Non-Opioid Pain Treatment Market By Drug Class (Nonsteroidal Anti-Inflammatory Drugs (NSAIDs), Acetaminophen, Local Anesthetics, Antidepressants, Anticonvulsants, Corticosteroids and Others), By Application (Neuropathic Pain, Chronic Pain, Post-operative Pain and Acute Pain), By Route of Administration (Oral, Topical, Injectable and Other Route of Administration), By Distribution Channel (Retail Pharmacies, Hospital Pharmacies, and Online Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151641

- Number of Pages: 326

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

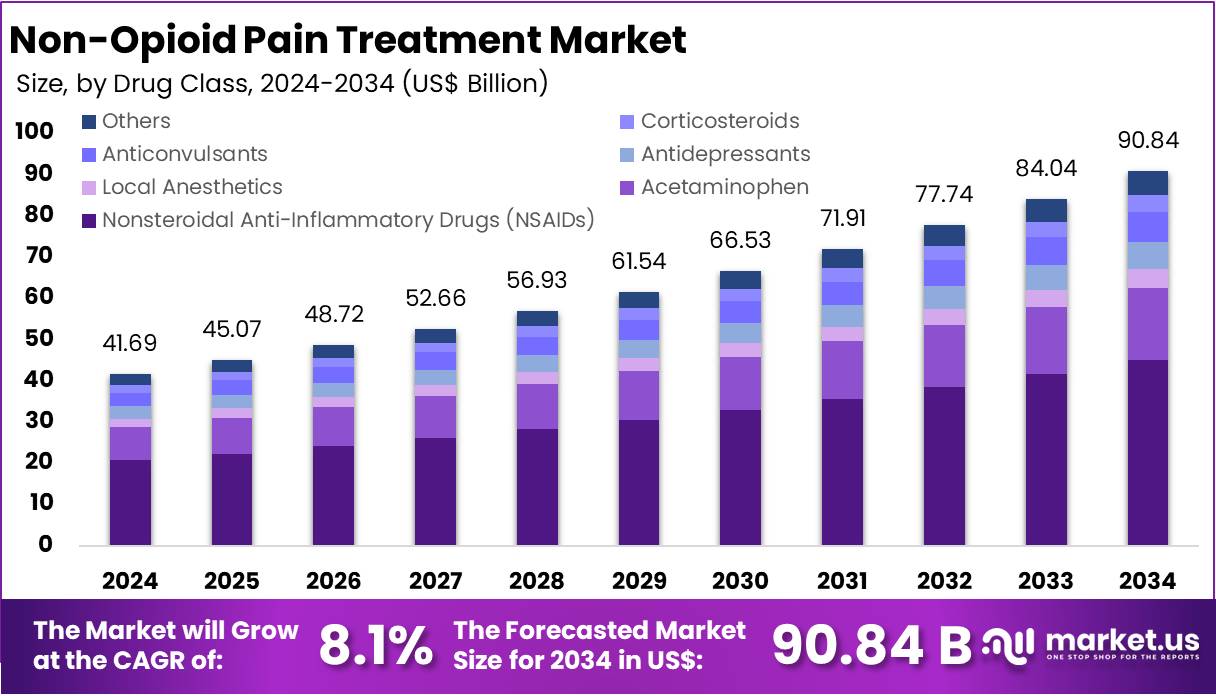

The Non-Opioid Pain Treatment Market Size is expected to be worth around US$ 90.84 billion by 2034 from US$ 41.69 billion in 2024, growing at a CAGR of 8.1% during the forecast period 2025 to 2034.

The Non-Opioid Pain Treatment Market is experiencing significant growth driven by increasing concerns over the opioid epidemic and the growing demand for safer, non-addictive alternatives for pain management. Opioids, widely used for pain relief, have been associated with a surge in addiction, overdose deaths, and long-term health complications. In response, healthcare systems and regulatory bodies are pushing for non-opioid treatments, which are perceived as less risky for long-term use.

The market encompasses a range of therapies, including nonsteroidal anti-inflammatory drugs (NSAIDs), acetaminophen, antidepressants, anticonvulsants, local anesthetics, and emerging options like medical cannabis. As per WHO, in 2021, approximately 296 million people worldwide (about 5.8% of the global population aged 15–64 years) used drugs at least once. Of these, around 60 million individuals used opioids. Additionally, about 39.5 million people were living with drug use disorders in 2021. While most opioid-dependent individuals used illicitly cultivated and manufactured heroin, the use of prescription opioids has been on the rise.

