Global Nematicides Market By Type(Fumigants, Non-Fumigants, Organophosphate, Carbamate, Bio-based), By Form(Liquid, Granular, Powder), By Application Method(Fumigation, Irrigation, Foliar Spray, Seed Treatment), By Nematode Species(Root-Knot Nematodes, Cyst Nematodes, Lesion Nematodes, Other), By Crop Type(Fruits & Vegetable, Cereals & Grains, Oilseeds & Pulses, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: June 2024

- Report ID: 121663

- Number of Pages: 339

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

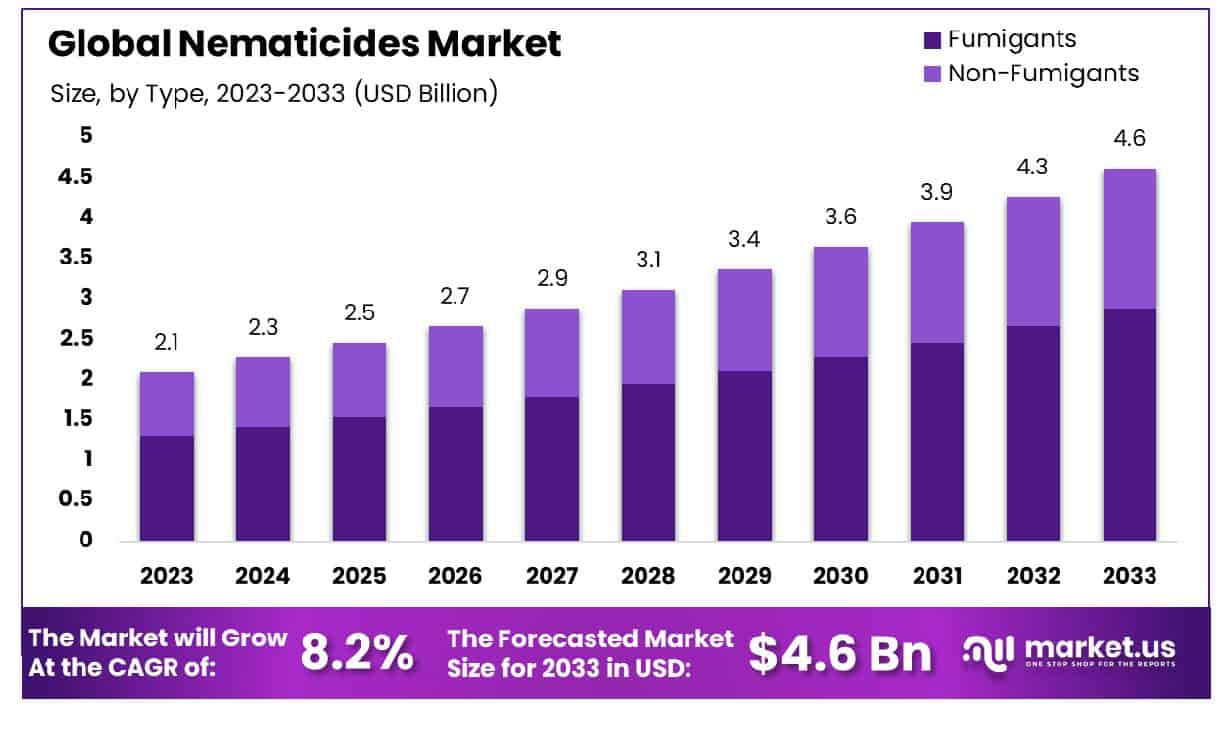

The Global Nematicides Market size is expected to be worth around USD 4.6 Billion by 2033, From USD 2.1 Billion by 2023, growing at a CAGR of 8.2% during the forecast period from 2024 to 2033.

The Nematicides Market refers to the segment within the agrochemical industry dedicated to the development, production, and distribution of chemical agents designed to control nematode populations in agricultural soils. Nematodes are microscopic roundworms notorious for causing detrimental effects on crop yield and quality, making nematicides crucial for safeguarding agricultural productivity.

This market encompasses a spectrum of products tailored to combat specific nematode species, offering innovative formulations and application methods to enhance efficacy while minimizing environmental impact. With increasing global concern over sustainable agriculture and food security, the Nematicides Market plays a pivotal role in enabling farmers and agribusinesses to mitigate nematode-related losses and optimize crop production.

