Global Nitrosylsulfuric Acid Market Size, Share, And Business Benefits By Application (Dyes Intermediate, Pharmaceuticals, Chemical Intermediates, Others), By Sales Channel (Direct Sales, Indirect Sales), By Region, and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 161849

- Number of Pages: 278

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

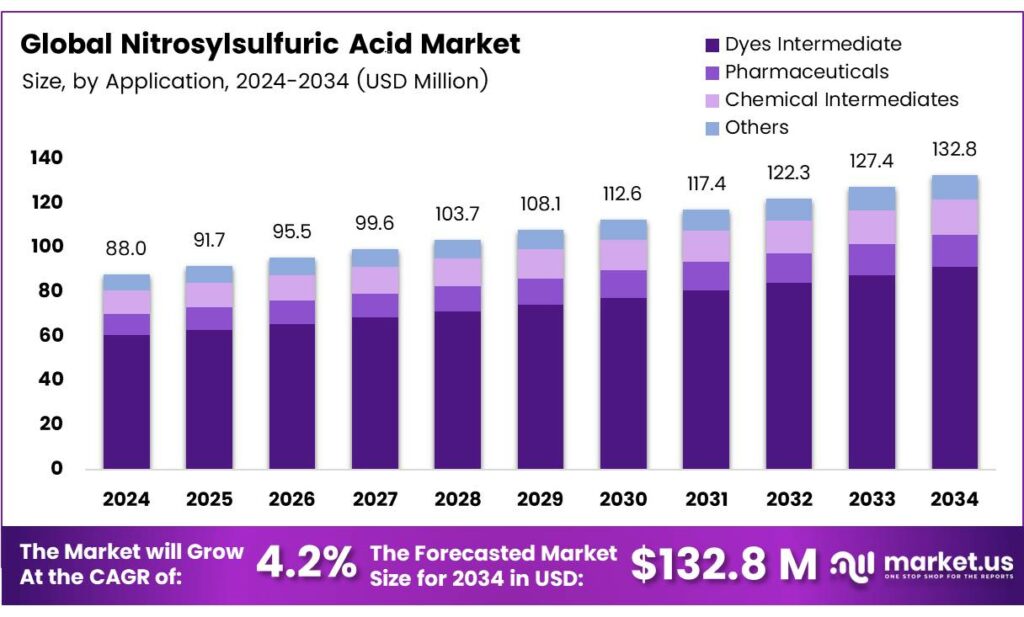

The Global Nitrosylsulfuric Acid Market size is expected to be worth around USD 132.8 Million by 2034, from USD 88.0 Million in 2024, growing at a CAGR of 4.2% during the forecast period from 2025 to 2034.

Nitrosylsulfuric Acid (CAS 7782-78-7) is a critical chemical in industrial applications, particularly in chemical synthesis and dye production. As a key diazotizing agent, it facilitates the diazo reaction essential for creating vibrant, durable colors in disperse dyes for the textile industry. It also serves as a versatile chemical intermediate in nitrosation, oxidation, and oximation reactions, supporting the synthesis of pharmaceuticals, agrochemicals, and fine chemicals.

- This compound, typically a viscous, straw-colored to milky yellow or greenish oily liquid, is often supplied as a 40% solution in 54% sulfuric acid for stability at room temperature. However, refrigeration at +4°C is recommended for long-term storage. With a melting point of -10°C, a boiling point of 333°C, and a density of 1.612 g/mL at 25°C, it has a low vapor pressure and a strong acidic nature (pKa -7.51). In its pure form, it is a crystalline solid that decomposes at 73°C.

Nitrosylsulfuric Acid is highly reactive and hazardous, acting as a strong irritant that can be toxic upon inhalation, ingestion, or skin/eye contact. It reacts vigorously with water, releasing toxic nitrogen dioxide (NO2) gas, with half the maximum theoretical yield produced in 0.14 minutes in a spill with at least a 5-fold excess of water. While soluble in concentrated sulfuric acid, it decomposes rather than dissolves in water, necessitating careful handling.

Nitrosylsulfuric Acid is vital for dye manufacturing and chemical synthesis, serving as a powerful diazotizing agent for dyes, drugs, and pharmaceuticals. Its reactivity with water causes decomposition, releasing toxic gases, but it is soluble in concentrated sulfuric acid. Safe handling is critical, and we provide high-quality products with detailed safety guidance. This ensures secure and effective use for our partners.

Key Takeaways

- The Global Nitrosylsulfuric Acid Market is projected to grow from USD 88.0 million in 2024 to USD 132.8 million by 2034, at a CAGR of 4.2%.

- Dyes Intermediate segment dominated in 2024, holding a 68.8% market share due to its key role in sulfonation and nitration processes.

