Global Noble Gas Market By Product (Helium, Argon, Neon, Xenon, Krypton and Other Products) By Application (Healthcare, Aerospace, Electronics, Construction and Other Applications) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jan 2024

- Report ID: 55515

- Number of Pages: 351

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

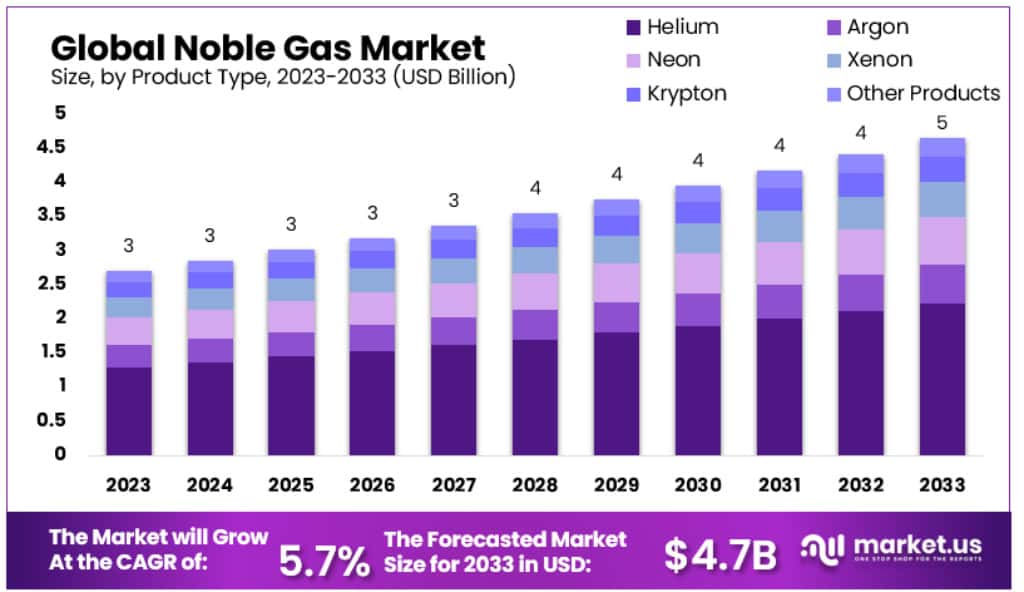

The Global Noble Gas Market size is expected to be worth around USD 5 Billion by 2033, from USD 3 Billion in 2023, growing at a CAGR of 5.7% during the forecast period from 2023 to 2033.

Noble gases, part of the 18th group in the periodic table, are unique elements known for their low reactivity and rarity. This group includes gases like helium, neon, argon, krypton, xenon, and radon. Their low reactivity is due to their full outer electron shells, making them stable and resistant to combining with other elements. Traditionally, these gases have been used in fluorescent tubes for lighting, especially in advertising. However, the high costs associated with these gases and their energy requirements have led to a decrease in their use for this purpose. This shift has prompted producers to explore new applications for noble gases.

Analyst Viewpoint

The noble gas market is experiencing a significant transformation, driven by expanding applications in various industries and supportive government policies. Key growth areas include:

- Healthcare Sector: Helium, in particular, is in high demand due to its unique properties like low reactivity and lightweight. It’s widely used in MRI machine cooling, an essential medical imaging technology, with over 37,000 MRI units globally. Additionally, helium-oxygen mixtures are increasingly used in treating respiratory conditions like asthma, suggesting a growing healthcare market for noble gases.

- Manufacturing and Industrial Applications: Noble gases are gaining popularity in manufacturing, especially in metal melting processes. Their inertness at high temperatures makes them ideal for such applications. Furthermore, they play a critical role in producing highly pure oxygen through the cryogenic distillation of air.

- Electronics and Display Market: The thriving electronics sector, particularly in countries like China and India with improving economic conditions, is boosting the demand for noble gases. Their use in the display market, crucial for electronic devices, signifies a substantial consumption increase.

- Diverse Industrial Uses: The unique properties of noble gases, such as their inertness and ability to improve yields, optimize performance, and reduce costs, are valuable across various industries, including chemical and electronics sectors.

Key Takeaways

- The Global Noble Gas Market is expected to reach approximately USD 5 billion by 2033, up from USD 3 billion in 2023.

- This growth represents a CAGR of 5.7% from 2024 to 2033.

- In 2023, helium accounted for over 46% of the noble gas market, mainly due to its extensive use in

- healthcare, aerospace, and manufacturing.

- The construction sector held 22.5% of the market share in 2023, driven by rapid global construction and infrastructure growth.

- The key regions dominating the noble gas market in 2023 include Asia Pacific (34% market share), North America, particularly the United States, and Europe.