The nematicides market is poised for significant growth, driven by the increasing demand for effective solutions to combat nematode infestations in agricultural crops. Nematodes pose a substantial threat to crop productivity, causing substantial yield losses worldwide. As global agricultural land area expands, reaching 4.79 billion hectares, with cropland comprising one-third of this area, the need for efficient pest management solutions becomes ever more critical.

The global production of primary crops has surged by 56% between 2000 and 2022, indicative of the escalating pressure on agricultural systems to meet the demands of a growing population. Amidst this backdrop, the nematicides market presents a compelling opportunity for innovation and investment. The rise in the production of sugar crops, with sugar cane alone accounting for 1.9 billion tonnes in 2022, underscores the significance of protecting high-value crops from nematode-induced damage.

As agricultural practices evolve and intensify, there is a growing awareness of the adverse effects of nematodes on crop health and yield. Farmers are increasingly seeking sustainable and environmentally friendly nematicide solutions that minimize harm to beneficial organisms and ecosystems. This shift in consumer preferences towards natural products aligns with broader trends in the agricultural industry towards sustainability and eco-conscious practices.

Key Takeaways

- Market Growth: The Global Nematicides Market size is expected to be worth around USD 4.6 Billion by 2033, From USD 2.1 Billion by 2023, growing at a CAGR of 8.2% during the forecast period from 2024 to 2033.

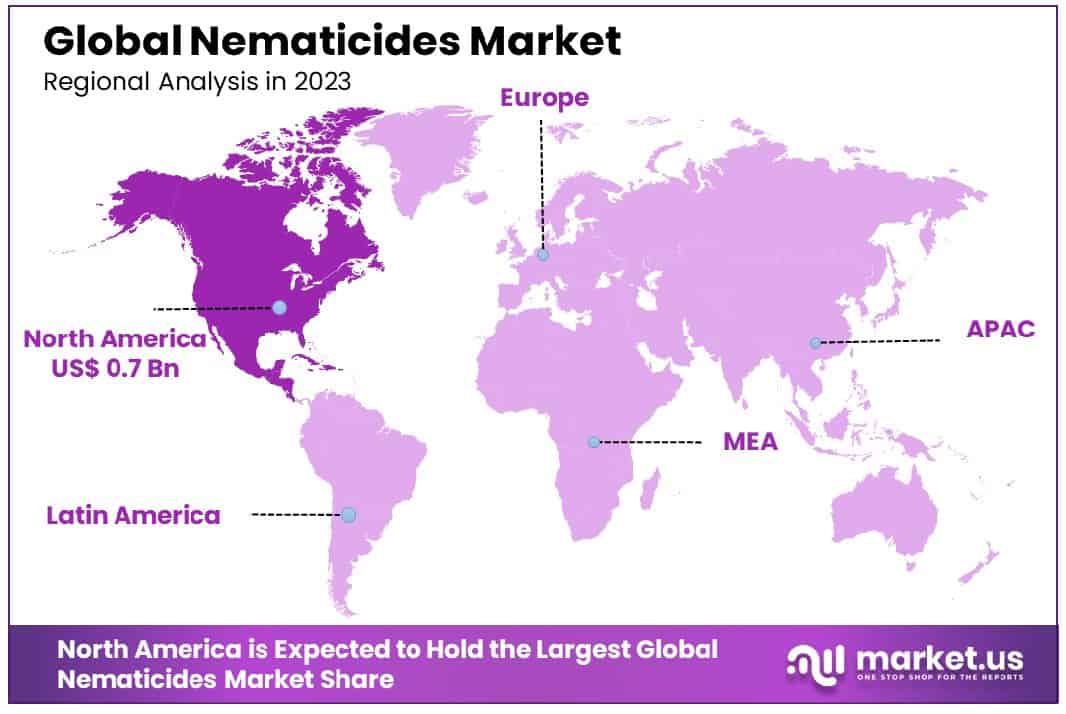

- Regional Dominance: In North America, the nematicides market grew by 34.6%, reaching USD 0.7 billion.

- Segmentation Insights:

- By Type: Fumigants dominate, comprising 62.4% of pest control methods in agriculture.

