Global Next-Generation Firewall (NGFW) Market Size, Share Analysis Report By Offering (Hardware, Software, Services (Professional Services (Consulting & Implementation, Support & Maintenance, Training & Education, System Integration)), Managed Services), By Application (Application Visibility and Control, Intrusion Detection and Prevention System (IDS/IPS), Content Filtering, User and Identity Awareness, SSL/TLS Inspection, Advanced Threat Protection, Other Applications), By Organization Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By Deployment Mode (On-premises, Cloud/Virtual), By Vertical (BFSI, Government, Healthcare & Life Sciences, IT & Telecommunications, Retail & Ecommerce, Energy & Utilities, Manufacturing, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150158

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- US Market Expansion

- North America Growth

- Offering Insights

- Application Insights

- Organization Size Insights

- Deployment Mode Insights

- Vertical Insights

- Key Market Segments

- Emerging Trends

- Business Benefits

- Driver

- Restraint

- Opportunity

- Challenge

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

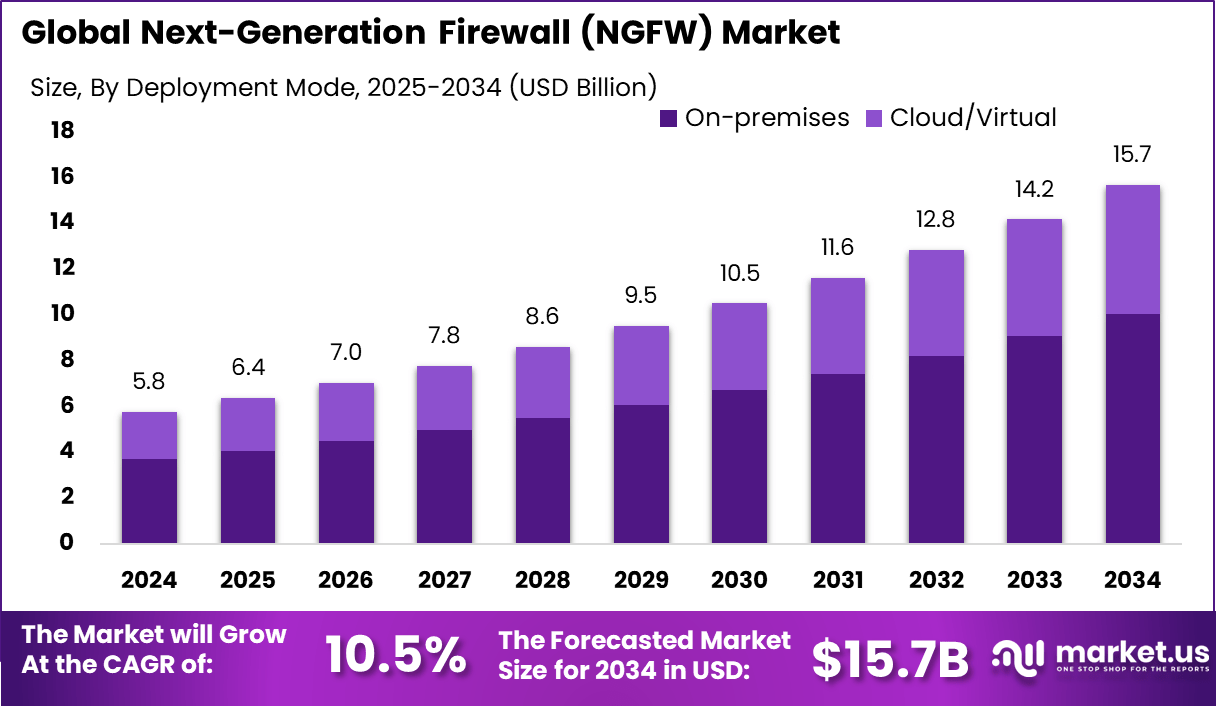

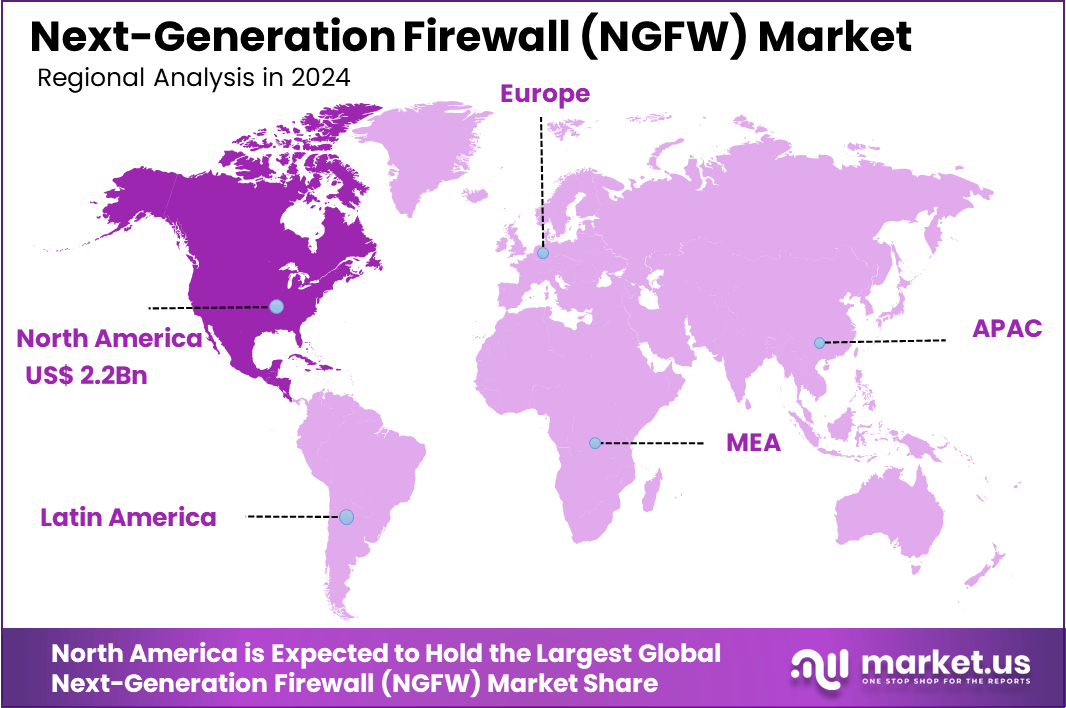

The Global Next-Generation Firewall (NGFW) Market size is expected to be worth around USD 15.7 Billion By 2034, from USD 5.8 billion in 2024, growing at a CAGR of 10.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38% share, holding USD 2.2 Billion revenue.

The global NGFW market has witnessed significant growth due to the escalating complexity of cyber threats and the increasing demand for robust network security solutions. Several key factors are propelling the NGFW market forward. The surge in remote work has heightened the need for secure network access, leading to increased demand for NGFWs that can safeguard decentralized work environments .

Additionally, the rapid adoption of Internet of Things (IoT) devices has expanded the attack surface for cyber threats, necessitating advanced security measures provided by NGFWs . Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) into NGFWs enhances their ability to detect and respond to emerging threats in real-time .

The demand for NGFWs is robust across various sectors, including healthcare, finance, retail, and government. Organizations in these industries are increasingly adopting NGFWs to protect sensitive data and comply with stringent regulatory requirements. The Asia-Pacific region, in particular, is experiencing rapid growth in NGFW adoption due to the rising number of cyberattacks and the expanding digital infrastructure.

Technological advancements are facilitating the widespread adoption of NGFWs. The incorporation of AI and ML enables NGFWs to analyze vast amounts of network traffic data, identify anomalies, and respond to threats proactively. Moreover, the integration of cloud-based services allows NGFWs to provide scalable and flexible security solutions that can adapt to the evolving needs of organizations.

Organizations are turning to NGFWs for several compelling reasons. These include the need for comprehensive security that encompasses application-level protection, the ability to manage and monitor network traffic effectively, and the desire to consolidate multiple security functions into a single, manageable platform. NGFWs also offer improved visibility into network activities, enabling organizations to detect and mitigate threats more efficiently.

