Global Next-Generation Packaging Market Size, Share, Growth Analysis By Material (Biodegradable & Compostable Packaging, Smart Materials, Active & Intelligent (Smart) Packaging, Recyclable & Sustainable Packaging), By Packaging (Flexible Packaging, Rigid Packaging, Smart Packaging), By Application (Food & Beverage, Healthcare & Pharmaceuticals, Personal Care & Cosmetics, Electronics, Supply‑chain), By End-Use (Primary Packaging, Tertiary Packaging, Secondary Packaging), By Distribution Channel (Direct‑to‑Consumer (e‑commerce), Wholesale, Retail), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jul 2025

- Report ID: 152940

- Number of Pages: 261

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

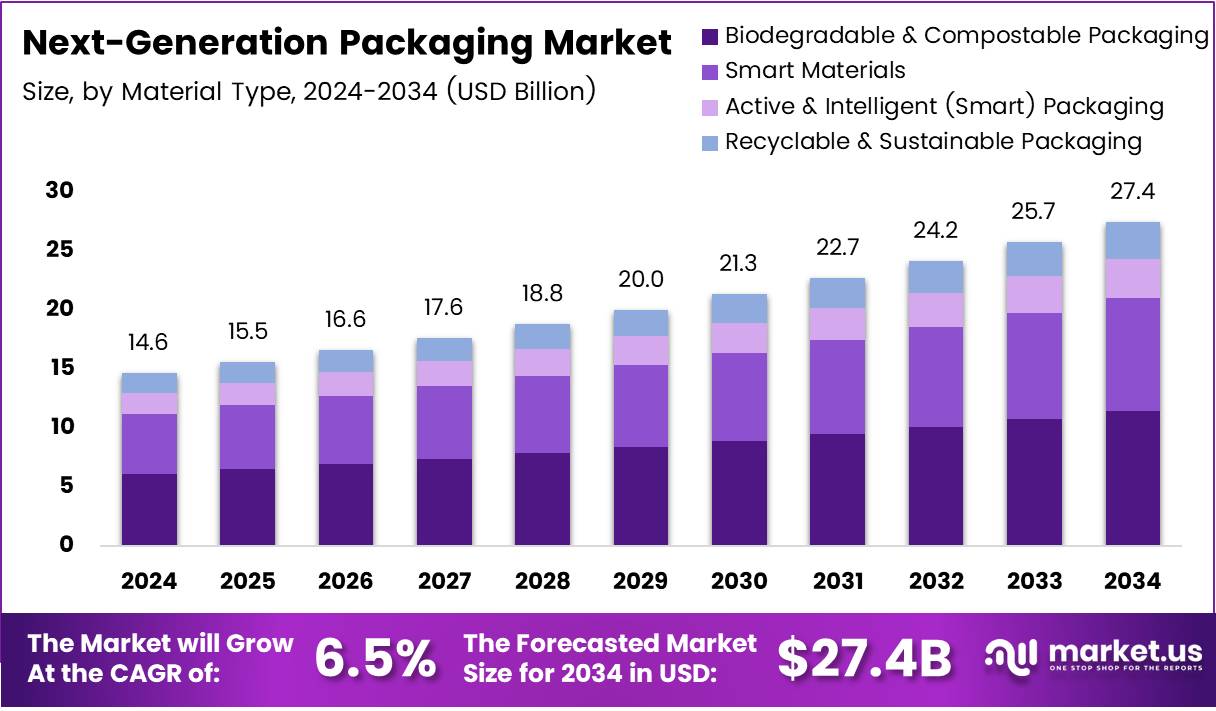

The Global Next-Generation Packaging Market size is expected to be worth around USD 27.4 Billion by 2034, from USD 14.6 Billion in 2024, growing at a CAGR of 6.5% during the forecast period from 2025 to 2034.

The Next-Generation Packaging market is rapidly evolving, driven by increasing consumer demand for sustainable and eco-friendly packaging solutions. This market includes packaging innovations aimed at reducing environmental impacts, enhancing consumer appeal, and improving supply chain efficiency. As consumers become more conscious of sustainability, companies are focusing on biodegradable, reusable, and recyclable materials to meet these demands.