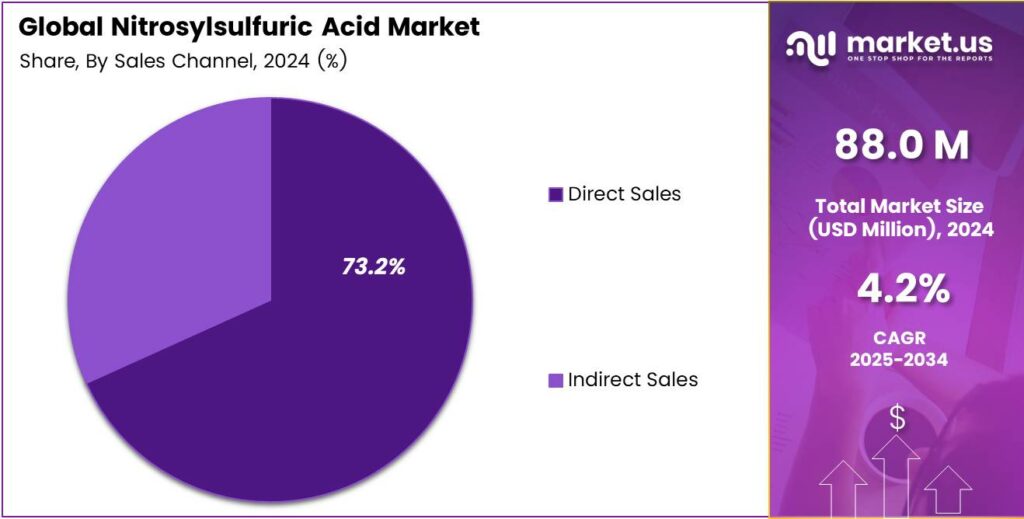

- Direct Sales channel led in 2024, capturing a 73.2% market share, driven by demand for quality and reliable supply.

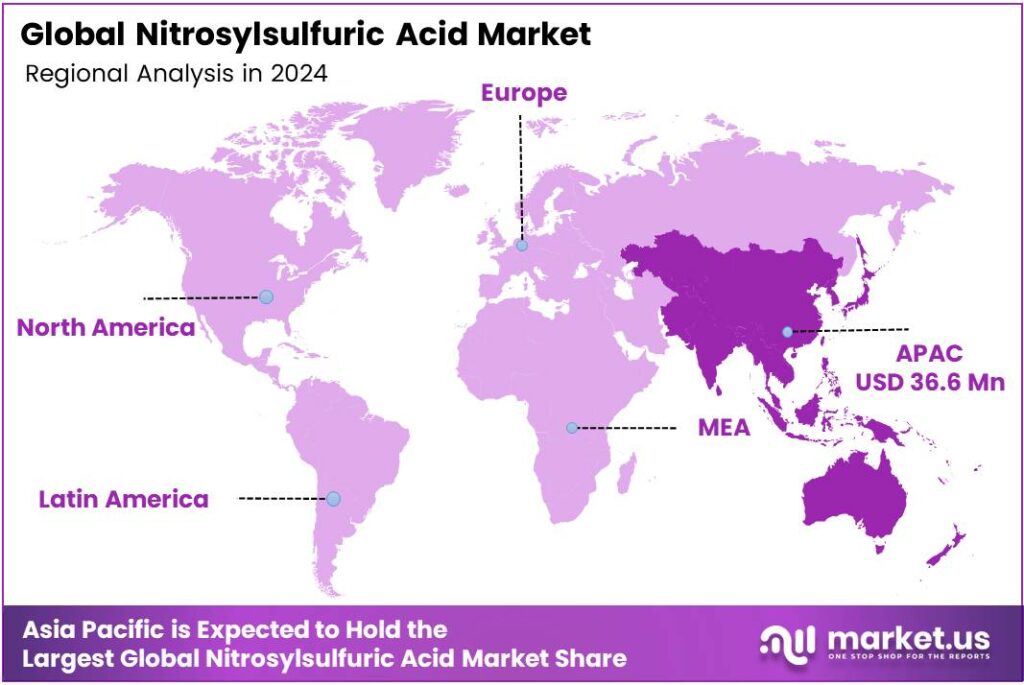

- Asia-Pacific region held a 41.9% market share in 2024, valued at USD 36.6 million, led by the chemical and dye industries in China, India, Japan, and South Korea.

By Application

Dyes Intermediate Segment Dominates with 68.8% Share in 2024

In 2024, Dyes Intermediate held a dominant market position, capturing more than 68.8% share of the global Nitrosylsulfuric Acid Market. This dominance is primarily attributed to the compound’s critical role in the sulfonation and nitration processes used to produce a wide range of dye intermediates.