Key Takeaways

- The Global Next-Generation Firewall (NGFW) Market is projected to reach USD 15.7 Billion by 2034, growing at a CAGR of 10.5% from 2025, reflecting increasing cyber threats and demand for integrated security solutions.

- In 2024, the market stood at USD 5.8 Billion, with adoption led by enterprises seeking deeper network traffic inspection and control.

- North America dominated the global landscape, capturing over 38% share in 2024, equating to USD 2.2 Billion in revenue.

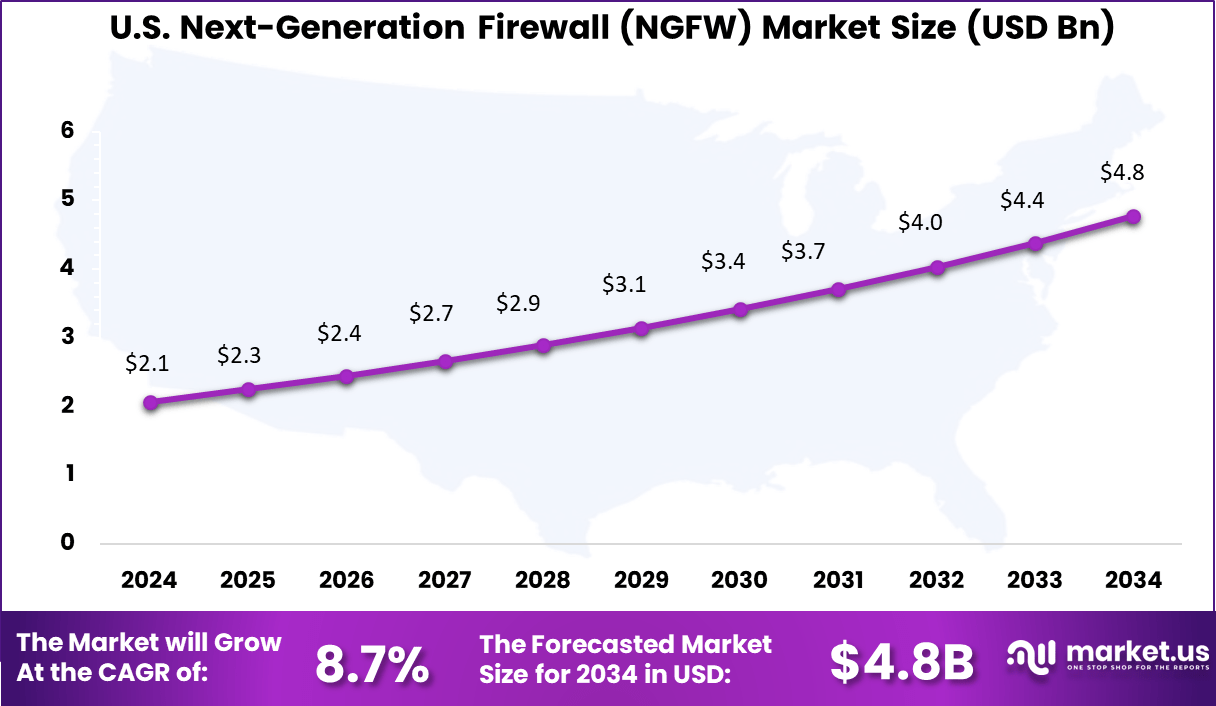

- The U.S. alone contributed USD 2.07 Billion, supported by a robust 8.7% CAGR, driven by stringent compliance requirements and cloud expansion.

- In terms of offering, Hardware-based NGFWs accounted for 40%, favored for their low latency and advanced threat detection at the network edge.

- Application Visibility and Control solutions captured 20%, as organizations prioritize monitoring of encrypted and evasive traffic across applications.

