North America Optical Fiber In-Vehicle Network Market Size, Share, Industry Analysis Report By Material Type (Plastic Optical Fiber (POF), Glass Optical Fiber (GOF)), By Mode (Multi-Mode Fiber (MMF), Single-Mode Fiber (SMF)), By Communication Method (MOST (Media Oriented Systems Transport), Ethernet (Ethernet Over Plastic Optical Fiber (POF), Ethernet Over Glass Optical Fiber (GOF)), Others (CAN, LIN, FlexRay, etc.)), By Communication Speed (≤ 1 Gbps, >1 Gbps to ≤ 10 Gbps, > 10 Gbps), By Application (Lighting Devices, Safety Systems, Infotainment, Communication Devices, Internal and External Sensing, Others), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 160664

- Number of Pages: 341

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

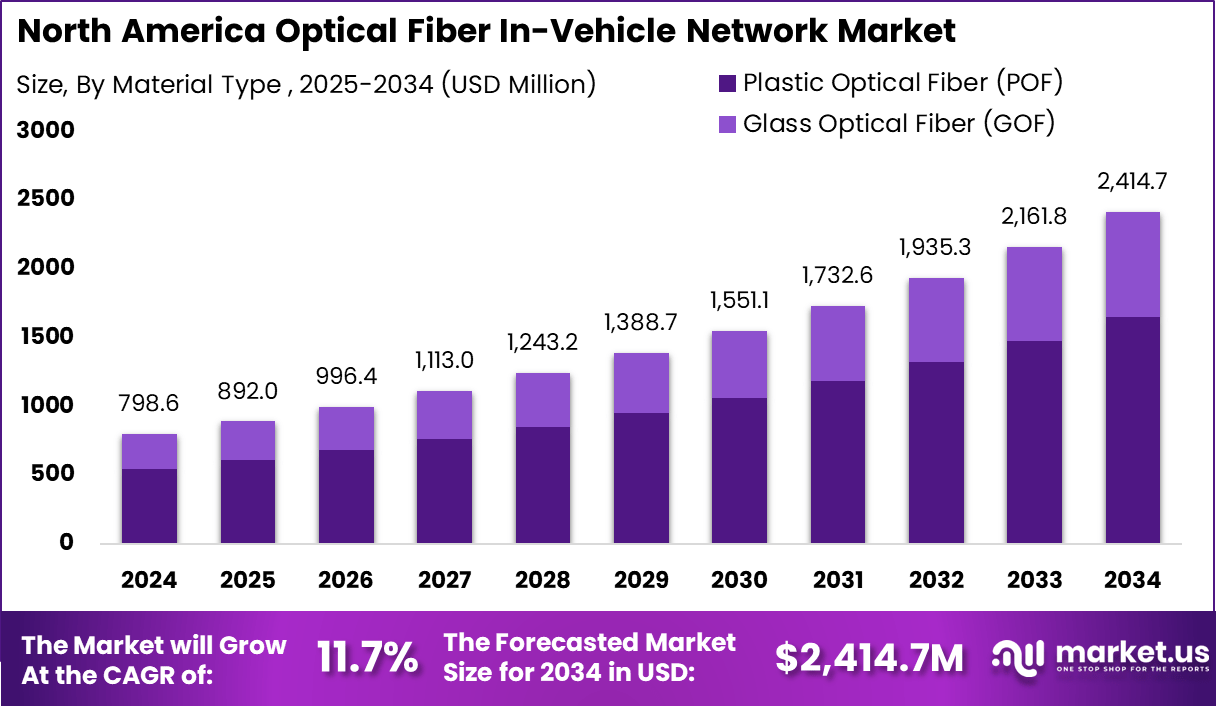

The North America Optical Fiber In-Vehicle Network Market generated USD 798.6 Million in 2024 and is predicted to register growth from USD 892.0 Million in 2025 to about USD 2,414.7 Million by 2034, recording a CAGR of 11.7% throughout the forecast span.

