fuel the market’s growth by enhancing the capabilities of Autonomous Underwater Vehicles (AUVs) and Remotely Operated Vehicles (ROVs). These innovations make ocean robotics a vital tool for industries such as environmental monitoring, defense, and subsea infrastructure maintenance.

For instance, In October 2024, Victoria-based Open Ocean Robotics secured a CA$2.8 million investment to advance its mission of sustainable ocean monitoring. The funding, co-led by Antares Ventures and Spring Impact Capital, will support product development, geographic expansion into Southeast Asia, and scaling manufacturing of its solar-powered uncrewed surface vehicles (USVs).

Scope and Forecast

Report Features Description Market Value (2024) USD 3.32 Bn Forecast Revenue (2034) USD 9.43 Bn CAGR (2025-2034) 11% Largest Segment Autonomous Underwater Vehicles (AUVs) Largest Market North America [40% market share] Largest Country U.S. [USD 1.23 Bn Market Revenue] According to JoinGenius, the global robotics industry is expected to reach $43.32 billion by 2027. Asia holds a dominant position, generating $13.51 billion in robotics revenue in 2023, accounting for over one-third of the global share. The electronics sector leads in new robot installations, contributing 28% of global deployment. However, workforce stability remains a concern, with 61% of robotics engineers staying in their roles for two years or less.

Key Takeaway

- The Global Ocean Robotics Market is projected to reach USD 9.43 billion by 2034, up from USD 3.32 billion in 2024, registering a CAGR of 11% during 2025–2034.

- In 2024, North America dominated with over 40% market share and revenue of about USD 1.32 billion.

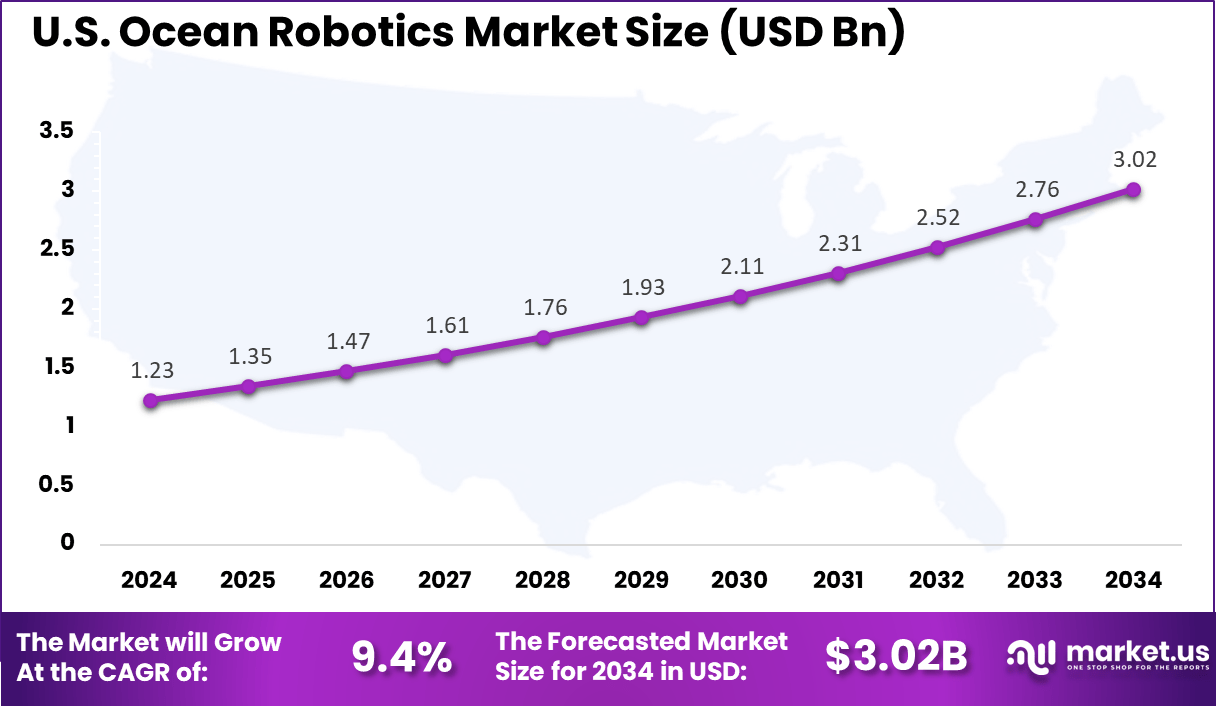

- The United States alone accounted for approximately USD 1.23 billion in 2024, growing at a CAGR of 9.4%.

