Global Non-PVC Plasticizers Market Size, Share, And Industry Analysis Report By Type (Adipates, Trimellitates, Benzoates, Epoxies, Others), By Application (Wire and Cable, Consumer Goods, Film and Sheet, Coated Fabric, Flooring and Wall Coverings, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 176417

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

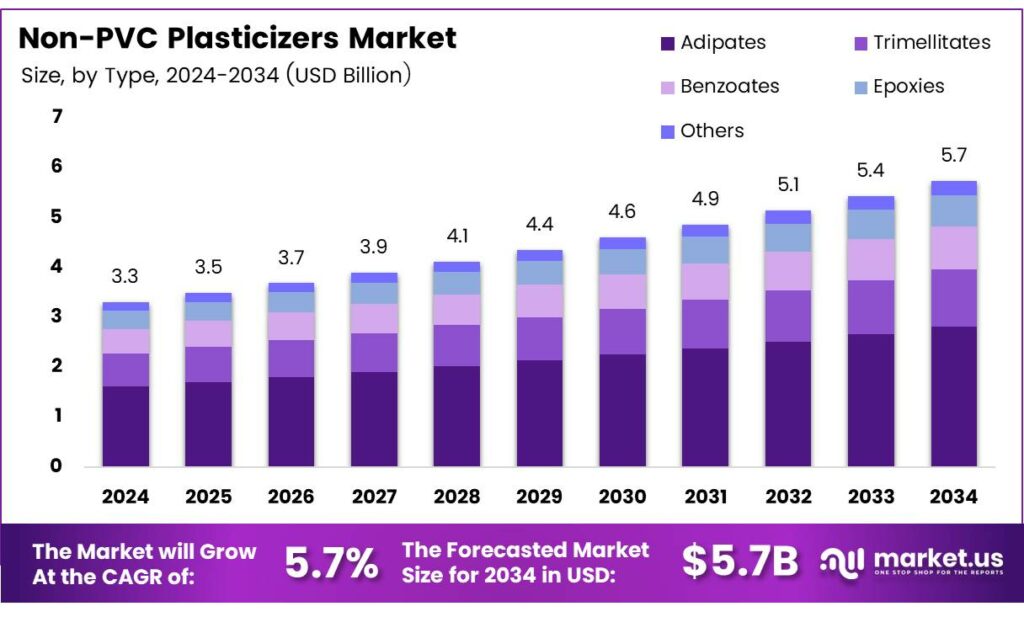

The Global Non-PVC Plasticizers Market size is expected to be worth around USD 5.7 billion by 2034, from USD 3.3 billion in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034.

The Non-PVC Plasticizers Market refers to the ecosystem of plasticizer chemicals designed for applications where PVC is not the primary polymer matrix. These plasticizers enhance flexibility, durability, and chemical resistance in materials such as rubber, coatings, adhesives, elastomers, and specialty polymers while meeting strict safety and environmental standards for global industries.

The Non-PVC Plasticizers Market continues expanding as industries shift toward safer, compliant, and application-friendly alternatives. Manufacturers increasingly demand plasticizer solutions that deliver flexibility without compromising regulatory standards. This shift strengthens opportunities across packaging, automotive interiors, textile coatings, and consumer goods, where performance consistency and low migration levels remain essential purchase drivers.

- Moreover, regulatory emphasis on non-migration performance strengthens premium product demand. GC-TOF/MS, plasticizer content between 20–50 wt% showed linear migration behaviors. Compounds such as DBP, DiBP, and DiNA recorded ingestion migration above 0.33 μg/cm²/min in saliva and dermal migration over 3.23 ng/cm²/min in sweat, highlighting regulatory risks.

Growing sustainability expectations further accelerate adoption. Industries now prefer formulations with lower environmental impact and stable thermal behavior. Additionally, cost parity with legacy phthalates improves market accessibility. With price differences often below 10%, businesses now transition with fewer cost concerns, supporting commercial scaling and higher global acceptance across regulated and semi-regulated sectors.