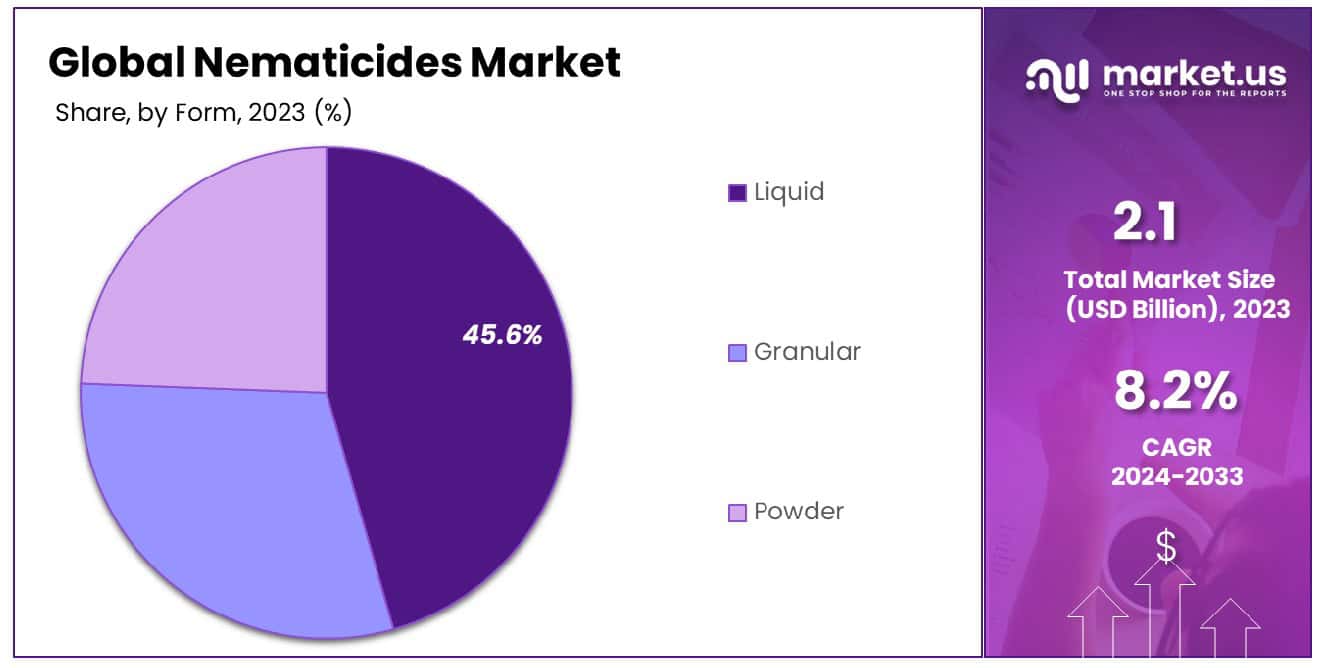

- By Form: Liquid form prevails, representing 45.6% of all pesticide formulations.

- By Application Method: Foliar spray is the preferred application method, constituting 40.3% of usage.

- By Nematode Species: Root-Knot Nematodes stand out as a prevalent nematode species.

- By Crop Type: Fruits & vegetables account for 48.4% of crops susceptible to nematodes.

- Growth Opportunities: The global nematicides market is experiencing a shift towards eco-friendly solutions driven by environmental concerns. Technological advancements in precision agriculture are enhancing efficiency and driving demand for innovative nematicide formulations.

Driving Factors

Expanding Agricultural Land Area Fuels Nematicides Market Growth

The expansion of global agricultural land area stands as a primary driver propelling the growth of the nematicides market. With the burgeoning demand for food production to sustain the ever-growing population, farmers are increasingly cultivating larger swathes of land.

This expansion, particularly in regions witnessing rapid urbanization and industrialization, necessitates enhanced pest management strategies to safeguard crop yields. As a result, the demand for nematicides, vital in mitigating nematode-induced crop damage, experiences a commensurate surge.

Rising Production of Primary Crops Boosts Nematicides Demand

The escalating production of primary crops worldwide significantly bolsters the nematicides market. As agricultural practices evolve to meet the demand for staple crops such as wheat, rice, corn, and soybeans, farmers encounter heightened risks posed by nematode infestations.

