Global Natural Language Processing Market Size, Share, Trends Analysis Report By Type (Statistical NLP, Rule Based NLP, and Hybrid NLP), By Component (Solution and Services), By Deployment (On-Premises and Cloud), By Application (Automatic Summarization, Content Management, Language Scoring, Sentiment Analysis, Data Extraction, Risk and Threat Detection, Others Applications), By Enterprise Size (Small and Medium-sized Enterprises (SMEs) and Large Enterprises), By Industry Vertical (Healthcare, Retail, High Tech and Telecom, BFSI, Automotive & Transportation, Advertising & Media, Manufacturing, Other Industry Verticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Nov. 2024

- Report ID: 16744

- Number of Pages: 369

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Type Analysis

- By Component Analysis

- By Deployment Analysis

- By Application Analysis

- By Enterprise Size Analysis

- By Industrial Vertical Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Top Use Cases

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

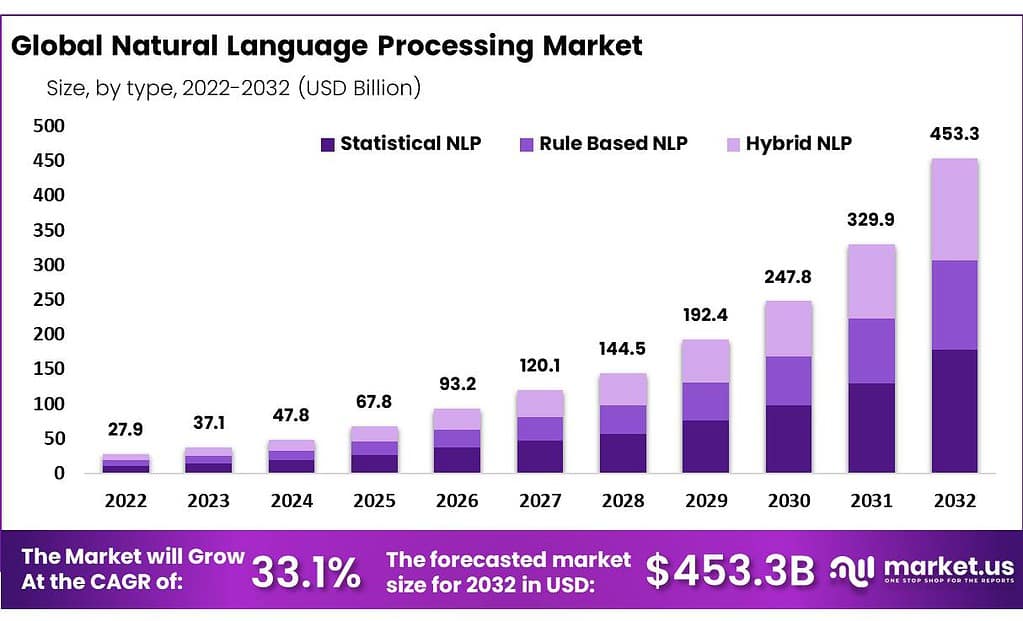

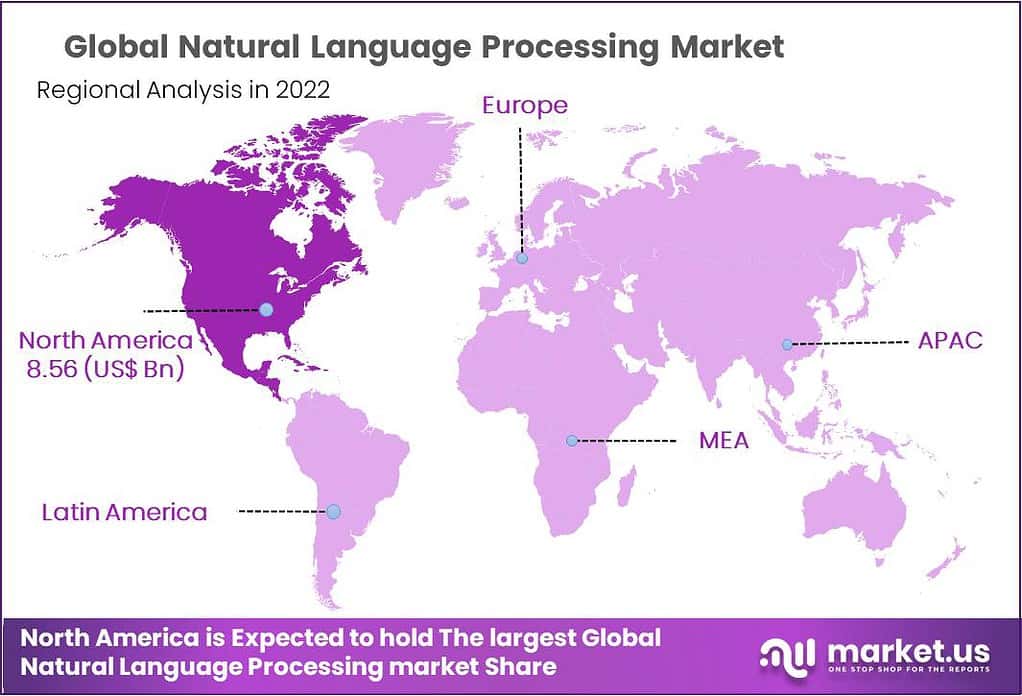

The Global Natural Language Processing Market size is expected to be worth around USD 453.3 Billion by 2032, from USD 37.1 Billion in 2023, growing at a CAGR of 33.1% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 30.7% share, holding USD 8.56 Billion revenue.

Natural Language Processing (NLP) is a branch of artificial intelligence that enables computers to understand, interpret, and generate human language. It involves the interaction between machines and humans using natural language, with a primary focus on enabling machines to process large amounts of language data. NLP techniques are applied in various domains such as speech recognition, language translation, sentiment analysis, and chatbots.

The NLP market is experiencing robust growth, with projections suggesting a continued expansion due to the increasing adoption of NLP technologies across various sectors. This market growth is largely driven by the need for better data handling capabilities to manage the surge in unstructured data, such as text and voice, generated from numerous digital sources. Companies are investing in NLP to enhance their customer experience, streamline operations, and gain insights from data that was previously inaccessible or unusable.

The demand for Natural Language Processing (NLP) is primarily driven by the increasing reliance on AI-based solutions for improving communication between humans and machines. Businesses are increasingly adopting NLP for applications such as sentiment analysis, chatbots, virtual assistants, and automated customer support, which streamline operations and enhance user experience.

