Global Neuroprosthetics Market By Product Type (Sensory Neuroprosthetics, Motor Prosthetics, Cognitive & Neuromodulation Prosthetics, Software platforms, Consumables & Accessories) By Type (Invasive, Non-invasive) By Technology (Neural Recording Interfaces, Neural Stimulation Interfaces, Others) By Application (Hearing loss, Vision loss, Motor impairments, Neurological Disorder, Cardiac disorders, Kidney disorders, Others) By End-User (Hospitals, Specialty care centers, Ambulatory surgical centers, Rehabilitation centers, Home care settings) and by Region and Companies-Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 160038

- Number of Pages: 219

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

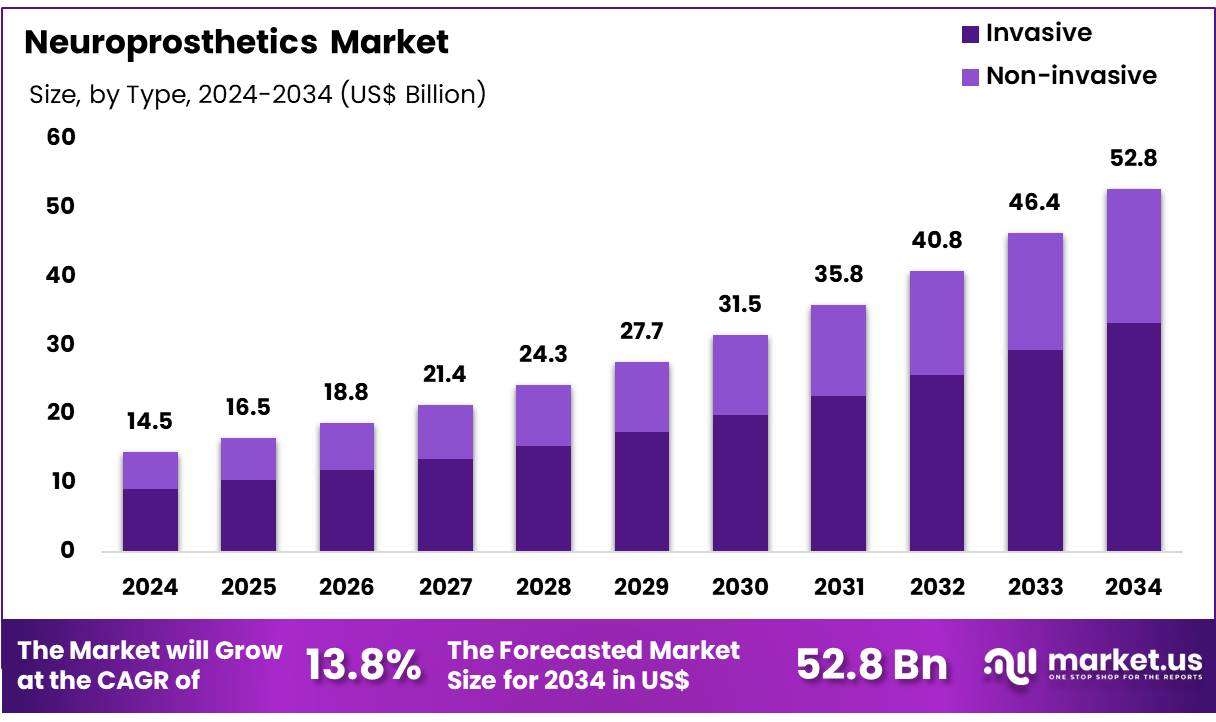

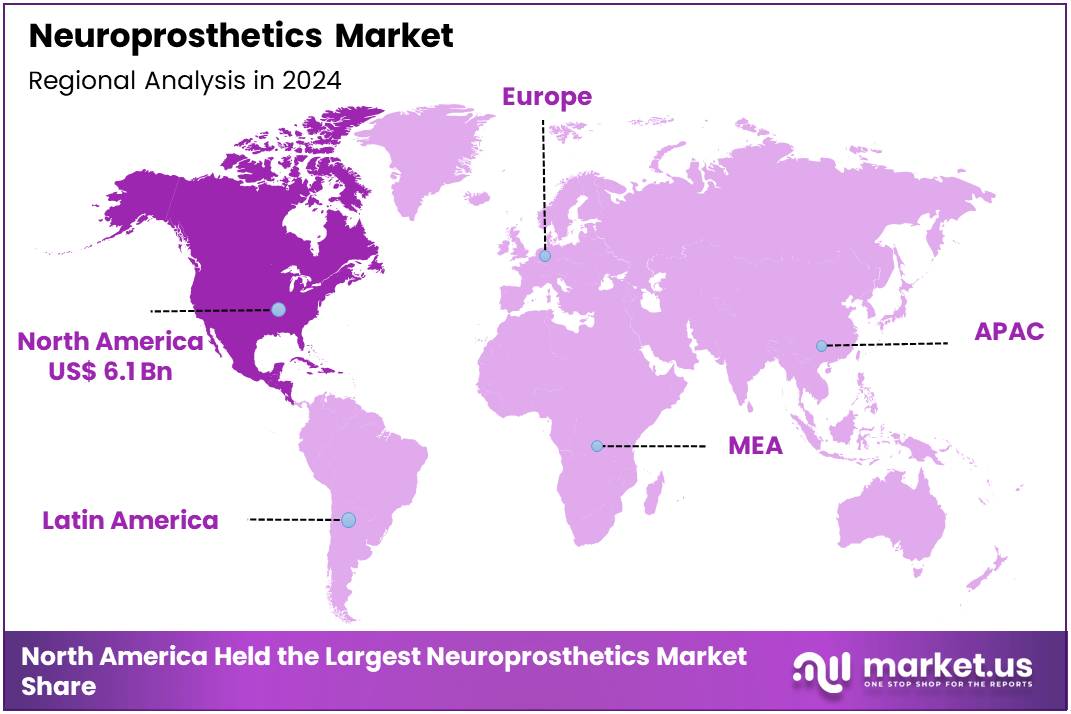

Global Neuroprosthetics Market size is expected to be worth around US$ 52.8 Billion by 2034 from US$ 14.5 Billion in 2024, growing at a CAGR of 13.8% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 42.4% share with a revenue of US$ 6.1 Billion.

The neuroprosthetics sector is experiencing strong growth, supported by multiple health and demographic factors. The primary driver is the rising burden of neurological disorders worldwide. According to the World Health Organization (WHO), more than 3 billion people were living with neurological conditions in 2021, representing over one-third of the global population. These disorders are now the leading cause of illness and disability globally. This growing patient base is steadily increasing the need for devices that can restore or replace lost neural functions.

An ageing global population further strengthens market growth. The United Nations projects that by 2050, the number of people aged 65 and above will reach around 1.6 billion. Ageing is closely linked with higher risks of hearing loss, vision impairment, stroke, Parkinson’s disease, and dementia. These age-related conditions create strong demand for neuroprosthetic technologies and rehabilitation support.