The growth of this market is significantly influenced by rising environmental concerns and the need for companies to adopt sustainable practices. Businesses are increasingly focusing on packaging technologies that minimize waste and utilize renewable materials. Moreover, advancements in packaging materials such as biodegradable plastics, paper-based packaging, and edible packaging are driving innovation within the sector.

Government investments and regulations play a crucial role in shaping the future of the Next-Generation Packaging market. For instance, the U.S. Department of Commerce has allocated $1.4 billion to support the development of advanced semiconductor packaging technologies, showcasing the significant government support in fostering innovative packaging solutions. These initiatives are expected to stimulate further investments in eco-friendly packaging and technological advancements.

The market presents numerous growth opportunities, particularly in the development of smart packaging and sustainable materials. Smart packaging, which includes technologies like QR codes, NFC tags, and temperature sensors, offers enhanced consumer engagement and supply chain visibility. Additionally, the growing demand for packaging that extends product shelf life presents further opportunities for market players.

Consumer preferences for sustainable packaging are growing, with 49% of Gen Z and 47% of Millennials willing to pay more for eco-friendly options, as reported by Shorr. Similarly, 41% of Gen X and 37% of Boomers exhibit similar behavior. Packaging design also influences 74% of U.S. consumers, according to MeteorSpace, highlighting the importance of both sustainability and aesthetics.

However, challenges persist in plastic recycling, with only 14% of plastic packaging recycled globally, according to Time. This emphasizes the need for better recycling technologies. Additionally, 58% of consumers, as per Meyers, are more likely to buy products with recyclable or reusable packaging, offering opportunities for brands to boost loyalty and market share.

Key Takeaways

- The Global Next-Generation Packaging Market is projected to reach USD 27.4 Billion by 2034, growing from USD 14.6 Billion in 2024, at a CAGR of 6.5% from 2025 to 2034.

- Biodegradable & Compostable Packaging is experiencing significant growth due to consumer demand for eco-friendly alternatives and regulatory pushes to reduce plastic use.

- Flexible Packaging is favored for its cost-effectiveness, lightweight nature, and waste-reducing properties, making it ideal for the food and beverage industry.