- By product type, Autonomous Underwater Vehicles (AUVs) held the largest share of around 41%, driven by demand for advanced subsea operations.

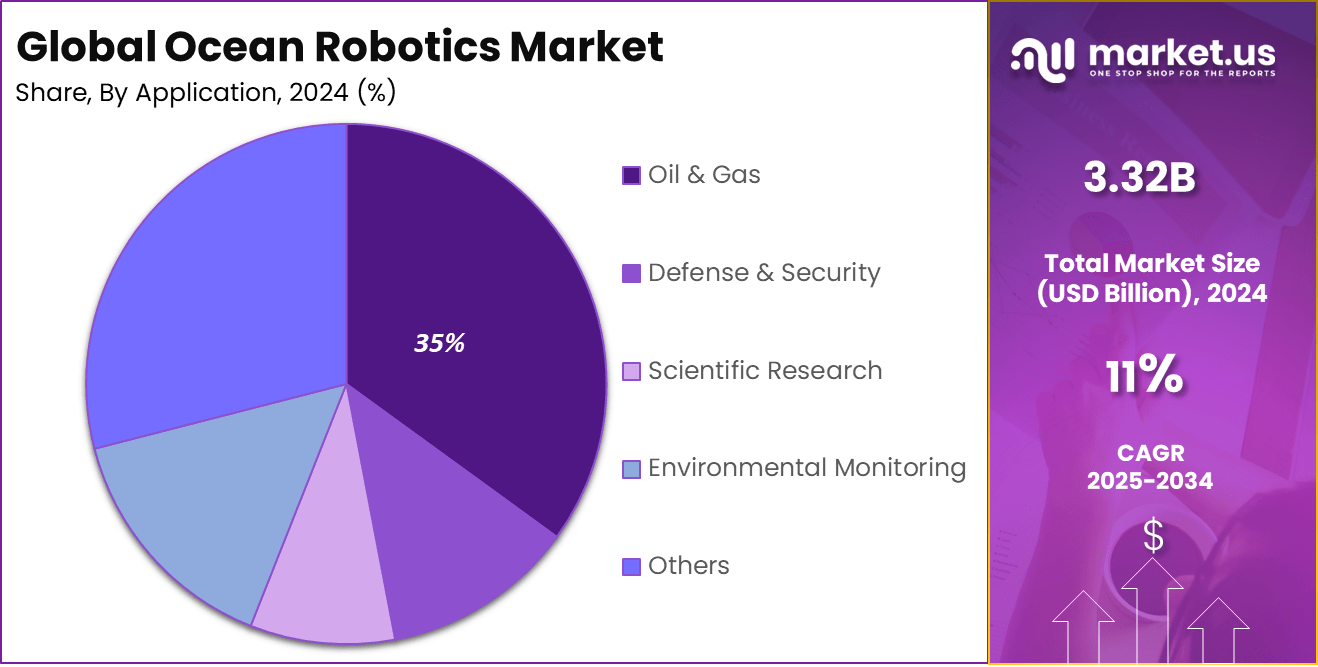

- By application, the Oil & Gas sector led with nearly 35% share, supported by offshore exploration activities.

- By end-user, the Commercial sector contributed about 38%, reflecting growing private investments in marine technology.

U.S. Ocean Robotics Market Size

The market for Ocean Robotics within the U.S. is growing tremendously and is currently valued at USD 1.23 billion, the market has a projected CAGR of 9.4%. The U.S. market for ocean robotics is witnessing significant expansion driven by active offshore endeavors, such as oil and gas exploration, renewable energy initiatives, and marine research.

The country has a significant advantage in terms of power due to substantial investment from both government and private sectors, as well as rapid advancements in autonomous underwater vehicles (AUVs), sensors, and artificial intelligence.

For instance, In March 2025, BlueHalo was awarded a $30.7 million contract by the U.S. Navy to support its Mission Specialist Defender ROV. This five-year deal, managed by the Naval Information Warfare Center Pacific, will strengthen the Navy’s Maritime Expeditionary Standoff Response (MESR) program. The focus lies on advancing mine countermeasures and improving underwater security capabilities.