The North American optical fiber in-vehicle networking market is experiencing robust transformation as vehicle connectivity becomes more central to both passenger and commercial automotive segments. Modern North American vehicles rely on high-speed, interference-free data for infotainment, navigation, advanced driver-assistance systems (ADAS), and emerging autonomous features.

The electric vehicle (EV) landscape, now at the forefront of North American automotive innovation, has contributed to a surge in optical fiber demand, with the segment reporting over a 40% increase in adoption for new EV models within the last two years. Vehicles integrating optical fiber see up to a 25% improvement in data transmission stability and a 15% reduction in wiring weight, directly supporting higher fuel efficiency and reliability.

Generative AI is reshaping the landscape for optical fiber in vehicles by enabling real-time data analytics, predictive maintenance, and advanced anomaly detection. Recent studies show that over 30% of North American OEMs have started integrating generative AI algorithms into their optical networks for tasks like optimizing traffic flow and reducing energy consumption.

According to Market.us, The Global Optical Fiber In-Vehicle Network Market generated USD 2,714.5 Million in 2024 and is projected to grow from USD 3,249.5 Million in 2025 to approximately USD 9,599.8 Million by 2034, registering a CAGR of 12.8% over the forecast period. In 2024, Asia Pacific dominated the market with over 45.5% share, accounting for around USD 1,235 Million in revenue.

Some deployments report up to 28% fewer downtime incidents in vehicles equipped with fiber-optic networks enhanced by AI-driven monitoring tools. The capacity of generative AI systems to interpret data from cameras, radar, and LIDAR over fiber channels opens new possibilities for smart safety features within passenger cars and commercial fleets.

Top Market Takeaways

- By material type, Plastic Optical Fiber (POF) leads with 68.5%, chosen for its durability and cost efficiency in vehicle integration.