Hearing loss is a major area of unmet need. WHO estimates that over 1.5 billion people currently live with some degree of hearing loss, including about 430 million with disabling conditions. By 2050, the number of people with disabling hearing loss could exceed 700 million. The annual global cost of unaddressed hearing loss is estimated at nearly US $1 trillion. With over 80% of hearing care needs currently unmet, cochlear implants and related devices are expected to play an increasingly important role.

Vision impairment adds further opportunity. WHO reports that at least 2.2 billion people live with vision impairment, and at least 1 billion of these cases could have been prevented or remain unaddressed. The “SPECS 2030” initiative, launched by WHO in 2024, highlights global policy efforts to expand access to eye care. Such initiatives may encourage broader adoption of neuro-enabled visual technologies.

Traumatic injuries and degenerative conditions are also shaping demand. WHO data show that more than 15 million people live with spinal cord injury, with hundreds of thousands of new cases annually. Stroke continues to be a leading cause of disability, with one in four people worldwide expected to experience a stroke in their lifetime. These trends support increased use of spinal cord stimulators, brain-computer interfaces, and functional electrical stimulation devices.

Public-health and policy support reinforce these drivers. WHO’s global action plan on neurological disorders emphasizes access to rehabilitation and assistive technologies. In parallel, government funding is advancing innovation. The U.S. NIH BRAIN Initiative continues to invest in next-generation neurotechnologies. Regulatory support, such as the FDA’s Breakthrough Devices Program, and expanded Medicare coverage for cochlear implants, further reduce adoption barriers.