In 2024, North America held a dominant market position in the Global Ocean Robotics Market, capturing more than a 40% share, holding USD 1.32 billion in revenue. North America has emerged as a major player in the ocean robotics sector, thanks to the increasing demand for efficient offshore exploration, underwater studies, and maintenance activities.

Advanced unmanned surface aircraft (AUV) and rocket launch vehicles (ROV) are advancements that improve capabilities in deep-sea exploration and infrastructure evaluation. Increasingly, sectors such as oil and gas, marine research, and defense are using these technologies, while investments from the U.S. government drive further expansion in the market.

For instance, In March 2025, Baird Maritime’s Unmanned Craft News Roundup featured key advancements in USVs and AUVs across North America. Among them, the U.S. Navy and Serco unveiled the NOMARS Defiant, a medium-sized unmanned surface vessel. This craft was developed under DARPA’s No Manning Required Ship (NOMARS) program, emphasizing autonomous operations without onboard crew.

Geographic Relevance

- Europe: Active in engineering and research, expansion of offshore wind farms, and significant deployment within Norway, the UK, Germany, and France.

- Asia Pacific: Fastest growth rate; China, Japan, Australia, and India see rapid industrialization, surging investment in offshore energy, and government funding in advanced robotics.

- Latin America: Emerging market led by Brazil and Mexico due to growing offshore exploration, maritime research, and biodiversity projects.

- Middle East & Africa: Rising adoption, mainly for energy sector (oil & gas), maritime security, and growing national capabilities, especially in the Gulf and North Africa.

Emerging Trends Analysis

Surge of Autonomous Intelligence in Ocean Robotics

One of the most exciting shifts happening in ocean robotics today is the rapid integration of artificial intelligence (AI) and machine learning. Ocean robots are no longer purely remote-controlled devices but are fast becoming independent agents capable of making complex decisions beneath the waves.

These machines now adapt to changing environments, process what they sense in real time, and guide themselves through challenging underwater landscapes with minimal input from humans. The deep learning capabilities that power this movement allow ocean robots to stay operational longer and perform far more intricate tasks.

The push towards self-directed robots has a profound impact not just on science, but also on industries that rely on accurate and efficient ocean data collection. As these robots become smarter, their ability to collect high-quality data improves, opening doors for deeper exploration and more effective resource management.

Moreover, the technologies used in these robots are tending towards miniaturization and energy efficiency, making them accessible for tasks that demand less intrusion into sensitive ecosystems. Enhanced communication tools are also part of this trend, making it easier for scientists and operators to stay connected with their robots in real time, despite the data transfer hurdles posed by the ocean

Product Type Analysis

In 2024, Autonomous Underwater Vehicles (AUVs) segment held a dominant market position, capturing a 41% share of the Global Ocean Robotics Market. This dominance is due to the growing demand for autonomous solutions in areas such as deep-sea research, inspection of offshore infrastructure, and environmental surveillance.

Compared to other equipment, AUVs offer exceptional efficiency, reduced operating expenses, and enhanced capabilities for long-distance underwater operations. AUVs are often favored over conventional remotely operated vehicles due to their autonomous capabilities and rapid technological advancements.

For Instance, In April 2025, Kongsberg Maritime’s HUGIN Autonomous Underwater Vehicle (AUV) continued to lead in autonomous subsea operations, marking a significant milestone in marine robotics. The HUGIN AUV, renowned for its versatility and high-resolution data collection capabilities, is utilized across various sectors, including commercial surveying, defense, and scientific research.

Application Analysis

In 2024, the Oil & Gas segment held a dominant market position, capturing a 35% share of the Global Ocean Robotics Market. The demand in the oil & gas sector is growing due to the need for efficient and cost-effective solutions for subsea exploration, infrastructure inspection, and maintenance.

Autonomous underwater vehicles and remotely operated vehicles, which are part of ocean robotics technology, are essential in managing harsh offshore environments by reducing risks and increasing efficiency. The need for frequent maintenance checks on older platforms has made underwater robotics a crucial factor in reducing downtime, complying with regulations, and improving operational safety.

For instance, In August 2023, researchers at the University of Houston unveiled an autonomous robot designed to enhance subsea pipeline inspections in the oil and gas industry. This innovative system integrates remotely operated vehicles (ROVs) equipped with smart touch sensors, video cameras, and scanning sonars to detect potential leaks and structural failures along subsea pipelines.