The shift towards non-opioid treatments is supported by increasing public awareness of opioid-related risks and the growing adoption of personalized medicine. Non-opioid pain management therapies are particularly effective for managing mild to moderate pain conditions, such as arthritis, back pain, and post-operative pain. Additionally, emerging technologies, such as wearable pain management devices and mobile health apps, are further enhancing the patient experience and effectiveness of these treatments.

A variety of non-opioid pain medications, available either over the counter or by prescription, include options like ibuprofen (Motrin), acetaminophen (Tylenol), aspirin (Bayer), and steroids. For some patients, these medications provide sufficient relief. Others may benefit from non-drug therapies, which can be used independently or alongside medications.

Key Takeaways

- In 2024, the market for Non-Opioid Pain Treatment generated a revenue of US$ 69 billion, with a CAGR of 8.1%, and is expected to reach US$ 90.84 billion by the year 2034.

- The Drug Class segment is divided into Nonsteroidal Anti-Inflammatory Drugs (NSAIDs), Acetaminophen, Local Anesthetics, Antidepressants, Anticonvulsants, Corticosteroids, and Others with Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) taking the lead in 2023 with a market share of 49.6%.

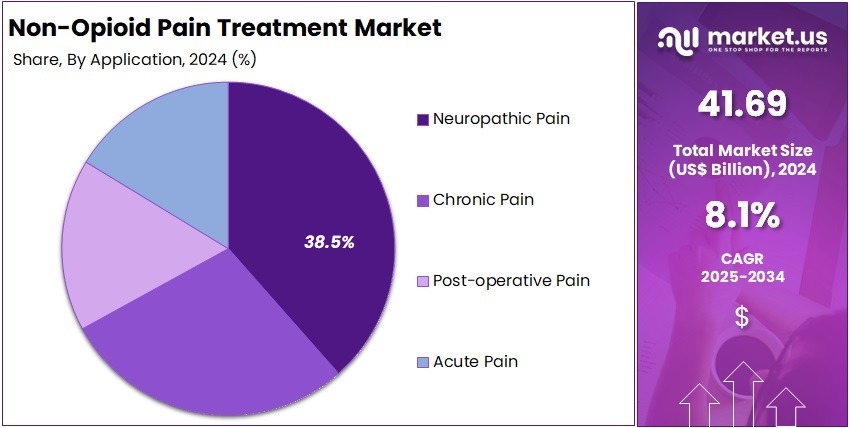

- By Application, the market is bifurcated into Neuropathic Pain, Chronic Pain, Post-operative Pain, and Acute Pain with Neuropathic Pain leading the market with 38.5% of market share.

- Furthermore, concerning the Route of Administration segment, the market is segregated into Oral, Topical, Injectable, and Other Route of Administration. The Oral route stands out as the dominant segment, holding the largest revenue share of 53.7% in the Non-Opioid Pain Treatment market.

- By Distribution Channel, the market is classified into Retail Pharmacies, Hospital Pharmacies, and Online Pharmacies. Retail Pharmacies held the largest market share in 2023 with 49.7%.