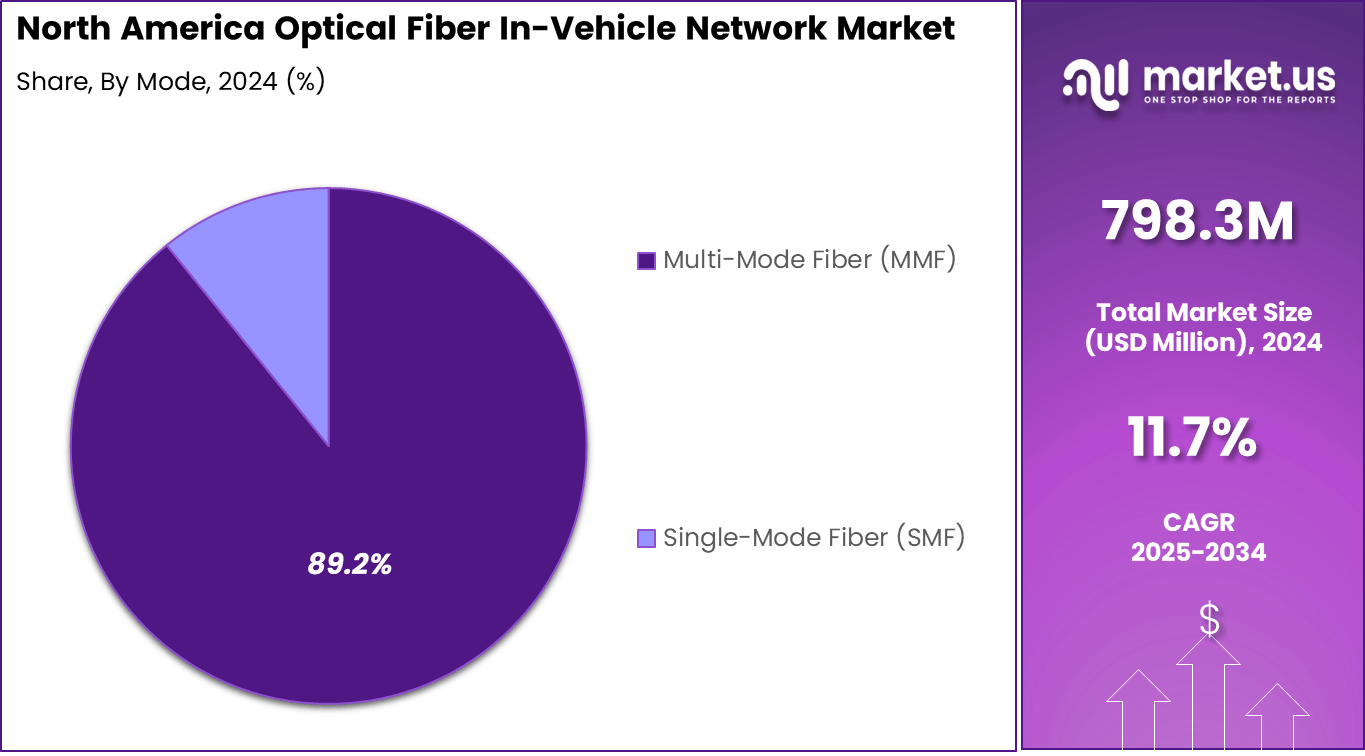

- By mode, Multi-Mode Fiber (MMF) dominates with 89.2%, reflecting its suitability for short-range, high-capacity data transmission in vehicles.

- By communication method, Ethernet accounts for 57.6%, highlighting its role as the backbone of modern automotive networking.

- By communication speed, ≤ 1 Gbps holds 73.3%, showing reliance on current gigabit-class systems while preparing for higher-speed adoption.

- By application, safety systems lead with 31.8%, driven by advanced driver assistance and vehicle safety technologies.

- By vehicle type, passenger cars dominate with 82.9%, as automakers prioritize connectivity and safety in mass-market vehicles.

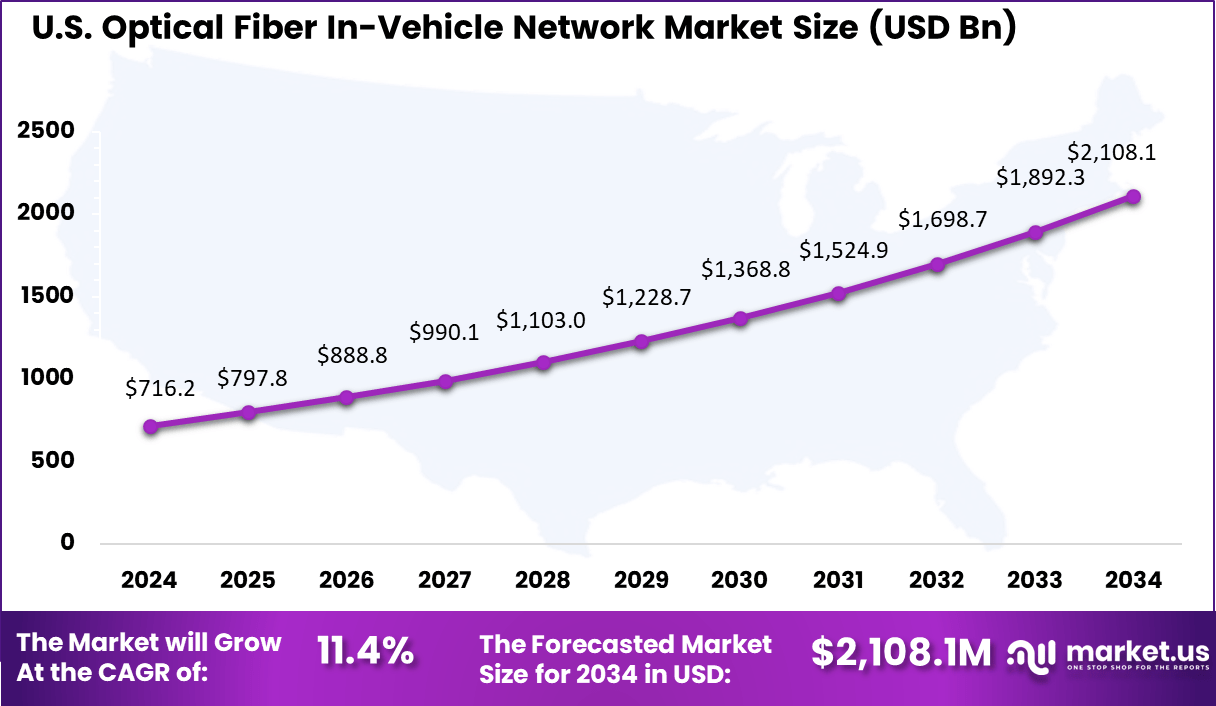

- The US market reached USD 716.2 million and is expanding at a steady CAGR of 11.4%, underscoring consistent investment in connected vehicle infrastructure.

