Anticonvulsants Market By Product Type (Barbiturates, NMDAR, Carbamate Anticonvulsants, AMPA, and Others), By Application (Migraine, Fibromyalgia, Epilepsy, Bipolar Disorder, and Anxiety), By End-User (Hospitals, Clinics, and Ambulatory Surgical Clinics), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146905

- Number of Pages: 315

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

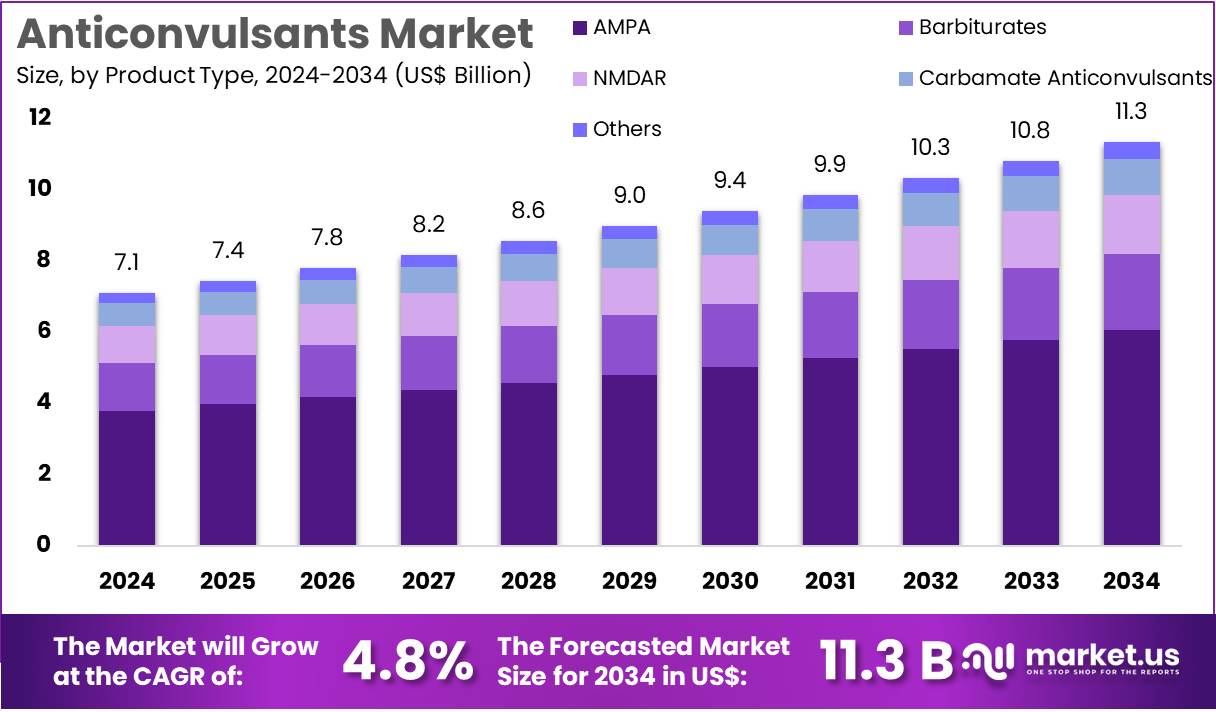

The Anticonvulsants Market size is expected to be worth around US$ 11.3 billion by 2034 from US$ 7.1 billion in 2024, growing at a CAGR of 4.8% during the forecast period 2025 to 2034.

Increasing global awareness of neurological disorders and the rising incidence of epilepsy and other seizure-related conditions are significant drivers of the anticonvulsants market. The need for effective treatment options has fueled demand for anticonvulsant drugs, particularly in managing epilepsy, seizure disorders, and other neurological conditions.

Both established and novel anticonvulsants are used to control seizures, offering opportunities for development in areas like personalized medicine and drug delivery systems. Recent trends show a growing focus on developing more targeted therapies with fewer side effects and better patient outcomes. In August 2022, UCB S.A. partnered with Bonheur Children’s Hospital, the Wisconsin Health Information Organization (WHIO), and Yale University to advance research on seizure cluster challenges.

This collaboration aimed to improve patient outcomes and raise awareness of this pressing condition. As the demand for advanced and more personalized treatments continues to rise, the market for anticonvulsants is expected to grow, offering new solutions for patients with complex seizure disorders.

Key Takeaways

- In 2023, the market for anticonvulsants generated a revenue of US$ 7.1 billion, with a CAGR of 4.8%, and is expected to reach US$ 11.3 billion by the year 2033.