Product Type Analysis

In 2023, helium maintained its lead in the noble gas market, accounting for over 46% of the market share. The demand for helium has been driven by its extensive use across healthcare, aerospace, automotive, deep-sea exploration, and manufacturing sectors. Notably, helium’s role in the healthcare industry is critical, especially in MRI machines where it is used to cool superconductive magnets.

Additionally, helium is used in eye surgeries and as a breathing gas in treatments for respiratory conditions like asthma and emphysema. Its unique properties, such as being colorless, odorless, tasteless, and inert, contribute to its wide range of applications. Most helium production, nearly 80%, comes from the U.S., extracted as a byproduct from natural gas fields. The segment’s growth is further supported by rising healthcare awareness, innovations in medical technology, and increasing investments in medical infrastructure in developing countries.

Following helium, argon represents another significant segment in the noble gas market. Its dominance is attributed to its widespread use as a protective gas in metal manufacturing, where it prevents oxidation and nitriding of rare metals. In aluminum production, argon is mixed with other gases for degassing, removing hydrogen and solid impurities from molten aluminum. Argon’s inert properties make it indispensable in these industrial applications.

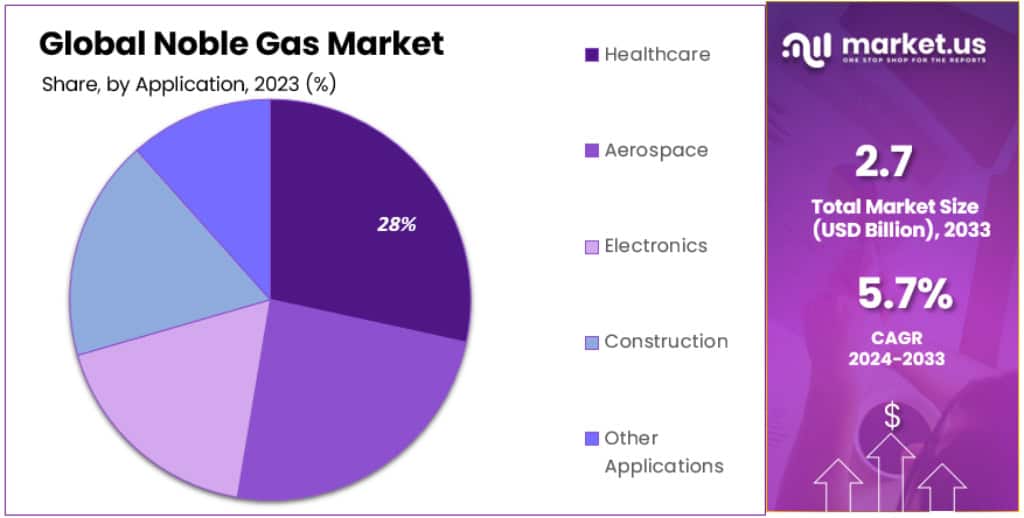

Application Analysis

In 2023, the construction sector led the noble gas market, commanding over 22.5% of the market share. This dominance is attributed to the rapid growth in construction and infrastructure activities globally, particularly in developing economies such as India, China, Brazil, Russia, and Saudi Arabia.

The use of noble gases like helium in arc welding and window insulation plays a pivotal role in this sector. Their low conductivity properties enhance energy efficiency in buildings, making them more appealing in modern construction. The escalating demand in shipbuilding and large-scale transport construction further reinforces the use of noble gases in this sector.

The healthcare segment also shows significant growth due to the unique properties of noble gases, such as low reactivity and inertness, making them safe and effective in various medical applications. The use of noble gases in MRI machines, respiratory therapies, and other medical treatments is driving this segment’s growth. With rising healthcare expenditures and ongoing technological advancements, the healthcare application of noble gases is expected to expand steadily from 2023 to 2030.

In aerospace and electronics, noble gases are integral in processes like etching, cleaning, and manufacturing silicon chips. The growing demand for microcontrollers and integrated circuits (ICs) is propelling the need for these gases in semiconductor manufacturing.

Conversely, the original application of noble gases in lighting, particularly in fluorescent tubes, is witnessing a decline. This is due to the development and adoption of more sustainable and cost-effective lighting solutions that consume less energy. As a result, the lighting segment has experienced negative growth during the study period.

Key Market Segments

By Product

- Helium

- Argon

- Neon

- Xenon

- Krypton

- Other Products

By Application

- Healthcare

- Aerospace

- Electronics

- Construction

- Other Applications

Drivers

- Healthcare Industry Demand: Noble gases, particularly helium, are increasingly used in the healthcare industry. Helium’s role in MRI scanners and respiratory treatments has driven its demand. For example, the U.S. healthcare expenditure, which was USD 4.3 trillion in 2021, representing 18.3% of GDP, and China’s healthcare expenditure of about 7.7 trillion yuan (USD 1.19 trillion) in 2021, highlight the sector’s growth and potential for noble gas use.