The rise in the use of voice-activated systems, along with the expansion of digital platforms, has further elevated the need for NLP solutions. Industries such as healthcare, finance, and retail are increasingly leveraging NLP to analyze large volumes of unstructured data, thus improving decision-making processes and operational efficiency.

Several factors contribute to the growth of the NLP market. Technological advancements in machine learning and artificial intelligence are the primary drivers, as they enhance the accuracy and capabilities of NLP systems. The exponential increase in data generation from digital sources provides a vast corpus from which machine learning models can learn and improve.

Additionally, the integration of NLP with other technologies like voice recognition and AI-driven analytics is expanding its application range, fostering further growth. Moreover, the increased adoption of cloud-based NLP solutions offers scalability and ease of integration, appealing to a broader range of businesses, from startups to large enterprises.

The NLP market is ripe with opportunities, particularly in developing regions where digital transformation initiatives are accelerating. There is also a significant opportunity in refining NLP applications for languages that are currently underrepresented in digital products, expanding the market reach. Another promising area is the integration of NLP with emerging technologies such as the Internet of Things (IoT) and wearable tech, where NLP can facilitate more natural interactions between humans and machines.

Furthermore, as the regulatory landscape evolves, there will be opportunities for NLP to play a crucial role in compliance monitoring and enforcement, particularly in highly regulated industries like finance and healthcare. As NLP technologies continue to mature, they offer substantial potential for creating more personalized and engaging user experiences across multiple platforms.

For instance, AlphaSense has secured $225 million in its latest funding round, elevating its valuation to $1.7 billion. This capital injection will be allocated towards product development, content expansion, and enhanced customer support, signaling a robust growth trajectory within the Natural Language Processing (NLP) sector.

Key Takeaways

- The Global Natural Language Processing (NLP) Market is projected to grow significantly, reaching USD 453.3 billion by 2032, from USD 37.1 billion in 2023, representing a compound annual growth rate (CAGR) of 33.1% over the forecast period from 2024 to 2033.