- The product type segment is divided into barbiturates, NMDAR, carbamate anticonvulsants, AMPA, and others, with AMPA taking the lead in 2023 with a market share of 53.5%.

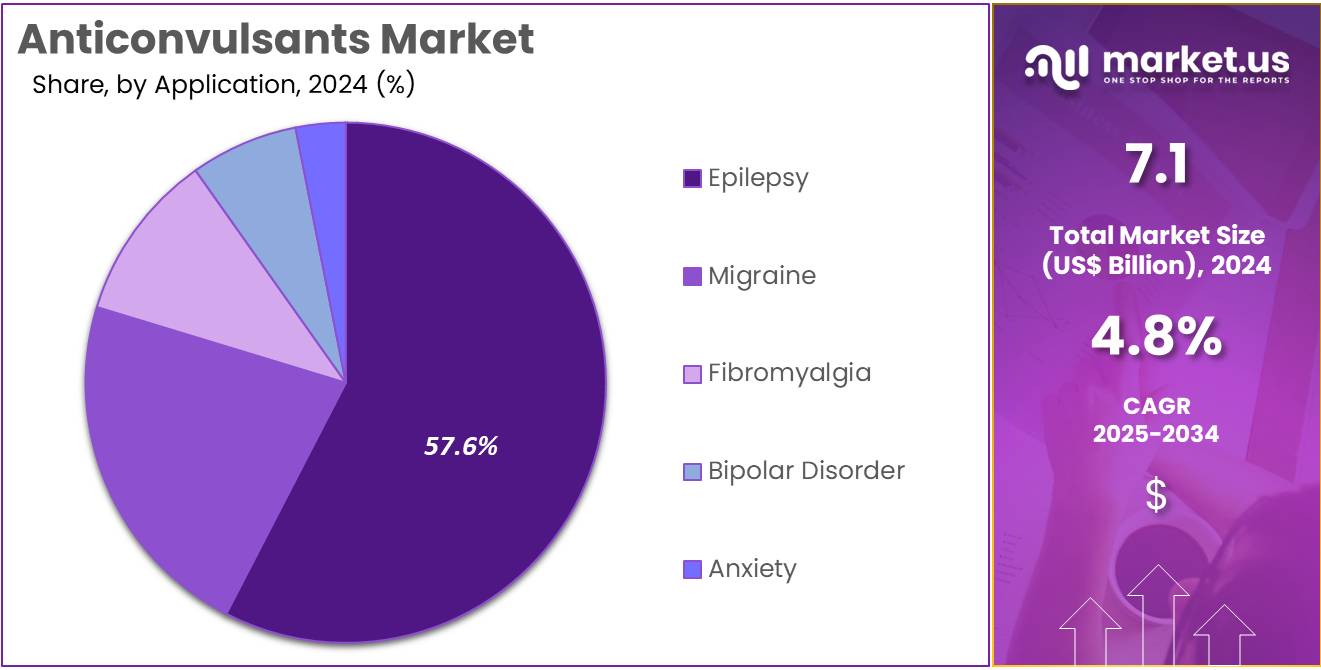

- Considering application, the market is divided into migraine, fibromyalgia, epilepsy, bipolar disorder, and anxiety. Among these, epilepsy held a significant share of 57.6%.

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, clinics, and ambulatory surgical clinics. The hospitals sector stands out as the dominant player, holding the largest revenue share of 59.3% in the anticonvulsants market.