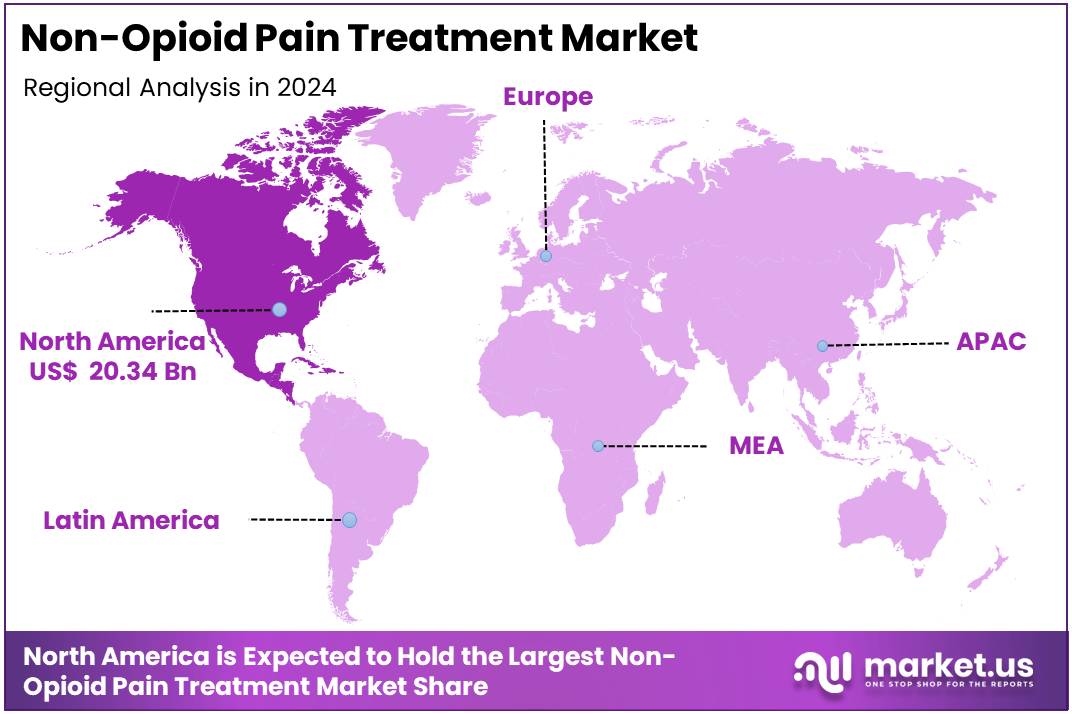

- North America led the market by securing a market share of 48.8% in 2023.

Drug Class Analysis

The Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) segment is the dominating drug class with a 49.6% market share in the non-opioid pain treatment market. NSAIDs, including drugs like ibuprofen, naproxen, and aspirin, are widely used due to their dual effect of reducing both pain and inflammation, making them effective for managing a wide range of conditions such as arthritis, muscle pain, and post-operative pain.

The popularity of NSAIDs can be attributed to their accessibility, affordability, and efficacy in treating mild to moderate pain. They are available both over-the-counter and in prescription-strength formulations, offering flexibility for patients and healthcare providers. NSAIDs are also well-studied and have a long track record of safe use when taken as directed.

Despite concerns over potential side effects such as gastrointestinal issues, cardiovascular risks, and kidney damage, NSAIDs remain the go-to choice for many pain sufferers. Their widespread use is further fueled by ongoing advancements in formulations, such as topical NSAIDs and extended-release options, which help to mitigate side effects while maintaining efficacy.

Application Analysis

The Neuropathic Pain segment is the leading application area accounting for 38.5% in the non-opioid pain treatment market. Neuropathic pain arises from damage to the nerves, often resulting from conditions such as diabetes, multiple sclerosis, shingles, and chemotherapy. It is typically described as burning, tingling, or shooting pain, which can be persistent and difficult to manage with traditional painkillers like NSAIDs.

Non-opioid treatments specifically targeting neuropathic pain, such as anticonvulsants (e.g., gabapentin), antidepressants (e.g., duloxetine), and topical treatments, have shown great promise in alleviating this type of pain. The increasing prevalence of conditions that cause neuropathic pain, such as diabetes, has driven the growth of this segment. Additionally, as awareness of opioid risks grows, patients and healthcare providers are more inclined to explore non-opioid therapies.

Route of Administration Analysis

The Oral route of administration is the dominant method in the non-opioid pain treatment market which hold a 53.7% market share in 2024. Oral medications, including NSAIDs, acetaminophen, and other non-opioid pain relievers, offer significant advantages in terms of ease of use, patient compliance, and cost-effectiveness. Oral medications are typically prescribed as tablets, capsules, or liquids, and are considered the most convenient and commonly used method for managing pain.

The simplicity of taking a pill makes it accessible to a broad population, from those with chronic conditions to those recovering from surgeries. This route is especially favored for its ease of self-administration, eliminating the need for healthcare provider involvement or specialized equipment. It also allows for both over-the-counter and prescription options, offering flexibility for patients. Oral medications for pain management can be taken at home, contributing to their popularity.