- Steel Industry Expansion: The steel industry’s expansion is a significant driver for noble gases like argon. Global crude steel production increased to 1,878 million tonnes in 2020, growing at 1.75% year-over-year. Argon’s use in steel manufacturing processes is critical, as it helps in homogenizing liquid steel and protecting against the formation of oxides and nitrides.

- Growth in Smart Electronics: The semiconductor industry’s growth, fueled by the demand for smart electronics, is pushing the need for noble gases. Helium, argon, and krypton are essential in semiconductor manufacturing for processes like silicon crystal drawing and sputter deposition.

Restraints

- Fluctuating Production Costs: The costs of noble gases vary due to factors like regional competition, contract duration, and transportation distance. For instance, U.S. helium prices fluctuated significantly between 2017 and 2018, impacting the market’s growth prospects.

Opportunities

- Unique Applications Through Research: Advances in forming stable compounds with noble gases, such as xenon and krypton, open new applications in areas like silicon etching and oxidation.

Challenges

- Shift in Lighting Segment: The decline in the use of noble gases for lighting, due to sustainable and cost-effective alternatives, presents a challenge for the market.

Regional Analysis

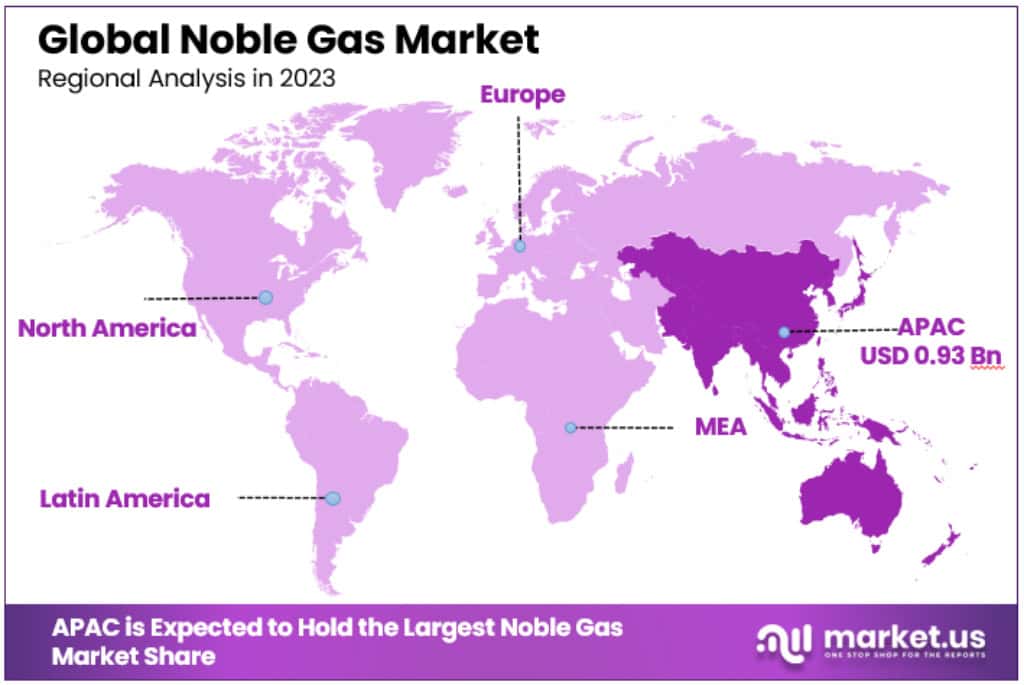

In 2023, Asia Pacific dominated the noble gas market, holding a 34% share with USD 0.93 billion. This dominance is largely attributed to the region’s robust manufacturing and electronics industries, supported by government initiatives and increasing foreign investments. China, India, and Japan, as the largest steel producers globally, significantly drive the demand for inert gases. Additionally, the prominence of these countries in electronics and semiconductor production presents a lucrative opportunity for noble gas producers.

The North American market, particularly the United States, is a significant player in the noble gas industry. The U.S. market is expected to witness substantial growth due to its large-scale application in aerospace, oil and gas, healthcare, and laser industries. The U.S. health expenditures, projected to rise 5.1% annually from 2021 to 2030, indicate potential growth for noble gases in healthcare. Furthermore, the U.S. being the largest crude oil producer, with a production rate of 16,585 thousand barrels per day in 2021, supports the market in the oil and gas sector. Additionally, the region’s utilization of noble gases in fluorescent lighting, especially in cities like Las Vegas, and the space sector, with companies like SpaceX and Iridium Communications, further drives demand.