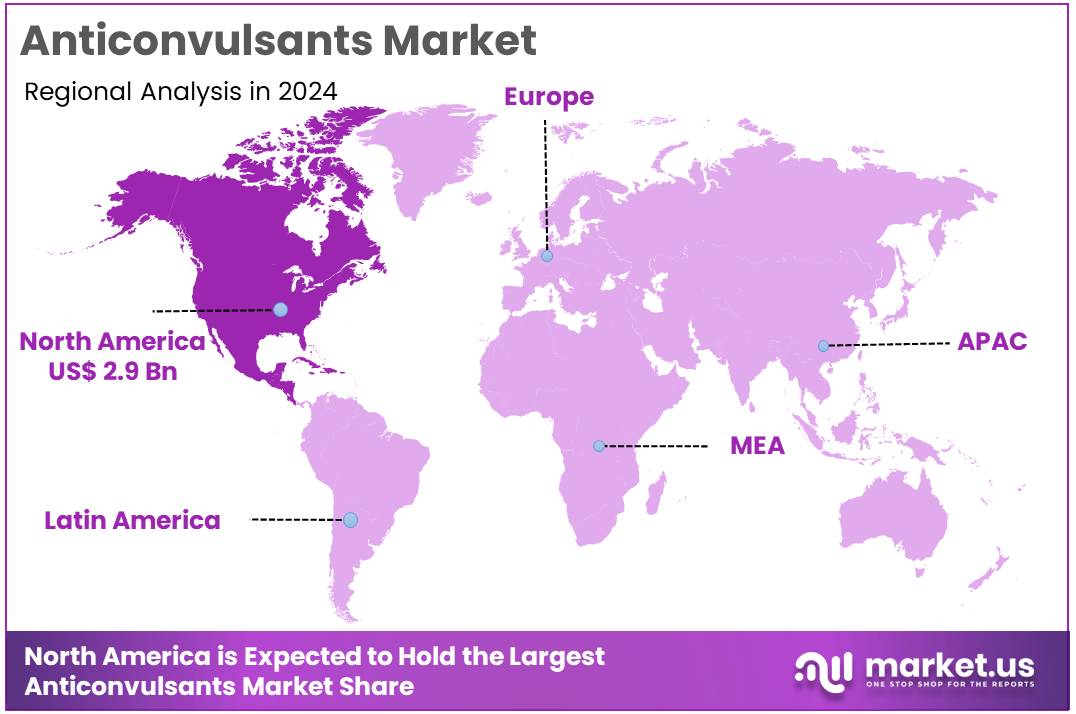

- North America led the market by securing a market share of 41.5% in 2023.

Product Type Analysis

The AMPA segment led in 2023, claiming a market share of 53.5% owing to the increasing demand for more targeted therapies for epilepsy and other neurological conditions. AMPA receptor antagonists, a newer class of drugs, are anticipated to offer enhanced efficacy by blocking excitatory neurotransmission, which is involved in seizures.

These drugs are projected to address treatment-resistant epilepsy, which remains a significant challenge for patients and healthcare providers. The rising number of epilepsy cases and the need for more effective and safer anticonvulsant options will likely drive the demand for AMPA-based drugs in the coming years.

Application Analysis

The epilepsy held a significant share of 57.6% due to the increasing prevalence of epilepsy worldwide. Factors such as genetic predisposition, aging populations, and the rising number of traumatic brain injuries contribute to the growing incidence of epilepsy.

Additionally, advancements in research are anticipated to lead to more effective anticonvulsant therapies with fewer side effects, improving patient outcomes. The focus on personalized treatment and the development of drugs that target specific types of seizures will likely contribute to the sustained growth of this segment in the anticonvulsants market.

End-User Analysis

The hospitals segment had a tremendous growth rate, with a revenue share of 59.3% as hospitals remain the primary setting for the treatment and management of severe neurological conditions, including epilepsy. Hospitals provide a wide range of specialized services, such as intensive care for patients with refractory seizures, making them a key end-user for anticonvulsant medications.

The increasing number of epilepsy cases, coupled with the rising demand for advanced healthcare services and specialized care, is projected to boost the use of anticonvulsants in hospital settings. Moreover, hospitals are expected to continue adopting the latest anticonvulsant treatments, contributing to market growth.

Key Market Segments

By Product Type

- Barbiturates

- NMDAR

- Carbamate Anticonvulsants

- AMPA

- Others

By Application

- Migraine

- Fibromyalgia

- Epilepsy

- Bipolar Disorder

- Anxiety

By End-User

- Hospitals

- Clinics

- Ambulatory Surgical Clinics

Drivers

Rising Prevalence of Epilepsy and Neurological Disorders is driving the market

The global anticonvulsants market is witnessing steady growth. This rise is mainly driven by the increasing prevalence of epilepsy and seizure-related disorders. Epilepsy is one of the most widespread neurological diseases worldwide. It affects individuals across all age groups. According to the World Health Organization (WHO), an estimated 50 million people had epilepsy in 2024. The condition is more common in low- and middle-income countries. This widespread incidence significantly fuels the demand for anticonvulsant medications to manage and control seizures effectively.

Beyond epilepsy, other neurological disorders also drive market growth. Stroke, traumatic brain injury, and central nervous system infections can all trigger seizures. These conditions add to the growing number of patients requiring anticonvulsant drugs. As such, the scope of anticonvulsant use extends beyond epilepsy treatment alone. The demand is rising for both short-term seizure control and long-term treatment. Increased diagnosis and improved access to healthcare further support this demand worldwide.