Key Takeaways

- Market Size: Global Neuroprosthetics Market size is expected to be worth around US$ 52.8 Billion by 2034 from US$ 14.5 Billion in 2024.

- Market Growth: The market growing at a CAGR of 13.8% during the forecast period from 2025 to 2034.

- Product Analysis: In 2024, North America led the market, achieving over 42.4% share with a revenue of US$ 6.1 Billion.

- Product Type Analysis: The motor prosthetics dominate the market, accounting for 43.0% of the total share in 2024.

- Type Analysis: In type analysis, the invasive segment dominates with a 63.1% market share.

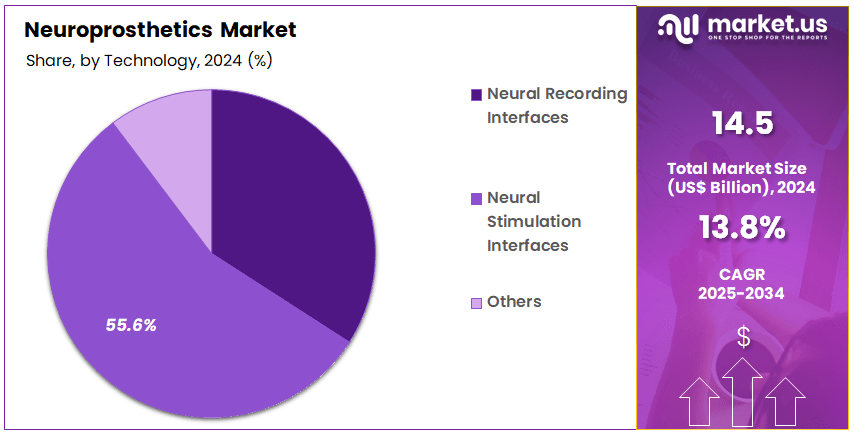

- Technology Analysis: In 2024, neural stimulation interfaces dominate the market with a 55.6% share.

- Application Analysis: Hearing loss applications are estimated to dominate the market in 2024, accounting for 31.2% of the total share.

- End-Use Analysis: Hospitals dominate the market with a 54.7% share in 2024.

- Regional Analysis: In 2024, North America held a dominant market position, capturing more than a 42.4% share and holding a market value of US$ 6.1 Billion for the year.

Product Type Analysis

The global neuroprosthetics market is segmented into motor prosthetics, sensory neuroprosthetics, cognitive & neuromodulation prosthetics, software platforms, and consumables & accessories. Among these categories, motor prosthetics dominate the market, accounting for 43.0% of the total share in 2024. The dominance of this segment is attributed to the rising prevalence of spinal cord injuries, limb amputations, and neuromuscular disorders, coupled with the increasing adoption of advanced robotic and brain-computer interface technologies for mobility restoration.

Sensory neuroprosthetics represent another significant segment, driven by advancements in cochlear implants, retinal prostheses, and auditory brainstem implants. The demand in this segment is fueled by the growing incidence of hearing and vision impairments worldwide.

The cognitive and neuromodulation prosthetics segment is expected to witness notable growth owing to their expanding applications in managing Parkinson’s disease, epilepsy, chronic pain, and psychiatric conditions. Increasing research in deep brain stimulation and vagus nerve stimulation technologies supports the adoption of this category.

Software platforms are emerging as a critical enabler for neuroprosthetics, offering advanced signal processing, AI-based control systems, and adaptive learning algorithms. Their role in improving device functionality and patient outcomes is expected to strengthen their contribution to the market.

Finally, consumables and accessories form a steady revenue stream, driven by recurring demand for electrodes, connectors, batteries, and maintenance kits essential for long-term usage of neuroprosthetic devices. This segment supports the installed base of devices and ensures continued operational efficiency.

Type Analysis

In type analysis, the invasive segment dominates with a 63.1% market share, reflecting its widespread clinical adoption and effectiveness in restoring motor and sensory functions.

The growth of this segment is attributed to the increasing use of deep brain stimulation (DBS), spinal cord stimulation, and implanted brain-computer interface systems for the management of neurological disorders such as Parkinson’s disease, epilepsy, and chronic pain. The high precision, durability, and proven therapeutic outcomes of invasive neuroprosthetics have reinforced their dominance in the global market.