DEHA and DnOP demonstrated minimal release, reinforcing the market’s interest in safer formulations. Additionally, non-DEHP solutions increasingly match performance expectations, supporting their broad use across packaging, elastomer products, and coated materials. As research confirms viable alternatives, industry players expand eco-friendly offerings that reduce health risks and adhere to evolving global safety standards.

Key Takeaways

- The Global Non-PVC Plasticizers Market is valued at USD 3.3 billion in 2024 and is projected to reach USD 5.7 billion by 2034 at a 5.7% CAGR.

- Adipates dominate the market by type with a 32.7% share in 2025.

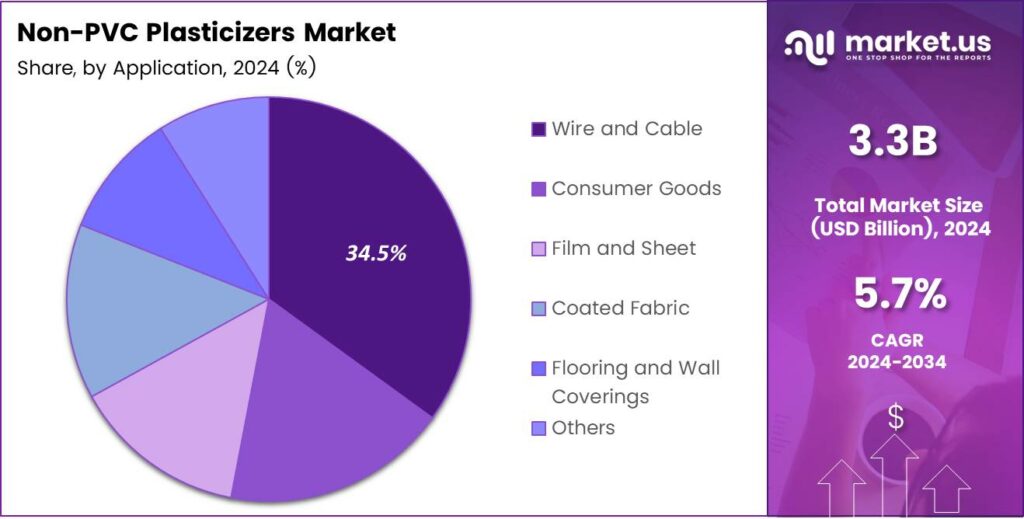

- Wire and Cable applications lead the market with a 34.5% share in 2025.