The aging global population is another contributing factor. Many age-related neurological disorders present with seizures, increasing the need for medication. As life expectancy rises, more people are living with chronic conditions that affect the brain. Effective seizure control is vital to improving patient quality of life. This growing need continues to propel the anticonvulsants market forward.

Restraints

Generic Erosion and Patent Expirations are restraining the market

The anticonvulsants market faces a significant restraint due to the generic erosion of several key branded drugs following patent expirations. Once the patent protection for a brand-name anticonvulsant expires, generic manufacturers can enter the market with lower-priced versions of the same drug. This leads to a substantial decrease in the revenue generated by the original branded product as market share shifts towards the more affordable generics.

Several widely used anticonvulsants have already lost or are expected to lose patent exclusivity during the 2022-2024 period. This availability of cheaper generic alternatives, while beneficial for patients and healthcare systems in terms of affordability, can significantly limit the overall revenue growth of the anticonvulsants market. Pharmaceutical companies face the challenge of innovating and developing novel anticonvulsants to offset the revenue losses from generic competition.

Opportunities

Advances in Drug Delivery Systems and Formulations are creating growth opportunities

Ongoing advancements in drug delivery systems and formulations for anticonvulsants are creating new growth opportunities in the market. These innovations aim to improve patient compliance, enhance drug efficacy, and reduce side effects. Examples include the development of extended-release formulations that allow for less frequent dosing, which can be particularly beneficial for individuals with epilepsy who require long-term medication.

Additionally, research into alternative routes of administration, such as nasal sprays or subcutaneous injections for rescue medications to treat acute seizures, is gaining traction. Pharmaceutical companies are also exploring novel formulations that may offer better bioavailability or targeted drug delivery to the brain. These technological advancements in how anticonvulsant medications are administered and formulated can lead to improved patient outcomes and create opportunities for premium-priced, value-added products in the market.

Impact of Macroeconomic / Geopolitical Factors

The anticonvulsants market is influenced by broad macroeconomic factors. Economic growth generally supports healthcare spending, increasing the accessibility of anticonvulsant medications for conditions like epilepsy, neuropathic pain, and bipolar disorder. Conversely, economic downturns can strain healthcare budgets and potentially limit access to these treatments.

Inflation can raise the cost of pharmaceutical production, potentially leading to higher drug prices. Geopolitical instability, including trade tensions and regional conflicts, can disrupt the supply chains of active pharmaceutical ingredients and finished drug products, causing price volatility and potential shortages. The increasing global prevalence of neurological disorders, such as epilepsy affecting around 50 million people worldwide according to the WHO, is a significant driver for market growth. Furthermore, increasing government support for drug approvals and R&D activities also propels market expansion.

The recent US announcement of a potential 10% baseline tariff on imported pharmaceutical products, which would likely include anticonvulsants, introduces uncertainty. While the US produces a majority of the active pharmaceutical ingredients consumed domestically by dollar value, a significant volume of finished drug formulations and some key ingredients are imported. Tariffs could increase the cost of these imports, potentially leading to higher prices for anticonvulsant medications in the US.

Given that generic drugs account for a large share of dispensed prescriptions (around 90% in 2022), tariffs could reduce their cost advantage, impacting affordability for patients. While the aim might be to boost domestic manufacturing, the process can be lengthy, and in the short term, increased costs could strain healthcare budgets and potentially affect access to essential anticonvulsant therapies. The possibility of retaliatory tariffs from other countries could further complicate the global supply chain for these crucial medications.

Latest Trends

Increasing Focus on Precision Medicine and Personalized Therapy is a recent trend

A significant recent trend in the anticonvulsants market is the increasing focus on precision medicine and personalized therapy approaches. Recognizing the heterogeneity of epilepsy and other seizure disorders, researchers and clinicians are striving to tailor treatment strategies based on individual patient characteristics, including genetic profiles, seizure type, and underlying etiology.

Genetic testing is becoming more prevalent in identifying specific genetic mutations associated with certain types of epilepsy, which can inform treatment decisions. Furthermore, advancements in neuroimaging and electroencephalography (EEG) are providing more detailed insights into brain activity, potentially allowing for more targeted interventions.

The development of biomarkers that can predict treatment response or the risk of side effects is also an area of active research. This move towards personalized approaches aims to optimize seizure control and minimize adverse events, representing a key evolving trend in the management of epilepsy and the anticonvulsants market.