The non-invasive segment, although comparatively smaller, is gaining momentum due to its safety profile and reduced surgical risks. Technologies such as transcranial magnetic stimulation (TMS), wearable brain-computer interfaces, and external neural devices are witnessing growing acceptance among patients and healthcare providers. Increasing demand for less complex procedures, coupled with advancements in non-invasive neurotechnology and AI-driven interfaces, is expected to expand this segment steadily.

Overall, invasive neuroprosthetics continue to lead the market due to their clinical reliability, while non-invasive solutions are emerging as attractive alternatives offering accessibility and reduced patient risk.

Technology Analysis

The neuroprosthetics market is segmented by technology into neural stimulation interfaces, neural recording interfaces, and other supporting technologies. In 2024, neural stimulation interfaces dominate the market with a 55.6% share, underscoring their extensive clinical utility in managing neurological disorders and restoring lost functions. This segment includes deep brain stimulation (DBS), spinal cord stimulation (SCS), peripheral nerve stimulation (PNS), and vagus nerve stimulation (VNS).

Their dominance is attributed to the growing prevalence of conditions such as Parkinson’s disease, epilepsy, chronic pain, and depression, where these technologies have demonstrated strong therapeutic efficacy. Rising adoption of implantable stimulators and continuous innovations in minimally invasive neurosurgery have further strengthened this segment’s leadership.

The neural recording interfaces segment is gaining traction, driven by increasing research into brain-computer interfaces (BCIs) and neuro-monitoring systems. These technologies enable direct decoding of brain signals to control external devices, offering transformative potential for patients with severe motor impairments, paralysis, or communication disabilities. The segment’s growth is supported by advancements in microelectrode arrays, signal processing, and AI-driven decoding algorithms.

The other technologies category, including hybrid systems and software-driven neuroprosthetic platforms, plays a complementary role by enhancing device integration, precision, and patient outcomes. These solutions provide critical support to both stimulation and recording technologies.

Application Analysis

The global neuroprosthetics market is segmented based on applications including hearing loss, vision loss, motor impairments, neurological disorders, cardiac disorders, kidney disorders, and others. Among these, hearing loss applications are estimated to dominate the market in 2024, accounting for 31.2% of the total share. This dominance is attributed to the widespread adoption of cochlear implants and auditory brainstem implants, driven by rising prevalence of hearing impairments, improved reimbursement policies, and rapid technological innovations enhancing sound quality and patient outcomes.

The vision loss segment is projected to witness steady growth, supported by increasing research in retinal implants and bionic eyes aimed at restoring partial vision in patients with degenerative retinal conditions. Although the segment holds a comparatively smaller share, continuous advancements in bioelectronics and government funding for vision restoration are expected to accelerate adoption.

Applications in motor impairments are gaining traction due to rising demand for deep brain stimulators and functional electrical stimulation devices for spinal cord injuries, Parkinson’s disease, and stroke rehabilitation. The growing burden of neurological disorders globally further supports this segment.

In addition, neurological disorder-related applications such as epilepsy and chronic pain management continue to expand, driven by deep brain and vagus nerve stimulation technologies. Meanwhile, the use of neuroprosthetics in cardiac and kidney disorders remains limited, primarily confined to niche interventions.

The “others” segment encompasses experimental and emerging applications, contributing marginally but representing future opportunities for market diversification.

Overall, while hearing loss remains the largest contributor in 2024, vision restoration and motor impairment applications present high-growth avenues due to expanding clinical applications and ongoing technological progress.

End-User Analysis

The neuroprosthetics market is segmented by end-users into hospitals, specialty care centers, ambulatory surgical centers, rehabilitation centers, and home care settings. Hospitals dominate the market with a 54.7% share, driven by their advanced infrastructure, availability of specialized surgeons, and comprehensive patient management systems. The high patient influx for neurological disorders, combined with access to advanced neuroprosthetic devices, has reinforced hospitals’ leading role in adoption.

Specialty care centers account for a notable share, supported by their focus on neurological and neurosurgical interventions. Their ability to deliver targeted treatments, coupled with rising referrals from general healthcare facilities, has strengthened their position. Ambulatory surgical centers are emerging as cost-effective alternatives, benefiting from shorter recovery times, reduced healthcare costs, and a rising preference for minimally invasive procedures.