Distribution Channel Analysis

The Retail Pharmacies segment holds the largest share of 49.7% in the distribution channel for non-opioid pain treatments. Retail pharmacies are key players in making over-the-counter pain relief products, such as NSAIDs, acetaminophen, and topical analgesics, easily accessible to consumers without the need for a prescription. This convenience is a major factor contributing to the dominance of retail pharmacies in the market.

They serve as the primary point of access for many individuals seeking quick relief from pain, with a wide range of affordable and readily available products. Additionally, retail pharmacies benefit from the increasing trend of self-care, where consumers are more inclined to manage mild to moderate pain independently. The presence of pharmacy chains, both physical stores and online platforms, ensures that these products are readily available to a vast population.

Key Market Segments

By Drug Class

- Nonsteroidal Anti-Inflammatory Drugs (NSAIDs)

- Acetaminophen

- Local Anesthetics

- Antidepressants

- Anticonvulsants

- Corticosteroids

- Others

By Application

- Neuropathic Pain

- Chronic Pain

- Post-operative Pain

- Acute Pain

By Route of Administration

- Oral

- Topical

- Injectable

- Other Route of Administration

By Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies

Drivers

Increasing Awareness of Opioid Abuse and Addiction

In recent years, public awareness about the dangers of opioid use has grown significantly. Concerns over addiction and misuse have led to a rise in demand for safer pain management options. This shift has propelled the growth of the non-opioid pain treatment market. Healthcare providers, advocacy groups, and governments are working together to reduce opioid reliance. Educational campaigns and tighter regulations are making opioid prescriptions less common. As a result, many patients are now seeking safer alternatives to manage chronic and acute pain.

Non-opioid pain treatments such as NSAIDs, acetaminophen, and medical cannabis are gaining acceptance. These options are seen as more appropriate for long-term use. Patients and healthcare professionals are showing increasing interest in therapies that pose fewer risks. The U.S. Food and Drug Administration (FDA) has responded by accelerating the approval process for non-opioid pain relief products. This regulatory support is strengthening the market outlook. New therapies under development also show promise in improving pain outcomes without the side effects linked to opioids.

According to the CDC’s 2025 report, opioid-related deaths have dropped significantly. Data from the National Vital Statistics System indicate a 24% decrease in drug overdose deaths in the U.S. for the 12 months ending September 2024. This decline—down from approximately 114,000 to 87,000 deaths—is the lowest seen since June 2020. These figures suggest that efforts to reduce opioid use are having a real impact. The move toward non-opioid solutions is contributing to this public health progress and supporting market growth.

Restraints

Limited Efficacy for Chronic Pain

Despite the increasing demand for non-opioid pain treatments, one major restraint hindering the market’s growth is the limited efficacy of these treatments for chronic pain management. While non-opioid medications, such as NSAIDs and acetaminophen, are effective for mild to moderate pain relief, their effectiveness is often diminished for patients dealing with severe or long-term chronic pain conditions.

Chronic pain, such as that experienced in conditions like fibromyalgia or severe arthritis, may not respond well to non-opioid therapies alone. As a result, patients may still require opioids or other potent medications to manage their pain effectively. This limitation can lead to frustration for both patients and healthcare providers, which could slow the transition from opioid-based therapies to non-opioid alternatives.

Additionally, certain non-opioid pain treatments, such as medical cannabis, are not universally accepted or regulated across all regions, further limiting their availability and usage. As a result, while non-opioid treatments are growing in popularity, their ability to fully replace opioids for all types of pain remains a challenge, affecting their market potential.

Opportunities

Development of Personalized Pain Management Solutions

One of the most promising opportunities in the non-opioid pain treatment market is the development of personalized pain management solutions. As research into pain mechanisms advances, there is increasing recognition that pain is a highly individualized experience. Factors such as genetics, underlying health conditions, and the psychological components of pain influence how individuals respond to different treatments.

Personalized medicine, which tailors treatments based on a patient’s genetic makeup and specific pain type, has the potential to revolutionize pain management. This approach could lead to more effective non-opioid treatments by offering targeted therapies that address the root causes of pain for each individual. Companies that develop advanced diagnostic tools and innovative therapies that can identify the best treatment options for specific patient profiles will likely gain a competitive edge in the market.

Additionally, the growing use of data analytics and artificial intelligence in healthcare can help to create more precise and effective pain management protocols. As healthcare providers shift toward more personalized and precision-based care, there is substantial opportunity for the non-opioid pain treatment market to expand and provide tailored pain relief solutions that go beyond traditional one-size-fits-all approaches.