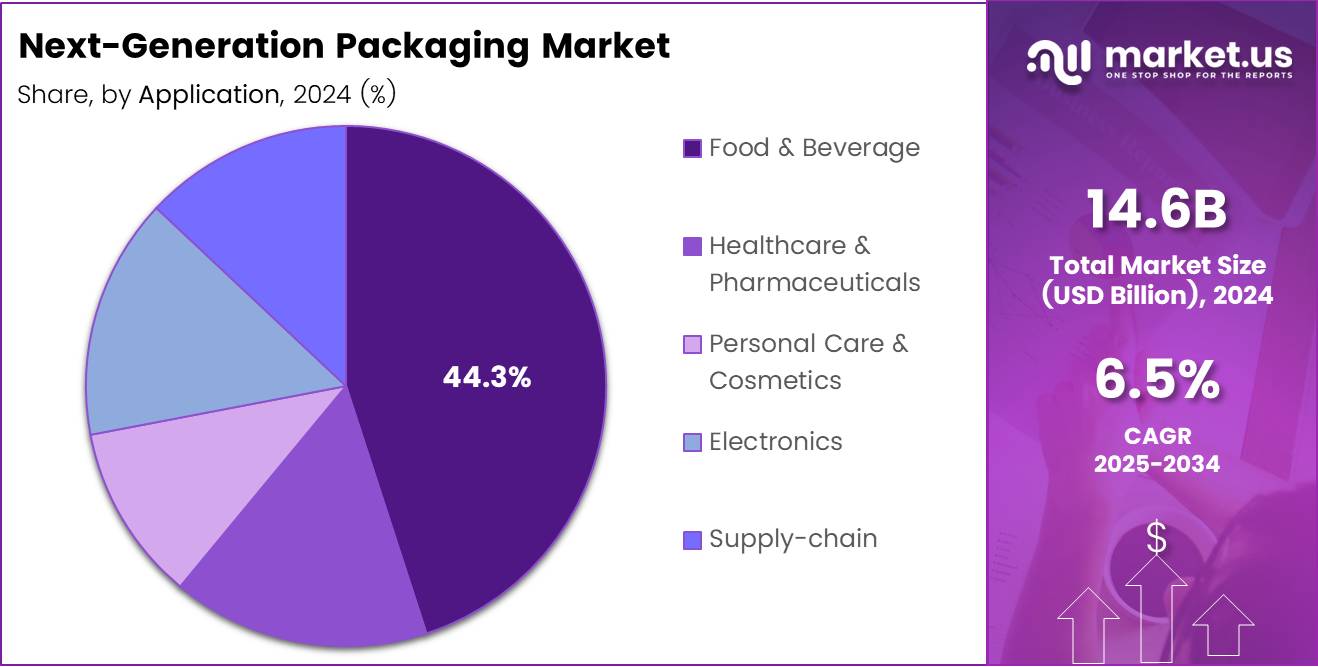

- The Food & Beverage sector holds 44.3% of the market share, driven by consumer preferences for convenience, product safety, and sustainability.

- Primary Packaging leads the market in 2024, crucial for product protection, containment, and branding.

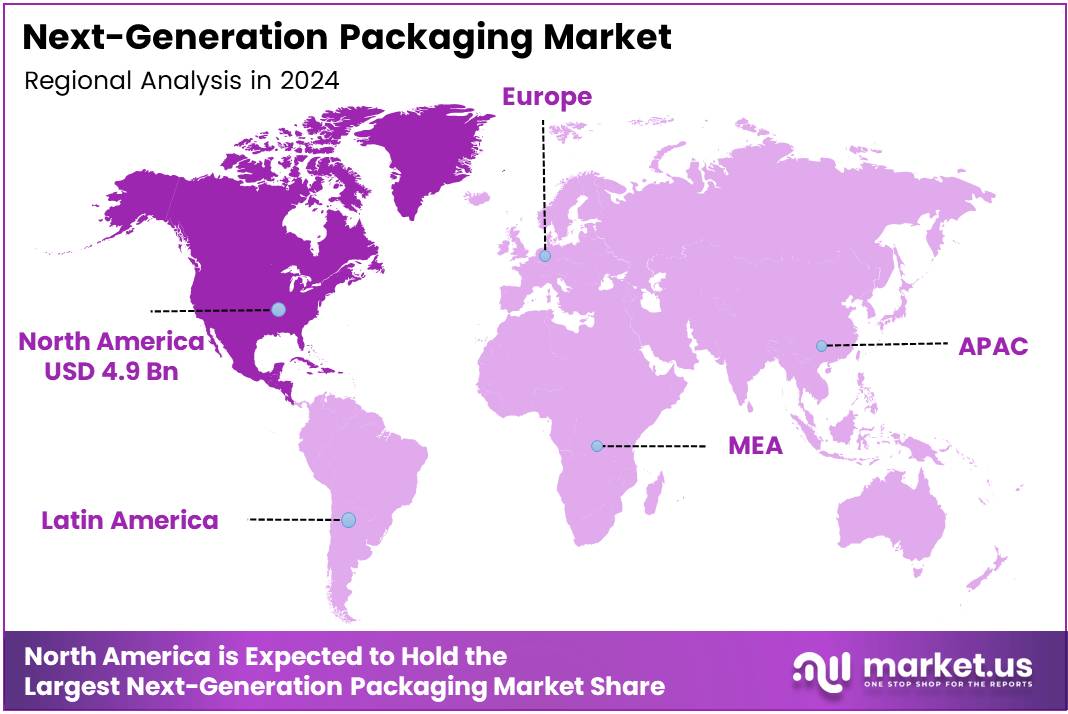

- North America dominates the Next-Generation Packaging Market with 34.1% market share, valued at USD 4.9 billion, driven by eco-friendly packaging demand and stringent regulations.

Material Analysis

Biodegradable & Compostable Packaging dominates in 2024 due to rising sustainability demand and stricter regulations.

Biodegradable & Compostable Packaging continues to experience significant growth within the Next-Generation Packaging Market. This trend is driven by increasing consumer demand for environmentally friendly alternatives and regulations pushing for reduced plastic use. Brands are investing heavily in this material category to align with sustainability goals, benefiting from favorable consumer sentiments.