Rehabilitation centers represent a steadily expanding segment, supported by increasing demand for post-surgical rehabilitation and long-term therapy for patients with motor impairments. The integration of neuroprosthetics into rehabilitation programs has enhanced patient outcomes, making this a growth-focused segment. Home care settings are witnessing gradual adoption, propelled by the growing emphasis on patient-centric care, advancements in portable prosthetic technologies, and the preference for personalized recovery environments.

Key Market Segments

By Product Type

- Sensory Neuroprosthetics

- Cochlear implants

- Retinal implants

- Others

- Motor Prosthetics

- Cognitive & Neuromodulation Prosthetics

- Software platforms

- Consumables & Accessories

By Type

- Invasive

- Non-invasive

By Technology

- Neural Recording Interfaces

- Neural Stimulation Interfaces

- Deep Brain Stimulation (DBS)

- Spinal Cord Stimulation (SCS)

- Peripheral Nerve Stimulation (PNS)

- Vagus Nerve Stimulation (VNS)

- Others

By Application

- Hearing loss

- Vision loss

- Motor impairments

- Neurological Disorder

- Parkinson’s disease

- Epilepsy

- Depression and OCD

- Neuropsychiatric conditions

- Alzheimer’s Disease

- Others

- Cardiac disorders

- Kidney disorders

- Others

By End-User

- Hospitals

- Specialty care centers

- Ambulatory surgical centers

- Rehabilitation centers

- Home care settings

Driving Factors

The principal driver for the neuroprosthetics market is the growing global burden of neurological disorders and functional deficits. According to the Pan American Health Organization, neurological conditions are responsible for millions of years lived with disability (YLDs) and years of life lost (YLLs), indicating a high disease burden that motivates demand for restorative devices.

In parallel, the U.S. NIH’s BRAIN Initiative supports development of advanced neural recording and modulation tools, accelerating innovation in neuroprosthetic technologies. The confluence of unmet clinical need, aging populations, and public funding of neuroscience infrastructure drives investment and uptake of neuroprosthetic solutions.

Trending Factors

A key trend in the neuroprosthetics market is the shift toward closed-loop and bidirectional systems that both sense neural activity and deliver stimulation adaptively. The NIH BRAIN Initiative explicitly prioritizes development of recording and modulation technologies at cellular or near-cellular resolution to enable real-time feedback control.

Academic literature also outlines emerging “neural co-processor” designs combining decoding and encoding functions to improve efficacy and plasticity induction. Such systems improve precision, reduce side-effects, and enhance usability compared to open-loop devices, establishing a technological trajectory in the field.

Restraining Factors

A significant restraint in the neuroprosthetics market arises from regulatory complexity, safety risks, and integration challenges. Clinical translation of neural implants must navigate strict oversight by agencies such as the FDA, where pathways (e.g. 510(k)) may bear uncertainty or recall risk.

Moreover, interagency coordination issues (e.g., between NIH, CMS, and FDA) have impeded investigator-initiated neuromodulation research. Implant safety concerns (infection, tissue damage, durability) and lack of long-term performance data limit commercialization and adoption in many jurisdictions.

Opportunity

The neuroprosthetics market holds considerable opportunity in underserved indications and emerging geographies. Public funding initiatives such as the NIH BRAIN Initiative allocate resources to translational trials of novel devices for conditions including paralysis, vision loss, depression, and epilepsy.

In low- and middle-income regions, rising prevalence of neurological disease and expanding healthcare infrastructure create demand for cost-effective neuroprosthetic solutions. Additionally, integration with AI, miniaturization, and new biomaterials offers the chance to deploy more accessible, reliable implants. The ethical and policy frameworks being fostered by neuroethics programs under BRAIN further allow responsible scale-up.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 42.4% share and holding a market value of US$ 6.1 Billion for the year. The strong position of this region is linked to early adoption of advanced medical technologies. High healthcare spending and favorable reimbursement policies further supported growth.

The presence of leading research institutions and specialized clinics has accelerated innovation in neuroprosthetics. Strong collaboration between universities, hospitals, and technology developers has boosted product availability. This has led to faster clinical adoption across applications such as motor prosthetics, brain-computer interfaces, and cochlear implants.