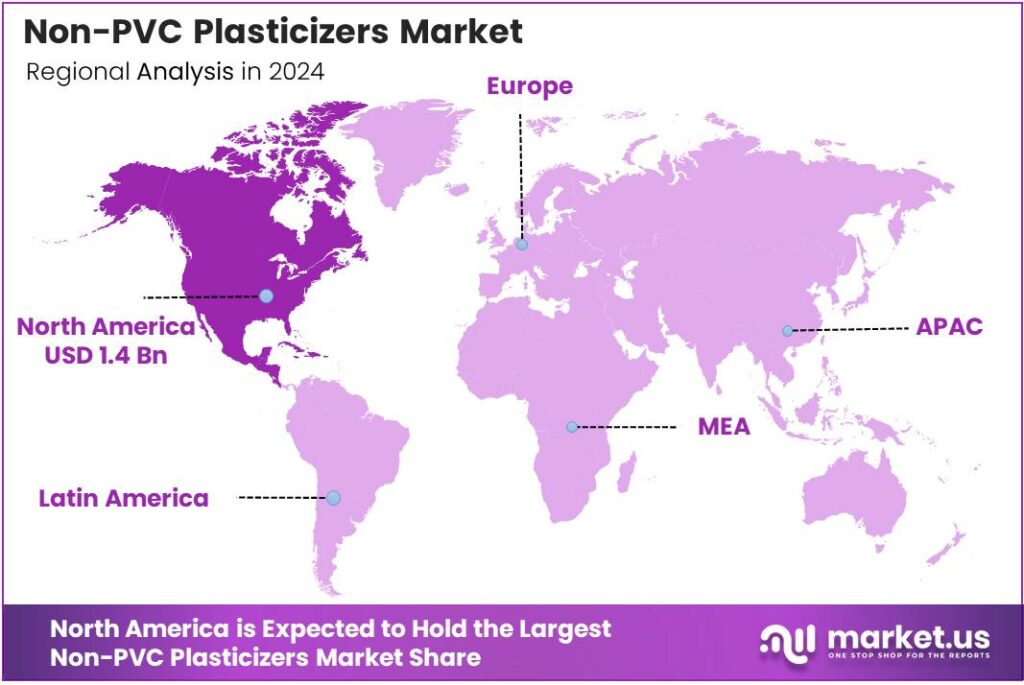

- North America holds the largest regional share at 41.5%, valued at USD 1.4 billion.

By Type Analysis

Adipates dominate with a 32.7% share due to their strong compatibility with flexible polymers and wider industrial acceptance.

In 2025, Adipates held a dominant market position in the By Type Analysis segment of the Non-PVC Plasticizers Market, with a 32.7% share. Their superior low-temperature performance and high flexibility continue to attract manufacturers seeking safer alternatives to conventional plasticizers. Industries prefer adipates because they enhance durability without compromising processing efficiency.

Trimellitates maintained steady growth as demand increased for heat-resistant and long-life plasticizer solutions. Their strong thermal stability makes them preferred in applications requiring extended service life. Industries using high-performance materials increasingly adopt trimellitates for consistent performance. These products remain relevant as environmental rules shift manufacturers toward safer and more stable alternatives.

Benzoates expanded their presence as fast-acting, high-efficiency options for several specialized uses. Their rapid solvency and compatibility help producers achieve enhanced material clarity and strength. Growing interest in consumer-safe alternatives supports their adoption across flexible goods. Benzoates continue to find opportunities as industries seek cost-effective yet compliant non-PVC plasticizers.

Epoxies and other remaining plasticizer types sustained demand due to their stabilizing effects and strong resistance to degradation. Epoxies offer excellent UV and chemical stability, supporting reliable production in evolving markets. Others in this category contribute specialty value in applications needing unique performance characteristics across varying temperatures and environmental conditions.

By Application Analysis

Wire and Cable dominate with a 34.5% share due to their extensive use in safety-compliant flexible insulation materials.

In 2025, Wire and Cable held a dominant market position in the By Application Analysis segment of the Non-PVC Plasticizers Market, with a 34.5% share. Their need for flexible, durable, and low-toxicity insulation materials strengthens demand, especially as industries transition to safer, eco-aligned electrical components across global infrastructure networks.

Consumer Goods continued expanding as manufacturers adopted safer plasticizer alternatives to ensure product compliance. Non-PVC plasticizers help improve flexibility and reduce health risks in everyday items. Increasing consumer awareness around chemical safety supports higher adoption, particularly in lifestyle, household, and personal product categories relying on flexible, long-life materials.

Film and Sheet applications maintained relevance as packaging, medical films, and protective layers shift toward low-toxicity solutions. Non-PVC plasticizers provide clarity, softness, and stability, helping manufacturers meet strict standards. Growing demand for sustainable packaging further supports the presence of alternative plasticizers in global film and sheet production environments.

Coated Fabric, Flooring and Wall Coverings, and Others collectively contributed to market expansion as industries adopt safer, flexible materials for interiors and industrial surfaces. These segments prefer non-PVC plasticizers for their enhanced performance, reduced emissions, and compliance advantages. Rising focus on indoor air quality continues to support demand across commercial and residential applications.