In response, they increasingly turn to nematicides to safeguard their crop yields and ensure optimal productivity. This surge in crop production, coupled with the need for effective pest management solutions, underpins the sustained growth of the nematicides market.

Increasing Awareness of Nematode-Induced Crop Damage Drives Market Expansion

The growing awareness of nematode-induced crop damage serves as a pivotal catalyst driving the expansion of the nematicides market. Agricultural stakeholders, including farmers, agronomists, and policymakers, are increasingly cognizant of the detrimental impact nematodes inflict on crop health and yield.

This heightened awareness underscores the critical importance of implementing proactive pest management strategies, including the utilization of nematicides, to mitigate losses and ensure sustainable agricultural practices. Consequently, as awareness continues to proliferate, the demand for nematicides is poised to witness robust growth, further buoying market expansion.

Restraining Factors

Regulatory Constraints Impede Growth of Chemical Nematicides Market

The presence of stringent regulatory constraints on chemical nematicides poses a significant impediment to the growth of the nematicides market. Regulatory bodies worldwide, in response to mounting environmental and health concerns, have implemented stringent regulations governing the use of chemical pesticides, including nematicides.

These regulations encompass stringent registration processes, usage restrictions, and permissible residue limits, thereby imposing substantial compliance burdens on manufacturers and users alike. As a result, the market for chemical nematicides faces challenges in terms of product innovation, market-entry, and overall growth potential, hindering its expansion.

Environmental Concerns Drive Shift Towards Sustainable Nematicides

The escalating environmental concerns associated with conventional nematicides drive a fundamental shift towards sustainable alternatives in the nematicides market. Conventional chemical nematicides, notorious for their adverse environmental impact, including soil contamination, water pollution, and harm to non-target organisms, increasingly face scrutiny from environmental activists, regulatory agencies, and consumers alike.

In response, agricultural stakeholders are actively seeking eco-friendly alternatives, such as biological nematicides, botanicals extract, and integrated pest management strategies, to mitigate environmental risks while effectively managing nematode populations.

This growing preference for sustainable nematicides not only addresses environmental concerns but also presents lucrative opportunities for market players to capitalize on the burgeoning demand for eco-friendly pest management solutions. Consequently, while regulatory constraints on chemical nematicides may hinder market growth, the shift towards environmentally sustainable alternatives fosters a paradigmatic evolution in the nematicides market, driving its long-term expansion and sustainability.

By Type Analysis

Fumigants dominate market share at 62.4%, suggesting prevalent use in agricultural pest control strategies worldwide.

In 2023, Fumigants held a dominant market position in the By Type segment of the Nematicides Market, capturing more than a 62.4% share. This notable dominance can be attributed to several factors, including their effectiveness in controlling nematode populations, broad spectrum of activity, and ease of application across various crops and soils. Agricultural Fumigants, such as methyl bromide and chloropicrin, have long been favored by farmers and agricultural professionals for their ability to penetrate the soil and target nematodes at various life stages.

Following Fumigants, Non-Fumigants emerged as the second-largest segment, comprising approximately 22.8% of the market share in 2023. Non-fumigant nematicides, including organophosphates and carbamates, offer an alternative approach to nematode management, often employed in integrated pest management (IPM) strategies to minimize environmental impact while maintaining efficacy.

Organophosphate nematicides accounted for a significant portion of the market, with a share of around 9.6%. These chemical compounds, such as ethoprophos and fosthiazate, inhibit the activity of acetylcholinesterase enzymes in nematodes, disrupting their nervous system function and ultimately leading to mortality.

Carbamate nematicides constituted approximately 4.9% of the market share in 2023. Products within this category, such as oxamyl and methomyl, act as acetylcholinesterase inhibitors similar to organophosphates but differ in their chemical structure and mode of action.

Lastly, Bio-based nematicides represented a smaller yet growing segment, comprising about 0.3% of the market share. With increasing consumer demand for sustainable and environmentally friendly agricultural practices, bio-based nematicides derived from natural sources, such as plant extracts and microbial agents, are gaining traction as viable alternatives to conventional chemical nematicides.

Overall, the By Type segment of the Nematicides Market in 2023 showcased a diverse range of products catering to the varied needs and preferences of farmers, while also reflecting a growing emphasis on sustainability and environmental stewardship within the agricultural industry.

By Form Analysis

Liquid formulations, comprising 45.6%, indicate a preference, possibly due to ease of application and efficacy.