Investment and Business Benefits

Investment is flowing toward next-generation optical fiber transceivers, enhanced connectors, and R&D for lightweight, automotive-grade fiber solutions. The EV boom is a prime driver, with automakers and technology firms channeling resources into the research and deployment of smart mobility platforms and integrated vehicle computing. As EV market share increases, new partnerships and regulatory incentives are unlocking further opportunities for disruptive business models around connected vehicle infrastructure.

Implementing optical fiber solutions translates into tangible business outcomes: improved safety and comfort due to reliable, high-speed signal transmission; reduced production and maintenance costs from less wiring; and stronger competitive positioning as vehicles increasingly compete on connectivity features. Industry analytics show manufacturers who have integrated optical fiber benefit from faster rollout of software-defined features and reduced warranty claims tied to electrical faults.

US Market Size

The US optical fiber in-vehicle network market is valued at USD 716.2 Mn and is expanding at an impressive CAGR of 11.4%. This growth is spurred by continued investment in vehicle connectivity, strong demand for advanced ADAS and infotainment, and the deployment of next-generation plastics and optics. American automotive manufacturers are at the forefront of integrating Ethernet and fiber-based solutions to support emerging trends like electric, autonomous, and connected vehicle platforms.

By Material Type

In 2024, Plastic Optical Fiber (POF) represents a commanding 68.5% of the North America optical fiber in-vehicle network segment, making it the preferred choice for automotive manufacturers in the region. POF is prized for its flexibility, ruggedness, and ability to withstand harsh automotive conditions including high temperatures and persistent vibration.

These fibers excel in short-distance, high-data-rate communication, which fits modern vehicle architectures that demand compact yet reliable networking, especially in infotainment and advanced sensor networks. North America’s emphasis on integrating innovative infotainment and sensor features in vehicles further supports the adoption of POF.

Market Share By Material Type (%), 2020-2024

Material Type 2020 2021 2022 2023 2024 Plastic Optical Fiber (POF) 69.7% 69.4% 69.1% 68.8% 68.5% Glass Optical Fiber (GOF) 30.3% 30.6% 30.9% 31.2% 31.5% The low cost and ease of installation make POF particularly attractive for producing vehicles that are lightweight and efficient, aligning with the market’s shift toward electric and hybrid models looking to optimize battery use and overall energy efficiency.

By Mode

In 2024, Multi-mode fiber (MMF) dominates the segment with an overwhelming 89.2% share. MMF supports simultaneous light transmission, essential for advanced in-vehicle networks needing high bandwidth across short distances – precisely what modern passenger vehicles require.

MMF’s thicker core compared to single-mode decreases signal loss inside cars, making it popular for safety systems, navigation, and infotainment modules that demand prompt, efficient communication. Ongoing advances in automotive electronics, including the increasing use of sensors and multimedia systems, reinforce the demand for MMF.

Market Share By Mode (%), 2020-2024

Mode 2020 2021 2022 2023 2024 Multi-Mode Fiber (MMF) 91.1% 90.5% 89.9% 89.4% 89.2% Single-Mode Fiber (SMF) 8.9% 9.5% 10.1% 10.6% 10.8% Its compatibility with Ethernet and other high-speed communication protocols ensures MMF remains a backbone for emerging automotive connectivity, supporting data-rich features without sacrificing performance.

By Communication Method

In 2024, Ethernet is the top communication method, comprising 57.6% of in-vehicle fiber networks in North America. Its widespread adoption is driven by standardized IT protocols, robust security, and the capability to provide fast, interference-free data exchange for real-time applications. Ethernet forms the foundation for seamless infotainment streaming, navigation, and advanced driver-assistance systems -functions now standard or optional in most passenger vehicles.