Europe is a key region in the noble gas market, particularly for research and healthcare applications. The use of helium in cooling technologies for particle accelerators, such as those at CERN in Switzerland and DESY in Hamburg, Germany, highlights the region’s innovative applications. Moreover, with the rising cancer instances, the demand for helium in MRI and NMR imaging is projected to grow, driving the noble gas market in this region.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

This market is highly competitive. Key players are involved in R&D activities. Vendors also invent constantly, making it one of the most crucial factors for companies to succeed in this sector. Joint ventures and acquisitions are a key part of the market, as they allow companies to improve their market position. The market’s dominant trends indicate that companies producing noble gases are buying companies with patents and technologies for making these gases.

Companies in the market are taking strategic steps to increase their use of renewable resources and recycle and reuse byproducts. Superior service and delivery are the keys to suppliers’ competitiveness. R&D to expand the applications of noble gases R&D in different sectors like healthcare, aerospace, and manufacturing will contribute to market growth over the next few years.

Маrkеt Кеу Рlауеrѕ

- Air Liquide S.A.

- Air Products Inc.

- BASF SE

- Linde plc

- The Messer Group GmbH

- Norco Inc.

- Iwatani Corporation

- SHOWA DENKO K.K.

- TAIYO NIPPON SANSO CORPORATION

- MESA Specialty Gases & Equipment

- Gulf Cryo

- Other Key Players

Recent Developments

- May 2023: American Noble Gas Inc. acquired a significant 60.7143% stake in GMDOC, LLC, a move highlighting the company’s strategic expansion in the oil and gas lease market. GMDOC, LLC previously purchased working interests in specific leases from Castelli Energy, L.L.C.

- June 2023: Air Products and Chemicals Inc. partnered with InnoGas to innovate noble gas extraction and production methods. Leveraging InnoGas’ cost-effective technology for extracting and purifying noble gases from the environment, this collaboration aims to create a more sustainable and affordable supply chain.

- April 2023: Linde AG announced a partnership with ExxonMobil, focusing on developing new technologies for specialty gases, including noble gases. This collaboration is notable for its emphasis on reducing emissions in the production of industrial gases.

- November 2022: Air Products secured a major contract worth USD 1.07 billion to supply 33 million liters of liquid helium to NASA’s Kennedy Space Center in Florida, USA. This contract is a testament to the company’s capacity to meet large-scale, specialized gas supply needs.

- April 2022: Linde signed an off-take agreement to recover helium from Freeport LNG’s production site in Texas, United States. Additionally, Linde plans to construct a helium processing plant for liquid helium in the U.S., marking a significant development in helium supply.

- December 2020: Messer Group invested over USD 40 million in a new air separation unit in Adel, Georgia. This facility is set to enhance the supply of industrial gases, notably to the healthcare, metal, and welding sectors in the Southeast U.S.

Report Scope

Report Features Description Market Value (2023) USD 3 Billion Forecast Revenue (2033) USD 5 Billion CAGR (2024-2033) 5.7% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Helium, Argon, Neon, Xenon, Krypton and Other Products) By Application (Healthcare, Aerospace, Electronics, Construction and Other Applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Air Liquide S.A., Air Products Inc., BASF SE, Linde plc, The Messer Group GmbH, Norco Inc., Iwatani Corporation, SHOWA DENKO K.K., TAIYO NIPPON SANSO CORPORATION, MESA Specialty Gases & Equipment, Gulf Cryo and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Q: What is the size of the Noble Gas Market in 2023?A: The Noble Gas market size is USD 3 Billion in 2023.

Q: What is the projected CAGR at which the Noble Gas Market is expected to grow at?A: The Noble Gas market is expected to grow at a CAGR of 5.7% (2024-2033).

Q: List the key industry players of the Noble Gas market?A: Air Liquide S.A., Air Products Inc., BASF SE, Linde plc, The Messer Group GmbH, Norco Inc., Iwatani Corporation, SHOWA DENKO K.K., TAIYO NIPPON SANSO CORPORATION, MESA Specialty Gases & Equipment, Gulf Cryo and Other Key Players are engaged in the Noble Gas market

-

-

- Air Liquide S.A.

- Air Products Inc.

- BASF SE

- Linde plc

- The Messer Group GmbH

- Norco Inc.

- Iwatani Corporation

- SHOWA DENKO K.K.

- TAIYO NIPPON SANSO CORPORATION

- MESA Specialty Gases & Equipment

- Gulf Cryo

- Other Key Players