- In 2022, the Statistical NLP segment held a dominant position in the market, accounting for over 39.3% of the global NLP market share.

- Similarly, the Solution segment led the market with a share exceeding 72.6% during the same year.

- The On-Premises segment captured a significant share in 2022, further underscoring the demand for secure and internally managed NLP solutions.

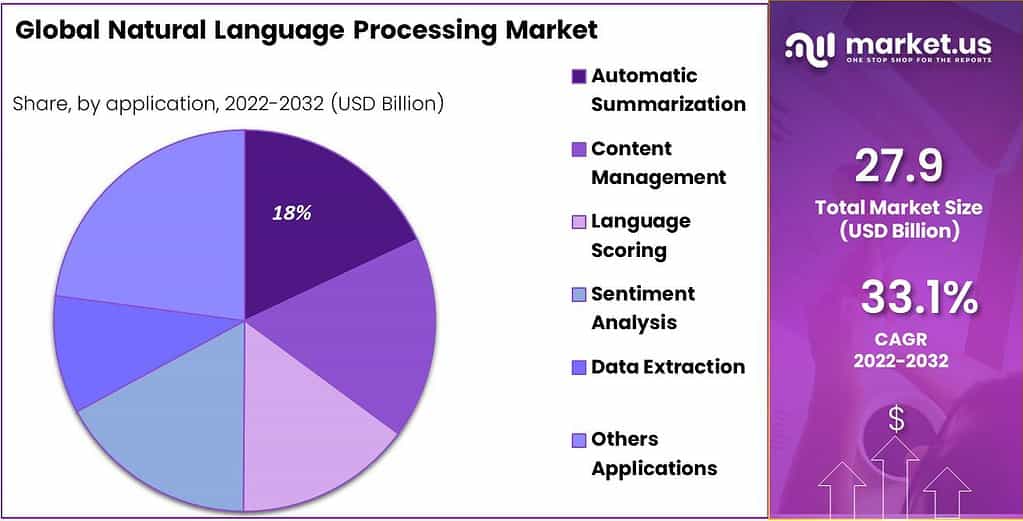

- Additionally, the Automatic Summarization segment maintained a strong foothold in 2022, with a market share surpassing 18%.

- The large enterprises segment led the market with more than 62.1% of the overall market share in 2022, reflecting the increasing adoption of NLP technologies by major corporations.

- Furthermore, the healthcare sector emerged as a key application area, contributing over 23.1% of the market share in 2022, driven by the growing need for efficient data processing and analysis in healthcare settings.

By Type Analysis

In 2022, the Statistical NLP segment held a dominant market position, capturing more than a 39.3% share of the global Natural Language Processing (NLP) market. This leadership can be primarily attributed to the efficacy of statistical methods in deriving meaning from vast datasets, a crucial factor in the deployment of NLP across various applications such as voice-operated GPS systems, customer service chatbots, and personal virtual assistants.

The robustness of statistical approaches, which utilize algorithms to discern patterns and make predictions based on data history, ensures a broad applicability, driving demand and integration in sectors requiring reliable text interpretation and automated response systems. Statistical NLP’s prominence is further bolstered by its maturity relative to other types.

It has been refined over decades, leading to a wealth of research and a solid foundation of resources that facilitate ongoing advancements and the swift implementation of solutions across diverse industries. This long-standing development translates to greater stability and accuracy in performance, qualities highly valued in industries like finance and healthcare, where the cost of errors can be exceedingly high. As organizations continue to prioritize data-driven decision-making, the precision offered by statistical NLP makes it an indispensable tool.

Moreover, the adaptability of statistical NLP models enables them to manage and make sense of unstructured data at scale. This capability is particularly crucial in the age of big data, where enterprises are inundated with vast amounts of information daily. The ability of statistical NLP to efficiently process and analyze this data supports enhanced business intelligence and analytics, leading to more informed decision-making and strategic planning.

By Component Analysis

In 2022, the Solution segment held a dominant market position within the Natural Language Processing (NLP) market, capturing more than a 72.6% share. This substantial market share is largely due to the increasing adoption of NLP solutions across various sectors that seek to enhance their operational efficiencies and customer engagement through advanced language understanding technologies.