Market Share By Communication Method (%), 2020-2024

Communication Method 2020 2021 2022 2023 2024 MOST (Media Oriented Systems Transport) 7.0% 7.0% 6.9% 6.8% 6.7% Ethernet 54.0% 54.8% 55.5% 56.3% 57.6% – Ethernet Over Plastic Optical Fiber (POF) 70.2% 69.9% 69.5% 69.2% 68.8% – Ethernet Over Glass Optical Fiber (GOF) 29.8% 30.1% 30.5% 30.8% 31.2% Others (CAN, LIN, FlexRay, etc.) 39.0% 38.3% 37.6% 36.9% 35.7% The appeal of Ethernet also lies in its future readiness, supporting scalable upgrades as the demand for higher communication speeds increases. This positions Ethernet to outpace legacy automotive communication protocols, accommodating the rapid shift toward zonal architectures and smarter vehicle-network designs.

By Communication Speed

In 2024, Communication speeds of ≤ 1 Gbps cover 73.3% of the North America segment. This range supports the majority of in-vehicle communication needs, from safety systems to comfort applications, providing a balance between cost and reliable transmission quality. Current passenger vehicles benefit from this standard, which is sufficient for integrated digital instrument clusters, rear-view camera feeds, and telematics.

Market Share By Communication Speed (%), 2020-2024

Communication Speed 2020 2021 2022 2023 2024 ≤ 1 Gbps 73.9% 73.8% 73.6% 73.4% 73.3% > 1 Gbps to ≤ 10 Gbps 22.7% 22.8% 22.9% 23.0% 23.1% > 10 Gbps 3.4% 3.4% 3.5% 3.5% 3.6% As automotive technology advances and the number of embedded digital systems in vehicles expands, this speed range ensures scalability. The adoption of fiber-based communication for in-car networks delivering real-time, high-integrity data at an affordable price point boosts the market appeal of ≤ 1 Gbps solutions.

By Application

In 2024, Safety systems are the largest single application, holding 31.8% market share. The rising integration of advanced safety features such as lane departure warnings, emergency braking, and real-time monitoring increases the requirement for robust in-vehicle networks. Fiber optics enhance the reliability and speed of these critical functions, ensuring that data from multiple sensors are unified and processed without delay.

Market Share By Application (%), 2020-2024

Application 2020 2021 2022 2023 2024 Lighting Devices 9.8% 9.7% 9.6% 9.6% 9.5% Safety Systems 30.2% 30.5% 30.9% 31.2% 31.8% Infotainment 30.5% 30.1% 29.6% 29.2% 28.5% Communication Devices 10.1% 10.1% 10.1% 10.1% 10.0% Internal and External Sensing 12.7% 13.1% 13.4% 13.7% 14.2% Others 6.7% 6.5% 6.4% 6.2% 6.0% Both passenger and commercial vehicles in North America now emphasize safety innovation, leading to a rapid increase in demand for optical fiber solutions. As regulations evolve and consumer demand for safer vehicles rises, the share of fiber-based safety systems is expected to grow further.

By Vehicle Type

In 2024, Passenger cars command an 82.9% share of the in-vehicle network market, making them the primary adopters of fiber optic technology. This dominance reflects trends in connectivity and infotainment, as consumers increasingly expect smart, interactive, and seamlessly connected driving experiences.

Optical fibers help automakers implement features like intelligent navigation, immersive media, and advanced driver-assistance with minimal wiring complexity and weight. The surge in electric and hybrid passenger vehicles also accelerates this trend, since efficiency and weight reduction are top priorities.