Impact of Macroeconomic / Geopolitical Factors

Economic conditions, such as inflation and economic downturns, often lead to budgetary constraints in healthcare systems globally. In countries with strained economic resources, patients may face difficulties accessing advanced pain management options, which can limit the adoption of non-opioid treatments. On the other hand, growing healthcare expenditure in developed economies supports innovation and the availability of newer, more effective non-opioid pain management therapies.

Increased affordability of non-opioid treatments during stable economic periods fosters their adoption as a more cost-effective alternative to opioids, especially for long-term pain management. The macroeconomic environment directly impacts insurance policies and healthcare funding. The growing emphasis on preventive care and cost containment in public health programs increases the demand for more affordable, non-opioid treatments.

Geopolitical factors heavily influence the regulatory frameworks surrounding non-opioid pain treatments. Strict drug regulations and differing approval processes across countries can either hinder or facilitate the entry of non-opioid treatments into the market. For instance, some regions may have more lenient policies toward the approval of cannabis-based treatments or novel pain therapies, while others may face lengthy approval delays. As countries increasingly recognize the risks of opioid use, governments are more likely to support the development and accessibility of non-opioid alternatives through favorable regulatory reforms.

Tariffs, import restrictions, and logistical challenges may increase the cost of raw materials required for manufacturing non-opioid treatments. These disruptions could lead to price hikes and delays in product availability, particularly in regions heavily dependent on imports. On a positive note, geopolitical cooperation between countries to combat the opioid crisis has led to the development of international initiatives to promote non-opioid alternatives. Collaborative research, sharing of clinical data, and multinational health policies aimed at curbing opioid dependence create favorable conditions for the growth of the non-opioid pain treatment market.

Latest Trends

Integration of Technology in Pain Management

A major trend influencing the non-opioid pain treatment market is the integration of technology into pain management solutions. Innovations in wearable devices, mobile applications, and telemedicine are transforming the way pain is managed and monitored. For example, wearable devices that deliver electrical nerve stimulation or heat therapy can provide continuous pain relief without the need for medication. These devices can help manage conditions like arthritis and back pain without relying on opioids.

Additionally, mobile applications that track pain levels, provide personalized recommendations, and connect patients with healthcare providers are becoming increasingly popular. These apps can provide patients with better control over their pain management and help clinicians make more informed decisions based on real-time data.

Furthermore, telemedicine is enabling remote consultations and ongoing monitoring, making it easier for patients to access pain treatment options, including non-opioid alternatives, from the comfort of their homes. The growing role of technology in pain management is not only enhancing the effectiveness of non-opioid treatments but also improving patient engagement, compliance, and overall outcomes. This trend indicates a shift towards more proactive, patient-centered care in the pain management field.

Regional Analysis

North America is leading the Non-Opioid Pain Treatment Market

The Non-Opioid Pain Treatment Market in North America is experiencing robust growth, driven by the rising awareness of the risks associated with opioid use and the increasing adoption of alternative pain management solutions. The opioid crisis has significantly influenced healthcare policies, prompting both the U.S. and Canada to focus on developing safer pain treatment options.

In 2022, nearly 110,000 Americans lost their lives to drug overdoses. Over 81,000 of these deaths were linked to either prescription or illicit opioids, marking an increase of approximately 400% over the past decade. As a result, non-opioid treatments such as NSAIDs, acetaminophen, anticonvulsants, and medical cannabis have gained traction as effective alternatives. The market is further supported by the region’s advanced healthcare infrastructure, favorable reimbursement policies, and high healthcare expenditure, allowing for easy access to non-opioid therapies.

Additionally, the growing aging population in North America, particularly in the U.S., drives the demand for effective pain management solutions for chronic conditions like arthritis and neuropathic pain. Regulatory support and an increased emphasis on personalized medicine also contribute to the expansion of non-opioid pain management therapies in the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Novartis AG is a major global healthcare company offering non-opioid pain relief solutions. Its portfolio includes nonsteroidal anti-inflammatory drugs (NSAIDs) and treatments for neuropathic pain. The company is also investing in gene therapies and biologics to manage chronic pain more safely. Teva Pharmaceutical Industries Ltd. is known for its wide range of generic drugs and specialty treatments. Teva’s non-opioid options include acetaminophen and NSAIDs, providing alternatives to opioid-based medications for pain relief in both acute and chronic conditions.