NLP solutions, which include tools for content categorization, topic discovery, sentiment analysis, and machine translation, are integral to automating and optimizing communication tasks, thereby reducing the need for manual intervention and accelerating response times. The ascendancy of the Solution segment is further supported by the continuous advancements in machine learning and artificial intelligence, which have significantly improved the accuracy and speed of NLP applications.

As businesses and organizations generate and handle increasing volumes of textual data, the demand for sophisticated NLP solutions that can analyze, interpret, and derive insights from such data has surged. These solutions are not only pivotal in managing large datasets but also crucial in extracting valuable information that supports strategic decision-making processes.

Additionally, the integration of NLP solutions into customer service platforms, such as chatbots and virtual assistants, underscores the segment’s growth. By leveraging NLP, companies can offer more human-like and efficient customer service, enhancing the overall user experience and satisfaction. This application is particularly transformative in industries such as e-commerce, banking, and healthcare, where understanding and processing customer inquiries accurately and swiftly is crucial.

By Deployment Analysis

In 2022, the On-Premises segment held a dominant market position within the Natural Language Processing (NLP) market, capturing a significant share. This prominence is attributed to the heightened security and control that on-premises solutions offer to organizations, particularly those in sectors like finance, healthcare, and government where data sensitivity is paramount.

Companies favor on-premises deployment as it allows them to maintain strict oversight over their NLP infrastructures and data storage, ensuring compliance with industry-specific regulations and standards. The preference for on-premises NLP solutions is also driven by the demand for customized solutions that are tightly integrated into existing IT infrastructures.

Organizations opt for on-premises systems when they require bespoke modifications and high-performance capabilities tailored specifically to their operational needs. This approach facilitates the optimization of NLP applications in sync with specific business processes, enhancing overall efficiency and effectiveness in operations such as data handling, customer service, and decision-making support.

Furthermore, despite the growing trend towards cloud services, the on-premises model continues to be favored due to concerns over data latency and the need for continuous and reliable performance. On-premises deployment can offer faster data processing speeds as the hardware resources are dedicated solely to one organization, reducing the potential for delays that might affect real-time data analysis and decision-making processes essential in fast-paced industries.

By Application Analysis

In 2022, the Automatic Summarization segment held a dominant market position within the Natural Language Processing (NLP) market, capturing a considerable share. This leadership stems from the escalating demand for tools that can quickly condense extensive texts into succinct summaries, facilitating efficient information processing and decision-making in businesses.

Automatic summarization tools are indispensable in sectors such as media, legal, and academic research, where professionals often need to derive key insights from large volumes of documents swiftly. The robust growth of this segment is further supported by advancements in AI and machine learning technologies, which have enhanced the accuracy and relevance of automated summaries.

As the volume of digital content continues to explode, the ability to automatically generate precise and contextually accurate summaries from diverse text sources such as news articles, research papers, and corporate documents becomes increasingly vital. This capability not only saves time but also improves the accessibility and usability of information, enabling organizations to remain agile and informed in a rapidly changing environment.

Moreover, the integration of automatic summarization within other IT systems and applications amplifies its impact across various business operations. For instance, integrating NLP-driven summarization into content management systems or customer relationship management (CRM) platforms allows for real-time processing of customer interactions and feedback, streamlining content strategy and customer service processes. This strategic application in operational workflows highlights the segment’s utility in enhancing organizational productivity and responsiveness.

By Enterprise Size Analysis

In 2022, the large enterprises segment held a dominant position in the Natural Language Processing (NLP) market, capturing more than a 62.1% share. This prominence can be attributed to several key factors that align with the operational needs and technological capabilities of large-scale organizations.

Primarily, large enterprises have the capital to invest in advanced NLP technologies which are often costly due to their complex algorithms and the need for extensive data processing capabilities. This investment enables these organizations to leverage NLP for enhancing customer experience, optimizing business processes, and gaining valuable insights from large volumes of data.

Moreover, large enterprises often operate in multiple markets and must handle diverse data sets in various languages and formats, driving the adoption of robust NLP solutions that can scale according to varying demands and complexities. The integration of NLP allows these organizations to automate and streamline communication channels, such as customer service bots and internal data management systems, thus improving efficiency and productivity.