In 2023, Liquid held a dominant market position in the By Form segment of the Nematicides Market, capturing more than a 45.6% share. This substantial dominance is indicative of the widespread preference for liquid formulations among farmers and agricultural professionals due to their ease of application, uniform coverage, and rapid absorption into the soil, thereby ensuring efficient nematode control.

Following Liquid, Granular formulations emerged as the second-largest segment, constituting approximately 35.2% of the market share in 2023. Granular nematicides offer distinct advantages, particularly in situations where targeted application is required or when treating specific areas with known nematode infestations. Additionally, granular formulations provide long-lasting residual activity, offering prolonged protection against nematode damage.

Powder formulations represented a smaller yet significant segment, comprising about 19.2% of the market share in 2023. Powdered nematicides are valued for their versatility and ease of storage and transportation. They can be easily mixed with water to create liquid solutions or incorporated into granular formulations, providing flexibility in application methods to suit varying agricultural practices and preferences.

Overall, the By Form segment of the Nematicides Market in 2023 demonstrated a diversified product landscape, with Liquid formulations leading the market due to their convenience and efficacy in nematode management. Granular and Powder formulations, while comprising smaller shares, offer distinct advantages and cater to specific application needs, contributing to the overall growth and dynamism of the nematicides industry.

By Application Method Analysis

Foliar spray, at 40.3%, emerges as the primary application method, ensuring direct pest management on plant surfaces.

In 2023, Foliar Spray held a dominant market position in the By Application Method segment of the nematodes market, capturing more than a 40.3% share. This significant market share underscores the widespread adoption of foliar spray applications among farmers and agricultural professionals for nematode management. Foliar spraying involves the direct application of nematicides onto the foliage of plants, enabling efficient uptake and systemic distribution within the plant tissues, thereby providing targeted protection against nematode infestations.

Following Foliar Spray, Seed Treatment emerged as the second-largest segment, comprising approximately 32.7% of the market share in 2023. Seed treatment methods involve coating seeds with nematicide formulations before planting, thereby providing early protection against nematode damage during the germination and early growth stages. This approach is favored for its efficacy, convenience, and ability to integrate seamlessly into existing planting practices.

Fumigation represented another significant segment, constituting around 20.5% of the market share in 2023. Fumigation involves the application of nematicides in gaseous form to soil or enclosed spaces, effectively targeting nematodes residing in the soil profile. While fumigation is highly effective in nematode control, it requires specialized equipment and expertise, making it less accessible to some farmers and restricted to specific cropping systems.

Irrigation, though comprising a smaller share, accounted for approximately 6.5% of the market in 2023. Irrigation-based application methods involve the incorporation of nematicides into irrigation water, delivering uniform distribution throughout the root zone to combat nematodes. This approach is particularly suited for crops grown in irrigated systems, offering continuous protection against nematode infestations throughout the growing season.

Overall, the By Application Method segment of the Nematicides Market in 2023 showcased a diverse array of application techniques, with Foliar Spray emerging as the preferred method among farmers, followed by Seed Treatment, Fumigation, and Irrigation, each offering distinct advantages in nematode management based on crop type, growing conditions, and operational considerations.

By Nematode Species Analysis

Root-Knot Nematodes stand out as a significant nematode species, potentially posing challenges to crop health and yield.

In 2023, Root-Knot Nematodes held a dominant market position in the By Nematode Species segment of the Nematicides Market. Root-Knot Nematodes, notorious for their detrimental effects on various crops, have spurred the demand for effective nematicides worldwide. These microscopic pests infest the root systems of plants, causing swellings or “galls,” which impede nutrient uptake and water absorption, ultimately leading to reduced crop yields and economic losses for farmers.

The dominance of Root-Knot Nematodes in this segment can be attributed to their wide-ranging host plant susceptibility and their ability to thrive in diverse soil conditions, making them a formidable challenge for agricultural producers across different regions. Consequently, the demand for nematicides tailored specifically to combat Root-Knot Nematodes has surged, driving market growth in this segment.

While Root-Knot Nematodes reign supreme, other nematode species also contribute significantly to the nematicides market. Cyst Nematodes, known for their cyst-like structures formed within plant roots, and Lesion Nematodes, which cause necrotic lesions in roots, represent notable segments within the market. Additionally, other nematode species, though less prevalent, contribute to the overall demand for nematicides, highlighting the comprehensive nature of pest management strategies employed by agricultural stakeholders.