Dr. Reddy’s Laboratories Ltd. is a key player in the global pharmaceutical sector. The company focuses on affordable healthcare and offers a broad selection of generic non-opioid pain treatments. These include NSAIDs and various over-the-counter pain relief formulations. Sun Pharmaceutical Industries Ltd. also contributes significantly to this market, producing non-opioid drugs for global distribution. Other notable companies include GSK plc, Pfizer Inc., Cipla Ltd., and Johnson & Johnson, all of which are expanding their non-opioid portfolios to address the global demand for safer pain management options.

Top Key Players in the Non-Opioid Pain Treatment Market

- Novartis AG

- Teva Pharmaceutical Industries Ltd.

- Reddy’s Laboratories Ltd.

- Sun Pharmaceutical Industries Ltd.

- GSK plc

- Pfizer Inc.

- Perrigo Company plc

- Cipla Ltd.

- Johnson & Johnson Services, Inc.

- Pacira Pharmaceuticals, Inc.

- Pierrel S.p.A.

- Vertex Pharmaceuticals

- Assertio Therapeutics

- Mylan N.V. (Viatris)

- Flexion Therapeutics

- Other Key Players

Recent Developments

- In January 2025: Vertex Pharmaceuticals Incorporated (Nasdaq: VRTX) has announced that the U.S. Food and Drug Administration (FDA) has approved JOURNAVX™ (suzetrigine), an oral, non-opioid, highly selective NaV1.8 pain signal inhibitor designed for the treatment of moderate-to-severe acute pain in adults. JOURNAVX is an effective and well-tolerated medication with no evidence of addictive potential, approved for use in managing all types of moderate-to-severe acute pain.

- In December 2024: SiteOne Therapeutics, Inc., a biopharmaceutical company focused on developing selective ion channel modulators for treating pain, cough, and other conditions, has announced a US$ 100 million Series C financing. The round, led by Novo Holdings and supported by OrbiMed, Wellington Management, Mission BioCapital, BSQUARED Capital, and existing investors, will fund the advancement of SiteOne’s portfolio of selective, small molecule ion channel modulators. The goal is to progress toward human clinical proof of concept for the treatment of sensory hyperexcitability disorders.

- In December 2024: Xgene Pharmaceutical announced positive results of a multi-center, placebo-controlled, dose-ranging Phase 2b study (registration number: NCT06017999) in patients undergoing bunionectomy. The study evaluated the safety and efficacy of the XG005 oral tablet in managing acute pain.

Report Scope

Report Features Description Market Value (2024) US$ 41.69 billion Forecast Revenue (2034) US$ 90.84 billion CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drug Class (Nonsteroidal Anti-Inflammatory Drugs (NSAIDs), Acetaminophen, Local Anesthetics, Antidepressants, Anticonvulsants, Corticosteroids and Others), By Application (Neuropathic Pain, Chronic Pain, Post-operative Pain and Acute Pain), By Route of Administration (Oral, Topical, Injectable and Other Route of Administration), By Distribution Channel (Retail Pharmacies, Hospital Pharmacies, and Online Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Novartis AG, Teva Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories Ltd., Sun Pharmaceutical Industries Ltd., GSK plc, Pfizer Inc., Perrigo Company plc, Cipla Ltd., Johnson & Johnson Services, Inc., Pacira Pharmaceuticals, Inc., Pierrel S.p.A., Vertex Pharmaceuticals, Assertio Therapeutics, Mylan N.V. (Viatris), Flexion Therapeutics, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Non-Opioid Pain Treatment MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Non-Opioid Pain Treatment MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Novartis AG

- Teva Pharmaceutical Industries Ltd.

- Reddy’s Laboratories Ltd.

- Sun Pharmaceutical Industries Ltd.

- GSK plc

- Pfizer Inc.

- Perrigo Company plc

- Cipla Ltd.

- Johnson & Johnson Services, Inc.

- Pacira Pharmaceuticals, Inc.

- Pierrel S.p.A.

- Vertex Pharmaceuticals

- Assertio Therapeutics

- Mylan N.V. (Viatris)

- Flexion Therapeutics

- Other Key Players