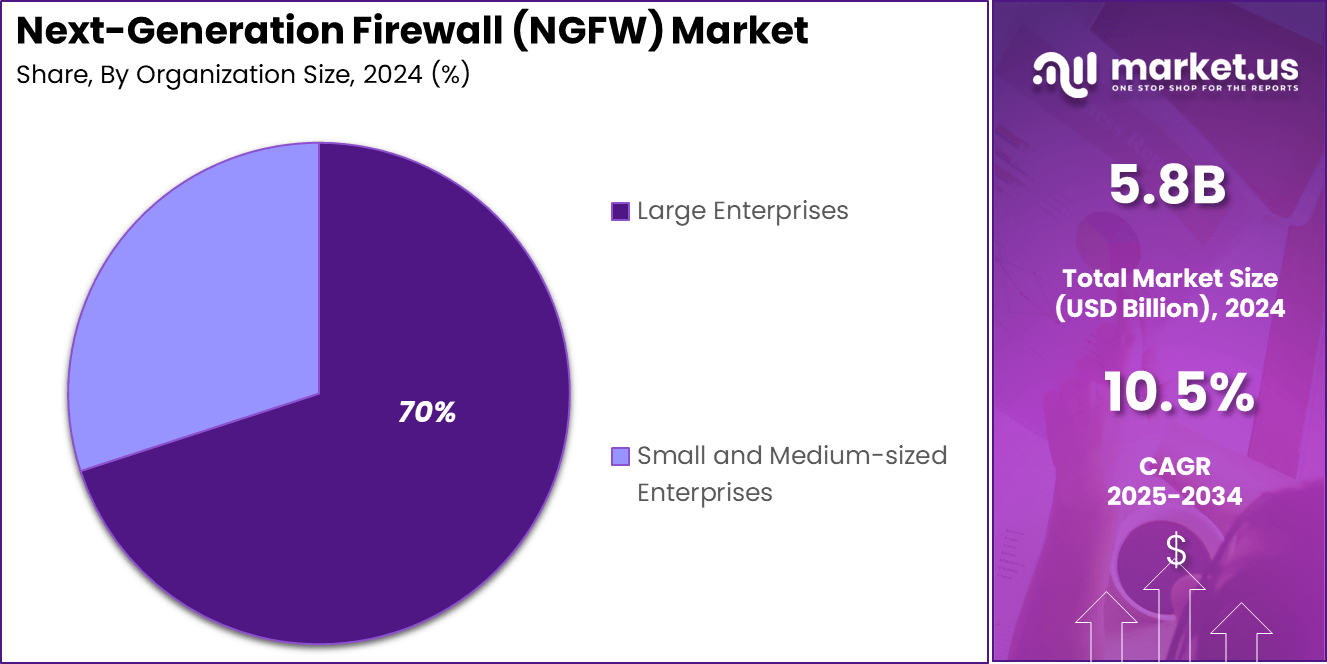

- By organization size, Large Enterprises held a commanding 70% share, driven by multi-site protection needs and regulatory-driven security budgets.

- On-premises deployment led with 64%, supported by sectors with legacy systems and strict data residency regulations.

- Within verticals, the BFSI sector dominated with 22%, fueled by high sensitivity to data breaches and compliance with financial security standards.

Analysts’ Viewpoint

The NGFW market presents significant investment opportunities, particularly in regions with growing digital infrastructures and increasing cybersecurity concerns. Investors can explore ventures in developing advanced NGFW technologies, expanding cloud-based security services, and providing specialized solutions for industries with unique security requirements.

Implementing NGFWs offers numerous benefits for businesses. These include enhanced protection against sophisticated cyber threats, improved compliance with regulatory standards, and streamlined security management through centralized control. By consolidating multiple security functions, NGFWs can also lead to cost savings and increased operational efficiency.

The regulatory landscape is increasingly influencing the adoption of NGFWs. Compliance with data protection laws and industry-specific regulations necessitates the implementation of advanced security measures. NGFWs assist organizations in meeting these requirements by providing comprehensive security features and detailed reporting capabilities, thereby reducing the risk of non-compliance penalties.

US Market Expansion

The US Next-Generation Firewall (NGFW) Market is valued at approximately USD 2.1 Billion in 2024 and is predicted to increase from USD 3.1 Billion in 2029 to approximately USD 4.8 Billion by 2034, projected at a CAGR of 8.7% from 2025 to 2034.