Key Market Segments

By Type

- Adipates

- Trimellitates

- Benzoates

- Epoxies

- Others

By Application

- Wire and Cable

- Consumer Goods

- Film and Sheet

- Coated Fabric

- Flooring and Wall Coverings

- Others

Emerging Trends

Growing Adoption of Bio-Derived and Low-Migration Plasticizers Shapes Market Trends

One of the strongest trends shaping the non-PVC plasticizers market is the rising preference for bio-derived ingredients. Manufacturers are exploring soybean oil, castor oil, and other natural sources to design high-performance, eco-friendly materials. This trend aligns with global sustainability goals and circular-economy initiatives.

- The expansion of research partnerships. Chemical companies, universities, and biotechnology firms are collaborating to develop next-generation plasticizers that balance safety, performance, and cost efficiency. The PVC share in medical devices within the total weight of medical waste fell from 10% to 2.5% and then to 0.6% after sustained phase-out actions.

Low-migration plasticizers are also gaining significant traction. As industries prioritize product safety and regulatory compliance, the need for materials that minimize chemical transfer into food, medical fluids, or consumer goods continues to rise. This has accelerated innovation in high-purity formulations.

Drivers

Rising Shift Toward Safer, Non-Toxic Plasticizers Drives Market Growth

Growing awareness about the health impacts of traditional phthalate-based plasticizers is increasing the demand for safer non-PVC alternatives. Manufacturers in packaging, medical devices, and consumer products are actively shifting toward non-toxic formulations to meet global safety standards.

- Total global plastics production was reported at 413.8 million tonnes (Mt). PVC accounted for 12.8% of production by polymer type—large enough that even partial substitution toward non-PVC flexible alternatives creates room for new plasticizer demand in adjacent polymers and compounds.

This change is helping the market gain strong momentum across developed and developing regions. Regulatory bodies are also tightening restrictions on harmful additives, which is pushing industries to replace older chemicals with bio-based and eco-friendly plasticizers. This regulatory support acts as a major catalyst for market acceptance.

Restraints

High Production and Raw Material Costs Restrict Market Expansion

One of the major restraints in the non-PVC plasticizers market is the high cost of producing safer and bio-based materials. Compared to conventional phthalates, eco-friendly alternatives require specialized processes and refined inputs, which increases overall manufacturing expenses. This limits adoption in price-sensitive industries.

- Many non-PVC plasticizers depend on agricultural or natural feedstocks, which are affected by climate conditions, crop output, and global trade disruptions. The Consumer Product Safety Commission (CPSC) set a clear compliance line for children’s products: more than 0.1% of certain phthalates is prohibited in children’s toys and child-care articles.

Technological barriers also slow down adoption. Non-PVC plasticizers require performance optimization to match the flexibility and durability offered by traditional plasticizers. This increases the need for R&D investments, which not all producers can afford.

Growth Factors

Expanding Use of Bio-Based Alternatives Creates Strong Growth Opportunities

The increasing global focus on sustainability is opening new opportunities for bio-based non-PVC plasticizers. Industries are actively searching for renewable and biodegradable options to reduce environmental impact. This shift is encouraging manufacturers to develop plant-derived and naturally sourced materials with improved safety profiles.

Another major opportunity lies in the medical and healthcare sector. As hospitals move toward non-toxic and non-leaching materials for equipment and flexible devices, demand for non-PVC plasticizers continues to rise. This segment is expected to witness strong long-term growth due to stricter safety regulations.

Food and beverage packaging also presents a high-potential growth area. With brands emphasizing safe contact materials and reduced chemical migration, non-PVC plasticizers fit well into new packaging innovations. The rise of ready-to-eat and convenience foods further strengthens this opportunity.

Regional Analysis

North America Dominates the Non-PVC Plasticizers Market with a Market Share of 41.5%, Valued at USD 1.4 Billion

North America leads the Non-PVC Plasticizers Market, accounting for a dominant 41.5% share and generating nearly USD 1.4 billion in value. The region benefits from strong demand in medical devices, flooring materials, and high-performance packaging, supported by strict regulatory pressure to minimize phthalate-based additives. Growing adoption of bio-based and safer alternatives has further strengthened North America’s leadership.