Market Share By Vehicle Type (%), 2020-2024

Vehicle Type 2020 2021 2022 2023 2024 Passenger Cars 82.3% 82.4% 82.5% 82.6% 82.9% Light Commercial Vehicles 13.2% 13.0% 12.9% 12.7% 12.6% Heavy Commercial Vehicles 4.5% 4.6% 4.6% 4.7% 4.5% Emerging Trends

Emerging trends in the market include the adoption of multi-gigabit optical links and the push towards fully software-defined vehicles. North American automakers are now installing 10Gbps optical backbones as standard in luxury SUVs and electric sedans, which allows seamless VR/AR applications, multiple 4K screens, and full-vehicle monitoring.

Surveys from late 2024 show that about 42% of regional suppliers expect to upgrade to multi-gigabit networks by late 2025. In addition, the integration of optical fiber with edge computing nodes in cars is resulting in a 21% improvement in data processing speeds, reducing response times for emergency functions and driver assistance technologies.

Rising demand for seamless connectivity, accelerated EV rollout, and regulatory pushes for advanced driver-assistance systems are contributing heavy momentum to market growth. More than 55% of consumers surveyed in Q3 2025 cited robust in-vehicle internet and low-latency media streaming as key purchase drivers – both enabled by fiber backbones.

Key Market Segments

By Material Type

- Plastic Optical Fiber (POF)

- Glass Optical Fiber (GOF)

By Mode

- Multi-Mode Fiber (MMF)

- Single-Mode Fiber (SMF)

By Communication Method

- MOST (Media Oriented Systems Transport)

- Ethernet

- Ethernet Over Plastic Optical Fiber (POF)

- Ethernet Over Glass Optical Fiber (GOF)

- Others (CAN, LIN, FlexRay, etc.)

By Communication Speed

- ≤ 1 Gbps

- >1 Gbps to ≤ 10 Gbps

- > 10 Gbps

By Application

- Lighting Devices

- Safety Systems

- Infotainment

- Communication Devices

- Internal and External Sensing

- Others

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Driver

High-Speed Data Demand in Modern Vehicles

The growing need for rapid and reliable data transmission within vehicles is a major driver for Optical Fiber In-Vehicle Networks in North America. Vehicles today, especially electric and autonomous ones, depend heavily on fast communication between numerous sensors, cameras, and advanced driver-assistance systems (ADAS).

Optical fiber provides much higher bandwidth than traditional copper wiring and is immune to electromagnetic interference. This allows better safety, connectivity, and user experience. As vehicles evolve to be more connected, the demand for faster data transfer rises, making optical fiber critical to support present and future innovations like vehicle-to-everything (V2X) communications.

Optical fiber networks enable seamless integration of multiple vehicle subsystems, optimizing performance and safety functions. The technology’s lightweight nature also benefits electric vehicles by reducing overall weight, thus improving battery efficiency and range. Automakers focusing on connected car features and enhanced infotainment systems find optical fiber networks essential for meeting consumer expectations.

Restraint

High Implementation Cost and Integration Complexity

The relatively high cost and complexity of integrating optical fiber networks within vehicle architectures act as significant restraints in the North American market. Optical fiber systems require specialized components such as connectors, transceivers, and protective housings, which drive up the initial investment needed.

Additionally, redesigning vehicle wiring to incorporate fiber optic technology can be complicated, especially in cost-sensitive mass-market vehicles. The automotive environment also poses durability challenges due to vibrations, temperature fluctuations, and mechanical stress.

Ensuring optical fibers meet stringent automotive standards requires intensive engineering and testing. These factors collectively slow adoption rates as manufacturers weigh costs against perceived benefits, limiting rapid expansion despite growing demand for advanced data communication solutions within vehicles.

Opportunity

Growth of the Electric Vehicle Market

The surge in electric vehicle (EV) adoption in North America presents a significant opportunity for optical fiber networks. EVs rely on complex electronic control units to manage battery systems, propulsion, and safety features, all necessitating high-speed, interference-resistant communication.

Optical fibers deliver these capabilities while reducing wiring weight, which can enhance vehicle range and performance. As stricter government regulations promote cleaner and safer transportation, automakers are pushed to adopt advanced technologies like optical fiber communication.

This trend aligns perfectly with the needs of electric and autonomous vehicles, opening the door for expanded use of optical fiber in North America’s automotive industry. The EV market’s growth is expected to be a key factor driving the future demand for in-vehicle optical fiber networks.