Nitrosylsulfuric acid acts as a powerful nitrating agent, enabling efficient synthesis of aromatic amines, nitro compounds, and other precursors vital for manufacturing azo, anthraquinone, and sulfur dyes. The textile and leather industries, which heavily rely on these dyes for coloration and finishing, have driven steady demand across Asia-Pacific and Europe in 2024.

The segment continues to benefit from expanding textile exports from India and China, where government initiatives such as the Production Linked Incentive (PLI) scheme for textiles support large-scale dye manufacturing. Additionally, stricter quality regulations in Europe and the U.S. for color consistency and eco-friendly dye processing are encouraging greater use of controlled intermediates synthesized via nitrosylsulfuric acid.

By Sales Channel

Direct Sales Channel Leads with 73.2% Share in 2024

In 2024, Direct Sales held a dominant market position, capturing more than a 73.2% share of the global Nitrosylsulfuric Acid Market. This strong share reflects the preference of large chemical manufacturers and industrial end users to procure nitrosylsulfuric acid directly from producers to ensure consistent quality, reliable supply, and better pricing terms.

Given the compound’s highly reactive and corrosive nature, bulk buyers in the dye, pharmaceutical, and specialty chemical sectors favor direct sourcing to maintain stringent handling standards and regulatory compliance. Direct transactions also allow for tailored logistics and customized packaging, reducing the risks associated with storage and transportation through intermediaries.

The direct sales model continues to strengthen as leading industrial consumers form long-term supply contracts with producers to stabilize procurement costs amid fluctuating raw material prices. Many regional chemical parks in Asia and Europe have integrated direct sales systems to streamline delivery from plant to customer, ensuring uninterrupted production cycles.

Key Market Segments

By Application

- Dyes Intermediate

- Pharmaceuticals

- Chemical Intermediates

- Others

By Sales Channel

- Direct Sales

- Indirect Sales

Emerging Trends

Stricter Regulatory Limits & Consumer Pressure Leading to Reduced Use of Nitrosating Agents in Food Processing

In recent years, food safety regulators and public health bodies have been stepping up scrutiny over nitrosating agents (which include chemicals that produce nitrosylation potential, such as from nitrites/nitrates) because of their link to the formation of nitrosamines, some of which are potentially carcinogenic.

- This trend is pushing food industries to reduce or replace the use of these agents in processed foods, especially meat curing and preservation. The European Food Safety Authority (EFSA) has reaffirmed that nitrites and nitrates used as food additives must stay within strict limits: an Acceptable Daily Intake (ADI) for nitrates at 3.7 mg per kg body weight per day and for nitrites at 0.07 mg per kg body weight per day.

Meanwhile, regulators outside Europe are also reinforcing limits. The U.S. Environmental Protection Agency (EPA), for instance, maintains a standard of 10 ppm for nitrates in drinking water and 1 ppm for nitrites. Though that is water regulation, it illustrates how cautious U.S. authorities remain about nitrogen-based species in consumables.

Drivers

Demand from Pharmaceuticals & Colorants for High-Purity Nitro Intermediates

A key driver of continued use (or at least demand) for nitrosylsulfuric acid is that many pharmaceutical and dye industries need highly pure nitro or diazonium intermediate compounds that require precise nitrosation steps. In many synthetic routes, uncontrolled or impure nitrosation leads to side-products, yield loss, or impurity issues in final drug/pigment products.

For instance, in academic papers and chemical process literature, nitrosylsulfuric acid is still preferred for sensitive nitrosations because it can deliver nitro or diazonium conversion rates above 90% yield under controlled conditions (versus lower yields with weaker nitrosating agents). This level of performance is hard to get with milder agents in many contexts.

Also, pharmaceutical regulatory agencies (like the U.S. FDA and European Medicines Agency) require extremely low levels of impurities/by-products. Where alternative nitrosation routes introduce unknown residues, companies are reluctant to adopt them unless thoroughly validated. That retains demand for more trusted reagents like nitrosylsulfuric acid in specific high-value syntheses.

Restraints

Safety, Toxicity, and Handling Risks

One major restraint on the growth or wider adoption of nitrosylsulfuric acid lies in its hazardous nature. Nitrosylsulfuric acid is strongly corrosive, oxidizing and reacts exothermically with water, releasing toxic gases. When dissolved in water, it decomposes into sulfuric acid and nitrous acid; nitrous acid further breaks down, potentially releasing nitric oxide (NO) or nitrogen dioxide (NO₂), both harmful gases.

This means strict handling protocols and engineering safeguards are needed. In industrial settings, this translates into higher cost, specialized materials (corrosion-resistant equipment), extra ventilation, safety training, and monitoring. These constraint costs reduce its competitiveness compared to milder reagents.

Opportunity

Rising Demand in Food Packaging & Specialty Colorants

One major growth factor for nitrosylsulfuric acid lies in its role in producing specialty colorants, dyes, and inks used in food packaging, labelling, and decorative applications. As global food trade and packaged food markets expand, demand for high-performance, stable, and food-safe color systems increases.