Smart Materials are gaining traction in the market due to their potential to enhance the functionality of packaging solutions. These materials allow for dynamic adjustments to packaging in response to environmental conditions, improving the overall performance and user experience.

Active & Intelligent (Smart) Packaging is another emerging trend within the market. This technology helps in monitoring the condition of packaged goods and extends shelf life, enhancing product quality and reducing waste.

Recyclable & Sustainable Packaging is an essential segment contributing to sustainability efforts across industries. The continuous development of recyclable materials plays a crucial role in creating a circular economy, pushing forward the transition to sustainable packaging solutions.

Packaging Analysis

Flexible Packaging leads in 2024 thanks to its cost-effectiveness, light weight, and versatility.

Flexible Packaging has firmly established itself as a leading packaging solution in 2024. The segment is favored for its cost-effectiveness, lightweight nature, and the ability to reduce material waste. This flexibility makes it ideal for a range of applications, especially in the food and beverage industry.

Rigid Packaging, on the other hand, is characterized by its durability and protective capabilities. While it remains essential for certain high-end products requiring solid protection, it faces increasing competition from lighter and more sustainable alternatives.

Smart Packaging is gaining momentum in the market. It integrates innovative technologies, such as RFID and sensors, to provide enhanced functionalities like tracking, temperature control, and product condition monitoring. This segment is expected to witness significant growth as technology continues to advance, improving the consumer experience.

Application Analysis

Food & Beverage dominates in 2024 with 44.3% Market Share, driven by the need for eco-friendly and convenient packaging solutions.

The Food & Beverage sector is the largest application segment for Next-Generation Packaging, accounting for a 44.3% of market share. The demand for sustainable and innovative packaging solutions in this sector is driven by increasing consumer preferences for convenience, product safety, and sustainability.

Healthcare & Pharmaceuticals represent a growing application for advanced packaging solutions. As the industry prioritizes sterility, temperature control, and compliance, there is rising demand for packaging that ensures product integrity from production to consumption.

Personal Care & Cosmetics is a key segment seeing growth in Next-Generation Packaging. Consumers are increasingly drawn to eco-friendly packaging options, driving the demand for biodegradable, recyclable, and innovative designs in beauty and personal care products.

Electronics and Supply-chain applications are also contributing to the market, driven by the need for packaging that ensures the safety and integrity of sensitive electronic products and facilitates efficient logistics operations.

End‑Use Analysis

Primary Packaging leads in 2024, essential for protecting, containing, and branding products.

Primary Packaging leads the market in 2024, as it is directly involved in the packaging of the end product for consumer use. This segment is essential in protecting, containing, and branding products, and is the most visible form of packaging across various industries.

Tertiary Packaging, which focuses on bulk handling and transportation, is crucial for logistics but does not hold as much prominence in consumer-facing applications. This segment is vital for the efficient movement of goods but contributes less to the overall market value compared to primary packaging.

Secondary Packaging supports the primary packaging by grouping items together for retail handling and transportation. Although it plays a critical role in the logistics and marketing of products, it holds a more supportive position within the broader packaging market.

Key Market Segments

By Material

- Biodegradable & Compostable Packaging

- Smart Materials

- Active & Intelligent (Smart) Packaging

- Recyclable & Sustainable Packaging

By Packaging

- Flexible Packaging

- Rigid Packaging

- Smart Packaging

By Application

- Food & Beverage

- Healthcare & Pharmaceuticals

- Personal Care & Cosmetics

- Electronics

- Supply‑chain

By End-Use

- Primary Packaging

- Tertiary Packaging

- Secondary Packaging

By Distribution Channel

- Direct‑to‑Consumer (e‑commerce)

- Wholesale

- Retail

Drivers

Advancements in Eco-friendly and Sustainable Materials Drive Market Growth

The next-generation packaging market is seeing significant growth due to advancements in eco-friendly and sustainable materials. Consumers and businesses are increasingly prioritizing environmental responsibility, leading to a shift towards packaging solutions made from recyclable, biodegradable, or compostable materials.