North America Growth

In 2024, North America held a dominant position in the global Next-Generation Firewall (NGFW) market, capturing over 38% of the market share and generating approximately USD 2.2 billion in revenue. This leadership is attributed to the region’s early adoption of advanced cybersecurity technologies, a robust digital infrastructure, and stringent regulatory frameworks that mandate enhanced network security measures.

The presence of key industry players, such as Palo Alto Networks, Cisco Systems, and Fortinet, further bolsters the market, fostering innovation and widespread deployment of NGFW solutions across various sectors, including finance, healthcare, and government. Moreover, the increasing frequency of sophisticated cyber threats has compelled organizations to invest in comprehensive security solutions, thereby reinforcing North America’s preeminence in the NGFW market.

Offering Insights

In 2024, the hardware segment held a dominant position in the global Next-Generation Firewall (NGFW) market, capturing approximately 40% of the total revenue share. This leadership is attributed to the critical need for dedicated, high-performance security appliances in large enterprises and data centers.

Hardware-based NGFWs offer robust capabilities such as deep packet inspection, intrusion prevention, and application-level filtering, which are essential for managing complex network infrastructures and ensuring low-latency performance. The reliability and scalability of these physical devices make them indispensable for organizations requiring stringent security measures and uninterrupted network operations.

The preference for hardware NGFWs is further reinforced by the increasing sophistication of cyber threats and the demand for comprehensive, on-premise security solutions. Industries such as finance, healthcare, and government, which handle sensitive data and are subject to strict regulatory compliance, rely heavily on hardware firewalls to protect against advanced persistent threats and ensure data integrity.

Additionally, the integration of advanced features like SSL/TLS inspection and application awareness in hardware appliances enhances their effectiveness in detecting and mitigating complex cyber attacks. The continued investment in specialized hardware solutions underscores their pivotal role in the cybersecurity strategies of organizations worldwide .

Application Insights

In 2024, the Application Visibility and Control segment held a dominant position in the global Next-Generation Firewall (NGFW) market, capturing over 20% of the total revenue share. This leadership is attributed to the increasing need for organizations to gain granular insights into application usage and enforce precise security policies.

As enterprises adopt a multitude of applications across on-premises and cloud environments, the ability to monitor and control application traffic has become essential for maintaining security and compliance. NGFWs equipped with advanced application visibility features enable organizations to identify, categorize, and manage application traffic effectively, thereby reducing the risk of unauthorized access and data breaches.

The prominence of this segment is further reinforced by the growing trend of remote work and the proliferation of mobile devices, which have expanded the attack surface for cyber threats. Application Visibility and Control capabilities allow organizations to implement context-aware policies that consider user identity, device type, and application behavior. This ensures that only authorized users can access specific applications, and any anomalous activities are promptly detected and mitigated.

Moreover, regulatory frameworks such as GDPR and HIPAA mandate stringent data protection measures, compelling organizations to adopt NGFWs with robust application control functionalities to ensure compliance. The integration of these features into NGFWs not only enhances security posture but also optimizes network performance by prioritizing critical application traffic.

Organization Size Insights

In 2024, the Large Enterprises segment held a dominant position in the global Next-Generation Firewall (NGFW) market, capturing more than 70% of the total revenue share. This dominance is attributed to the complex and expansive network infrastructures of large organizations, which necessitate advanced security solutions to safeguard sensitive data and ensure regulatory compliance.

Large enterprises often operate across multiple regions and manage vast amounts of data, making them prime targets for sophisticated cyber threats. To mitigate these risks, they invest heavily in NGFWs that offer comprehensive features such as deep packet inspection, intrusion prevention systems, and application-level filtering. These capabilities are essential for maintaining robust security postures and protecting against evolving cyber threats.

Furthermore, large enterprises are subject to stringent regulatory requirements, such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA), which mandate the implementation of advanced security measures. Compliance with these regulations drives the adoption of NGFWs that can provide detailed logging, reporting, and policy enforcement capabilities.