The ability to quickly analyze and respond to consumer sentiments and market trends also provides these enterprises a competitive edge in rapidly changing industries. The demand within large enterprises for NLP technologies is also bolstered by their need to comply with regulatory requirements across different regions, which necessitates sophisticated tools capable of managing and analyzing large volumes of sensitive data securely and efficiently.

As such, the continuous advancements in AI and machine learning, coupled with the increasing availability of customizable NLP solutions that can cater to specific business needs, ensure that large enterprises not only continue to dominate the NLP market but are also primed to expand their utilization of these technologies.

By Industrial Vertical Analysis

In 2022, the healthcare segment held a dominant market position in the Natural Language Processing (NLP) market, capturing more than a 23.1% share. This significant market share is largely driven by the escalating demand for improved patient care and the need for healthcare organizations to optimize operational efficiency.

NLP technologies are increasingly utilized in the healthcare sector to extract meaningful information from unstructured data sources such as clinical notes, research articles, and patient feedback, facilitating more informed decision-making and personalized patient care.

The integration of NLP in healthcare not only enhances clinical decision support systems but also aids in managing vast amounts of data related to patient care management, thus reducing errors and improving treatment outcomes. Moreover, NLP applications such as chatbots and virtual health assistants have become essential in managing patient interactions, scheduling, and providing continuous patient support without the need for constant human intervention, thereby increasing accessibility and efficiency.

Additionally, the adoption of NLP in healthcare is further spurred by the ongoing digital transformation in the sector, which emphasizes data-driven strategies to tackle complex healthcare challenges, including epidemic tracking, therapy development, and personalized medicine. The technology’s ability to analyze and interpret complex medical vernacular and texts quickly and accurately helps in expediting research and diagnostics, making it a critical tool in the healthcare industry’s ongoing efforts to innovate and improve patient outcomes.

Key Market Segments

By Type

- Statistical NLP

- Rule Based NLP

- Hybrid NLP

By Component

- Solution

- Services

By Deployment

- On-Premises

- Cloud

By Application

- Automatic Summarization

- Content Management

- Language Scoring

- Sentiment Analysis

- Data Extraction

- Risk and Threat Detection

- Others Applications

By Enterprise Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By Industry Vertical

- Healthcare

- Retail

- High Tech and Telecom

- BFSI

- Automotive & Transportation

- Advertising & Media

- Manufacturing

- Other Industry Verticals

Driver

Expanding AI Implementation Across Industries

The significant expansion of artificial intelligence (AI) technologies across various industries is a primary driver of growth in the Natural Language Processing (NLP) market. Industries are increasingly adopting NLP to enhance customer experience and streamline business operations.

Major tech companies continue to invest heavily in AI to leverage its potential in improving efficiency and innovation, which directly benefits NLP by enhancing its capabilities and integration into more complex systems. This trend is observed not only in technology-oriented sectors but also broadly across fields such as healthcare, financial services, and customer service, where NLP applications are becoming vital for operational efficiency and competitive advantage.

Restraint

Shortage of Skilled Professionals

One of the main restraints in the NLP market is the acute shortage of skilled professionals who can develop, implement, and maintain NLP systems. The field of NLP requires specialized knowledge in both linguistics and computer science, and the gap between the demand for such expertise and the available workforce is widening.

This shortage is slowing down the potential scale and speed of NLP technology deployment across sectors, impacting companies that could benefit from its application but find the technological intricacies challenging to navigate without expert help.

Opportunity

Advancement in Machine Learning and AI

There is significant opportunity in the integration of advanced machine learning and deep learning techniques with NLP solutions. As AI technology evolves, so does the capability of NLP systems to perform more complex tasks such as sentiment analysis, automated summarization, and real-time translation with higher accuracy and efficiency.

These advancements present substantial growth opportunities for businesses to adopt NLP to gain insights from unstructured data, automate responses, and improve decision-making processes. The continuous improvements in AI will likely drive further innovations in NLP, making it more accessible and effective for various applications.

Challenge

Handling Multilingual Content and Contextual Nuances

A significant challenge facing the NLP market is the complexity involved in processing and understanding multilingual content and contextual nuances. NLP systems often struggle with languages that have less available training data or are structurally different from those most commonly used in AI training sets.

Additionally, interpreting context, sarcasm, and implied meanings in text remains a complex hurdle. These linguistic challenges require ongoing research and sophisticated model training, which can be resource-intensive and technically demanding.