This trend is particularly prevalent as governments and regulatory bodies impose stricter regulations on waste management and sustainability practices. Packaging that reduces the environmental footprint is becoming essential, driving demand for innovative materials such as plant-based plastics, recycled paper, and biodegradable films.

Companies investing in these sustainable alternatives are better positioned to meet consumer preferences and align with environmental goals.”

Restraints

Environmental Impact of Non-Recyclable Packaging Options Restrains Market Growth

Despite the rapid adoption of next-generation packaging solutions, non-recyclable packaging remains a significant restraint. Many packaging materials still contribute heavily to landfill waste, particularly single-use plastics.

As environmental concerns grow, there is increasing pressure from consumers, regulators, and environmental organizations to limit the use of non-recyclable options. This leads to a shift in demand towards more sustainable solutions.

Additionally, supply chain disruptions, such as raw material shortages or transportation delays, can further impact packaging availability. These disruptions complicate the production process and raise costs, which companies must navigate while adopting sustainable practices.

Growth Factors

Expansion of Biodegradable Packaging Solutions Presents Growth Opportunities

The expansion of biodegradable packaging solutions presents an exciting growth opportunity for the market. As consumers and businesses embrace sustainability, the demand for biodegradable materials, especially in the food and beverage sector, continues to rise.

Consumers are becoming more conscious of the environmental impact of packaging and prefer brands that use eco-friendly alternatives. This shift toward biodegradable materials is increasingly common in sectors where sustainability is a key differentiator.

Furthermore, there is a notable surge in demand for pharmaceutical packaging innovations. These innovations focus on ensuring the safety and effectiveness of drugs while being environmentally responsible. The adoption of packaging automation technologies is also expected to increase efficiency and reduce costs, fostering further market growth.

Emerging Trends

Integration of IoT and AI Technology in Packaging Fuels Market Trends

The integration of Internet of Things (IoT) and Artificial Intelligence (AI) technologies in packaging is transforming the industry. IoT-enabled packaging offers improved tracking, inventory management, and enhanced consumer engagement. This innovation helps businesses monitor and optimize packaging usage in real-time.

Meanwhile, AI is revolutionizing packaging design, allowing for more efficient, customized solutions that reduce waste and improve functionality. These technologies enable packaging that is both smarter and more sustainable.

The rise in packaging for health and wellness products further supports this trend. Consumers demand smart packaging solutions that improve convenience and product integrity. Additionally, minimalist packaging designs are gaining popularity for their sustainability benefits and consumer appeal, contributing to a significant shift in market trends.

Regional Analysis

North America Dominates the Next-Generation Packaging Market with a Market Share of 34.1%, Valued at USD 4.9 Billion

In 2024, North America holds the dominant position in the Next-Generation Packaging Market, capturing 34.1% of the total market share, valued at USD 4.9 billion. The market growth in this region is driven by the increasing demand for eco-friendly and sustainable packaging solutions. Consumer preferences, stringent regulatory standards, and significant investments in technological innovations are further fueling the region’s market expansion.

Europe Next-Generation Packaging Market Trends

Europe is expected to experience steady growth in the Next-Generation Packaging Market, with a strong focus on environmental sustainability and reducing packaging waste. The demand for biodegradable and recyclable materials is increasing, driven by both consumer demand and government initiatives promoting sustainability. The region’s market is projected to continue expanding due to the growing e-commerce sector and rising awareness of packaging’s environmental impact.

Asia Pacific Next-Generation Packaging Market Trends

Asia Pacific is poised for significant growth in the Next-Generation Packaging Market due to rapid industrialization and urbanization, particularly in countries like China and India. The increasing adoption of sustainable packaging materials and solutions in the food and beverage, and consumer goods industries is contributing to the market’s growth. Moreover, the growing e-commerce sector in the region is expected to further accelerate packaging innovations.

Middle East and Africa Next-Generation Packaging Market Trends

The Middle East and Africa (MEA) region is gradually expanding its presence in the Next-Generation Packaging Market. The demand for sustainable packaging solutions is rising, particularly in countries with a strong retail presence and e-commerce activities. Market growth is supported by increasing investments in the region’s infrastructure and a heightened focus on reducing plastic waste and improving recyclability.