As agricultural practices continue to evolve and environmental concerns shape pest management approaches, the Nematicides Market remains dynamic. The dominance of Root-Knot Nematodes underscores the urgent need for innovative nematicide solutions to mitigate crop losses and ensure global food security. Consequently, stakeholders in the agricultural sector are actively seeking efficacious and environmentally sustainable nematicides to combat nematode infestations and safeguard crop productivity.

By Crop Type Analysis

Fruits & Vegetable cultivation, accounting for 48.4%, underscores the critical role of pest management in safeguarding yield quality.

In 2023, Fruits & Vegetables held a dominant market position in the Crop Type segment of the Nematicides Market, capturing more than a 48.4% share. This substantial market share reflects the significant demand for nematicides in the cultivation of fruits and vegetables, where nematode infestations can cause substantial yield losses and quality degradation. Farmers and growers in the fruits and vegetable segment prioritize effective nematode management strategies to ensure the productivity and marketability of their crops.

Following Fruits & Vegetables, Cereals & Grains emerged as the second-largest segment, constituting approximately 29.6% of the market share in 2023. Nematode damage in cereals and grains, such as wheat, corn, and rice, can lead to reduced yields and compromised grain quality, making nematode control essential for optimizing production and profitability in these staple crops.

Oilseeds & Pulses represented another significant segment, comprising around 18.3% of the market share in 2023. Nematodes pose a significant threat to oilseed and pulse crops, including soybeans, peanuts, and lentils, impacting both yield quantity and oil or protein content. Effective nematode management practices are critical for sustaining the productivity and profitability of oilseed and pulse production systems.

The “Others” category encompassed a smaller yet noteworthy share of approximately 3.7% in 2023. This segment includes crops such as forages, specialty crops, and ornamentals, each facing unique nematode challenges and requiring tailored management approaches to mitigate yield losses and ensure crop health.

Overall, the By Crop Type segment of the Nematicides Market in 2023 highlighted the diverse range of crops requiring nematode management solutions, with Fruits & Vegetables dominating the market due to their susceptibility to nematode damage and the high value placed on quality and yield in these crops. Cereals & Grains, Oilseeds & Pulses, and Other crops also demonstrated significant demand for nematode control products, reflecting the widespread impact of nematode infestations across diverse agricultural systems.

Key Market Segments

By Type

- Fumigants

- Non-Fumigants

- Organophosphate

- Carbamate

- Bio-based

By Form

- Liquid

- Granular

- Powder

By Application Method

- Fumigation

- Irrigation

- Foliar Spray

- Seed Treatment

By Nematode Species

- Root-Knot Nematodes

- Cyst Nematodes

- Lesion Nematodes

- Other

By Crop Type

- Fruits & Vegetable

- Cereals & Grains

- Oilseeds & Pulses

- Others

Growth Opportunities

Rising Demand for Eco-Friendly and Sustainable Nematicide Solutions

Against the backdrop of escalating environmental concerns and stringent regulations, the global nematicides market witnessed a notable shift towards eco-friendly and sustainable solutions in 2023. This trend is primarily fueled by increasing awareness among farmers about the adverse effects of conventional chemical nematicides on soil health and ecosystem balance.

Consequently, stakeholders in the agricultural sector are embracing bio-based and organic nematicides as viable alternatives. The growth of the market can be attributed to the expanding portfolio of eco-friendly nematicide products, coupled with rising adoption rates across various agricultural regions worldwide.

Technological Advancements in Precision Agriculture

The integration of advanced technologies, particularly in precision agriculture, played a pivotal role in driving growth opportunities for the global nematicides market in 2023. Innovations such as precision application systems, sensor-based monitoring, and drone technology have revolutionized nematicide application methods, enabling farmers to optimize resource utilization and minimize environmental impact.

Furthermore, the advent of digital farming platforms equipped with data analytics capabilities has empowered growers to make informed decisions regarding nematicide usage, enhancing efficacy and productivity. As a result, the market witnessed a surge in demand for technologically advanced nematicide formulations tailored to meet the specific needs of modern farming practices.