Growth Factors

The Natural Language Processing (NLP) market is experiencing robust growth due to several key factors. One significant driver is the increasing implementation of AI and machine learning across various industries, aiming to enhance efficiency and innovation.

These technologies improve the capabilities of NLP systems, enabling them to handle complex tasks like real-time customer service interactions and large-scale data analysis more effectively. The surge in data generation across sectors necessitates sophisticated tools for data processing and analysis, further propelling NLP adoption.

Emerging Trends

Several emerging trends are shaping the NLP landscape. Advances in machine translation are enhancing its accuracy and making it more contextually relevant, which helps break down language barriers and facilitates global communication. Additionally, the development of domain-specific NLP solutions tailored to industries like finance, law, and healthcare is gaining traction.

These solutions are designed to meet unique industry requirements, offering more precise and efficient processing of relevant textual data. Another notable trend is the enhancement of document summarization and information retrieval techniques, which are becoming increasingly sophisticated, aiding sectors such as research and legal in accessing and processing information more efficiently.

Top Use Cases

NLP technologies are widely applied in several key areas. Customer service enhancements through chatbots and virtual assistants are one of the primary use cases, where NLP helps in automating responses and improving customer interactions. In the healthcare sector, NLP facilitates the extraction of insights from medical records and literature, enhancing diagnostic processes and patient management.

Other significant applications include sentiment analysis for market research and brand monitoring, and automated translation services that support global business operations. The integration of NLP in these areas not only streamlines operations but also enhances decision-making capabilities across various business functions.

Regional Analysis

In 2022, North America held a dominant market position in the Natural Language Processing (NLP) market, capturing over 30.7% market share and generating approximately USD 8.56 billion in revenue. This region’s leadership in NLP can be attributed to several key factors, primarily driven by rapid advancements in AI technologies, a strong presence of major tech companies, and increasing demand for NLP applications across diverse industries.

The United States, in particular, has been at the forefront of NLP innovation, largely due to the high concentration of AI and machine learning research and development hubs. Companies such as Google, Microsoft, and IBM, which are headquartered in the region, have invested heavily in NLP research. Their extensive resources and talent pools have accelerated breakthroughs in natural language understanding and processing, making North America a leader in this field.

Furthermore, the region’s robust demand for NLP technologies stems from its early adoption across key industries such as healthcare, finance, and retail. In healthcare, for instance, NLP is being used for predictive diagnostics and patient data analysis, while in the finance sector, it is critical for fraud detection, sentiment analysis, and customer service automation. These industries, characterized by their vast amounts of unstructured data, are leveraging NLP to enhance operational efficiency and improve decision-making processes.

The regulatory environment in North America has also played a role in supporting NLP growth. Government initiatives promoting AI adoption and data-driven solutions, along with significant venture capital investments, have fueled market expansion. As a result, North America continues to lead globally, outpacing other regions in terms of both revenue and technological advancements in the NLP sector.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Natural Language Processing (NLP) market is highly competitive, with several key players driving innovation and expanding market reach. Among the top companies, Google Inc., IBM Corporation, and Microsoft Corporation stand out as leaders in the NLP space. These companies have made significant investments in research and development, leading to advancements in AI-powered language processing technologies.

Google Inc. has been a major force in NLP, leveraging its deep learning models, such as BERT and Transformer architecture, to improve search algorithms and voice assistants like Google Assistant. With a strong focus on natural language understanding, Google has integrated NLP across its platforms, making it a core part of its ecosystem.

IBM Corporation is another key player, particularly through its IBM Watson platform, which has been a pioneer in applying NLP to business solutions. IBM Watson’s NLP capabilities are widely used in healthcare, finance, and customer service, offering tailored solutions for sentiment analysis, language translation, and document classification.

Microsoft Corporation, through its Azure Cognitive Services and Microsoft Cortana, has made significant strides in NLP by enabling businesses to incorporate language understanding and speech recognition into their applications. Microsoft’s robust cloud infrastructure supports scalable NLP services, making it a top contender in the market.

Top Natural Language Processing Market Players

- Apple Inc.

- Inc

- Google Inc.

- Hewlett-Packard Enterprise

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- Narrative Science

- SAS Institute Inc.