Additionally, the financial resources available to large enterprises enable them to allocate substantial budgets for cybersecurity initiatives, including the deployment and maintenance of NGFWs. This financial flexibility allows for the integration of NGFWs into broader security architectures, ensuring comprehensive protection across all network layers.

Deployment Mode Insights

In 2024, the on-premises segment held a dominant position in the global Next-Generation Firewall (NGFW) market, capturing over 64% of the total revenue share. This dominance is primarily attributed to the preference of organizations for maintaining direct control over their security infrastructure.

On-premises NGFWs offer enhanced customization, allowing enterprises to tailor security policies to their specific needs, and provide immediate response capabilities to potential threats. Industries such as finance, healthcare, and government, which handle sensitive data and are subject to stringent regulatory requirements, often opt for on-premises solutions to ensure compliance and data sovereignty.

Furthermore, on-premises deployments are favored for their ability to integrate seamlessly with existing network architectures, offering consistent performance and reliability. They eliminate dependencies on internet connectivity for security operations, ensuring uninterrupted protection even during network outages.

Additionally, organizations with substantial investments in physical infrastructure find on-premises NGFWs to be cost-effective in the long term, as they can leverage existing resources and avoid recurring subscription fees associated with cloud-based solutions. The combination of control, compliance, and cost considerations continues to drive the preference for on-premises NGFW deployments among large enterprises.

Vertical Insights

In 2024, the Banking, Financial Services, and Insurance (BFSI) segment held a dominant position in the global Next-Generation Firewall (NGFW) market, capturing over 22% of the total revenue share. This leadership is primarily attributed to the sector’s critical need for robust cybersecurity measures to protect sensitive financial data and ensure compliance with stringent regulatory standards.

The BFSI industry’s reliance on digital platforms for transactions and customer interactions has heightened the risk of cyber threats, necessitating advanced security solutions like NGFWs that offer deep packet inspection, intrusion prevention, and application-level filtering.

Furthermore, the BFSI sector’s commitment to maintaining customer trust and safeguarding financial assets has driven substantial investments in NGFW technologies. These firewalls provide comprehensive protection against sophisticated cyberattacks, including zero-day exploits and advanced persistent threats, which are increasingly targeting financial institutions.

Additionally, NGFWs facilitate compliance with regulatory frameworks such as the Payment Card Industry Data Security Standard (PCI DSS) by enabling detailed monitoring and control of network traffic. The integration of NGFWs into the BFSI sector’s cybersecurity infrastructure underscores their pivotal role in ensuring secure and resilient financial services.

Key Market Segments

By Offering

- Hardware

- Software

- Services

- Professional Services

- Consulting & Implementation

- Support & Mainternance

- Training & Education

- System Integration

- Managed Services

- Professional Services

By Application

- Application Visibility and Control

- Instrusion Detection and Prevention System (IDS/IPS)

- Content Filtering

- User and Identity Awarness

- SSL/TLS Inspection

- Advanced Threat Protection

- Other Applications

By Organization Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Deployment Mode

- On-premises

- Cloud/Virtual

By Vertical

- BFSI

- Government

- Healthcare & Life Sciences

- IT & Telecommunications

- Retail & Ecommerce

- Energy & Utilities

- Manufacturing

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

Integration of Artificial Intelligence and Machine Learning

The NGFW market is witnessing a significant shift with the integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies. These advancements enable firewalls to analyze vast amounts of network data in real-time, identifying and mitigating threats more effectively.

The adoption of AI and ML in NGFWs enhances their capability to detect sophisticated cyber threats, such as zero-day attacks and advanced persistent threats, by learning from patterns and adapting to new attack vectors. This trend is driven by the increasing complexity of cyber threats and the need for more proactive security measures.

Emphasis on Cloud-Based and Hybrid Deployment Models

Organizations are increasingly adopting cloud-based and hybrid deployment models for NGFWs to accommodate the growing demand for scalable and flexible security solutions. Cloud-based NGFWs offer the advantage of centralized management and the ability to secure distributed networks, which is essential in the era of remote work and cloud computing.