Looking ahead, continued investments in research and development are expected to further propel the market growth, offering promising prospects for stakeholders across the agricultural value chain.

Latest Trends

Shift towards Natural and Bio-Based Nematicides

The global nematicides market experienced a significant shift towards natural and bio-based solutions in 2023, driven by escalating environmental concerns and increasing consumer demand for sustainable agricultural practices. This trend reflects a growing preference among farmers for alternatives to conventional chemical nematicides, which are known to have adverse effects on soil health and ecosystem balance.

As a result, market players have intensified their efforts to develop and commercialize eco-friendly nematicide formulations derived from natural sources such as plant extracts, microbial agents, and organic compounds. The rising adoption of these bio-based alternatives signifies a paradigmatic transition towards environmentally responsible pest management practices, presenting lucrative growth opportunities for stakeholders in the global nematicides market.

Integration of Digital Technologies for Real-Time Pest Management

In 2023, the global nematicides market witnessed a notable trend towards the integration of digital technologies for real-time pest management, aimed at enhancing efficacy, precision, and sustainability in agricultural practices. Leveraging advancements in precision agriculture and data analytics, farmers are increasingly adopting digital tools and platforms to monitor and manage nematode infestations with unprecedented accuracy and efficiency.

From sensor-based monitoring systems to drone-enabled aerial surveillance, these digital solutions enable farmers to identify pest hotspots, optimize nematicide application rates, and mitigate risks proactively. Moreover, the integration of artificial intelligence and machine learning algorithms allows for predictive modeling of nematode outbreaks, empowering growers to implement preventive measures in a timely manner.

As such, the incorporation of digital technologies in pest management signifies a transformative trend in the global nematicides market, promising enhanced productivity, sustainability, and profitability for agricultural stakeholders in the years to come.

Regional Analysis

In North America, the nematicides market witnessed a robust growth of 34.6%, reaching a value of USD 0.7 billion.

The nematicides market exhibits a diversified landscape across key regions including North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

In North America, the market commands a significant share, accounting for 34.6% of the global market, with a valuation of USD 0.7 billion. The dominance of North America in the nematicides market can be attributed to the extensive adoption of advanced agricultural practices, coupled with the presence of prominent market players. Additionally, the region benefits from robust government support and initiatives aimed at enhancing agricultural productivity.

Moving to Europe, the market demonstrates steady growth, driven by increasing awareness regarding the detrimental impact of nematodes on crop yields. Europe is characterized by stringent regulations pertaining to pesticide usage, which has stimulated the demand for environmentally friendly nematicides. The region also witnesses substantial investments in research and development activities to introduce innovative solutions, further fueling market expansion.

In the Asia Pacific, the nematicides market is poised for exponential growth, propelled by escalating demand for high-quality crops amidst a burgeoning population and changing dietary preferences. Countries like China and India emerge as key contributors to market proliferation, driven by rapid urbanization and modernization of agricultural practices. Moreover, supportive government policies aimed at enhancing agricultural productivity and mitigating crop losses due to nematodes bolster market prospects in the region.

The Middle East & Africa and Latin America regions present lucrative opportunities for market players, owing to the increasing focus on agricultural intensification and sustainable farming practices. These regions are witnessing a growing adoption of nematicides to address the escalating threat posed by nematodes to crop production. However, market growth may face certain constraints due to challenges related to regulatory frameworks and limited awareness among farmers.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

Key Players Analysis

In 2023, the global nematicides market witnessed a dynamic landscape, characterized by the strategic maneuvers and competitive prowess of key industry players. Among the stalwarts shaping the trajectory of this market, Bayer CropScience AG emerges as a pivotal figure, wielding significant influence and commanding attention within the sector.

Bayer CropScience AG, renowned for its commitment to innovation and sustainability, stands as a beacon of excellence in the field of agrochemicals. Leveraging its formidable research and development capabilities, the company continues to introduce cutting-edge nematicide formulations that not only deliver superior efficacy but also align with stringent environmental standards. Through strategic partnerships and alliances, Bayer CropScience AG reinforces its market position, fostering collaborations aimed at enhancing product efficacy and expanding market reach.

Furthermore, the company’s robust distribution network and global presence afford it a competitive edge, enabling widespread accessibility of its nematicide portfolio to farmers worldwide. Bayer CropScience AG’s emphasis on customer-centric solutions, coupled with its proactive approach to addressing emerging challenges in pest management, further solidifies its standing as a frontrunner in the global nematicides market.