Latin America Next-Generation Packaging Market Trends

Latin America is witnessing moderate growth in the Next-Generation Packaging Market, driven by the rising demand for sustainable and eco-friendly packaging solutions. The market is evolving with advancements in biodegradable materials and an increasing awareness of environmental issues. The expansion of retail and e-commerce in the region is contributing to the demand for innovative packaging solutions tailored to consumer needs.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Next-Generation Packaging Company Insights

In 2024, AMCOR PLC continues to lead the global Next-Generation Packaging Market, renowned for its innovative sustainable packaging solutions. The company’s commitment to reducing environmental impact through advanced recycling technologies and biodegradable materials positions it as a dominant player in the packaging industry.

Mondi stands out in the market with its strong focus on eco-friendly packaging products. Known for its paper-based packaging and efforts to shift towards fully recyclable materials, Mondi is well-positioned to address the growing demand for sustainable packaging in various industries, including food and consumer goods.

Berry Global has maintained a solid market presence by emphasizing product innovation and sustainable packaging. The company’s diverse portfolio includes flexible plastic packaging and is noted for integrating advanced materials like post-consumer recycled content, enhancing its sustainability credentials.

Sealed Air has built its reputation around creating protective packaging solutions, with a particular focus on its eco-conscious innovations. Their packaging products, such as bubble wrap and other air cushioning materials, are designed to reduce waste and improve product protection, aligning with the increasing demand for sustainable and effective packaging solutions.

Top Key Players in the Market

- AMCOR PLC

- Mondi

- Berry Global

- Sealed Air

- Sonoco Products Company

- Smurfit Kappa Group

- Ball Corporation

- Cosmo Films

- Stora Enso

- Oji Holdings

- Amkor Technology Inc

- Constantia Flexibles

- Ester Industries Ltd

- TCPL Packaging Ltd

Recent Developments

- In January 2025, NIST announces US$1.4 billion in final awards to support the next generation of US semiconductor advanced packaging, aiming to strengthen the country’s leadership in semiconductor manufacturing innovation.

- In February 2025, a multimillion-pound research project is launched to advance the production of next-generation sustainable packaging, focusing on enhancing eco-friendly materials and processes to reduce environmental impact.

- In December 2024, the European Union approves €1.3 billion in funding for the establishment of a semiconductor advanced packaging facility, helping Europe secure its competitive edge in the global semiconductor market.

- In January 2024, Xampla secures US$7 million in funding to advance plastic elimination, supporting the company’s efforts to develop innovative alternatives to traditional plastic materials.

Report Scope

Report Features Description Market Value (2024) USD 14.6 Billion Forecast Revenue (2034) USD 27.4 Billion CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Biodegradable & Compostable Packaging, Smart Materials, Active & Intelligent (Smart) Packaging, Recyclable & Sustainable Packaging), By Packaging (Flexible Packaging, Rigid Packaging, Smart Packaging), By Application (Food & Beverage, Healthcare & Pharmaceuticals, Personal Care & Cosmetics, Electronics, Supply‑chain), By End-Use (Primary Packaging, Tertiary Packaging, Secondary Packaging), By Distribution Channel (Direct‑to‑Consumer (e‑commerce), Wholesale, Retail) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape AMCOR PLC, Mondi, Berry Global, Sealed Air, Sonoco Products Company, Smurfit Kappa Group, Ball Corporation, Cosmo Films, Stora Enso, Oji Holdings, Amkor Technology Inc, Constantia Flexibles, Ester Industries Ltd, TCPL Packaging Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Next-Generation Packaging MarketPublished date: Jul 2025add_shopping_cartBuy Now get_appDownload Sample

Next-Generation Packaging MarketPublished date: Jul 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AMCOR PLC

- Mondi

- Berry Global

- Sealed Air

- Sonoco Products Company

- Smurfit Kappa Group

- Ball Corporation

- Cosmo Films

- Stora Enso

- Oji Holdings

- Amkor Technology Inc

- Constantia Flexibles

- Ester Industries Ltd

- TCPL Packaging Ltd