Challenge

Standardization and Scalability Issues

A major challenge for optical fiber networks in North American vehicles is the lack of universal standards and scalable solutions. The automotive industry requires interoperable technology to ensure compatibility across various vehicle models and manufacturers. However, standards specific to automotive optical fiber communication are still developing, creating uncertainty for both suppliers and automakers.

Scalability also presents difficulties as networks must support a wide range of data rates, from a few hundred megabits per second to multi-gigabit speeds, depending on the vehicle system. Balancing cost, performance, and reliability while addressing these requirements demands ongoing innovation and industry collaboration. Overcoming these issues is essential for optical fiber to become a mainstream, widely accepted in-vehicle communication technology in North America.

Competitive Analysis

The Optical Fiber In-Vehicle Network Market is led by major connectivity and cabling providers such as Fujikura Ltd., Sumitomo, and Prysmian Group. These companies supply high-performance optical fiber solutions designed to support advanced in-vehicle communication systems, including ADAS, infotainment, and autonomous driving platforms.

Component and connector manufacturers such as Amphenol Corporation and TE Connectivity play a critical role in integrating optical fiber into vehicle architectures. Their solutions include fiber-optic connectors, harnesses, and transceivers that enable high-speed data transfer across electronic control units. These companies support OEMs and Tier-1 suppliers with scalable, lightweight, and thermally stable interconnect systems.

Material and technology developers including Corning and Toray Industries contribute through innovation in fiber design, plastic optical fiber (POF), and glass-based technologies suitable for harsh automotive environments. Their advancements enable greater bandwidth, signal integrity, and miniaturization of vehicle networks. A growing number of other players continue to expand the ecosystem, supporting the shift toward connected, electric, and autonomous vehicle platforms.

Top Key Players in the Market

- Fujikura Ltd.

- Sumitomo

- Prysmian Group

- Amphenol Corporation

- TE Connectivity

- Corning

- Toray Industries

- Others

Recent Developments

- June 2025: Prysmian Group completed the $950 million acquisition of Channell Commercial Corporation in North America, extending its fiber-to-the-home (FTTH) solutions by integrating Channell’s advanced thermoplastic enclosures. This strategic move strengthens Prysmian’s position in providing comprehensive optical fiber connectivity solutions supporting emerging 5G and data center growth.

- March 2025: Fujikura Ltd. began production of its SWR™ optical fiber cables at a new plant in Sakura Works and launched sample shipments of the “TitaniaBend PANDA PM fiber”, enhancing its offerings in advanced optical fibers suitable for in-vehicle and data network applications.

- February 2025: Sumitomo Electric Lightwave won recognition for its Lynx-CustomFit™ Splice-On Connector and Transit Tunnel Optical Network Solutions in the 2025 Lightwave+BTR Innovation Reviews, highlighting innovation in scalable, cost-effective optical networks for the telecommunications industry in North America.

Report Scope

Report Features Description Market Value (2024) USD 798.6 Mn Forecast Revenue (2034) USD 2,414.7 Mn CAGR(2025-2034) 11.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Material Type (Plastic Optical Fiber (POF), Glass Optical Fiber (GOF)), By Mode (Multi-Mode Fiber (MMF), Single-Mode Fiber (SMF)), By Communication Method (MOST (Media Oriented Systems Transport), Ethernet (Ethernet Over Plastic Optical Fiber (POF), Ethernet Over Glass Optical Fiber (GOF)), Others (CAN, LIN, FlexRay, etc.)), By Communication Speed (≤ 1 Gbps, >1 Gbps to ≤ 10 Gbps, > 10 Gbps), By Application (Lighting Devices, Safety Systems, Infotainment, Communication Devices, Internal and External Sensing, Others), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles) Competitive Landscape Fujikura Ltd., Sumitomo, Prysmian Group, Amphenol Corporation, TE Connectivity, Corning, Toray Industries, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  North America Optical Fiber In-Vehicle Network MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

North America Optical Fiber In-Vehicle Network MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-