Hybrid models combine on-premises and cloud-based solutions, providing a balanced approach to security that caters to diverse organizational needs. This shift is influenced by the rise in remote workforce security requirements and the migration of applications to the cloud.

Business Benefits

Enhanced Security Through Deep Packet Inspection and Application Awareness

NGFWs offer advanced security features, including deep packet inspection and application-level awareness, which allow for more granular control over network traffic. These capabilities enable organizations to identify and block malicious traffic effectively, reducing the risk of data breaches and cyberattacks. By understanding the context of network traffic, NGFWs can enforce security policies more accurately, ensuring that only legitimate applications and users have access to critical resources.

Simplified Network Management and Cost Efficiency

The integration of multiple security functions into a single NGFW solution simplifies network management by reducing the need for multiple standalone security devices. This consolidation leads to cost savings in terms of hardware, maintenance, and administrative overhead.

Additionally, NGFWs provide centralized visibility and control over the network, enabling IT teams to respond to threats more swiftly and efficiently. The scalability of NGFWs also allows organizations to adapt to changing network demands without significant additional investment .

Driver

Escalating Cyber Threats Necessitate Advanced Security Measures

The increasing frequency and sophistication of cyberattacks have underscored the critical need for robust network security solutions. Traditional firewalls, which primarily focus on port and protocol filtering, are no longer sufficient to combat modern threats.

Next-Generation Firewalls (NGFWs) address this gap by offering deep packet inspection, application-level traffic analysis, and integrated intrusion prevention systems. These capabilities enable organizations to detect and mitigate complex cyber threats effectively, thereby safeguarding sensitive data and maintaining operational integrity.

The adoption of NGFWs is further driven by the proliferation of remote work and the increasing use of cloud services, which have expanded the attack surface for cybercriminals. NGFWs provide comprehensive security by monitoring and controlling network traffic across various environments, including on-premises, cloud, and hybrid infrastructures.

Restraint

High Implementation Costs Limit Adoption Among SMEs

Despite their advanced capabilities, the high cost associated with implementing NGFWs poses a significant barrier, particularly for small and medium-sized enterprises (SMEs). The expenses encompass not only the initial purchase of hardware or software but also ongoing costs related to maintenance, updates, and personnel training.

For organizations with limited budgets, these financial demands can be prohibitive, leading to reliance on less comprehensive security solutions that may not offer adequate protection against sophisticated threats. Moreover, the complexity of NGFW deployment and management requires specialized IT expertise, which may not be readily available within SMEs.

This lack of in-house technical resources can result in suboptimal configuration and utilization of NGFWs, diminishing their effectiveness and further deterring investment. Consequently, the high cost and complexity of NGFWs remain significant challenges to their widespread adoption among smaller organizations.

Opportunity

Integration with Cloud-Based Services Enhances Market Potential

The growing adoption of cloud computing presents a substantial opportunity for the NGFW market. As organizations migrate their operations to cloud environments, the need for security solutions that can seamlessly integrate with cloud platforms becomes paramount.

NGFWs are evolving to meet this demand by offering features such as cloud-native deployment, scalability, and compatibility with various cloud service providers. This adaptability enables organizations to maintain consistent security policies and threat protection across diverse and dynamic cloud infrastructures.

Furthermore, the integration of NGFWs with cloud-based services facilitates centralized management and real-time threat intelligence sharing, enhancing the overall security posture of organizations. By leveraging the scalability and flexibility of the cloud, NGFWs can provide cost-effective and efficient security solutions that cater to the evolving needs of modern enterprises.

Challenge

Complexity in Integration with Existing IT Infrastructure

Integrating NGFWs into existing IT infrastructures poses a significant challenge for many organizations. Legacy systems and heterogeneous network environments can complicate the deployment and configuration of NGFWs, leading to potential compatibility issues and operational disruptions.

Ensuring seamless integration requires careful planning, thorough understanding of the existing infrastructure, and often, customization of NGFW settings to align with organizational requirements. Additionally, the advanced features of NGFWs, such as deep packet inspection and application-level controls, demand substantial processing power and can impact network performance if not properly optimized.