Government support for neurological disorder treatment programs has also played a crucial role. Increasing prevalence of conditions such as Parkinson’s disease, epilepsy, and stroke is driving demand for neuroprosthetic devices. High patient awareness levels in the United States and Canada have further supported widespread use.

In addition, the region benefits from a robust venture capital ecosystem. Continuous funding for start-ups and research initiatives has strengthened the pace of product launches. The availability of skilled healthcare professionals and advanced infrastructure ensures rapid integration of these technologies into clinical practice.

Key Regions and Countries

North America

- The US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The neuroprosthetics market is shaped by the active participation of medical technology innovators, research institutions, and specialized device manufacturers. Key players focus on expanding their product portfolios through continuous investment in advanced neural interface technologies.

Strong emphasis is placed on miniaturization, biocompatibility, and wireless connectivity to enhance patient comfort and functionality. Collaborative research with academic centers and clinical institutions accelerates development pipelines, while strategic alliances with hospitals and rehabilitation centers strengthen distribution channels.

Leading participants are also prioritizing regulatory approvals to secure faster market entry across developed regions. Substantial investments in artificial intelligence and machine learning integration are being made to improve device responsiveness and accuracy.

Additionally, partnerships with insurance providers support favorable reimbursement frameworks, enhancing adoption rates. Competitive intensity is marked by frequent product launches, clinical trials, and technological upgrades. Overall, the market is defined by innovation-driven strategies, patient-centric design, and long-term investment in neurotechnology advancement.

Market Key Players

- Medtronic Plc

- Cochlear Ltd.

- Boston Scientific

- LivaNova

- St. Jude Medical, Inc.

- NeuroPace, Inc.

- Abbott Laboratories

- Nervo Corp.

- Sonova

- Retina Implant AG

- BrainGate

- Cyberonics Inc.

- Synchron Inc.

- Blackrock Neurotech

- Pixium Vision SA

Recent Developments

- Medtronic Plc: May 2025 – Medtronic announced the intention to spin off its Diabetes business into a separate, publicly traded entity. This portfolio restructuring allows Medtronic to concentrate more on high-margin growth areas such as neuromodulation and neurotechnologies.

- Cochlear Ltd.: Cochlear projected the commercial release of the Nexa system, along with new sound processors (Kanso 3 Nexa, Nucleus 8 Nexa) to complement the smart implant upgrade path.

- Abbott Laboratories: Abbott continues to invest in neuromodulation and implantable device technologies, integrating offerings from the acquired St. Jude portfolio (e.g., deep brain stimulation, neurostimulation).

- St. Jude Medical, Inc.: NeuroPace continues to develop and market its responsive neurostimulation (RNS) systems for epilepsy. A significant new product or launch during 2024–2025 was not documented in publicly accessible sources.

Report Scope

Report Features Description Market Value (2024) US$ 14.5 Billion Forecast Revenue (2034) US$ 52.8 Billion CAGR (2025-2034) 13.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Sensory Neuroprosthetics, Motor Prosthetics, Cognitive & Neuromodulation Prosthetics, Software platforms, Consumables & Accessories) By Type (Invasive, Non-invasive) By Technology (Neural Recording Interfaces, Neural Stimulation Interfaces, Others) By Application (Hearing loss, Vision loss, Motor impairments, Neurological Disorder, Cardiac disorders, Kidney disorders, Others) By End-User (Hospitals, Specialty care centers, Ambulatory surgical centers, Rehabilitation centers, Home care settings) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Medtronic Plc, Cochlear Ltd., Boston Scientific, LivaNova, St. Jude Medical, Inc., NeuroPace, Inc., Abbott Laboratories, Nervo Corp., Sonova, Retina Implant AG, BrainGate, Cyberonics Inc., Synchron Inc., Blackrock Neurotech, Pixium Vision SA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Medtronic Plc

- Cochlear Ltd.

- Boston Scientific

- LivaNova

- St. Jude Medical, Inc.

- NeuroPace, Inc.

- Abbott Laboratories

- Nervo Corp.

- Sonova

- Retina Implant AG

- BrainGate

- Cyberonics Inc.

- Synchron Inc.

- Blackrock Neurotech

- Pixium Vision SA