Nitrosylsulfuric acid (or related nitrosating chemistry) can be a key reagent in synthesizing azo dyes, diazonium salts, and related compounds that adhere well, resist migration, and maintain color under food contact conditions. Let me put some context: in 2023, the value of global food and agricultural trade reached about USD 1.9 trillion.

As more food moves across borders, packaged and labeled food items become more common, increasing demand for decorative and functional inks in food contact materials. Also, the Food Outlook forecasts that core food commodity production (rice, maize, oilseeds) will hit new record levels, reflecting the growth of processed and packaged food systems.

Regional Analysis

Asia-Pacific leads with a 41.9% share and a USD 36.6 Million market value.

In 2024, Asia-Pacific emerged as the dominant regional market for Nitrosylsulfuric Acid, accounting for 41.9% of the global share, valued at approximately 36.6 million units. The region’s leadership is underpinned by its vast base of chemical and dye manufacturing industries concentrated across China, India, Japan, and South Korea. These nations possess advanced sulfuric acid and nitric acid production infrastructure, critical feedstocks for nitrosylsulfuric acid, ensuring a continuous supply and cost efficiency.

China and India, in particular, have seen rapid expansion in the dyestuff, pigment, and pharmaceutical intermediate sectors, with growing investments in downstream chemical processing zones and industrial parks. The Indian government’s Production Linked Incentive (PLI) scheme for chemicals and petrochemicals and China’s Made in China industrial policy are further encouraging domestic value addition in fine chemicals and specialty intermediates, strengthening the regional supply network.

Asia-Pacific’s demand is also sustained by the growing textile and food packaging industries, which utilize nitrosylsulfuric acid in the synthesis of azo dyes and colorants. Furthermore, regional producers are investing in closed-loop acid recovery and effluent management systems to align with stricter environmental standards, improving both operational sustainability and export competitiveness.

Europe and North America maintain stringent regulatory frameworks and smaller-scale specialty use, Asia-Pacific’s combination of scale, skilled labor, and favorable policy environment makes it the center of gravity for global nitrosylsulfuric acid production and consumption. The region’s continued investments in specialty chemical parks and integrated production clusters are expected to sustain its leadership well beyond 2025.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Deepak Nitrite is a pivotal player in the nitrosylsulfuric acid market. Its strength lies in robust, integrated manufacturing and a strong domestic supply chain. The company primarily utilizes this intermediate for its own production of valuable dyes, pigments, and specialty chemicals. This captive consumption, combined with significant merchant market sales, solidifies its leadership position and makes it a critical supplier for various downstream industries reliant on diazotization reactions.

Zhejiang Runtu Co., Ltd. is a key global force in nitrosylsulfuric acid production. The company leverages China’s extensive chemical infrastructure and cost-competitive advantages. Its output is essential for manufacturing dyes, pigments, and agrochemical intermediates, catering to a massive domestic and international market. Runtu’s scale and export orientation make it an indispensable supplier in the global supply chain, significantly influencing market prices and availability.

Aarti Industries Ltd is a leading Indian specialty chemical company with a significant stake in the nitrosylsulfuric acid market. It employs a strong vertical integration strategy, producing the acid primarily for captive use in its extensive portfolio of benzene-based downstream products, including dyes and pharmaceuticals. This internal demand, coupled with a focus on custom manufacturing and long-term client contracts, ensures its stable market position and makes it a reliable partner for global chemical companies.

Top Key Players in the Market

- Deepak Nitrite

- Zhejiang Runtu Co., Ltd.

- Aarti Industries Ltd

- Others

Recent Developments

- In 2024, Zhejiang Runtu, a leading Chinese producer of dyes and intermediates (including NSA via subsidiaries like Jiangsu Yuanzheng Chemical), focuses on disperse and reactive dyes. Its stock reflected stable operations in textile auxiliaries and chemical raw materials.

- In 2024, Aarti Industries, an Indian specialty chemicals firm with NSA production for dyes and pharma intermediates. It operates benzene/toluene derivatives and sulfuric acid units, key to NSA synthesis, strengthening the sulfuric acid/NSA portfolio for agrochemicals.

Report Scope

Report Features Description Market Value (2024) USD 88.0 Million Forecast Revenue (2034) USD 132.8 Million CAGR (2025-2034) 4.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Application (Dyes Intermediate, Pharmaceuticals, Chemical Intermediates, Others), By Sales Channel (Direct Sales, Indirect Sales) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Deepak Nitrite, Zhejiang Runtu Co., Ltd., Aarti Industries Ltd, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Nitrosylsulfuric Acid MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

Nitrosylsulfuric Acid MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Deepak Nitrite

- Zhejiang Runtu Co., Ltd.

- Aarti Industries Ltd

- Others