Organizations must balance the need for comprehensive security with the imperative to maintain system efficiency and user experience. Addressing these integration challenges necessitates investment in skilled personnel and potentially, infrastructure upgrades, which can be resource-intensive and time-consuming.

Key Player Analysis

Juniper Networks has been a notable player in the Next-Generation Firewall (NGFW) market, particularly following its acquisition of NetScreen Technologies in 2004, which bolstered its security portfolio. In January 2024, Hewlett Packard Enterprise (HPE) announced plans to acquire Juniper for approximately $14 billion, aiming to enhance its AI-driven networking capabilities.

Palo Alto Networks has solidified its position in the NGFW market through strategic acquisitions and product innovation. Notably, in April 2025, the company announced its intent to acquire Protect AI, a move aimed at enhancing security for AI applications. This follows a series of acquisitions, including Zingbox in 2019, which expanded its IoT security capabilities.

Dell Technologies entered the NGFW market through its acquisition of SonicWALL in 2012, integrating SonicWALL’s firewall technologies into its security portfolio. Although Dell sold SonicWALL to private equity firms in 2016, the company has continued to invest in cybersecurity solutions.

Top Key Players Covered

- Juniper Networks Inc.

- Palo Alto Networks Inc.

- Dell Technologies

- Huawei Technologies Co. Ltd

- Fortinet Inc.

- Barracuda Networks Inc.

- Forcepoint LLC

- WatchGuard Technologies Inc.

- Check Point Software Technologies Ltd.

- Hillstone Networks

- Sophos Technologies Pvt. Ltd (Cyberoam)

- Untangle Inc.

- Zscaler Inc.

- Other Key Players

Recent Developments

- In April 2025, Palo Alto Networks announced its intent to acquire Protect AI, a company specializing in securing artificial intelligence (AI) and machine learning (ML) applications. This acquisition aims to bolster Palo Alto’s Prisma AIRS™ platform, providing end-to-end security for AI systems from development to deployment.

- In January 2024, Hewlett Packard Enterprise (HPE) proposed a $14 billion acquisition of Juniper Networks to enhance its networking business, particularly in AI-driven solutions. However, the U.S. Department of Justice filed a lawsuit in January 2025 to block the merger, citing concerns over reduced competition in the wireless networking market.

Report Scope

Report Features Description Market Value (2024) USD 5.8 Bn Forecast Revenue (2034) USD 15.7 Bn CAGR (2025-2034) 10.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Offering (Hardware, Software, Services (Professional Services (Consulting & Implementation, Support & Maintenance, Training & Education, System Integration)), Managed Services), By Application (Application Visibility and Control, Intrusion Detection and Prevention System (IDS/IPS), Content Filtering, User and Identity Awareness, SSL/TLS Inspection, Advanced Threat Protection, Other Applications), By Organization Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By Deployment Mode (On-premises, Cloud/Virtual), By Vertical (BFSI, Government, Healthcare & Life Sciences, IT & Telecommunications, Retail & Ecommerce, Energy & Utilities, Manufacturing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Juniper Networks Inc., Palo Alto Networks Inc., Dell Technologies, Huawei Technologies Co. Ltd, Fortinet Inc., Barracuda Networks Inc., Forcepoint LLC, WatchGuard Technologies Inc., Check Point Software Technologies Ltd., Hillstone Networks, Sophos Technologies Pvt. Ltd (Cyberoam), Untangle Inc., Zscaler Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Next-Generation Firewall MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Next-Generation Firewall MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Juniper Networks Inc.

- Palo Alto Networks Inc.

- Dell Technologies

- Huawei Technologies Co. Ltd

- Fortinet Inc.

- Barracuda Networks Inc.

- Forcepoint LLC

- WatchGuard Technologies Inc.

- Check Point Software Technologies Ltd.

- Hillstone Networks

- Sophos Technologies Pvt. Ltd (Cyberoam)

- Untangle Inc.

- Zscaler Inc.

- Other Key Players