- Verint Systems, Inc.

- Other Key Players

Recent Development

- Microsoft Corporation: In 2023, Microsoft introduced AI-powered improvements in their suite of products, focusing on integrating advanced NLP technologies into Microsoft Azure and Office tools. These developments enhance customer service automation and document processing using NLP.

- Apple Inc.: In July 2023, Apple further expanded its use of NLP by improving the capabilities of Siri and other voice recognition systems, enhancing user experience through more accurate speech-to-text features.

- Meta Inc.: Meta made advancements in NLP to improve its AI-driven chatbots and content moderation systems. In March 2023, Meta launched new multilingual NLP models for its platforms, enabling better understanding and processing of user-generated content in various languages.

- IBM Corporation: IBM has been actively involved in NLP developments by launching the “Project Wisdom” initiative in September 2023, which focuses on creating NLP solutions for code understanding and generation, helping developers interact more intuitively with AI-powered coding assistants.

- Hewlett-Packard Enterprise (HPE): In 2024, HPE announced partnerships with AI-driven startups to integrate advanced NLP solutions into their cloud services, emphasizing enhancing business operations through better data interpretation.

- Google Inc.: In February 2023, Google enhanced its NLP models for healthcare, allowing better analysis of medical data and offering more accurate diagnosis support through Google Cloud’s NLP API.

Report Scope

Report Features Description Market Value (2023) USD 37.1 Bn Forecast Revenue (2032) USD 453.3 Bn CAGR (2023-2032) 33.1% Base Year for Estimation 2022 Historic Period 2019-2021 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered (Solution and Services), By Deployment (On-Premises and Cloud), By Application (Automatic Summarization, Content Management, Language Scoring, Sentiment Analysis, Data Extraction, Risk and Threat Detection, Others Applications), By Enterprise Size (Small and Medium-sized Enterprises (SMEs) and Large Enterprises), By Industry Vertical (Healthcare, Retail, High Tech and Telecom, BFSI, Automotive & Transportation, Advertising & Media, Manufacturing, Other Industry Verticals) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Apple Inc., Meta Inc., Google Inc., Hewlett-Packard Enterprise, IBM Corporation, Intel Corporation, Microsoft Corporation, Narrative Science, SAS Institute Inc., Verint Systems, Inc., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Natural Language Processing (NLP)?Natural Language Processing (NLP) is a branch of artificial intelligence (AI) that focuses on the interaction between computers and human languages. It enables computers to understand, interpret, and generate human language, allowing for tasks such as language translation, sentiment analysis, text summarization, and speech recognition.

What are the key applications of Natural Language Processing?NLP finds applications in various fields, including healthcare, customer service, marketing, finance, and education. It is used for tasks such as chatbot development, language translation services, voice-activated assistants, content analysis, and information retrieval, among others.

How big is the natural language processing market?The Global Natural Language Processing Market in terms of revenue was estimated to be worth USD 37.1 Bn in 2023 and is poised to reach USD 453.3 Bn by 2032, growing at a CAGR of 33.1% from 2023 to 2032.

What is the demand of NLP in the market?The demand for NLP in the market is driven by the need for automated language-based tasks, personalized user experiences, and data-driven insights across industries such as healthcare, finance, customer service, and marketing. NLP enables organizations to extract valuable information from text and speech data, improve customer interactions, and enhance decision-making processes through automated language processing and analysis.

How does Natural Language Processing contribute to business growth?NLP contributes to business growth by enabling organizations to automate various language-based tasks, enhance customer interactions, extract valuable insights from unstructured data, improve decision-making processes, and develop more personalized and user-friendly products and services.

Who are the leaders in the natural language processing market?Top Key Players: Apple Inc., Meta Inc., Google Inc., Hewlett-Packard Enterprise, IBM Corporation, Intel Corporation, Microsoft Corporation, Narrative Science, SAS Institute Inc., Verint Systems, Inc., and Other Key Players

Natural Language Processing MarketPublished date: Nov. 2024add_shopping_cartBuy Now get_appDownload Sample

Natural Language Processing MarketPublished date: Nov. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Apple Inc.

- Inc

- Google Inc.

- Hewlett-Packard Enterprise

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- Narrative Science

- SAS Institute Inc.

- Verint Systems, Inc.

- Other Key Players