End-User Analysis

In 2024, Commercial Sector segment held a dominant market position, capturing a 38% share of the Global Ocean Robotics Market. The dominance of ocean robotics is reflected in industries such as offshore energy, marine research, and environmental regulation.

The commercial arena has become the primary market for underwater inspections, data collection, and maintenance, as these activities demand affordable yet safe and secure solutions that outperform both military and scientific user categories.

For Instance, In May 2020, ECA Group secured a €20 million export contract to modernize naval mine warfare robots for an undisclosed navy. The 48-month project aims to enhance the customer’s mine clearance capabilities against evolving sea mine threats. ECA Group, with over 50 years of experience in providing unmanned systems for underwater mine clearance, continues to be a trusted partner for navies worldwide.

Key Market Segments

By Product Type

- Autonomous Underwater Vehicles

- Remotely Operated Vehicles

- Unmanned Surface Vehicles

- Others

By Application

- Oil & Gas

- Defense & Security

- Scientific Research

- Environmental Monitoring

- Others

By End-User

- Commercial Sector

- Military & Defense

- Research & Academia

- Government Agencies

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Expanding Need for Underwater Exploration and Monitoring

The increasing human interest in the ocean as both a resource and a subject of research is fueling investment in ocean robotics. Across the world, various sectors – defense, environmental science, and resource extraction – are seeking more extensive and reliable information about subsea environments.

Ocean robots enable safer exploration of previously unreachable areas, such as deep-sea mineral zones or hazardous subsea settings. The demand for continuous environmental monitoring has also grown in response to concerns over climate change and biodiversity loss.

These robots can operate uninterrupted for weeks or months, gathering the long-term data needed to track shifts in marine health. The need for efficient underwater inspections has made robots essential for ocean exploration and resource management.

For instance, In April 2025, Nauticus Robotics officially commenced the 2025 offshore season, marking a significant milestone in its operational calendar. The company launched its Gulf Coast offshore activities with substantial engagements, including an ROV contract with a drill ship and the initiation of a multi-month Petrobras project in Brazil.

Restraint Analysis

High Costs and Technical Barriers Slow Widespread Adoption

Despite remarkable technological advancements, high development and operational costs remain a persistent barrier. Building an ocean robot robust enough to withstand harsh underwater conditions, while ensuring it can perform tasks accurately, demands significant financial resources and technical know-how.

Even the maintenance, upgrade, or replacement of damaged components often comes with a steep price tag, limiting accessibility for smaller organizations and research teams. Besides cost, technical complexity adds another layer of challenge. Operating advanced robotic systems requires specialized skills, and the unpredictability of underwater environments can amplify system failures.

Communication with robots underwater is notoriously difficult, as traditional radio signals do not travel efficiently through water. Instead, operators must rely on acoustic signals, which are often disrupted by environmental noise and bandwidth limitations.

For instance, In June 2025, Nauticus Robotics and Open Ocean Robotics formed a strategic partnership to lower the high costs of subsea inspections and maintenance. The collaboration combines Nauticus’s autonomous subsea vehicle, Aquanaut®, with Open Ocean’s solar-powered surface vehicle, DataXplorer™.

Opportunity Analysis

Sustainability and the Next-Generation Blue Economy

A powerful opportunity emerging for ocean robotics is the global emphasis on sustainability and the blue economy. There is growing momentum behind initiatives aimed at reducing the environmental impact of industrial and scientific activities in the ocean.

Robotic solutions can make these efforts more feasible and effective by enabling precise interventions, monitoring environmental change, and reducing direct human activity in fragile marine areas. Innovation in sensor design, battery technology, and communications means robots can carry out detailed monitoring around renewable energy installations, track pollution, and support large-scale ocean cleanup projects.

As the world shifts towards greener industries and carbon-conscious policies, ocean robotics will become central to implementing and validating these sustainability missions. The combination of smart robotics and eco-friendly goals has the potential to unlock fresh areas of investment and societal benefit, further driving the evolution of the blue economy.

For instance, In August 2024, EyeROV, an Indian startup specializing in underwater drone technology, secured funding under the Technology Development Fund (TDF) scheme to develop a long-range Remotely Operated Vehicle (ROV) for underwater object detection and neutralization. This initiative is part of a significant collaboration with the Defence Research and Development Organization (DRDO).