As the industry continues to navigate evolving regulatory landscapes and sustainability imperatives, Bayer CropScience AG remains at the vanguard of innovation, poised to drive sustainable agricultural practices and shape the future of crop protection. In the competitive arena of the global nematicides market, Bayer CropScience AG stands as an exemplar of excellence, poised to steer the industry toward greater resilience, efficiency, and environmental stewardship.

Market Key Players

- Bayer CropScience AG

- BASF SE

- The Dow Chemical Company

- Syngenta

- FMC Corporation

- Sumitomo Chemical Co., Ltd.

- Monsanto Company

- Isagro S.P.A

- Corteva Agriscience

- UPL

- American Vanguard Corporation

- Nufarm

- Adama Agricultural Solutions Ltd.

- DowDuPont

Recent Development

- In February 2024, Corteva Agriscience launched Salibro nematicide in India, utilizing Reklemel Active to combat nematodes while preserving soil health. The innovation underscores Corteva’s commitment to sustainable agriculture and advancing Indian farming.

- In December 2023, Syngenta launched CERTANO, a microbiological bionematicide for sugarcane in Brazil, combating nematodes and diseases. Bacillus velezensis-based, it offers bio fungicide and growth-promoting action, addressing losses and enhancing crop longevity.

Report Scope

Report Features Description Market Value (2023) USD 2.1 Billion Forecast Revenue (2033) USD 4.6 Billion CAGR (2024-2033) 8.2% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Fumigants, Non-Fumigants, Organophosphate, Carbamate, Bio-based), By Form (Liquid, Granular, Powder), By Application Method(Fumigation, Irrigation, Foliar Spray, Seed Treatment), By Nematode Species(Root-Knot Nematodes, Cyst Nematodes, Lesion Nematodes, Other), By Crop Type(Fruits & Vegetable, Cereals & Grains, Oilseeds & Pulses, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Bayer CropScience AG, BASF SE, The Dow Chemical Company, Syngenta, FMC Corporation, Sumitomo Chemical Co., Ltd., Monsanto Company, Isagro S.P.A, Corteva Agriscience, UPL, American Vanguard Corporation, Nufarm, Adama Agricultural Solutions Ltd., DowDuPont Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Nematicides Market Size in 2023?The Global Nematicides Market Size is USD 2.1 Billion in 2023.

What is the projected CAGR at which the Global Nematicides Market is expected to grow at?The Global Nematicides Market is expected to grow at a CAGR of 8.2% (2024-2033).

List the segments encompassed in this report on the Global Nematicides Market?Market.US has segmented the Global Nematicides Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type(Fumigants, Non-Fumigants, Organophosphate, Carbamate, Bio-based), By Form(Liquid, Granular, Powder), By Application Method(Fumigation, Irrigation, Foliar Spray, Seed Treatment), By Nematode Species(Root-Knot Nematodes, Cyst Nematodes, Lesion Nematodes, Other), By Crop Type(Fruits & Vegetable, Cereals & Grains, Oilseeds & Pulses, Others)

List the key industry players of the Global Nematicides Market?Bayer CropScience AG, BASF SE, The Dow Chemical Company, Syngenta, FMC Corporation, Sumitomo Chemical Co., Ltd., Monsanto Company, Isagro S.P.A, Corteva Agriscience, UPL, American Vanguard Corporation, Nufarm, Adama Agricultural Solutions Ltd., CHR Hansen, DowDuPont

Name the key areas of business for Global Nematicides Market?The US, Canada, Mexico are leading key areas of operation for Global Nematicides Market.

- Market Growth: The Global Nematicides Market size is expected to be worth around USD 4.6 Billion by 2033, From USD 2.1 Billion by 2023, growing at a CAGR of 8.2% during the forecast period from 2024 to 2033.

-

-

- Bayer CropScience AG

- BASF SE

- The Dow Chemical Company

- Syngenta

- FMC Corporation

- Sumitomo Chemical Co., Ltd.

- Monsanto Company

- Isagro S.P.A

- Corteva Agriscience

- UPL

- American Vanguard Corporation

- Nufarm

- Adama Agricultural Solutions Ltd.

- DowDuPont