Europe follows as a strong market, driven by stringent chemical safety standards and early adoption of eco-friendly alternatives. The region’s regulatory framework encourages manufacturers to shift away from traditional phthalates, strengthening demand for citrate, adipate, and bio-derived plasticizers. High usage in automotive interiors, medical tubing, and building materials supports growth, while innovation in low-toxicity formulations continues to expand market potential.

Asia Pacific is witnessing rapid expansion due to strong manufacturing activity, rising medical infrastructure, and growing consumer demand for safer materials. Countries such as China, India, and Japan are increasingly integrating non-PVC plasticizers into packaging films, toys, and healthcare applications. Accelerating urbanization and cost-effective production capabilities make the region a key growth hotspot over the forecast period.

The Middle East & Africa region is experiencing a gradual adoption of non-PVC plasticizers, primarily supported by construction expansion and increased interest in sustainable materials. Rising healthcare investments across Gulf nations have boosted the demand for flexible yet safe plastic alternatives. Regulatory modernization and industrial diversification are expected to further support market penetration.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2025, the global Non-PVC Plasticizers Market continues to expand as industries seek safer, more compliant materials for packaging, consumer goods, and specialty applications. Leading companies are strengthening capacity, enhancing product purity, and focusing on bio-based solutions to meet global regulatory and sustainability expectations.

Velsicol Chemical, LLC remains a strategic participant, benefiting from its long-standing position in specialty plasticizers. In 2025, the company continues to focus on high-performance formulations designed for consumer safety and regulatory alignment, enabling it to support industries transitioning away from traditional phthalates.

Lanxess AG demonstrates strong market influence through its portfolio of environmentally friendly plasticizer alternatives. The company’s emphasis on safer chemical processing and global distribution helps it meet the rising demand from construction, electronics, and flexible packaging manufacturers looking for sustainable options.

KLJ Group expands its relevance in the non-PVC plasticizers segment through consistent investments in capacity and quality upgrades. Its strong presence across Asia supports manufacturers seeking a reliable supply in a region experiencing rapid industrial expansion and tightening material standards.

KAO Corporation brings a chemistry-driven approach to the market, offering high-purity plasticizers tailored for applications such as coatings, adhesives, and specialty polymers. The company’s innovation-led manufacturing practices enhance product performance while aligning with global sustainability initiatives.

Top Key Players in the Market

- Velsicol Chemical, LLC

- Lanxess AG

- KLJ Group

- KAO Corporation

- Jiangsu Zhengdan Chemical Industry Co., Ltd

Recent Developments

- In 2025, Velsicol is a producer of dibenzoate plasticizers under the Velsiflex brand, which are non-phthalate alternatives using benzoic acid as a key raw material. The company has played a role in the shift from phthalate to non-phthalate plasticizers and continues to explore opportunities in bio-based plasticizers to expand its product line.

- In 2025, Lanxess offers a range of non-phthalate plasticizers, including the Mesamoll brand. Mesamoll is a phthalate-free universal monomeric plasticizer used in PVC, PUR, acrylates, and rubber. Lanxess transitioned to a more sustainable version of Mesamoll using carbon-reduced raw materials via a mass balance approach, reducing the product carbon footprint without affecting quality or performance.

Report Scope

Report Features Description Market Value (2024) USD 3.3 Billion Forecast Revenue (2034) USD 5.7 Billion CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Adipates, Trimellitates, Benzoates, Epoxies, Others), By Application (Wire and Cable, Consumer Goods, Film and Sheet, Coated Fabric, Flooring and Wall Coverings, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Velsicol Chemical, LLC, Lanxess AG, KLJ Group, KAO Corporation, Jiangsu Zhengdan Chemical Industry Co., Ltd Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Non-PVC Plasticizers MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Non-PVC Plasticizers MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Velsicol Chemical, LLC

- Lanxess AG

- KLJ Group

- KAO Corporation

- Jiangsu Zhengdan Chemical Industry Co., Ltd