Challenge Analysis

Operating in Unpredictable and Complex Marine Environments

Working under water presents one of the most challenging environments for any kind of technology. Extreme underwater pressures, strong currents, low temperatures, and near-total darkness escalate the technical demands placed on robotic systems.

For these robots to succeed, they must not only survive these conditions but continue to perform at a high level, processing data and maintaining safe functionality in the face of uncertainty. Another major challenge relates to system reliability. Ocean robots require sophisticated control schemes to adapt to unpredictable water movement and environmental disturbances, which often necessitate ongoing research and iterative improvement.

Communication standards underwater are far from uniform, complicating real-time data transmission and collaboration among multiple robots in swarm-based missions. Engineering robust manipulation systems for delicate or precise operations, such as scientific sampling or infrastructure repairs, remains a significant hurdle, highlighting a gap between laboratory prototypes and fully operational field systems.

For instance, In January 2025, President Joe Biden banned new offshore oil and gas drilling across 625 million acres of U.S. coastal waters, including the Atlantic, Pacific, and Northern Bering Sea. Aimed at protecting marine ecosystems, this decision poses challenges for ocean robotics firms, as reduced offshore activity impacts demand for subsea exploration and maintenance technologies.

Key Players Analysis

Oceaneering, Kongsberg Maritime, and Lockheed Martin lead the ocean robotics market with strong portfolios in ROVs and AUVs. Their technologies serve defense, energy, and deep-sea exploration needs. Continuous innovation in sensors, AI, and automation has strengthened their global footprint.

SAAB Group, TechnipFMC, and BAE Systems are advancing underwater defense and offshore robotics. Their systems enhance marine surveillance, inspection, and data gathering. Investments in naval modernization and offshore infrastructure are driving their growth.

ECA Group, Atlas Elektronik, and Teledyne Gavia focus on compact marine robots. OceanServer (L3Harris), General Dynamics, and TMT provide inspection and survey solutions. Firms like ISE, Deepinfar, and ROBOSEA are scaling through regional expansion and partnerships.

Top Key Players in the Market

- Oceaneering

- Kongsberg Maritime

- Lockheed Martin

- SAAB Group

- TechnipFMC

- BAE Systems

- ECA Group

- Atlas Elektronik

- Teledyne Gavia

- OceanServer Technology (L3Harris)

- General Dynamics

- Total Marine Technology (TMT)

- International Submarine Engineering

- Deepinfar Ocean Technology

- ROBOSEA

- Other Key Players

Recent Developments

- In February 2025, Saab launched a new manufacturing campus in Fareham, Hampshire, expanding its defense operations in the UK. The facility supports the development of advanced radar systems and Seaeye’s underwater robotics. Key technologies include the Giraffe 1X and AMB radars, TAIPAN artillery radar, and the Seaeye SR20, an all-electric subsea ROV.

- In November 2024, BAE Systems successfully conducted the first in-water demonstration of its Herne Extra-Large Autonomous Underwater Vehicle (XLAUV) off the south coast of England. Over two weeks, the Herne XLAUV performed an intelligence, surveillance, and reconnaissance (ISR) mission, showcasing its capabilities to representatives from 10 nations, including NATO and Five Eyes partners.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product Type (Autonomous Underwater Vehicles, Remotely Operated Vehicles, Unmanned Surface Vehicles, Others), By Application (Oil & Gas, Defense & Security, Scientific Research, Environmental Monitoring, Others), By End-User (Commercial Sector, Military & Defense, Research & Academia, Government Agencies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Oceaneering, Kongsberg Maritime, Lockheed Martin, SAAB Group, TechnipFMC, BAE Systems, ECA Group, Atlas Elektronik, Teledyne Gavia, OceanServer Technology (L3Harris), General Dynamics, Total Marine Technology (TMT), International Submarine Engineering, Deepinfar Ocean Technology, ROBOSEA, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Oceaneering

- Kongsberg Maritime

- Lockheed Martin

- SAAB Group

- TechnipFMC

- BAE Systems

- ECA Group

- Atlas Elektronik

- Teledyne Gavia

- OceanServer Technology (L3Harris)

- General Dynamics

- Total Marine Technology (TMT)

- International Submarine Engineering

- Deepinfar Ocean Technology

- ROBOSEA

- Other Key Players