Regional Analysis

North America is leading the Anticonvulsants Market

North America held the largest market share, accounting for 41.5% of the total revenue. This dominance is mainly due to an aging population and a high prevalence of neurological disorders. According to the CDC, about 2.9 million U.S. adults reported active epilepsy between 2021 and 2022. Older adults are more likely to have epilepsy than younger people. This growing number of diagnosed cases is pushing the demand for better treatment options. As a result, the region is seeing continued growth in epilepsy-related healthcare.

The Epilepsy Foundation confirms that epilepsy is more widespread among older adults. This group needs long-term care and ongoing management. To support this, the National Institute of Neurological Disorders and Stroke (NINDS) funds research in the field. NINDS is part of the National Institutes of Health (NIH). Its focus remains on understanding seizure-related conditions. This continuous investment in research shows a strong commitment to improving patient care. The research findings help in the development of new treatment methods.

In 2024, the FDA approved new seizure drug formulations and generics. This has made treatments more accessible to patients across the U.S. It has also encouraged wider use of anti-seizure medications. Awareness and early diagnosis of neurological conditions are increasing. These factors are driving steady growth in the epilepsy treatment market.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing awareness of neurological conditions and improving healthcare infrastructure. The World Health Organization (WHO) estimates that nearly 80% of people with epilepsy live in low- and middle-income countries, many of which are in the Asia Pacific region. As healthcare systems develop and diagnostic capabilities improve across the region, a larger proportion of individuals with epilepsy are expected to be identified and treated.

Furthermore, government initiatives aimed at enhancing access to essential medicines and improving neurological care are likely to contribute to the increased adoption of these medications. The rising geriatric population in many Asia Pacific countries, as highlighted by the United Nations Economic and Social Commission for Asia and the Pacific (ESCAP), which projects a significant increase in the elderly population by 2050, is also expected to drive the demand for therapies managing age-related neurological conditions, including those causing seizures.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market employ several strategies for growth. They focus on increasing research and development activities to introduce novel formulations and innovative therapies for seizure disorders. Strategic collaborations, mergers, and acquisitions enable companies to expand their product portfolios and geographical reach. Furthermore, they actively seek regulatory approvals for new drugs and indications to cater to a broader patient base.

A significant emphasis on creating awareness about epilepsy and improving diagnostic capabilities also drives market expansion for these companies. UCB S.A. is a global biopharmaceutical company headquartered in Brussels, Belgium. The company focuses on the discovery and development of innovative medicines and solutions for people living with severe diseases of the immune system and the central nervous system.

UCB has a strong presence in the neurology segment, offering a range of treatments for epilepsy, including Keppra (levetiracetam) and Briviact (brivaracetam). Beyond pharmaceuticals, UCB also provides patient support programs and digital solutions to enhance the lives of individuals with chronic conditions. The company operates globally, with a commitment to scientific innovation and patient-centric solutions.

Top Key Players in the Anticonvulsants Market

- UCB Group

- Pfizer Inc

- Novartis AG

- Cephalon Inc

- Catalyst Pharmaceuticals

- Biohaven Pharmaceutical

- Astrazeneca Plc

- Abbott Laboratories

Recent Developments

- In December 2022, Catalyst Pharmaceuticals reached an agreement with Eisai Co., Ltd. to negotiate exclusive rights for the U.S. commercialization of Fycompa, an antiepileptic drug, as part of a potential asset transfer, marking an expansion opportunity for Catalyst in the epilepsy treatment market.

- In February 2022, Biohaven Pharmaceutical acquired Kv7 channel activators from Channel Biosciences, focusing on developing treatments for conditions such as epilepsy, pain disorders, and mood-related disorders, further strengthening its pipeline in neurological and psychiatric care.

Report Scope

Report Features Description Market Value (2024) US$ 7.1 billion Forecast Revenue (2034) US$ 11.3 billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Barbiturates, NMDAR, Carbamate Anticonvulsants, AMPA, and Others), By Application (Migraine, Fibromyalgia, Epilepsy, Bipolar Disorder, and Anxiety), By End-User (Hospitals, Clinics, and Ambulatory Surgical Clinics) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape UCB Group, Pfizer Inc, Novartis AG, Cephalon Inc, Catalyst Pharmaceuticals, Biohaven Pharmaceutical, Astrazeneca Plc, and Abbott Laboratories. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- UCB Group

- Pfizer Inc

- Novartis AG

- Cephalon Inc

- Catalyst Pharmaceuticals

- Biohaven Pharmaceutical

- Astrazeneca Plc

- Abbott Laboratories